Miles Franklin: Precious Metals Investments; Interview with Andy Schectman, President

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/4/2021

Andy Schectman, who is President of Miles Franklin, tells why they are the safest way to do business in the industry. They are licensed, bonded, and background checked, every single year, by the State of Minnesota Department of Commerce. They are participating in the Sport Natural Resource Symposium and work with Rick Rule and his clients. They have never had a customer complaint and have several worldwide exclusive arrangements with Brink's in terms of our rate structure and our safety deposit box program in Canada. Andy thinks silver is probably the finest investment on the planet. When the gold/silver ratio gets closer to 35:1, switch to gold. But right now, unquestionably, silver is a better buy. When you email andy@milesfranklin.com and put referred by MetalsNews in the subject, he will make sure you get the best price in America on all of the products.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Andy Schectman, who is President of Miles Franklin.

I wonder, Andy, if you could give our readers/investors an overview of Miles Franklin; also, what differentiates Miles Franklin from others?

Andy Schectman

Andy Schectman: Yes, sir. Thank you. I appreciate being here.

Miles Franklin has been in business for 30 years, this year. We just eclipsed $6 billion in transactions. We've never had a customer complaint ever. We're one of only 24 or 25 companies that have ever been approved as an authorized reseller from the United States Mint.

We have an A plus rating with the Better Business Bureau. As I mentioned, we've never had any customer complaints. People can go to Google and search that; never find any.

But all of the accolades, like working with Rick Rule and his clients, or never having a customer complaint, having several worldwide exclusive arrangements with Brink's in terms of our rate structure and our safe deposit box program in Canada. All sorts of things that really put a feather in our cap.

Those things don't mean much to the state of Minnesota. We have to be licensed, bonded, and background checked every single year in the state of Minnesota. It's the only state in America where those guidelines pertain.

As a result, it really means that doing business with us is unequivocally, the safest way to do business in the industry.

The real differentiating factor on top, of our reputation, is the accreditation by the state of Minnesota. The majority of the competition outside the state, our competition; that I would consider competition; the nationally listed dealers, almost all of them, 98% of them or more have boycotted Minnesota, where they would need to be subservient to the Department of Commerce here in Minnesota, the way that we are.

Seal of the State of Minnesota

That's really what sets us apart, our reputation and our accreditation.

Dr. Allen Alper: Well, that sounds excellent. That's something to be extremely proud of. That's great. It's nice to have a feeling of safety and security when you're dealing with money and savings, et cetera.

Could you tell our readers/investors how your services work? What kind of metals you deal in, and how they would interact with you? How the transactions would take place and how they could enter into them?

Andy Schectman: Sure. We took our online store offline because of the tremendous amount of online fraud and identity theft. So we do things the old-fashioned way.

We do things by a phone call. We lock in an order. Lately, we have been guaranteeing the lowest price in America. We've had great success, doing that.

It's typically not our model, but since the beginning of the year, we have beaten every single price from a nationally listed retailer in the country.

As far as placing an order, they give one of our brokers a call. We discuss product and price. We confirm the order by lock-in. We send an invoice by email typically.

Then after confirmation, people can pay for it with a check, with a wire, or by ACH. Upon clearing of funds, if necessary, everything is shipped out by insured UPS. It's literally that simple.

Secure Storage

We do offer storage. We have some exclusives with Brink's, both in the United States and in Canada. We have facilities in Toronto, Montreal, Vancouver, JFK, New York City, Los Angeles, and Salt Lake City, and exclusive arrangements with them that no one else in the industry has.

Dr. Allen Alper: Well, that sounds excellent. What are your thoughts on the precious metals market?

Andy Schectman: Yeah, I think the reclassification of gold, as the only other Tier 1 asset in the world last April, was the most game-changing, watershed, groundbreaking event of my 30-year career.

The fact that the central banks now have revalued gold as the only other Tier 1 asset in the world speaks volumes as to where the price is going.

