Seabridge Gold (TSX: SEA, NYSE: SA): Unparalleled Leverage in an Emerging Gold Bull Market, Transformative Acquisition of Pretium Resources’ World-Scale Snowfield Property; Rudi Fronk, Chairman & CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/14/2020

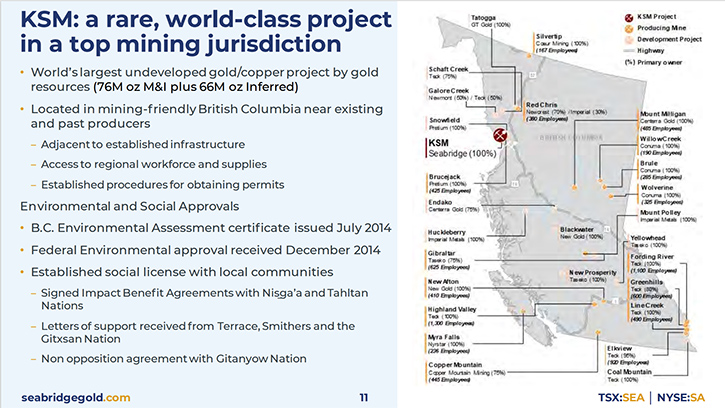

We learned from Rudi Fronk, Chairman & CEO of Seabridge Gold (TSX: SEA, NYSE: SA), that they are buying Pretium Resources’ world-scale Snowfield Property, which hosts a large gold resource, immediately adjacent to Seabridge's 100%-owned KSM gold-copper project, in northeast British Columbia, Canada. This transformative acquisition enables exciting new development opportunities for KSM, which could have a significant positive impact on project economics. Snowfield today already has a resource base of 35 million ounces of gold, of which 26 million ounces are measured and indicated, in a configuration that could be mined as an open-pit. In 2021, Seabridge Gold is going to update the KSM pre-feasibility study to incorporate Snowfield into its mine plan.

Dr. Allen Alper: That's great news that you are buying Pretium Resources’ world-scale Snowfield Property, which hosts a large gold resource, immediately adjacent to Seabridge's, 100%-owned, KSM gold-copper project, in northeast British Columbia, Canada. I think the timing is excellent. Very exciting! A great time for Seabridge Gold! So that's excellent. I'm very happy that we have the opportunity to talk about it today.

Rudi Fronk: Thanks Al. We are very excited about the acquisition. I've been in the business for 40 years now and this is not only the largest acquisition, with which I have been involved, but over time I believe it will prove to be the most accretive, in terms of adding value for our shareholders.

Dr. Allen Alper: Rudi Fronk is both Chairman and CEO of Seabridge Gold. Rudi, could you give our readers/investors an overview of your Company, what differentiates your Company from others, and also talk with us about your exciting new acquisition of Snowfield.

