Rafaella Resources Limited (ASX: RFR): Fast Tracking Tungsten Production, a Strategic Critical Material in Spain, Targeting Cash Flows in 1H 2021: Steven Turner, Managing Director Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/31/2020

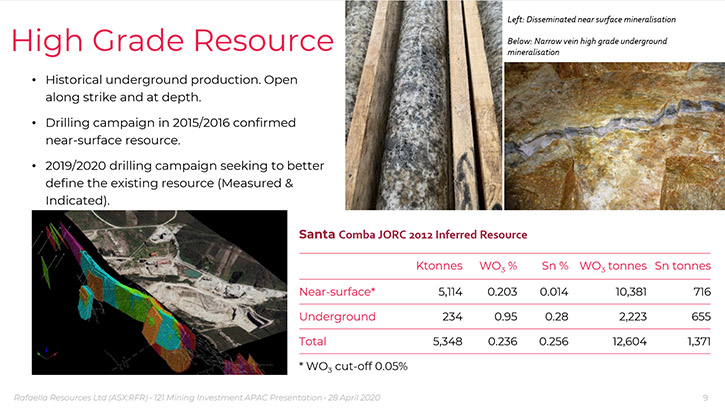

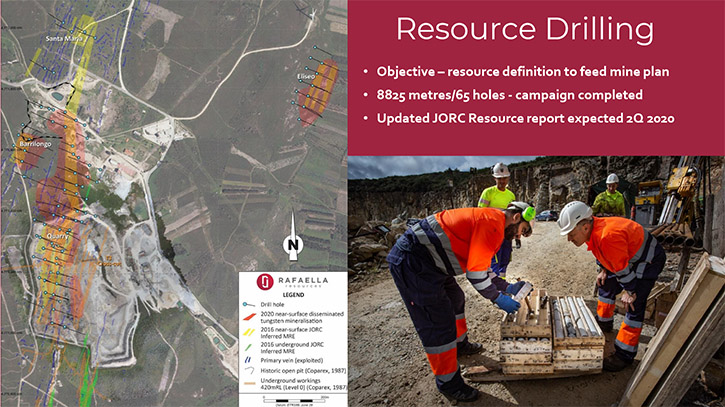

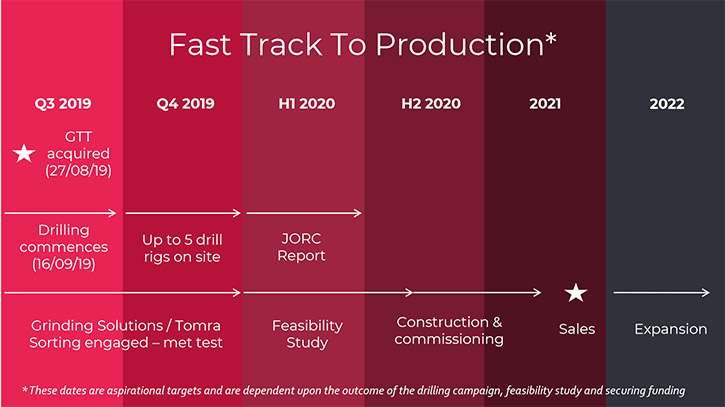

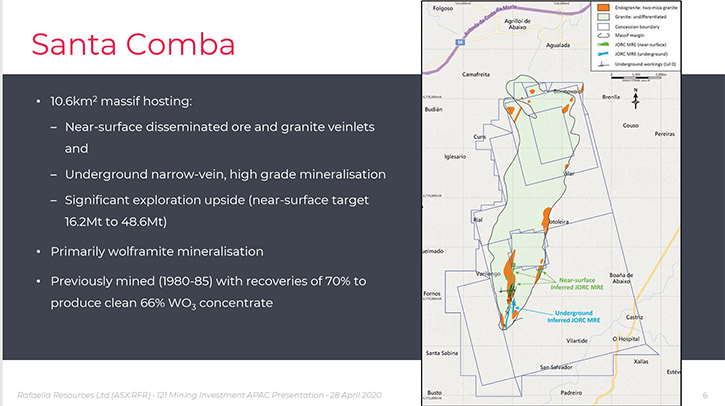

We learned from Steven Turner, Managing Director of Rafaella Resources Limited (ASX:RFR), that they are focused on fast-tracking their wholly-owned Santa Comba tungsten project and are targeting cash flows in 1H 2021. Santa Comba is a past producer, with a well understood resource, great infrastructure, close to deep water ports, which makes the cost of getting back into production quick and very low. In March, Rafaella Resources completed a 9,000 meter drilling campaign to convert their five million tonne inferred resource into over six million tonnes of measured and indicated. In addition, the Company's estimate of additional near surface mineralization yet to be drilled out, is up to 46 million tonnes.

Steven Turner, Managing Director of Rafaella Resources Limited (ASX:RFR)

Rafaella Resources Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Steven Turner, Managing Director of Rafael Resources. Steven, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

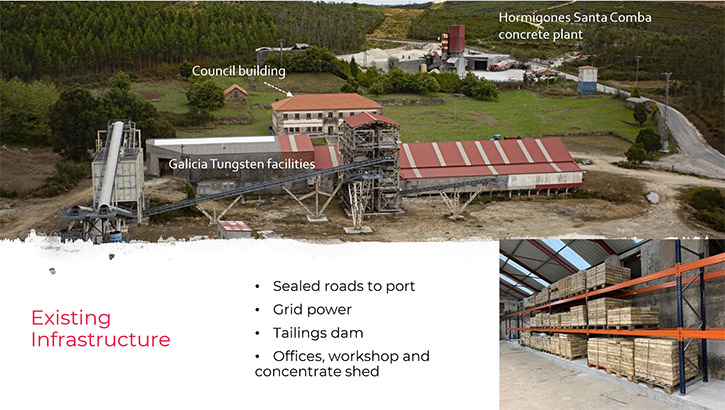

