Red River Resources Ltd (ASX: RVR) Building a Multi-Asset Base and Precious Metals Operating Business in Australia; Interview with Mel Palancian, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/4/2021

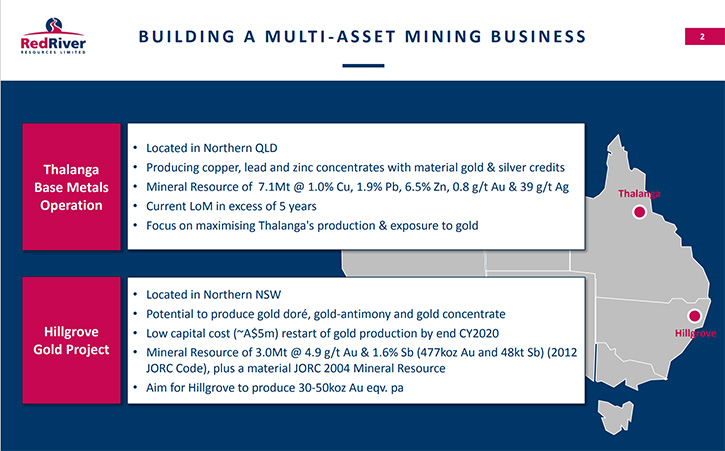

Red River Resources Limited (ASX: RVR) is seeking to build a multi-asset operating business, focused on base and precious metals. Red River's foundation asset is the Thalanga Base Metal Operation, in Northern Queensland that has been producing copper, lead and zinc concentrate, since 2017. RVR has recently acquired the past producing, high-grade Hillgrove Gold Project, in New South Wales, which is scheduled to restart at the end of 2020. We learned from Mel Palancian, Managing Director of Red River Resources, that at Thalanga/ they are currently running their plant at about 400,000 tons per year, with plans to increase the throughput to 650,000 a year and increase the mine life through exploration drilling. At Hillgrove, near term plans include expanding resource to over a million ounces, by March. According to Mr. Palancian, Red River team has a huge history operating in base metals and gold. He worked for the majors and understands mining really well.

Red River Resources

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mel Palancian, Managing Director of Red River Resources Limited. Mel, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

Mel Palancian: We mine copper, lead and zinc at Thalanga in Queensland. The mine is about 200 kilometers inland from Townsville. The copper and the lead concentrates also contain silver and gold as by-product credits. We're on our second ore body at Thalanga, we've been operating there continuously since September 17. We have over three years of operations there, but the Thalanga's been there since around about the late eighties. And, we've just recently acquired the Hillgrove goldmine in New South Wales, which is near Armidale. It's about 200 kilometers inland from Coffs Harbour. That mine has a very, very rich history in gold and antimony and currently it's not running, but we're about to put it into operation just before Christmas. Over the next four weeks we plan to press the start button and start producing gold at Hillgrove.

What differentiates Red River is that we're operators. We have a team, from the Board down, that has a huge history operating in base metals and gold. We've worked for the majors and we understand mining really, really well. Our focus is to leverage our skills on picking up unloved, mismanaged, poorly strategized operations and turning them around and bringing them to production.

Dr. Allen Alper: Well, that's excellent. You're in a great position, a lot of juniors are years away from actually producing. So, that's excellent. And you're in great locations. Could you tell our readers/investors a little bit more about your projects?

Mel Palancian: With Thalanga, really the plan there is, we're currently mining far West, that has about a four year mine life, but once the decline gets down deep enough we'll drill from underground for further extensions. I'm hopeful that we can add more mine life there. The other lever at Thalanga is that we have a plant that has done 650,000 tons per annum previously, currently we're running it around about 350, 400,000 tons per annum from Far West. Our largest ore body, Liontown, we've yet to develop. That's currently under permitting and hopefully this time next year, we'll actually start some material earthworks there and that'll enable us to have two mines feeding the Thalanga plant and getting that throughput up.

I think the other thing at Thalanga is that since we bought it in 2014 we've increased the resources significantly. We've discovered more ore, we've pretty much extended every ore body we have. So I'm confident that Thalanga will be, like most other VMSs if you keep drilling year in, year out, you'll keep having a three to six year mine life for a very long time. That's certainly what's happening at Thalanga.

One of the differences for us is we do really go hard with the drill bit, when we can afford to, and extend our resources. We've been very successful at Thalanga in that space and I don't see any reason why that would change. Hillgrove's probably the same. I think the focus for us is going to be the gold. Hillgrove's produced over 730,000 ounces of gold. And it also has produced about 50, 60,000 tons of antimony. When I look back at Hillgrove, when people have really focused on the gold that's when it's done well. Some of the more recent history of Hillgrove, in the last 20 years, there's been probably too much focus on the antimony. So for us, the focus will be on the gold. Any drilling that we do and any capital development that we do will be focused on gold.

We have about 700,000 ounces in JORC 2012 resources there now. We have another 400,000 in JORC 2004. So hopefully by the end of March, we'll have that converted to JORC 2012 and have over a million ounces. I take that to be our focus, we'll start up on the Baker's Creek stockpile. The stockpile was about 225,000 tons there around about two and a half grams gold, and it's free gold so we'll be pouring doré on that and then go underground. There are three ore bodies there and over 400,000 ounces in resource. So that'll keep us going for a long time, but then the expansion at Hillgrove will be centered on Eleanora. So we're currently drilling Eleanora and hope to have that resource upgraded by March. That should get us over the million ounces, but importantly get us in a position where we may be able to feed two ore bodies into that one plant and expand our throughput and our production.

