GoGold Resources Inc. (TSX: GGD, OTCQX: GLGDF): Silver and Gold Producer, Developing, Exploring and Acquiring High-Quality Projects in Mexico.; Interview with Bradley Langille, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/13/2020

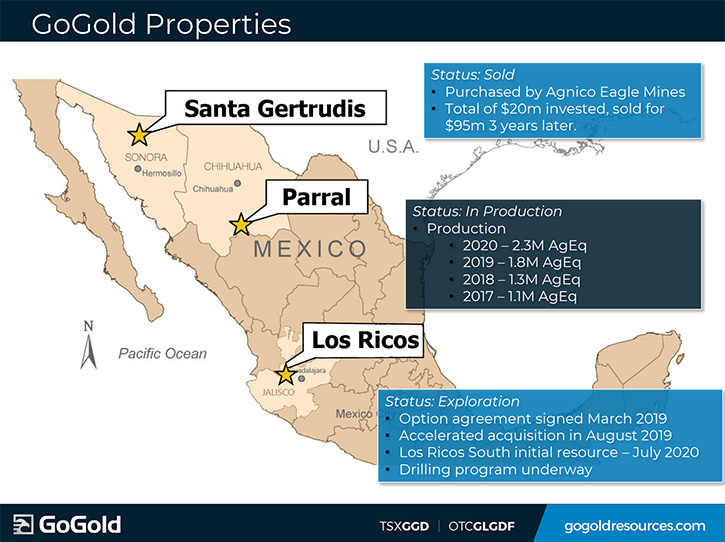

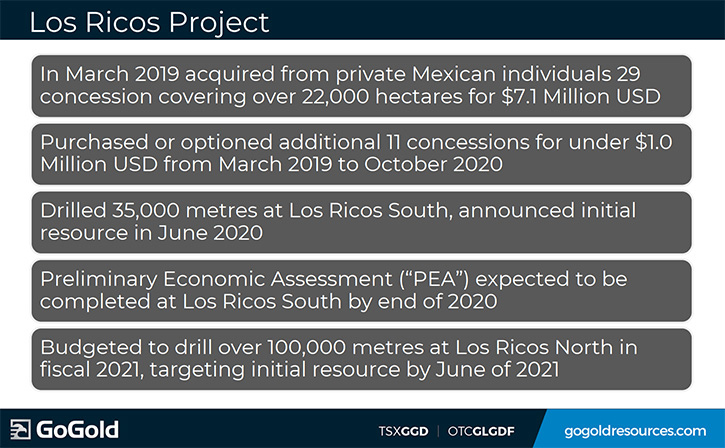

GoGold Resources Inc. (TSX: GGD, OTCQX: GLGDF) is a Canadian-based silver and gold producer, focused on operating, developing, exploring and acquiring high-quality projects in Mexico. GoGold operates the Parral Tailings mine, in the state of Chihuahua and has the Los Ricos South and Los Ricos North exploration projects in the state of Jalisco. We learned from Bradley Langille, President and CEO of GoGold Resources, that they make ~$2 million a month of free cashflow, from the Parral Tailings operation. Their exploration focus is currently in the Los Ricos district, where they have released their first maiden resource on one target, and allocated a budget for another 100,000-meter drill program over the next 12 months. According to Mr. Langille, GoGold has a strong technical team, with approximately 25 years of experience in Mexico, a very strong balance sheet with $52 million in cash, and GoGold's Management owns about 20% of the Company's shares.

GoGold Resources Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Bradley Langille, who is President and CEO of GoGold Resources. Bradley, could you give our readers/investors an overview of your Company and what differentiates your Company from others.

