Marvel Gold Limited (ASX: MVL): Advanced Gold Exploration Projects and Extensive Landholdings in South and West Mali; Interview with Phil Hoskins, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/1/2020

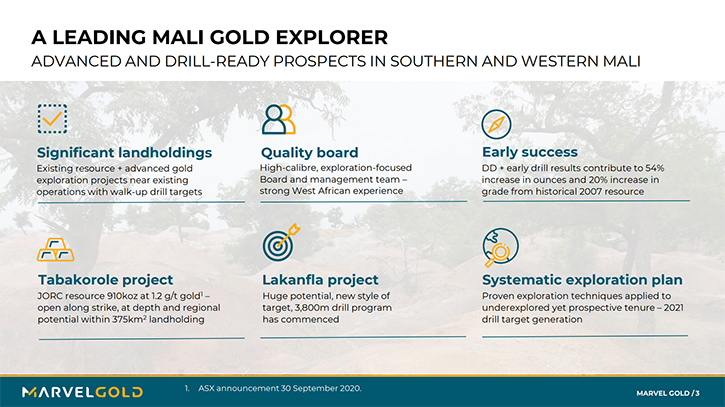

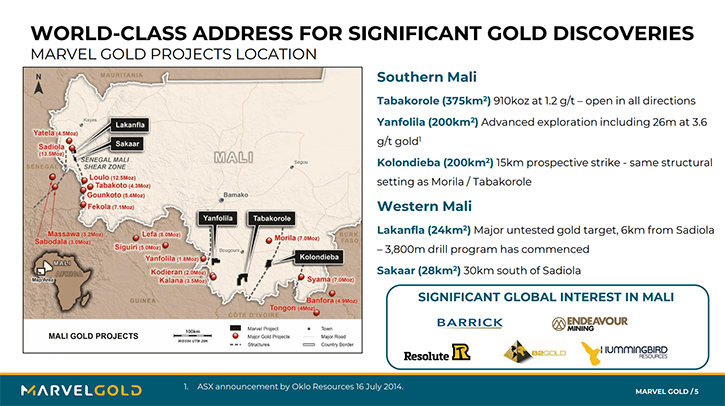

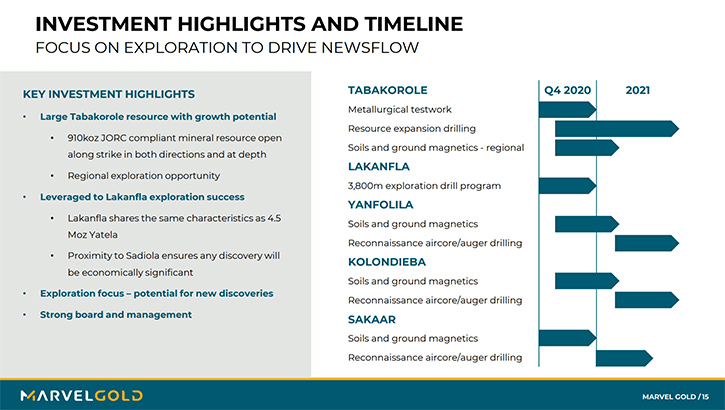

Marvel Gold Limited (ASX: MVL) is a Mali-focused gold explorer, with advanced gold exploration projects and extensive landholdings in South and West Mali. Mali has been the third largest gold producer in Africa. The Company's main projects are the Tabakorole Gold Project, with a large existing resource and expansion potential, and the Lakanfla Gold Project, which is a major untested gold target, 6km from the Sadiola gold mine, Mali's largest gold deposit. We learned from Phil Hoskins, Managing Director of Marvel Gold, that in the next 12 months, they will continue drilling at Tabakorole, where they have recently increased the gold resource 54% to 910,000 ounces. At Lakanfla, where there is already a non-JORC estimate of 100,000 ounces of gold on the property, Marvel is currently in the middle of a 3,800 meter drilling program on a quest for a multi-million ounce deposit.

