Peninsula Energy Limited (ASX: PEN): First Uranium Company in the United States to Pursue the Low PH Low-Cost In Situ Recovery; Interview with Wayne Heili, Managing Director and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/14/2020

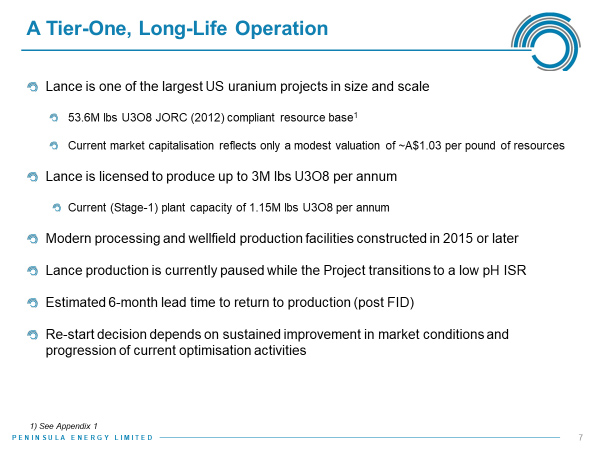

Peninsula Energy Limited (ASX: PEN) is a uranium mining company, which commenced in-situ recovery operations in 2015 at its 100% owned Lance Projects, in Wyoming, USA. Following a positive feasibility study, Peninsula is embarking on a project transformation initiative at the Lance Projects, to change from an alkaline ISR operation to a low pH ISR operation, with the aim of aligning the operating performance and cost profile of the project, with industry-leading, global uranium production projects. We learn from Wayne Heili, Managing Director and CEO of Peninsula Energy, that they are the first company in the United States to pursue the low pH in situ recovery. The other thing that sets Peninsula Energy apart, from the other junior uranium mining companies, is that over the next decade the Company has sales contracts in place for 5.5 million pounds of uranium, which means that it will be generating revenues through its sales from now until the end of 2030.

Lance Projects Process Plant and Admin Building, Wyoming, USA

Dr. Allen Alper: This is Dr. Allen Alper, talking with Wayne Heili, who is Managing Director and CEO of Peninsula Energy. Wayne, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

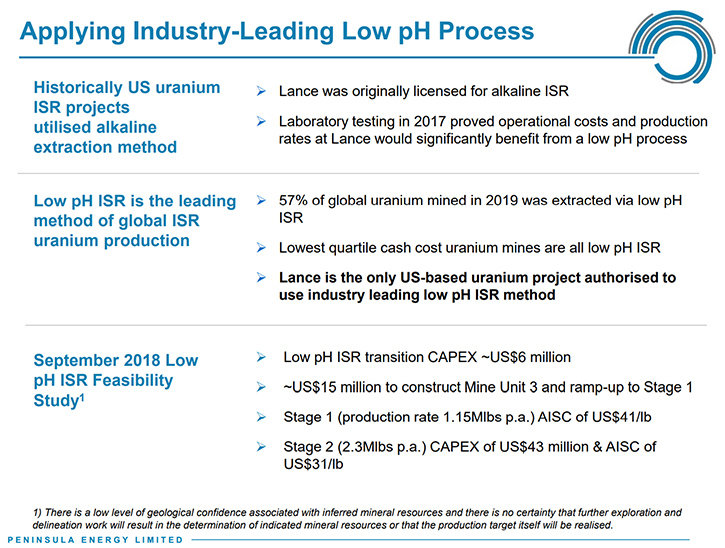

Wayne Heili: Sure, Allen. Thank you. Peninsula Energy is an Australian Exchange-listed uranium mining company, with assets in the United States. The Lance projects in Wyoming are in situ recovery assets and the Lance projects were put into production in late 2015. Subsequent to that, in the middle of 2019 and because of market conditions, Peninsula idled its production operations. But we have been working diligently to advance change and process chemistry at the Lance projects, and we're transitioning the project from an alkaline-based chemistry to a low pH or an acid-based chemistry. The key for us is that all of the top-quartile low-cost uranium production around the world is completed and conducted by low pH in situ recovery. And we're the first company in the United States to pursue that chemistry set, rather than the alkaline chemistry, which has been the staple for the US industry for the last several decades.

