Neometals Ltd (ASX: NMT) Joint Venture with SMS group, Primobius GmbH: Advances their Lithium Ion Battery Recycling Project, Recovering Ni, Co, Mn, Li and C; Interview with Mike Tamlin, COO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/24/2020

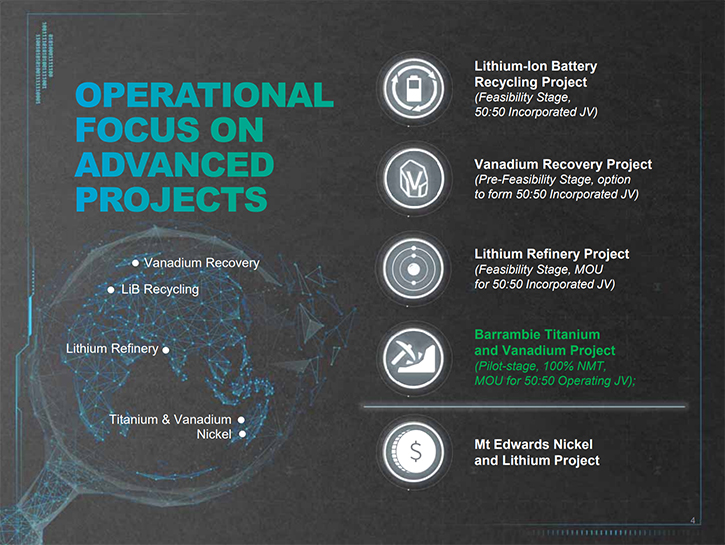

Neometals Ltd (ASX: NMT) innovatively develops opportunities in minerals and advanced materials essential for a sustainable future. With a focus on the energy storage megatrend, the strategy revolves around de-risking and developing long life projects, with strong partners and integrating down the value chain to increase margins and return value to shareholders. We learned from Mike Tamlin, COO of Neometals, that their key projects are the lithium ion battery recycling project, the vanadium recovery project, the lithium refinery, and vanadium and titanium projects. The projects are expected to come towards production maturity, starting in about 2023 and spaced every couple of years towards the end of the decade.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mike Tamlin, who is COO of Neometals. Mike, could you first give our readers/investors an overview and update of Neometals, what is happening with the reclaim of lithium batteries, and what's happening with Neometals?

Mike Tamlin: Yes, indeed. I will be very happy to. Neometals is a project development company, based in Perth, Western Australia. We're listed on the Australian Stock Exchange and we have four core project activities now. Each project has an assigned project development team. The key elements of interest are lithium, cobalt, nickel, vanadium, and titanium. We have developed our business model quite a bit, over the last couple of years, since our last discussions with you. Sustainability is very much on the forefront of both users’ and investors’ minds. Most of our developments are focused on sustainability, supply chain security, supply chain independence and carbon footprint, not as end goals in themselves, but as integrated characteristics of those projects.

In order of timing, I'll list the projects, first the lithium ion battery recycling project. Second our vanadium recovery project, third our lithium refinery, and fourth the Barrambie vanadium and titanium project. We also have mining tenements under development, where we're exploring for nickel and have had some success in identifying nickel sulfate mineralization and are currently expanding the mineral resources there. We have a development timeline that has staggered development, so that we have projects that we expect to come towards production maturity, starting in about 2023 and spaced every couple of years towards the end of the decade.

Dr. Allen Alper: That sounds great! Very interesting! Great critical products that are very important! All growth products! Excellent!

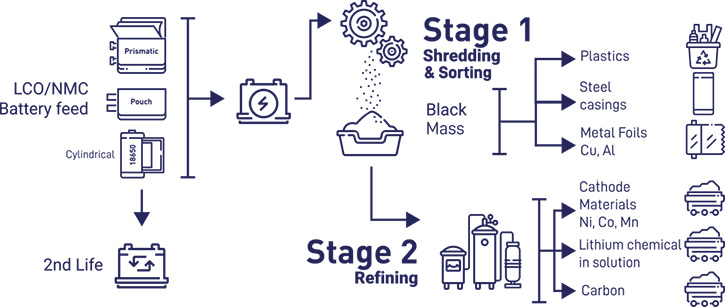

Mike Tamlin: Yes. We have worked on developing a portfolio of products and elements that are on the critical list for a lot of jurisdictions, but particularly, the United States and Europe. We're also identifying resources that have a very real chance of success in these areas. I think it's all very good to develop in the right elements, but the resource that you are developing still has to be fundamentally good. In the case of lithium ion batteries, we have a very different type of resource from our traditional resource, which was the lithium spodumene resource, which we divested about 18 months ago. So lithium ion batteries, rather than being undeveloped resources in the ground, are fully formed manufactured products that are themselves both a very high-grade concentrate of metals, such as nickel, cobalt, lithium and manganese and also potentially hazardous waste materials.

