Dr Allen Alper Interviews Mark Selby, Chairman, CEO and Director of Canada Nickel Company Inc. (TSX-V: CNC)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/3/2020

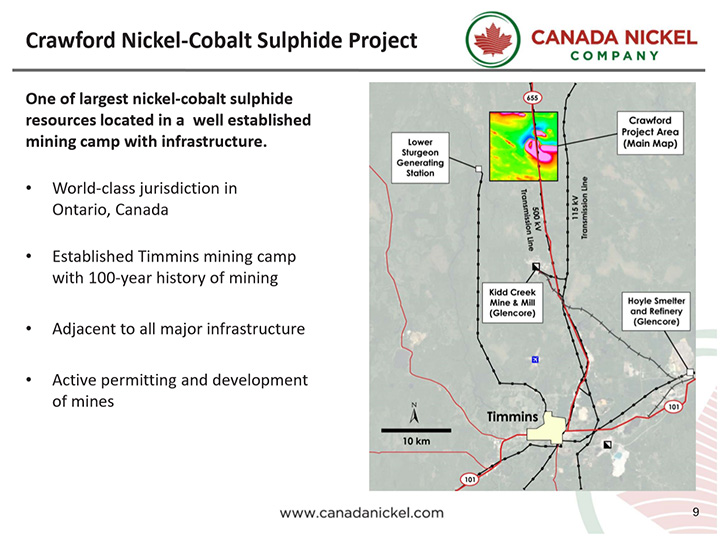

Canada Nickel Company Inc. (TSX-V:CNC) is a new mineral resource company focused on their 100% owned flagship, Crawford Nickel-Cobalt Sulphide Project, in the heart of the prolific Timmins-Cochrane mining camp. We learned from Mark Selby, Chairman, CEO and Director of Canada Nickel Company, they are going to advance it, aggressively, through to a PEA/scoping study, by the end of this year, and then roll right into a feasibility study, which they expect to be completed by the end of 2021. We learned from Mr. Selby, Canada Nickel is advancing the next generation of nickel-cobalt sulphide projects, to deliver nickel and cobalt required to feed the high-growth electric vehicle and stainless steel markets. Canada Nickel Company has applied in multiple jurisdictions to trademark the terms NetZero NickelTM, NetZero CobaltTM, NetZero IronTM and is pursuing the development of processes to allow the production of net zero carbon nickel, cobalt, and iron products.

Mark Selby, Chairman, CEO and Director

Canada Nickel Company Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mark Selby, who is Chairman and CEO and Director of Canada Nickel Company. Mark, I wonder if you could, give our readers/investors an overview of your Company and what differentiates your Company from others?

Mark Selby: Sure, we're a brand new company that has been around for less than a year. We just started trading at the end of February, just over five months ago. We were formed to advance a new nickel sulfide discovery that was made in 2018, which is called the Crawford Nickel-Cobalt Project. It's just outside Timmins, which is a long-established mining camp.

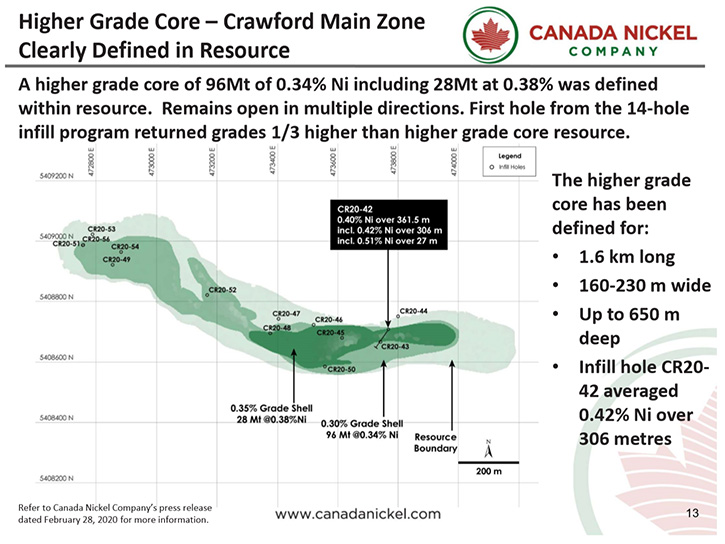

We formed the Company in the summer of 2019 and acquired 100% ownership of Crawford. We raised $6.5M dollars privately, and began drilling in September of 2019 for six months. In our maiden resource, we already discovered the 11th largest nickel sulfide resource on less than 20% of the structure that we think hosts nickel at Crawford.

