Elementos Ltd (ASX: ELT): Positioned to Meet Some of the Forecasted Global Tin Supply Shortfall of 40,000 tpa; Interview with Christopher Dunks, Executive Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/8/2020

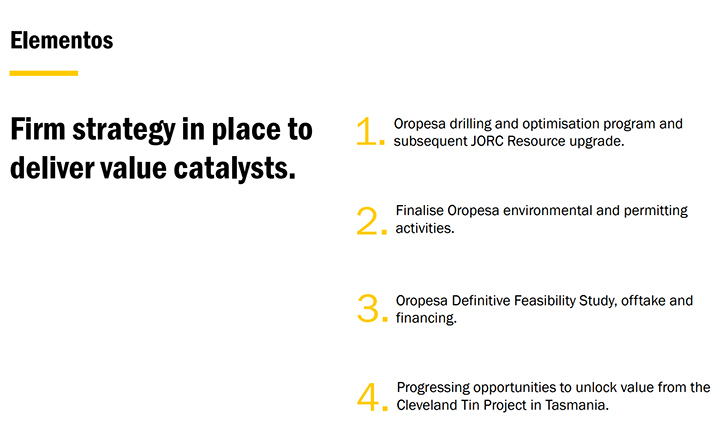

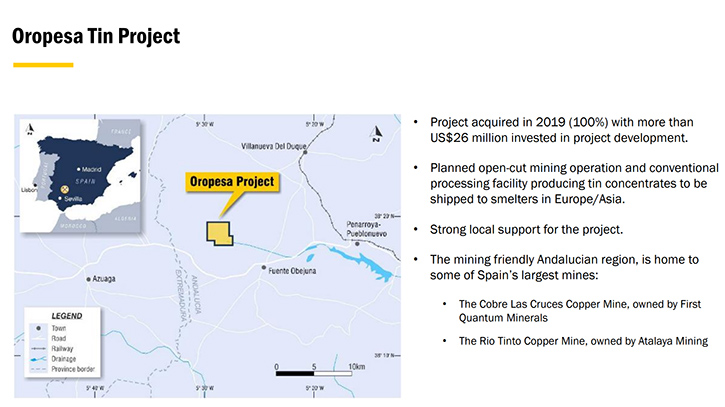

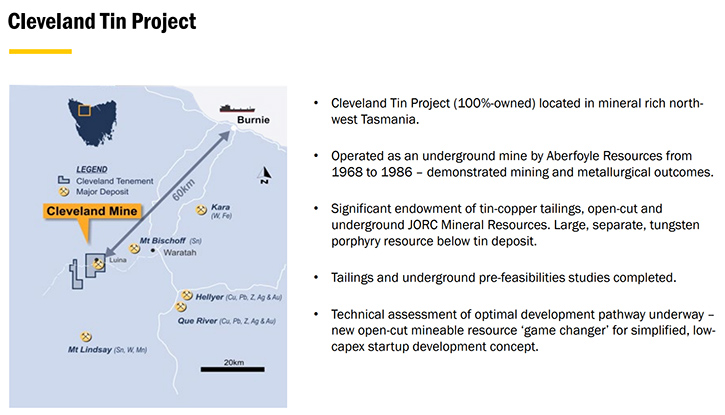

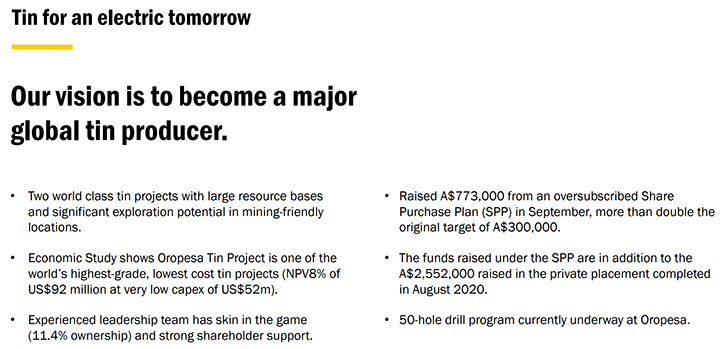

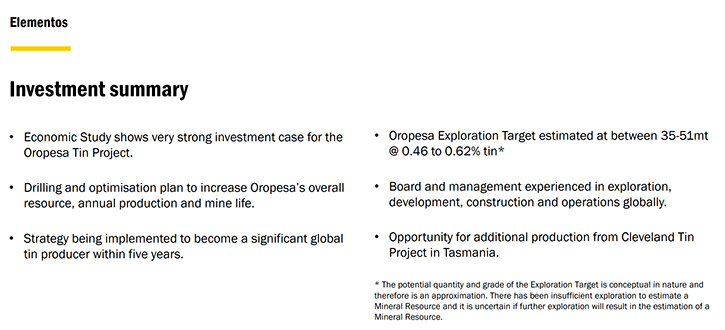

Elementos Limited (ASX: ELT) is looking to fill a gap in the tin market and expects to commence tin production in 2023, aiming to meet some of the forecast global tin supply shortfall of 40,000 tpa. The Company's assets include two projects; The Oropesa Tin Project in Spain will have an open-cut mining operation and a conventional processing facility, producing tin concentrates to be shipped to smelters in Europe/Asia. The Cleveland Tin Project, located in mineral-rich northwest Tasmania, is a new open-cut mineable resource, located on the historic Cleveland mine site, a game changer for the simplified, low-capex startup development concept. We learned from Christopher Dunks, Executive Director of Elementos, that for the remainder of 2020 they are focused purely on drilling in Spain and turning their attention to the Australian project as soon as 2021.

Elementos Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Chris Dunks. I wonder if you could give our readers/investors an overview of your Company, and what differentiates your Company from others.