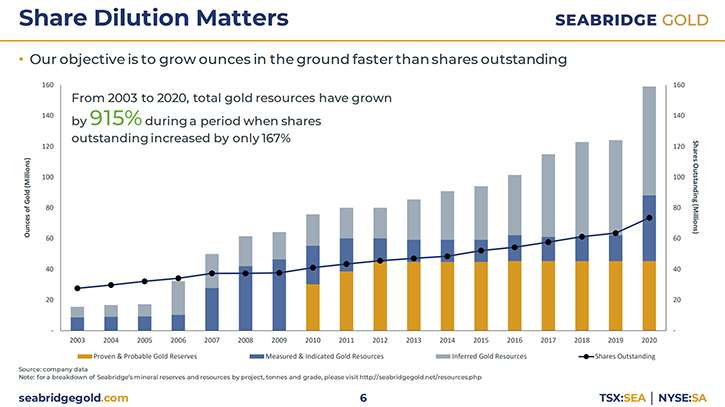

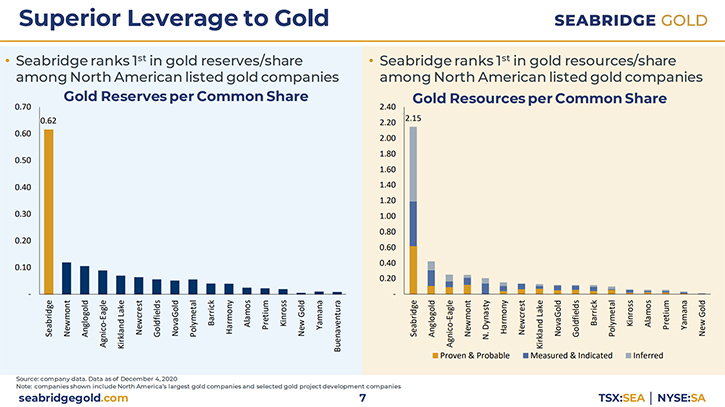

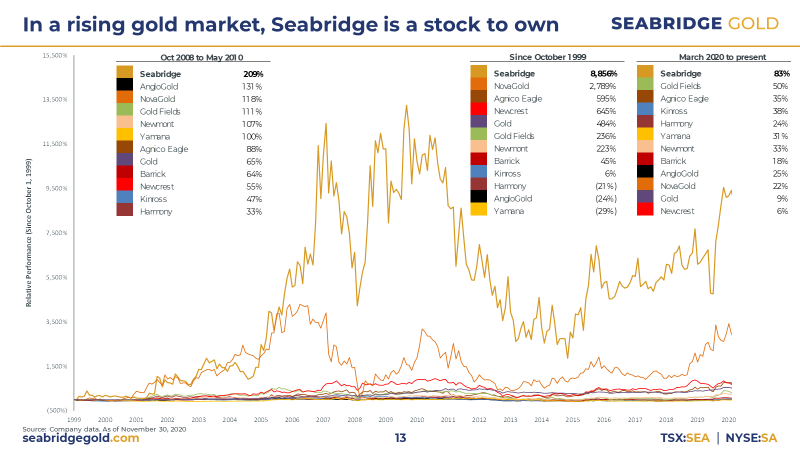

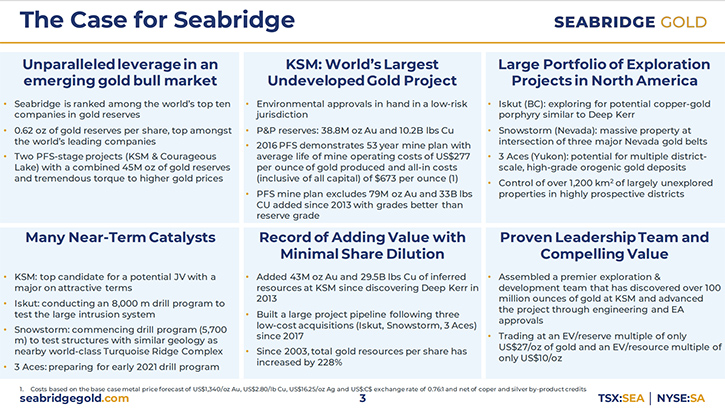

Rudi Fronk: My colleagues and I formed Seabridge in 1999, with a view that over time the price of gold would go substantially higher. Gold then was trading at about $260 an ounce and today, as you know, the price of gold is above $1800. Our goal was to create the best leverage play to a rising gold price. We accomplish that through the simple business plan of trying to grow our ounces in the ground faster than our shares outstanding. We believe that the more gold ownership you provide per share, the more leverage you should have to a rising gold price. Investors buy gold stocks as a proxy for gold.

If you look at our 21 year track record, we've delivered on the concept of growing ounces per share, year in and year out. In fact, today we provide far more gold ownership per share than any other North American listed gold company. As a result, our share price has significantly outperformed the gold price and other gold equities, during the past 21 years. We still believe that the price of gold will go substantially higher from current levels, and if that is the case, our shares should continue to provide exceptional leverage to higher gold prices. And with Snowfield, we think our share price goes higher, even if the gold price doesn’t.

Dr. Allen Alper: Oh, that's fantastic! That's a great accomplishment! It shows that you and your Team are doing all the right things.

Rudi Fronk: Well, thank you. We believe we are. That's what our shareholders expect us to do.

Dr. Allen Alper: Great! They're in good hands. Could you tell our readers/investors a little bit about your new acquisition, how important it is, your plans for it and how it strengthens Seabridge and the synergy it gives you?

