Pelangio Exploration Inc. (PX: TSX-V; OTC PINK: PGXPF): Exploring World-Class Gold Belts in Two of the World's Most Favorable Gold Jurisdictions in Ghana and Canada, Ingrid Hibbard, President and CEO Interviewed, November, 2020

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/11/2020

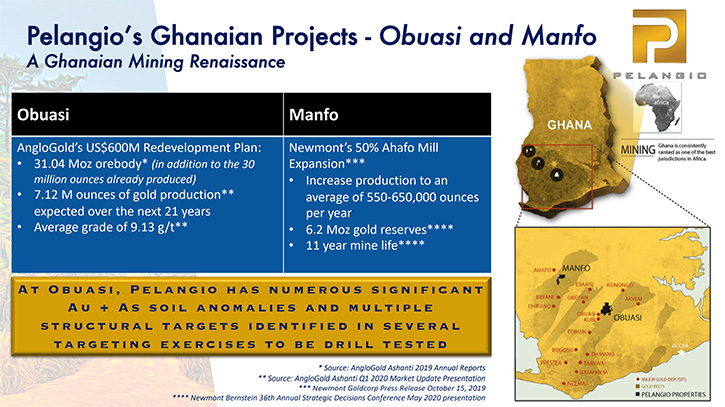

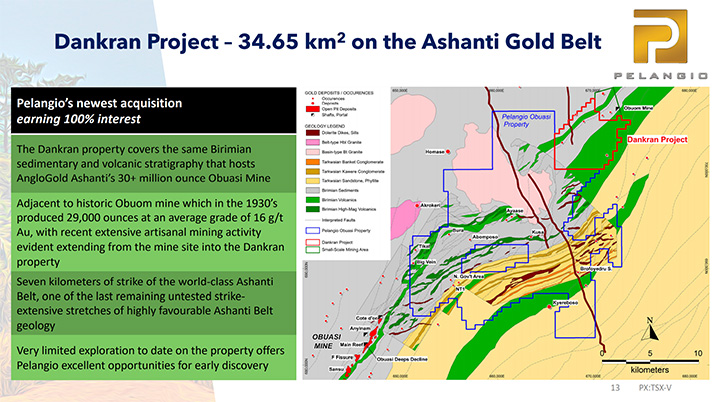

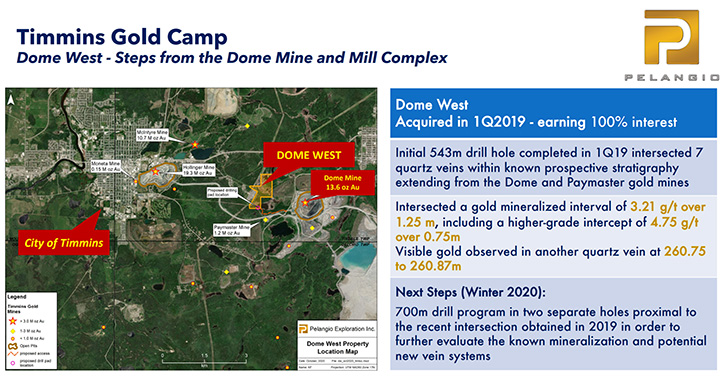

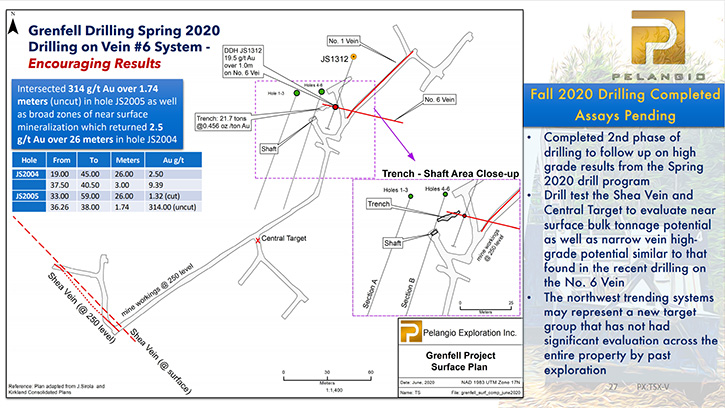

Pelangio Exploration Inc. (PX: TSX-V; OTC PINK: PGXPF) is exploring large land packages on world-class gold belts in Ghana and Canada, two of the world's most favorable gold jurisdictions. In Ghana, Pelangio owns three properties: the Manfo Property, which is a 100 km2 camp-sized project and the site of seven near-surface gold discoveries; the 284 km2 Obuasi Property, located 4 km on strike and adjacent to AngloGold Ashanti’s prolific high-grade Obuasi Mine; and the newly optioned Dankran property, located adjacent to the Obuasi Property. In Canada, the Company is currently focused in Ontario on its Grenfell property, located 10 km from Kirkland Lake; at its Dome West property, situated some 800 meters from the Dome Mine in Timmins; and is advancing its Hailstone property in Saskatchewan. We learned from Ingrid Hibbard, who is President and CEO of Pelangio Exploration, that in the near-term, they are looking to expand the resource in Africa. In Canada, despite the COVID restrictions, Pelangio has demonstrated agility through continuing its exploration programs, during unprecedented economic uncertainty, and has been agile and able to continue to explore. They are currently waiting for the results of their last drilling program at their Grenfell gold project.

Manfo, diamond drilling

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Ingrid Hibbard, who is President and CEO of Pelangio Exploration. Ingrid, could you give our readers/investors an overview of your Company and also, what differentiates your Company from others?

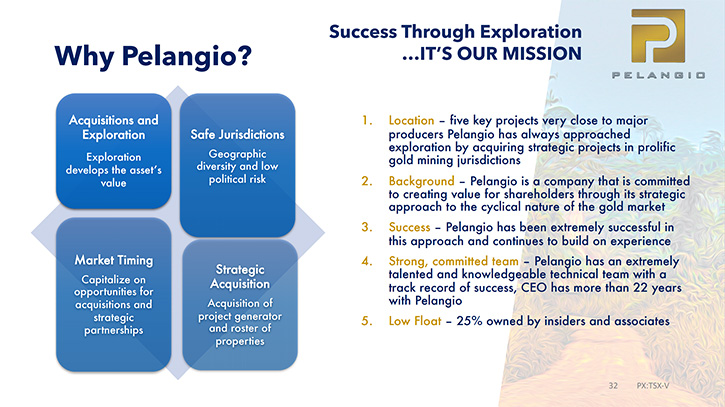

