Dr. Allen Alper Interviews Dale Wallster, CEO, President & Director of Southern Empire Resources (TSX-V: SMP; Frankfurt 5RE)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/27/2020

The SMP Team, Including Ron Netolitzky, Have an Outstanding Track Record

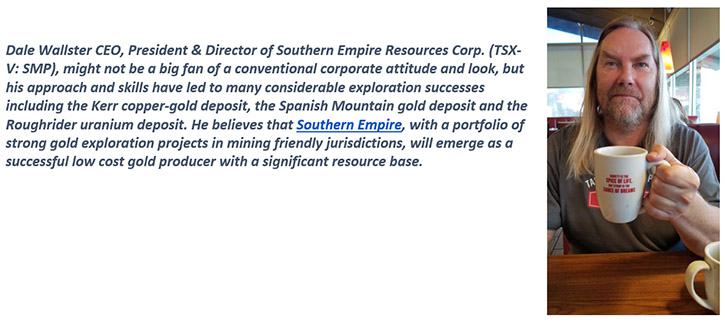

Metals News, spoke with Dale Wallster, CEO & Director of Southern Empire Resources Corp. (TSX-V: SMP; Frankfurt: 5RE), a prospector and geologist, with over 40 years’ experience in mineral deposit exploration and development. Dale and his Team, including Ron Netolitzky, 2015 Canadian Hall of Fame inductee, have a history of important mineral deposit discoveries and a strong track record of capital market achievements.

Southern Empire has two high-grade, oxide gold projects in the southwestern USA; Oro Cruz in California and Eastgate in Nevada. Both projects have strong historical results and planned drill programs.

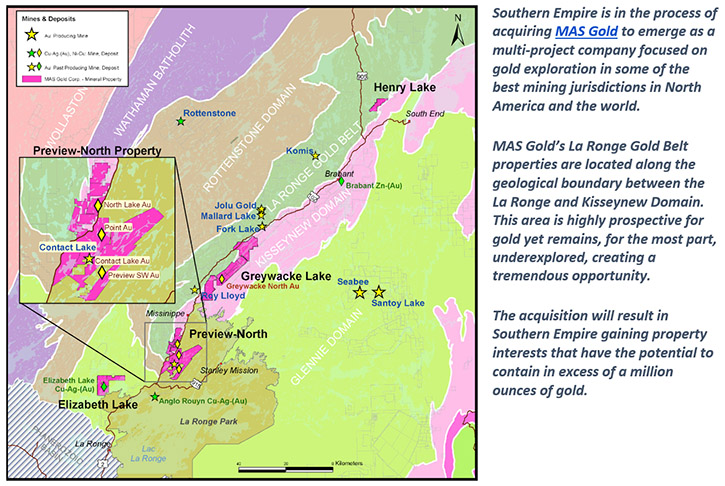

In addition, Southern Empire also just recently announced the acquisition of MAS Gold Corp. (TXS-V: MAS), a Canadian mineral exploration company, focused on developing gold exploration projects in Saskatchewan. MAS Gold’s road accessible projects are located along the La Ronge Greenstone Belt, approximately 60 kilometres (37 miles) west of SSR Mining Inc.’s Seabee operations and their producing Santoy gold mine.

Southern Empire is working hard to expand their gold resource base, make new discoveries and ultimately become a low-cost gold producer.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Dale Wallster CEO, President & Director of Southern Empire Resources Corp. Dale, could you tell our readers/investors about how Southern Empire Resources came about?

Dale Wallster: Our Chairman, Ron Netolitzky and I were extremely interested in gold exploration in the southwestern U.S. and we had mutual ownership interests in two projects in that part of the world. Ron and I, in our discussions, basically asked, "What should we do with these projects?"

