Desert Mountain Energy Corp. (TSX.V: DME, U.S. OTC: DMEHF, Frankfurt: QM01): Accomplished Team Discovering and Developing of Helium in the US, Critical to Green Energy and High Tech; Don Mosher, VP of Finance Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/27/2020

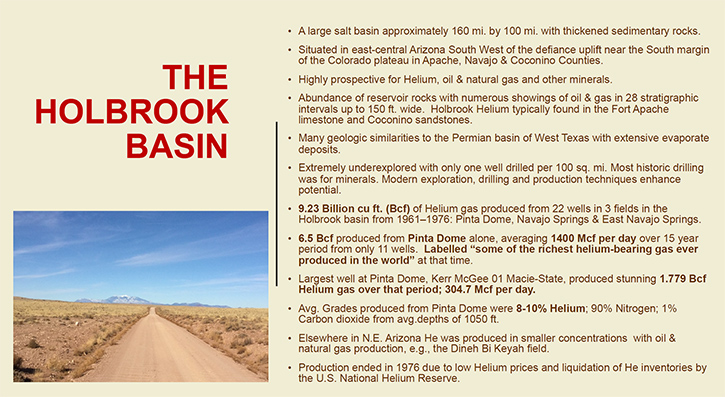

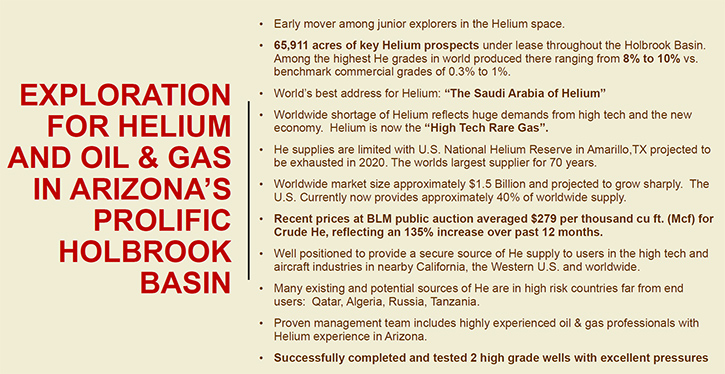

Desert Mountain Energy Corp. (TSX.V: DME, U.S. OTC: DMEHF, Frankfurt: QM01) is focused on the discovery and development of helium gas fields in the US, with particular interest in elements deemed critical to the green energy and high technology industries. We learned from Don Mosher, Vice President of Finance for Desert Mountain Energy, that they are exploring for helium and Oil & Gas in Arizona's prolific Holbrook Basin, home of the highest helium grades in world. Desert Mountain Energy successfully completed and tested 2 high-grade wells, situated not far from the historically famous helium field, called the Pinta Dome, with excellent pressures. In 2020, the Company made some major changes to its Board and raised $13 million Canadian. Near term plans include drilling a third well, and ultimately building a fully integrated helium production company with all necessary infrastructure. According to Mr. Mosher, Desert Mountain Energy expects to go into production with four to six Wells in October of 2021.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-In-Chief of Metals News, talking with Don Mosher, who is Vice President of Finance for Desert Mountain Energy Corp. Don, Could you give us an overview of your Company and also tell us about your Management. Also if you could update our readers/investors on the importance of helium.

