Canagold Resources Ltd., (Previously Canarc Resource Corp.): An Experienced Team Advancing Western Canada’s Highest-Grade Undeveloped Ore Body, with 1Moz High Grade in BC; Interview with Scott Eldridge, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/29/2020

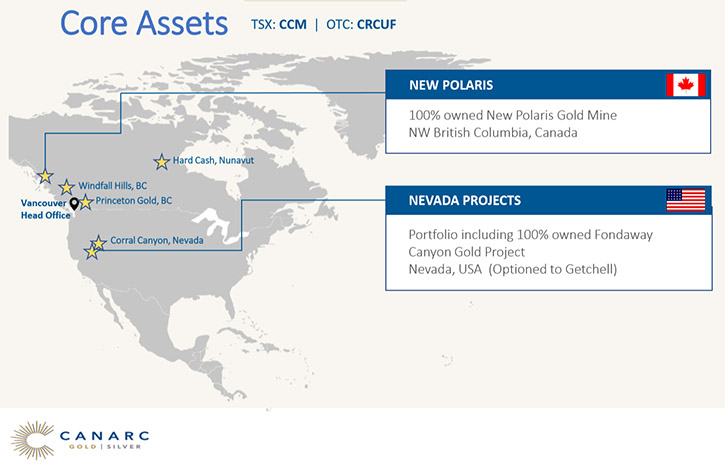

Canarc Resource Corp. (TSX: CCM, OTC-QB: CRCUF, Frankfurt: CAN) is currently advancing two core assets, each with substantial gold resources, and has initiated a high impact exploration strategy to acquire and explore new properties that have district-scale gold discovery potential. We learned from Scott Eldridge, who is CEO of Canarc Resources that their flagship asset is the New Polaris past-producing, high-grade, underground gold mine, up in Northwestern BC. After a very robust PEA, based on a one-million-ounce resource, the project is now ready to go into the development stage of advancing into a feasibility study. The Company owns an exploration portfolio in Canada and just completed drilling on Windfall Hill in BC and Hard Cash in Nunavut. In Nevada, Canarc Resource owns 10 projects, the flagship Fondaway Canyon holds a one-million-ounce resource and is currently optioned to Getchell Gold (GGLDF).

Canarc Resource Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Scott Eldridge, who is CEO of Canarc Resources Corporation. Scott, could you give our readers/investors an overview of your Company and also what differentiates Canarc Resources from others?

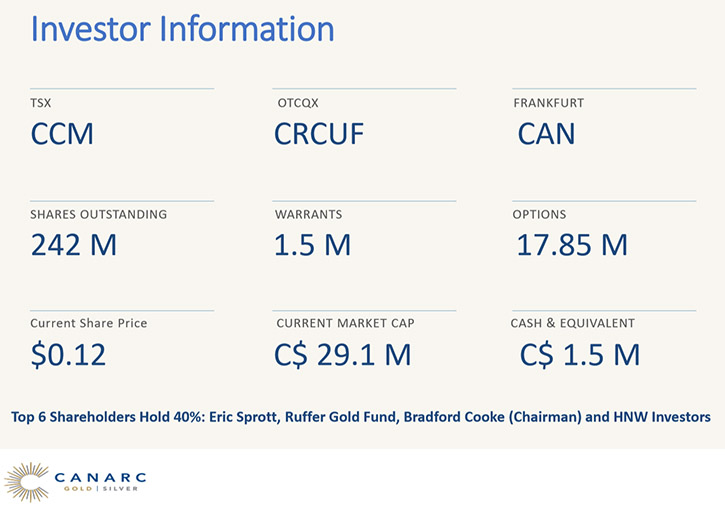

Scott Eldridge: Absolutely. Canarc is a publicly traded company, listed on the TSX, OTCQX in the US and the Frankfurt Exchange in Germany. We have a market cap of approximately $30 million Canadian and we are focused on developing and exploring for gold, within Canada and to a lesser extent in the United States.

We do have a portfolio of gold projects, primarily concentrated in Canada. Our flagship asset is the New Polaris past producing, high-grade, underground gold mine in Northwestern BC. With a diluted resource grade of 10 grams per tonne, the project is Western Canada’s highest grade undeveloped ore body. We have published a very robust preliminary economic assessment on the project at $1,500 gold, based on a one million ounce resource. That project is now ready to go into the development stage of advancing into a feasibility study and has very robust economics, including an after-tax IRR of 56%, NPV5 of half a billion Canadian and a payback of under 2 years. Our flagship assets looks even more robust at current spot prices.

Moving farther north, we have a project where our phase 1 drill program, targeting high-grade mineralization, just concluded. That project is called Hard Cash, and it's located in Southwestern Nunavut, where we are targeting a high-grade discovery, in the western extension of the Ennadai Greenstone belt, which is host to other high-grade gold mines. We should get the assay results, starting to trickle in, probably in the next 2 weeks. Nunavut is home to Meadowbank and Meliadine, both high-grade mines.

