U.S. Gold Corp. (NASDAQ: USAU): Renowned Mine Builders, Advancing World Class Gold and Copper Projects, in Mining Friendly Wyoming, Nevada and Idaho; Ed Karr, CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/1/2020

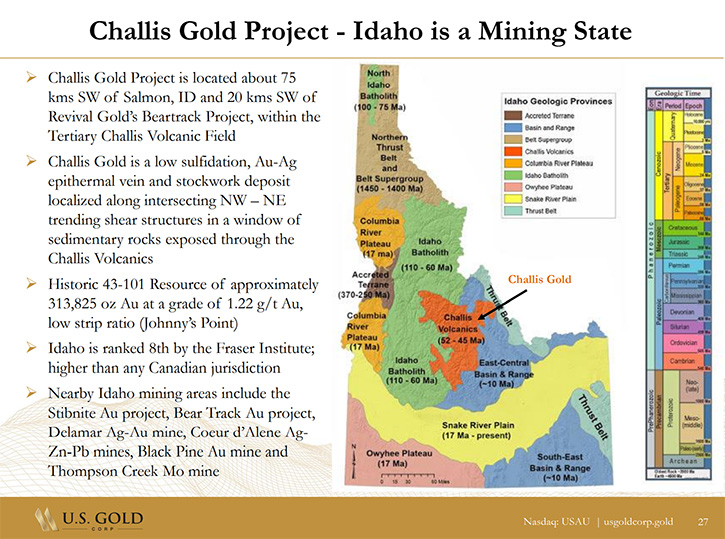

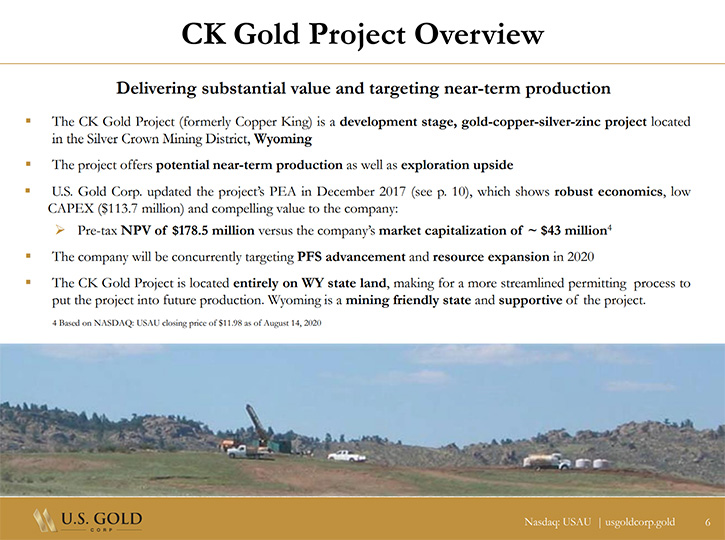

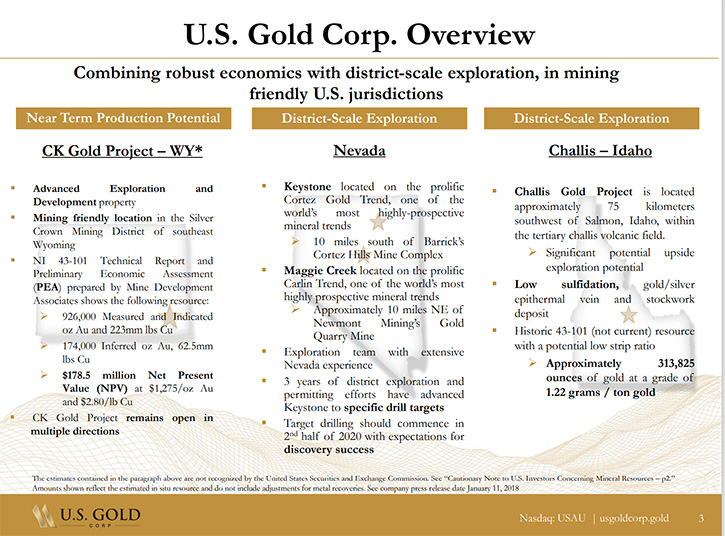

U.S. Gold Corp. (NASDAQ: USAU) is a U.S. focused, gold exploration and development company, advancing high potential projects, in mining friendly jurisdictions of Wyoming, Nevada and Idaho. We learned from Ed Karr, who is CEO of U.S. Gold Corp., that in Mid-August of 2020, they acquired Northern Panther Resource Corporation, a private company, owned by leading people in the mining industry, which holds the Challis Gold exploration project, located in Idaho. The project has a historic 43-101 report that shows a 313,000-ounce gold resource, average grade of about 1.22 grams per ton. In addition, the acquisition brought in $8 million cash. U.S. Gold Corp. is currently drilling and pushing forward, with the very robust pre-feasibility study, at the Company's CK Gold Project, located in Wyoming.

