Arrow Minerals Ltd (ASX: AMD): Advancing Two of the Most Prospective and Fast-Growing Gold Projects in Burkina Faso and Western Australia; Howard Golden, Managing Director Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/10/2020

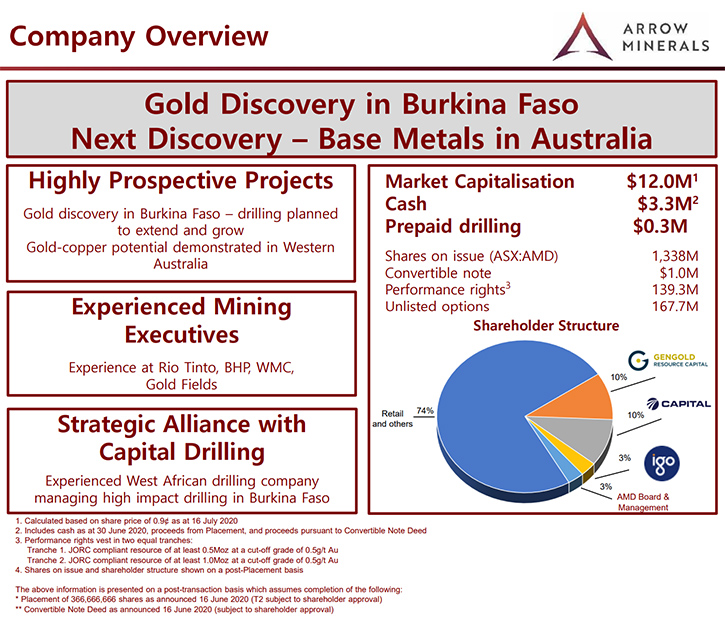

Arrow Minerals Ltd (ASX: AMD), as a result of its 2019 merger with Boromo Gold, is an emerging gold exploration company, with about a $10 million market cap, advancing its projects in Burkina Faso and Western Australia, two of the most prospective and fast-growing geological environments in the world. We learned from Howard Golden, Managing Director of Arrow Minerals, that with the discovery over in Africa, and with very interesting conductive anomalies, combined with very high-grade geochemistry in Western Australia, the Company finds itself in a great position. Near-term plans include exploration drilling on the Dassa discovery in Burkina Faso, as well as soil sampling and generating drill targets on three other West African early-stage projects, led by the local team of dedicated skilled geologists. In Western Australia, Arrow is planning a drilling program to start November-December.

Arrow Minerals Ltd

Dr. Allen Alper: This is Dr. Allen Alper, Editor-In-Chief of Metals News, interviewing Howard Golden, who is Managing Director of Arrow Minerals. Howard, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

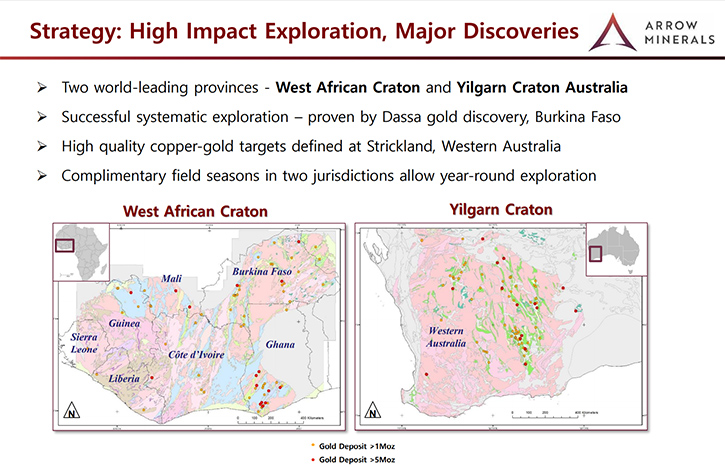

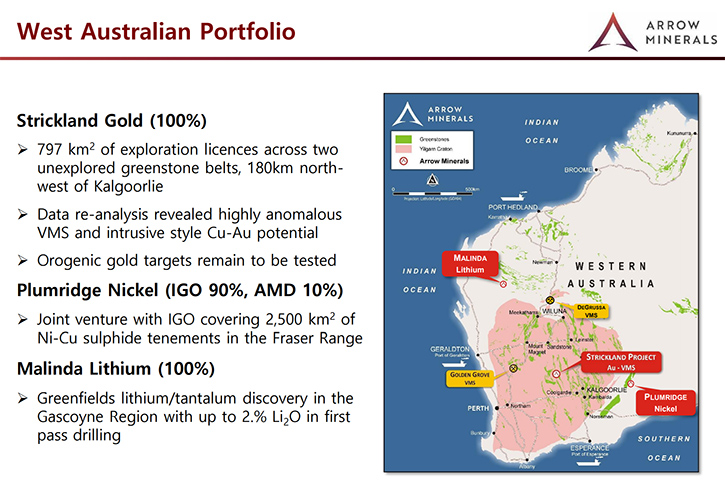

Howard Golden: Sure, Allen. Thanks very much for interviewing me for Metals News. Arrow Minerals is a small company, listed on the ASXas AMD. We have about a $10 million market cap. We have an interesting mix of projects comprising gold projects in Burkina Faso and copper and gold projects in Western Australia. Strangely, even though they're a billion years apart in age, the geology is actually very similar in many ways.

