ANGOLD Resources Ltd. (TSXV: AAU, FRA:13L1): Targeting Multi-Million Ounce Gold Projects in the Proven Districts of Maricunga, Chile, Nevada and Ontario; Adrian Rothwell, President & CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/13/2021

ANGOLD Resources Ltd. (TSXV:AAU, FRA:13L1) is an exploration and development company that recently commenced trading on the TSX Venture Exchange, following the successful completion of its acquisition of Federal Gold Corp. and concurrent subscription receipt financing of $8,000,000. We learned from Adrian Rothwell, who is President, CEO and Director of ANGOLD, that they see the opportunity to bring quality multi-million-ounce projects to the market by targeting large-scale mineral systems in the proven districts of the Maricunga, Nevada and Ontario. ANGOLD owns a 100% interest in the Dorado, Cordillera and South Bay-Uchi projects, and certain claims that append the optioned Iron Butte project.

ANGOLD Resources

Dr Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Adrian Rothwell, who is President, CEO and Director of ANGOLD Resources. Adrian, could you give our readers/investors an overview of your Company, and what differentiates your Company from others?

Adrian Rothwell: For sure Allen, and thanks for interviewing me for Metals News. ANGOLD is a new listing. Our team is seeing the opportunity to bring some quality multi-million ounce projects to the market with historic resources and projects that are in a little more advanced exploration stage to give investors an opportunity to invest in a portfolio as well. We have two flagship advanced exploration projects, one in Chile and one in Nevada. That gives investors a year-round opportunity to participate in our Company with year-round news and year-round drilling.

Dr Allen Alper: That sounds great. Could you tell our readers/investors a little bit more about both properties?

Dorado Project

Adrian Rothwell: Sure. We have four projects. One of which is our listing project in the Birch-Uchi district of Ontario, Canada. But that's an early stage project, in our back pocket, which we'll work on in the background. The near-term opportunity is surrounding our Dorado project in the Maricunga District of Chile. We have two projects in this district, the other being slightly earlier stage project called Cordillera. This is between the Maricunga Mine and the Norte Abierto joint venture (Cerro Casale and Caspiche). This is a joint venture between Barrick/Newmont-Goldcorp. Dorado is near the Marte-Lobo development project, which will start to see a lot of news in 2021 as Kinross has deployed capital to that project.

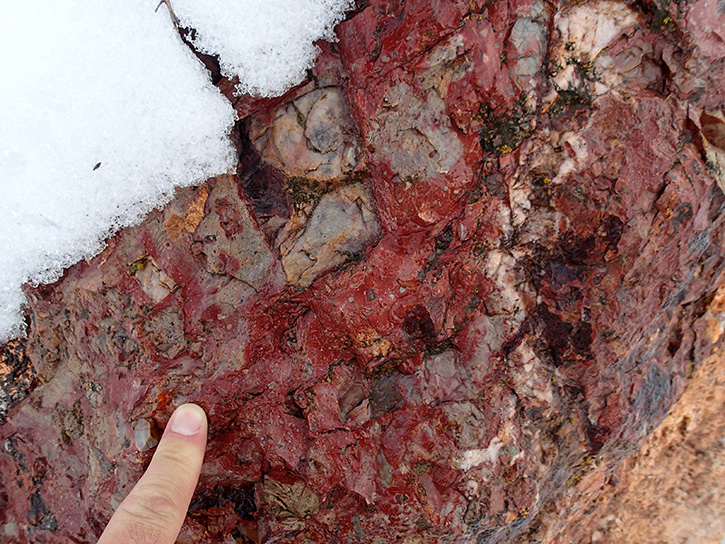

Dorado Project, Lajita Area, Maricunga Type Banding Veinlets

Dorado is a gold project, gold porphyry. We have picked that up, with around 10,000 meters of historic drilling. It has a historic resource of about a half million ounces of gold, but we believe that that is not being really well-defined. And so, our first action post-listing will be to commence drilling this week of around 5,000 meters of core on Dorado, to test the depth potential and the potential laterally, in oxides, on that project.

The other project is Iron Butte, in the Battle Mountain trend of Nevada. That's a project we've been working on for the last three months or so. At surface we've been doing some reconnaissance mapping in order to get drill targets. We'll be drilling on that in Q1 through Q2 this year.

The Iron Butte Project

Dr Allen Alper: Well those sound like excellent projects that could be multi-million ounce projects. Is that correct?

Adrian Rothwell: That's what we believe, yeah. The Iron Butte project has a historic resource on it as well, around 600,000 ounces. We've been aggressively staking on both projects, around the core of the historic resources, because we believe there's much more exploration upside in those areas. That's why we believe that each of these has the potential to be a multi-million ounce deposit. Of course that's where the hard work begins.

Dr Allen Alper: Well that's excellent! Could you tell our readers/investors a little bit about yourself, your Team, and your Board? I noticed your Chairman is an award-winning Geologist.

Adrian Rothwell: He is. Our Board has consisted of Galen McNamara, to whom you just referred. He is the present CEO of Summa Silver. That's a very successful company, and they have a great project in the Tonopah district in Nevada. He knows Nevada quite well because of that. That's where they came across Iron Butte.

We also have Brandon Bonifacio, he's come out of multiple years working with Goldcorp and then Newmont, and in the last two years he was working down in the Maricunga in Chile. He's been indispensable helping us get setup to actually execute on a drill program down there.

Rony Zimerman, is a well-respected Canadian Chilean, who lives out of Santiago. He has his own law firm in Santiago, Chile and knows the lay of the land very, very well. Critical to our success.