Chris Dunks: Sure. Elementos is developing two mining projects, one in Spain and one in Australia. They're both focused around tin and developing the next generation of tin mines. That project in Spain is a primary tin mine. So it will be an open pit operation and is progressing through environmental approvals and upgrading of the resource. The project that we have in Australia is a tin and copper project. And we are about to restart work on that project in the next six to 12 months to get that up. Looking to get that up into production as soon as we can.

Dr. Allen Alper: Very good! Could you tell our readers/investors a bit more about your projects?

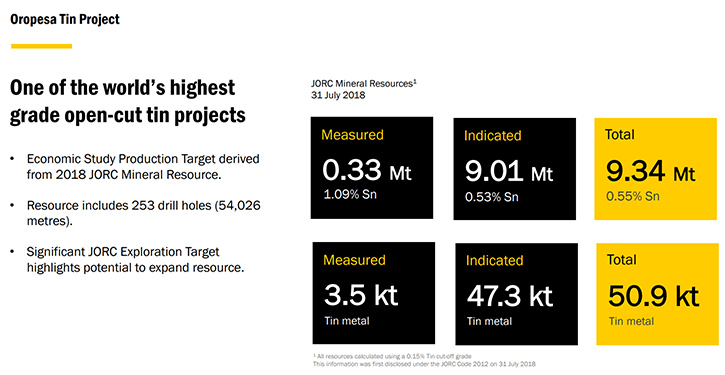

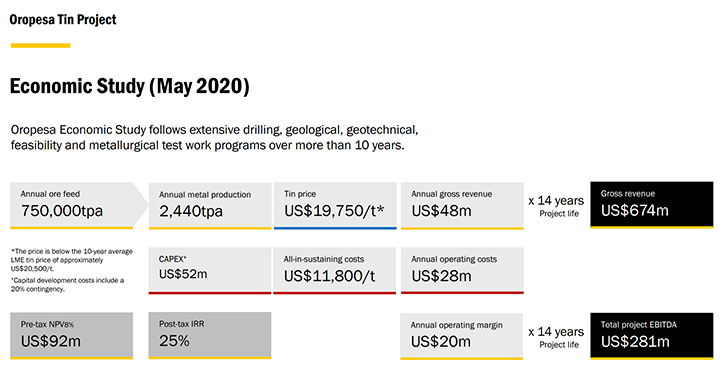

Chris Dunks: The project in Spain is a 12 million ton resource. That's 9 million tons of measured and indicated resource and 3 million tons of inferred resource. Its grade is .55% tin, which actually makes it one of the highest grade, open pit, tin projects in development. Tin, as a commodity, isn't necessarily well understood. Although it's used by everybody, every day, in all the electronics that they use, because it's the source of solder, which binds electronics together. Tin has an interesting, high commodity price. It sits around between $18,000 and $22,000 a ton as a commodity price. What characterizes tin projects is that they are generally low volume, generally low throughput, but they're very high value if you have the right grade and the right mining cost structures. You don't get large copper-style projects in the tin space.