Arrow is the result of a merger of two small companies, a private company and an ASX listed company. We put these two assets together and after this merger we ended up with excellent exploration assets and a very good management team which I have the privilege of leading.

I am originally American and have lived in Australia for 21 years now. I've also lived in Africa for seven years. I'm French speaking and I love being in Africa. I moved back to Australia about a year-and-a-half ago after spending four years in Russia. I was very pleased to get back here and get back to Africa.

So I’m leading the charge. I'm a geophysicist by training, having spent more than 30 years doing exploration. Our Board is made up of other people who are very experienced in the mining industry, and our small team in Australia and Africa is very experienced.

We're in Burkina Faso in West Africa. That is one of the most exciting gold emerging terrains in the world. 14 years ago, there was no gold production there at all, now there are 15 operating mines. It's the fourth largest gold producer in Africa. And we're in Western Australia in the Yilgarn Craton, which is, as I'm sure you would know, one of the most prolific mineral production provinces in the world as well.

So we're in a good place - we have good people, we have about $3 million in the bank now, and we are in a really interesting phase in our projects, where we have very good indications. We have the discovery over in Africa, and we have some compelling conductive anomalies over some very high-grade copper and gold geochemistry in Western Australia. So I think we're poised to really come through with the goods.

Dr. Allen Alper: Well, that sounds great. Could you tell our readers/investors a little bit about your plans going forward in Africa and West Africa and your plans going forward in Australia for the rest of 2020 into 2021?

