Idaho Champion Gold Mines Canada Inc. (CSE: ITKO) (OTC: GLDRF): Exploring Highly Prospective Mineral Properties in Idaho, United States; Interview with Jonathan Buick, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/7/2020

Idaho Champion Gold Mines Canada Inc. (CSE: ITKO) (OTC: GLDRF) is a discovery-focused gold exploration company that is committed to advancing its 100% owned, highly prospective mineral properties, located in Idaho, United States. Idaho Champion is vested in Idaho, with the Baner Project in Idaho County, the Champagne Project, located in Butte County near Arco, and four cobalt properties in Lemhi County in the Idaho Cobalt Belt. We learned from Jonathan Buick, President, and CEO of Idaho Champion Gold Mines, that having raised $8.1 million, the Company is fully-funded through 2021, and they are currently drilling at both projects, with lots of news flow, lots of activity, and assays in the lab, waiting for results.

Champagne Project: Idaho Champion Gold Mines Canada Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Jonathan Buick, President, and CEO of Idaho Champion Gold. Jonathan, could you give our readers/investors an overview of your Company, and what differentiates your Company from others.

Jonathan Buick: Sure, and thank you again, Allen, for interviewing us today. Idaho Champion has two gold projects in the state of Idaho. We have the Baner Gold Project, which was a brand new discovery for us in the 2018 drill program. Also we have the Champagne Project near Arco, which is a past-producing, open pit heap leach that Bema Gold had in production from 1989 to 1992. We currently have two drill programs underway, doing a Core program at the Baner, and we have an RC and the Second Core Rig, at Champagne.

So we are in the midst of an 8,000 meter program between the two projects, with lots of news flow, lots of activity, and assays in the lab, waiting for results. In terms of the overview, listed in Canada, we also have an OTCQB listing. Our ticker in the US is GLDRF, in Canada, ITKO, I for Idaho, T-K-O for technical knockout, we have decent volume. We closed a bought deal prospectus, offering financing on July 30th of this year. We raised $8.1 million and 30 cents. So we're, fully-funded through 2021, and actively going to be aggressive, in terms of the drill bit, but also in terms of getting in front of readership and investors through conferences and online formats. So thank you for this opportunity.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit more about your two key projects, and what information you have now, and what your plans are?