Marvel Gold Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Phil Hoskins, who is Managing Director of Marvel Gold. Phil, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

Phil Hoskins: Sure. The Company overview is that we are a relatively new rebirth of a Company. We've acquired a number of gold assets in Mali over the last five months. Those assets are from a JORC resource level, to advanced exploration phase that we're drilling right now, and also a couple of other pipeline assets as well. They're very exciting exploration assets, in what is a very prospective country in Mali. What sets us apart? I think for a Company with a significant JORC resource of 910,000 ounces, and with some of the exploration on the rest of our properties, I feel that we're under-valued. The intangible that I think sets us apart is how hard we work and what we've been able to achieve in such a short space of time.

I think the transactions we've been able to execute and the initial work programs we've been able to conduct, even during the wet season in Mali, will set us apart. We'll continue to work these properties systematically and come out with results as cost effectively as possible.

Dr. Allen Alper: Sounds excellent! Could you tell our readers/investors a little bit more about your properties, and what you've discovered so far, what your plans are for the remainder of 2020, going into 2021?

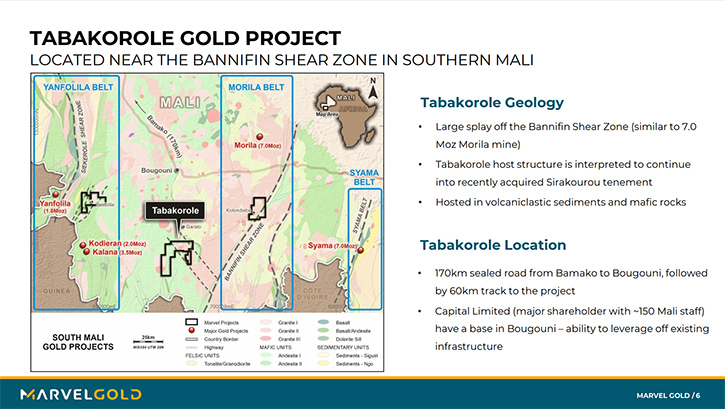

Phil Hoskins: Absolutely. The first project I'll talk about is the Tabakorole Gold Project, it's located in Southern Mali. Structurally, it's a second-order structure off the main Bannifin Shear Zone, which is a big structure in Southern Mali. When we picked up the project, it had a 600,000 ounce NI43-101 resource estimated in 2007. What we could identify was that there had been a lot of drilling done since the historical resource. We've also gone onto the ground and done a small drill-program ourselves. Within a few months of owning the project, we've increased the resource by 54% to 910,000 ounces, quite a significant resource for listed Companies in West Africa. It's from surface. There're many incredible intercepts throughout it, and it's open in both directions. We can see that this resource is going to grow as we drill both strike extensions.

It also sits on a 375 square kilometer land package that we've assembled across these two transactions. Then, there is the regional exploration story that over the next six months, we'll be working up the baseline data sets and then going to drill some of these regional prospects as well. Tabakorole already has this substantial resource, it's going to be a great resource growth story for us over the next 12 months, involving a lot of drilling.

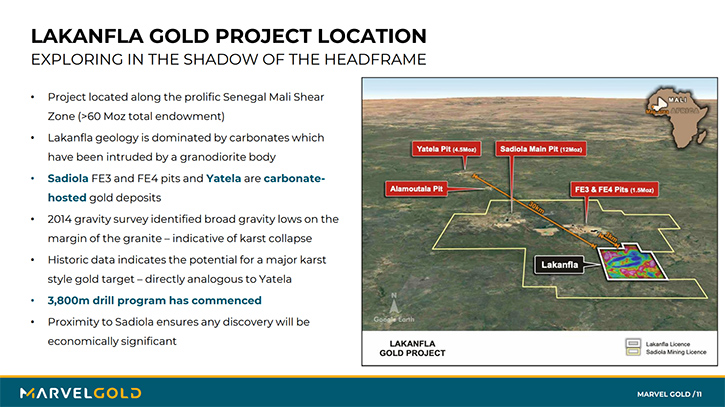

The other major project that we have to look at is all about location really, and the deposit model. It's sitting in an enclave in the Sadiola mining license. Sadiola is one of Mali's largest gold deposits. Throughout the Northern part of the Senegal-Mali Shear Zone, which is a major structure between those two countries, that's been responsible for several multi-million ounce gold discoveries along that Shear zone.