U.S. Gold Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Ed Karr, who is CEO of U.S. Gold Corp.

Ed, I wonder if you could give our readers/investors an overview of your Company, what differentiates it from others, and update us on what's happening with your great projects and portfolio in Nevada, Wyoming and Idaho.

Edward Karr: Sure, Al, be happy to, and thank you so much for having us back on Metals News and for the interest in U.S. Gold Corp.

It's a very exciting time for us at U.S. Gold Corp. We recently announced an acquisition of a private company, called Northern Panther Resource Corporation. That was in Mid-August of 2020. Northern Panther has three different things. Number one, we picked up a new gold exploration project called the Challis Gold Project, which is located in Idaho. I'm sure you and your readers know Idaho is a very favorable mining state, a lot of companies are pushing forward on exploration and mining projects there. So we're excited about Challis. Challis actually has a historic 43-101 report that shows a 313,000 ounce gold resource, with an average grade of about 1.22 grams per ton.

Northern Panther Resource Corporation was founded by some of the leading people in the mining industry.

One of the founding shareholders is Robert Schafer, and I've known Bob for many years. Bob is a very experienced mining industry professional, a PhD in geology, who worked many years for Hunter Dickinson, formerly, I believe, with BHP Billiton, Kinross, et cetera. Bob was the driving force behind the Challis Gold Project and Bob believes it really has upside exploration potential. He thinks, with some exploration programs and some future infill drilling, we should be able to increase this deposit potentially up to a million plus ounces. So we're very excited about it.

And the last thing in Northern Panther Resource Corporation was cash, which obviously is always important for a junior exploration company like U.S. Gold Corp. We picked up an additional $8 million in cash. We had about $2 million before the acquisition, and we picked up an additional $8 million. After the acquisition we had about $10 million in cash and we have no debt in the Company.

One of the other well-known shareholders in Northern Panther is George Bee, who is a seasoned mining industry executive, with a 16 year career at Barrick Gold. He was actually the mine manager that brought the Goldstrike deposit in Nevada into production. He's had a very illustrious career. He went on to become the Chief Operating Officer of Aurelian Resources, when they were a Canadian junior, with about a $30 million market cap. They discovered the Fruta del Norte deposit, sold it to Kinross for $1.2 billion Canadian. So he's had tremendous success. George Bee is one of the most accomplished mine operators and developers in the world. George Bee did pretty extensive due diligence on U.S. Gold Corp., and specifically our project in Wyoming, which is the CK Gold Project, formerly known as Copper King.

I'm sure, as your readers/investors know, our project in Wyoming, the CK Gold Project, is quite robust. It's an at surface deposit. The PEA, (preliminary economic assessment) shows that we have 1.1 million ounces of gold and 300 million pounds of copper. Currently the deposit is about a thousand feet long, 300 feet wide, 300 feet deep and comes right up to surface, so it has a low potential future strip ratio. Copper King has a higher-grade center of gold and copper, surrounded by a lower grade deposit, but the real consistency of grades throughout the whole deposit makes it very amenable for future mining.