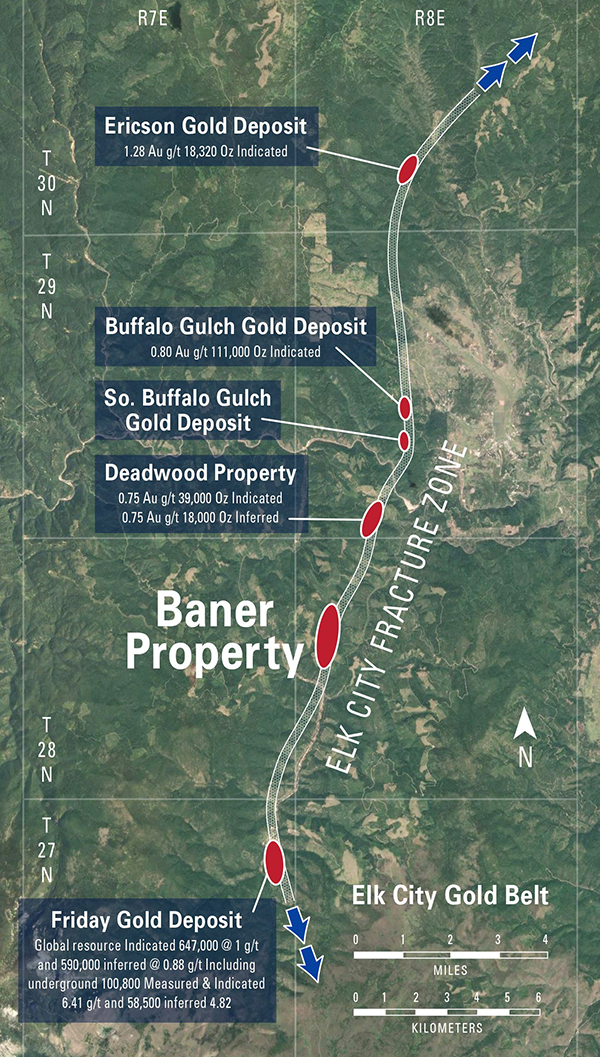

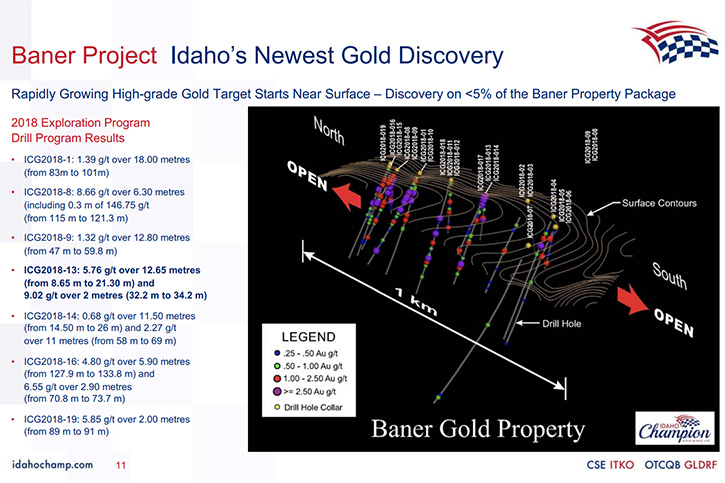

Jonathan Buick: Sure. So, I'll start with Baner, over near Elk City, Idaho, central Idaho. We drilled 19 for 19, in our discovery program. So, in 2018, the question was, "Is there gold?" We answered that question, with those drill holes. The question of this current program is, "How much gold is there?" Our discovery zone at Baner, was 500 meters North-South, by 200 meters East-West. With the permit we have currently, and the drill program we have currently, we're marching the drill bit north to expand that discovery zone. It's our expectation that, through this current program, we will see that footprint of discovery increase dramatically.

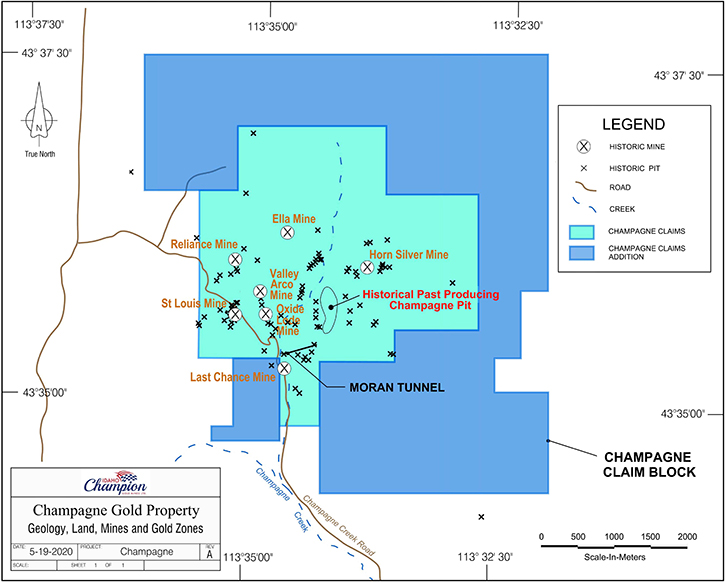

At Champagne, this is our first year of drilling. We were able to take advantage of the spring and fall, increasing our land package there. This was a project that we had staked in February 2018.