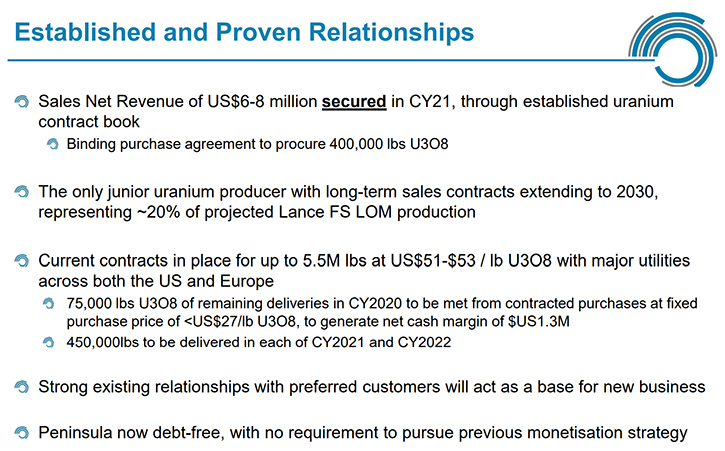

Peninsula has taken a path to low pH in situ recovery. We're fully permitted and authorized to do that now. I guess the other thing that really sets us apart from the other participants, in the junior space for uranium mining, is that Peninsula has sales contracts in place, a significant book of contracts that reaches out to the year 2030. Over the next decade, we have about five and a half million pounds of sales under contract, with a little over four million in guaranteed deliveries. The balance of it is at our customer's option. So Peninsula will be generating revenues through its sales from now until the end of 2030. All the other junior uranium companies are hoping to have a contract book, hoping to sign contracts with customers, and Peninsula has an excellent, in the money, contract book today.

That is a summary of the two key points of differentiation between Peninsula Energy and our peers.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors a little bit more about the project, the quantity, and how you stack up cost-wise versus others?

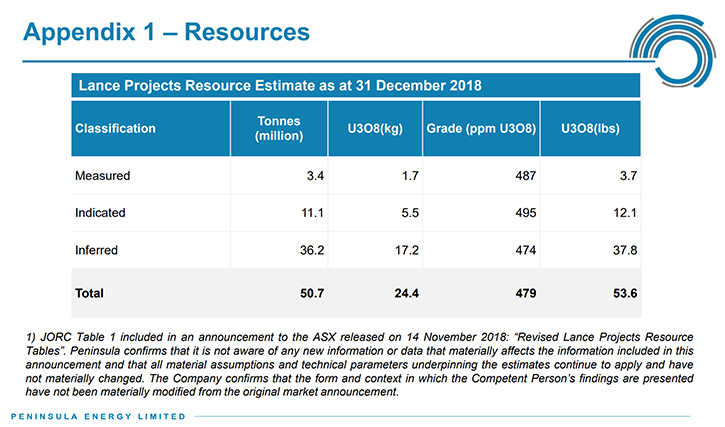

Wayne Heili: The key feature of Peninsula's Lance projects, in Wyoming is its abundant uranium resource. At this one project, we have 53 million pounds of JORC- compliant uranium resource identified. Compared to any other US project, that's probably two to three times as much uranium. Most uranium companies in this space, may have 20 to 30, and even up to 50 million pounds of resource, but that's over multiple projects. The Lance project, in one location, in Wyoming has a significant large uranium resource, making it a very investible project. We've licensed the facility earlier in the last decade and completed licensing for up to 3 million pounds per year of production at the Lance projects. The initial construction and design for the projects was to produce at around 1 million pounds per year, and that's what we're currently constructed for.