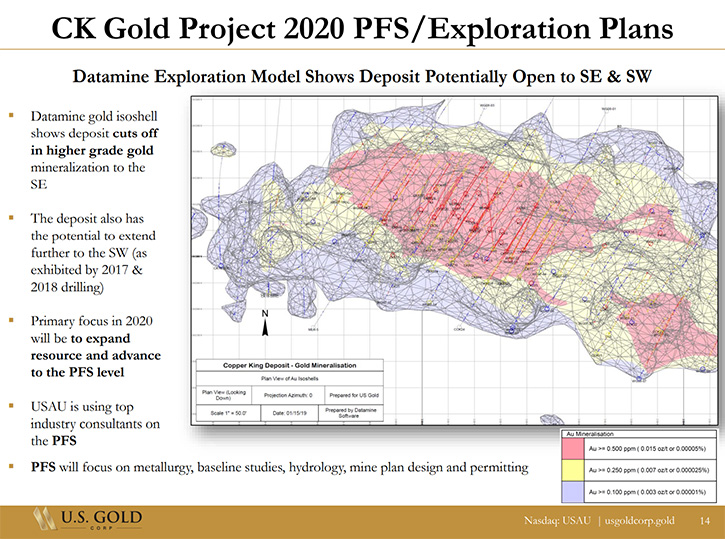

George Bee looked at the CK Gold deposit and absolutely loved it. It's on all State of Wyoming ground, so we believe we have a very clear pathway forward, for permitting and dealing with the regulators. And right now, as of September 16, 2020, we are pushing forward, with our pre-feasibility study at the CK Gold Project. Drill rigs are on the project right now. Our pre-feasibility study is led by George Bee and a team of some of the industry's leading consultants. It is going to be a very robust PFS. We're looking at drilling for mineralization. We really want to tighten up the prior assumptions from the PEA. There are prior metallurgical studies and reports that have been done at the CK Gold Project, but we need to better define this for a future production decision, so we’re drilling for mineralization.

We're also going to be doing the environmental and baseline studies, capturing all that data. A year from now, we should be in really good shape to potentially file a mine plan permit. We're looking at hydrology. We're looking at mine plan design and in addition, we're also going to be doing some additional infill drilling. We're drilling core for mineralization, and we're going to bring in an RC rig as well. Also, we'll be doing some infill drilling, trying to upgrade some of that inferred category into measured and indicated.

Also, we know that the CK Gold deposit has expansion potential. We showed this when we drilled out to the west in 2017-18, and added to the overall metal endowment. We know the deposit is open potentially to the southeast and at depth. So there'll be a lot of news in the next couple weeks and months, coming out of the CK Gold project, as we get towards this pre-feasibility report. We are all very hopeful that this pre-feasibility study shows a really robust resource.

We've also had some historic silver in the deposit. Those silver values and overall silver credits were never calculated into the historic net present value from the PEA economics. And I tell you, Al, this is a really viable project. Today, at $2,000 gold and $3 copper, we updated internally, on a sensitivity analysis, the net present value. Using $1,600 gold and $2.80 copper, below the current market prices, the Copper King deposit has a $321 million net present value. It is potentially quite economic. Ourselves, as a publicly traded company, we all believe, the management, that we are still quite undervalued in the market because a lot of our competitors, trade at 30 to 40% of their NPVs. And today I think we're trading at about 10% of our NPV, so we are still undervalued, just based on our CK Gold Project.

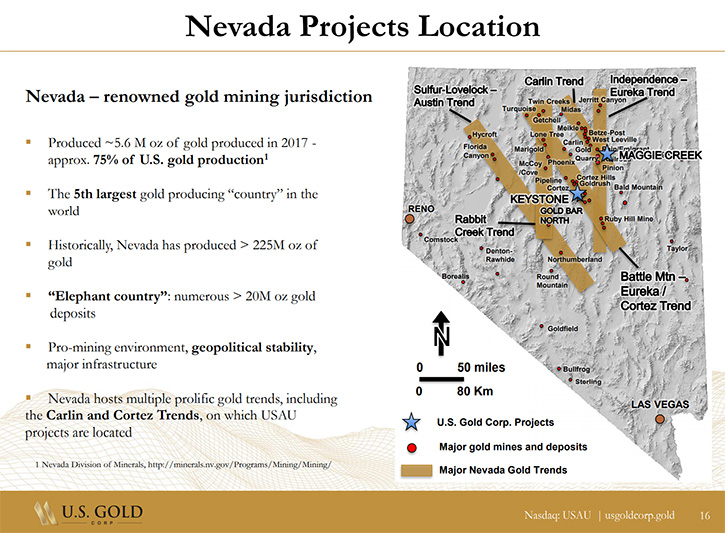

The last two projects we have, Al, are in Nevada. We have two district scale exploration projects in Nevada. Keystone is located on the Cortez Trend. It's about 10 miles south of Barrick Gold's Cortez Hills complex. It's a big project, 20 square miles, 12,000 acres, 650 mining claims and looks very prospective. We've been hard at work at Keystone, over the last several years. And then we have Maggie Creek. We have an option on the Maggie Creek claims. Maggie Creek is located on the Carlin Trend, a parallel trend to the Cortez Trend, at the south end of the Carlin, just next door to Newmont Mining's massive Gold Quarry mine. These are very prospective projects that give our shareholders a lot of optionality for a potential discovery on some of the leading gold trends in Nevada. That is an overview of the Company and the projects we have today.

