Altus Strategies Plc (AIM: ALS & TSX-V: ALTS): Successful Royalty and Project Generator Focused on Africa with 1Moz, a Strong Portfolio and Pipeline and La Mancha as a Strategic Investor; Steve Poulton, Chief Executive interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/2/2020

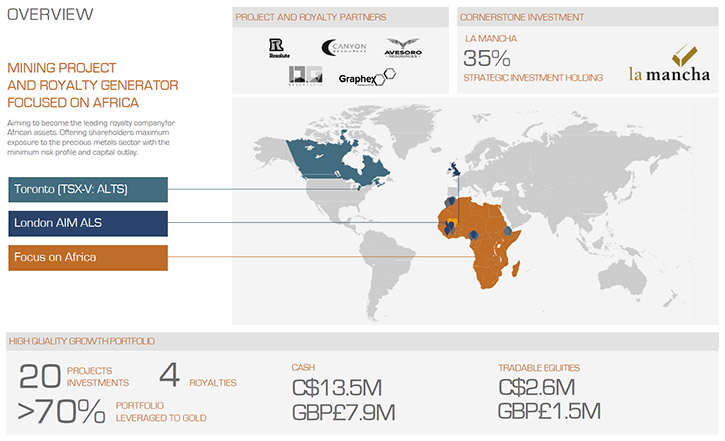

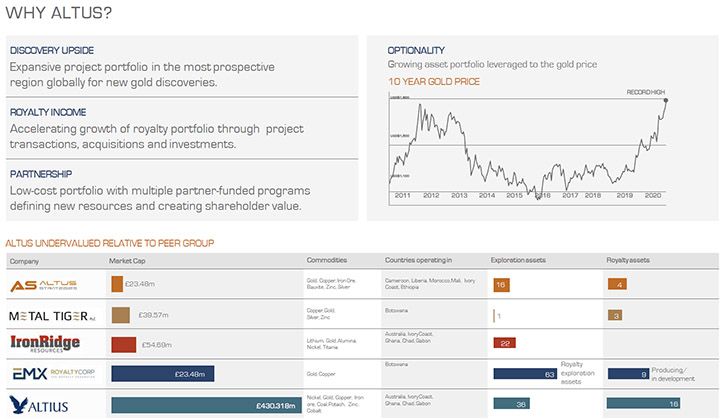

Altus Strategies Plc (AIM: ALS & TSX-V: ALTS) is a royalty and project generator focused on Africa. Altus's differentiated approach of generating royalties on its own discoveries, as well as through financings and acquisitions with third parties, has attracted key institutional investor backing including from La Mancha who own 35% of the Company, alongside the Board with a holding of 20%. We learned from Steve Poulton, who is a co-founder and CEO of Altus Strategies, that they offer a diverse portfolio of various stages precious and base metals assets and royalties in Mali, Cameroon, Morocco, Ethiopia, and Cote d'Ivoire. We learned from Mr. Poulton, that the Company is in an aggressive growth phase, and provides shareholders with diversification of jurisdictional risk from geopolitical events, as well as commodity risk. According to Mr. Poulton, Altus Strategies is a way for shareholders to gain exposure to a great deal of upside from discoveries, as well as the potential for long-term royalty income streams, all in the one listed vehicle.

Altus Strategies Plc

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Steve Poulton, who is Chief Executive of Altus Strategies Plc. Steve, could you give our readers/investors an overview of your Company, your strategy, and your business model?

Steve Poulton: Absolutely Allen and it’s a pleasure to be in touch. Altus Strategies is a royalty and project generator. The Company’s shares are listed in London and in Toronto, with the ticker in London being ALS and in Toronto we’re ALTS. Our focus is on Africa and that is perhaps our USP for royalty generation.

Dr. Allen Alper: That sounds great. Could you also tell us what differentiates your Company from others?

Steve Poulton: Well, we've been running Altus for 13 years but only took the business public in 2017, initially in London and then we dual listed in Canada in 2018. We acquired a portfolio of assets in Mali from Legend Gold, which was a TSX dual-listed company. Our Board and Management Team have career long track records in discovering new projects and monetizing them successfully for shareholders. The Board are also strongly aligned with the interests of our shareholders, as they have a 20% equity holding and are all investors in Altus.