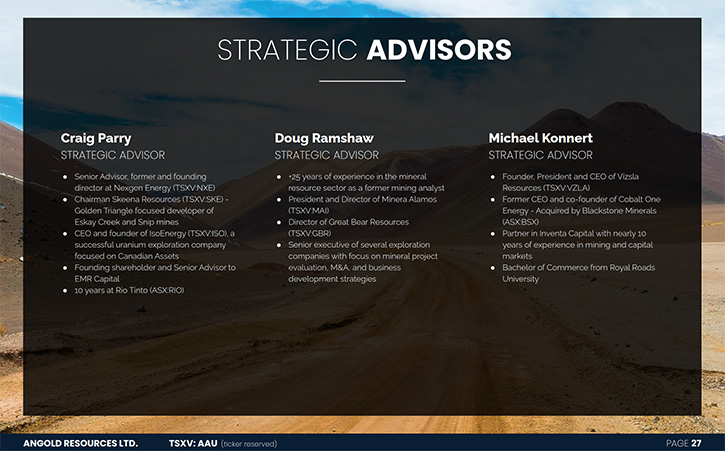

That's just on the Board. We have advisors as well, Craig Parry, Doug Ramshaw, and Michael Konnert, each of whom offer their experience, getting this Company set up, with the right capital structures and the right assets. Myself, I worked for Goldcorp for a few years and left end of 2015. I founded a Company called KORE Mining, with multiple assets again. This is why I like ANGOLD. KORE was set up with two advanced exploration, almost development stage assets in the United States, each with multi-million ounces. And I can see this again with ANGOLD and the projects we have in our portfolio here.

In these times of COVID it's really important to have a good strong local team. And that's what we have. We've hired a senior geologist out of Santiago, Chile, and he knows the Maricunga district very, very well. We have a logistics team, based out of Copiapó, which is the nearest town to the Dorado and Cordillera projects. And our VP Exploration is based in the United States, so he's able to focus on our global exploration portfolio. Obviously he's been to the Iron Butte Project.

Dr Allen Alper: Oh, that sounds excellent! Could you tell our readers/investors your primary goals for 2021?

Adrian Rothwell: Well, certainly add ounces, but primarily breaking it down into the first stage of understanding the projects with this initial drill program, that's why our initial drilling will be core only. We won't be doing any RC or anything like that for now. The reason for that is, we get a much better perspective on structure. We've already started the first phase of this, which is doing surface testing and staking all the best prospective ground, around each of these projects. The first phase will be looking at extensions to the existing resource. And then as we have success in that program, looking to step out a little further. Dorado has new targets to be tested and we will be looking at extending Iron Butte’s historic resource. The big milestones will be redefining resources towards the end of the year.

Dr Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your share and capital structure?

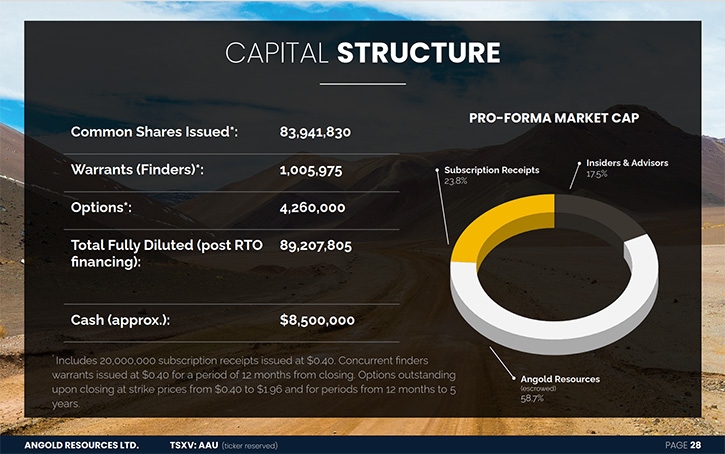

Adrian Rothwell: We're a new listing, just came out in the market on the first day of trading on December 31 and we have almost eighty four million shares outstanding, Fully diluted it's eighty nine million. Those diluted instruments are all at 40 cents or higher. Most recently, we completed a subscription receipt financing at 40 cents for $8 million. That's how much cash we'll have coming out into the market. So that's sufficient cash to do the work that we've been talking about. Out of that eighty four million shares, we have quite a tight share structure, with insiders and advisors, including myself, owning 18% of the Company. The only real free trading stock is the twenty million subscription receipts at 40 cents that we just raised. A very, very small amount of free trading stock, in the shell as well, for which the cost base is much higher than where we are right now. So it's a good tight share structure and we expect to do well in 2021.

Dr Allen Alper: Oh, it's good to see Management has skin in the game and is committed to the success of your projects. Could you tell our readers/investors the primary reasons they should consider investing in ANGOLD Resources?

Adrian Rothwell: Investing in gold juniors, exploration juniors, really is an investment in the future of gold, first and foremost. Our underlying commodity is gold. We do have some silver at Iron Butte, but really this is a gold project, a gold company. We provide investors with leverage to what I and many others believe to be an upcoming fantastic year for gold. First and foremost, ANGOLD is well-managed. We have advanced stage exploration projects, since it's not moose pasture. I think the money that comes into the juniors first goes to the better quality projects and that's what we have in some very favorable jurisdictions, with ANGOLD.

Dr Allen Alper: Sounds excellent! Those are very compelling reasons for our readers/investors to consider investing in ANGOLD. Adrian, is there anything else you'd like to add?

Adrian Rothwell: There's more information on us and what we're doing on our website at www.angoldresources.com

Dr Allen Alper: That sounds great. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.ANGOLDresources.com/

Adrian Rothwell

CEO & DIRECTOR

866-852-8719

info@ANGOLDresources.com

|

|