And so we are now going to advance it aggressively through to a PEA or a scoping study by the end of this year, and then roll right into a feasibility study, which we expect to be completed by the end of 2021. The reason we're advancing this project aggressively is because, we believe we're heading for a new nickel super-cycle, coming in the middle part of this decade, as the sort of strong demand growth from traditional stainless steel uses is now going to be complimented by very strong growth of the electric vehicle market, where nickel is increasingly becoming the dominant metal in the cathodes of most electric vehicle batteries. So far everything's worked out quite well with the technical and timing aspects of Crawford.

Dr. Allen Alper: Well, that's amazing. I'm very impressed with how rapidly you are moving. That's really terrific! Could you tell our readers/investors a little bit more about the property and a little bit more about your plans for this year going into 2021?

Mark Selby: Sure. If you travel up a highway that runs north from Timmins about 25 minutes out of town, literally sitting adjacent to the highway is where the Crawford deposit is located. There's a very large geophysical anomaly that's about eight kilometers in length overall. The initial resource was less than two kilometers of that. In this type of deposit, you can use the geophysics very well to target your drilling.

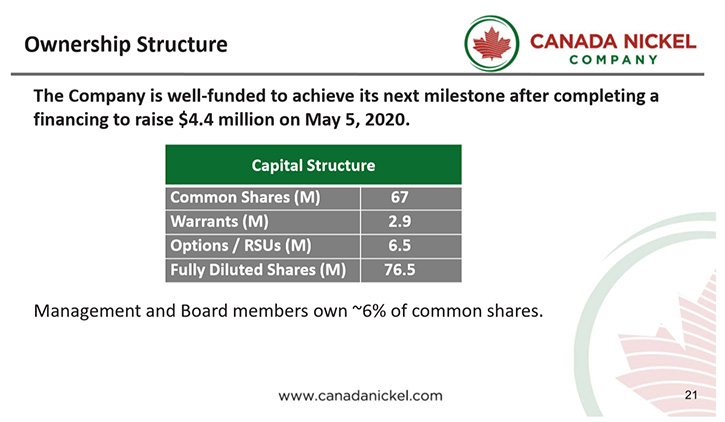

That's good because the area is completely undercover – there's no outcrop. So you have to rely on the geophysics to get a view of what's in the ground. We have a number of targets still left to drill. After the initial resources, we raised another $4.5M in April and closed in early May to progress that work, which I was quite proud of.

The last raise was in the middle of COVID. I think, it’s a testament to the quality of the project and the team, that we were able to raise that money during a very challenging time in the market. That money is being used to do three key things, which will be the bulk of the work through the end of the year.

First off is exploration – one is infilling the resource that we defined at the end of February. We're focused on getting the highest grade portion of it, as part of the scoping study, we can produce a mine plan to fill the mill with as much higher grade material as possible in the early years of mining.

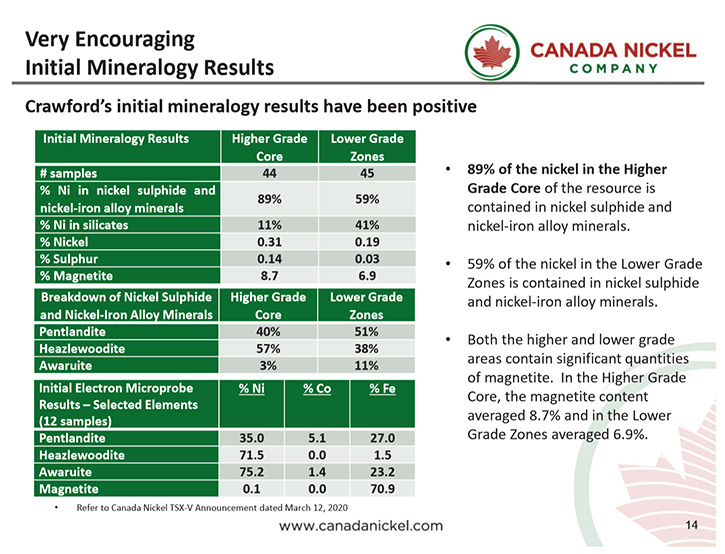

Secondly, as the mineralogy and metallurgy work in these types of deposits, there's only a certain amount of the nickel that ends up in a recoverable mineral. So it's important to do the work, to understand how much of it is potentially recoverable and then actually do the recovery testing, so you're content in terms of what the recoveries will be, and that'll be an input into the process flowsheet in the PEA that'll be done by year end.

The last piece is the engineering around things like tailings design, waste, dumped and so forth. Fortunately for me and the project, is that I was involved, in my past life at RNC minerals, with the Dumont Nickel Project, which we took from early stage resource right through to a fully permitted feasibility study stage project that's ready to build today. These deposits are only a few hundred miles apart. They were put down around the same time geologically, so they share a lot of characteristics. The terrain in which both deposits are located also have a lot of similarities.

