Canada Rare Earth Corp. (TSX.V: LL): Developing an Integrated Global Rare Earth Business; Interview with Tracy A. Moore, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/22/2020

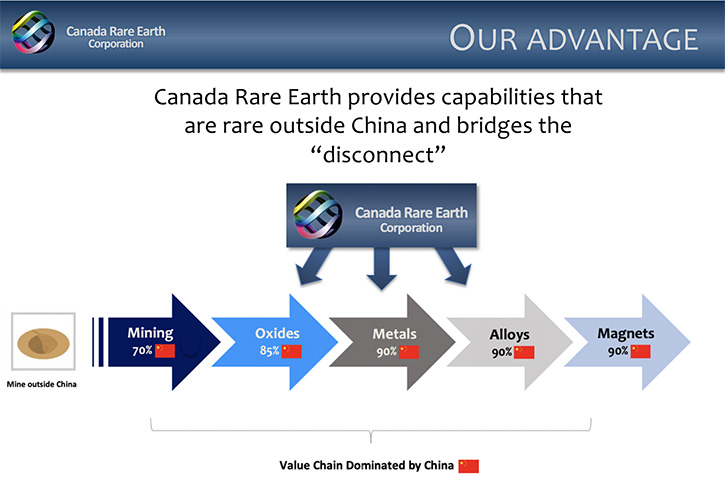

Canada Rare Earth Corp. (TSX.V: LL) is developing an integrated business, within the global rare earth industry. Each year $3 billion of rare earths are critically incorporated into $7 billion of high-tech and green tech products including electric vehicles, computers and military equipment. One country dominants supply (80% of global supply) and many countries and major companies are looking to diversify their supply source.

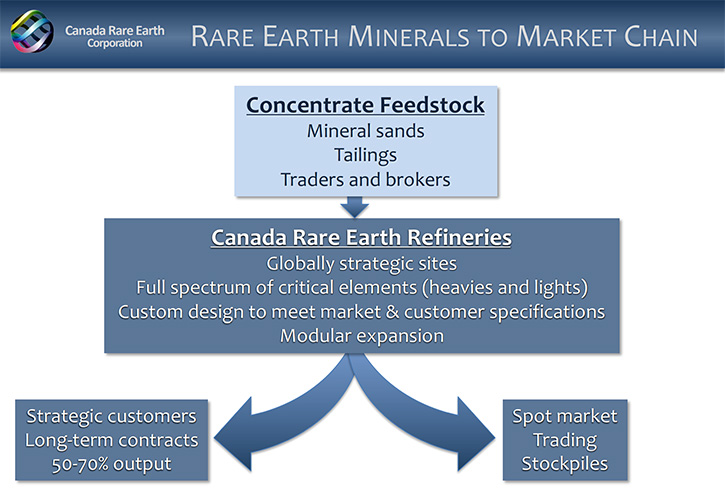

We learned from Tracy A. Moore, CEO of Canada Rare Earth, that Canada Rare Earth is becoming involved in all aspects of the supply chain from sourcing raw materials through to oxide, metal, and alloy production. Placing particular focus on the processing of rare earth concentrates is an area of significant competitive advantage for the Company, as this is the area of greatest need in the supply chain.

The Company is expanding concentrate supply from multiple sources, both existing and new, including from its own properties and through contractual arrangements with third parties. These concentrate supplies are currently sold to a solid customer base and, in time, will also be delivered to the Company’s own refineries as a bold step towards vertical integration.

