Genex Power Ltd (ASX: GNX): Developing a Portfolio of Renewable Energy Generation and Storage Projects Across Australia; Interview with Simon Kidston, Executive Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/27/2020

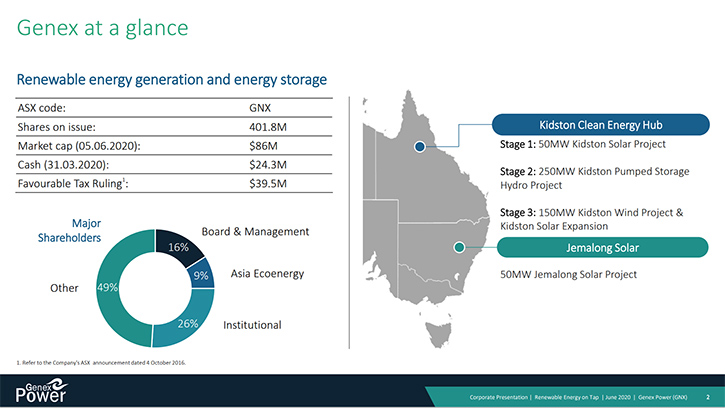

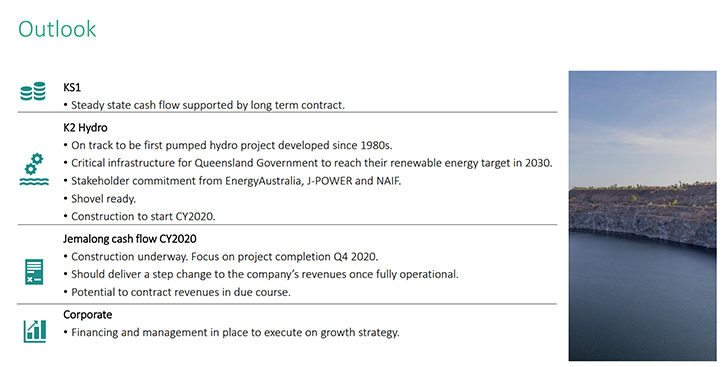

Genex Power Limited (ASX: GNX) is focused on developing a portfolio of renewable energy generation and storage projects across Australia. The Company’s flagship Kidston Clean Energy Hub, located in north Queensland, will utilize a former gold mine to integrate large-scale solar generation with pumped storage hydro. We learned from Simon Kidston, Executive Director of Genex Power, that they have an operating 50MW solar farm, which has a revenue contract, with the Queensland government, providing very stable long-term revenues. Next stage is going to be the 250MW pumped hydro storage project, with potential for further multi-stage wind and solar projects. According to Mr. Kidston, the pump hydro project will commence construction early 2021.

Kidston Renewable Energy Hub

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Simon Kidston, who is Executive Director of Genex Power. Simon, I wonder if you could give our readers/investors an overview of your Company and what differentiates your Company from others?

Simon Kidston

Executive Director

(BCom, Graduate Diploma in Applied Finance and Investment, MAICD)

