Aztec Minerals Corp. (AZT: TSX-V, OTCQB: AZZTF): Exploring District Scale Gold-Copper Discoveries in Sonora, Mexico and Silver-Lead-Zinc-Gold in Arizona, USA; Simon Dyakowski, CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/21/2020

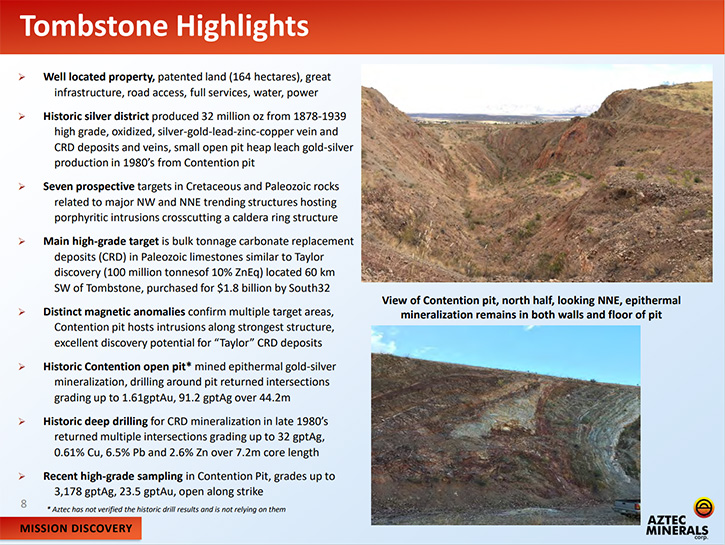

Aztec Minerals Corp. (AZT: TSX-V, OTCQB: AZZTF) is a mineral exploration company, focused on the discovery of large gold-copper deposits in the Americas, with two main assets: the prospective Cervantes porphyry, gold-copper property in Sonora, Mexico, and the historic, district-scale, Tombstone properties, in Cochise County, Arizona, that host both bulk tonnage epithermal gold-silver, and CRD silver-lead-zinc mineralization. We learned from Simon Dyakowski, CEO of Aztec Minerals, they are working to acquire a 75% interest in the Tombstone project, through a series of cash and share payments and work expenditures. The 3000 meter, 20-hole drilling program is under way at Tombstone, targeting shallow epithermal gold silver mineralization, around the historic past producing Contention pit. The first five holes, from the drill program, returned significant intersections from the center of the pit. Aztec Minerals has a steady stream of drill results and updates to present to the market, over the coming weeks into 2021.

View of the Contention pit looking north

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Simon Dyakowski, who is CEO of Aztec Minerals. Simon, could you give our readers/investors an overview and what differentiates your Company from other companies? Also what's happening with Aztec Minerals and tombstone projects and exploration?

Simon Dyakowski: Sounds good Dr. Alper. Aztec Minerals is a mineral exploration company listed on the TSX venture exchange under the symbol AZT and on the OTCQB symbol, AZZTFF. Aztec currently has an interest in two projects. The first being the Tombstone gold silver project, in Arizona, and the second being the Cervantes gold copper porphyry project, in Sonora, Mexico. We are currently focused on the tombstone project. We have an option to acquire a 75% interest in the project, through a series of cash and share payments and work expenditures. We are close to vesting our 75% interest, with this current work program that we'll discuss today. The program that we're working on at Tombstone is a 3000 meter, approximately 20 hole, reverse circulation drill program. In this drill program, Aztec is targeting shallow epithermal gold silver mineralization, the Tombstone project is well known for being in an area of prolific mining activity, predominantly in the period between 1880 and 1940, when old time miners mined 32 million ounces of silver out of the CRD deposits and high grade, oxidized, silver-gold-lead-zinc-copper veins, in underground workings. In the early 1980s, a group put into production, a small open pit heap leach mine at the Tombstone property.