We then did some acquisitions in the spring. We bought the data set from Kinross, who had bought Bema in 2006. We got the data from Kinross in March. As a company, we were very fortunate that the governor of Idaho deemed mining and exploration essential services through the COVID pandemic. So a lot of our colleagues were told, tools down. We were able to stay busy and active in the field. And so we consolidated, through three acquisitions, and a lease option. And then, in our own staking, we now control 10 square miles at Champagne. The objective of the program currently, is twofold. One is to see how much of the oxides were left behind by Bema. We know they mined for three years, but based on the data we got from Kinross, we also feel comfortable, and I can say confidently that the assays were left behind.

So we're looking to understand better what happened there. Bema, during their drilling, never drilled below a hundred meters. And we think there's something happening at depth. We could potentially be sitting on top of a porphyry system, or a collapsed collaborator. Bringing in the core rig, we're now drilling 500 meter holes to try to see if we can understand what's happening at depth. We announced an IP program last week, and so we're going to continue to get a better appreciation and understanding of what's happening across our bigger land package. The reason we increased our land package was, once we had that data from Kinross, we felt that this was a camp, not a project. So we wanted to control as much of that camp as possible.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about Idaho, and its significance in gold mining?

Jonathan Buick: Sure. That's a great question. Idaho is a continuous mining state since the 1860's, better known for the Silver Valley, up near Coeur d'Alene, but certainly there's been ongoing mining in the state since the 1860's. In terms of gold, you have a number of past-producing oxide deposits. You have the Integra, with the DeLamar Project, very similar geology to Champagne. You have Liberty Gold at the Black Pine, also very similar geology to Champagne, and then you have Revival Gold, over at the Beartrack, similar geology to the Baner. So there are a number of opportunities, amongst juniors in Idaho, to advance historic known resources and deposits. We've seen, as a state, over $220 million raised this calendar year for companies operating in the state. So that's quite exciting for us, but certainly there are a number of different government agencies that are very supportive.

I've heard the governor speak at a number of different conferences. He's so positive towards our industry and they're open for business. They want to see jobs operating in a place like that. It is fantastic for us, for our Company, and our shareholders. Also, Idaho sits directly above Nevada, which has always been considered the number one place to be for gold. That's a man-made border, and I'll tell you right now, the gold doesn't stop at that border. So there're lots of opportunities in Idaho, and we continue seeing more and more appeal from other companies coming into the state.

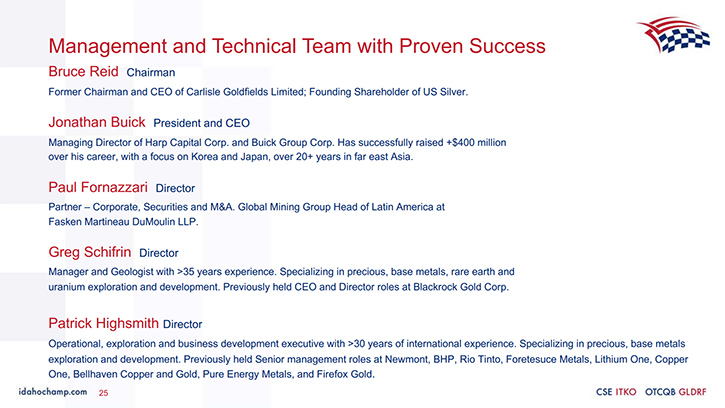

Dr. Allen Alper: Oh, that sounds excellent. Jonathan, could you tell our readers/investors a little bit about your background and your Team?

Jonathan Buick: My background is corporate finance. I've raised over $400,000 million for companies in the natural resource business. And as a team, I have a very strong, technical based Board. I have three geologists on my Board. I also have a lawyer, the whole point of his job is to keep us out of trouble. He is a securities lawyer, he's a senior partner at Fasken in Toronto. I have myself and Bruce Reid, both Toronto based. Bruce is a geologist by background, a former analyst and banker out of Toronto. The two most recent appointments are Greg Schifrin, and Patrick Highsmith, both US citizens, both geologists. Greg is based in Sandpoint, Idaho. He's been crucial for us as a Company, and for me personally, over the last six months. With the restrictions on travel, having Greg be our boots on the ground, and our representative in dealing with the different agencies, and the families as we did, those acquisitions, has been crucial for us.

