Northisle Copper and Gold Inc. (TSX-V: NCX): One of the Most Promising Copper and Gold Porphyry Deposits in Canada; Interview with from Sam Lee, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/27/2020

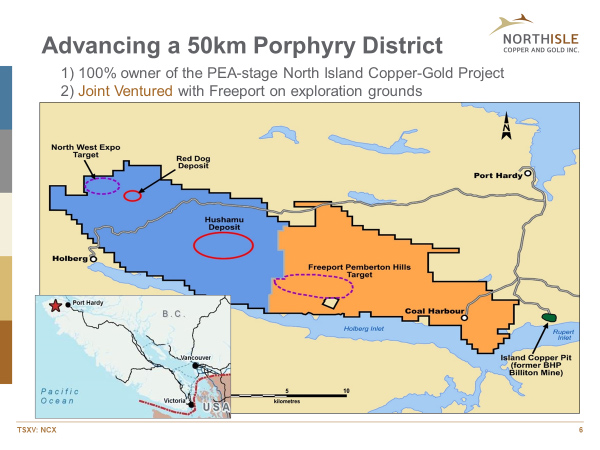

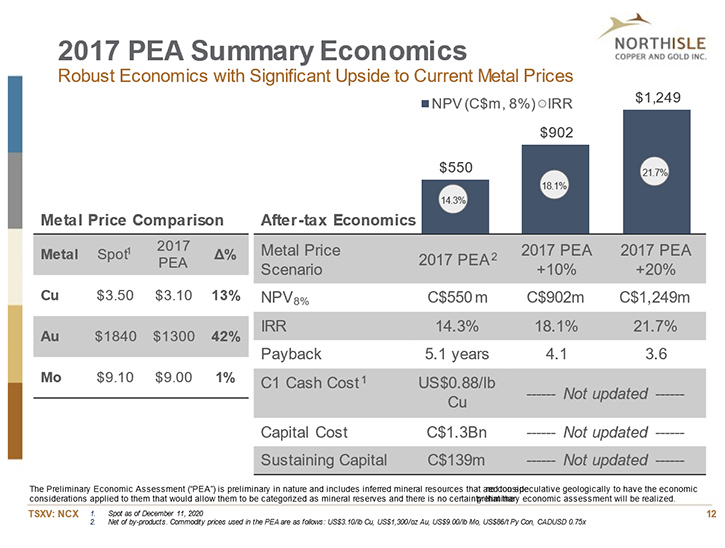

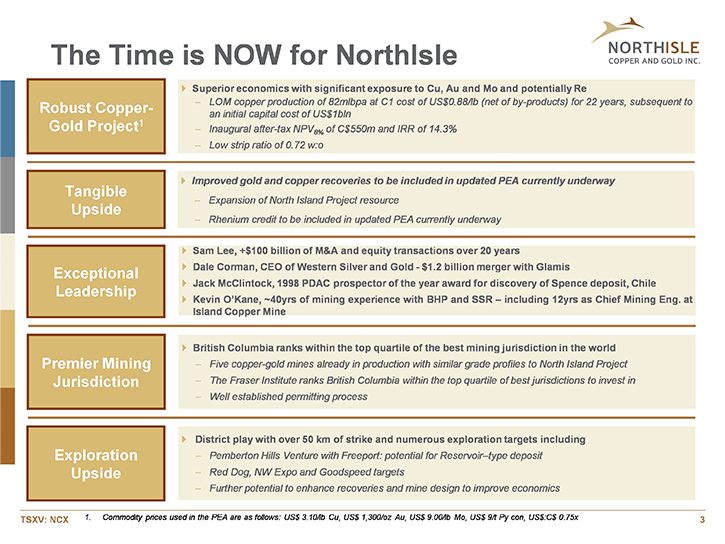

Northisle Copper and Gold Inc. (TSX-V: NCX) owns the North Island Project, which is one of the most promising copper and gold porphyry deposits in Canada. North Island is a district-scale project, located near Port Hardy, British Columbia, stretching 50 kilometres northwest from the now closed Island Copper Mine, operated by BHP Billiton. The project boasts a large resource with 1.83 billion lbs. of copper, 3.2 million oz. of gold, and 57.8 million lbs. of molybdenum. The 2017 PEA shows robust economics, with a 5 year payback and great expansion potential. We learned from Sam Lee, President and CEO of Northisle Copper and Gold, that the next steps are – updating the 2017 PEA for increased copper, gold, and rhenium recoveries, accelerating exploration activities for the 2021 drill program and advancing discussions, with First Nations, BHP and regulators, regarding access to key infrastructure.

Northisle Copper and Gold

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Sam Lee, President and CEO of Northisle Copper and Gold Inc. Sam, could you give our readers/investors an overview of your Company and also what differentiates your Company from others?