You generally get between half a million and maybe 1.3 or 1.5 million ton throughput. But what you end up with is between 2,000 and 5,000 tons a year of tin production, in general, from these projects at a high value, at a high margin. That's what we have with our projects. In Oropesa, in Spain, tin has an all-in sustaining cost of about $11,800 a ton. And if we're looking at a revenue of around $20,000 a ton, then we have a really strong margin. The same goes for that project in Tasmania. It has an all-in sustaining cost that's low. When we have an average of $20,000 a ton, as a revenue stream, then we have very high margin projects.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors a little bit more about your plans for the remainder of 2020 and going into 2021?

Chris Dunks: I'd love to. For the remainder of 2020, we're purely focused, right now, on Oropesa, which is our project in Andalusia in Spain. On that project, we're executing a number of different drilling strategies. We are expanding our resource. We are turning inferred resource into indicated resource. We're putting additional holes into the resource, which is currently inferred, to have better definition and to be able to turn that into indicated. That's progressing right now. I think we've completed about 15 holes now, and we have material going for assay in the next couple of days. We're also drilling. We have some very large geophysics data that tells us that we might have extensions to our existing resource. We're drilling in the areas where there's an indication that there might be additional tin.

That's very exciting. We're also doing some shallow drilling because we believe there may be mineralized ore in what we have currently characterized as waste rock. If that's mineralized that can change the economic model by reducing our stripping ratio. That makes the financial model of the project even stronger than it currently is. So right now, in 2020 we are just focused on our Oropesa, executing that drilling work on the ground. We have a fantastic team in Spain, a project manager and a couple of project engineers. We have an onsite geological team, and our drilling team. We have about 10 people on site, working incredibly hard at the moment.

And then we're also starting to turn our attention to Cleveland, in determining the work programs that we need to actually get Cleveland back on track for environmental approvals, to get the project to a decision to mine. So that additional field work will start in 2021 at Cleveland. But right now, for the remainder of this year, we are focused on identifying and planning what we're going to be doing at Cleveland. So in 2021, at Oropesa, we'll have completed the drilling program, and then we're going to be going straight into the definitive feasibility study. That work is going to be progressing through most of the year. And that's really going to be driven by the resource upgrade and the resource model that comes out of the drilling program. Then we'll be back on the ground at Cleveland sometime in 2021 as well.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors a little bit more about the tin market?

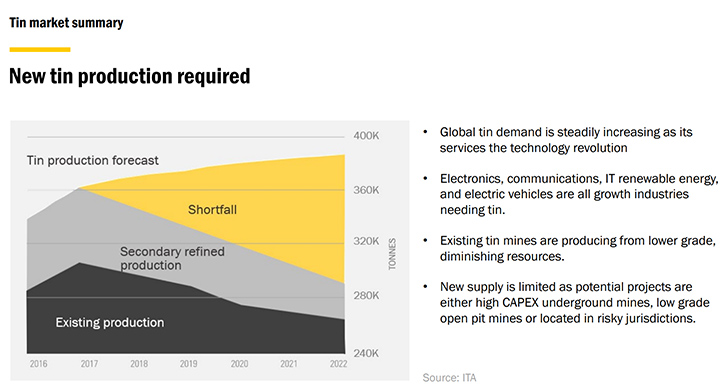

Chris Dunks: The tin market's an interesting market. It's a London metal exchange traded commodity. So there's always a spot price for selling tin. As a tin producer, you can always sell your concentrate. There will always be a market. There are a dozen large metals trading organizations that are always looking for tin concentrate. There are a number of smelters in Southeast Asia that will take tin concentrate. And of course the Chinese smelters will always take a tin concentrate. So you can always sell it. It's not a market, which is characterized by contracts that aren't necessarily well understood by the market, like the lithium market. The tin market is a very transparent market. Annually, there're 350,000 tons of tin produced or recycled. So it's a 350,000 ton per annum market. The main producers are dominated by Chinese production out of Yunnan province.

There's significant production that comes out of Indonesia every year. In the last few years, Myanmar has been a big producer. That's in decline. And there have been conversations, a lot over the last 10 years, about a general decline in supply in the global market. And we're starting to see that happening. It's taken a while for it to occur, but we're starting to see that. So there haven't been many new discoveries in the tin space for many, many years. As a result, no one's really looking for new tin projects. But a lot of old projects have been rehashed. Like our Cleveland project was a historic mine and we're rebuilding that.