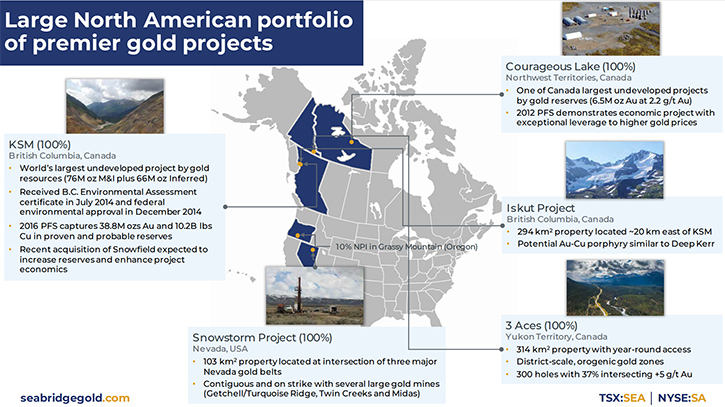

Rudi Fronk: As a bit of background, we've been working diligently on our KSM project since 2006, which is now defined as the largest undeveloped gold-copper project in the world, as measured by our reserves and resources. We finished a pre-feasibility study on KSM in 2016 that captured 38.8 million ounces of gold and 10 billion pounds of copper, in proven and probable reserves. These reserves come from four deposits, which would be sequentially mined over a 50 year mine period, incorporating both open-pit and block cave mining.

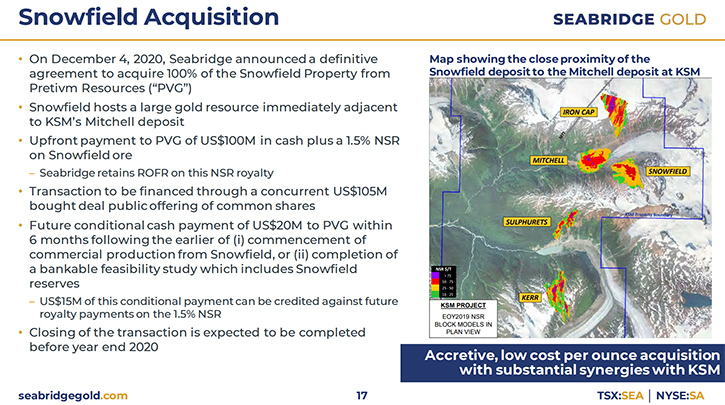

Just east of KSM, sits the Snowfield deposit, owned by Pretivm Resources since 2010. They’ve concentrated their efforts over the past decade on their 100% owned Brucejack project, which is now a successful high-grade underground mine.

We've been studying Snowfield for years, thinking that it would make sense to one day incorporate Snowfield into the greater KSM. In fact, in 2011, we did a joint study with Pretivm to look at how Snowfield could improve KSM’s economics and came to the conclusion that yes, it could have a meaningful positive impact on KSM. However, it took us another 9 years to reach an agreement with Pretivm that satisfies each of our objectives. The reality is that Snowfield really has no logistical way forward, except as part of KSM, so this sale was inevitable.

In the deal we just announced, we get Snowfield at a great price and Pretivm gets US$100 million up front in cash that they will use to pay down debt, plus Pretivm retains a 1.5% royalty on future production from Snowfield. We also agreed to a future conditional payment of US$20 million, at the point when a bankable feasibility study is completed on KSM that incorporates reserves from Snowfield into KSM’s mine plan. US$15 million of that payment will be in the form of an advanced royalty, credited against future royalty payments.

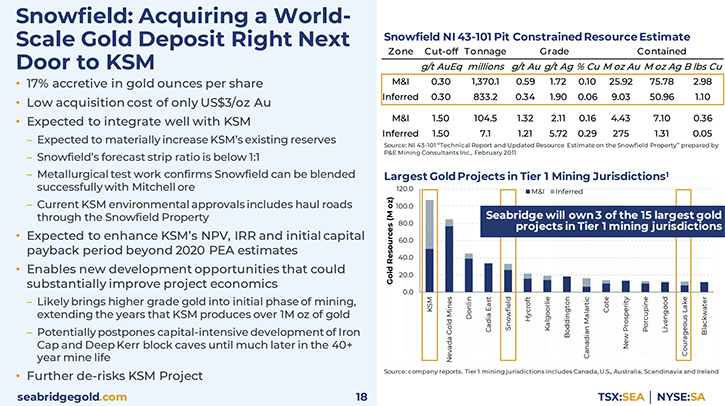

Snowfield already hosts 25.9 million ounces of gold in the measured and indicated categories, plus an additional 9 million ounces of inferred gold resources. At an upfront purchase of US$100 million, we are buying existing gold resources at about US$3 per ounce. Previous studies by Pretivm show that Snowfield could be mined as an open pit, with waste to ore ratios of less than 1:1. In our joint studies with Pretivm in 2011, we conducted metallurgical tests showing that material from Snowfield could successfully be blended with ore from KSM.

