Aurania Resources Ltd. (TSXV: ARU, OTCQB: AUIAF, Frankfurt: 20Q): A Successful Team Exploring an Extensive Precious Metals-Rich Belt in Ecuador; Dr. Richard Spencer, President Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/30/2020

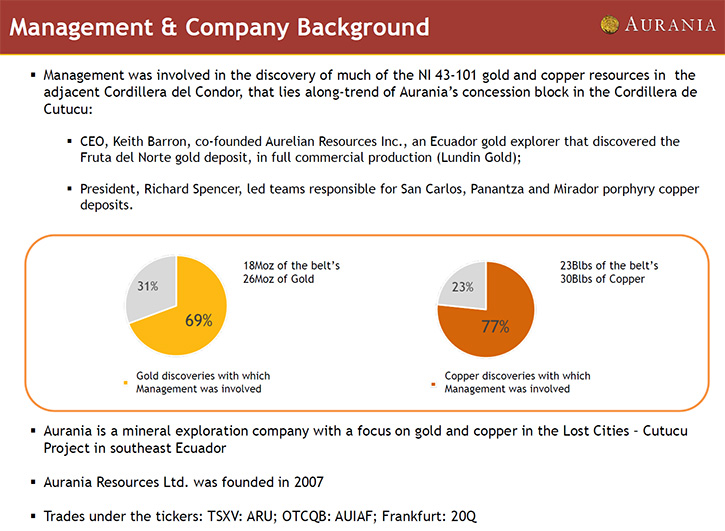

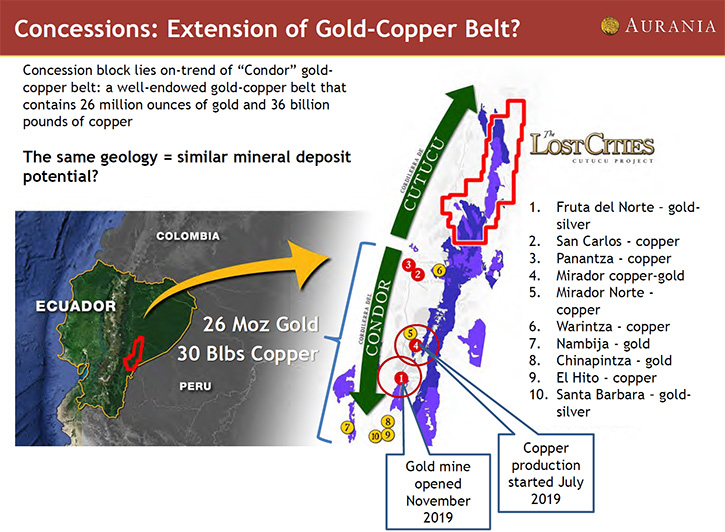

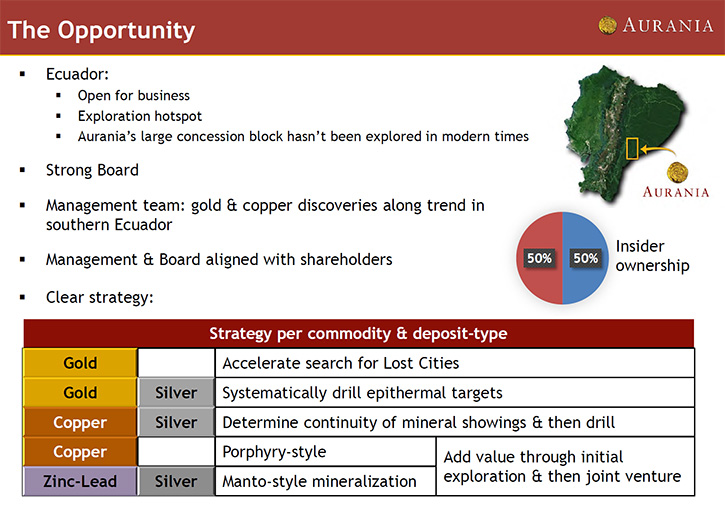

Aurania Resources Ltd. (TSXV: ARU, OTCQB: AUIAF, Frankfurt: 20Q) is a mineral exploration company engaged in the identification, evaluation, acquisition and exploration of mineral property interests, with a focus on precious metals and copper in South America. Its flagship asset, The Lost Cities – Cutucu Project, is located in the Jurassic Metallogenic Belt, in the eastern foothills of the Andes mountain range of southeastern Ecuador. We learned from Dr. Richard Spencer:, President and Director of Aurania Resources, that Aurania's Management, who owns 50% of the Company, was involved in the discovery of several, now producing, gold and copper mines, located along-trend of Aurania’s concession block. Near-term plans include exploration drilling, mapping, sampling, LiDAR interpretation, and heliborne geophysics programs, at four very strong gold, copper, and silver targets.