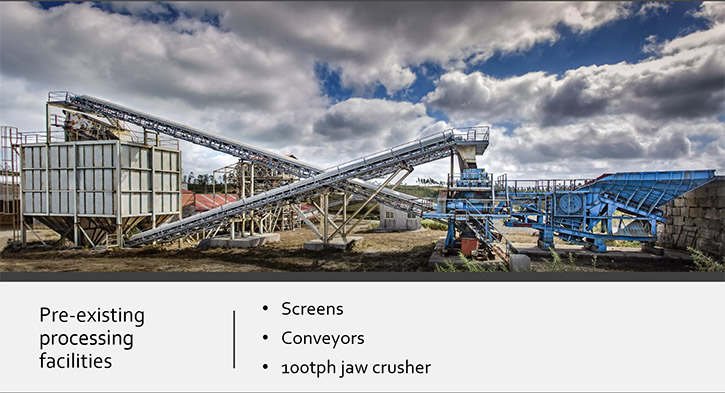

Steven Turner: Thank you, first of all, for this opportunity, Allen. It's very kind of you. Rafaella Resources can differentiate itself from other juniors quite easily. The reason for this is that we have a project that was previously mined, so it's a brownfield development benefiting. We have a resource and that is well-understood and a history of producing high-grade clean concentrate. The project is in an area that already has mining permits and licenses in place out to 2068, which is a key differentiator from other juniors. We also benefit from significant infrastructure. We have access to power. We're close to deep water ports. We have offices. We have a number of pieces of equipment in place already for processing. So it's a project that is well along the way to being developed.

So unlike other juniors that might be taking a greenfield resource and looking to build a project around it, we basically have a project already. What we've been doing recently is revisiting the resource itself and better defining it. The project was previously mined underground and what we've been doing is looking at adding the open pit potential. So the main difference from what was mined in the past is the addition of a near surface resource. When we took over this project back in August of last year, the first thing we did was get out onto the ground and started drilling.

