District Metals Corp. (TSX-V: DMX, FRA: DFPP): Advanced Exploration Stage, Polymetallic Project, in the World Class Bergslagen Mining District of Sweden; Garrett Ainsworth, President and CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/19/2020

District Metals Corp. (TSX-V: DMX, FRA: DFPP) is focused on its advanced exploration stage, polymetallic Tomtebo Property, located in the Bergslagen Mining District of south-central Sweden District, right in between two very, very large polymetallic deposits. We learned from Garrett Ainsworth, President and CEO of District Metals that they acquired the project in July this year, raised $2.4 million, and strengthened the shareholder registry with Sprott US, Commodity Capital, Gold Breaker, Bridgeport Capital, and several other institutional and high-net-worth investors. Near-term plans include a drill program in the first quarter of 2021.

District Metals Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Garrett Ainsworth, who is President and CEO of District Metals Corp. Garrett, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

Garrett Ainsworth:District Metals is a fairly new Company. When I left NexGen Energy in early 2018, as VP Exploration & Development, I went looking for the right vehicle to select and I found it with District Metals, given who the founding shareholders are and the share structure. When I came on, it was just a shell company, but I was given a mandate to go out and find a highly prospective project somewhere around the globe. I wanted high-grade and precious metals, base metals, the bread and butter type commodities, no more specialty metals.

So it was about an 18-month process that I started. And in late 2019, I was looking through EMX Royalty's portfolio in Scandinavia, and one of their projects, called Tomtebo, stuck out very prominently. It's a high-grade, polymetallic project, in south-central Sweden. So we made moves, signed a definitive agreement in February of 2020. We closed the acquisition in June/July of this year and in doing so, we also did a financing to fund some of the pre-drilling activities that we've been up to this year. We raised $2.4 million and strengthened the shareholder registry, whereby Sprott US came in and took an 11% position in District Metals Commodity Capital, Gold Breaker and some other funds out of the US, a couple of funds out of BC and numerous high-net- worth individuals.

So we have a very good shareholder base and a very clean structure, with no warrants at this point in time. We've been going full-steam, since fully acquiring the project in July of this year, which is leading us towards a drill program in the first quarter of 2021.

Dr. Allen Alper: That's excellent. Could you tell our readers/investors a little bit more about your projects and your properties?

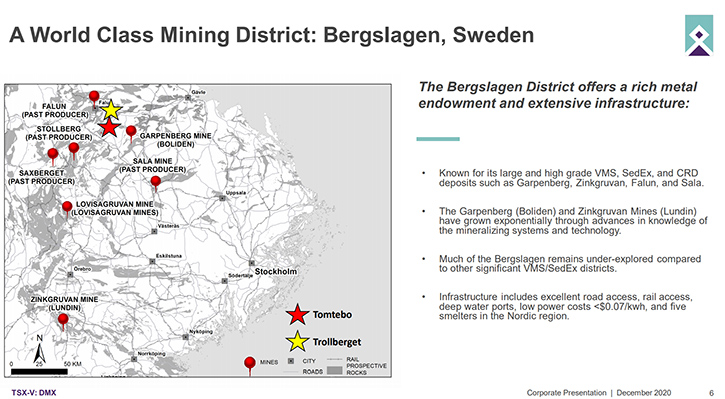

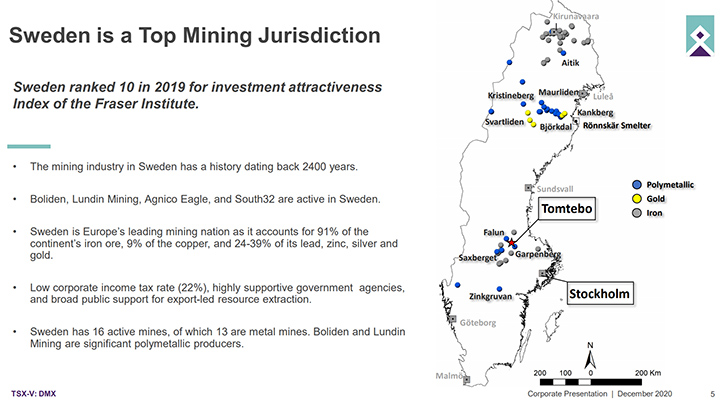

Garrett Ainsworth: Yes, for sure. The Tomtebo project is our main asset. We also have the Trollberget project, which is smaller and less advanced. Tomtebo is what I would call an advanced stage exploration project. The region it's in is called the Bergslagen Mining District. The size of the mineralizing systems in this district got me really excited.