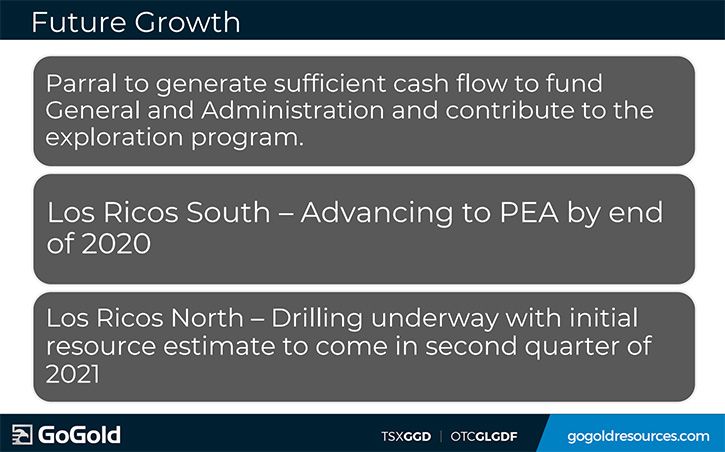

Bradley Langille: Well, GoGold is a junior resource exploration development company and a miner. We are a producer as well. Our projects are in Mexico, where we have a very strong technical team. Of my 27 years in the business, I've spent almost all of it in Mexico. In the past, with other projects I've led in Mexico, other companies I've led as President CEO, we built three mines, and we major- refurbished a fourth. In GoGold, we have the Parral Tailings reprocessing project, which has now been operating for six years. It has another eight years of reserves remaining. Currently, we are producing approximately $2 million a month of free cashflow from that operation, and we have our Los Ricos exploration and development district, where we have released our first maiden resource at one target, and are currently drilling, with six drill rigs, and have budgeted for a 100,000 meter drill program, over the next 12 months.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit more about your properties and your production?

Bradley Langille: Production-wise, our producing asset has eight years left in reserves and has been producing for six years, and it is cashflow positive. It produces $24 million a year of free cashflow and is projected, going forward. It has been producing approximately $2 million a month of free cashflow. On our exploration development assets, we have six drill rigs operating. We expect to expand that to eight to 10 over the coming months. At 100,000 meters of drilling over the next 12 months, we will be one of the largest exploration projects in Mexico. That's on our Los Ricos asset in Politico state, in Mexico. It is only an hour and 45 minutes outside of the second largest city in Mexico, Guadalajara.

One other thing I think I should mention is, besides having a very strong technical team, with approximately 25 years of experience in Mexico, we have a very strong balance sheet. We currently have in excess of $52 million in cash on our balance sheet, with no debt. Our management and management insiders hold 20% of our shareholdings, 20% of the Company. We have a very good institutional following, with some of the larger institutions in the resource space. And they would comprise about 30% to 35% of our shareholdings, along with our retail shareholders.

Dr. Allen Alper: That sounds great. That's an excellent position to be in. Few companies can make that boast! Excellent! That's fantastic!