We have already started working on an updated KSM pre-feasibility study that we believe will increase KSM’s gold reserves and significantly improve KSM’s net present value, internal rate of return, and capital payback. These expected improvements will come not only from some of the better gold grades that sit at the top of the Snowfield deposit, but also from our expectation that we will be able to show a project, where the first 30+ years of mine life will come from open pit operations, thereby delaying the need to develop capital intensive underground block caves for decades. We believe that over time the market will understand why this acquisition is so accretive to us and our shareholders will be rewarded in terms of share price appreciation.

Dr. Allen Alper: Well, that's excellent. That sounds like it's a great opportunity for Seabridge Gold and for your investors and stakeholders. There's such great synergy between that property and your current properties! So I think that'll be great! Could you tell us a little bit more about the financing arrangement of the funding and how that's going to work?

Rudi Fronk: To complete the purchase we had to find a way to pay US$100 million upfront. Concurrently with signing the acquisition agreement with Pretivm, we arranged a US$105 million bought deal financing led by Cantor Fitzgerald. We have now closed the financing, bringing in US$115.7 million in gross proceeds as Cantor also exercised their 10% over allotment option. We were pleased to see that our existing shareholders subscribed for well over half of this financing.

Dr. Allen Alper: Well. That's excellent. That's great to be in a position where you have such loyal, dedicated shareholders, who have faith in your Company and what you're doing and have been able to help you complete this transaction.

Rudi Fronk: One of the reasons we have such a loyal and long-standing shareholder base is staying true to our long standing corporate objective of growing ounces per share. For this acquisition we issued 6.7 million shares to pay for Snowfield. In return, we are buying 25.9 million ounces of gold in the measured and indicated categories, plus an additional 9 million ounces of gold in the inferred category. So when you do the math, we're getting more than five ounces of gold per common share issued. This is well above our ounce to share count prior to this acquisition. It has been this discipline over the past 20 plus years that has led to our share price outperformance measured against gold and other gold equities.

Dr. Allen Alper: Fantastic! That's really an excellent opportunity and synergy for Seabridge Gold. A lot of planning went into this and a lot of negotiation and you and your Team did extremely well. It shows you are not only geologists and mining engineers but also great businessmen.

Rudi Fronk: Well, thank you.

Dr. Allen Alper: Could you tell our readers/investors your plans for the remainder of 2020, and also 2021?

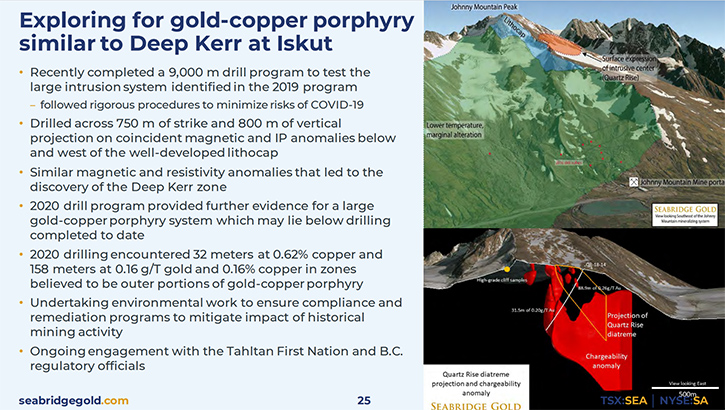

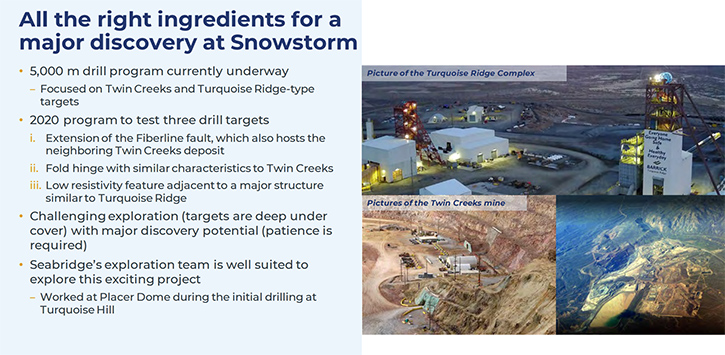

Rudi Fronk: As of now, we have completed most of our 2020 programs. We announced the results of an exploration program we completed at Iskut, a project in British Columbia Canada and close to KSM, focusing on the discovery of a gold-copper porphyry deposit beneath a lithocap. In the program we did encounter gold and cooper and alteration consistent with the outer limits of a porphyry system. We are currently drilling at our Snowstorm project located in Nevada where we believe we have the opportunity to find a deposit similar to the nearby Turquoise Ridge and Twin Creeks mine owned by Barrick and Newmont. We expect to complete the program at Snowstorm in early 2021

We are now focusing on defining our 2021 programs. At KSM we are planning on collecting the necessary data required to complete an updated pre-feasibility study to incorporate Snowfield. We will also continue to satisfy the conditions of the environmental approvals and permits we have in place.

