Wiluna Mining Corp. Ltd (ASX: WMX): Defined Resource of 6.4 Moz, Grade of 2.1 g/t Au; Milan Jerkovic, Executive Chairman, Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/15/2020

Wiluna Mining Corporation Limited (ASX:WMX) is an Australian gold producer that controls over 1,600 square kilometres of the Yilgarn Craton, in the Northern Goldfields of WA, and owns 100% of the Wiluna Gold Operation, which has a defined resource of 6.4 Moz, at a grade of 2.1 g/t Au. We learned from Milan Jerkovic, who is Executive Chairman of Wiluna Mining, that they are the largest operating gold company in the central part of Western Australia, producing about 60,000 ounces of gold a year. Wiluna's ambitious goal is to increase the yearly production to 250,000 ounces of gold, in concentrate, in the next three years. We learned from Mr. Jerkovic that they already have sold their future gold concentrate to two major off-takers: 70% to Polymetal International, and 30% to Trafigura.

Wiluna Mining Corporation Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Milan Jerkovic, who is Executive Chairman of Wiluna Mining. Milan, could you give our readers/investors an overview of your Company?

Milan Jerkovic: Yes. Thanks, Allen. Good to talk to you. Wiluna is one of the largest gold operators in central Western Australia, and we hold a substantial resource base, over six million ounces, in what is Australia's most prolific gold belt. We have a very large asset; we've been drilling since April with the aim of converting a large drilled resource, plus some additional extension, to a reserve that will support this essentially increased production rate. We're currently doing about 60,000 ounces of gold production a year.

We're looking to transition from our current operation to a sulfide concentrator, producing 100,000-120,000 ounces of production, and then continue through the next three years to expand that to approximately 250,000 ounces of production of gold in concentrate and also there's some gold doré on-site as well. So that's a fairly ambitious plan. However, the scale of this geology, there's a lot of mine development here already. There are five big lines into the ore body. There's 100 kilometers of ore, but the ore body's quite wide, shallow, the endowment per vertical meter is more than 10,000 ounces per vertical meter. We have a very simple route to commercialize the sulfidic ore body. That is a simple concentrate. We have sold that concentrate for the next three years to a company called Polymetal International, which is listed on the London Stock Exchange. The other 30% is sold to Trafigura, which is a very large international trade.

Dr. Allen Alper: Oh, that sounds great! Could you tell our readers/investors, your primary goals for the remainder of 2020 and going into 2021?

Milan Jerkovic: Yes. So the rest of 2020 is about demonstrating base cashflow from our modern current operation. The quarterly comes out, we have a resource update coming out effective in the next few days, and then a pretty substantial reserve resource update, which will include all of the drilling we've done to the end of September this year. And then, there were four weeks on-site and two underground. So on the surface, all of that data will be up until the end of September. We fed in the new numbers and the Board will also make a commitment, hopefully in the next few days, to start the construction on the concentrator for stage one production, which will match the current mine development underground that is happening for that. And of course, drilling results. We will continue to drill, and there have been spectacular drilling results, and you'll see those every month coming through.

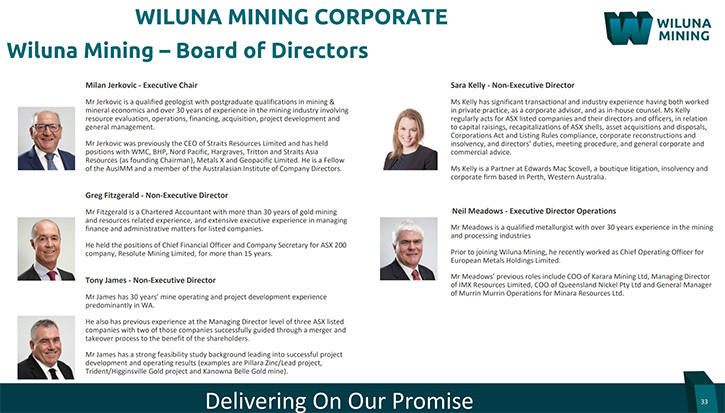

Dr. Allen Alper: Well, that sounds excellent. Milan, could you tell our readers/investors a little bit about yourself and your Directors and Team?

Milan Jerkovic: Of course. I have a geology, mining, engineering, and economics formal background, but I've been in the industry forever, 30 years, essentially involved initially as a practitioner, operating and building mines and then I was a Chief Executive Chairman for the last 15 years or so. My business experience, at that point, was with large-scale short positions that are undervalued and either bringing them to provide the production through methodical project commercialization, and cleaning up Companies as well in the process and then getting them back on track.

With me, I have Jim Malone doing Investor Relations. He's been in the industry for as long as I probably, and experienced around the world. Neil Meadows, my Operations Director, is a very experienced metallurgical engineer and a general manager so he's been also on-site, he's doing the current operational improvements and also supervising the construction of our first bench concentrator, but he's also going to help us define the feasibility for stage two expansion, with his experience. Sara Kelly, the Non-Executive Director, joined us recently. She's a corporate lawyer from Perth. She brings another dimension to the Board. A mining engineer, Tony James, Non-Executive Director. Greg Fitzgerald, ex-CFO of Resolute, is our lead Independent Director.

