Torex Gold Resources Inc. (TSX: TXG): A Growing and Well-Managed Intermediate Gold Producer, 454,810 Ounces of Gold in 2019: Interview with Jody Kuzenko, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/10/2020

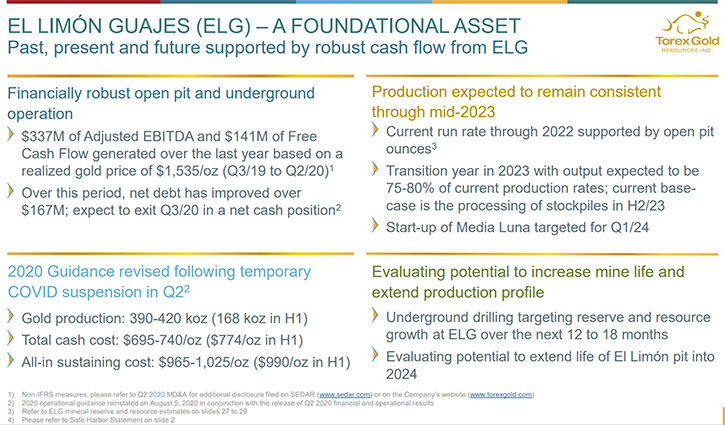

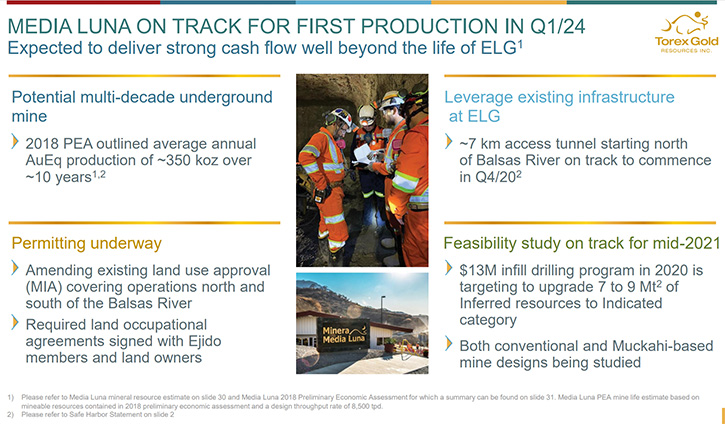

Torex Gold Resources Inc. (TSX: TXG) is an intermediate gold producer, based in Canada, engaged in the exploration, development, and operation of its 100% owned Morelos Gold Property, an area of 29,000 hectares in the highly prospective Guerrero Gold Belt, located 180 kilometres southwest of Mexico City. We learned from Jody Kuzenko, President and CEO of Torex Gold, that their assets in Mexico include the El Limón Guajes mining complex (ELG), with three open pit mines, an underground mine (including zones referred to as Sub Sill and El Limón Deep), and a fully integrated processing plant that produced 454,810 ounces of gold in 2019. A Feasibility Study is currently underway for Torex’s Media Luna deposit, located seven kilometres from ELG, with first production targeted for Q1/2024.

Torex Gold Resources Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Jody Kuzenko, who is President and CEO of Torex Gold. Jody, could you give our readers/investors an overview of your Company?

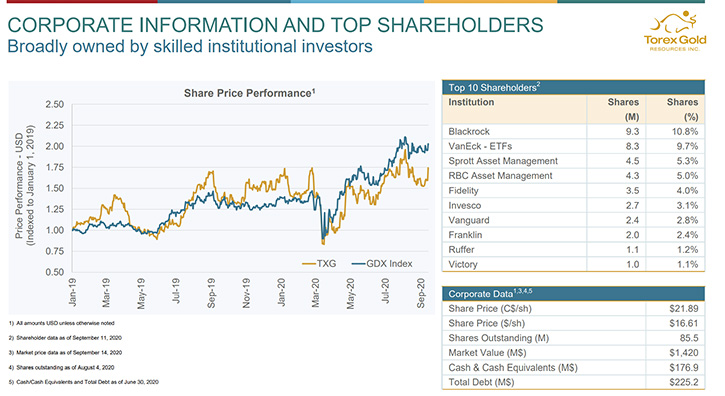

Jody Kuzenko: Yes. Happy to, Al. Torex is a mid-tier gold producer, headquartered in Toronto, Canada. At yesterday's close, we had a market cap of about $1.6 billion (CAD). Our principal asset is the Morelos Gold Property. This is located in the Guerrero Gold Belt, which is a highly prospective area in Southwest Mexico.