Dr. Allen Alper: Well, that's an outstanding portfolio and really great projects that you have in great districts. You also have a fantastic team, so you have really a lot going for you and your Company. So that's excellent! Could you tell our readers/investors your primary goals for the rest of this year going into 2021?

Edward Karr: Absolutely. Our primary objective for the remainder of 2020 will be working towards the completion of the pre-feasibility study at the CK Gold Project in Wyoming. As I mentioned, we have the drills onsite now. We will most likely be drilling all of September and all of October. We have some additional geological and consulting work we'll need to do, so I think that's going to take us right up until the end of the year for that work. The PFS itself will hopefully be published in the first half of 2021. Just last week, George Bee, Ken Coleman, our project geologist and Bob Schafer were all in Idaho. They were up visiting our Challis Gold Project, our newest acquisition. We're looking at that right now, most likely going to perform some soil samples there, to see what a future drill program would look like. What we have to do at Challis, for the remainder of this year, is to start the permitting process. The Challis Gold Project is on US Forest Service land. We'd like to file a plan of operations to get that permitted for exploration projects that will probably, we hope, come through next year.

At Keystone and Maggie Creek, both George Bee and Ken Coleman are looking at those projects right now, refining our exploration plans. At Keystone, we have a plan of operations approved there. We need to permit some additional disturbance at Keystone. We need to do our archeological and wildlife surveys, then ultimately some dirt work before we can get a drill rig out there. So that's all occurring throughout September into October and November, and we'll have to see. There is a weather window specifically at Keystone in Nevada, because it's at altitude. It is quite mountainous. If the snows come early, we'll have to see if we can get a drill rig out there this year or if our exploration plans get pushed into 2021.

Dr. Allen Alper: That sounds great! Those are excellent plans. Could you tell our readers/investors about your tight share and capital structure?

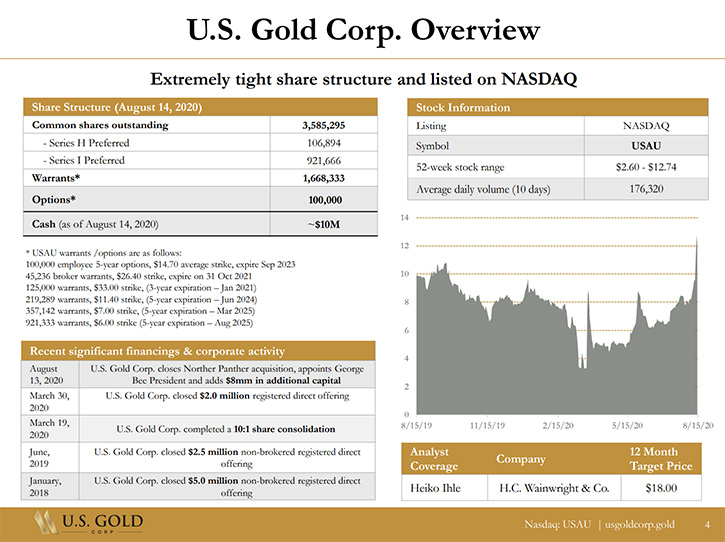

Edward Karr: Sure, be happy to. You know, Al, we're proud of the fact that we're listed on the NASDAQ, one of the very few gold exploration companies trading on the NASDAQ. Our symbol is USAU, U.S. Gold. We have an extremely tight cap structure. As of today, we have just 3.58 million shares of common outstanding. We have some preferred that could potentially convert into common. It's going to require a shareholder vote and our annual general meeting is coming up at the beginning of November. But as of today, there're 3.58 million shares of common, 1.03 million preferred. There are warrants outstanding that, if they were all exercised, would bring about another $15 million of capital into the Company. Today, we have been spending money on the CK Gold Project, so our 10 million in cash is down below that number. I don't know exactly today, but we still have nice cash on the balance sheet and no debt in the Company. We believe we're well-funded, at least for the next 12 plus months of G&A and exploration.