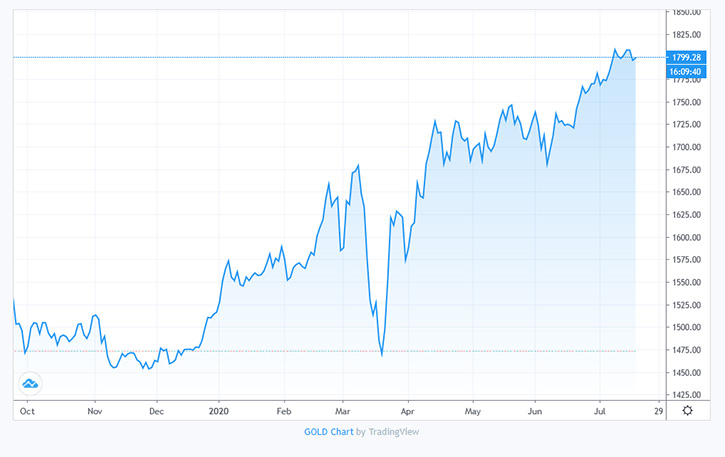

If you look at a graph of what gold has done over the last year, since April of last year, April of 2019, it is literally straight up at a 45-degree angle.

I think that the price of gold has really nowhere to go, in my opinion, but higher. Because you have the most sophisticated, well-informed, well-funded influential traders on the globe amassing tremendous amounts.

In fact, what's interesting if you go back to 2017; the central banks were net sellers. In 2018, out of nowhere; if you look at a graph starting in 2018, you see it goes straight up 45 degrees.

It has gone unabated since then, minus some corrections, because that reclassification has prompted the central banks to massively acquire it.

And when you see the most sophisticated, well-informed and influential traders on the planet, de-dollarizing and accumulating gold voraciously since 2018.

If you took all the central bank purchases in 2018, cumulatively they purchased more gold as a group than they did in the previous 60 years combined, in 2018. Massive, massive accumulation in 2018. In 2019, those numbers were up 90%, and continue today.

As far as gold is concerned, here again, the reclassification of it, to me, has signaled that it has nowhere to go but higher.

And when you talk about silver, the fact that J.P. Morgan has gone long in the futures market after 12 years of being short; and is facing six racketeering charges, federal indictments for their manipulation of the silver market; to me, it portrays for much, much higher silver prices going forward as well.

I guess the bottom line is there's been a change by the banks. They went from selling and capping to going long and accumulating. I don't think we've seen anything yet, to be honest with you.

Dr. Allen Alper: Oh, that sounds excellent for our readers/investors. Could you tell our readers/investors a little bit about your background?

Andy Schectman: I've been doing this since I was 19 years old. My father and I started the Company together. We started literally off a wing and a prayer in 1989.

Our original business was acting on behalf of BFI Consulting, a Swiss insurance agent in Zurich. Our main thrust was to help people buy Swiss annuities. We realized very quickly that the same person who bought Swiss annuities purchased gold. So literally, we come from nothing.

My father's middle name is Miles. His best friend, who loaned us $60,000 to start the company, his middle name was Franklin. We bought him out a year or two after we started the company, and we just eclipsed $6 billion in transactions without a customer complaint.

My background from the time I was 19 years old, and I'll be 50 this summer, has been dedicated to growing Miles Franklin from a small three-person startup to a Company that just eclipsed 6 billion in sales, and is on the U.S. Mint website as one of only a couple of dozen authorized resellers of their product.

We're very, very proud of our history and our lineage. I guess you could say we're somewhat the embodiment of the American Dream, starting from literally; financially, anyway; nothing and ending up here.

Dr. Allen Alper: Well, it sounds fantastic. That's really something to be extremely proud of. Both the growth and the record that you have achieved and the reputation. That's really outstanding, Andy.

Andy Schectman: Well, I appreciate that. I appreciate that very much.

Dr. Allen Alper: I would say that in this business, security, safety, reliability, those are probably the most important factors.

Now, do people deal with gold through you, with retirement accounts? Or how would that work?

Andy Schectman: Yes, sir. We do work with all of the IRA custodians. If a person wanted to buy physical precious metals, yes, absolutely. It would be no problem at all. We would have no problem helping them with an IRA.

So yes, we do do all of the self-directed IRA programs through all the various custodians.

Dr. Allen Alper: Well, that sounds excellent. Could you summarize why our readers/investors should consider investing in precious metals?

Andy Schectman: Well, I think the alternatives; I think the bond market arguably is the mother of all bubbles. I think the stock market, by every single metric, is as overvalued as it has ever been, and is detached from Main Street.

With half of the working population unemployed, and being paid by the Federal Reserve to be unproductive, it is incredibly inflationary.

I think that we are heading down a very frightening path. If you take a look at, for example, the bond market, normally when people are afraid, they'd run to the safety of the bond market.