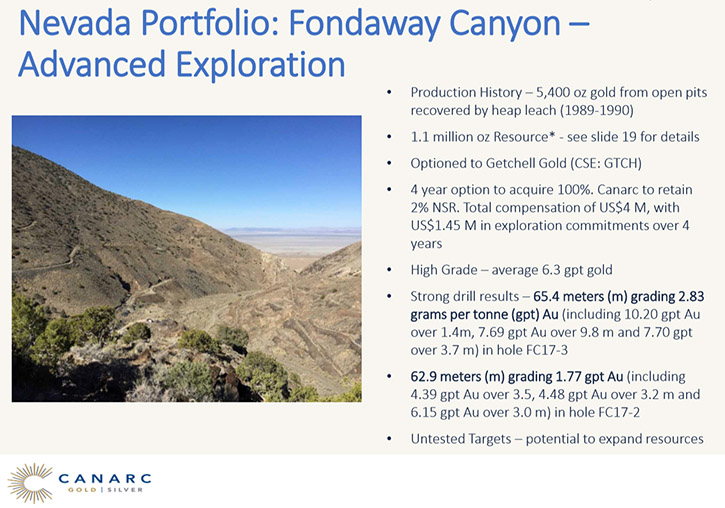

In the US, we have 10 projects in Nevada. The flagship there is a project called, Fondaway Canyon. It also has a one million ounce resource on it. We currently have that optioned out to another junior, publicly listed gold company called Getchell Gold and they have recently commenced drilling activity. The remainder of what we have in Nevada is more grassroots exploration, which we intend to option out to create shareholder value, given our renewed focus is in Canada.

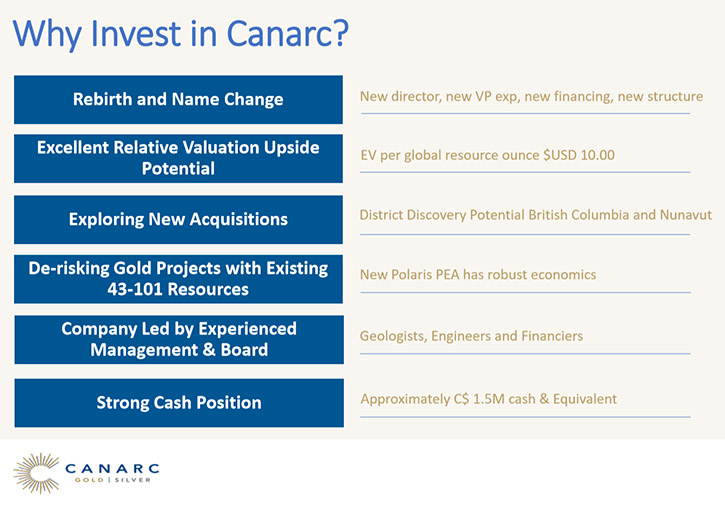

In terms of what sets us apart from other companies, I think that brings us back to our flagship asset, New Polaris, a one million ounce high-grade resource, representing the highest grade undeveloped ore body in Western Canada at 10 grams per ton. From a valuation perspective, based on enterprise value per resource ounce in the ground, Canarc does trade at about $10 US per ounce, which is a significant discount to our peer group. So I think the differentiator for investors is that there's definitely upside potential in our Company based on ounces in the ground, combined with the potential for high-grade or district scale gold discovery within one company.

Dr. Allen Alper: Well, you have an excellent portfolio, some excellent projects. Could you tell our readers/investors your plans going forward in 2020, into 2021?

Scott Eldridge: Most definitely! On August 19th we announced multiple corporate changes including an equity financing, which we subsequently upsized to $8.4 million CAD. It will close in the coming days. Included in the August 19th news release, we are going to be changing our name from Canarc to Canagold. We're doing a five-for-one share consolidation. Andrew Bowering, a well-known mining executive, is joining our Board of Directors. So we're pretty excited about these corporate changes and we think it's a new beginning, the rebirth of the Company. We look forward to working with our new Director, with a renewed focus coming back to our Canadian projects.

Our activities for 2020 and even into 2021, will include drilling on three different projects, giving shareholders exposure to multiple projects, over the next 12 months. We plan to commence infill drilling on New Polaris to lead into the feasibility study. We just completed the phase two drill program on Windfall Hill and anticipate drill results on Hard Cash, on what could be a high-grade discovery. So there's a lot of action going on within Canarc. You'll see steady news flow out of our Company over the coming months. There are a lot of exciting things going on. It's a great time for shareholders and those that aren't shareholders to be following our progress, through our news releases.

Dr. Allen Alper: Oh, that sounds excellent! Sounds like it is going to be a very exciting time, with so much news and results being reported so often. It's really going to be great! Could you tell our readers/investors about your background, your Team and your Board?