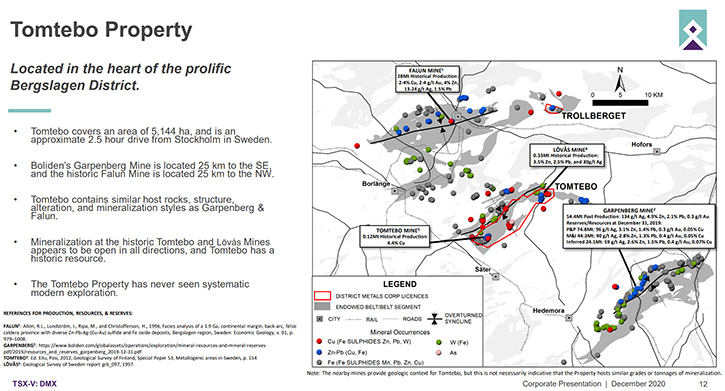

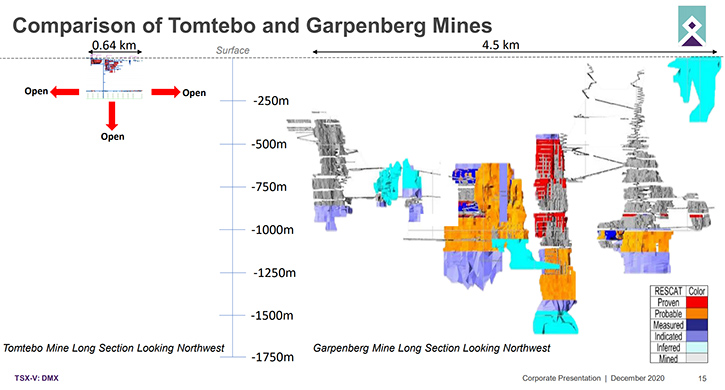

Our Tomtebo project's right in between two very, very large deposits, one called Falun, which was mined out in the 1990s, with 28 million tons produced; around 3% copper, 3 g/t gold, and then all the other metals as well. Garpenberg is 25 kilometers to the Southeast. That's an active mine that Boliden is operating. They're mining it very productively down at the 1400 meter level. So these have a huge vertical extent to them. At Garpenberg, they've produced 54 million tons, where the grades were 134 grams per ton silver, 4.9% zinc and then the other metals as well are in there. At today's prices, it's definitely a silver mine. Then you have Lundin, operating the Zinkgruvan Mine, down in the southern part of the Bergslagen district. There they have over 20 million tons that are being produced, so same type of scenario as Garpenberg. They're down at the 1300 meter level, and it's a highly productive, underground mine.

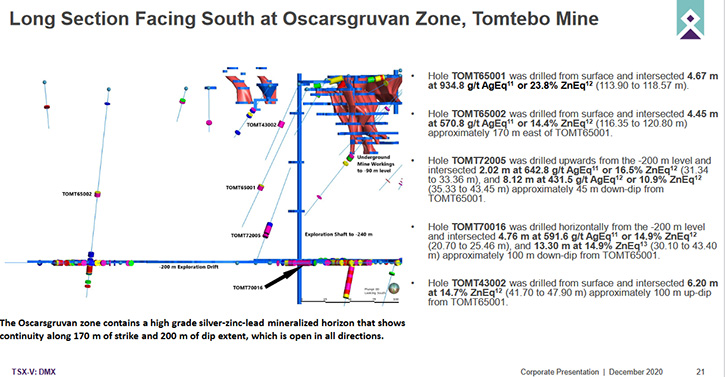

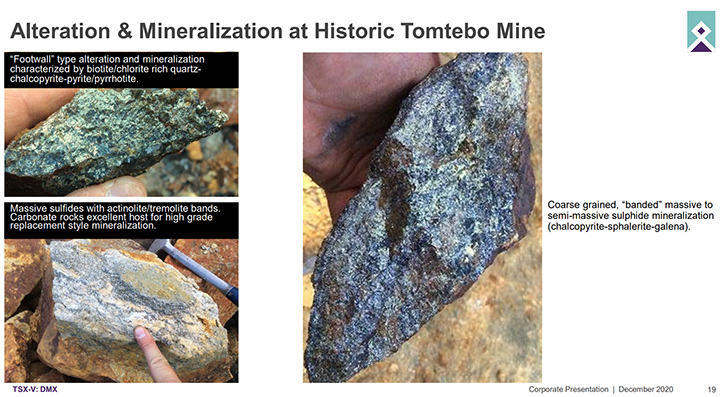

Our Tomtebo project, is quite large at about 5,100 hectares. We cover 17 kilometers of strike length of prospective geology. It has the same geology and structure as the Falun Mine and Boliden's Garpenberg Mine. A number of mineral occurrences, polymetallic and whatnot, exist on the property. But most importantly, we have two historic mines, the Tomtebo Mine and the Lovas Mine, that have exploration data either in the form of mine plans or historic drill holes that show significant polymetallic intercepts or mineralization that's open along strike and at depth down to the 200 meter level.