For us to be exploring on that Shear Zone, within six kilometers of one of the largest gold deposits in Mali, is a good place to be looking. Secondly, the deposit style we're looking at has all the hallmarks of a deposit called Yatela 30 kilometers to the North. So you have this direct analog for what we're looking at. And it's not your ordinary sort of a gold deposit model, it's called a karst model, which is dissolved carbonate rocks. So these are rocks that have been dissolved by contact with the nearby granite intrusion. What is hoped is the gold in the system can make its way through the collapsed voids and other things in those carbonate rocks to form a higher grade, supergene enriched gold zone, at the contact point with the fresh rock.

We're drilling that right now. The 3,800 meter program is almost complete, we're extremely confident that the deposit model holds together, in terms of it being a karst. Whether there are economic concentrations of gold mineralization or not, certainly the size of the prize here and the footprint at Lakanfla could be, on the upside, a multi-million ounce deposit, or as a fallback, there is already 100,000 ounces of gold on the property and we know that the Sadiola Gold Mine is short on oxide reserves. They only have two years left on their oxide reserves. So anything we find here at Lakanfla will be extremely economic and able to be put through that plant.

So there are the two projects. I think the Tabakorole Project is what underpins our story and what underpins our valuation in any market, not just in the market that we're in right now. I think it also demonstrates some really good exploration upside. The market is really rewarding new discoveries at the mines. We hope that we can be another one of those companies as well with Lakanfla.

Dr. Allen Alper: It sounds exciting! It sounds like it will be a very exciting, fruitful time for Marvel Gold.

Phil Hoskins: Yes absolutely!

Dr. Allen Alper: Could you tell our readers/investors how it is operating in Mali, and also the importance of Mali and gold mining?

Phil Hoskins: Mali is the third largest gold producer in Africa. It's been a stable gold producer for a long period of time. In terms of operating in Mali, we have a Country Manager there, he's very familiar with the laws and the operations of the mining industry. We have an expatriate PhD level geologist, who is our Exploration Manager, who oversees all of the programs. Things like COVID haven't had any impact on their ability to conduct exploration programs. He lives in Cote d'Ivoire, which borders Mali, so his ability to be in country and manage these programs is the reason that we continue to operate through these sorts of challenging circumstances. We're really happy to be in Mali, there was a military coup of the government most recently, but there’s been an interim government installed on a pathway back towards democratic elections.

But we, as an exploration company, and the producing gold companies haven't reported any change in the ability to conduct our businesses nor have we had any impacts on our operations. And I think I put that down to the importance of gold mining to the country, they need the industry and have supported it with stability in the mining code. It's been incredibly stable for a long period of time. So we're really happy to be in Mali, it's a really prospective country, one of the final frontiers in West Africa for finding really big gold deposits and we're quite excited because to us it still remains relatively under-explored. This, jurisdiction is our 100% focus.

Dr. Allen Alper: Well, that sounds excellent. Phil, could you tell our readers/investors a little bit about your background, your Board, and business team?

Phil Hoskins: My background is in corporate and financial roles. I started my career as a chartered accountant and then moved into finance roles in Australia and in the UK, in the property development industry. Over the last 10 years I have been in mining. I started with finance roles in the mining industry across a number of commodities, iron ore, nickel, and graphite. I also gained experience across operations, exploration and project development. More recently, I was CEO of a company that was developing a Tanzanian Graphite Project. And we got that all the way through to permitting and feasibility studies and we were on the cusp of financing when COVID came. Marvel Gold actually was the company that was spawned out of that company. The old company was called Graphex Mining.