The design rate of production today is just over one million pounds per year. We think our all-in sustaining costs, using the low pH chemistry, will be around $40 a pound for production at a 1.1 million per year rate, and that's pretty good all in all. We're talking about all-in sustaining costs, not just direct operating costs. In the US market, compared to other US peers, that's a pretty good number.

Dr. Allen Alper: Well, that sounds very good. Could you tell our readers/investors a little bit more about your plans for the remainder of 2020 and going into 2021?

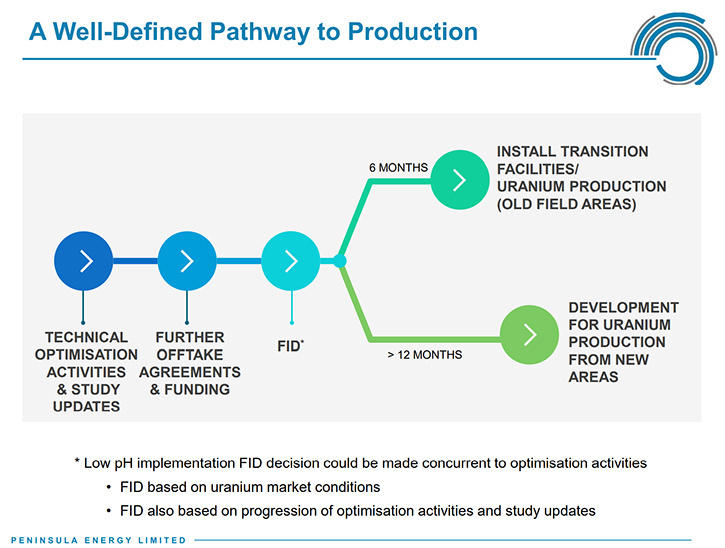

Wayne Heili: In 2018 and 2019 we put a lot of effort into showing that the low pH chemistry will work better at the Lance project. We conducted a field leach trial in 2019 that allowed us to obtain our final permitting authorizations to proceed with mining and developing new mine areas using the low pH chemistry. But today, we're doing a low pH field demonstration and our focus for the balance of this year and going into 2021 is really on this field demonstration, showing that the laboratory work that we've done can actually enhance the recovery results, the uranium grades and the overall performance of low pH in-situ recovery, compared to what we initially assessed in our feasibility study in 2018. In August of this year, 2020, we started a low pH field demonstration in the unmined area MU1A, and that field demonstration is just getting ramped up now.

We anticipate running it for the next 12 to 18 months, trying to develop a full recovery curve in a fresh mining area that's never been impacted by the alkaline chemistry. So a big part of our business plan in the coming year is continuing to validate the assumptions and prove that the low pH chemistry is far superior to the alkaline chemistry at our project site. Along with that, we're preparing our project for the resumption of production. With these contracts that we have in place, we need to be a producer again in the future. So we continue to prepare the project site to return to production status. I often tell investors, it's not a question of if, but when. Today we're able to satisfy most of our contracts through purchases in the market. And unfortunately, the uranium market prices are below our cost of production.

Today it is more economic for us to acquire product from the market than it is for us to produce, and we're satisfying our contracts that way. But we're preparing for the future where we will be producing again.

Dr. Allen Alper: What are the projections for uranium supply and demand in the future?