And you'll remember, I mentioned Garpenberg and Zinkgruvan are both mining down around the 1400 meter level. There's a huge opportunity on the vertical extent side, but not to say that we're going to be drilling deep holes right away. We have some very shallow targets, as shallow as 42 meters.

So that's essentially the Tomtebo Mine in a wrap.

Dr. Allen Alper: Oh, that sounds excellent. It sounds like these next six or so months are going to be a very exciting time for District Metals.

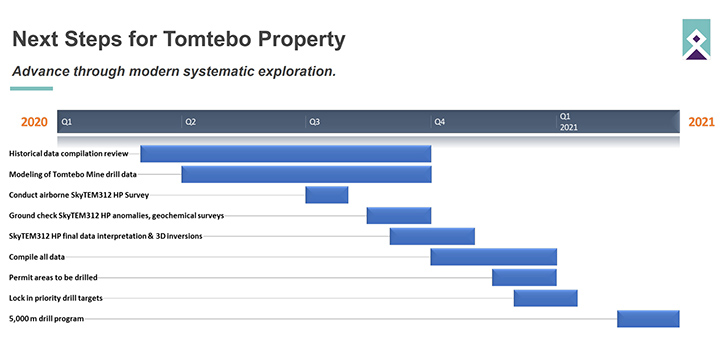

Garrett Ainsworth: Definitely, yes. There has been a lot of work that we've done this year, getting ready for the drill program that we're looking at commencing February/March 2021. One of the things that I identified in Sweden and Scandinavia is that there really hasn't been a lot of modern exploration done on a lot of highly prospective areas, which is largely due to only state-owned companies being allowed to own mining licenses in Scandinavia until the 1990s. This has resulted in Tomtebo not seeing any significant work done since the 1970s.

For instance, the project had never been flown by a deep penetrating electromagnetic and magnetic survey. So that was the first thing we did when we acquired Tomtebo in July of this year, we flew a SkyTEM survey. We put news out yesterday on the results. There are about seven high priority targets and about 18 medium priority targets that were identified on the property. So it was a very successful application of modern exploration techniques and we continue to do that.

I also brought on some consultants. One of them is a local geological expert in the Bergslagen, by the name of Rodney Allen. He played a very important role at the nearby Garpenberg Mine, in helping it to not close down and making some key discoveries there, with his team, to take it to a Tier 1 asset for Boliden. So Rodney came into our project, with some other geologists, and did some mapping and prospecting and sampling. And the interpretations are still ongoing, but it has really tightened up our understanding of the Tomtebo project and really helped us focus on where we need to be drilling.

Also with the historic Tomtebo Mine, we have about 139 historic drill holes, 12,000 meters of historic drilling. So we took all of that data that was in paper form, we digitized it, we brought it into a database and into a Leapfrog 3D model. So it's given us a good look at what the mineralized bodies look like. There are numerous stacked lenses. We have 33 mineralized domains, and it really helped us to pinpoint where we want to start drilling early next year. So, those are the three main pre-drilling type activities that we've been working on at Tomtebo.

Oh, that sounds excellent. Garrett, I wonder if you could tell our readers/investors a little bit more about yourself and your team. I know you're well-recognized and accomplished and have received awards.