Scott Eldridge: Absolutely! With junior companies in the mining business, it all starts with the team, in addition to projects. We have a strong experienced team. I'm the CEO of the Company. I joined almost two years ago. For the last 12 years, I've been working in the metals and mining sector, primarily on the financial side. I used to run my own merchant banking firm that raised equity and project finance debt for global mining projects. I've been on the issuer side of the business for the last four years having had various executive roles, including CEO and CFO, and independent Board seats on mining companies.

I’ve known our Chairman, Brad Cooke going back about 10 years. I used to raise money for his silver company, Endeavour Silver. Brad is the founder of Canarc. He's been in the business for over 30 years, a very strong background on the technical side, and significant capital markets experience.

Moving over to our independent Directors, you did see in the news release yesterday that Andrew Bowering has joined the team. He's a venture capitalist, been in the mining space for about 30 years. He's known for funding and founding multiple different mining companies that have done really well. His most recent successes are Prime Mining and American lithium. Deepak Malhotra is also on our Board. He's a PhD metallurgist, with over 40 years of experience working globally on gold projects. Finally, rounding out our Board is Martin Burian. He's very strong on the corporate governance side. He's a chartered accountant by background. Those are the five Board Members.

Then moving over to the Management Team; Garry Biles is our President and COO. He's a metallurgical engineer. He's built and operated four gold mines over his career, one of which was the fabulously high-grade Eskay Creek Mine in BC that most people have heard of. Troy Gill is our VP Exploration. He's won a few awards for discoveries. Troy is new to the team. And finally, Philip Yee is our CFO, over 25 years in accounting and reporting experience, with public issuers.

Dr. Allen Alper: Well, you and your Team and your Board have excellent backgrounds, excellent track records. So that's really great. It gives investors great confidence in your Company.

Scott Eldridge: Thank you.

Dr. Allen Alper: Could you tell our readers/investors about your share and capital structure and some of your key investors?

Scott Eldridge: Absolutely. Prior to the news release, we had 242 million shares outstanding and we've announced a five-for-one consolidation in addition to a financing. Pre-financing, our share count was approximately 48 million shares. We've announced the financing at 8 cents with a half warrant at 13 cents. We thought it was an appropriate time to restructure the Company, make it more attractive for institutional investors and we do have a significant amount of institutional participation in this financing.

In terms of our top shareholders, our top six shareholders own about 40% of the Company, including the Ruffer Gold Fund, Eric Sprott, Brad Cooke, our Chairman, and then several US-based high-net-worth individuals. So for a small company, we're fairly tightly held and we have some pretty significant investors.

Dr. Allen Alper: Oh, that's very impressive. It's nice to see that Management has such a commitment to the Company and also some key strategic and knowledgeable investors like Eric Sprott have their money in the game. So that's really great.

Scott Eldridge: Yes. Thank you.

Dr. Allen Alper: Could you tell our readers/investors, Scott, the primary reasons they should consider investing in your Company?

Scott Eldridge: Absolutely. We are undervalued, relative to our peers and that's measured by an enterprise value per resource ounce in the ground. We trade at about $10 US per resource ounce in the ground, whereas our peers, as we see them, are more in the $40 to $60 range. We feel there's significant upside there. In addition to that, there is substantial value to be unlocked at New Polaris as we move from a PEA into feasibility study. That will include permitting, infill drilling on the inferred and completing a 43-101 feasibility study to further de-risk the project, moving it towards a construction decision, further emphasizing the fact that Canarc and specifically the New Polaris are potentially an M&A candidate for, say a junior producer that is looking to add production to their current portfolio.

New Polaris itself would represent 80,000 ounces of production per year over an initial 8 year mine life. But keep in mind, these are very, very high margin ounces. As published in the preliminary economic assessment, the cash costs on the project are under $500 an ounce. So overall, we believe we are undervalued combined with the fact that we are de-risking New Polaris further towards a construction decision, there's significant value there for shareholders. We feel that our exploration portfolio offers blue sky potential. We just completed drilling on two projects that are sort of a lottery ticket.

Dr. Allen Alper: Well, those sound like excellent reasons for our readers/investors to consider investing in Canarc. Scott, is there anything else you would like to add?

Scott Eldridge: In summary, we're very happy to have Andrew Bowering join our Board of Directors. I'm looking forward to working with Andy. I think he'll help bring some further attention to the Company. I'm really looking forward to closing this financing. That'll happen in the next week or so and then we can get back to work on New Polaris and our other projects with further drill activity.

I'll just remind your readers that the best drill hole out of New Polaris was six meters of over 44 gram per ton gold, which is a world class drill hole. So as we infill drill this deposit, we'll have a steady news flow of intercepts that we’ll be happy to tell the market about.

Dr. Allen Alper: That's fantastic. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://canarc.net/

Scott Eldridge, CEO

Toll Free: 1-877-684-9700

Tel: (604) 685-9700

Cell: (604) 722-5381

Email: scott@canarc.net

|

|