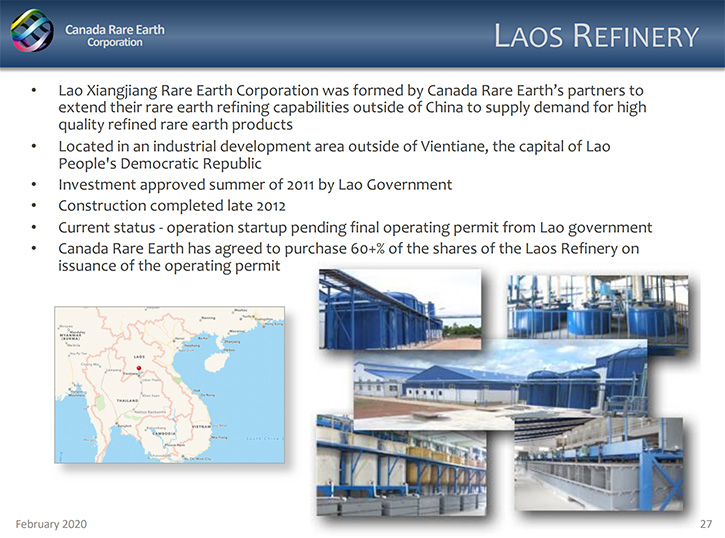

Presently, Canada Rare Earth is working to bring one of its properties into production, within the next nine months, and to complete the acquisition of two existing refineries outside of China. The Company is evaluating the feasibility of a third refinery within the Americas.

Canada Rare Earth Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Tracy A. Moore, who is CEO of Canada Rare Earth Corporation. Could you give our readers/investors an overview of your Company, and what differentiates your Company from others? I believe you have some unique capabilities that many other companies do not have.

Tracy A. Moore: Of course. Canada Rare Earth is continuing to generate revenues and gross profits. Our trading activities are expanding and becoming more and more consistent. We have delivered thousands of tons of rare earth concentrate from South America and recently we completed our first purchase and sale of material sourced in Africa. These trading activities generate gross profits and contribute greatly to funding our core operating costs, but much more significant revenues and gross profits will be generated from our own refinery operations once on stream.

We are fortunate to have direct access to well-proven processing technology, know-how and experience through our very close relationships with our partners who have successfully and profitably operated business in all aspects of the rare earth industry. As a result of our relationships and strategy, we are well positioned to acquire substantial equity positions in two completed rare earth refineries situated outside China and we are considering development of a third refinery in the Americas. We believe rare earth processing is the most significant link in the supply chain and that gives us a tremendous competitive advantage.

Because of our experience and contacts, we've been contacted by groups in the Middle East and in Southeast Asia to help them develop processing capability. Their motivation is to optimize value from their natural resources and assist in the economic well-being of their home countries. They recognize there is a limited market for concentrate and in order to maximize value they must enter into off-take agreements with a processor (such as Canada Rare Earth) or enter into a joint venture with a company such as ours.

We're developing proprietary sources of concentrate and are using agents to source additional concentrates. Our rare earth concentrates are primarily derived from tailings of mines and heavy mineral sand operations. This is a much more environmentally friendly approach than to be developing new mines as many in our sector are doing. These concentrates are sold to an existing customer base with a growing demand. In the future, the concentrates will also flow to our own refineries once acquired / developed. Right now, our customer base demand greatly exceeds the amount that we're able to supply. So, we're continually looking for new immediate sources to help satisfy that demand and to generate sales and gross profit.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors your primary goals for the remainder of this year and 2021?

Tracy A. Moore: Our main goal is to build on our existing success in supplying concentrates and to becoming a rare earth producer with Canada Rare Earth refinery(s) and our South American property. We will continue to increase revenues and gross profits through three means:

1. Startup of operations of our property in South America to provide another proprietary stream of concentrates and other valuable minerals. Along with two partners, we purchased 590 hectares of tailings which contain rare earths, zircon, ilmenite and cassiterite. We developed an operational plan to process these tailings and Canada Rare Earth has secured a customer for 4,000 metric tons of product per month which is expected to generate $4 million of revenues for the group each month. COVID has impacted our timeline, but with the advent of a vaccine being broadly available, we expect to get back on track quickly.