Dr. Allen Alper: Oh, you are in a great position to move your Company forward and you have great projects. Ed, could you summarize the primary reasons our readers/investors should consider investing in U.S. Gold Corp.?

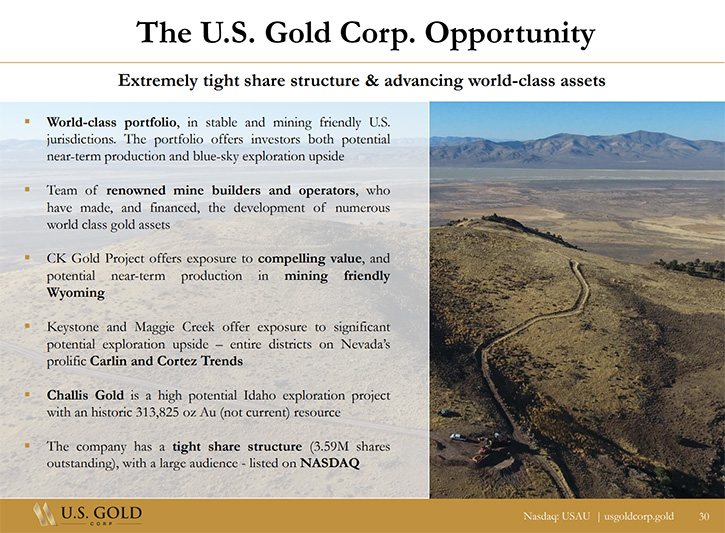

Edward Karr: Number one, we have great projects in great jurisdictions. We are in the mining-friendly states of Wyoming, Nevada, and Idaho, no geopolitical risk, all located in the United States of America and in great states for exploration and development projects. Number two, our CK Gold Project in Wyoming has real value, with a $321 million NPV at $1,600 gold, I think your readers/investors can really hang their hat on that valuation. Number three, we have tremendous blue sky upside with Keystone, Maggie Creek and the Challis Gold Project. Number four, we have a Management Team comprised of George Bee, one of the world's leading mining engineers and developers, running our technical projects forward, with myself as a real proven capital markets professional. We have a great Board, including Secretary Ryan Zinke and many other Board Members who've been supportive.

And finally, we have cash in the bank and no debt. We are in very good financial shape. I believe we are probably only in maybe the second or third inning of a nine inning ball game in this natural resource cycle. I think these markets are going to continue to do well. I believe the gold price is going to continue to move up into 2021, certainly the copper price. And it should be a really good time here in the next couple years for U.S. Gold Corp.

Dr. Allen Alper: Sounds like outstanding reasons for our readers/investors to consider investing in U.S. Gold Corp. Is there anything else you'd like to add?

Edward Karr: If people would like to get more information, they can go to our website, www.usgoldcorp.gold and sign up for the news and look for additional information. They can email me, or call me anytime. I'm very available. We do lots of webinars to give the audience lots of updates on the Company. Continue to watch the Company. We'll have a lot of catalysts, a lot of news releases between now and the end of the year. We're looking forward to advancing all of our projects and really appreciate your interest.

Dr. Allen Alper: Well, that sounds great. It's really fantastic to be involved in such great projects, in such great jurisdictions, and to have such an outstanding team moving the Company forwards, so well-balanced in geologists, mining, and also in financial business background. So that's really excellent and I'm very, very excited to see what you and your Company are doing. It's fantastic!

Edward Karr: We think it's really transformative for us, Al, especially with George Bee's addition. He has a tremendous following, both on Wall Street and Bay Street, huge institutional credibility, with the major investors and funds. I think this is really going to bring a lot of new research, a lot of institutional sponsorship, and I'm very, very excited about it.

Dr. Allen Alper: Well, that sounds extremely exciting, and it looks like 2020 and 2021 are going to be excellent times for U.S. Gold Corp. and for your investors, shareholders and stakeholders.

Edward Karr: Yeah, exactly. Thank you for interviewing U.S. Gold Corp. for Metals News.

Dr. Allen Alper: We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.usgoldcorp.gold/

+1-800-557-4550

ir@usgoldcorp.gold

|

|