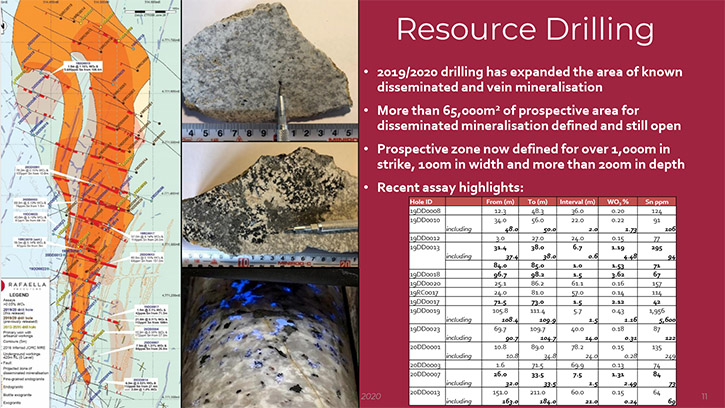

We completed, in March, a 9,000 meter drilling campaign, 65 holes. The purpose of that was to convert what we already had, as an inferred resource, into measured and indicated. So we had a five million tonne inferred resource for the open pit, and at the end of June, we issued a new mineral resource estimate. So now we have over 10 and a half thousand tons of ore, of which nearly 60% is sitting in measured and indicated. We have over six million tonnes of ore sitting at 0.16% of tungsten trioxide and a small amount of tin that now could feed into a mine plan.

The Company has been very much focused on better defining the resource and looking at the metallurgy for the near surface mineralization to finalize a process flow sheet to maximize our recoveries and pull that all together into a feasibility study, which should be completed in the next four to six weeks. We've been moving full speed ahead, better defining the resource, de-risking the project, making sure we have the optimal pit shells, and mine plans, and processing flow sheets, so we can get this project back into production as quickly as possible.

One of the big advantages over other juniors, Al, is because of all this infrastructure that's in place and all this work that's already been done in the past, the cost of getting us back into production is really very low. So relative, again, to other juniors who have a resource they need to define, our project already has a lot of the equipment and infrastructure in place. So to get us back into production will be both quick and relatively cheap.

Dr. Allen Alper: That sounds like an excellent position to be in. Could you tell our readers/investors a little bit more about your resource, your grade and what some of the numbers look like, the financial projections?

Steven Turner: Our mineral resource assessment that came out at the end of June shows us that we have 10,607 tonnes of ore, in measured, indicated and inferred. That's sitting at 0.175% tungsten trioxide, which is a very good grade indeed for a tungsten mine. And we have 0.015% tin, which is relatively small, but if you look at the overall contained metal, we have over 18 and a half thousand tons of tungsten, and we have over one and a half thousand tons of tin sitting in our resource.

One of the things that our drilling campaign did show, though, is that the resource is open to the north, to the south and at depth. The current resource that we've defined is about a kilometer long, and it's 100 meters wide, 200 meters deep. It's a very neat and tidy resource that we can put a very efficient pit around. There continues to be upside all around this. The deposit is hosted, within a granite massif that's over seven kilometers long by one to two kilometers wide. So there's a lot of additional mineralization yet to be drilled out.

We have a starter pack, which is a very compact deposit, but we have a lot of upside. In fact, our estimate of additional near surface mineralization, yet to be drilled out, is up to 46 million tonnes. So there's a lot more to come. At the moment, we have a resources that's sufficient for eight to ten years of mining, but we can easily increase the throughput and we could increase the life, for many, many years to come. It’s a great project at the moment, and there's a long term prospect to this as well.

Dr. Allen Alper: That sounds excellent. Could you describe your location in Spain?

Steven Turner: We're in northwest Spain, in a province called Galicia. It's right up in the northwest, just north of Portugal. It's the bit that sticks out facing the Atlantic, so that means it’s not like a lot of Spain to the south, which is dry. There's plenty of water, plenty of rain, which is good for our operation. So we have no issues around water. We are located 60 kilometers from A Coroña, which is a deep water port. We actually have another two deep water ports, all within 120 kilometers of the site. We have access to those deep water ports through sealed roads. The actual mine itself is located in an industrial area. There's no agricultural farmland encroaching in the area. There's actually a cement plant just beside us and there's an aggregate quarry plant located within our site. So it's already an industrial area.