But at 6/10ths of a percent interest on a 10-year treasury, issued by an insolvent country running massive inflation, that's certainly not a good idea. With real interest rates basically negative already, and the prospects of interest rates going lower in the near future, even perhaps, on the horizon. Ultimately, we see higher interest rates as the Fed is the only one buying the 10-year treasury right now. At some point they either have to continue to monetize, which is inflationary, leading to higher interest rates. Or they step away and let the bond market collapse.

So, to me, the bond market is the worst place to be. The stock market, which has detached from reality, and detached from Main Street, is far too overvalued and unjustifiably so, when reflected against the real economy and the massive amount of unemployment.

So the alternatives as to where to put your money, whether it be fixed income or equities, are few and far between. There are a lot of people who talk about gold being the ultimate inflation hedge. Certainly, what the Federal Reserve is doing is massively inflationary.

But I would argue that the reason they're doing that is to hold back the global tide of deflation. They're trying to forestall a depression. I would argue that gold performs best even in a deflationary scenario, in a depression.

In fact, because gold is the only object that is not simultaneously someone else's liability. Whether it's inflation, whether it's deflation, I think you're protected with gold.

And when you look at the alternatives; bonds and stocks to me, they are not attractive. The bond market, the stock market, and the real estate market have all become make-believe, courtesy of Fed-induced asset price inflation.

The banks haven't been really willing to expand their balance sheet and make loans. Instead, all that money's holed up in asset prices for now, making gold that much more attractive.

But I guess the bottom line is, that when you see real interest rates, basically negative; 6/10ths of a percent on the 10-year, with inflation running way higher than that. In fact, the Fed says they want to strive for 2%. John Williams of Shadowstats would say we're much higher than that.

The argument against gold is it pays no interest. But it sure beats the pants out of negative interest.

Dr. Allen Alper: Well, I appreciate your comments and your insights for our readers/investors. Do you have any thoughts on investing in gold versus, say, silver?

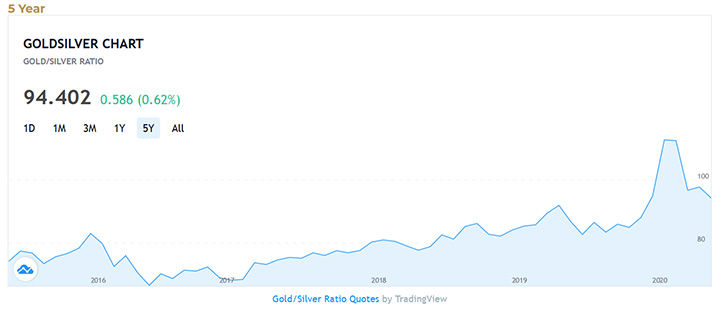

Andy Schectman: I think silver is probably the finest investment on the planet right now. And I think it's the most undervalued commodity on the planet. I think it will be the go-to investment second half of this year and on. I wouldn't count out gold, due to the reclassification of it. I think it makes it particularly attractive right now.

But I think that the real value is silver at a hundred-to-one ratio. There will come a time to trade that silver to gold, perhaps when that ratio gets below 35 to one or so, as I expect it to.

When I talk to Keith Neumeyer, who will be at this show and the CEO of First Majestic, he'll tell you publicly what's coming out of the ground is about eight to one.

So when you see a hundred to one ratio, when you see J.P. Morgan amassing a billion ounces, according to Ted Butler, and going long in the silver market.

And when you see both the gold and silver market on the COMEX becoming a delivery mechanism, meaning people are standing for delivery, which makes it much more difficult for these commercial banks to manipulate the price under the guise of a hedge. I think that the handwriting is on the wall.

I think silver probably is the finest investment on the planet. And I think when the ratio normalizes, when it gets closer to 40 to one, 35 to one, you switch to gold. But right now, unquestionably, silver is a better buy.

Dr. Allen Alper: Well, I appreciate your insights for our readers/investors. That's excellent. Andy, is there anything else you'd like to add?

Andy Schectman: Well, anyone who's reading this, for your readers, mention this interview. Or in the subject line, your publication, they can email me at andy@milesfranklin.com. I will 100% make sure that they receive the lowest price in America on any of the products that they want to buy.

Dr. Allen Alper: That sounds fantastic. That's a great, great offer. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.milesfranklin.com/

For More information on purchasing Precious Metals contact:

Dr. Allen M. Alper drallenalper@icloud.com; Cell: 1 781 500 9780

|

|