And then the rest of my executive team is Cain Fogarty, our Chief Geologist; he has a lot of experience with Barrick and other companies. Anthony Rechichi is our CFO, also ex-Resolute. Wayne Foote is coming as General Manager of Major Projects, and he was involved in Resolute and other companies, a lot off-shore. He was the gentleman, who did the feasibility study for Gold Road, who ended up eventually selling 50% of the assets to Gold Fields. We've also brought in a number of resource specialists, mining engineers to assist with the current study and the first stage underground mine and surface specialists.

Dr. Allen Alper: Well, that sounds great, a very experienced, knowledgeable, rounded team. Could you tell our readers/investors a little bit about your financials?

Milan Jerkovic: Yes, our current production is reasonably high-cost, $1,900 all-in SC, or the per ounce of $1,600 cash. We have about $2,600 Australian, so we're generating pretty good margins. Our cash balance is about $15 million or so. And we are in the process of closing the second portion of our debt facility for this stage. One expansion, once the reserves are published into this year, we have an agreement in place already for about 40, 45 million. It'll come down to what we agree on with them. And we'll be drawing that facility down in January. Our market cap's about $200 million Australian, at the moment.

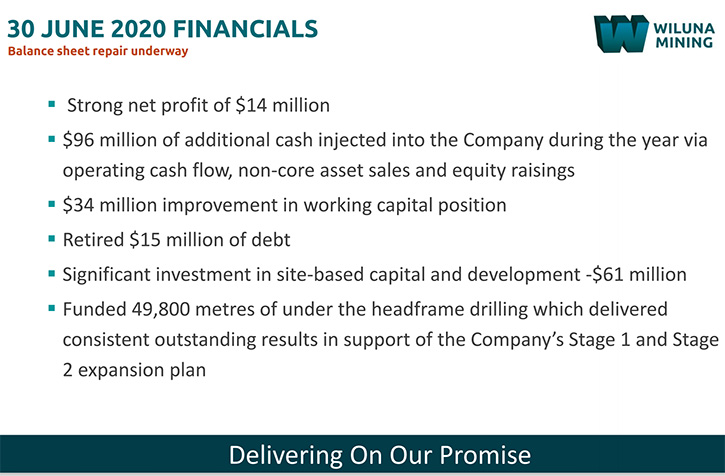

Dr. Allen Alper: Could you tell our readers/investors a little bit about your balance sheet?

Milan Jerkovic: Owing to a combination of improved operating performance, the realization of value from the sale of non-core assets, and proceeds from equity transactions, the Company was able to achieve significant balance sheet repair including: $34m improvement in its working capital position; and a total debt reduction of $15m.The rest of the balance sheet is just assets really. We're going to generate through to the commissioning of our concentrator next year about $40 to $50 million of annualized operating cashflow.

Dr. Allen Alper: Sounds excellent, Milan! Could you summarize the reasons our readers/investors should consider investing in Wiluna Mining?

Milan Jerkovic: Yeah. The main reason to invest in us is that we're a turnaround story, with a very large geological resource to convert into a reserve, expanding cash. We are undervalued in a C1 jurisdiction, relative to our peers. Look at the average resource ounce valuation for companies, or reserve per ounce valuation, with international and Australian peers, we're one of the best value companies. As you know, these are Australian dollars, but our valuation is $32 per resource ounce, our valuation on our reserve ounces is 170-173, which is a fraction of what the average is for our peers globally and in Australia.

That's because the Company came from a reasonably difficult situation a year ago - fellowship problems, a large amount of debt, which had to be cleaned up, which we've done. We brought some very solid international shareholders on the register in April, out of London and North America, who are interested in the large scale and the geology. Since then we raised our last money at a dollar a share, we've doubled that value in the last four months, twelve months, but really the biggie, what I think is going to be a significant rewriting of the Company, is if we continue to hit outsiders.

Dr. Allen Alper: Well, that sounds like your team has done an excellent job in rebooting the Company. It's on a great track now, and there's great potential. You have a great resource and a great Team and now excellent financial backing. So it sounds like it would be an excellent opportunity for our readers/investors. Milan, is there anything else you'd like to add?

Milan Jerkovic: I think if people are looking for a small company with potential to generate at tier one, in a tier one jurisdiction, with the geology pretty well already showing its scale, we're that company. In a market that's obviously conducive to gold at the moment, I think we offer a very clean leverage and cashflow. We have cashflow while we try to grow. So we're a development, exploration company, with bonus cashflow support. Our goal is to convert this current potential to a much larger operation, within three years.

Dr. Allen Alper: That sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://wilunamining.com.au/

Milan Jerkovic

Executive Chair

T +61 8 9322 6418

F +61 8 9322 6429

info@wilunamining.com.au

|

|