In 2021 we also expect to undertake follow-up drill programs at Iskut and Snowstorm, and our first drill program at 3 Aces, a project in the Yukon we acquired this year. All in all, 2021 is shaping up to be a very busy year for us. Hopefully, by the time we start our field programs, which tends to be May or June, the world will have opened up a bit more, in terms of restrictions we may encounter as a result of COVID.

Dr. Allen Alper: Oh, that sounds great. It does sound like 2021 will be an extremely exciting time for Seabridge.

Rudi Fronk: Our big push next year is to secure a joint venture partner for KSM. As you know, we need a major mining company with the technical, financial and social capabilities to advance KSM to production. We believe the addition of Snowfield makes KSM a highly desirable target for potential partners, especially those who prefer open pit mining. In addition, gold and copper prices are higher than they have been in years so these large companies are now generating cashflows sufficient to fund KSM. The fact is, the industry’s reserves of gold and copper are on life support. It’s time for the majors to start addressing their need to replace reserves. When you combine all of these factors, the stars are lining up for us to get a deal done on terms that suitably reward our shareholders.

Dr. Allen Alper: Oh, that sounds great. That sounds like everything is falling together. Rudi, would you tell our readers/investors a little bit more about yourself and your Team and also your book?

Rudi Fronk: I am a mining engineer and have been in the gold business for about 40 years. In 1999 I co-founded Seabridge and have served as the Company’s CEO since its inception.

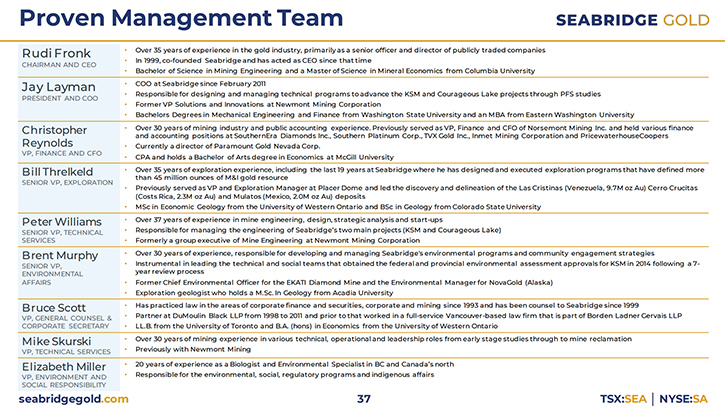

One important lesson I've learned in my career is not so much what you can do and what you know, it's who you bring around you as part of a team. I could not be more pleased with the Team we've assembled here at Seabridge from the engineering team that mostly come from Newmont, to the exploration team that mostly come from Placer Dome and the environmental group that has successfully obtained environmental approval and permits for KSM, the largest project ever permitted in Canada. The Team is what makes it happen. Everybody working together, with the same guiding principles designed to create value for all stakeholders.

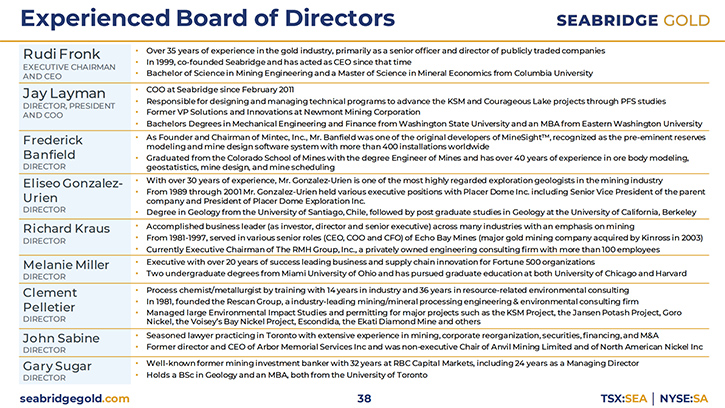

Dr. Allen Alper: You have a very balanced Board.