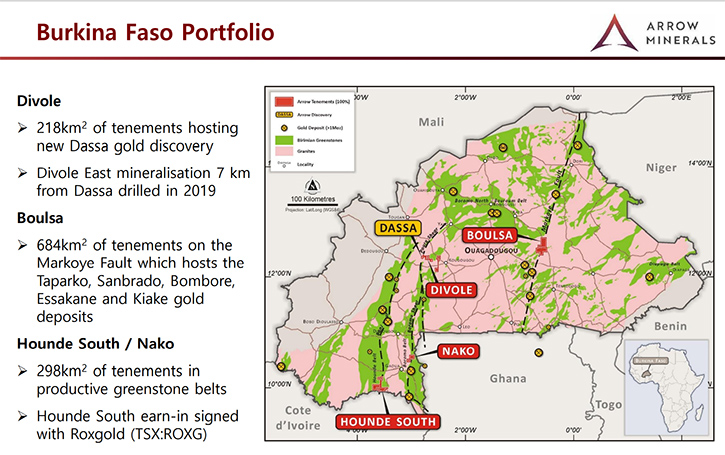

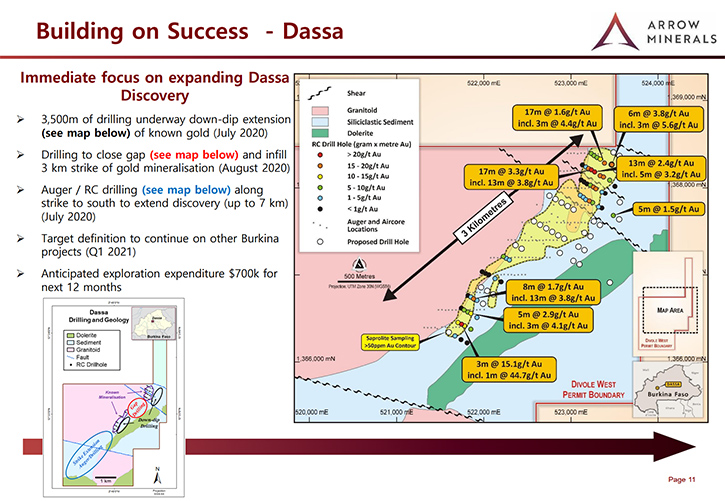

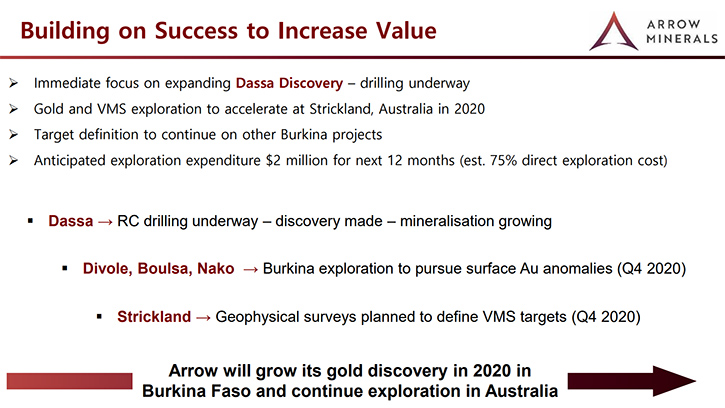

Howard Golden: We're pretty excited about the next steps. In West Africa, in Burkina Faso, we have a discovery there. It looks like about a kilometer by kilometer, with some very high grades, up to 45 grams of gold, averaging probably something over two grams. We are just now in the process of organizing a drill, a drilling contractor, and precise plans to go to reverse circulation drilling there, to try to really understand exactly how big it is and see at what point we can progress that into some kind of a resource stage.

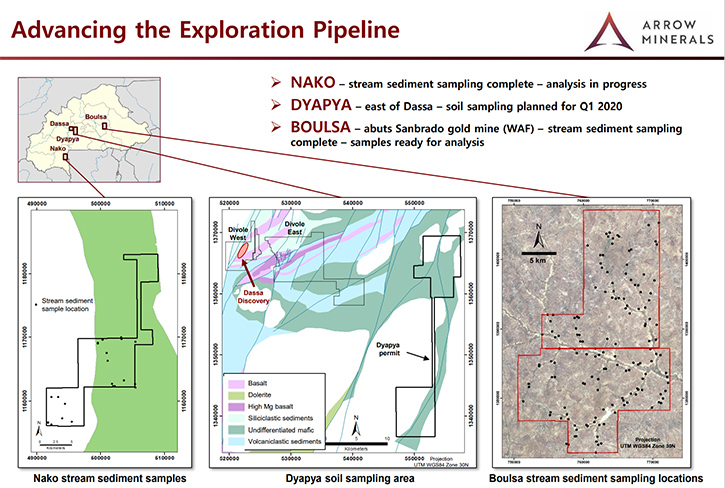

We also have three other projects in West Africa that are very early stage. They were granted later, and we have our team on the ground ready to develop drill targets in the coming months, which is very important.

Before the whole pandemic started, we were very keen to have a dedicated, skilled set of local African employees in Burkina Faso. At the time, we thought it was a good idea. It turns out now that it was a great idea because these professionals can just go out and do the work now. They're now preparing to go do drilling plus soil sampling on our other Burkina Faso projects.

So we'll be generating a pipeline of drill targets on the other Burkina Faso projects, even as we're advancing our drilling at the discovery known as the Dassa project.

Dr. Allen Alper: Well, that sounds great, that sounds like this is going to be a very exciting time for Arrow Minerals.

Howard Golden: Yes! We intend to that on the ground as soon as the rain stops. We’re in the rainy season over there now. It usually dries up in early November, although every year it gets harder and harder to predict when the season starts and stops. But in principle, all things being equal, we should be able to get in there by mid-November.

Dr. Allen Alper: Well, that's great! Those are excellent results that you've gotten so far. That's really great.

Howard Golden: Indeed, we're pretty happy with the results we are seeing in Burkina. It is a classic Birimian greenstone belt, associated with a major structure, which is where most of these orogenic gold deposits sit. And it really looks a lot like some of the other deposits.

The one that springs to mind is Morila. It's very similar because it's on the contact of sediments and granites and we're pretty excited about the possibility of being able to grow this into something substantial in the coming months.

Dr. Allen Alper: Well, that's great. And what about your plans for Australia?

Howard Golden: Well, this is actually kind of a nice story. In Western Australia, we have an interesting project that has been on Arrow’s books for several years. My predecessors here at Arrow did a lot of work looking for orogenic gold. As part of that, they collected about 40,000 soil samples and shallow drilling samples and analyzed most of them for up to 40 elements. So we have tens of thousands of samples.

When the COVID crisis hit and we were pretty much locked in here, we came up with several very interesting geochemical anomalies. They were coincident anomalies with elements such as gold, silver, copper, and some very interesting pathfinder elements, such as arsenic, tungsten and bismuth, which just really smell like volcanogenic massive sulfide deposits such as those in Canada, but several have been discovered in Western Australia in the last several years as well.

So just about two weeks ago we completed a helicopter electromagnetic survey, effectively a very sophisticated airborne metal detector, and flew over these geochemical anomalies. We were very pleased that we discovered seven very nice, discreet, conductive anomalies at quite shallow depth. So we're in the process, right now, of planning a drill program to test these anomalies.

They're a lot of fun because geophysical anomalies are beautiful, you can see them. You can see them on your screen and you know exactly where they are. And you can drill them and see what's down there. So our big challenge is there actually isn't as much of a technical problem as much as finding a drill rig, because the mineral industry is absolutely booming in Western Australia and it's difficult to find a drill rig. So we're talking to contractors now and doing final stages of planning and would hope to be able to do that drilling as well in November or December.