Our assets in Mexico include the El Limón Guajes mining complex, which we call, ELG. There we have three open pit mines, two underground deposits, and a fully integrated processing plant, from which we produce doré bars. We also have our development stage project, south of the Balsas River, called Media Luna. We expect to bring that online in the early part of 2024.

In terms of size and scale, in 2019, we produced 454,000 ounces of gold out of ELG. There are two important things about that number, Al. First, that level of production sees us as the second largest gold producer in all of Mexico in 2019.

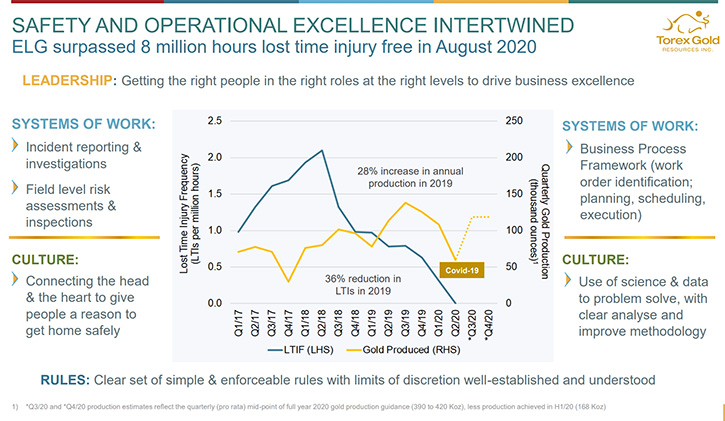

The other important thing about that number, from my perspective, is that it represents a 28% improvement over 2018 production numbers. It's a real indication that our assets and our people there are really dialing in to a continuous improvement methodology.

The other important thing about 2019 over 2018 is that we improved our safety performance, as adjudicated by lost time injury frequency. We reduced it year on year by more than 30%. I am quite proud to tell you that, as of August, our operations there surpassed 8 million hours lost time injury free. We're operating at a lost time injury frequency of zero and have been since April, certainly one of the proudest accomplishments of my career. That means our 900 employees and 1,100 contractors come in and put in an honest day's work for an honest day's pay, and go home safely to their families at the end of every shift. That's something that we're quite proud of at Torex.

Dr. Allen Alper: That's outstanding.

Jody Kuzenko: Thank you. We're very excited about it. It is the result of a lot of hard work, getting the right leaders in the right roles, putting the right systems in place and getting rules in place that are consistently enforced and that make sense to people in terms of why they are there. All of that, we think, Al, builds a culture, where people come to work and work together and care for one another and willingly give the best they've got. I think Torex distinguishes itself from the field in that way for sure.

Dr. Allen Alper: That's very good.

Jody Kuzenko: Thank you.

Dr. Allen Alper: Could you tell us a little bit more about your production and then also your reserves and resources?

Jody Kuzenko: Sure. At the end of 2019, we had 2.2 million ounces in reserves at three grams. In terms of the production profile, I've already said what we did in 2019. 2020, apart from the COVID interruption, looks very much like 2019, as does 2021 and 2022. 2023, from a production perspective, becomes an interesting year for us because our open pits are scheduled to sunset in mid-2023. Our current base case has us processing stockpiles in the second half of 2023; however, we are currently evaluating the potential to extend the life of our El Limón Pit into 2024. In early 2024, we will be looking to bring Media Luna online.

We put a PEA to market in September of 2018 on Media Luna that shows that that mine has more than 10 years of mine life. However, it's important to know that only about a third of that magnetic anomaly has been drilled off.

In terms of the resource for Media Luna, we have an indicated resource of 2.2 million gold-equivalent ounces. That's about 12.5 million tonnes at 5.5 grams per tonne gold-equivalent. Our inferred resource stands today at 4.5 million gold-equivalent ounces. That's about 33 million tonnes at 4.2 grams per tonne gold-equivalent. I should say Media Luna is a little bit deeper in the system that we have on the ELG side, so it comes with a gold plus copper plus iron signature.

When I talk about forward looking ounces from Media Luna, I'm talking about gold equivalent ounces. Out of that mine, we expect to produce around 350,000 gold equivalent ounces per year and about 30% of the value of that mine comes from the copper. We will be building a float circuit in our process plant to float off copper, put our copper concentrate to market and expect to produce about 45 to 50 million pounds of copper per year when that mine is running.