On top of the Board’s material shareholding, our shareholder register includes a key strategic investor in the form of La Mancha, who owns a 35% stake. They acquired that by participating in a financing earlier this year. La Mancha has two other investments in the listed mining sector. One is a 24% interest in Endeavor Mining, and then they also own over 30% of Golden Star Resources, which are both TSX listed gold producers that are very much focused on Africa and are being very successful.

Dr. Allen Alper: Could you elaborate on some of the major projects and joint ventures that you have?

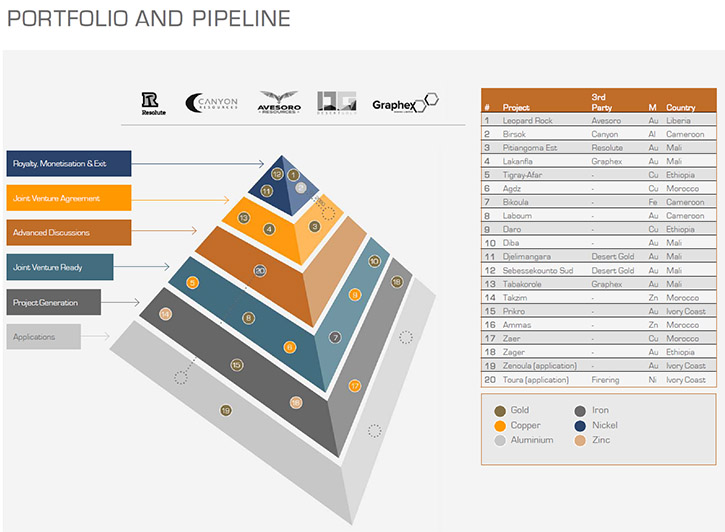

Steve Poulton: Absolutely. We have around 20 projects and royalties across six countries in Africa. Our main focus is gold and our most advanced gold assets are in Mali, where we have three projects under JV, two royalty interests in assets we advanced and sold and we retain a one hundred percent interest in a fifth.

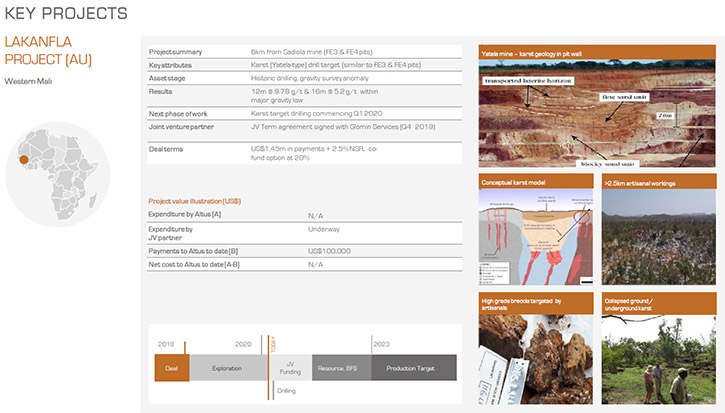

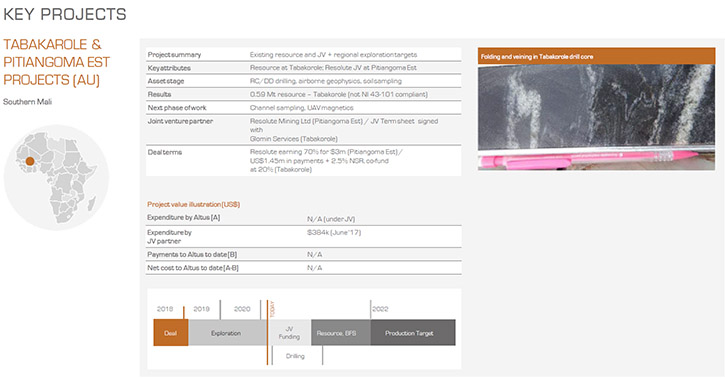

Our joint venture partner, on two of those properties, is Graphex Mining, which is listed on the ASX and will shortly change their name to Marvel Gold. Graphex are earning into our Tabakorole and Lakanfla assets. Tabakorole has a historic 600,000 ounce resource, while Lakanfla is a potential karst-style target that's next to the Sadiola gold mine, and specifically next to a couple of the major open pits, which were also karst-style deposits. Separately Resolute Mining is earning in on our Pitiangoma East property in the South of the country.