2. Acquiring and commencing operations of one, and likely two rare earth refineries. Each refinery will produce about 3,000 metric tons of oxides annually, which should generate revenues in the order of approximately $50 million each year. We have been working on behalf of one of the refineries and we believe we are close to receiving the final operating permits. We've been close a few times, and are currently optimistic of some positive news in the not-too-distant future, and

3. Continued expansion of our trading activities of mineral products (particularly rare earth concentrates).

Dr. Allen Alper: What concentrates do you supply and for what kind of applications?

Tracy A. Moore: We look for concentrates containing the full spectrum of commercially traded rare earths. Many refineries situated outside of China are only capable of separating a portion of the concentrate – creating a few of the possible rare earth oxides and the balance must be sold as a mixed concentrate. The systems we are affiliated with are capable of producing the entire spectrum of individual rare earth oxides, which provides greater flexibility for us, greater revenue potential and significant competitive advantages. For example, our targeted refineries are capable of producing neodymium (“Nd”) and praseodymium (“Pr”), which are high profile components of electric vehicles. But, very importantly and uniquely, the two refineries are also capable of producing dysprosium (“Dy”) and terbium (“Tb”) which are used with Nd and Pr and sell for 5 to 12 times as much. Most refineries, situated outside of China, are not capable of producing Dy and Tb.

Dr. Allen Alper: This will allow for processing rare earths to refine oxides into individual oxides and metals, outside of China.

Tracy A. Moore: That's correct. Yes.

Dr. Allen Alper: Great. But the primary products you deal with and sell to others are concentrates, is that correct?

Tracy A. Moore: That's correct at the present time, but as I mentioned before that will change once we have our refineries operating. We have sold over $3 million of mineral products over the past few years – primarily rare earth concentrates and some rare earth oxides. We have sourced from South America, India, Africa and China and sold into the United States, Canada, Europe and China. Our customer base will gladly purchase $15 million of product annually from us. So, we are continually looking to increase our sources of supply. Our property in South America will initially produce a mixed concentrate, comprised of rare earths, zircon, ilmenite and cassiterite. Once we have our own refineries, our supply needs will increase further and our oxide sales will increase significantly. The refineries will also be able to produce rare earth metals and alloys.

Dr. Allen Alper: Do you need partners for near term expansion initiatives in South America, Laos and Southeast Asia? How do you plan to go forward with that?

Tracy A. Moore: We are interested in finding the right financing partners and we're in discussions with a number of them, who are interested in the rare earth sector in general, and with us in particular because we’re generating revenues and we have visibility for near term significant growth. We have a number of strategic partners, including a commodity trading company, who are interested in the sector.

Dr. Allen Alper: Oh, that sounds very good. I would think that it might be possible to get money from governments, who want to be independent of China for rare earths. Are you looking at that too?

Tracy A. Moore: We've had discussions with a number of government agencies, some of which have funds available. The “apparent” funds tend to be a portion of what is required and, as you would expect, have a number of stringent requirements particularly regarding the originator of technology and know-how. That said, one particular government-sponsored financing organization is keenly waiting for us to get back to them, regarding a number of our initiatives. We'll have to see, but I'm sort of wary that they might be unduly conservative and may not be as forthcoming with the funds as more commercially oriented organizations, but we'll see. We will certainly continue to interact with them.

Dr. Allen Alper: That sounds good. We have a wide audience and there may be some who would benefit from a summary of the industry. I think it might be a good idea to give an overview of the rare earth market, its uses, et cetera.

Tracy A. Moore: Rare earths are widely used; however, few people are aware of them even though they're critical to so many applications. The uses are very surprising: nuclear submarines, night vision goggles, laptops, cell phones, guidance systems on missiles, windmills, and electric vehicles are a major use these days. The neodymium and praseodymium that I mentioned are very important, but also the terbium and dysprosium all help out with the electric vehicles. The current view is that $3-4 billion a year of rare earths are critically incorporated into, I've heard now, $7 trillion of products. So, in relative terms, not a lot of rare earths are needed for any one application, but they are critical for the whole range of high-tech and green-tech products, along with more mundane applications such as cracking oil and polishing lenses. One specific example is the use of the powerful rare earth magnets in electric vehicles (EVs) - the stronger the magnets, the greater the range of the EVs.