So we're looking to make an economic development of recovery of metals from these batteries, so we can return the materials to the supply chains from which they arose and prevent them going into landfill. We're focused on doing that in a sustainable way, with a small carbon footprint. Sounds like a lofty goal, but it is a very real and tangible outcome for us. Digressing from lithium ion batteries, it is the same for our vanadium recovery project. They are still making slags in Scandinavia, which typically have a high vanadium content. In the case of our project, we have secured agreements for supply from SSAB, the large Swedish steel making company, who have stockpiled slags. Their vanadium content typically is much higher than primary vanadium in the ground and forms a very good basis for us as raw material. In the case of both the lithium ion batteries and the vanadium, we're skipping the step of conventional mining, drill and blast, load and haul.

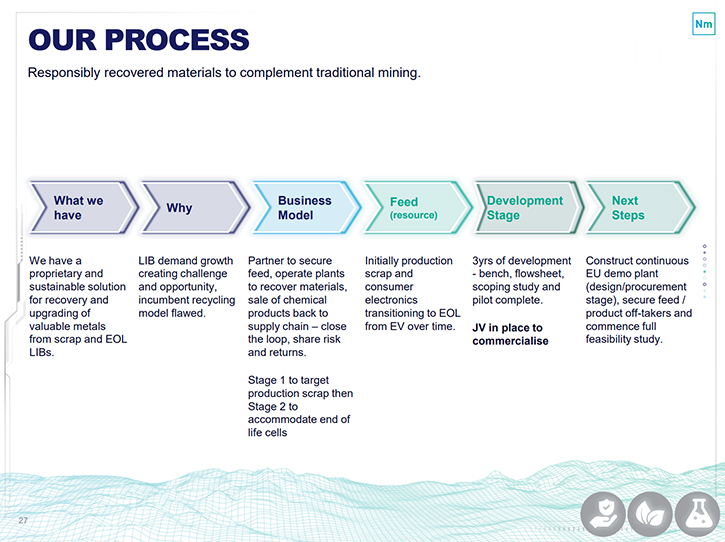

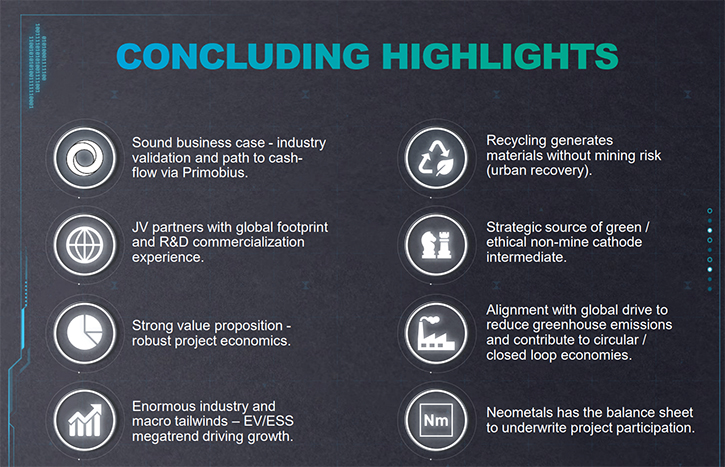

We are immediately getting a head start in terms of carbon footprint and the energy consumed in extracting metals. I think this is a very important point for us. One key principle that we have long-held, as a project developer, is to have a very well-developed strategy where we identify resources. We develop value in the resources through development of processes to extract and recover the key elements. Then we engage, with strong development partners, in joint ventures to bring those through to commercial operation. We do that with partners that are selected for their complementary attributes. So while we have technical development skills, but a reasonably small organization, our partners are typically large, have well-developed construction and operation skills and large balance sheets. Moving specifically to the lithium ion battery recycling, we have formed a joint venture with SMS group, the multi-billion dollar privately-owned German engineering company.