It has grid power to site and a lot of infrastructure there. So it's very well-located to service the markets of both Europe and North America. We can get the product, in concentrate, out to the ports very quickly, which is important, because both those areas are short of tungsten concentrate. Europe has about 16,000 tons of tungsten demand per annum. They produce less than half of their requirements. The US and Canada currently have no production of tungsten concentrate. Their tungsten is sourced from overseas. We're extremely well-placed to supply that.

This is important because tungsten is a critical metal and has been identified as such. There are no obvious substitutes. It's used in important industries such as mining. It's used for drilling in the mining and oil and gas industries. It's used in the manufacture of aircraft engines. It's got wide uses, wide applications with no substitute. Even down into your mobile phones, the vibrating element is tungsten. And the reason for this is tungsten is the second hardest mineral in the world after diamond and it's highly resistant to heat change. It has the highest melting point of any metal. It's unique in its properties, making it a critical metal and recognized as such around the world.

Dr. Allen Alper: That sounds excellent. Steven, could you say a few words about your background and your Team?

Steven Turner: My background is largely corporate. I've worked in both oil and gas and mining for over 25, nearly 30 years, based out of the UK, Singapore and more recently Australia. I've looked after such areas as treasury and capital raising, focused on project finance, always around the development of new projects. I've worked both within industry and within banking. In corporate finance, for example, out of Asia, I used to cover metals and mining, and oil and gas for all of Asia for ABN AMRO. But more recently, I've been in Australia for the last seven years, primarily looking after business development for a private hard rock miner based in Australia. I helped that Company grow with a number of material acquisitions.

And then I came across this project a few years ago. A group out of Hong Kong owned it with a partner in Spain, and they were looking for how best to move it forward. They're a venture capital group. They were seeding it and had completed a small drill program and had put together a scoping study. That's how they got the inferred resource around it. I agreed to work with them and help to find a home. I found Rafaella Resources, introduced them, which was a listed company on the Australia stock exchange, and put that deal together that resulted in the acquisition of Santa Comba back in August of 2019. I helped put all that together and then stepped in as Managing Director at that point to take it forward. But my background is very much corporate, capital raising, and commercial/business development. I'm supported by a very, very experienced technical team.

Our person running our feasibility work is someone with over 30 years of mining experience in tin, tungsten, gold, etcetera, around the world. I have very experienced geologists, both here in Australia and in Spain. We've recently appointed our project manager for Santa Comba. He's a Spanish mining engineer. We picked him up working in copper in Africa, very experienced internationally, having worked in many locations. So he brings not only the international perspective, the health and safety standards, processing, etcetera, but he's also a local Spaniard and speaks Gallego, which is actually quite important, because where we're operating, they don't only speak Spanish but they also speak the local dialect, and he does that as well. So a tremendous appointment in Oscar Amigo. He joined us back in June and he's hit the ground running, driving the project there at site.

So we have a very experienced team and that team will grow as we move forward through into the development phase. So yes, good access, great access to experienced workers in Spain, which has a long history of mining. There's a lot of experienced workers there, but the good thing is a lot of them also have international experience that they can bring to bear and we're certainly benefiting from that.

Dr. Allen Alper: Oh, that sounds excellent. Could you tell our readers/investors a little bit about your share and capital structure?

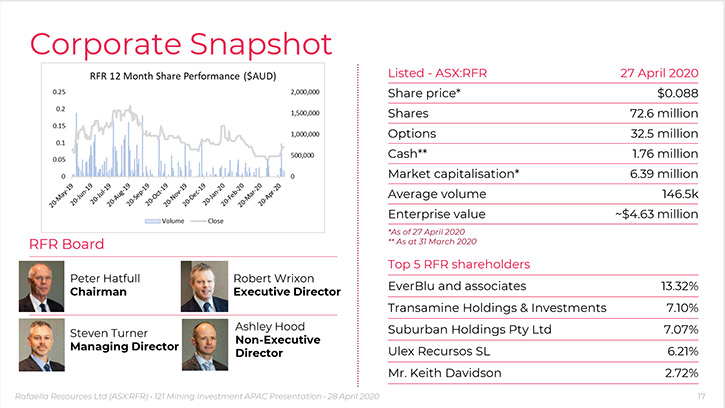

Steven Turner: We have just over 72 million shares in issuance. This Company was listed in July 2018, so it doesn't have hundreds of millions or billions of shares out there. It's a very neat share capital. There are some performance rights out there, and there are some options. Fully diluted we're just over a hundred twenty million shares, so it's still a fairly small share capital. We have a fairly wide spread of shareholders. We do have some important strategic ones.