Ingrid Hibbard:Pelangio is a Canadian-based gold exploration company, with properties in Canada and Ghana, two of the world's most favorable gold jurisdictions, in terms of historical gold production and political stability. We have had previous success with our spin off of the Detour Mine, which is now part of the Kirkland Lake family, and we have some spectacular-sized land packages in West Africa and some really strategically located projects in Canada. Some of the things that differentiates us from our peers are the team, the experience and the property portfolio.

Dr. Allen Alper: Excellent. Could you tell our readers/investors a little bit more about the properties and also the areas they're in, and why they're so strategically located?

Ingrid Hibbard: Let's start off with Ghana, which is where we started working, following the Detour transaction. We look for big land packages on some of the world's most prolific belts. We have some tremendous news out this week, as we've just expanded our land package in Ghana. In Ghana, we have a premier exploration project: one of the most highly prospective land packages in all of West Africa. We have 284 square kilometers, adjoining the AngloGold Ashanti Obuasi mine, and we just added another 35 square kilometers, tied on to that, which has not received any modern exploration in the last couple of decades. It's extremely underexplored. Our land package is now about 320 square kilometers, sandwiched between the giant AngloGold Ashanti Obuasi mine, which is a 60 million ounce gold deposit on the one side.

On the other side, along the structure and on the belt, is the Obuasi mine, it's a little bit smaller, but did produce some exceptionally high-grade gold. This property is contiguous with our underexplored Obuasi land package, and we are really excited to acquire Dankran and increase the size of our land holdings. In the coming weeks our plan is to commence soil sampling at Dankran after we complete our initial community engagement. In January, we hope to begin drilling at Dankran. Our other land package in Ghana, is a 100 square kilometers on the Sefwi-Bibiani Belt. We have a resource there of almost 300,000 ounces in the inferred category, and 200,000 ounces in the indicated category.