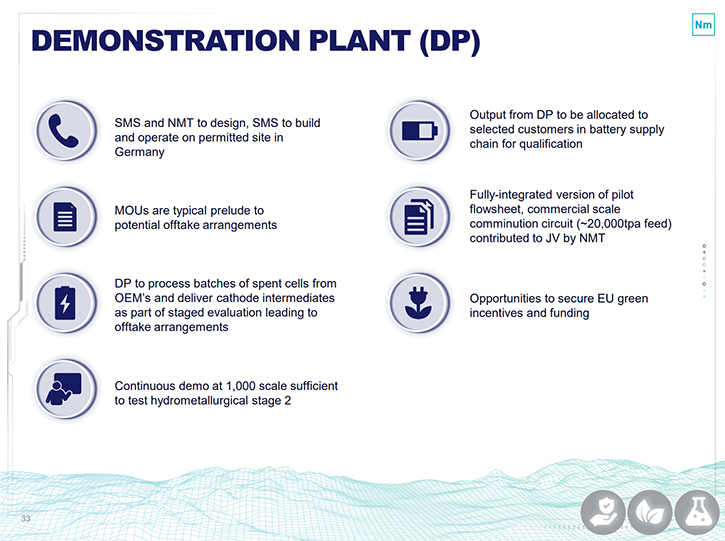

Between SMS and Neometals, we each own 50% of a Company that has been incorporated in Germany. The Company's name is Primobius GmbH and we've established the Company, incorporated it, registered it and we're in the process now of building demonstration facilities for the recycling process. I have been nominated co-Managing Director of Primobius and have a counterpart, Horst Krenn of SMS, who is also the Managing Director of SMS Process Technologies. We have Primobius under active development now. Our engineers are pooling their resources. We're building a demonstration plant at a town called Hilchenbach in Germany, which is just to the East of Dusseldorf at SMS group's main engineering and production facilities in Germany. The development of the recycling process has been quite a long one for Neometals. It's been about five years since we started work.

We've been through two semi-successful processes and then scrapped them and developed a third process, which has the performance attributes that we wanted, meaning that it has high recoveries of the elements that go into making a battery with low emissions and low energy consumption. It produces chemicals that can be directly reused in battery cathode production, such as high purity nickel sulfate and high-purity cobalt sulfate. It is meeting the draft and imminent European regulations regarding the objectives on total recovery from batteries. So far, we have recoveries from piloting this process of up to 85% of the total battery. We are continuing development of recoveries through the demonstration plant, to reach into the nineties and our target is about 95% recovery at the moment. That includes the casings, which are made of steel and plastics, the hydrocarbons that are used for the electrolytes, all of the copper and aluminum foils, which are the substrates for the electrodes and graphite materials, which are a very large component of batteries (through the anodes) and all of the major active (cathode) ingredients in the batteries.

We started out with lofty goals and we're very happy now that we are achieving what we set out to do. The commercialization strategy is now in progress to prove this up through demonstration. We have already purchased and prepared the largest battery shredding facilities in Europe. They have a capacity of about 20,000 tons per year of battery feed and we will be demonstrating that alongside a smaller capacity extraction plant. It's important also to mention that we've chosen a hydro-metallurgical process to extract all of the ingredients from the batteries. It was an important choice for us to make. We could have gone with a pyro-metallurgical solution, which would be expedient and is used in a few cases in the world today, but from satisfying the carbon footprint and energy usage and recovery aspects, it wouldn't have been successful.

Our estimates at the moment are that the recycling of lithium ion batteries, will have a very significant impact on the carbon footprint of new battery production when recycled materials become a noticeable component of new batteries. Estimates show that if you were to make a new metal sulfate, such as a cobalt sulfate, or a nickel sulfate, and the lithium carbonate or hydroxide through conventional mining, there's roughly eight tons of CO2 per ton of these materials and these materials are now going into batteries. Now, if you recycle batteries by the reasonably conventional pyro metallurgical route, which means smelting them, burning them and some of the other components and creating CO2, you probably have a CO2 generation of possibly half of that. Our measures at the moment are showing that our hydromet recycling process is in the region of a few hundred kilograms of CO2 per ton.

The increase in recycling of batteries is going to stop landfill and it is also going to make battery production more sustainable. It's going to flow into the manufacturing of electric vehicles and reduce that breakeven crossover point where the manufactured inputs in terms of CO2 for a car equal the CO2 outputs from burning fuels to make the power that go into cars. So I think that will be a big step forward, with being able to commercialize recycling and commercialize it in a way that makes money. So despite having the availability around the world of a lot of government incentives to assist in funding development, we have developed a process that will be commercially viable. Therefore, we're looking forward to earn that income for the Company, Primobius, and then to be shared equally between the shareholders of Primobius.

Dr. Allen Alper: Well, that sounds fantastic. Sounds like you've made great progress in the last couple of years, both in a technical way, and in a business way, in developing a great relationship. So that's excellent!