This heap leach mine was based on sampling of the underground workings and surface trenching, and mining commenced without a robust surface drill program. This mine ran for approximately five years, between 1980 and 1985. This open pit, heap leach operation was known as the Contention pit, and it resides within the tombstone project, in which Aztec is optioning to acquire a 75% interest. In the early 1990s, a company, by the name of USMX, put a series of shallow RC drill holes in the North end of this pit, testing the theory that mineralization continues outside of the old stopes and tunnels and the old open pit, with grades high enough for heap leach mining operations. These holes were limited to the center and north of the Contention pit. The project was not abandoned due to lack of exploration success, but rather, the previous operator didn't continue on with it due to priorities among other projects, in a declining gold price environment in the 1990s.

Aztec acquired the option to acquire 75% of Tombstone in 2017, at a time when gold was trading below 1,300 per ounce. We have been working for the last two and a half years, preparing for an initial RC drill program. Just on September 29th, we announced the results from the first five holes of our 20-hole drill program. We were very pleased with the results announcing significant intersections from the center of the Contention open pit. We drilled four holes in a spoke pattern. We're generally testing the mineralization with what we call “spoke patterns” of four holes, in three areas of the open pit, one in the center, one in the North and one in the South.

We've now completed 11 out of the 20 holes, representing the drilling in the center and north of the pit, and are currently drilling to the South of the pit. The results that we announced on the 29th were four holes headlined by a 77.7 meter intersection of 0.94 grams per ton gold and 42.1 grams per ton silver, or 1.6 grams per ton gold equivalent, over 77.7 meters. This is a phenomenal result for us, as it confirms the theory we're testing. It confirms the historic drilling by US Amex in the early 1990s. And it represents a grade that is very much in line and exceeds that of a typical heap leach operation, in this part of the world. Heap leach in Arizona, Nevada and Mexico can profitably be mined at an average grade between 0.4 and 0.6. So our 1.6 grams per ton gold equivalent intersection represents a grade that exceeds the higher end of this range. We expect to have further drill results over the coming weeks, including results from the North spoke that we've drilled and from the South spoke.

I'll note that the Contention pit area, in which we're drilling, runs about one kilometer of strike and it's up to 200 meters across in width. We're also drill-testing several targets to the West and also to the East of the old open pit. Finally, we're going to be pre-collaring two holes to test at a separate and unique target, early next year. It’s buried below the shallow epithermal gold-silver target area. This target is going to be going after CRD or carbonate replacement style deposits, potentially hosting silver lead zinc mineralization in deeper targets. The target model is similar to that of the Taylor deposit, the Taylor discovery that was made 40 miles to the Southeast of us, underlying the historic Hermosa silver district. That discovery was made by a company called Arizona mining back in 2015 and resulted in an eventual friendly buyout by major mining company, South32 for C$1.8 billion in 2018.

To summarize our current work program, 20 reverse circulation holes, are being undertaken this year at Tombstone, including two pre-collars, which will help us drill deeper targets next year. We're initially, at this point, planning on 2 x 750 meter core drill holes, testing deeper CRD hosted targets. All in all, we are excited by the results. We've discovered new mineralization, and we have a steady stream of drill results and updates to present to the market, over the coming weeks and into the new year 2021.

Dr. Allen Alper: Well, that's excellent. Really fantastic results! You have an excellent drilling program plan for this year and going into 2021. It will be a very exciting time for our readers/investors to learn more about Aztec, as you get more and more data.

Simon Dyakowski: Absolutely, yes! And it will be coming in batches through October and November. We expect to have plenty of opportunities to gain an understanding of the bulk tonnage potential of the shallow gold and silver mineralization at Tombstone. Then we'll start looking forward to the deeper drilling beyond that.

Dr. Allen Alper: Well, that's really excellent! Sounds like you have great potential. This is going to be a lot of fun for you and your stakeholders and shareholders. So that's really a very exciting time for Aztec and your investment community.

Simon Dyakowski: Absolutely! We couldn’t be more excited, at this point, in the project’s development.