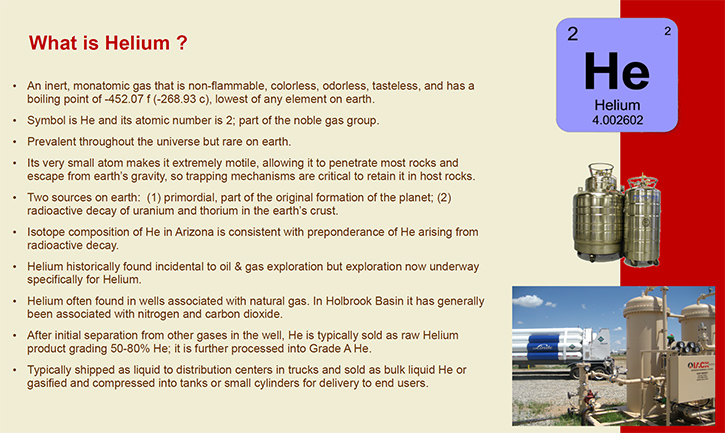

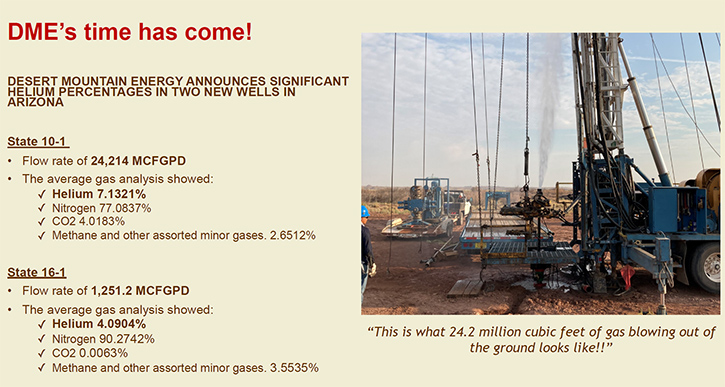

Don Mosher: It’s my pleasure, thank you very much. We are primarily looking for helium in Arizona. We have over 80,000 acres of land of which approximately ¾ is State owned ground with the balance being private ownerships. We also have some options on some private land in Arizona. The first two wells we drilled are located about 35 miles from a historically famous helium field called the Pinta Dome. For 13 years, 11 wells produced six and a half BCF of Helium, over that time span, at very high grades. Their grades ran anywhere from 7-11% helium. If you compare that to the grades coming out of natural gas fields as a credit, grades of .5% to 2% helium are considered commercially viable.

What we're looking at are high-grade helium wells, with no natural gas. We're primarily drilling for helium. The composition of the first two wells that we've drilled, the one well ran over 4% helium, the second well ran north of 7% helium. The majority of the gas in the Wells was nitrogen. The one well ran, 90% nitrogen and the other one ran 78% nitrogen. Then we have a small component of the CO2 and a small component of methane need to be sequestered.

August we transitioned new Management and put three new Board Members on the Board. We brought on Dr. Jim Cronoble from the University of Oklahoma. We brought on Jenaya Rohlfing, from Conoco Philips. She runs a second largest oil-field in North America for Conoco, and I came on the Board. We brought on a new CEO, Rob Rohlfing, who was formally VP of exploration, while the former CEO, Irwin Olian, went into retirement. We've made some other transitional changes, bringing on people that have expertise in the gas field business. We raised $13 million Canadian, at a $1.60 a unit and closed that in October.

The next step that we're looking at is drilling a third well, which is going to be about 70 miles away from the two that we've already drilled. All the holes we are drilling are considered Wildcat Wells.

With the funds raised, our plan is to build a fully integrated helium production company. The last financing that we did, raised $13 million, the unit had a $2 warrant attached to it. If we can force the warrants, we should have enough money to build all the infrastructure that we're looking at. We have locations already picked out for the infrastructure, and we're looking at a total capital expenditure of about $30 million, to turn ourselves into a producer. The Company plans to go into production, with four to six Wells in October of 2021.

The reason we've made the decision to turn ourselves into a vertically integrated producer, as opposed to just doing off takes and getting into immediate cashflow, is the differential in the price of crude helium coming out of the ground compared to selling finished helium to end users. Finished helium sells anywhere between $450 to $3,500 US per MCF. Crude helium, coming out of the ground, sells for about $280 US per MCF. If you do an offtake, the middleman is going to take probably $50 to $60 of that. So you're lucky to come out with $200 to $220 per MCF for the helium.

So it makes a lot of sense to spend $30 million, to be able to finish your product and upgrade the pricing by 4 or 5 times what you would get otherwise.

Dr. Allen Alper: That's an excellent business decision.

Don Mosher: We believe so, the success is going to be dependent on our geological model. Right now we're two for two on drilling wild cat wells. This third well will give us a really good idea how precise we are with our geological model. We will collect a lot of data, run some additional seismic and analysis, markers within the drill core, all that information will be gathered for further review. In addition to that, if we have success with the third well like we had with the other two, we're going to see a definite jump in share price.

Dr. Allen Alper: Well, that's excellent! Your shares have done very well this year!