I don't know where we'd be without Greg, but also Patrick Highsmith. We've brought him onto the Board, post financing, in August. He has just come back from a two year stint with Fortescue, in Australia. I've known Patrick 15 years. I asked him to join the Board with the sole purpose of, from his time at Newmont, where he was responsible for doing joint ventures with juniors, I've asked Patrick to come in and help us manage our data. While we have a lot of historic data at Champagne, we're also generating lots of new information as a Company. We've been approached by a couple of mid-tier and large cap gold companies. And our need for Patrick, is to make sure that we put together, and manage our database of information, in a way that represents the opportunity. We see two wealth-growing opportunities at Baner and Champagne, and it's the opportunity for us right now to be able to communicate and articulate that. Champagne's a past producer, Baner's a brand new discovery.

The newest gold mine in Idaho is the Friday, which is five miles South of the Baner, which tells me, as an investor, which I am, I'm the second largest shareholder in the Company, knowing that I see a mine, that has the permit, and has started production in April of this year, tells me that if we can prove up enough ounces at Baner, we have the path towards permitting. So we're very comfortable about where we are, and look to lean on both Greg and Patrick, based on their backgrounds.

Dr. Allen Alper: Well, it sounds like you and your team are very experienced, very knowledgeable, and very well balanced. So, that's excellent!

Jonathan Buick: Yes, we're very privileged, working in lots of great communities. The other thing that people often overlook, is your community relationships. And we've been blessed with the people in both Arco, and Elk City, and their belief in what we're trying to do, and the support. Wherever we can, we're hiring local, and trying to make an impact in those economies. It's been a tough year for everybody. These are very small, remote locations, and so the more we can spend in those communities, and hire locally, the more we'll be doing our part.

Dr. Allen Alper: Oh, that's great! Could you tell our readers/investors about your share, and capital structure?

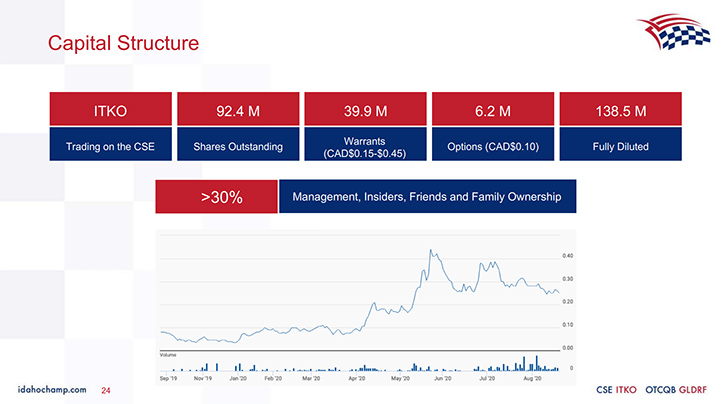

Jonathan Buick: Management owns 32% of the Company, that's all paid for stock. I've agreed to a lock up, as the second largest shareholder. I believe that this is a wealth creating opportunity for my shareholders. Our shareholders are our partners. The advantage they have is liquidity. We have 92 million shares outstanding. We just raised $8.19 million on July 30th. Right now our treasury sits around seven million, because we were spending on drilling two projects. Our burn rate to calendar year end, with the two drill programs, is 3.2 million, US. So we'll certainly have a lot of money left in the treasury for 2021.

