Gran Colombia Gold Corp. (TSX: GCM; OTCQX: TPRFF): High-Grade, Largest Colombia Underground Gold and Silver Producer with Great Exploration and Development Potential; Mike Davies, CFO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/24/2020

Gran Colombia Gold Corp. (TSX: GCM; OTCQX: TPRFF) is a mid-tier gold producer, with its primary focus in Colombia, where it is currently the largest underground gold and silver producer, with several mines in operation at its high-grade Segovia Operations. Gran Colombia owns approximately 57.5% of Caldas Gold Corp. (TSX-V: CGC; OTCQX: ALLXF), a Canadian mining company, currently advancing a major expansion and modernization of its underground mining operations at its Marmato Project in Colombia. Gran Colombia’s project pipeline includes its Zancudo Project in Colombia together with an approximately 20% equity interest in Gold X Mining Corp. (TSXV: GLDX) and an approximately 26% equity interest in Western Atlas Resources Inc. (TSX-V: WA). Mike Davies, CFO of Gran Colombia Gold, believes that the Company is undervalued compared to peers, and expects a re-rating as they continue to execute their strategy in this strong gold market.

Gran Colombia Gold Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mike Davies, CFO of Gran Colombia Gold. Mike, could you give our readers/investors an overview of your Company? What differentiates your Company and what has been happening in 2020 and going into 2021?

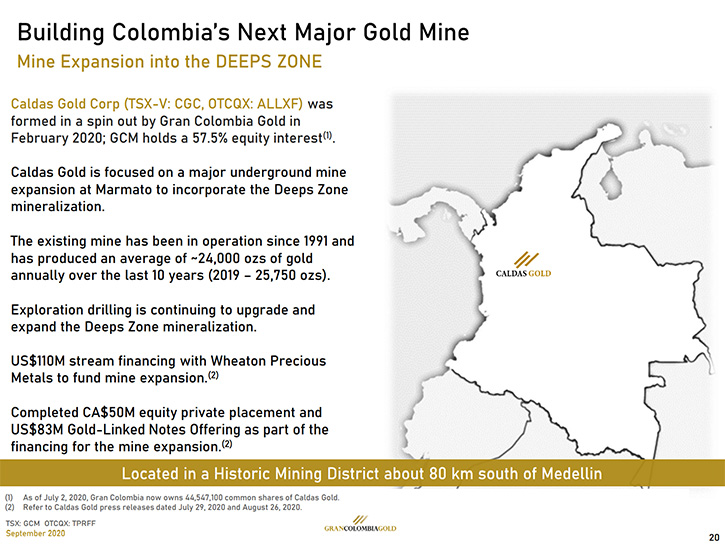

Mike Davies: Thank you. I appreciate the opportunity. 2020 has been another great year for Gran Colombia and we are continuing along. We are the largest gold and silver producer in Colombia. This year it is major news that we've spun out Marmato project successfully to a new separate TSXV-listed Company Caldas Gold Corp. Now that's allowing us to focus on what we consider to be our two flagship operations. We have the Segovia project, of which we own a 100% in Colombia. That's one of the top five highest-grade, global underground gold operations. We now are in the process of building Colombia gold mine at Marmato, through our 57.5% ownership interest in Caldas Gold.

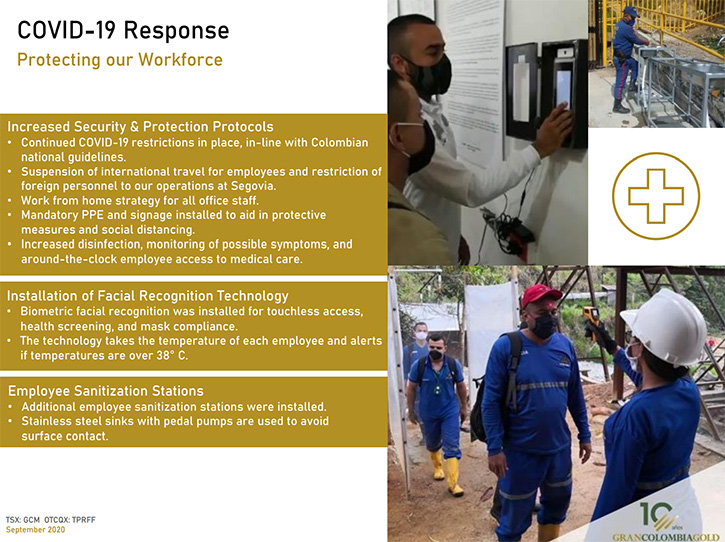

COVID-19 has certainly been on everybody's minds in 2020 and we've been very fortunate that our team in Colombia has been able to keep the operations going, both at Segovia and Marmato. We adapted relatively quickly to the situation with Segovia and from mid-April till now, we've been able to run the mine at very normal levels. We just reported August production and we're up over 17,000 ounces for the month. We're on track towards 200,000 ounces here this year at Segovia. And it is continuing to generate significant free cash flow for our shareholders.