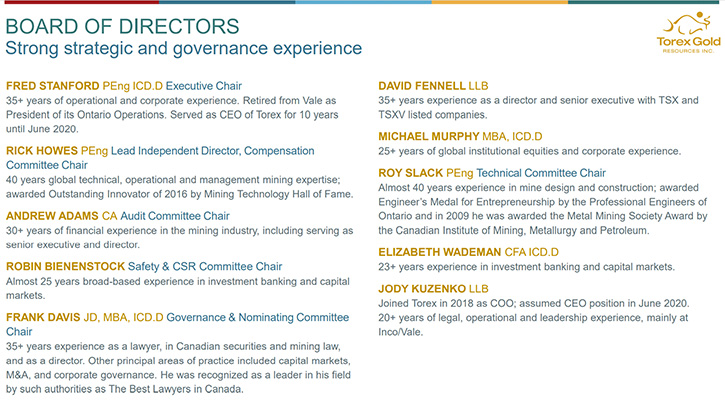

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your background, your Team, and the Board?

Jody Kuzenko: Sure. I am a lawyer by trade. Spent the first 10 years of my professional career practicing law. Made the leap to the mining industry coming from Sudbury, Ontario, Canada, which is widely known as the nickel mining capital of the world. Having seen Inco and Falconbridge growing up, made the leap to the mining industry in the early 2000s in a legal role at Inco and quickly had a look around and decided that all of the coolest people and the coolest problems were in the operations, so made the transition to the operations and never looked back.

By this point, Vale had acquired Inco, and one of the beauties of working at a major like that is that you can get exposed to lots of different areas of the business in two to three year time horizons. I led many different areas including energy, utilities, strategy, health, safety and environment and the Ontario Refineries. I used my time there to learn as much as I could from the men and women running the mines, processing plants and all facets of the operations.

Ultimately in 2018, it was time for me to make a bit of a move. I had known Fred Stanford, who is now our Executive Chair. He and I met at Inco back in the early 2000s. We stayed in touch and he convinced me to make the move to Torex as Chief Operating Officer. And in June 2020, I was promoted to CEO.

I can tell you that our team, both at the corporate level and at the site level, is second to none. At site, it's important for readers/investors to note that we take a view that it is important to have local people operate that site, and they do it very well.

The vast majority of our site-based Management Team is from Mexico. My VP of our Mexican operation is from Sinaloa, Mexico, so has an excellent understanding of the political and cultural environment that we are working in there. He also brings that level of knowledge to the executive table.

Our Board and Executive Team have more than a hundred years of experience collectively in the mining industry, ranging from capital markets to shaft sinking, to mining all over the world, to sustainability. We bring a wealth and breadth of experience to Torex, and I think the testament to that is in our results. For example, our ELG asset was built from nothing on schedule and on budget, which is almost unheard of in this industry.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your balance sheet and also a little bit about your share and capital structure?

Jody Kuzenko: In terms of our balance sheet, as of the end of Q2 2020, we were in a net debt position of $53.5 million. Given our production over Q3, we expect to exit the quarter in a net cash positive position. I will tell you that we have a credible scenario, where we can be completely de-leveraged and debt-free by the end of 2021. If gold continues to stay at current levels, we may be debt-free even in advance of that.

In terms of the forward look and the Media Luna build, the PEA capital price tag for Media Luna is $500 million. Approximately half of that is to build the underground mine and the other half of that is to build the reconfiguration of the surface plant to enable us to process that copper I talked about.

How this relates to the balance sheet is that we have such healthy cash flow out of ELG, that we can pay for the entire Media Luna build at $1,400 gold, so at today’s gold prices we have a lot of upside available to us in terms of our balance sheet.

Dr. Allen Alper: That sounds excellent. Could you tell us a little bit more about your share and capital structure?

Jody Kuzenko: In terms of the capital structure, we plan to pay down debt, fund the Media Luna build, and scan the horizon for M&A opportunities that are value accretive, looking at both producing assets and at development assets. Given the current run on prices, a lot of these opportunities don't currently screen in as value accretive; however, we can be patient, and will be patient. You can expect to see Torex enter the M&A space in an opportunistic way over the next number of years, to diversify away from single asset risk.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors the primary reasons they should consider investing in Torex Gold?