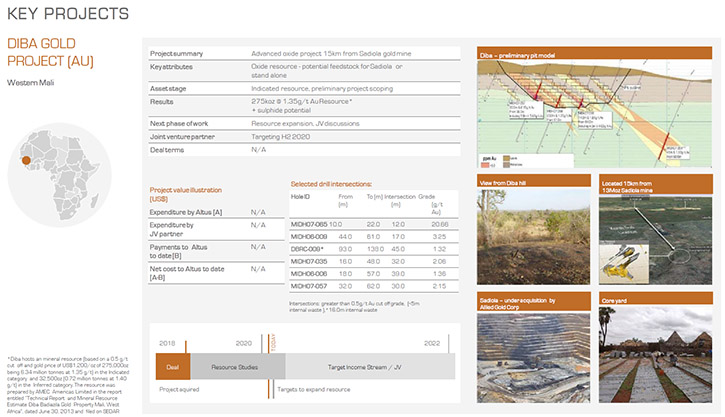

At the turn of the year, we sold two projects to TSXV listed Desert Gold, in return for equity in Desert Gold, plus a royalty on each of those assets. The final asset we have in Mali is called Diba, which as mentioned is one hundred percent owned by Altus. We recently announced a preliminary economic assessment on the Diba project, and it showed an after tax NPV of US$81 million on a conservative US$1,500 gold price, on just the oxide portion of the ore body, that’s been discovered so far. Aside from the Diba resource area, there are at least seven further geochemical targets that need to be tested. It will come as no surprise therefore, that we believe Diba has huge potential and are looking forward to drilling it shortly.

Outside of Mali, we are in Cote d'Ivoire, where we have recently announced a potential sale and royalty transaction on two of our gold properties, with TSXV listed Stellar AfricaGold Inc. We also have a nickel cobalt asset under application, which is going into an option and royalty agreement, with a private company.

In Cameroon, we have exposure to a very major bauxite deposit. It may be the world's largest, highest grade, undeveloped bauxite deposit and it is located on a rail line. That asset is being operated by ASX listed Canyon Resources. Altus currently hold 16 million shares in Canyon, and our Chairman sits on Canyon’s Board as their Chairman. We're expecting a further 10 million shares of Canyon early next year as part of the dissolution of our former JV. It's a very exciting asset and looks even more compelling as the global economy seeks ever more energy efficient means of transportation. Aluminum will be a key metal of the future. Also, in Cameroon, we’ve made a potentially significant gold discovery at a project called Laboum, which sits on a major shear zone. We've been working there for some time and believe we’re on the tail of a very large gold system. We're looking forward to undertaking some trenching and drilling on that property, in the not too distant future.

In the south of the Cameroon, we have an iron discovery, with a JORC resource on it; it is a high-grade and effectively direct shipping ore project. While iron ore has been out of favor for many years, it is increasingly back in favor, not least with the global response for infrastructure in the post COVID world. A very exciting asset.

In the Northeast of Africa, in Ethiopia, we have three gold and copper project, primarily focused on VMS style systems. These projects are right next to discoveries that are being made by companies such as Newmont Mining and Sun Peak, which is making its debut on the TSX, with a very strong management team.

In Morocco, we have a copper-silver deposit, which is about 15 kilometers away from a mine that's being operated by Managem, the Moroccan state mining group. Our project is called Agdz; it's a very exciting system, which even has some historical underground copper-silver workings on it.

Spinning farther South into Liberia, we have a two and a half percent net profit interest royalty on the Leopard Rock gold prospect, which is in the Bea Mountain concession, operated by a private gold mining company called Avesoro.

So that's our portfolio of assets. We are very much still in our growth phase and actively looking at numerous other royalty, projects and potential license applications. We have a very exciting twelve months ahead of us, in terms of new assets. As you can see for your readers/investors, our portfolio provides a great deal of political, geological and commodity diversification. This sets us apart from many of our competitors. We believe we provide shareholders with exposure to the two sweet spots of the sector, which are the phenomenal short term returns that can be made from making an economic discovery, and the sustained long term income that can be earned from royalties on mining assets; in both cases without taking on board the risk of operating the assets.