Our plans for advancing the Manfo project have several objectives. We'd be looking to expand the resource and to make additional discoveries, because we have multiple trends with multiple parallel structures, over seven kilometers, to look at on that 100 square kilometer land package. We are really excited about our African projects. In Canada, we have a couple of really strategically located packages. They're not as big in size as they are on the African side, but virtually in downtown Timmins, right in the heart of a Porcupine Gold Camp. We have our Dome West property, which is located 800 meters from the Dome Superpit.

Unfortunately, we aren't able to access the Dome property to explore, right at this minute, due to COVID restrictions, which limit access to the property. We are so close to the mine that we're literally on the mine's property and they own the surface rights. As a result of the pandemic, they're not allowing non Newmont personnel on the mine property right now. Fortunately, we’ve seized the opportunity to work at our Grenfell Project located 10 km from Kirkland Lake. We are just completing a follow up drilling program. Right now, the core is in for assay and we are awaiting results.

Our previous program at Grenfell, in the spring of 2020, provided some pretty exciting results. We intersected two and a half grams over 26 meters and a very high-grade intercept (uncut) of 314 grams over 1.7 meters, within a broader interval of 1.3 g/t Au over 26 meters. It's an area that had some old workings in it from the 1930s and 40s, had about 265 feet of shaft sinking and 2,000 feet of underground development. There were some bulk samples taken back at that time, 21 tons, almost 22 tons, 0.56 ounces from the surface pit and 177 tons of 0.7 ounces at the 60-foot level.

So, you can see that we're pretty active. We have a lot of things going on and we’re operating in very favorable jurisdictions.

Dr. Allen Alper: Well, that's amazing. You have amazing properties in Ontario and also in Ghana, and in very excellent areas and jurisdictions. The remainder of this year and 2021 will be extremely exciting times for Pelangio, its stakeholders and shareholders.

Ingrid Hibbard: I really think so! One of the big topics now is ESG-environment, social, and governance practices. Because we operate in areas where people are used to gold mining, community engagement and the current community relations are very good. The locals understand gold mining and they understand what it means to their economy and for job creation, and not just for good job creation, but for business creation. Having the support of local communities is critical to the stability of the jurisdictions we operate in.

Dr. Allen Alper: That's excellent. It's great to have local support and be in the areas where people know about mining, appreciate mining and know how to work with miners. Also, you have a lot of skilled workforce in that area of people, who know and have worked in mining for years.

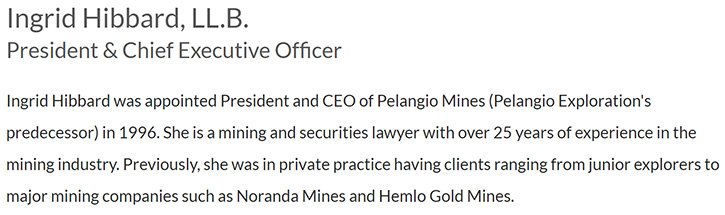

Ingrid Hibbard: Yes. It makes all the difference, doesn't it? Not only do we have great properties and maybe even more importantly, we have great people. I'm the CEO and that's really a small part of what it takes to get this all done.

Dr. Allen Alper: Since you have an outstanding career and accomplishments, maybe you could mention just a few of them.

Ingrid Hibbard: Thank you. We are the team that identified the Detour Camp as an undiscovered gem. We bought the mine from Placer Dome at the bottom of the cycle. So, a big part of Pelangio is about recognizing opportunities and recognizing where you are in the cycle. We were able to buy the Detour mine at a period in the cycle when people were not interested in gold at all, and the mine was shutting down. It was a 52 square kilometer land package on an underexplored part of the Abitibi Greenstone Belt. Similar to what we're talking about at Obuasi, a huge underexplored part of the Ashanti Belt. It's now a 15 million ounce plus, gold mine, and we were able to do it in such a way that when we did the original spinout, we found, again, people are what matter and our shareholders benefitted greatly, which is what motivates us daily.

We found the right people with the Gerard Panneton and Hunter Dickinson team that could finance it and move it forward and make those discoveries and start to get the mine built. It is now a 15 million ounce mine. With Kirkland Lake working it, and with the exploration that's ongoing there, I see it growing and growing tremendously; many more discoveries to be made there in the future. About a year and a half ago, Kevin Filo, who was working with Pelangio, back when we bought the Placer rights, had been running a private project generator in Canada, and we saw the opportunity to work together again. So, that's how we expanded our Canadian portfolio, indeed, that Grenfell project came, when we did the acquisition of 5SD Capital.