Aurania Resources Ltd.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Dr. Richard Spencer:, who is President and Director of Aurania Resources. Richard, I wonder if you could tell our readers/investors, about your strategy, your vision, and give us an overview of your Company and what differentiates your Company from others.

Dr. Richard Spencer: Thanks very much, Dr. Alper, and thanks for interviewing the Company. Aurania is a TSX V listed company, and it also trades in Frankfurt and on the OTCQB in the States. The Company was started as a gold exploration company, uniquely to find two gold mines or so-called lost cities that were mined by the Colonial Spanish back in the late 1500s. They were mined for about 40 years. Some maps from that time indicate, pretty precisely, where those two mines were located. Our CEO and Chairman, Dr. Keith Barron, applied for the concession area that covered those two locations. So, we've ended up with a land position of over half a million acres. The original premise was to find those two historic mining centers, which were recorded in old Spanish literature, in the Vatican, and elsewhere, as being very high-grade.

When we got into the area, which is jungle-covered and pretty tough terrain, we just started doing basic exploration the way any company would, using stream sediment sampling and some regional geophysics. We applied those exploration techniques because we knew that the spoil heaps from that old Colonial Spanish mining would have drained their gold into the streams and we would be able to find those locations through stream sediment sampling. But at the same time that we were doing that, we also analyzed for a whole bunch of other elements, including, gold and silver and pathfinders, which are elements that very often occur with gold, as well as copper. So, we've now have a really exciting portfolio of gold, silver and copper targets.

Then our field geologists – bearing in mind that this is an area that hasn't been explored before in modern times – were stumbling across copper-silver mineralization that was just sticking out of the jungle floor. After assembling a large amount of field data, we’ve started to understand the copper-silver mineralization much better over the last couple of months - we've started to understand what drives that copper-silver system fundamentally. And we’re now lining up those targets for scout drilling. On the gold exploration, we're still working at it really hard, but we haven't reached that “light bulb” moment, when everything comes together and simplifies into a clean concept. We're still very excited about the gold exploration potential of the concession block – and we know that “aha” moment will come – when all the details resolve into a simple concept.

One of the key things that we're looking for in our gold exploration, apart from the Spanish mines, is an epithermal deposit similar to Fruta del Norte, a rich gold-silver deposit that our Chairman and CEO’s exploration team discovered on geological trend, a hundred kilometers south of our concession area. That mine has been put into production commercially in November last year by Lundin Gold. And Lundin is doing a spectacular job of producing gold from it. They are producing very, very profitably at these gold prices.

What makes the Company unique is this concept of the historical leading us in there. But now that we're in that area, the experience that Keith Barron brings, in having made a major gold discovery, a long trend in exactly the same geological belt, carries a huge amount of weight. And a little bit before Keith, I worked in that adjacent area, and our teams were very successful in finding a string of copper porphyries. We found what has been fleshed out into about 24 billion pounds of copper there. So, both Keith and I, Keith on the gold side and myself on the copper side, have extensive experience in exploring the contiguous mineral belt.

I would say the third thing that's crucial about the Company is the share ownership structure. About 50 percent of the shares are owned by Management, the vast majority of that by Keith Barron himself. Management and the Board are absolutely aligned with the shareholders. I think those are three really positive attributes that set the Company apart from most other companies out there.

Dr. Allen Alper: Well, that sounds excellent. I understand you've identified four targets. I wonder if you could tell our readers/investors a little bit about each one and what your thoughts are.