Dr. Allen Alper: Oh, that's excellent. Sounds like this is a very exciting time for Red River?

Mel Palancian: Yeah, it is. And we have a great bunch of shareholders that have been with us for a long time and support us. This is what we do. We basically seek out unloved, mismanaged assets and turn them around and try and spend very little money in doing so. The Hillgrove restart is going to be about $5 million in capital. We try and do it as cheaply and as quickly as we can. Then once it's in operation, we'll look for expansion opportunities.

Dr. Allen Alper: Well, that's excellent. Could you tell our readers/investors, a bit about your background, the Board and the Management Team?

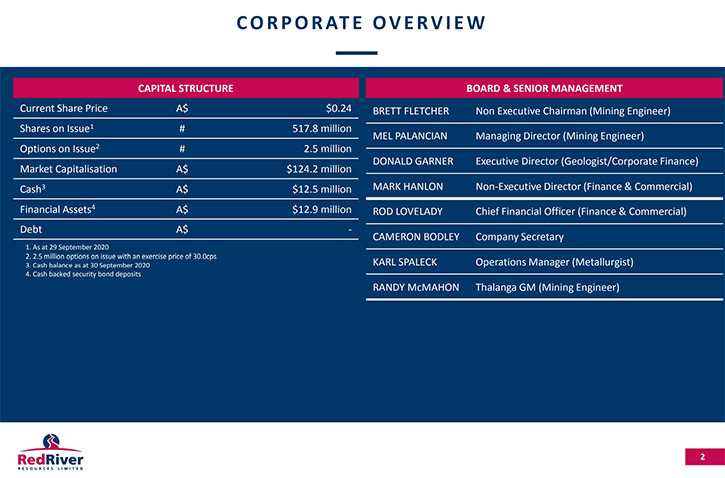

Mel Palancian: I'm a mining engineer. I basically started off as an underground miner and worked my way up through the ranks over the years. I just love mining. It's in my blood and I can't think of doing anything else for a living. Our Chairman, Brett Fletcher, is also a mining engineer. He's currently the CEO of a company called Ravenswood Gold. Before that he was an executive in Newcrest, the Chief Operating Officer in MMG Oz Mineral/Zinifex. So yeah, Brett has a deep operating history. Donald Garner, our Executive Director, is a corporate M and A guy and a geologist also by background. Very operationally focused, but with one eye on the next project and the next asset that we can bring to Red River.

Mark Hanlon is very operationally focused on the finance side. He has a really, really long history in mining and understands mining really well and on a very practical level as well. And we have our two GM's, Randy McMahon at Thalanga and Karl Spaleck at Hillgrove. Again, they have decades of managing mines and working in mines and that's our focus, to build a base metals and gold business. It is more of a long term focus. So we are looking at having multiple operating assets and hopefully we'll achieve that in the next four weeks, when Hillgrove comes on. Yeah.

Dr. Allen Alper: Well, it sounds like you all have great backgrounds and great experience that will enable you to grow very successfully.

Mel Palancian: Yeah. And I guess the other thing, Al, is that we've all worked for larger companies and we've seen the good and the bad. I'm trying to make sure that from a corporate perspective and a strategic perspective that we don't make some of the decisions that some of the bigger companies would make. For example, IT and HR, some of the bigger companies can spend a lot of money in that space, where our focus is the ore bodies. We are really, really keen to invest in the assets and invest in our people, at the asset, rather than grow the corporate office. That's our focus.

Dr. Allen Alper: Well, that sounds very good. Could you tell our readers/investors a little bit about your share and capital structure?

Mel Palancian: Our current market cap is about $140 million Australian. I think we have about just over 500 million shares on issue. There's no debt in the business. It's a very clean and open register and a very clean company structure, nothing complicated. We like to keep our finances transparent. So, we make sure that our i's are dotted and our t's are crossed and the auditors are happy.

Dr. Allen Alper: Oh, that sounds great. Could you tell our readers/investors the primary reasons they should consider investing in Red River Resources?

Mel Palancian: Well, I think that they would be investing in a Management Team that has a deep operating history of base metals and gold. I think we're in the right mix of metals, so if you want exposure to copper, zinc and lead we have that. We also have exposure to silver. Thalanga produces 350,000 ounces of silver per annum. With the silver price going at $24 a pound, that's been really, really good for us. And hopefully in a few weeks’ time we'll have some material gold production kicking in at Hillgrove. I think, we have the right mix of metals in the business. They're bread and butter metals that everyone enjoys and consumes. The third reason is we're in a good jurisdiction. Australia is a safe place to invest. It's a really good place for mining and I'm confident that we'll continue on our journey, bringing more assets into the fold and growing the business.

Dr. Allen Alper: All that sound like very compelling reasons to consider investing in Red River Resources, Mel. Is there anything else you'd like to add?

Mel Palancian: Not really. Other than the DNA of Red River is a little bit different from most other companies. We are very, very focused on operations and growing our resources and value. We have many years of experience under our belt and hopefully we'll continue to grow the business.

Dr. Allen Alper: Well, that sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.redriverresources.com.au/

Mel Palancian

Managing Director

mpalancian@redriverresources.com.au

+61 3 9017 5380

|

|