At Marmato, the operation struggled a little bit more with COVID-19, since many of those workers come from outside the municipality of Marmato and the restrictions on people movement affected our availability of workers. But of late we've been seeing improvements. August turned in a very good month. It was up about 66% from where we were at July. We did over 2,700 ounces. So we're now feeling very optimistic about our path forward with Marmato.

We're now starting to implement a new pre-feasibility study, with a mine optimization in the existing mine. I think the most exciting news for, not only Caldas Gold shareholders, but Gran Colombia, who's never really received much of a valuation of Marmato in its stock price, is that Caldas is now fully financed to move forward with the expansion project to go into the deep zone. So it's been a very busy year for us, but I think we've continued to pursue our strategy very well.

Dr. Allen Alper: Well, that sounds excellent. Sounds like you're doing very well in a very difficult period of time. Sounds excellent! Could you tell us a little bit more about the production you've achieved and what your exploration activity is?

Mike Davies: Through the first half of the year, we reported that we produced about 104,000 ounces of gold. That was down from 118,000 in the first half of 2019, the impact of COVID-19, principally at the Marmato project which only did about 60% of normal for Q2. It also reflects a bit of a shortfall compared to normal in the first half of April in Segovia. But I think the biggest news for us, coming out of that, is that our cash flow has made up the difference with the much higher gold prices we're seeing this year, which was up about over $300 an ounce compared to the first half the year before.

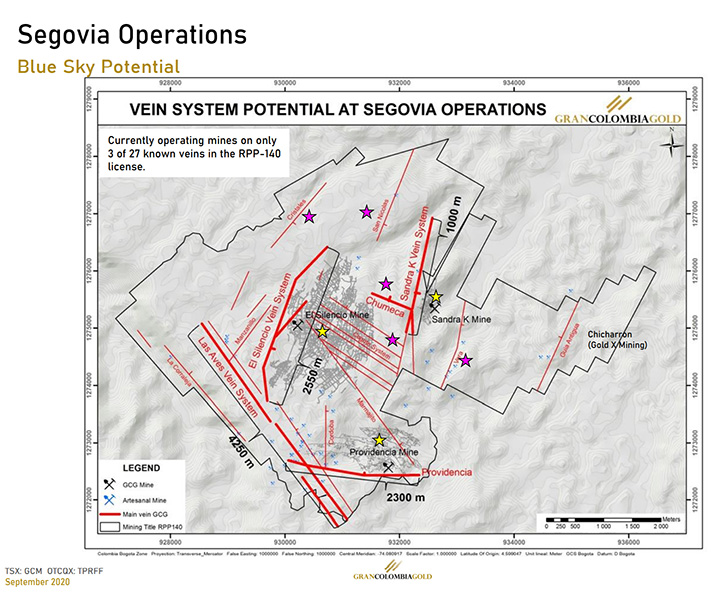

On the exploration front at Segovia, we were able to continue to operate within the mine site, continuing to focus on the three mines, where we're currently operating and in El Silencio, certainly making more progress on the deep zone exploration, below the existing resource and continuing, as we reported not long ago, to get some very good results that keep us very excited about the opportunity to expand resources at El Silencio. At the Providencia and Sandra K, we've continued to infill drill and drill for extensions on those veins and having successes as we've reported. The planned 2020 regional drilling program, expected to start earlier this year, was delayed due to COVID-19 and getting underway this month.

It's focused on a number of targets in 24 out of the 27 veins at Segovia that we're not currently mining. So we're very excited now to be able to get into this portion of the exploration program, to start to look at areas in Segovia of past mining and giving us an opportunity to look at which of those areas we can target for development of operations for future mining. Marmato has also been busy drilling this year, continuing to get good results. The ore body there is open at depth and to the North and to the East. We're starting to do some step out drilling, looking for extensions to the mineralization. We've discovered one new parallel zone, and we're continuing to work on drilling at Marmato. So pretty active at both properties!

Dr. Allen Alper: Sounds excellent. Could you tell us about your reserves and resources?