Rudi Fronk: My view on a Board is that you cover off all of the technical, financial and ESG disciplines necessary. We have all the boxes checked on our Board in terms of the disciplines needed to be effective.

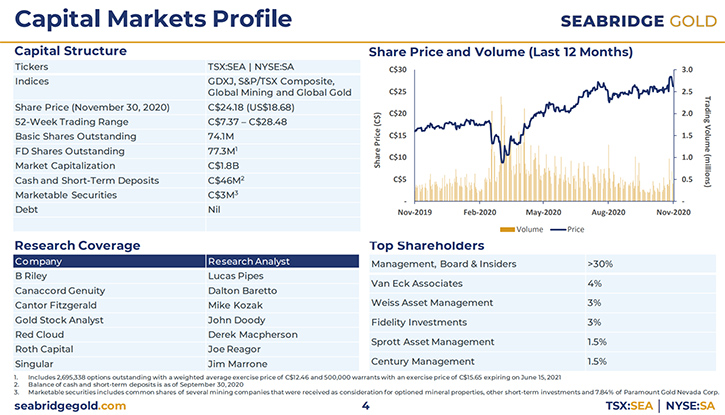

Dr. Allen Alper: Well, you have a great Team and Board. Very well-balanced! So that's excellent! Could you tell our readers/investors a little bit about your share and capital structure?

Rudi Fronk: We are very proud of the fact that after 21 years, we only have 74 million shares outstanding. One of the biggest risks you face in the exploration and mine development business is the risk of equity dilution. It always amazes me how quickly share counts in companies can grow to hundreds of millions of shares outstanding, without offsetting dilution with accretion in value. Our capital discipline revolves around following our guiding principle of growing ounces per share. It’s now been 21 years since we took over Seabridge, which at the time was a shell company with about 17 million shares outstanding. Yes, the share count has gone up, but our ounce count has grown at a much higher rate. As a Company, we now report approximately 88 million ounces of gold in the measured and indicated resource categories, plus an additional 71 million ounces in the inferred category. And this excludes our enormous mineral resource inventory of copper and silver

I think a lot of our success can be attributed to the support we have from our shareholders. Many shareholders, who participated in this last financing, have been with us for well over 10 year, some for our entire 21 year history. It's gratifying to know that shareholders continue to have faith in our stewardship.

Dr. Allen Alper: Oh, that sounds excellent. That's really something of which you can be very proud - how you've managed the Company and how you haven't diluted your shares. Rudi, could you tell us the primary reasons our readers/investors should consider investing in Seabridge Gold?

Rudi Fronk: Well, I think first and foremost is our leverage to the gold price. We have a 21 year track record of showing significant outperformance in our share price relative to the gold price and other gold equities. We believe that gold is now set to go a lot higher as a result of what's going on in the global financial markets. As good as gold has been over the past 20 years, we think the best is yet to come. If that is the case owning our shares should continue to provide significant leverage to a rising gold price.

Second, we own 100% of the largest undeveloped gold-copper project in the world today, which not only sits in one of the safest mining jurisdictions in Canada, but also has gone through the environmental assessment process, with assessment certificates in hand and permits to begin construction. The project just got a lot better with the addition of Snowfield.

Finally, Seabridge has been built off the back of exploration success. Our Team has found more gold over the past 15 years than any other gold company on the planet and that includes the majors. Over the past several years, while the gold market was depressed, we took advantage of that and went out and acquired three earlier stage exploration projects, any one of which we believe could be a company maker. We are now just getting started on these projects and I believe our exploration success will continue.

Dr. Allen Alper: Well, those are very compelling reasons for our readers/investors to consider investing in Seabridge Gold. Not every company has that track record. I think you are unique with the track record you have, compared to others. Rudi, is there anything else you'd like to add?

Rudi Fronk: Keep an eye on the gold price. I think we're about to see the unleashing of huge amounts of quantitative easing in the US. The deficits we are running in the US are unprecedented, and they're being funded by money printing by the Fed. We believe that more stimulus spending and historically low real interest rates are a recipe for much higher gold prices.

Dr. Allen Alper: Well, that sounds excellent. Sounds like the timing is great for people, who are interested in investing and making money and creating wealth through investing in gold.

https://www.seabridgegold.com/

Rudi P. Fronk

Chairman and C.E.O.

Tel: (416) 367-9292

Fax: (416) 367-2711

Email: info@seabridgegold.com

|

|