Dr. Allen Alper: That's excellent. So, that's really a growing market.

Tracy A. Moore: Oh yes. I think even China announced recently that they're hoping to become carbon neutral, within the next decades, dependent in a large part on the technologies available with rare earths. In order for China to accomplish this target, the rare earth market would have to double or triple in size. Think of the number of electric vehicles and solar panel applications – this would be a huge boost to the rare earth industry.

Dr. Allen Alper: It sounds exciting. Could you explain to our readers/investors, why it's so critical to establish sources for rare earths outside of China?

Tracy A. Moore: Well, China is unto itself in many respects. Because of differences in history, customs and culture, there can be and often are misunderstandings and different self-interests leading to distrust and uncertainties. As a result, for example, China is endeavoring to improve its economy and the standard of living for its citizens. In the case of rare earths, which are very important to the Chinese economy, the Chinese government could impose restrictions on the export of rare earths for the benefit of its citizens and to the detriment of everyone outside of China. As China produces approximately 80% of the global supply of rare earth oxides the rest of the world is economically dependent on China for a continuing supply and to have the supply of rare earths cut off or restricted would have significant economic impacts on western countries.

Dr. Allen Alper: What about the technology? Is there sufficient technology outside of China for refining and developing the critical rare earths?

Tracy A. Moore: There are a handful of refineries outside of China and I believe all have had some degree of Chinese involvement. These refineries, by and large, focus on a portion of the spectrum of rare earths, classified as light rare earths. Light rare earths include neodymium and praseodymium, Nd and Pr, which are in high demand. The refineries for the most part do not produce the heavy rare earth oxides, such as, dysprosium and terbium, which go hand in glove with the Nd and Pr to improve electrical performance. So, that's an issue.

There are also a number of upstart technologies designed to enhance concentrate and then separating the enhanced concentrate into individual rare earth oxides. To the best of my knowledge, none of these upstarts have advanced beyond the lab or pilot plant phases and none have been scaled up to commercial size yet. So, there's a question as to whether they're really viable solutions. The technology we're dealing with, we know has been proven and has been in business for many, many decades and has been continually improved. The two refineries we're looking at are state-of-the-art refineries, capable of processing the entire spectrum of commercially traded rare earths.

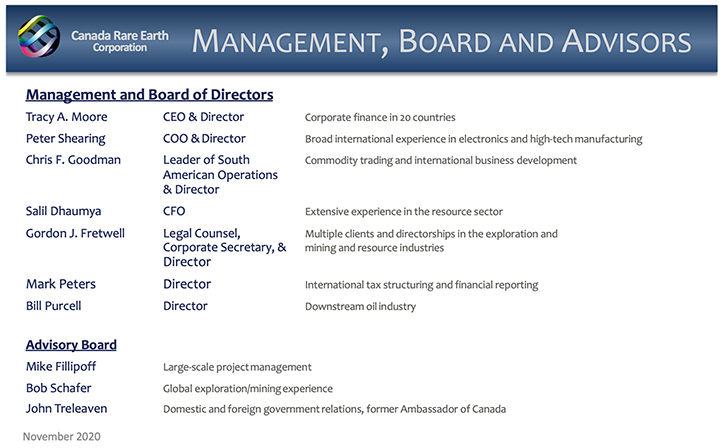

Dr. Allen Alper: Oh, that's excellent, Tracy. Could you tell our readers/investors a little bit about your background and your team?

Tracy A. Moore: My background is corporate finance and international business development. I've worked in over 20 countries. Peter Shearing, who is our Chief Operating Officer, is an engineer, experienced in contract manufacturing and international business, including working in Asia extensively. Other members of our team have large scale project management experience. One was a former ambassador for Canada, and he works closely with someone, who was a Canadian ambassador in Southeast Asia. So, we feel that we have a very good team of people that can provide the full complement of services. And to the extent that we might have a shortcoming in some area, we have friends and allies that can quickly step in and help us.