Mike Tamlin: It's a big team effort, Al. Our shareholders are very much a part of the team in the sense that we have to do things that benefit the shareholders. We are combining something that has sustainability benefits, with our current shareholders in mind, and with future shareholders, because we're seeing a resurgence of the shareholding type that values sustainable production and sustainability.

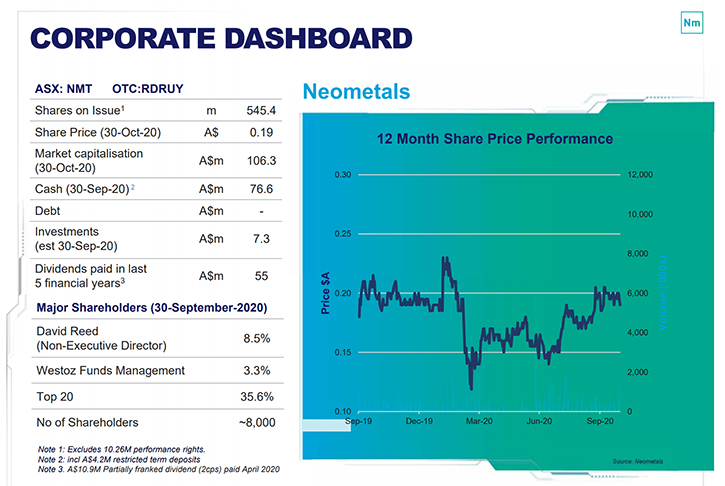

Dr. Allen Alper: Well, that's excellent. Could you tell our readers/investors the share structure of Neometals?

Mike Tamlin: We're listed on the Australian stock exchange. We have a fairly open share register made up of a lot of individuals, some high-net-worth people, some mom and dad type investors, and a few of the institutional types, but we're not heavily weighted towards institutional types. In terms of the shareholding structure, we have a a few large investors with the Top 20 holding around 30% and then a lot of smaller investors. Neometals has been listed on the stock exchange since 2002, and have been conducting our business according to the regulations in Australia. We also have over the counter access on NASDAQ and in Germany for overseas investors. So it is actually feasible for somebody in the United States or Europe to make an investment in Neometals in a fairly straight forward way.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about your background and your team?

Mike Tamlin: Yes. Since the days that I started having discussions with you, Al, we've moved from about five people in the Company to about 20. We had a luncheon recently to celebrate the retirement of one of my colleagues and there were 20 at the table. He has retired and handed over his responsibility to a colleague that has been on board with us for a while. We have teams associated with each of the projects. We have a fairly open office, so we get a lot of cross-pollination and interaction between people. We have a team that has the normal administration and accounting functions, but we also have teams that are made up of a Project Manager for each project and a project General Manager for the technical aspects, as well as technical assistance.

We do not spend money unnecessarily. We tend to be quite multitasking. On the recycling project, for example, Matt Read is the General Manager for the battery recycling project, taking over yesterday from Andy Robb. Andy had carriage of the project for about the last 14 months after coming on board. Matt has been with us for considerably longer and also manages our lithium refinery project, so he has a responsibility for both those projects. Gavin Beer is our GM of process development for the lithium ion battery and the lithium recycling. Those projects actually have quite a bit of synergy because as the lithium ion battery name suggests, there's lithium in the batteries, and we produce a lithium product from our recycling process. We also have some support from key subcontractors in Perth, particularly Strategic Metallurgy has been very helpful and Primero Group, the engineering contractors. They've been working with us very closely, over the last few years, as we've moved from the initial process development into modeling of the process.

Our process for battery recycling has been modeled firstly, in what is known as METSIM software and now in Sys CAD software. It's had a lot of work put into those models to simulate the process dynamics. That work will be completed through the demonstration plant feedback, by our colleagues at SMS in Germany, in due course. The demonstration activities actually will be in Germany, starting in early 2021, we're now making provisions for project supervision from the Neometals perspective by engaging one or two people in Germany before we're able to send our own staff over there to join colleagues at SMS. So it's been pretty interesting because our team has had to manage work that has been as close as suburban Perth, and as far away as Lakefield in Ontario, where the pilot operations were conducted and now in Germany, in our joint venture in Primobius.

It's been a challenge, but I think as we've all found with video conferencing during the COVID restrictions this year, it's starting to become second nature. We're actually managing pretty well by doing a lot of video communication. The same goes for our other projects, the vanadium project headed by my colleague, Darren Townsend, and Dr. Dave Robinson is responsible for process development. One important addition to our team that we've made during this year has been Dr. Ivanova. Irina has been engaged as the project controller. Every project needs to be scrutinized and Irena is a very accomplished metallurgist, who is able to do the technical equivalent of HAZOP studies to ensure that we're not making mistakes, before it’s too late.