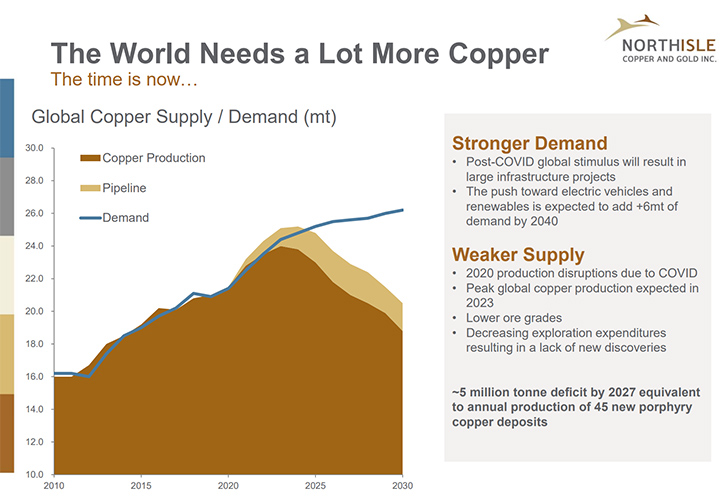

Sam Lee: Sure, Al. Thanks for that. Perhaps the best place to start is the reason I joined a copper and gold development Company after working for over 20 years as an investment banker. I am trained as a hydrometallurgical engineer, with a focus on large copper and gold porphyry systems. I am a huge believer in copper as a strategic commodity and gold as a strategic currency. China is importing unwrought copper at a record-breaking pace, which reminds me of the run we saw, over a decade ago, resulting from similar government stimulus packages spurred by the global financial crisis. The difference between then and now is that there seems to be a differentiation between copper and the rest of the base metals. To me, current copper demand is directly driven by the rapid movement towards technology and innovation such as electric vehicles, and demand from China is driven by their ability to efficiently realize their electrification strategy. The supply side has historically been constrained by larger and larger projects that become more and more unsustainable to develop given environmental, social, and financial constraints. This has recently become exasperated by COVID-19, where you see production and development being halted across the globe and social license being tested, under these extraordinary circumstances. It all points towards a very interesting time for copper. In contrast gold, in my opinion, is a currency not a commodity, with embedded option value and “safe haven” investor sentiment, which justifies its price today currently trading at historical highs.

Our Northisle copper and gold project has it all. As you mentioned in the beginning, it boasts a very large copper and gold resource base, with over 33,000 hectares of under-explored territory on our 100% owned property. The project is located in British Columbia, which is one of the safest and most prolific mining jurisdictions in the world, where social and environmental sustainability is at the forefront of every decision that is made. We are located adjacent to the now reclaimed Island Copper Mine, owned and operated by BHP, whose existing infrastructure could really help us as we develop our mine.

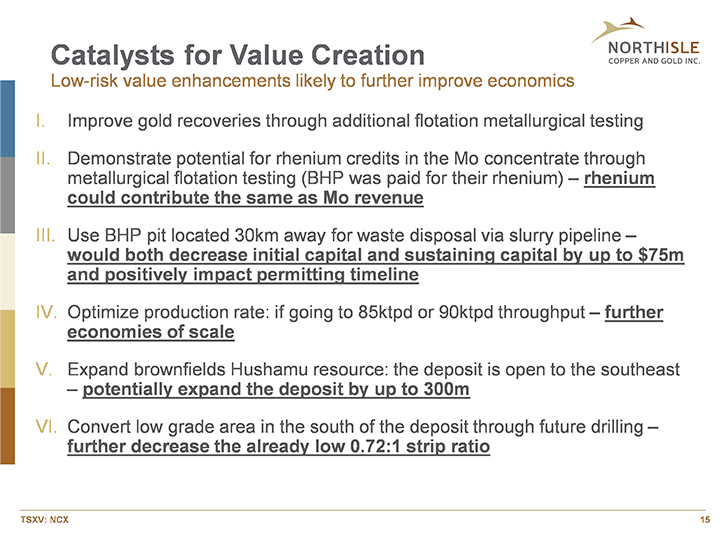

We are advanced beyond just a typical exploration company. We completed a preliminary economic assessment in 2017, which yielded a robust project. We’re in the midst of updating this study for increased metallurgical recoveries and updated resource and economic assumptions.

