Orestone Mining Corp. (TSX-V: ORS, Frankfurt: WKN: A2DWW7): Exploring Gold-Copper High Impact Exploration Projects in British Columbia, Canada; David Hottman, Chairman and CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/21/2020

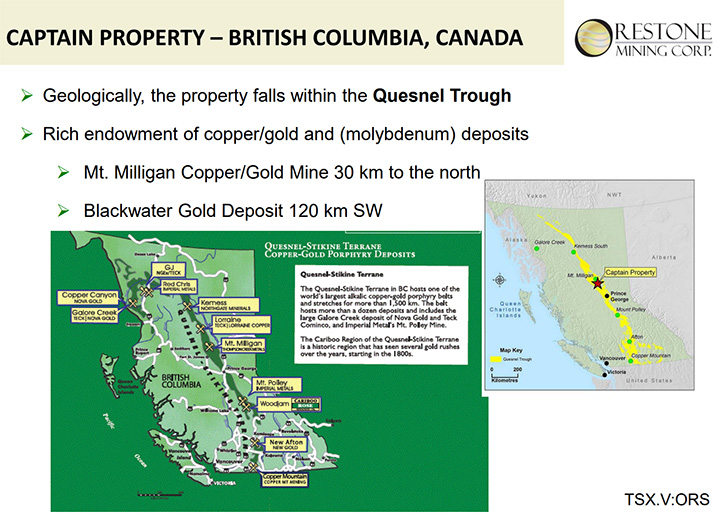

Orestone Mining Corp. (TSX-V: ORS, Frankfurt: WKN: A2DWW7) owns a 100% percent interest in the Captain gold/copper porphyry project in north central British Columbia, 41 kilometres north of Fort St. James, B.C. and 30 kilometres south of the Mt. Milligan copper-gold mine, which is a very large deposit that has been in production for many years. Captain hosts a cluster of large porphyry targets, advanced through geophysics and drilling. We learned from David Hottman, Chairman and CEO of Orestone Mining, that they plan a three to six hole drilling program, to start in November, to test several of their potentially high-impact targets. According to Mr. Hottman, with the current $2 million market cap, the Company could be a very attractive opportunity for investors, as it provides a huge amount of leverage for shareholders to be involved in an early discovery of a big deposit.

Orestone Mining Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing David Hottman, who is Chairman and CEO of Orestone Mining Corp. David, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

David Hottman: Yes, Orestone is a Company that is headquartered in Canada, managed by mining professionals, with an average of probably 30-35 years of corporate and company building experience. We have high-impact Gold-Copper porphyry drill ready targets in Canada. We are also reviewing a lot of projects, for acquisition in Chile. We're seeking to identify and drill projects that have high-impact on the share price and would create wealth for shareholders.

Dr. Allen Alper: Oh, that sounds excellent! Could you tell our readers/investors about your major projects and your focus in British Columbia?

David Hottman: Yes, in British Columbia, we have a 100% owned project, called the Captain Project. It's approximately 30 kilometers south of the Mount Milligan copper gold mine, which is a very large deposit. It's been in production for many years. It started out as almost a billion ton porphyry deposit, which produces a couple hundred thousand ounces of gold, and many, many thousands of tons of copper a year.

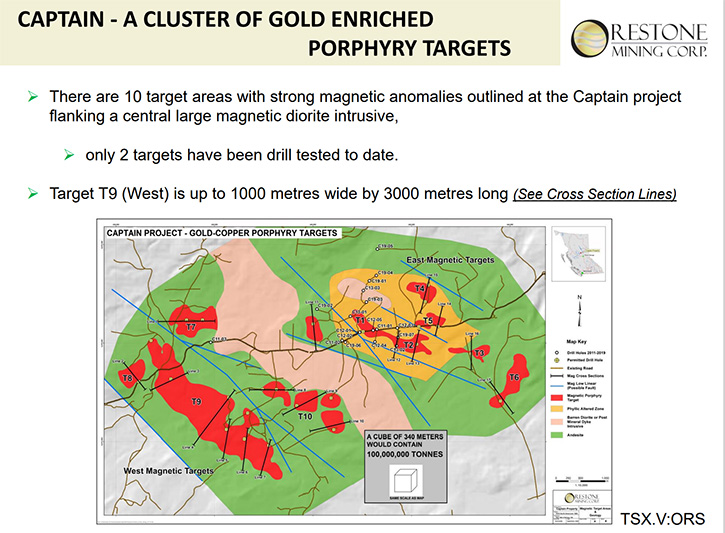

Our project is focused on a cluster of porphyry targets, where we have outlined nine targets to date. We've only drilled two of those, which are mag high targets. The results to date are in the range of 0.3, 0.4 grams of gold per ton, with some copper credits. The 10 targets are fairly large in size, any one of which could be 100 million tons or more. One particular target could be of Mount Milligan size or twice that size.

The original concept is targets that can make a dramatic difference in share value and thereby create wealth for shareholders.

Dr. Allen Alper: Oh, that sounds very good! Could you tell our readers/investors what your plans are for the remainder of 2020 and also going into 2021?