We also have $4 million of in-the-money warrants, predominantly held by insiders, and friends, and family. That's warrants that we can call, and bring in fairly quickly, and fairly easily, should we need to, and then there's an additional $6 million of warrants that were tied to the financing in July, at 45 cents. My belief is that with the drill results coming back from the lab, and that we started to put up the regular news floor around the drill programs, our stock should be repriced and rerated. When I look at our treasury over the next 18 months, I really see a war chest of $17 million, not the seven we have in the bank right now.

Dr. Allen Alper: It sounds fantastic. Could you tell our readers/investors the primary reasons they should consider investing in Idaho Champion Gold?

Jonathan Buick: Well, we have two projects, both have a multi-million ounce opportunities. There's huge potential. At Baner, we're in a historic mining camp in Elk City, with Idaho's newest goldmine five miles south. We're drilling into an oxide discovery, and we're expanding that discovery zone as we speak. We'll see news flow start in the next 10 days, out of those drill holes that are in the lab at Baner. At Champagne, we have a past-producer, with known metallurgy. We believe very strongly that there's a much larger system at play, than the hundred meter holes that Bema defined in the eighties. So we think there's a huge opportunity at Champagne, both in gold, but also in base metals at depth. We have a Management Team that controls 32% of the Company, that's aligned with our shareholders. We're well-funded in the capital markets, we have a research report from Beacon Securities.

We also had 14 institutions participate in that financing. And I think that speaks volumes to the quality of the opportunity, in that 14 institutions would buy a company that had a market cap of $6 million at the time of funding.

So location, Idaho is now ranked eighth in the world by the Fraser Institute, and third in North America. We have seen developed infrastructure throughout. We have paved highways to both properties. We have power close by, a willing workforce, major investments into the state. We see Idaho as a state that will continue to rise in prominence, in terms of resource opportunity. We're now triple listed, in Canada, the US, and in Frankfort, with a significant amount of news. I anticipate having a news release a week, between now and January of 2021.

So lots of new information coming into the market, showing the advancements of the projects, with a management team that's aligned with the shareholders. If I were looking for an investment, I'd want to know I could invest in a company that has the possibility of a permit, but before the permit, the possibility of ounces that are meaningful. Right now we're drilling two oxide deposits in a great jurisdiction, and a third of our market cap is in cash. So I'd say those are reasons to take a closer look at us.

Dr. Allen Alper: Very, very strong reasons for our readers/investors to consider investing in Idaho Champion Gold! Is there anything else you'd like to add, Jonathan?

Jonathan Buick: We've now created a YouTube channel, as part of our ongoing program. We are flying regular drone footage, because of the people's inability to travel to conferences or events, to understand what's going on where you invest your money. We thought it was important for us to find new ways to communicate with our shareholders, or potential investors, and I would direct people to look up Idaho Champion on YouTube, where you can see drone footage from both Champagne and Baner. You can see the rigs being mobilized, you can see the rig turning, you can almost get a touch-feel sensation out of those videos, that you can't get through a presentation, or a press release on a website. So I'd say take advantage of the videos, and my contact information is on the presentation. People can now call, or email. I’m happy to get on the phone, and discuss all the reasons why we're excited about Idaho Champion.

Dr. Allen Alper: It sounds excellent. A way of our readers/investors to learn more about Idaho Champion, and see what's currently happening with the Company, drilling and get results. Sounds like this will be a very exciting time for Idaho Champion, and you'll be producing a lot of information for our readers/investors.

Jonathan Buick: Correct. Correct. I know it's going to be an exciting next 12 months, and onward, but certainly more immediately, the news flow tied to those drill programs is going to be meaningful for our team, and our shareholders. Hopefully new investors will have a chance to start to check boxes, and appreciate the activity level we're regenerating, and Dr. Alper, I appreciate the opportunity to introduce Idaho Champion to your readers/investors.

Dr. Allen Alper: Oh, that's excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://idahochamp.com/

Nicholas Konkin, Marketing and Communications

Phone: (416) 477 7771 ext. 205

Email: nkonkin@idahochamp.com

|

|