There's a long life cycle that's required that every mining company, development company, is experiencing from discovery or decision to progress, with just rebuilding an old mine. There's a long time from starting that process to actually getting into production. As a result, you have a declining supply. Demand continues to grow every year. We have had a hiccup of course, with this year. The demand being down because of a lack of purchasing of electronic goods globally, and what's happened with the global economy. But our expectation is that that's all going to be coming back. And so the tin market remains, and the bottom line is that tin is a commodity that's required for the manufacturing of all electronics. So there's always going to be a market for tin. But we see supply side dropping, over the next few years and the demand continuing to grow. So there'll be some interesting price changes in the pricing of the commodity over the next five years.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors, a little bit more about the Australian project?

Chris Dunks: Sure. Cleveland is in Tasmania. It's a project that was operated from 1968 to 1986 by a very well-known Australian mining company called Aberfoyle. They built an underground mine at Cleveland. They made the discovery in the 1950s, and they built this underground mine. It was a very revolutionary mine at the time. It was the first trackless mine in Australia, with a significant decline slope, a five-by-five decline. From a metallurgy perspective with tin, it was the first site in the world that actually, successfully floated tin in the process. That was shut down in 1986, along with many, many other tin projects around the world because of the collapse of the tin market. We're looking to reopen this mine. There are a number of different resources that we actually are looking to explore at Cleveland. There's a highly economic tailings dam, which is just under 4 million tons of reserve. There's a lot of value in that tailings dam.

And we have the existing underground deposit, which is tin and copper. That actually starts at surface. So we're looking at a small open pit operation, and then heading back into the underground. At depths at Cleveland, we also have a very large tin and tungsten porphyry deposit. So we have these multiple resources at Cleveland. We also have the benefit of having copper there as well, in economic grades, and that also boosts the cash flow and allows us to focus on tin and to also have this additional copper income that offsets the operating costs.

What we're planning with Cleveland is a three-phase strategy. The first phase is processing the tailings and doing that in combination with the open pit operation. Then once that's up and running, we'll actually de-water the underground mine. We will look to drill the high-grade areas that we know exist in the underground mine, and then get back into the underground operation after a period of time and start mining underground again. So it's an exciting project. It's a really interesting project. It's of tremendous value at Cleveland. And it's something that we're really starting to look at right now.

Dr. Allen Alper: That sounds good. Could you tell our readers/investors, a little bit about your background and your Board and your Team?

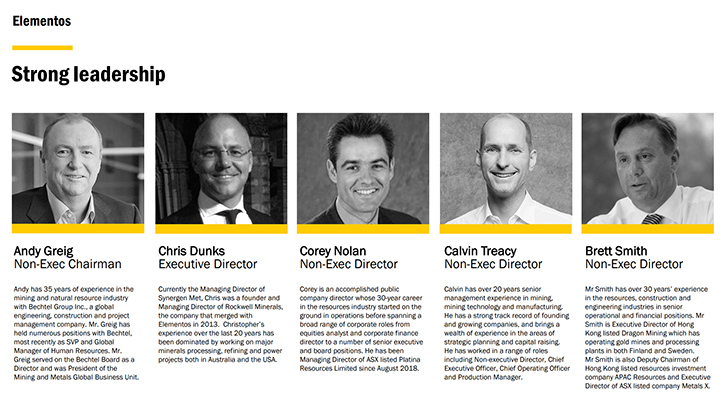

Chris Dunks: Sure. I'm a mechanical engineer. My experience has been in engineering construction. I worked for Bechtel Group, Jacob's and Worley Parsons and focused on project execution and moving things into production. Our Board is quite similar. Our Chairman is a gentleman by the name of Andy Greig. Andy ran Bechtel's mining division for 14 years. We have some junior mining industry experience on the Board with Corey Nolan, who also has a mineral economics degree. We also have Brett Smith on our Board. Brett has tremendous experience building and operating mines, all around the world. He's currently the Executive Director at Metals X, which runs the Renison mine, which is the only tin operation in Australia. It's a large tin project, about 30 kilometers from our Cleveland site directly.