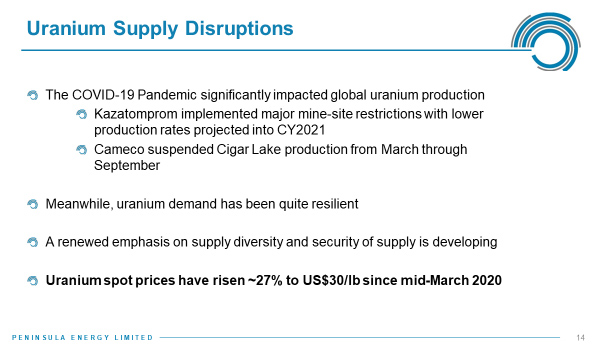

Wayne Heili: Demand for nuclear fuel is growing year in, year out at a rate of one to 2%. That's been true for the last decade, and I think that'll be true for the coming decade or two. Demand is very predictable, as it's based on the number of operating nuclear reactors, and nuclear reactors are large scale visible investments that just don't appear overnight. The projections are for continued growth in the uranium market. But supply, particularly this year with the COVID-19 pandemic going on, has been severely impacted. Globally, demand is projected to be around the 180 million pounds per year range. And in 2020, primary production of uranium from the global mines is estimated to be around 120 million pounds. So, we will have a 60 million pound, or almost 30% shortfall in production compared to consumption this year.

Now, there're inventories of uranium that have been made available to absorb the impact of the supply disruptions and the uranium market itself hasn't significantly changed because of the supply disruptions, but the price of uranium in the market is up over 27% year-to-date, and the supply disruptions are going to continue in the market and the projection is for strengthening of prices in the uranium spot market going into 2021.

Dr. Allen Alper: Well, that sounds interesting. Wayne, could you tell our readers/investors a little bit about your background and your team?

Wayne Heili: Certainly. Thank you for asking. I've been a part of the US domestic uranium industry since the late 1980s. I'm 30 years plus in uranium production myself. I have a background in metallurgical engineering and a mineral processing emphasis. I came out of the university and went into the uranium production industry, when the uranium production industry was far from glamorous in the late eighties. I've been fortunate to make a career in this industry and to survive over 30 years to come to this stage of my career. I work with some exceptionally talented and similarly positioned people at Peninsula and our fully owned US subsidiary, Strata. Ralph Knode, our Chief Executive Officer at Strata Energy, which is the operating arm for the Lance projects, has probably 10 years of experience on me in the uranium industry, as a geologist and a gentleman who's worked around the globe in uranium production, including countries like Kazakhstan, and is well known throughout the industry here in the United States.

He's complimented with a Senior Vice President for regulatory affairs, who has many, many years of experience and has been able to drive the permitting actions for us very effectively, a Senior Vice President of geology at the site, who also has probably in the order of 40 years of experience. In just a very small handful of individuals, collectively, we have over 150 years of uranium mining experience on our Team at Peninsula Energy.

Dr. Allen Alper: Well, that's very impressive. It's good to have a Company that has such strong experience and knowledge of the industry and the mining business.

Wayne Heili: Nothing makes things go like the people, who are asked to make it go, and when you have such experienced people, the job gets a lot easier.

Dr. Allen Alper: That's absolutely true! It gives confidence to readers/investors. Could you give our readers/investors a background of your share and capital structure?

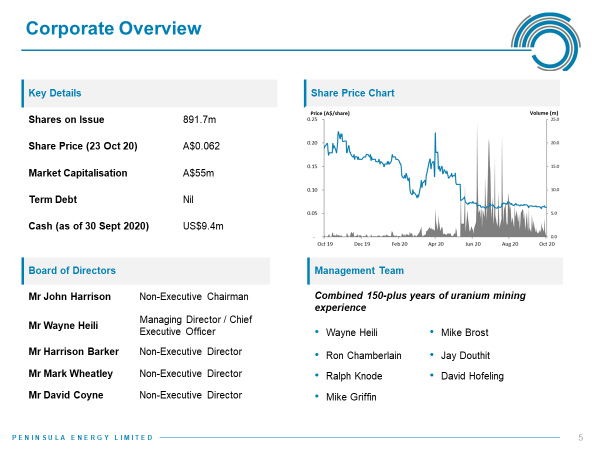

Wayne Heili: Right. Well, it is an Australian Exchange listed stock, and like so many, we have a capital structure that features a lot of shares at a low price compared to North American companies. So we have about 880 million shares outstanding, at the price of around 7 cents per share Australian. That gives us a market cap of around $60 million Australia. The exchange rate is about 0.7 right now or somewhere around $40, $45 million US in market cap. The Company sits with over $9 million in the bank. We're sitting term debt-free. We repaid our long-term debt earlier this year and so we're in probably the healthiest financial condition that the company's been in in a long time. No term debt, over $9 million US in the bank, and capable for funding our activities from now into 2022 very comfortably, especially considering that we have revenues coming from uranium sales, both in the fourth quarter of this year and throughout 2021.