Mike Davies: In Segovia we have resources in the measured and indicated category of about 1.3 million ounces. And similarly about 1.3 million ounces in inferred resources, averaging between 10 and 12 grams per ton. We have about a 700,000 ounce reserve at the end of 2019, which gives us line of sight for our mine planning for about the next three to four years. At Marmato we just completed a PFS study that we announced the results of in July, and with the additional drilling that we did in the back half of 2019, our measured and indicated resources at Marmato have gone up to four million ounces, two million ounces of that are now qualified through the PFS as proven and probable reserves. That gives us about a 14-year mine life at Marmato. And we have another 2.3 million ounces of inferred resources at Marmato that we're currently drilling to upgrade additional amounts into the indicated category and eventually qualify those for additional reserves. A very strong reserve and resource at Marmato will commence the expansion project.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors your primary objectives for 2021?

Mike Davies: I think the continuation at Segovia, which is very stable now in terms of operating and its cost structure and is benefiting from the high gold prices. The second half of this year, we're going to be better than the first half, given that gold prices are about $250 an ounce higher than they were in the first half of the year. So we want to put that free cash flow back to use, to explore Segovia. We have a couple of other new things going on. We've just recently announced in Gran Colombia that we're commencing a quarterly dividend, starting with September 30th as the first record date. It will be paid October 15th. So we'll continue the quarterly dividend.

And we'll be looking to our continued success to determine whether that rate, which is starting off at about one and a half cents Canadian, will unfold in future quarters and potentially look to upsize it, if the metrics and everything support a change. But we started out with an annualized dividend that's about 1% of share price, and we'll try to stay at that level as we move ahead. We’ve also recently announced a normal course issuer bid to buy back up to 5.9 million or just under 10% of our shares. So we'll continue to monitor how we use that to defend our stock in any down dip days. But for the most part, we're going to continue to build a cash flow in Gran Colombia, do the exploration in Segovia, and strengthen the balance sheet further by taking our gold notes down. And then at Marmato, pursuing the expansion strategy that we've now funded, with our activities this summer.

Dr. Allen Alper: Oh, that sounds excellent. Could you refresh the memories of our readers/investors and our new readers/investors about your background and some of the key Management and Board people?

Mike Davies: The Company was founded by Serafino Lacono, 2010. We just recently celebrated our 10th anniversary in Gran Colombia. I've been there from the beginning with Serafino. Lombardo Paredes is our CEO, joined in 2014, and has done a terrific job leading the turnaround of the operations at Segovia. Alessandro Cecchi, our VP exploration, has equally done a great job with the exploration programs at both Segovia and Marmato. When it comes to Caldas Gold, Serafino, Lombardo, and I joined forces to help continue the strategy that we have at Marmato to push it ahead. I know Lombardo is going to do a great job leading the execution of the project plans that we have in the PFS, and Alessandro and his team will continue to drill.

Lots of experience! One of the key things that helps our management team in Colombia, is that we have the, "Know how," and the, "Know who," to execute our plans. And that's most important for us in achieving our success.

Dr. Allen Alper: That's a great team you have, excellent and very successful. Could you tell our readers/investors a little bit about your balance sheet and share and capital structure?

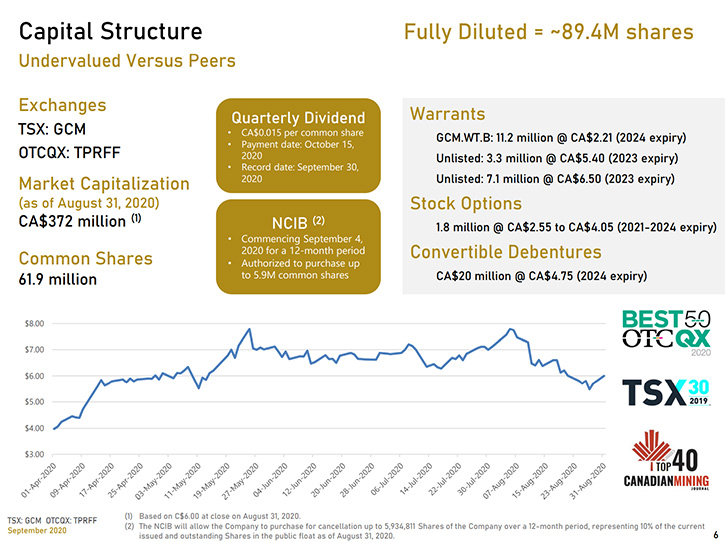

Mike Davies: At the end of June, Gran Colombia’s cash balance sat at about $85 million. We had $38 million in gold notes outstanding, after the payment we made in July. And another $15 million of convertible debentures that have a CS$4.75 strike price. So we've still continued to have a very strong balance sheet as our cash balances have been keeping up over $80 million. Our debt balance is coming down systematically, each quarter, through the amortization of the gold notes. We currently have 62 million shares issued and outstanding, a fully diluted share count of 89 million shares, including the warrants, the options, and the convertible debentures that trade on both the TSX and the OTCQX.