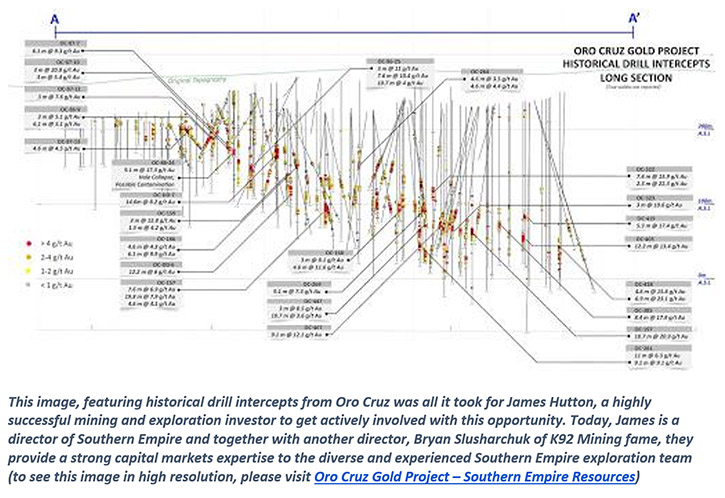

It just so happened that a short while later, in February or March of 2019, I was on the phone with James Hutton. James said that he'd put together a capital pool company, Owl Capital, and he wanted to do a gold deal because he thought that the gold markets were soon to be “heading north”. His partners in Owl Capital at the time wanted to do a pot deal or something else, but James was really convinced that the gold market was turning, and he was bang on.

So I said, "Well, James, we’ve got to get together and have a coffee, I have to show you a map of the Oro Cruz Gold Project.” And he said, "Yeah, come on over to my house."

James and I had done a number of things in the past. I first met him through the original Roughrider Uranium, which is a Company that I incorporated in January of 2003. Roughrider Uranium merged with Hathor Exploration in 2006 and our projects became Hathor's focus. My Team made the Roughrider uranium deposit discovery in the Athabasca Basin of northern Saskatchewan, and were ultimately taken over by Rio Tinto in 2012 for about $650 million, but that's another story.

I got together with James over at his house. I brought him a map showing high-grade drill intercepts of the Oro Cruz Gold Project in southeastern California. James took a look at the map, and he said, "Holy crap, those are great results. I want to do this deal."

So we came to an agreement and announced the Qualifying Transaction for Owl Capital in April of 2019. Owl Capital was halted, which is standard Exchange practice while the transaction closed, and the deal took much longer to complete than we anticipated as there was a lot of regulatory red tape to overcome. We'd originally thought that we'd be up and trading in September of 2019, but we didn’t get conditional approval from the Exchange until late November, just in time to start raising money around Christmas time - good luck with that!

We started raising money in January and were getting good traction through the PDAC and then all of a sudden, COVID hit and the markets fell apart. Despite that, we still managed to close an oversubscribed, qualifying transaction private placement of a little over $3 million in mid-March, 2020; just as the markets were starting to crater. With Bryan Slusharchuk leading the charge, we got it done, and we started trading.

Then in June we did another successful, oversubscribed private placement of just over $4 million.

Dr. Allen Alper: Congratulations on being able to raise money and close the deal under such trying conditions. Could you please explain to our readers/investors what sets you apart from other similar companies?

Dale Wallster: There are a number of things, but first and foremost are the people associated with Southern Empire. We have put together a great Team.

On the technical side of the equation, our chairman, Ron Netolitzky is very well known in our industry having had many exploration and development successes. Ron was very deservingly inducted into the Canadian Mining Hall of Fame in 2015.

Then we have Jim Currie, a professional engineer, and the former COO of Ross Beaty's Equinox Gold where he oversaw other projects in southeastern California; including the Mesquite mine operations and the Castle Mountain mine development, both currently operated by Equinox Gold. Jim's also the former COO of New Gold and Pretivm. Regarding the Mesquite mine, he has actually been involved twice, once when New Gold owned it, and then again when Equinox bought it and took over those operations.

We have exceptional capital markets experience on our Team as well, represented by Bryan Slusharchuk and James Hutton, who I mentioned earlier.

Bryan Slusharchuk, the Founder and former President of K92 and now heading up Fosterville South (TSX-V: FSX), is a capital markets powerhouse and goes non-stop. For many years James Hutton ran the largest flow-through funds in Canada and raised billions of dollars in the flow-through industry. His Company was ultimately bought out by Dundee. I'm sure, Allen, that you are aware of the benefits of flow-through funding, but in case your readers/investors wonder, it is a very unique and popular tax advantaged way of raising money for exploration at home, here in Canada.

Dr. Allen Alper: How about yourself Dale? What is your background as the CEO of Southern Empire?