So we can leverage a lot of the work that we did at Dumont. And we're using the same engineering firm that did all the work at Dumont to do it on this project. So that is what is allowing us to move very quickly to getting a PEA done by the end of this year. And then, as I said, we'll look to roll right into a feasibility study, which will aim to complete by the end of 2021. We're fully funded through the end of the year to do everything we need to do for the PEA. We will need to raise the money to do the feasibility study, which we expect to do sometime between now and year end.

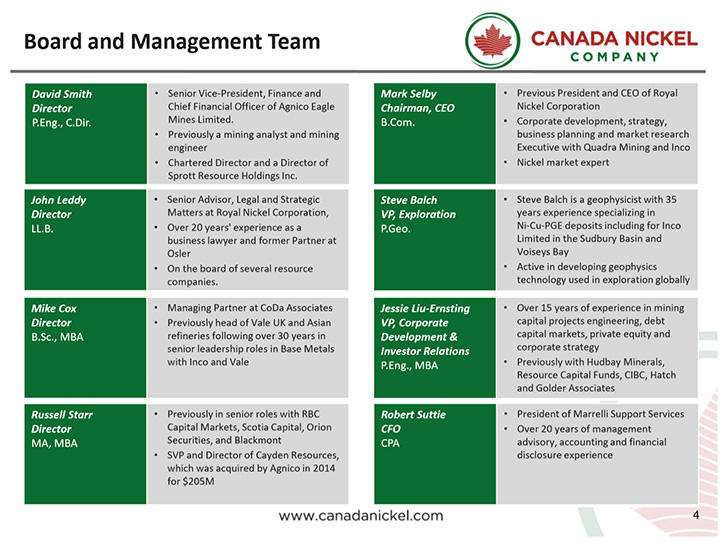

Dr. Allen Alper: Oh, that sounds excellent, what you and your team are doing. I know you're well-recognized in the nickel industry as the expert. Could you talk a little bit more about your background and your team?

Mark Selby: I worked outside mining for the first 10 years of my career. In 2001, I joined Inco as the head of commodity research. I had a bunch of roles within the marketing group, to continue to oversee the market research function. Then I took over as head of strategy for the Company in 2005, just before we tried to merge with Falconbridge to create a large diversified base metal company in Canada, unfortunately that didn't come to pass. And at that time Xstrata, now Glencore, ended up with the Falconbridge assets. So I've been involved in and around the nickel space for close to 20 years. I'm one of the people who regularly speaks on nickel as a commodity and so you'll be able to see posts of mine, over the last 10 years. And I think you could even dig out

presentations that I didn't give, but for which we did all the research in the early 2000’s. So you can see that we've generally been pretty good and pretty ahead of the curve in terms of where nickel is headed a bunch of the time. When I joined RNC back in 2010, we knew nickel was going to go through a challenging four or five years as the market absorbed all that NPI production that was going to be coming from China and then Indonesia, but the reality is long-term Indonesia can't be the only source of supply going forward.

And so, I think we will get a lot of interest from the EV sector of the auto industry, who is looking to completely retool their entire engine platforms to be electric based as opposed to internal combustion. So, I think we'll be well positioned to take advantage of that shift.

Dr. Allen Alper: Oh, that sounds great. Could you tell our readers/investors a little bit more about the market for nickel?

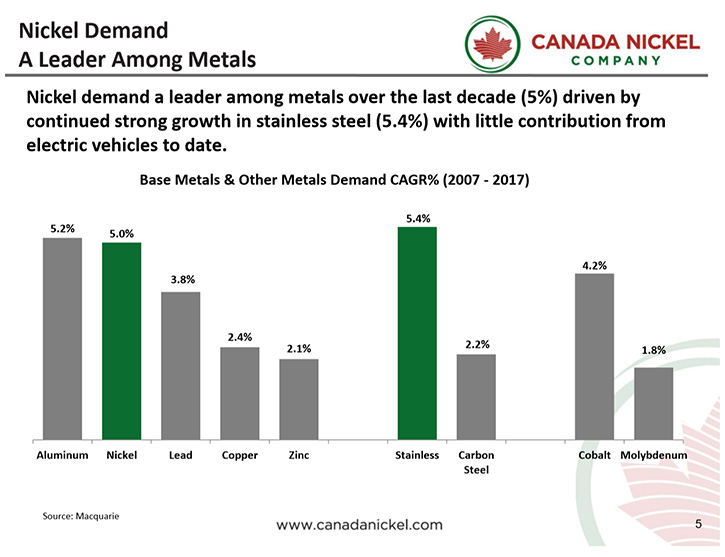

Mark Selby: Historically, nickel’s main use has been in stainless steel. The thing that really differentiates nickel from some of the other base metals, is it has tended to be a very high growth metal. So if you look over long periods of time, you'll see nickel demand growing at 4% to 5% a year. That has been driven by stainless steel demand growth, which has grown at 5% or 6% a year.