That's an important project control aspect for us, the technical scrutiny of projects as they develop. We develop our projects through stage-gate controls and really have a much more rigorous approach now than we did two or three years ago, towards passing those toll gates. So our team, in summary, is heavily weighted towards technical and process people. My background is in metallurgy and I've had a technical and commercial career, but my task is to coordinate all of these people. And I'm very lucky to have a group of people that is both easy to coordinate and extremely good at what they do.

Dr. Allen Alper: Oh, it sounds like you and your team have a great background and a great technical and business background, so that sounds great. Could you tell our readers and investors, what are the primary reasons they should consider investing in Neometals?

Mike Tamlin: Yes. Neometals has enough cash to pursue the development of these projects towards the commercial phase. We have the capability of doing what we say we're going to do. We have a pipeline of projects that is reaching towards earnings from these projects in a staged fashion. So that means that we will be able to develop earnings and then accelerate earnings as these projects stabilize in a sequential way, and also manage the capital requirements by having staged demands from each of these projects. We have a track record in having developed Mount Marion lithium mine, with partners. So we are using the same partnering strategy for our battery recycling, recycling of vanadium from slags and our lithium refinery projects. That is aimed to lower the risk to investors by increasing the chance of success or successful development through to commercial operations. And in terms of the attraction of these projects, I think we're in the right area.

We will produce critical metals that are in demand from Western countries, particularly United States and Europe. Our business focus is on these regions and not on business with China, so we are trying to develop long-term stable, secure supply chains for European and for American users, particularly in the automotive industry. And we are fully cognizant of the need for production to be sustainable and friendly on the environment that we all live in. That means that we're looking at low energy consumption, low carbon footprint, and particularly with the recycling project for batteries and vanadium, we're using waste materials, preventing them from doing any harm to the environment and developing from them high recovery of all the components for reuse in the industries.

I think that sustainability issue is increasingly important - and I know my kids keep telling me that it's very cool to see me involved in these areas, but I think from the point of view of future generations, developments like this will be very beneficial and they can be done such to the benefit of the environment and still make good returns for our investors. I think the final aspect for us is that we are certainly historically prepared to share those returns with our investors. We have paid a dividend to NMT investors in the last five consecutive financial years in Australia, and we have an aspiration to continue that track record. So returning value to the shareholders is the primary goal. We don't hold onto the rewards but we do share success and for investors in good times and bad, I think that is something that would be very attractive to a potential investor.

Dr. Allen Alper: Well, those are excellent reasons for our readers and investors to consider investing in Neometals. Mike, is there anything else you'd like to add?

Mike Tamlin: I think for the moment, Al that covers it. Thanks. I could go on for hours talking about these things because they are very dear to the heart, but I would like to say please watch this space because over the next six months and 12 months, we're moving towards completing demonstration of the recycling. We're looking for an investment decision from the shareholder boards of Primobius by the end of next year and moving into development phase. And so that will be quite an exciting time for us. We anticipate that our development of raw material security, meaning contracts for supply of the scrap batteries and so on will be coming over the next six to 12 months and we've actually started the first one of those through an MOU with a new battery-producing company in Eastern Europe called InoBat where we're evaluating a joint venture for them to supply their scrap batteries and for us to process them and return materials to them. So you can anticipate, I think, seeing some announcements from us along the similar lines for that business model.

Dr. Allen Alper: Well, that sounds fantastic. It sounds like you and your team are both technical and business oriented and well-focused. You have a great business model, very enviable and you're in a great area, an area that's growing and one that's needed worldwide.

Mike Tamlin: Very much so and thank you for the compliment, Al. We spent a lot of time trying to not only live the dream, but to make it more than a dream.

Dr. Allen Alper: Oh, that's fantastic. Well, I think what you've done with you and your Team is outstanding. So I think that's really great accomplishments in a very short time. And our readers/investors will be paying a lot attention to what's happening this coming year as you develop and news is announced.

Mike Tamlin: Thank you.

Dr. Allen Alper: We’ll publish your press releases as they come out so our readers/investors can follow your progress. I think you all can be very proud of your accomplishments now and what will be happening in the future.

Mike Tamlin: Thank you.

https://www.neometals.com.au/

Chris Reed

Managing Director

Neometals Ltd

T: +61 8 9322 1182

E: info@neometals.com.au

|

|