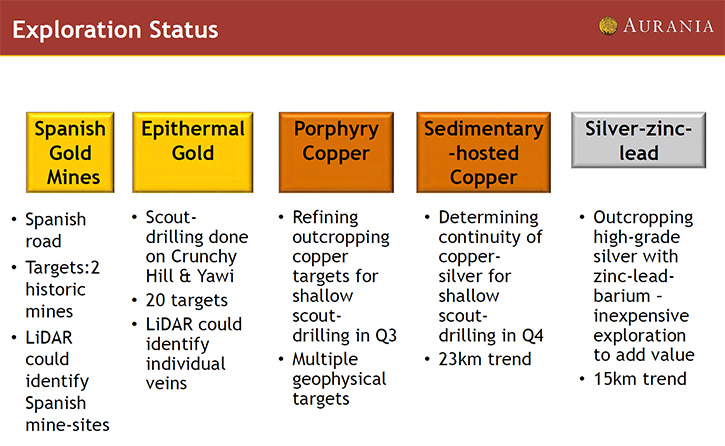

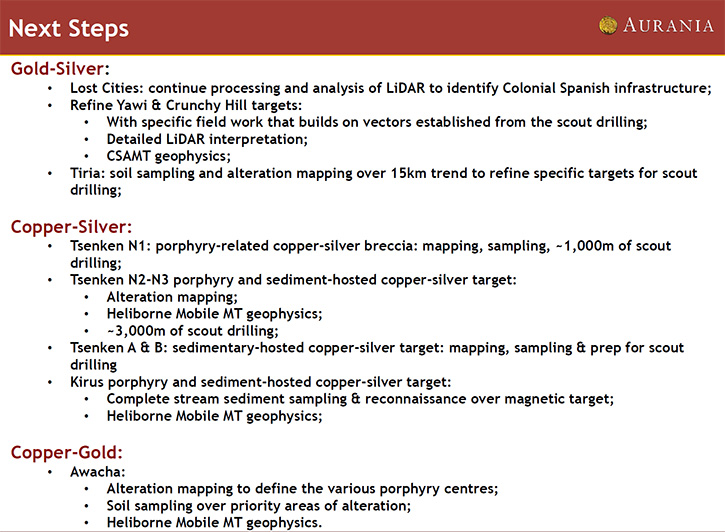

Dr. Richard Spencer: We have five silos of target areas at the moment. One is the historic gold and we're working on that as we speak. We're using a LiDAR, which is a way of seeing through the jungle to the jungle floor, digitally stripping away the vegetation so we can see the topography of the jungle floor. And that's an absolute game changer. It's helping us identify old Spanish historic infrastructure that we think will be another component that leads us to where those mines were.

In addition to that, we have the second silo, these epithermal gold-silver deposits like Fruta del Norte that our Chairman discovered in the adjacent belt. Then we have the porphyry copper, with which I have a lot of experience and my team has a lot of experience and we've made numerous discoveries.

The thing that was unexpected in the fourth silo was the sedimentary copper, which is exciting because it forms relatively simple flat sheets. The processing of this type of mineralization is relatively cheap when we get to that point and the mining is likely to be relatively cheap.

In addition to that, the fifth silo that we have is a 15-kilometer-long belt of a silver with zinc and lead in it. Also not something that we were particularly looking for, but there are big deposits of that type in adjacent Northern Peru. Our job is to create shareholder value. It doesn't really matter which commodity it's coming from.

But in terms of the four targets to which you were referring, we're starting a drill program. We call it scout drilling, where we drill just a handful of holes into each target. Bearing in mind that everything is jungle-covered, it's very difficult to see the geology as one does in Southern Peru or Northern Chile, where there's no vegetation. Here, it's a real battle to see through the vegetation. And so, we use these lightweight rigs to drill into the target and retrieve a “core’ of the underlying rock. That allows us to see whether a target is really true and valid.

The concept is that we keep that scout drill moving from one target to the next, and then if we're successful with a discovery, we would bring in a more heavyweight, more powerful rig to do more extensive exploration of that target. The targets that we have lined up, at the moment, are copper-silver and all within one area. We're very excited about starting that drill campaign in early September. The plan is to start drilling on one of the four targets, and keep drilling through the other four.

While we're defining those targets, our results are coming back from other areas and we're starting to see a fifth target and in fact a sixth target in that same area. Although we're planning to drill four at the moment, I expect that by the time we’ve drilled the first four targets, others will be lined up for drilling. So pretty exciting times! And you know, this is very high-grade copper and silver! So yeah, very close to really validating these targets through drilling.