Kevin Filo has joined the team to be taking care of the Canadian assets. He has a lot of experience and a successful track record.

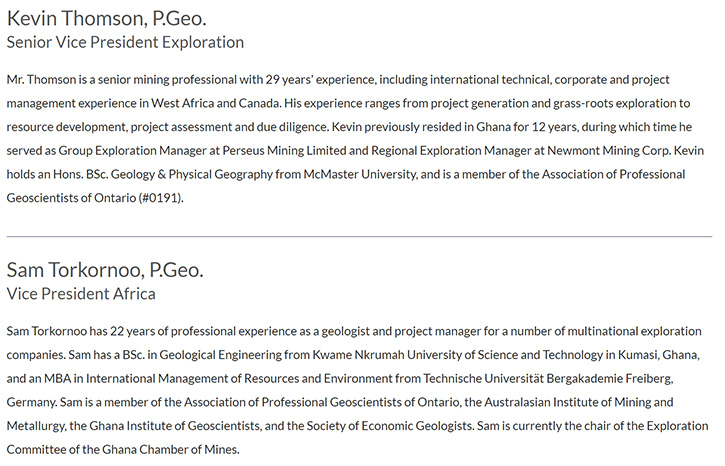

On the African side, Kevin Thompson has worked in Ghana for over 20 years. He was with Newmont as their Head of Exploration for West Africa, and then he worked with Perseus, when they were drilling off a couple deposits, and he lived in Ghana for about 12 years. He has tremendous experience and a skillset in Ghana and on the ground. I think this is very important that our Senior VP of Exploration is Canadian and has lived in Ghana. We have filled our team with some younger geologists. It doesn't require experts to be running back and forth all the time, and because of Sam Torkornoo, our VP Africa, who resides in Ghana, and Kevin Thompson, we were able to make the acquisition of this Dankran property.

We think it is a Jewel, 35 square kilometers that's virtually unexplored on the Ashanti Belt to add to our Obuasi project. It is an exciting opportunity for us. And we think the timing is spectacular. One of the things I talked about was timing. The market is starting to improve; it's been coming along. We see gold’s function in the economy as more money is printed. I don't see the price of gold collapsing based upon all of the money being printed. There will be more interest in exploration as mines continue to produce.

Dr. Allen Alper: Oh, you have a fantastic thing, and you have a great sense of timing of when to buy properties and to pick great areas for exploration and for wealth generation. So, that's fantastic.

Ingrid Hibbard: Well, it's funny, you talked about wealth generation, because that's really when people talk about what business we're in. One of the big drivers is an opportunity to generate opportunities for your shareholders, for sure, and for the management team. But the really exciting thing is when you are successful, even when you're exploring, you're making business opportunities and creating jobs that just didn't exist before. When you find a mine, it's impactful. For example, Detour created a thousand jobs in Northern Ontario that didn't exist before. Those are direct jobs. When you add indirect jobs and business opportunities that come out of that, it has an even greater impact. When you look at Ghana, for instance, typically where these mines were being found in more remote areas where, when you are successful, you really have the opportunity to enrich people’s lives, who had very little before. You have the opportunity to change people's lives by generating more money for education for their children, and it's really a wealth generating opportunity, creating a business.

Dr. Allen Alper: That's great. That's really an amazing opportunity for the community and for the shareholders and stakeholders. So that's really great. You must be very proud of your accomplishments to date and the opportunities that you see going forward.

Ingrid Hibbard: I'm really excited, really, really excited about what the future is going to bring.

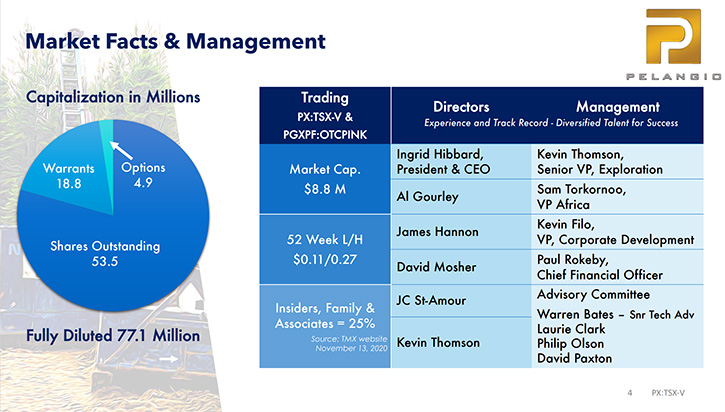

Dr. Allen Alper: That's excellent. Could you tell our readers/investors a little bit about your share and capital structure? I know your Management Team is committed and well-invested in Pelangio Exploration.