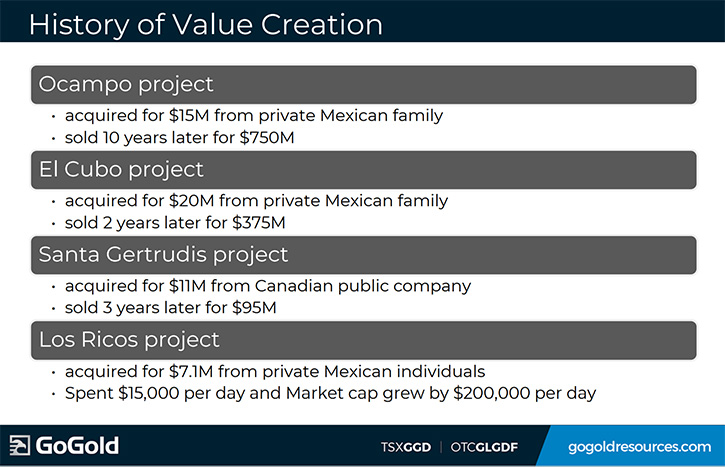

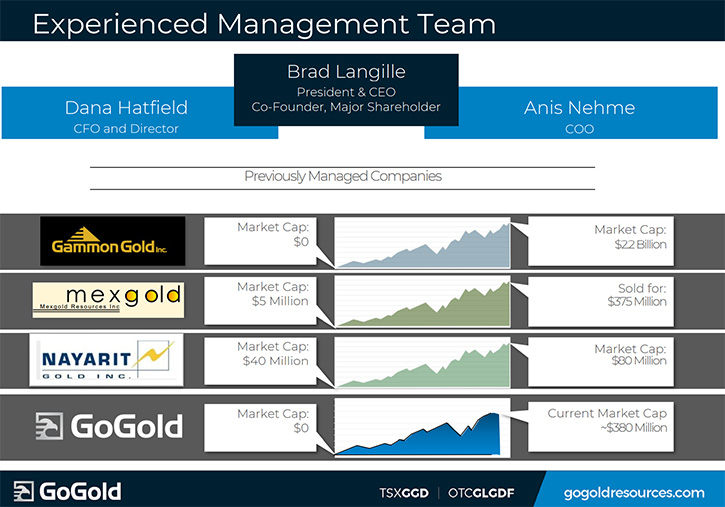

Bradley Langille: My home has been focused in Mexico. Junior mining in particular has a significant risk associated with it, but also, especially in the cyclic industry that we're in, has significant opportunity for appreciation of stock value and for increase in gain in the value of an investment. We're subject to the normal risks of junior mining, no metallurgical risk, resource risk, but the way you mitigate junior mining risks is, to deal with management teams who are experienced. Our experience in Mexico has been around 25 years. I was CEO of a company called Gammon Lake Resources, where we build two large mines in Mexico. The team that did that is still with me today. After producing over a million ounces of Gold, that project was ultimately sold to Carlos Slim for 750 million.

Also, I founded, and led a company, as CEO, called Mexgold, which we bought from a private family, with an approved asset, which we revived. It was a large underground mine. We bought it for 20 million. We invested 45 million, doubling the production. Two years later, we sold it for $375 million. We also had a small company called Nayarit Gold, where we had a discovery in 2010. We sold that to a public company out of New York called Capital Gold for 80 million. In GoGold, more recently in 2017, we sold an exploration asset to Agnico Eagle for $80 million US cash, plus a 2% royalty. A little over a year ago we sold that royalty for another $15 million US and our total investment in that project at that point was 20 million US.

With Los Ricos, our focus is strong technical work, with our well-capitalized balance sheet, to apply that experience and strong technical team to developing Los Rico's asset, which we feel is one of the very best districts remaining in Mexico to be developed.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors a little bit more about your Team and Board?

Bradley Langille: We have an excellent team of Engineers, NGOs and Geologists, with a long history of mining and exploration. There's a very good talent base in Mexico, very technically competent geologists and engineers.

About 250 people are working for the Company. Only five of us were from Canada like myself. We have a couple Engineers and Geologists from Canada. I am a Geologist by education as well. There are advantages in that. First of all, the Mexicans have a lot of experience in mining and exploration, and we're viewed in the country as a Mexican company.

Therefore we're very involved in the mining organization in Mexico. We have local and state and even countrywide connections. That is how we've sourced out many of the very successful projects we've had over the last 25 years. We've dealt a lot with the private families in Mexico, who had mining assets. We’ve brought the capital to these projects. We have financed equity-wise. We raised about $700 million of equity for our projects, over the last 15 to 20 years.

And we've done several hundred million dollars of debt deals to build our projects, with banks such as Bank of Nova Scotia and Bank of Montreal, and other private equity over the years as well. So we have all the elements of technical experience; country experience, strong labor force in the country, and markets experience, where we've been able to finance our projects. We've explored projects, sold projects that we built, bought projects, and have gone all the way to production.

Dr. Allen Alper: That sounds excellent! You and your Team have an excellent track record and skin in the game.

Bradley Langille: Yeah! As CEO, I myself own about 8% of the Company.

Dr. Allen Alper: That's great. Could you tell our readers/investors the primary reasons they should consider investing in GoGold Resources?

Bradley Langille: The best way to mitigate risks in the resource mining sector is to deal with experienced management, technically experienced, capital market experienced, with a long track record of building mines and exploring and discovering deposits. Those are the reasons I think, your readers/investors should look at investing in GoGold. We have all those elements and we believe it's the recipe for success in this business. Our track record demonstrates that.

Dr. Allen Alper: Sounds excellent, Bradley! Is there anything you'd like to add?

Bradley Langille: With our team, we've always been mining-focused and exploration-focused. It's all we do. Mining is a cyclic industry. I've been through several cycles in the mining industry and there's a good hope here that we're on a real upswing in the mining cycle, with the commodity prices, with gold and silver. We're heavily weighted towards silver in GoGold silver and gold resources. We're about 60% by value silver. Over the next 12 months, we have a very large exploration project, with over a hundred thousand meters. It should be very exciting. We'll be coming to the market, almost on a weekly basis, with press releases, keeping everybody very well-informed on how we're progressing with our development at the Los Ricos project, and how well we're doing at our producing mine as well.

Dr. Allen Alper: Sounds excellent! Sounds like it's going to be a very exciting time for GoGold stakeholders and shareholders.

Bradley Langille: Yes. 2020 has been an exceptional year for the Company and we expect 2021 to be another successful year of global advancement!

Dr. Allen Alper: Sounds exciting! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.gogoldresources.com/

Steve Low

Corporate Development

GoGold Resources

T: 416 855 0435

E: steve@gogoldresources.com

|

|