Dr. Allen Alper: Well, that's excellent. Sounds like you're in a great position to be in and strengthening as you go into 2021. It sounds like you're in a great position!

Wayne Heili: Well, we think so. We've put a lot of effort, over the last several years, into putting Peninsula into this position, being prepared to ramp up production in the low pH chemistry, which is certainly much more effective at this project site. But we became the thought leaders in the US industry in making that transition to low pH in-situ recovery. I think others will follow as they see the success that we'll have with it, both economically and on our overall uranium recovery basis. And I think that the work that we've put in, invested in the project over the last three years in the technical and regulatory fronts, and then also in repositioning and recapitalizing the Company, leaves us very strongly positioned for the future.

Dr. Allen Alper: That sounds excellent. Wayne, I wonder if you could summarize the primary reasons our readers/investors should consider investing in Peninsula Energy.

Wayne Heili: Well, I think we've hit on the high points. We are well-funded without term debt and positioned ready to restart our projects. We have a modern project, it was just constructed in 2015, so there's nothing obsolete about the technologies we use. We're moving ahead, with the world leading, low cost, uranium production methodology at Peninsula. I think that makes us a standout company here in the United States. We've gone through quite a bit of effort to put ourselves into this position today. I think we're significantly undervalued compared to our peers, which are traded in the North American markets. I think that's an opportunity for investors to look at a quality company, well-positioned and undervalued as we've gone through this transformation process, and today sit very ready to move forward into the future.

Dr. Allen Alper: Well, that sounds excellent. Is there anything else you'd like to add, Wayne?

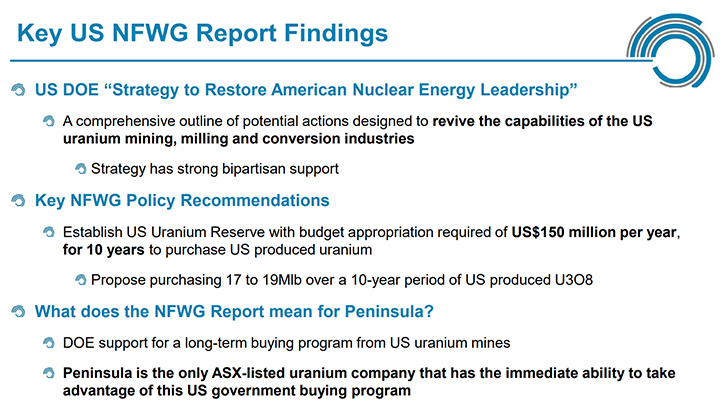

Wayne Heili: No, I think you've asked some great questions. I guess just in the global uranium markets, supply and demand is going to rule the day. Allen, I think that the markets have been out of balance, with a bit of oversupply or quite a bit of over supply for a long period, but a lot of the uncertainty in the uranium markets has resolved itself, over the course of this year. And it's providing an opportunity now for fuel buyers and the main consumers of uranium to start looking at entering into longer-term supply contracts, appropriately priced. And there are going to be some great opportunities for US producers to supply materials also to the US government for a strategic uranium reserve. So I think that while there's been a malaise in the uranium market for the last couple of years, the patient investor is going to be rewarded soon. And I think the uranium prices are due to rebound and strengthen, and companies like Peninsula, who are ready to respond to an improving market, are going to be the beneficiaries of that improving market in 2021.

Dr. Allen Alper: That sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.pel.net.au/

Wayne Heili

Managing Director / CEO

info@pel.net.au

|

|