Dr. Allen Alper: Sounds excellent! Great progress, doing a great job, the team! Could you tell our readers/investors the primary reasons they should consider investing in Gran Colombia Gold?

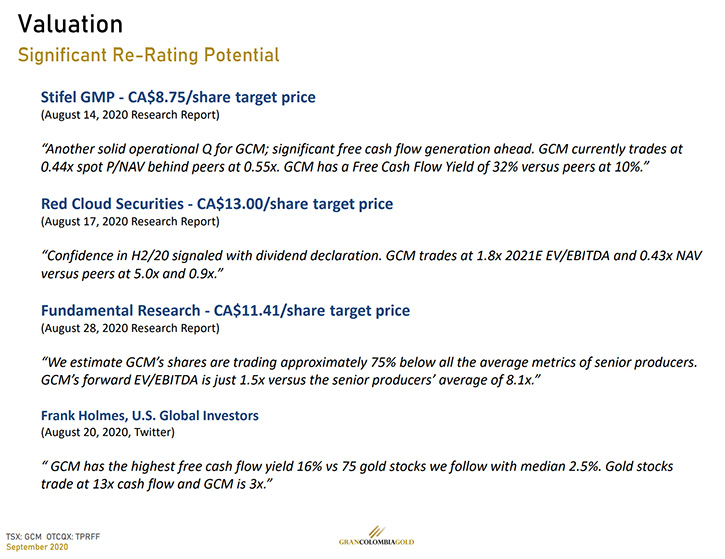

Mike Davies: Well, I think the number one thing is that investors are always looking for returns on our stock. We have three analysts right now that have target prices from CA$8.75 by Stifel to just over CA$11.00 with Fundamental Research and Red Cloud currently has a CA$13.00 target price. All of them benchmarking us, with various different metrics, but everyone certainly calculating our numbers to be well below, from a valuation standpoint, similar peers, and expecting a re-rating as we continue to execute the strategy in this strong gold market. Frank Holmes of U.S Global, has been making some comments about the Gran Colombia story of late, stating that of 75 gold stocks that U.S Global follows, we're at the top of the list in a number of metrics, like free cash flow yield. And yet we're only three times cash flow in terms of valuation.

The peers are averaging around 13 times cash flow. So everybody we seem to talk to on the outside recognizes the undervalued nature of the stock. We think it's still a story that is coming back to life and people are turning their attention to us. I think we’ve flown a little bit under the radar, given the challenges we had five and six years ago. And despite our marketing efforts, I think many people are still surprised by the results they're seeing in the Gran Colombia story. The Management team has the ability to operate and build mines. We've certainly demonstrated that through the turnaround, great quality assets, both in Segovia, with one of the top five, highest grade, underground global gold mines. Marmato, a new large underground mine, going forward, will be mechanized in the Deep Zone and the porphyry material is going to be a fabulous new mine in Colombia, when it's in full steam operation by late 2023.

So good quality assets, good quality management team and good valuation opportunity, I think are the three things that I would summarize with.

Dr. Allen Alper: Outstanding reasons for our readers/investors to consider investing in Gran Colombia gold. Mike, is there anything else you'd like to add?

Mike Davies: Thank you. I appreciate the opportunity to talk with you as always. It's been challenging during COVID-19 for everyone, we continue to commend our local operating team for the work that they've done, adapting and supporting the communities as well as supporting the workers. We certainly appreciate the support of our investors over the summer and look forward to the next chance we have to talk to you and give you another update.

Dr. Allen Alper: It's been great! I enjoyed talking with you. I'm very impressed with what you and your Company, Gran Colombia gold, are doing.

Mike Davies: We're really happy with the progress, as you say, it's been challenging for everyone, but now we've been very, very fortunate that we have what we have in front of us.

Dr. Allen Alper: We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.grancolombiagold.com/

Mike Davies

Chief Financial Officer

(416) 360-4653

investorrelations@grancolombiagold.com

|

|