Dale Wallster: I've been involved in the junior mining business since, it seems like forever now. I was working for ASARCO, a large American mining company that decided to shut down offices worldwide in about 1980. As a result, I became involved in the junior mining business in Vancouver, as a consultant and contract geologist. I quickly decided that I'd rather be working for myself and doing my own projects rather than just working on projects for others.

My first direct foray into the public markets was with a company called Sulphurets Gold Corporation that I incorporated in 1986. I have my name on the claim posts of the Kerr deposit that we discovered up in the Golden Triangle. I was in the Golden Triangle before our Chairman, Ron Netolitzky gave it that name back in the late 80s. The Kerr deposit, now owned by Seabridge Gold, hosts reserves and resources in excess of 2.6 million ounces of gold and 3.4 billion pounds of copper. I've been focused on property acquisitions, exploration and development, and junior resource companies since then.

Dr. Allen Alper: It's a very impressive group that has all come together, a group that should give investors great confidence.

Dale Wallster: Yes, we are very fortunate to have been able to put together such a strong Team. However, I really must state that it is not only the Directors of Southern Empire that are an integral part of our Company, but our Management and consulting group too. I have to give kudos to Lubica Keighery, who is in charge of our market outreach and whatever else needs to be done around the office, Andrew Davidson, our CFO, and Dave Tupper, our VP of Exploration. Tupper has worked with Ron for many years, so there is a lot of synergy and a lot of shared experience we can build upon.

Dr. Allen Alper: The spring of 2020 brought an unexpected situation of lockdowns and other pandemic related complications. How has that affected your business and working plans?

Dale Wallster: We are very fortunate to also have very competent and trusted consultants that are located in Reno, Nevada and Tucson, Arizona. As such, we can still advance our American projects but don’t need to worry about crossing the border during these COVID times.

Molly Hunsaker, a geologist who is working almost exclusively on projects related to our group, is one of our key people down in the States. She is joined by Tarryn-Kim Cawood, a very bright PhD candidate at the University of Southern California. Part of Tarryn’s thesis is concerned with our Oro Cruz gold deposit. She's looking at the structural controls and the timing of gold-mineralizing events and how this all fits into the regional structural/orogenic picture.

Molly and Tarryn have done some terrific work to date, and will be integral to our ongoing exploration and development at Oro Cruz.

Del Fortner is another key member of our team. Being a former Deputy State Director of the U.S. Bureau of Land Management for Nevada, Del is coordinating our permitting efforts and environmental studies working together with some of the other very respected consultants that we have engaged, including Stantec, WestLand Resources and AMS - American Mine Services.

Dr. Allen Alper: Would you consider Oro Cruz your key project at the moment?

Dale Wallster: Yes, as Southern Empire sits today, Oro Cruz is our cornerstone property.

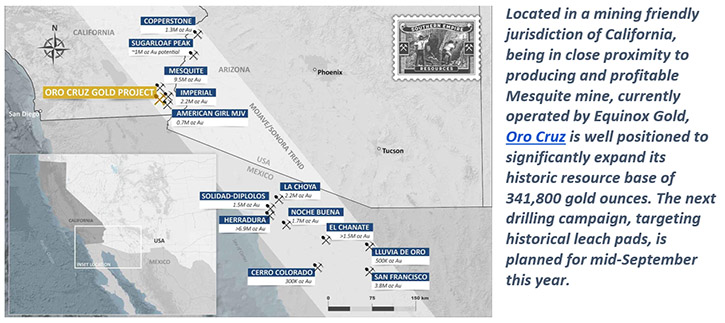

Oro Cruz is within the Cargo Muchacho Mountains of Imperial County, southeast California and is thought to have been the site of the first gold mine in the United States.