Dr. Allen Alper: Well. That sounds good. And you have advisors too that I've noticed on your website.

Tracy A. Moore: Yes. I was actually referring to them as well, such as the ambassador and the large-scale project manager.

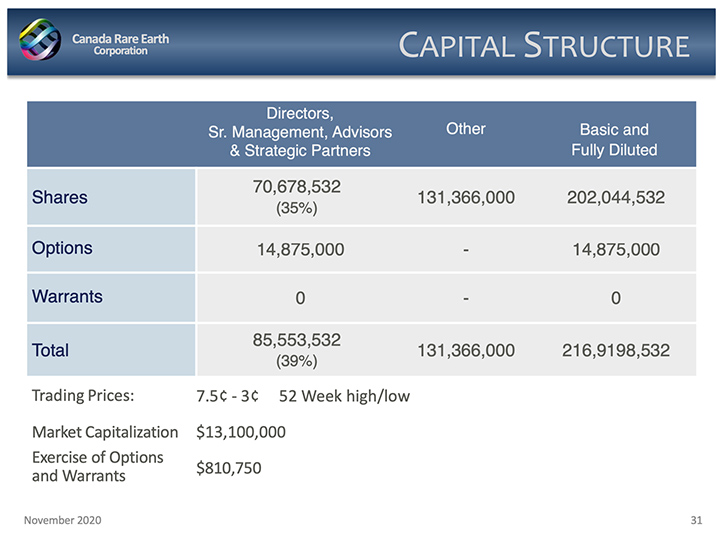

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your share and capital structure?

Tracy A. Moore: Yes. Currently we have about 200 million shares issued and about a third of these are closely held with officers, directors, close advisors, and there're roughly 15 million options outstanding, also to closely connected persons. So, it's quite a tightly held Company, poised for growth.

Dr. Allen Alper: Could you tell our readers/investors where your Company is listed and traded?

Tracy A. Moore: Our main listing is in Canada on the TSX Venture Exchange. The trading symbol is LL.

Dr. Allen Alper: Okay, great! Could you tell our readers/investors the primary reasons they should consider investing in your Company?

Tracy A. Moore: Yes. With the acquisition of the refineries that we are working towards, we are quickly moving to become one of very few real rare earth producers, outside of China, with capabilities that others don’t possess. So we will be key to the supply chain of major western and European companies, who are dependent on rare earths for their technologies and products. In addition, we are in business generating revenues and gross profits, which is another differentiator when compared to other companies in our sector. Our revenues are expected to increase dramatically, in the near future, as our property in South America commences operations and once we acquire one or both of the rare earth refineries we are pursuing.

In comparison, many companies in the rare earth sector are either focusing on exploring and developing rare earth properties (which in most cases will be years from production and with large capital expenditure requirements and mining risks) or are developing new approaches and technologies for processing rare earth concentrates (and are therefore subject to numerous risks). We, on the other hand, are focused on immediate commercial activities and with our access to proven processing capability, we have an easier time sourcing concentrate and processing the concentrate. We have an established customer base, which is willing and able to purchase much more product from us than we are currently able to provide.

Dr. Allen Alper: Sounds like very good reasons to consider investing in Canada Rare Earth. Is there anything else you'd like to add Tracy?

Tracy A. Moore: I'd like to emphasize that we've been working for many years, developing our vertically and horizontally integrated supply chain and most of the pieces are about to be fitted together. We're garnering more and more attention, with financiers and even with our peers in the industry. A number of people have remarked recently, “Canada Rare Earth is a great, best kept secret”. With the business base in place we are about to accelerate. Now is the time to make our position in the rare earth industry more known.

Dr. Allen Alper: That sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.canadarareearth.com/

Tracy A. Moore

Chief Executive Officer & Director

tmoore@canadarareearth.com

|

|