Jody Kuzenko: With Torex you have a Company that will continue to deliver consistent production and strong cashflow from ELG. You have a Company that will continue to focus on increasing reserves and resources at our underground deposits. You have a Company that is quite advanced in de-risking and advancing Media Luna, which is our project across the river, which will see us operating in Guerrero for many years to come.

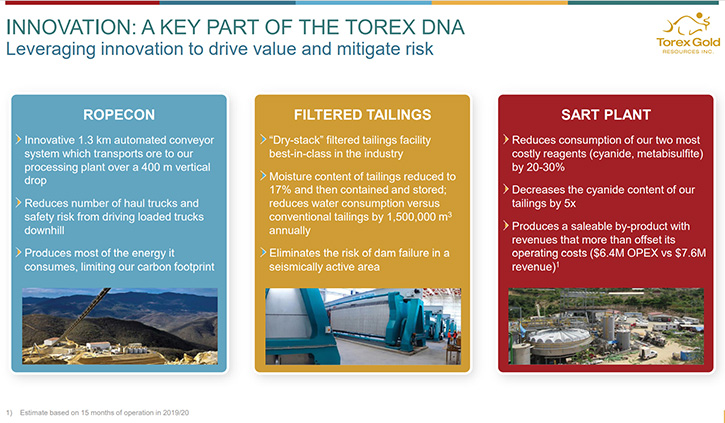

With Torex, you also have a Company that truly embraces innovation to drive value and mitigate risk. For example, we have a ‘dry stack’ filtered tailings storage facility, one of the largest in the world, that essentially eliminates the risk of dam failure. We have a SART Plant that reduces the consumption of cyanide and produces a saleable copper by-product with revenues that more than offset its operating costs.

And we have something called a rope conveyor, which is essentially a ski lift for the conveyance of ore. It travels a 1.3 kilometer span from the pitch to the plant, while producing most of the energy it consumes. It also sees us mitigating the risk of loaded haul trucks driving down steep hills.

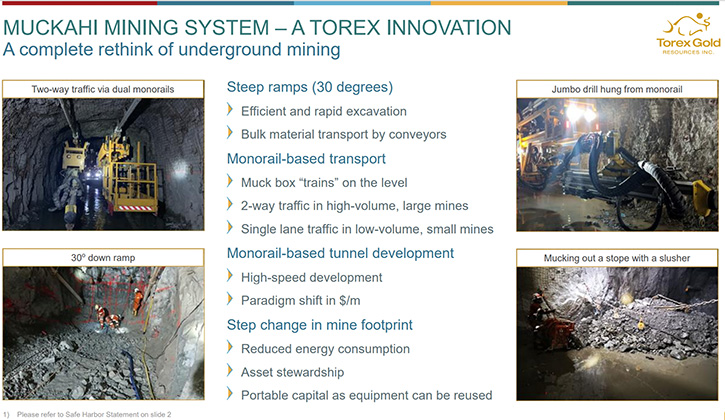

Of course, we also have a proprietary innovation called Muckahi, which is a complete rethink of underground mining that has the potential to disrupt not only the cost and capital structure for Torex, but be applicable to disrupt the mining industry as a whole.

We are in the midst of proving up that technology at our ELD underground operations and will do so over the course of the back half of this year and into 2021.

When compared to conventional underground mining methods, we believe Muckahi has the potential to reduce underground OpEx by up to 30%, reduce underground CapEx by up to 30%, and speed up the time to first production by somewhere in the order of 80%. And importantly, Muckahi lends itself to being an all-electric mine, so a reduction of GHGs by up to 95% over conventional mining is possible.

That, I think becomes important as the industry is coming to terms with setting carbon neutrality goals and really makes the case for investment in a company that has solid cashflow, excellent industry experience, a project that is well on its way to being de-risked and advanced and a company that is outstanding from an ESG perspective. Cool industry disruptive technology offers some upside optionality in terms of investment in a gold company.

All of those things taken together, I think, make a pretty compelling case for investment. The last thing I'll say is that our share price has underperformed peers in the last six months. It is certainly an attractive entry point these days, as I think about what the future of Torex holds.

Dr. Allen Alper: That sounds outstanding. It sounds like very, very compelling reasons for our readers/investors to consider investing in Torex Gold. Jody, is there anything else you'd like to add?

Jody Kuzenko: Just to thank you for interviewing Torex Gold for Metals News.

Dr. Allen Alper: You are very welcome. You can be very proud of Torex Gold! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.torexgold.com/

Jody Kuzenko

President and CEO

Email: jody.kuzenko@torexgold.com

|

|