Dr. Allen Alper: It sounds excellent. Could you tell our readers/investors a little bit more about your background and your team?

Howard Golden: I was born in the U.S. I studied at the University of Utah and then got an advanced degree from the University of Leeds in the UK. I have worked with most of the majors, including over 15 years with BHP. I worked with Western Mining here in Australia, and at Rio Tinto as well. So I've done a lot of work here in Western Australia, and in Africa including Gabon, in the Ivory Coast and Burkina Faso.

I spent the last four years living in Moscow, working for a company called Nordgold that works in Russia and West Africa. So now I'm here running this Company, to which I bring a wealth of experience, not just from a geoscientific perspective, but I have spent a lot of time working with communities in the developing world. I think that puts me in a really good place because without the support of the local communities, these projects don't work at all. We have a very firm policy of creating value for our shareholders, and creating value for the local communities as well.

I'm joined on the Board by Tommy McKeith, who has had several senior roles. Most recently, he was a Senior Manager for Goldfields. After leaving those positions, he is serving on the Boards of several companies here, including Evolution Mining, one of the top 50 gold miners in the world. My other Board colleague is Frazer Tabeart, who has a Ph.D in geology, with whom I worked 20 years ago in Western Mining.

Dr. Allen Alper: That sounds great.

Howard Golden: Frazer, he's a great hand and a brilliant geologist, and he serves on a couple of boards. He's a major contributor to a company called Polar X that has some really interesting evolving projects in Alaska. And then, of course, we have our small team of four people in Burkina Faso, led by Ballo Boureima, who is a very experienced geologist who has worked for Western companies, local companies, knows his way around traps in government and so on, and he's excellent with the local communities as well.

Our CFO is Janine Owen. She has very rapidly come to grips with the West African French derived accounting and regulatory environment as well as the Australian environment. So she has really done a great service for us on both sides of the ocean.

Dr. Allen Alper: It seems like you have a great team there, excellent experience, and quite diversified, so that's excellent. Could you tell our readers/investors a little bit about your capital structure and share structure?

Howard Golden: Sure. Our share structure often sounds a little unusual to North American investors because we have 1.3 billion shares issued. That's actually not that unusual on the Australian Securities Exchange.

People often ask us if we're thinking about reorganizing the capital and doing some kind of a consolidation, and it doesn't seem like a good use of our resources right now, but obviously down the track, we may well have a look at that.

We're sitting today at about $10 million market cap. And we have about $3 million, I think yesterday it was $2.7 million in the bank. We also have a one million dollar convertible note, also some performance rights and a few options on issue.

Dr. Allen Alper: I noticed you have a strategic alliance with Capital Drilling. Could you tell us a little bit about that?

Howard Golden: That's correct. Capital Drilling is a very solid investor, we like them a lot, and they also are very good drillers. Capital Drilling actually has two arms, the drilling arm and an investment arm. The investment arm invested in our company when we did one of our capital raisings, but we also, simultaneously, did an independent negotiation for drilling, and they gave us some very fair contract terms.

While we're not required to use them, we usually go to them, they're our first choice because they drill for a fair price and with good quality, we love working with them because they're a loyal investor. So that's our deal with Capital Drilling. It did involve some prepaid drilling, but we've drawn down on that. So at this point, it just continues to be a good relationship.

Dr. Allen Alper: That's excellent. Howard, could you tell our readers/investors the primary reasons they should consider investing in Arrow Minerals?

Howard Golden: That's a two-part answer. The first is the basic technical setup. We have the expertise in hand, we have the cash resources, and we have some excellent projects. So obviously, those are three things that you need to go to the next stage of adding value.

But I think the other thing is we are in a classic sweet spot for junior explorers. If you're in the very, very greenfield stage and you have really nothing to show except for a good idea and a good piece of ground, you're not quite there.

If you've already drilled a resource, then the opportunity for major growth, five or 10-fold growth, starts to disappear as you head into production. But we're in this spot, where we've narrowed down our search base, we have real anomalous results, with real mineralization. The next step is the step where we hope that we can take the value of the Company up several stages quite quickly.

Dr. Allen Alper: That sounds excellent! Is there anything else you'd like to add, Howard?

Howard Golden: I think it's important to know that we're doing something that we love. I love what I do, I love where I do it, and I really enjoy working with the people here in Australia, and the lovely people in Africa and the local communities. I think if you really enjoy what you do, it is reflected in the quality of your work.

Dr. Allen Alper: Oh, that sounds terrific. That's excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://arrowminerals.com.au/

Arrow Minerals Limited

Mr Howard Golden

Managing Director

E: info@arrowminerals.com.au

|

|