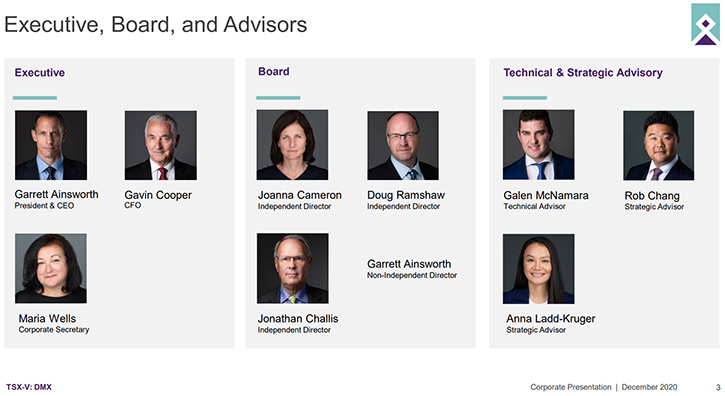

Garrett Ainsworth: Absolutely. I'm a geologist by training. I started off my career, for the most part, in the Athabasca Basin, looking for and discovering high-grade uranium deposits, specifically in the Southwest Athabasca. I won some industry awards along the way as well. I was the VP Exploration for Alpha Minerals, which we got bought out in 2013 by Fission Uranium for $189 million, and that was for 50% of the Patterson Lake South project. Then in 2014, I went on to NexGen Energy, and was the VP Exploration & Development there for four years, had a great deal of success with the Arrow Deposit and other satellite deposits, where we made discoveries and developed it all up. But by 2018, things were moving towards mine development and permitting activities, and that's not really my passion, so it was a good time for me to exit and start up District Metals.

Joining me from NexGen; Joanna Cameron is a Director on District's Board and she was VP Legal with NexGen; Galen McNamara was a Senior Project Manager from NexGen, with whom I worked very closely and he's on our Technical Advisory Board. Also on the Board, we have Doug Ramshaw, who's very well known in the industry and he's an executive on Minera Alamos and a Director with Great Bear Resources. Jonathan Challis is a mine engineer and a MBA. He has many decades of experience on the capital markets side, and also on the issuer side with the likes of the Ivanhoe Group. So he has a huge breadth of experience. I really enjoy listening to his advice.

Our strategic advisors are Rob Chang, who was an analyst with Cantor. Also Anna Ladd-Kruger, an executive with McEwen Mining. I'm joined on the executive team by Gavin as CFO and Maria as Corporate Secretary, supporting me there.

Dr. Allen Alper: Well, you and your team are very experienced and very accomplished. So it's a great team, great group. Could you tell our readers/investors the primary reasons they should consider investing in District Metals Corp.?

Garrett Ainsworth: Definitely. District Metals was put together with a great deal of thought. That started with making sure that the founding shareholders were the right group to be with and the structure was a key consideration.

Our Tomtebo project came into District Metals, as a result of an 18-month due diligence process. We looked at hundreds of projects before selecting Tomtebo. A lot of projects we looked at, I just shrugged my shoulders and was on to the next. But Tomtebo really does tick all the boxes, in that it's in an amazing jurisdiction being Sweden. Scandinavia is very supportive of exploration through to mining. The permitting process is very, very straightforward. There's a long history of mining in Sweden. They have excellent infrastructure, which helps keep costs down. The all-in drilling costs are about $300 a meter Canadian, which is very competitive, no matter where you are in the world.

The infrastructure consists of an amazing network of roads, rail access, and deep water ports. There are low power costs because they use hydro and nuclear quite a bit. Also, very importantly, there are five smelters in the Nordic region. So any concentrate, from the mines in the region, doesn't have to go to Asia. They stay in Scandinavia. And the Scandinavian countries are very much going green. There's actually a battery factory up in Northern Sweden, called Northvolt that's being built right now. Their whole platform is going to be a net zero battery factory. They've stated that they're going to source all their metals locally. That's where everything's going in Europe and in Scandinavia.

So jurisdiction-wise, it's a big, big box that gets ticked. Also in terms of a district, with large polymetallic mineralizing systems, I don't really know too many other districts that have what Bergslagen has with the mines, like Garpenberg Mine and Zinkgruvan Mine, those are very, very large systems. And that's what we're looking for, an elephant-sized polymetallic deposit, on our Tomtebo project. I think the fact that we're sandwiched right in between two very significant deposits is a very good way to start, especially given that we're an advanced-stage exploration project, with two historic mines that have all sorts of significant drill intercepts on record, which is absolutely key. And it doesn't hurt to be polymetallic, because you're hedged with all the different metals. And of course, we have very high precious metal content, which is very helpful with where we are currently, where it looks like aggressive inflation is going to come eventually.

Dr. Allen Alper: Sounds like very strong reasons to consider investing in District Metals Corp. Garrett! Is there anything else you'd like to add?

Garrett Ainsworth: We're on schedule to have a very exciting 5,000 meter drill program early next year. It's all coming together quite well and we're very excited to kick it off.

Dr. Allen Alper: That sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.districtmetals.com

Garrett Ainsworth

President and CEO

(604) 288-4430

|

|