So we have a Board that's full of capabilities for project execution. And when we brought Brett back on the Board in January this year, we really needed some of that mining experience. And he certainly brought that to the Board. So we feel we have a very strong Board. We have a Board that has a very strong debate about strategy and about how we're moving forward. We're all aligned in that we want to build a company that's actually going to be a mining operation. We want to build a mining company. We want to be generating profits, and we want to be generating dividends for our shareholders. So we are focused on getting into production.

Dr. Allen Alper: It sounds like you and your team have great experience and backgrounds, so you should be able to be very successful with your tin projects.

Chris Dunks: We have an excellent team and I think we have the foundation to be able to make this very successful.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors a little bit about your share and capital structure?

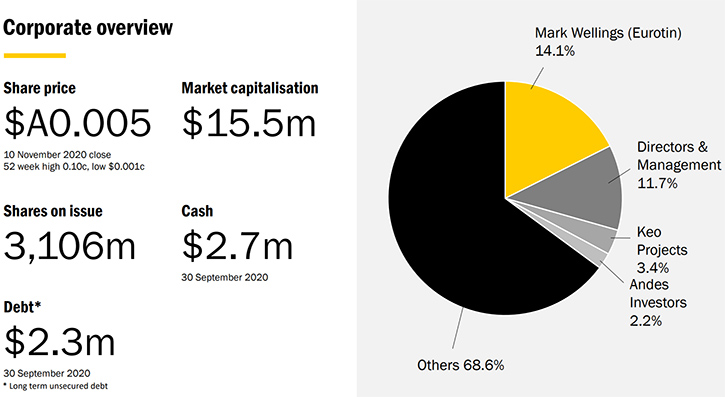

Chris Dunks: Sure. We have many shares on issue at the moment. It's a result of how the markets worked for us over the last few years. You might call us a typical Australian junior mining company with three and a half billion shares on issue. And we're trading at about a $0.006 at the moment, which is around a $20 million Australian dollar market cap. We have a couple of major shareholders. Andy Greig, our Chairman is our second biggest shareholder. Our largest shareholder is a gentleman who is in Toronto, Mark Wellings, who was the Chairman of Eurotin. And I think he sits at about 16%.

The Board and Management own about 12% of the Company. So we're very aligned with the success of this business. And we actually have a very tight shareholding structure. We have shareholders who really believe in the story and they're very loyal. No one's selling. It's one of the challenges that we have, share liquidity, since we don't have many sellers. We have people who really want to invest for the long term and ultimately see success come to the business.

Dr. Allen Alper: It's good to see management have skin in the game and be committed to the success of the projects.

Chris Dunks: Absolutely. Agreed.

Dr. Allen Alper: Could you, Chris, tell our readers/investors the primary reasons they should consider investing in Elementos Limited?

Chris Dunks: Absolutely. As a Company in the tin space, we're generally not as recognized as companies that are in the gold space or iron ore or copper. But tin's a base metal. As far as base metals projects go that are in development around the world right now. Our Oropesa project certainly would be, from an economic viability perspective and from the perspective of being able to generate the returns to shareholders, one of the most progressed. The overall value that we have in the ground and that we can generate from Oropesa makes it a project that really should be recognized and the market doesn't yet recognize that. And that's for a number of reasons.

And so we need to work harder as a business, to be recognized for what we have in this commodity space. We need to educate the public a little bit more effectively. We do have a tremendous amount of value that is untapped in the share price and in the value that we have in the Company. So I would say to people that we are undervalued and it is a good time to invest in Elementos right now. We look forward to sharing our drilling results with the market over the next two, three, four or five months, and we move into this final phase of development before we make the decision to proceed with the mining. We have strong interest from the professional investing market, the private equity investors and the banks that are financing mining projects. There is an enormous amount of interest to actually move ahead and support this project in Spain.

Dr. Allen Alper: That sounds like very good reasons to consider investing in Elementos, Ltd., Chris. Is there anything else you'd like to add?

Chris Dunks: I think we're at a really exciting point right now. It's a really exciting Company to be looking at and to be invested in right now, because of what we're focused on achieving and focused on getting done. If you take our tin project, not necessarily as tin, but looking at it as base metals, and comparing it with copper, zinc, lead projects that are in development around the world, you'll find that our project is as advanced. There are very few projects that are as advanced as what we have.

Dr. Allen Alper: Sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.elementos.com.au/

Christopher Dunks

Executive Director

0410 435 554

cd@elementos.com.au

|

|