Dr. Allen Alper: Well, it sounds like the remainder of 2020 and going into 2021 will be a very exciting time for Aurania for finding and discovering and exploring your properties.

Dr. Richard Spencer: Yeah, we have the wind at our backs, a little bit, on the copper-silver side of things. Exploration is like that; you do a lot of slogging and then suddenly everything starts to fit together. We're not quite there on the gold side yet, but we're working really hard on making that breakthrough. I think we're pretty close to the targets really jelling for us.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors a little bit more about your capital structure?

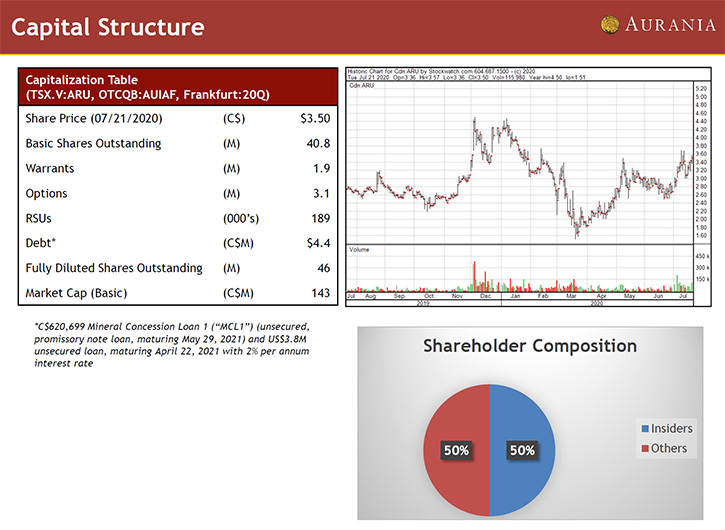

Dr. Richard Spencer: Yes. The capital structure is nice and tight. Round about 50 percent is held mainly by the Chairman and other members of the management team and the directors. So fully diluted, we're at just shy of 46 million shares. The basic shares outstanding are just under 41 million. The stock has been moving quite nicely, with many other stocks in the last couple of weeks. That's exciting because I think some of that share price strength is in anticipation of the upcoming drilling. The crucial thing is that we're not just drilling one target, we're drilling multiple targets. We're starting off with four. The Company has just over 4 million in debt. But that is held with a friendly party on friendly terms. We have a nice, neat and simple share structure. There are just under 2 million warrants. The warrants are priced at just over $4 and about 3 million options, variable pricing on them.

Dr. Allen Alper: Well, that sounds very good. Could you tell our readers/investors a little bit about how it is working in Ecuador, the environment, the government, and the support of mining, et cetera?

Dr. Richard Spencer: We are dealing, right at the moment, with a pretty dire COVID situation in the country in general. Where we're working, we have an incredibly strict back-to-work protocol. We've done a lot of testing; we've done just under 300 COVID tests, for not only our staff, but the people that we are working with in the various communities. So, first of all, although Ecuador is hard hit, we're working in a little bit of a bubble, where we so far are managing to control the situation. It gives us a great opportunity to work with the communities and to get to know the communities in a different sort of dimension.