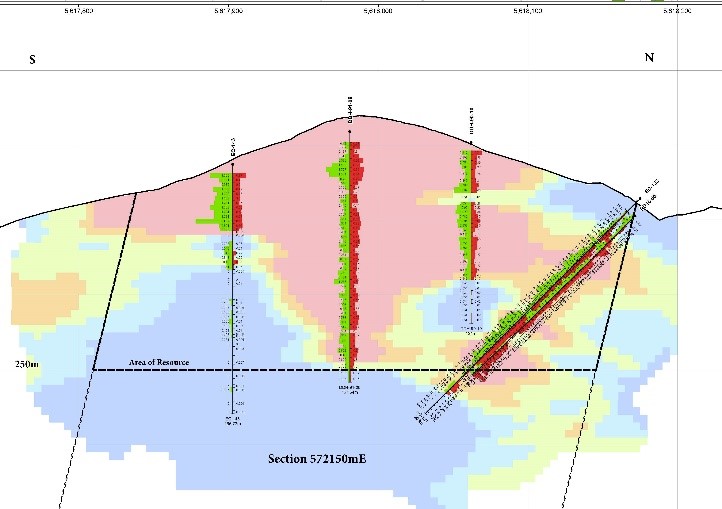

I should note that one of the most attractive things about this project is its low strip ratio of approximately 0.72:1 waste to ore. The fact that we are not spending all of our efforts moving waste, really helps decrease our operating costs substantially. That is one of several factors that makes this project so special.

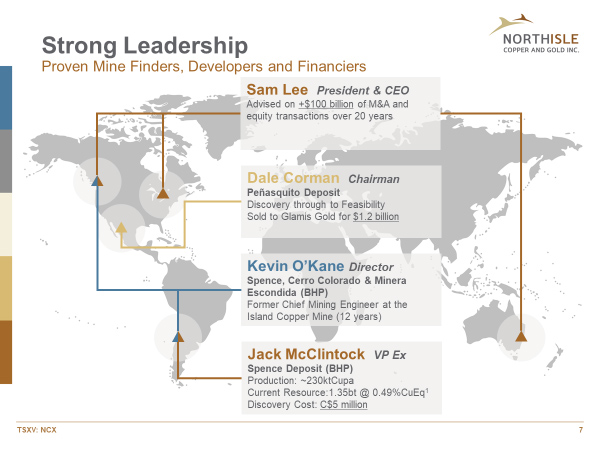

And lastly but certainly not least, our team is comprised of some of the most well-known and respected geologists, engineers, developers and capital market experts in the world. Dale Corman, our founding Chairman, took the Penasquito deposit from discovery to sale to Glamis/Goldcorp (now Newmont) for $1.2 billion. Jack McClintock, who is our VP Exploration, was recognized for discovering the world-class Spence deposit for BHP. And we recently added Kevin O’Kane to our Board who has over 40 years’ experience working for BHP and SSR, developing, expanding, and operating some of the most significant mines in the world, including Spence, Escondida, and Cerro Colorado. Kevin also started his career at the adjacent Island Copper Mine, where he rose to Chief Mining Engineer.

Dr. Allen Alper: That sounds excellent! Sounds like you're in a great position! It's great that you were able to get Kevin on the Board and have the BHP mine next door. That all sounds like great symmetry to have such a fabulous large resource in a wonderful location and on Vancouver Island. You have a lot going for you, and it's great that you have the background in both hydrometallurgy and also the banking experience to get the funds necessary to develop the project.