Ingrid Hibbard: We have about 55 million shares outstanding, and it's going to be increasing, with the recent financing. Insiders plus their families and close associates probably have between 20% and 25% of the shares, and the market cap is undervalued at this point in time. But, as we do more work and make more discoveries and the market recognizes juniors a bit more, we fully expect that to be addressed. We've had some additions on our Board side as well. We've had a couple of retirements recently, so we have done some regenerating on our Board, and Al Gourley has joined the Board recently. Al is a Managing Partner for Fasken in London, and Al and I have worked together in the past. So, we have some experience with, and some knowledge of each other's working habits. James Hannon is also out of London. He's a CA, also experienced on the corporate finance side, so two huge additions. Dave Mosher of course, has been with us for a while, but he's run both mining companies and been a Director of a number of juniors. J.C. St-Amour was a Corporate Finance person at Fraser McKenzie, and then of course, Kevin Thompson. So, if you take a look at the team, I just keep coming back to it's about people who have the skills to capitalize on opportunity. And with our projects, which are highly prospective in great areas, I think we are in a really good spot for our current shareholders and new investors right now.

Dr. Allen Alper: Oh, that sounds excellent. It’s truly a great position to be in now, with half of your really experienced team in the field, and your experienced Board Members. It shows you the Management Team is committed and has skin in the game. I expect great success in the future.

Ingrid Hibbard: Well, we're certainly working hard at it.

Dr. Allen Alper: Oh, that's great. Could you summarize the primary reasons, readers/investors should consider investing in Pelangio Exploration?

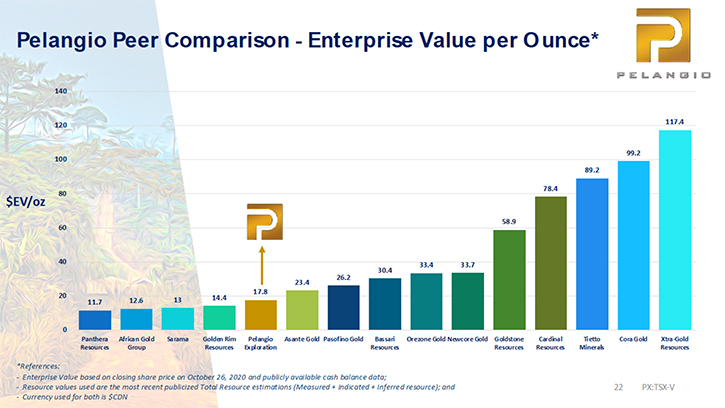

Ingrid Hibbard: Here is a slide where we've done a comparison. It really is at a good entry spot for investors. We are relatively undervalued, with respect to our peers. With this most recent raise, we are about to become very active in West Africa. I see much more interest in West Africa. On top of that, we are drilling our Canadian assets.

We also have the skill set to make strategic acquisitions. We understand market timing, and that is a big, big part of your success is monetizing or taking advantage of the opportunities at the top of the market and doing your acquisitions earlier in that cycle. We have a strong, committed team. We have a history of success, and we have strong community support. We're in areas, exactly as you said, where people understand and workforces are available. All of the infrastructure that you need for exploration and indeed for mining, exists there. They're great places to be. We have the people, the projects, local support, the funding right now, so we tick all of the boxes.

Dr. Allen Alper: Outstanding! Compelling reasons for our readers/investors to consider investing in Pelangio Exploration. Is there anything else you'd like to add?

Ingrid Hibbard: I think I've covered it all.

Dr. Allen Alper: Excellent! I enjoyed talking with you again. I'm very impressed with what you're doing, and with your Company and your business plan and model. I think you're doing a fantastic job, you and your team.

Ingrid Hibbard: Thanks, Al.

Dr. Allen Alper: You are very welcome. We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

https://pelangio.com/

Ingrid Hibbard, President and CEO

Tel: 905-336-3828 / Toll-free: 1-877-746-1632 / Email: info@pelangio.com

|

|