Dr. Allen Alper: That's fantastic. I'm very, very impressed with your portfolio, with your ability to plan and explore projects, and then also your ability to create favorable business and royalty deals. So that's really amazing.

Steve Poulton: Thank you, Al. We have about 15 geologists in the Company and the Board and management team at Altus have a strong track record of exploring in Africa, making discoveries and monetizing them, 20- or 30-year track records, in many cases, of undertaking this exact same business model as at Altus. Also, and very importantly, the alignment of economic interests between the Board and our shareholders is strong with the directors owning 20% of the equity.

Dr. Allen Alper: That sounds excellent. Steve, could you tell our readers/investors a little bit more about your background, your Board and your Team?

Steve Poulton: Absolutely, it would be a pleasure. I trained as a geologist and then a mining geologist, at the Camborne School of Mines in the late nineties; joined a company that was exploring for gold, diamonds and iron ore in West Africa, a CDNX and London listed company. I co-founded a business in 2002, which we took into Turkey to develop gold assets, and we listed that company in 2005 on the London stock exchange having acquired an asset from Newmont; that company is called Ariana and is still producing gold from the original asset under the stewardship of its MD and fellow co-founder Kerim Sener.

In 2004, we created a company called African Aura Resources, which we listed on the TSX venture exchange in 2008. It also proved to be very successful business, making a major iron ore discovery in Cameroon and a gold discovery in Liberia. We created Altus in 2007 as a way of bringing everyone, who we had met, who had shared mindsets, in terms of the mining sector, together to pool their ideas and capital.

Matthew Grainger, was also an Altus co-founder, he graduated in the same year and was similarly a co-founder of Ariana and the COO of African Aura. Shortly after creating Altus, David Netherway joined us as our Chairman. He was effectively a co-founder of the Company as well. David's background is as a mining engineer, he has built a number of gold mines across Africa, and one in China, very successfully.

Also, on our Board is Michael Winn. Michael the Chairman of EMX Royalties, on the TSXV and New York. He is a geologist by background, has worked in investment management, and brings a huge amount to the Company, in terms of his perspectives on the royalty and project generation from a North America perspective.

Woody Milroy is a Non-Executive Director. He is based in Guernsey and has a background is in capital markets, specifically in investment management, but he has also had a successful career in the resources sector. And the final Director is Karim Nasr. Karim is the CEO of La Mancha and he joined Altus as their representative this year after La Mancha acquired their 35% stake. Karim has a very strong background in asset management and private equity, specifically in telecoms and natural resources and specifically in Africa. Karim brings a huge wealth of intellectual capital to the table. Our Board is very strong for a company of our size.

We also have, Alister Hume as our New Business Development Manager. Alister joined Altus from specialist technology metals group Kobold Minerals. Before that he was with the Sentient Group of natural resource funds. Our CFO is Martin Keylock, who has a fantastic pedigree in cross jurisdictional accounting. Most recently Sandra Bates joined the team as our General Counsel. Sandra has over twenty years of experience in the natural resources sector, specializing in complex commercial negotiations and Environmental, Social and Governance (ESG) engagement. We basically have a very strong and growing team of resource professionals at Altus.

Dr. Allen Alper: Well, you have an outstanding background and your Board is also fantastic, very strong, very experienced, and very accomplished. That's really great.

Steve Poulton: Absolutely. Thank you. I agree.