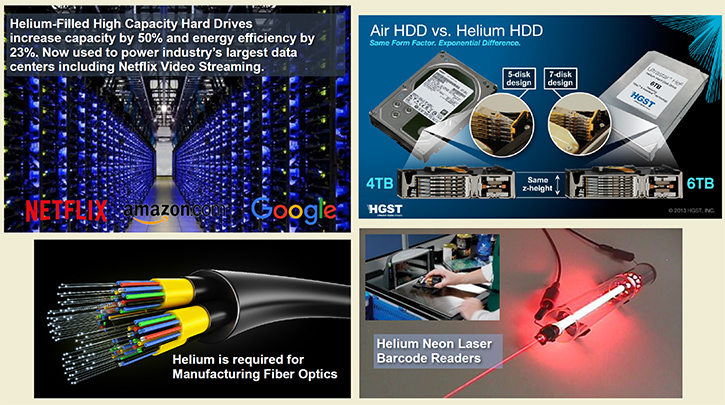

Don Mosher: People are either unaware or don't appreciate the value of helium because it's more of a modern technology type of element. MRIs use helium to cool the magnets with the medical industry using about 30% of helium’s annual production. You're also using it for Fiber-optic manufacturing and helium hard drives that increase the speed and reduce the energy consumption of computers. For example, if you take a look at EVs, there are 17 computers on board an electric vehicle. If you can reduce the energy consumption, that is a major step, let alone increasing the speed of the actual hard drives themselves. Another example of the value of helium is its use in space programs. They are dependent on helium for purging rocket engines prior to launch. These are all important, but generally unknown applications that a majority of people aren’t aware of when it comes to the importance of helium.

Dr. Allen Alper: Well they are excellent applications, growing applications. So that's good. It sounds like you're in a great position. Could you say a little bit about supply and demand?

Don Mosher: The United States of America had a strategic supply of helium that was put together for military purposes back in the 30s. If you remember when the Hindenburg blew up, dirigibles had a larger role within the military. The US Military realized that helium was a safe alternative to hydrogen. Back about 12 or 15 years ago, it was decided that the government should recoupe the money they've spent on the helium strategic supply, and started to sell it all off. As that supply has sold off, you have seen demand rise, while production has dropped. Therefore, the prices started to escalate about 10 years ago. 20 years ago, helium was selling for $6.50/ MCF, and now it's selling for $280/MCF. There's always a lag in the commodities market. We saw commodity prices increase with Chinese demand resulting in the Super Cycle starting in early 2004. You saw the price of copper jump from 68 cents, running upwards of $3.

You always get that lag when commodity prices are dropping because people quit exploring and developing projects. I think that's really what you've seen with helium. The idea that we can walk into an area, with the highest grade commercial helium production ever and be able to acquire the land package that we have, I find simply amazing. It's similar to people that look for gold. If you're going to go find a gold mine, you tend to go where the old existing mines were and look for similar geology and it's the same here with us.

We're looking at anticlines and salt domes to try and capture the helium that we can drill into. The drilling operation is relatively easy for us. We're not drilling really deep. We're drilling 3000 foot wells. They're simple vertical wells. We're not dealing with anything that's explosive or flammable. We don't have gases, such as hydrogen sulfide that complicate refinement and we’ve acquired a large land package. The geological model that we have is because our CEO, Robert Rohlfing, has spent over 20 years studying and planning this project. He was way ahead of everybody else when it came to looking ahead into the future and seeing helium shortages. Rob has quietly worked away on what he thought the geological model should look like. Now, he has actually drilled the first two holes, proving his thesis correct.

Dr. Allen Alper: Oh, that's great. It's great to have one's theories substantiated with results.

Don Mosher: Well, I can't say enough about Rob. I mean, our CEO has extensive experience in the oil and gas business. He's drilled hundreds of wells himself, he's run gas collection businesses and has spent 20 years planning this whole operation and now we're able to exercise it, with the funding that we raised back in October.

Dr. Allen Alper: Well, that's excellent. The Company is in a great position and you're in a great location. It's nice to be in Arizona and have such a nice land package.

Don Mosher: One very important advantage about being in Arizona over and above geopolitical concerns, is the fact that we have at least 17 end users located in Arizona. Helium's very difficult to transport, because it's such a small molecule it will escape any containment that you put it into.