Probably the one I want to mention most at the moment is Transamine Trading. That's a private commodity trader, based out of Geneva. They're the world's oldest private commodity trader. They have significant trades in nickel, tin, copper, zinc etcetera around the world. They came onto our share register back in August 2019 when Rafaella Resources completed the acquisition of the Santa Comba project. They own about 7% of the Company and back in May, they nominated a representative onto our Board. So that's extremely important for us going forward, because we then have a very large industry player sitting behind us, providing us support in different areas. Not least, they've agreed, for example, to three years of off-take on all our tungsten and tin and provide us with the logistical support, which is very important, when you're starting up as a new business, to have that sort of experience behind you to make sure we commission smoothly and we get the concentrate out efficiently to the market. So that's a great addition to our shareholder base.

We also have our local Spanish group that originally owned the mine that vended into Rafaella. They're another significant shareholder and they're very important to us because they provide us with additional local experience. They run an engineering company and we've been tapping into their mining engineers and knowledge of the local markets over this last year, as we've been doing both the drilling campaign and moving forward on our feasibility study. So we have a very good, strong local presence through our shareholder base.

Dr. Allen Alper: Oh, that sounds very good. Could you tell our readers/investors the primary reasons they should consider investing in Rafaella Resources?

Steven Turner: Well, the primary reason, which is of interest to any shareholder, really, is the value uplift on this stock. At the moment we are trading at a very low enterprise value. Our enterprise value is just over $4 million and yet we expect to have a very low capital cost to get into production, and when this project is in production, it will be throwing off substantial cash. There are not many tungsten operating companies out there that are listed. They trade at six, seven times EBITDA. If we applied those sort of numbers to our projects, the uplift on our share price could be substantial for any shareholder coming in. It hasn't been picked up or recognized yet, so we think it's a very, very good time to buy into the Company.

The Directors have been buying when they can. The Directors own around 7% of the Company at the moment, excluding the Transamine Director, obviously. That would take us up to 14%. So the Directors believe in the business. We have a good shareholder following that believes in the business. But there are not a lot of shares out there and the volumes are not great. As a consequence of that, the share price is languishing somewhat at a low point at the moment and offers a great investment opportunity for anybody wanting to come in.

Dr. Allen Alper: Oh, those sound like excellent reasons to consider investing in Rafael Resources. Steven, is there anything else you'd like to add?

Steven Turner: We do have more than Santa Comba in the portfolio. We have a very interesting exploration play out in Canada as well, a polymetallic one with copper and cobalt, which we are doing a little bit of work on. Santa Comba is our flagship. And the important thing about that is it is a near term development. It is a project that'll get into production quickly, give us strong cash flows and it will fundamentally change the shape of this Company very, very quickly. That is not reflected at all in our share price and yet the project is continually being de-risked.

Our resource estimate that came out recently has addressed any concerns around the resource. The resource has shown to be very compact, good grade and amenable to open-pit mining. Our metallurgical test work is ongoing and ore sorting test work continually shows that this is a project that looks exciting and one will have good, robust economic metrics. Those metrics should come out to the market in the next four to six weeks. Once the market starts to recognize the value of this project, I think that investment opportunity will slip away. So I think now is a very good time to come in.

Dr. Allen Alper: Well, it sounds like this next few months will be a very important time for shareholders of Rafael and a great opportunity for new investors. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://rafaellaresources.com.au/

Rafaella Resources Limited

Steven Turner, Managing Director

Ph: +61 (08) 9481 0389

E: info@rafaellaresources.com.au

|

|