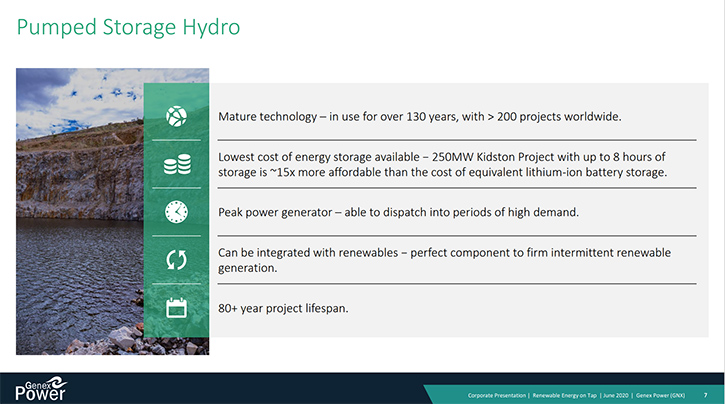

Simon Kidston:Genex Power is a renewable energy generation and energy storage business. We're developing the old Kidston Gold Mine in North Queensland, once one of the largest gold mines in Australia, into a renewable energy hub. And that renewable energy hub is being developed in stages. The first stage is now an operating solar farm, which has a revenue contract with the Queensland government, providing very stable long term revenues. The second stage, we think of it as a giant water battery, but it's a pump hydro project, which is a way of storing energy. We utilize the old gold mine pits, so there's an upper and lower reservoir. Our third stage is a wind project, which will produce wind resources connected into the same hub.

It's a unique project globally. It utilizes a former mine to generate renewable energy. Essentially it's the Holy Grail of renewables because we generate solar energy when the sun shines, wind energy when the wind blows, and we can store energy through the pump hydro to produce renewable baseload, clean, green energy.

Dr. Allen Alper: Well, that sounds great. Could you tell us a little bit more about your plans for the remainder of 2020 going into 2021?

Simon Kidston: The big milestone for us, on which we're very focused, is achieving financial close for our flagship pump hydro project. This is AUD Australian $750 million of project investment to convert the old gold mine into this pump hydro project. Having worked on this now for several years in the development phase, we are now finalizing the documentation and funding to enable that financial close to occur in December of this year, with construction to commence early 2021. It's a major milestone for the business to deliver this iconic energy infrastructure asset into the grid.

Dr. Allen Alper: So you will supply them energy to the grid and that's how you will get finances. Does this all start next year?

Simon Kidston: The Company has a number of operating solar farms that are now generating and producing revenue. The pump hydro project will commence construction early 2021. It's a big project, so there're three and a bit years of construction. We won't be generating into the grid until 2024, by which time it will be fully operational. We're doing so under a long term 30-year contract, with one of the major energy utilities in Australia, called Energy Australia. They will operate the hydro project and pay us, as owners, a fixed rental payment for the rights to operate the plant.

Dr. Allen Alper: Well, that sounds great. Could you also tell us about some of your hydro projects and wind projects?

Simon Kidston: We see ourselves as a diversified renewable energy company across solar, wind, batteries and hydro. I just spoke about the hydro pump storage, which is our flagship project. Next, in our energy storage portfolio, will be a battery development in Queensland, Australia. We're seeking to develop a 50 megawatt battery, which is a large scale stand-alone battery on and near a town called Rockhampton on the East Coast of Australia. That project, we expect, will commence construction around the middle of 2021. That will be our second energy storage asset. In terms of the other generation assets, we expect to commence work on our wind project next.

Dr. Allen Alper: That sounds very good. Could you tell us a little bit more about the battery project, how it works et cetera?

Simon Kidston: We've partnered with a global Tier 1 battery supplier. A well-known US firm will be supplying the battery systems and energy trading systems. We're putting in place the pre-connection process at the moment. Concurrent with that, we're working on the project financing. The project has been sized as 50 megawatts or 75 megawatt hours, which means the 50 megawatts can generate for 1.5 hours before the battery's been discharged.

And interestingly, from a revenue perspective, it has two forms of revenue. One is energy arbitrage, which is the delta between peak and off peak energy prices. That's the first revenue stream. The second revenue stream is what they call auxiliary services, or FCAS services, which has proven to be a very, very profitable revenue stream for other battery developments that are operating in the Australian market. So we'll be targeting both revenue streams. The beauty of battery projects is they can be built very quickly and we would expect that project to be operating by early 2022.

Dr. Allen Alper: That sounds very good. Could you tell us about some of the other projects?

Simon Kidston: The milestone we're working on right now is the completion of the construction of the Jemalong Solar Farm, which is a solar project located in Central New South Wales. It's a 50 megawatt project, and we expect that project to finish the construction phase in December, with first energization and first revenue from that date. That alone is an important milestone for us, because it takes us from a single asset generating company to having diversification, with a second solar farm generating strong cash flows into the grid.