The farther the end user is from the source, the more of the product he will lose as it is transported. There is really nothing you can do to prevent the loss. Helium will escape the earth’s atmosphere. Every time a rocket engine is purged, the helium that was used is non recoverable, which is why the industry has to keep looking for new sources of helium.

The reason it's so often found in natural gas fields, is because they're drilling quite deep. If you have the right mix of rocks to contain the helium, and you have degrading uranium 238 and thorium, you have the right materials to create helium. You need to have a really specific set of parameters to have a commercial grade of helium. We're in a very unique location, not being a natural gas field, but having these helium pods rather than a field. You can't think of this like an oil-field, this is more pods. What you're looking for are these anticlines that have collected the helium and you're drilling into the top of them, pulling off the helium as it comes out of the ground under pressure.

Dr. Allen Alper: Well, that's great. It sounds like you really have a great location, a great area. It's good to be next to the market, particularly, with something that escapes on your transport and it has to be in a product that is not easily recoverable and recycled.

Don Mosher: Yes. The infrastructure in our area is very good. We have interstate highways running North, South, East, and West. There is a railroad running through the project. Our finishing facility will be built in an industrial park with railroad sidings and a 3-phase line. In order to control energy costs, a solar farm is planned, allowing us to feed power into the grid during the day and pull power out when needed.

Dr. Allen Alper: That is excellent. Could you tell our readers/investors a little bit more about your share and capital structure?

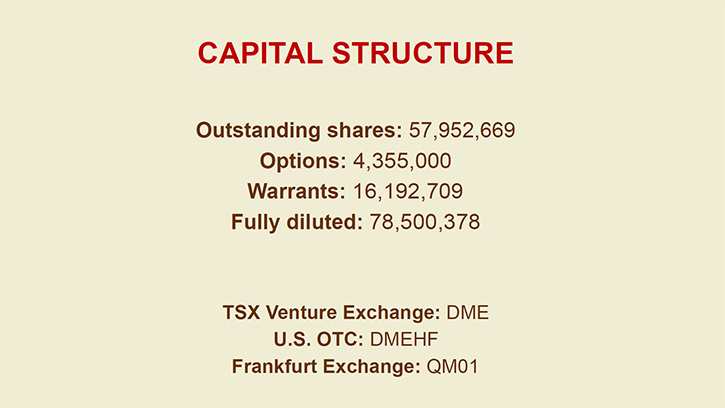

Don Mosher: Fully diluted we have 78 million shares out right now with 58 million issued and outstanding. We completed a financing in October at $1.60 that raised $13 million. The previous financing was done at 35 cents in June. The success of the first two wells has been really well rewarded by the market. They recognize the value of the discovery, and they've rewarded it for us by allowing us to raise money at much higher prices far less dilution.

Dr. Allen Alper: Oh, that's excellent. Very few junior miners or junior companies are in that kind of position. So that's a great position to be in.

Don Mosher: Yes, it is. We're really looking forward to drilling this third well. I think if we're successful, we'll definitely get another step up in share price. We're not looking for financing. That's the beauty of it. If we get a step up in share price, there is a forced exercise clause attached to the warrants that we currently have outstanding. If we see the stock trading at $4 or higher, we'll see another $16 million come into the treasury, with no commissions or any other costs associated with financings. It's basically a free financing sitting there dependent on share price movement.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in your company?

Don Mosher: Well, we're very unique. You're going to have a lot of trouble finding many publicly traded helium deals to start with. It's a green energy. It's absolutely critical, for even cooling the cloud-based computer Super Centers. So if you're cloud-based, with any of your business, you're dependent on helium, the unknown gas. The gas is incredibly valuable and in demand, we think that we're onto something very, very good here that has a lot of room to move to the upside.

Dr. Allen Alper: That's excellent. Those are compelling reasons to consider investing in Desert Mountain Energy Corp. Is there anything else you'd like to add?

Don Mosher: Not really. Not until after we drill this third hole, then based on the success of that, I should have a lot to say. If you want to stay up to date with the latest news, you can sign up to receive emails from us at desertmoutainenergy.com or follow us on LinkedIn.

Dr. Allen Alper: That sounds excellent. We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

https://desertmountainenergy.com/

Don Mosher, Vice President of Finance

(604) 617-5448

E-mail: Don@desertmountainenergy.com

|

|