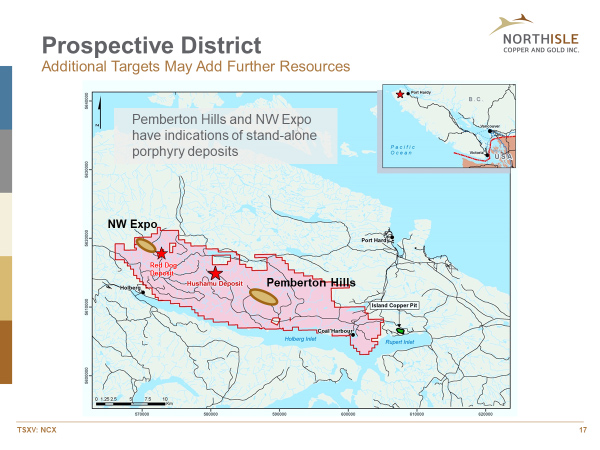

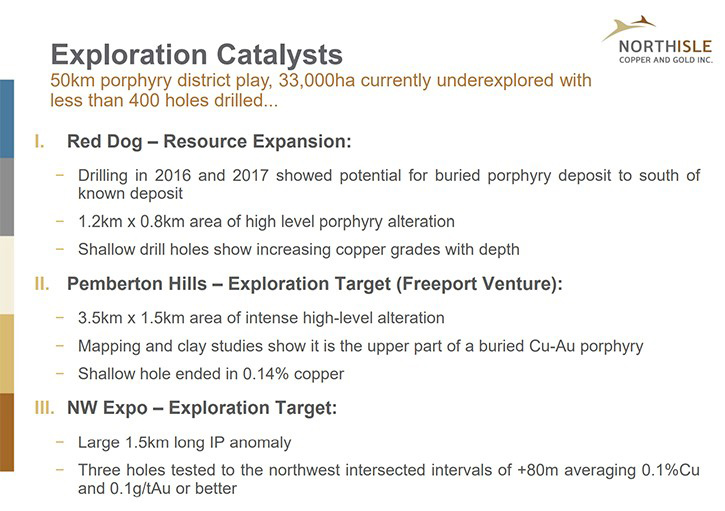

Sam Lee: Thank you. One thing that I want to re-emphasize is that we have a very prospective land holding, over a 50 km porphyry district play, which has been underexplored to date. To have a proven mine finder, like Jack, running our exploration program is truly unique and enhances our chance of further discoveries. Among the higher potential targets is the Pemberton Hills property, where Freeport currently holds an earn-in option. The hypothesis is that this target has the same signatures as the Timok deposit in Serbia that was owned by Nevsun and Freeport and sold to Zijin for over $1.5 billion. This would be a new discovery outside of our current project. In addition to this target, we will also be advancing resource expansion drilling around our higher-grade starter pit at Red Dog and discovery drilling at NW Expo, just adjacent to Red Dog.

Dr. Allen Alper: Oh, that sounds excellent! Could you tell our readers/investors a little bit more about your capital and share structure?

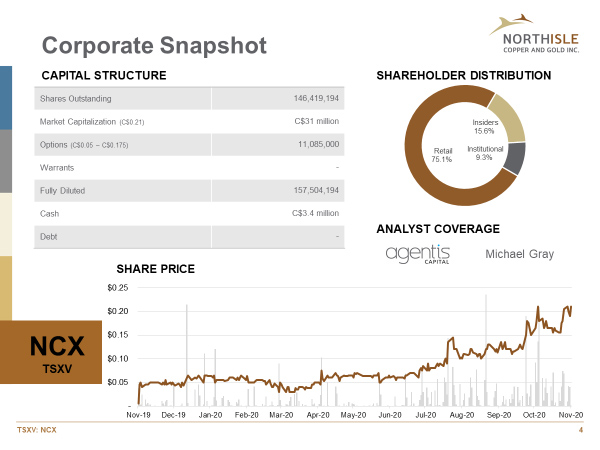

Sam Lee: It's clean! That was obviously an important part of my diligence before joining. We just recently raised $3.2 million in hard dollars. This Company doesn't have any warrants outstanding and we remained disciplined about issuing them relating to this financing. Post offering, we have approximately 146 million shares outstanding and approximately 11 million options outstanding issued to Management and Directors. We have approximately $3.4 million in cash and no debt. Management and Directors own approximately 16%, while institutions own approximately 9%. Sprott was our lead institutional investor, in our last offering. We will continue to build out our institutional base moving forward. I have forgone my base salary, taking all my compensation in options. I also subscribed to the last offering, purchasing approximately 1.2 million shares, at the offering price.

Dr. Allen Alper: That sounds good. It's good to see that you have skin in the game and that you're confident in the Company and you're willing not to take a salary and just to invest in the Company.

Sam Lee: I wouldn't have it any other way.

Dr. Allen Alper: Sam, could you tell our readers/investors the primary reasons they should consider investing in Northisle?

Sam Lee: Sure. Northisle represents a unique opportunity to invest in an attractive risk return profile, with exponential leverage to the upward trending copper and gold price movements. We are systematically de-risking the project through to a production decision, with an excellent foundation to support our belief that this will be a leading candidate among the next mines to be developed in BC. I am confident that if you believe in copper and gold, and take a look at our project, location, existing infrastructure and the people involved, you will find this story quite attractive.

Dr. Allen Alper: That sounds excellent, Sam. Is there anything else you'd like to add?

Sam Lee: The next six months will be very active. First, and most important, we will be dedicating a great deal of attention to building our relationships with First Nations and the communities near the North Island project. In parallel, we will be updating our PEA and proceeding to a pre-feasibility study in short order. During this period, we will advance our exploration work aggressively. Finally we will continue to take a disciplined approach to strategic alternatives, including partnership, mergers and acquisitions.

Dr. Allen Alper: Well, that sounds great. It sounds like it's an excellent opportunity for our readers/investors. This coming year is going to be a very exciting time for Northisle, by producing results and updating your PEA.

Sam Lee: Absolutely.

Dr. Allen Alper: We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.northisle.ca/

Sam Lee

President and CEO

Phone: 604-638-2515

Email: info@northisle.ca

|

|