And we've been very, very pleased actually, Al, because managing the construction during COVID has been challenging, as you can imagine. Dealing with global supply chains, getting equipment imported in from other countries, managing a workforce with COVID has proven challenging. But we're very proud to say that as of today, the project is on time and on budget, with first revenue and first energization in December 2020.

Dr. Allen Alper: Well, that's excellent. That's an excellent accomplishment, in a very difficult time, to meet your budgeted requirements. So that's excellent! Could you tell our readers/investors a little bit about your background and your Board and Team?

Simon Kidston: I have a project finance background. I spent many years operating in the international investment banking industry. I'm primarily based out of Sydney, Australia. It was through that work that my business partners and I identified opportunities in renewable energy and energy storage. The Company listed on the Australian Stock Exchange in 2015 and I've been a part of the Management Team since that time.

I have, as you would imagine, a very experienced Board, led by Dr. Ralph Craven, who's an electrical engineer, with deep experience in the electricity markets. Our CEO, James Harding, is an experienced project delivery person, with experience in Asia and Australia, and supported by a very strong engineering-led Management Team. The team has a proven ability to deliver large, complex projects on time and on budget.

Dr. Allen Alper: That sounds excellent. Sounds like you and your Team have great backgrounds. So that's excellent!

Simon Kidston: That's very kind of you to say that.

Dr. Allen Alper: And it sounds like you're really a pioneer in this area, in green energy. So that's excellent!

Simon Kidston: Well, it's interesting. On the Australian stock exchange, there are very few pure play renewable companies. The ones that have existed, have tended to be taken over by big, large global infrastructure funds or super funds. So we are an anomaly. But of course, in other markets such as the United States and Europe and the UK, for example, there are many successful examples of public companies dedicated to providing strong cash flows to investors from renewable energy.

Dr. Allen Alper: Oh, that's excellent! Could you tell our readers/investors a little bit about your share and capital structure?

Simon Kidston: Our market capitalization is a hundred million Australian dollars. We have 500-odd million shares on issue and we're trading around 20 cents per share. And we have 3,500 shareholders. The largest shareholders are Board and Management, so we're significantly invested in the business. Therefore, I believe we have a strong alignment of interests, as a Board and Management Team with each and every shareholder. We have roughly 25% of the shares held by institutional investors, primarily Australian institution investors, and the balance are roughly 3,500 private investors or individual investors that make up our share registry.

Dr. Allen Alper: Well, that's great and it's great to see that you, the Board and the Management Team have skin in the game and are committed to the success of the Company.

Simon Kidston: That's one of the key things I look at when I invest in other companies, to see how focused and how invested Management Teams are. So it's something, which I'm proud to say holds true with Genex Power.

Dr. Allen Alper: Well, that's excellent! Could you tell our readers/investors the primary reasons they should consider investing in Genex Power?

Simon Kidston: First and foremost, we have a series of what we think will be very material announcements coming up over the next six to 12 months, which have the potential to significantly re-rate our valuation. So that's the first key driver, based on the pipeline of projects we'll be delivering into the market over that period. But the second issue is an emerging issue, the focus from investors on ethical and sustainable investment. One thing on which we pride ourselves is our environmental credentials. We measure that by way of CO2 abatement, so the amount of carbon that is saved or not emitted into the environment, by virtue of our clean, green portfolio. Our portfolio, in total, saves around 2 million tons of CO2 per annum, or will do by the time the portfolio is fully operational in 2024. First and foremost, investors will have exposure to what we think is a growing business, with the potential for re-rating, but secondly, an ethical and sustainable investment opportunity.

Dr. Allen Alper: Oh, that sounds excellent. Is there anything else you'd like to add, Simon?

Simon Kidston: Al, I think you've covered it, hit the key points.

Dr. Allen Alper: Well, that's great. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.genexpower.com.au/

Simon Kidston, Executive Director

+61 2 9048 8852

sk@genexpower.com.au

|

|