Dr. Allen Alper: Simon, could you tell our readers/investors a little bit about your background and the Team?

Simon Dyakowski: I joined Aztec as the CEO, just this summer in August. I come from a capital markets background as a former stockbroker and research analyst in Vancouver. I've worked for the last few years, advising junior resource companies on marketing financing strategies and execution of exploration programs. Our Chairman, Brad Cooke, is the Founder of the Company and he is currently the CEO of Endeavor Silver Corporation. Our Chief Geologist and VP of Exploration is Joey Wilkins. He's based down in Tucson. He's located near both of our projects. And he has had a successful career in mineral exploration, making mineral discoveries, including the Gold discovery that Aztec made at the Cervantes project in 2018. Our Board of Directors is rounded out by other well-known mining entrepreneurs and geologists including Canadian Mining Hall of Fame member, Mark Rebagliati. We have a very seasoned Board and Management Team that is complimented by both capital markets and technical geological expertise.

Dr. Allen Alper: You have a great background and a great team, well-balanced, highly experienced, extremely knowledgeable and very successful. So it sounds like you have everything going for you. Then the group - really fantastic! Sounds like you have a great property, with great potential, in a great location and a great team. Excellent combination! Also, you have experience funding projects, as you go forward.

Simon Dyakowski: That's correct. That's a very key part of any exploration company, having the funds to advance the project. We have all the agreements in place, with good projects, in good jurisdictions with great potential. We're also fortunate to be in a part of the precious metal cycle that is conducive to funding projects. I think we're early in the gold and silver cycle, even though we've already had a great run. I think there are some legs left to the rally for the foreseeable future, given the dynamics of the world and the reports of currency debasement that we're seeing, on what seems to be a daily basis. It's a great time to be exploring, particularly in Arizona and Mexico, in very well-known mining districts, where the probability of developing mines, whether brownfield or greenfield is excellent in those jurisdictions. I should also mention that the Tombstone project is located primarily on private land in Arizona. So that again is a huge advantage to any project that's looking to be developed.

Dr. Allen Alper: That's excellent! Could you tell our readers/investors a little bit more about your share and capital structure?

Simon Dyakowski: Yes. Certainly, our share structure currently stands at approximately 52 million shares outstanding. That's a basic share count, with about 70 million fully diluted. Our cash balance today sits at around two and a half million dollars. So we were fully funded to complete our current drill program, as well as our next deeper drill program and our shares are trading at about 43 cents Canadian as of October 1st, 2020, leaving us with a market cap of approximately $21 million Canadian.

Dr. Allen Alper: Well, that's very good. Could you summarize the primary reasons our readers/investors should consider investing in Aztec Minerals.

Simon Dyakowski: Yes. Our main reasons, for investing, are to gain exposure to two gold primary projects; one in Arizona, one in Mexico. We have robust news flow coming up from both. In the immediate near future, we have multiple batches of drill results, coming from the tombstone project we're drilling. We've had a great head start with our initial four holes. We have results pending from another six, and we're in the process of completing drilling on 10 holes beyond that as well. Next year, we'll be focusing again on our project in Mexico, the Cervantes project, which had made a gold discovery in 2018, and we look forward to proposing a robust phase two drill program. Investors, looking at Aztec today, would gain exposure to two perspective bulk tonnage gold projects, with good exploration upside at both projects, at a very reasonable valuation of $20 million Canadian, as of early October.

Dr. Allen Alper: Well, those sound like excellent reasons for our readers/investors to consider investing in Aztec Minerals. Simon, is there anything else you'd like to add?

Simon Dyakowski: I think that about covers the update and a refresh on the story. We appreciate you interviewing Aztec Minerals Corp. for Metals News. We'll be very pleased to answer any questions from your readers/investors.

Dr. Allen Alper: Well, that's excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://aztecminerals.com/

Simon Dyakowski, CEO

Tel: (604) 619-7469

Email: simon@aztecminerals.com

|

|