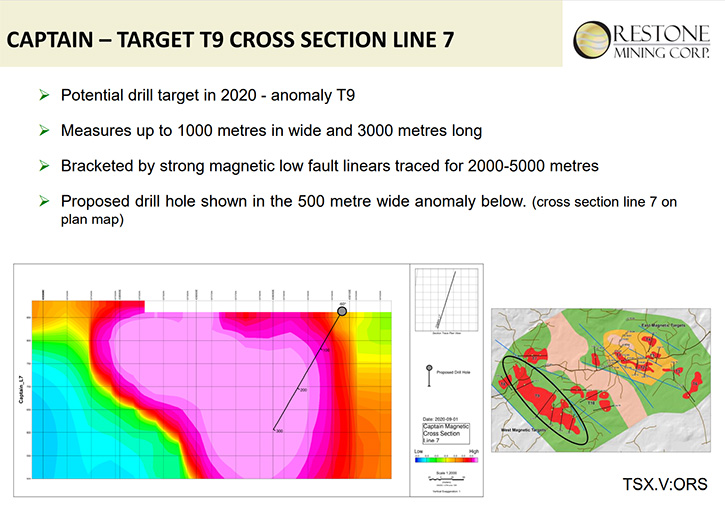

David Hottman: We have a drill program planned for later in 2020. It should kick off in late October, and we're planning to drill three to six holes. We have the funding in place for that. We may want to raise a few more dollars before we start the drill program. That will be focused on primarily our T9 target, which is one by three kilometers in size, which would be two miles by about three quarters of a mile wide. It's centered on a mag high, with coincident moderate IP of 10 to 15 millivolts on the edges of it.

Dr. Allen Alper: Oh, that sounds very good. Could you tell our readers/investors a little bit about your background and your Team?

David Hottman: Yes, my background is initially as a broker. The first company I started working with was Bema Gold Corporation. That has since been taken over by Kinross many years ago. A group of us then split off and formed Eldorado Gold, which is still an independent company. It trades on the New York Stock Exchange. After leaving there, I started a Company called Nevada Pacific Gold. That company was the subject of a takeover by U.S. Gold in 2007 and was renamed McEwen Mining.

The team has been involved in many large porphyry discoveries. Combined, the team has been involved in putting 10 or 12 different mines into production around the world and consists of geologists, engineers and accountants. Bruce Winfield, the President, has had a long career in discovering and being involved with developing mining projects, primarily in the gold space. He worked with us back at Eldorado Gold. Mark Brown our CFO, was Controller at Eldorado Gold years ago. It's over 20 years ago that we all left. Gary Nordin is an independent Director of the Company. He was also a Founder of Bema, and a Founder of Eldorado. He is a well-respected geologist, with many successes behind him. We've worked together almost continuously for over 30 years.

The other three Team Members; James Anderson is a corporate finance and company restructuring expert. He's been involved with the brokerage side of the business for nearly 20 years and now is involved with some public companies such as Vangold Mining Corp which has very exciting potential. John Kanderka, another independent Director, has been more of an entrepreneur in the resource space, primarily in oil and gas, but here again a 35-year career. The last member of the Team is Patrick Daniels, he was one of our engineers at Bema Gold, when we put the first mine into production.

So the team is made up of people that Gary and I have worked with, off and on, throughout our careers. They're all good, solid, hardworking, honest people. That pretty much rounds out the team.

Dr. Allen Alper: It's nice to have a diversified Team, and a team that knows how to work with each other, respects each other, and has a lot of experience in the mining sector. Could you tell us a little bit about your share and capital structure?

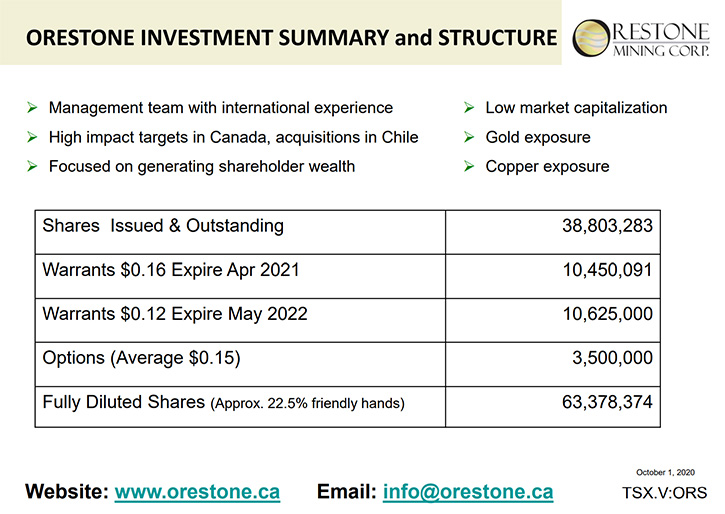

David Hottman: Capital structure consists of approximately 39 million shares outstanding. The share price is currently a $0.065 Canadian, which gives us about a $2.5 million Canadian or a $2 million US market capitalization. There are options and warrants outstanding that would bring in another $3 million+ if exercised. That would give us about 60 million shares outstanding.

The beautiful thing about the capital structure is, with the current $2 million market cap, drilling into a large gold-copper porphyry deposit would be very beneficial to the share price, and provide a huge amount of leverage for shareholders to be involved in an early discovery of a big deposit.

Dr. Allen Alper: That sounds excellent! Could you elaborate on the primary reasons our readers/ investors should consider investing in Orestone Mining?

David Hottman: Yes, In summation, a strong and successful Management Team, with high impact drill-ready targets, primarily gold-focused with a copper credit, and a really good capital structure to take advantage of discovery. We're a serious team that can provide a good, honest shot for shareholders to create wealth.

Dr. Allen Alper: Well, those sound like very good reasons for our readers/investors to consider investing in Orestone. David, is there anything else you'd like to add?

David Hottman: Just to thank you for interviewing Orestone Mining Corp. for Metals News. We're a good solid team, with good projects, and we would welcome people to do their due diligence.

Dr. Allen Alper: That sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.orestone.ca/

David Hottman

CEO

Tel: +1 604.629.1929

Email: info@orestone.ca

|

|