Stainless steel is a very attractive commodity. And given people's concerns about both the environment and sustainability and so forth, Stainless steel is a very attractive product, it has a very long life cycle. It's highly recyclable because of the nickel content that's in it, which makes it a more valuable steel. Even with all that high growth, stainless steel is still only 3% of the overall steel market. So again, we expect a very long period of high growth in the stainless steel market.

With demand growth at 5% a year, supply needs to double every 14 years. So it's not surprising that in nickel, unlike other metals, we kind of go through these regular cycles every 15 to 20 years. We go through one of these super-cycles where you see a very, very sharp increase in nickel prices. We saw one in the late 1960s, one in the late 1980s, and another one in the mid-2000’s. And then again, I think we're shaping up for another one coming in the mid-2020s because this robust demand growth for stainless steel is now going to be by, very robust growth in a battery.

The Tesla Capstone is made up of almost 9% nickel and many, many car companies are looking at using very high nickel content batteries. The reason that they want so much nickel in the battery, is that nickel gives the batteries the energy density, which gives the cars the range, which people are concerned about the most.

Today the electric vehicle market is maybe only 3% or 4% of overall nickel demand, but, we expect well over a million tons of nickel to be required just for the EV market. The nickel market today is about two and a half million tons, another half a million tons by 2025 of annual demand and well over a million tons by 2030. And the forecast is for even more nickel required by that point in the future, depending on what your view is of how fast electric vehicles are going to be taken up.

Dr. Allen Alper: Well, that sounds exciting. It sounds like the next few years will be a great time for nickel and positioning your Company very well for the expansion of the market and the future. So that's excellent! Could you tell our readers/investors a little bit about your share and capital structure?

Mark Selby: One of the things I was excited about, nearly as much as the deposit itself and the location of the deposit is the fact that we were getting to start with a brand new Company, a completely new Company. It wasn't a shell that existed before that we've put the asset into. So it was a very clean capital structure. We just announced we are accelerating the exercise of some warrants, giving existing shareholders some more exposure.

After the most recent raise, we have 70 million shares outstanding today, we have a pretty good view in terms of where those shares are sitting. In fact, we picked up some additional properties in the region, the Exchange required us to get shareholder approval and we were able to do that with a written resolution, because it didn't take too many shareholders to get to over 50% of the Company. Having a nice tight share structure will allow us to, as we continue to develop, as we continue to put out a steady series of news flow, that we should see that reflected in our share prices as we move forward. We started trading the last day of February, just before COVID really hit North America. Despite that our share price is up since that pre-market price.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors, what are the primary reasons they should consider investing in Canada Nickel?

Mark Selby: Number one, we've already identified the 11th largest nickel sulfide, a world scale asset that would be very attractive to any mid-tier or major who wants to expand, not only their base metal portfolio, but a number of those companies want to get into the battery metal sector too. We're in a location where it's just about as good as you can get in terms of a place where you can actually build, development and permit a mine. Just North of Timmins, we have all the infrastructure in place, the community and local First Nations groups are very supportive of resource development. So, we expect, as we move the project through the various engineering stages that we'll also be able to move the project forward very quickly to be in a position where we can build the project very well.

We think we're developing this project in a very very strong nickel market. In the past, if you look back, there have been one or two good nickel sulfide discoveries in companies like Vale, which discovered Voisey's Bay, companies like LionOre, and Jubilee in the 2000’s and another company called Sirius Resources, which was acquired in 2015. All were taken out for very large price tags. Because they were the companies who made those one or two good nickel sulfide discoveries per decade.

And we have a very good corporate share structure that we intend to keep as tight as possible, which will benefit our shareholders including myself. I have most of my non-real estate net-worth invested in Canada Nickel. So I'll be right alongside our shareholders, allowing them to recognize the gains as we de-risk and advance the project further.

Dr. Allen Alper: Excellent. Is there anything else you'd like to add, Mark?

Mark Selby: I would encourage people to buy early and buy often. Because I think we're going to have a very exciting 18 months.

Dr. Allen Alper: Well, that sounds great. That does sound like this year is going to be a great year for Canada Nickel and also the industry. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://canadanickel.com/

Mark Selby, Chair and CEO

Phone: 647-256-1954

Email: info@canadanickel.com

|

|