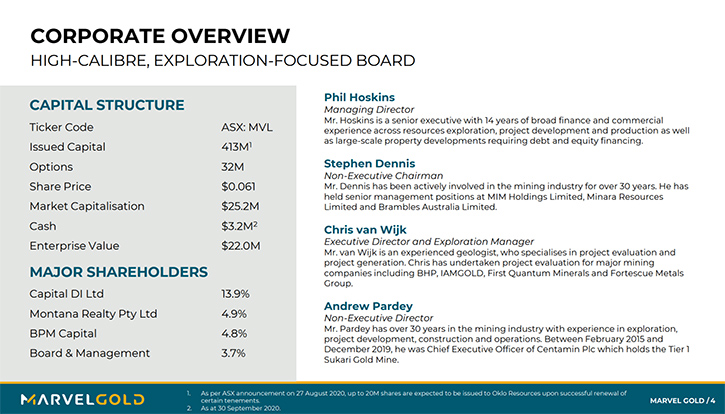

So this is the rebirth of the company that I mentioned earlier. In terms of the rest of the Board, on the Executive side, we brought in Chris van Wijk, Zimbabwean born geologist, who's worked for BHP, Iamgold, First Quantum Minerals and Fortescue Metal Group in a business development role. He is the one who identified the Tabakorole and Lakanfla Projects for the Company. On the non-executive side, our Chairman, is Stephen Dennis. He had a long history in the mining industry, with several large companies; Mt Isa Mines, Minara Resources, CBH Resources. In the last few years, he's just served on Boards of a number of resource companies. His background is corporate and financial. Lastly, Andrew Pardey, Non-executive Director, is also a geologist. His most recent role, up until 12 months ago, was CEO of Centamin plc, a very large UK listed gold producer, with the tier one, Sukari gold mine, a $2 billion company.

He's had 25 years of West African gold experience, absolutely critical to overseeing our exploration efforts and understanding how to do business and find gold deposits in West Africa. It's quite a balanced Board of skills and expertise, one that is working really well so far! That rounds out the team, we're in a shared office to save on corporate and administration costs, but we do have access to a high quality CFO and Company secretary, with African experience as well. So we are a really good team. We have the right team to take those assets forward.

Dr. Allen Alper: It sounds like an extremely strong, experienced and successful team. So, that's great! Could you tell our readers/investors a little bit about your capital market and share structure?

Phil Hoskins: There're currently 413 million shares on issue, which at a share price of around seven cents, we're about a $30 million market capitalization at the moment. We closed 30 September, with $3.2 million in the bank. There're 30 odd million options on issue, as well as varying stock prices, from 3.5 cents, 6 cents and 10 cents. Our major shareholder is a company called Capital DI, which is an investment subsidiary of Capital Limited, which is a drilling and mining services company listed in the UK. They've been supportive of the mine for some time, and also very supportive of these incoming transactions. You might see them as major shareholders of a number of West African gold explorers, including Predictive Discovery, Chesser Resources, Golden Rim, Tanga Resources. They're quite heavily invested in West African gold, the rest of our register includes some institutions, high-net-worth, but we do have some good, broad based support from a number of Australian brokers and also from a UK broker as well. So a couple of brokers writing research on us from Bridge Street Capital and also from Tamesis Partners. So I think we have a good base of support. If we can have some success, it should be able to result in some meaningful improvements in the share price.

Dr. Allen Alper: I’m sure. Could you tell our readers/investors the primary reasons they should consider investing in your Company?

Phil Hoskins: For a company with a 910,000 ounce resource, we're highly undervalued, compared to a lot of the other West African gold explorers. Several pre-resource companies have market capitalizations two to five times ours. I think we'd stack up incredibly favorably against some of the companies not even including our other exploration assets and potential outside of the country as well. I think that’s because we are a new company. We are establishing credibility as a gold explorer in Mali. I think the market is still wrapping their heads around us, but I think as more and more people become aware of the story, and we continue to have success, that valuation gap will close. We are a pretty safe bet, with the resource in our back pocket and that we are undervalued compared to our peers.

Dr. Allen Alper: Well, it sounds like a very good opportunity for our readers/investors to consider. Is there anything else you'd like to add, Phil?

Phil Hoskins: Just on that investment opportunity. It's obvious the gold market is going incredibly well at the moment. And I think most people expect that it's going to continue. So it's a good commodity to be in. We see a lot of upside over the medium term. Thank you for interviewing Marvel Gold for Metals News.

Dr. Allen Alper I’ve enjoyed learning more about your progress. It’s very exciting! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://marvelgold.com.au/

Phil Hoskins – Managing Director

Tel: +61 8 9200 4960

|

|