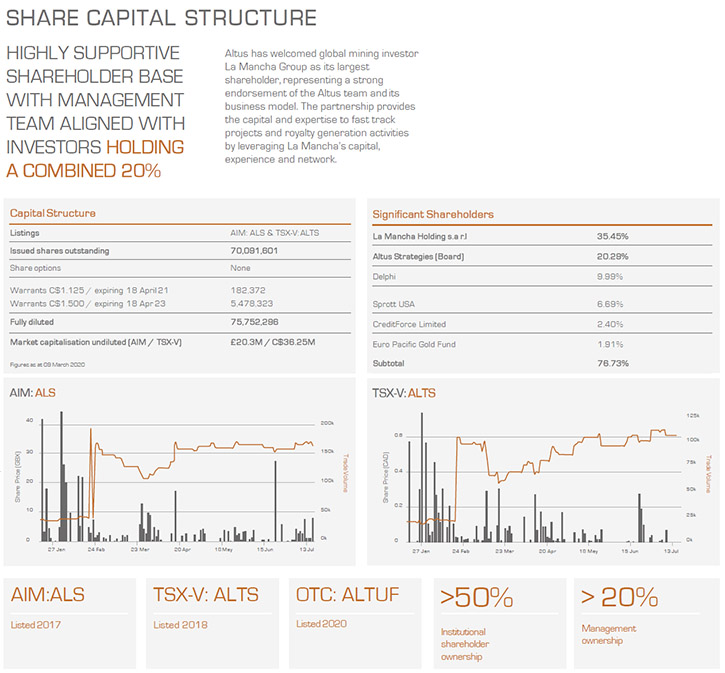

Dr. Allen Alper: Could you tell our readers/investors a little bit more about your share and capital structure

Steve Poulton: We have approximately 70 million shares on issue and currently trade at approximately C$1.10 in Toronto and £0.65 in London. We have just over 5 million warrants, with an exercise price of $1.50. And there're a couple of hundred thousand warrants at C$1.125. We do not currently have any share options on issue, but expect to grant some during the course of the next few months.

We undertook a five for one rollback in February of this year. Before La Mancha invested in the Company, approximately half our shareholder register was on held on the venture market, and about half on the London market. The 35% stake acquired by La Mancha is held on the London market. That now gives us an approximate two thirds, one third split in terms of the distribution of shareholders between London and Toronto. In the last few months we have seen fairly good liquidity in our shares in both markets, certainly compared to previous years.

It looks as if the improved liquidity is here to stay as more and more generalist investors are starting to rightly look at gold equities, and specifically the people becoming involved now are perhaps the most sophisticated part of the generalist investor spectrum. They're already identifying gold and gold mining shares as being a good place to invest, but they're selectively doing so. They are picking what they believe are the companies, which have the strongest asset bases and soundest track records. We're very pleased to have received an influx of new investors, and our share price has done particularly well. However, I strongly believe this market is going to run for some time because the lack of discoveries in the mining space, the lack of investment in exploration and in good quality teams to explore, or make discoveries has been so dramatic that there is huge pent up demand for assets and only a very small supply of new projects, certainly of quality projects to the market.

Those conditions speak very favorably for companies with good quality assets who are willing to transact on them, such as Altus. The proverbial canary in the coal mine for many investors will be Warren Buffett's acquisition of shares in Barrick and his disposal of shares in Goldman Sachs. It's a very interesting trade. Everyone is aware of his historic and less than favorable views on gold. It is perhaps the most public signal that even those who have been least convinced of the merits of investing in gold and gold mining equities are now taking a serious look if not already investing. We're very positive about the next couple of years ahead.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in Altus Strategies?

Steve Poulton: It boils down to value. We believe that we represent fantastic value at current prices. We offer investors a diversified portfolio of precious and base metals, and that is at the project level, in the equity level of companies and at the royalty level. We genuinely believe, we capture the two sweet spots of the mining sector for investors; our focus on Africa provides diversification of jurisdictional risk from geopolitical events, but also commodity risk too. All in all, Altus is a one stop investment for shareholders to gain exposure to a great deal of upside, as well as the potential for long-term income streams, all in the one vehicle.

Dr. Allen Alper: Well, those are very compelling reasons for our readers/investors to consider investing in Altus Strategies. Steve, is there anything else you'd like to add?

Steve Poulton: I think Al you've asked some excellent questions and we've covered all of the ground, so I'm very happy. We’d be pleased to answer all your readers/investors’ questions at Altus. We're always very happy to take calls and respond to electronic communications that we receive through our website or directly to info@altus-strategies.com.

Dr. Allen Alper: That sounds great. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.altus-strategies.com/

Steve Poulton, Chief Executive

Tel:+44 (0) 1235 511 767

E: info@altus-strategies.com

|

|