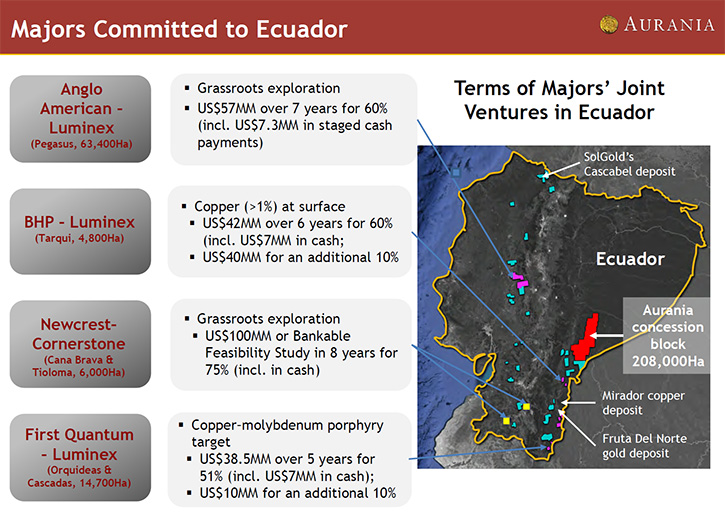

In terms of government policy, the Ecuadorian economy is based pretty much on oil, and then agriculture, bananas, shrimp, that sort of thing. Mining hasn't really contributed much in the recent past. The mining that there has been, has been pretty informal and not really pulling its weight in terms of contributing to tax revenue. But now that Fruta del Norte is fully in production, the government is starting to see real revenues from that mining operation. In Ecuador, a royalty, a 3 percent NSR, goes directly to the communities that are within the area of influence of the mining operations. So an area like Fruta del Norte is in a remote area, and not only have those communities benefited through direct work, but also, Lundin has done an incredibly good job in terms of training the local people up, providing microloans and that kind of thing, to get them to form service companies. And the local people are doing very well out of that and supporting the mine. But in addition to that, they get this NSR, which is well over a million dollars a month going to communities that were basically forgotten up to the time that the discovery was made.

So, for the first time in Ecuador's history, there is a huge benefit to the local communities, which are generally in pretty remote locations. I think the perception of mining in Ecuador is starting to change. Originally the picture of mining there was artisanal mining, that isn't known for its environmental care, to put it mildly. Now they're seeing a company like Lundin Gold putting Fruta del Norte into production in an absolutely impeccable way from a social point of view and an environmental point of view.

The other thing is that Ecuador has also seen the writing on the wall in terms of oil prices. The Vice President, who is a young individual, in his mid-thirties, has been very outspoken about the role that responsible mining needs to play. In terms of not only job growth, but revenue for the country as it weans its way off the oil production, which is obviously, not making much money at these prices. He recently resigned as Vice President so that he could participate fully in Ecuador’s upcoming election to be held early in 2021. He has thrown his weight behind a business-friendly candidate, as has one of the other main fiscally conservative candidates to form a stronger, more united, business-friendly block. So responsible mining is being seen as a real opportunity for the country going forward - provided it's done in a socially and environmentally responsible way. You see news out of Ecuador that is sometimes anti-mining by individual groups. But I think now that we have an example of what modern mining is, through Fruta del Norte, that perception is beginning to change with the people and certainly with the government. The government absolutely recognizes that mining can make a huge, positive impact on its revenues.

And, you know, as tragic as the COVID situation is, it puts the government in a more difficult situation in terms of growing the economy. They don't have a choice, but to find the industries that will generate revenue and jobs, which mining is certainly doing.

Dr. Allen Alper: Well, that sounds very good for the future of Aurania, in Ecuador and for the mining industry. Richard, could you tell our readers/investors the primary reasons they should consider investing in Aurania Resources?

Dr. Richard Spencer: Dr. Alper, I think the first thing is the share structure. There are not many companies where 50 percent of the shares are owned by insiders. That means that every one of us is aligned with the shareholders. Everyone in the Company, all the way down the scale, has share options. So everyone who's working in the field is incentivized for success. I think that's the first thing.

The second thing is that this copper and silver that we have stumbled across, and we only found it because we were the first ones to be exploring this area in several centuries, is an absolute gift. It wasn't what we were necessarily looking for. But, the Kupferschiefer in the eastern part of Germany and Poland is the prime example of this kind of silver and copper mineralization. And, you know, the Kupferschiefer has been mined for 2000 years. So I'm not saying that we found another Kupferschiefer, we don't know that yet at all. That's what our drilling is aimed at testing. But we have the potential to have something really significant by the tail here. And we're starting the drilling, which will help us define that in about a month's time.

The next thing we're looking for is the copper in porphyries, which is known from the region, and the gold-silver in the deposits like Fruta del Norte, which there's a reasonable chance of us having in our area. We have this amazing basket of targets that we're going to start drilling, starting in September.

Dr. Allen Alper: Well, that sounds excellent. Sounds like very compelling reasons for our readers/investors to consider investing in Aurania Resources. So that's really great. Is there anything else you'd like to add, Richard?

Dr. Richard Spencer: No, Dr. Alper, I think your questions were excellent and pretty much covered it. Thank you.

Dr. Allen Alper: You and your Company are doing an exceptionally excellent job. I think you have amazing potential there. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.aurania.com/

Dr. Richard Spencer:

President

Aurania Resources Ltd.

(416) 367-3200

richard.spencer@aurania.com

|

|