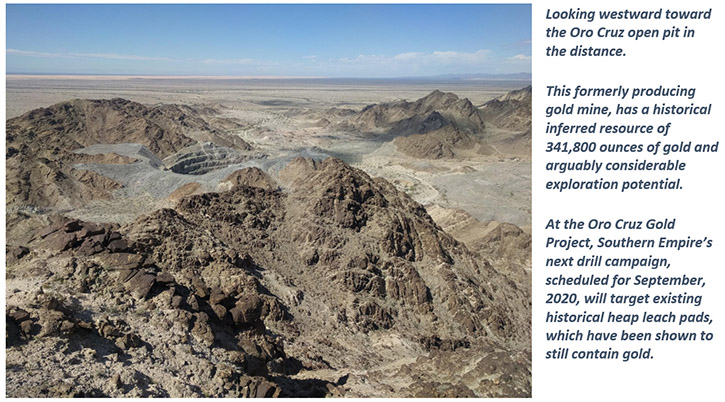

It was mined by the Spaniards, then again at the turn of the 20th Century and briefly again during 1995-96. As part of the last round of work there, nearly 500 historical holes were drilled at Oro Cruz and as a result, Oro Cruz has a heap leach amenable, historical inferred resource estimate of 341,800 ounces of gold – based on 4,386,000 tonnes at an average grade of 2.2 grams gold per tonne. That is a very good starting point for Southern Empire and we believe that the potential for a million plus ounces gold is there.

Some of the gold grades in those historical drill holes were truly exceptional; the reason James Hutton was so keen on doing the Owl Capital transaction.

Dr. Allen Alper: How about the Eastgate Gold Project in Nevada?

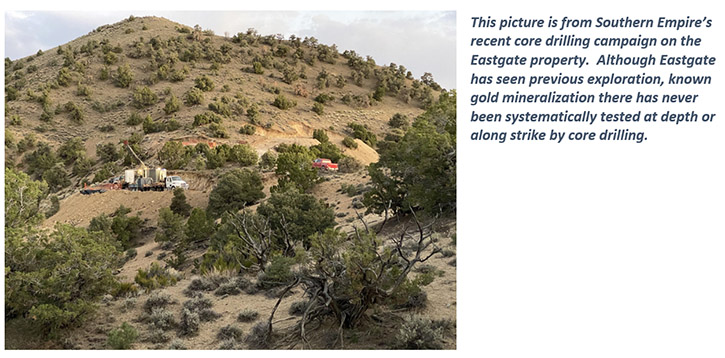

Dale Wallster: The Eastgate Gold Project in Nevada was the original reason that Ron and I got together to compare notes and say, "How are we going to move this project forward?"

Eastgate is a very interesting project that was looked at quite some time ago, in the early nineties, for its bulk tonnage potential. We, however, are now looking at the opportunity presented by a low-sulphidation, epithermal vein type system.

At Eastgate, one sees much higher grades than what is common with the majority of bulk tonnage Nevada gold projects, but these higher grades are hosted by narrow vein systems. Should our drilling pan out, we see an underground high-grade model for this property, However, having said that, if the right configuration of veins is there, and the topography and other conditions are favourable, perhaps an open pit scenario can come into play. It’s too early to know.

Dr. Allen Alper:Southern Empire has recently announced an agreement to acquire MAS Gold Corp., a company with properties in Saskatchewan, Canada. What is the reasoning behind this acquisition?

Dale Wallster:Southern Empire has a common management team with Ron, Dave, Andrew and Lubica, who are all part of MAS Gold. It came to the point when it just made perfect sense to move forward with this acquisition; a combination of adding ounces and saving costs.

MAS Gold is a great opportunity to add gold ounces to our current portfolio; ounces in one of the world’s top mining jurisdictions. We arguably know the MAS Gold assets and understand their potential better than anybody else out there. We felt that MAS Gold was really undervalued so we struck a deal that we considered to be reasonable, fair and at good value for both sides. When the acquisition is completed, we'll have a presence in Nevada, we'll have a presence in California and we'll have a presence in Saskatchewan.

Both Ron and I have also had considerable success in Saskatchewan. With Roughrider/Hathor I had a wonderful success in the uranium space in Saskatchewan. As well, for me, it's kind of like going home, as I'm originally from that province. I'm really happy to be looking at the gold potential of the La Ronge Gold Belt and the potential for gold elsewhere in Saskatchewan, especially as that Canadian province is continually ranked as one of the best mining jurisdictions in the world.

Dr. Allen Alper: Saskatchewan is not generally known for gold exploration. What are you hoping to accomplish there?

Dale Wallster: You are correct. Most people associate Saskatchewan with uranium or potash, not with gold. I think that perception will change with the application of new geological knowledge, theories and models, sophisticated modern exploration technologies, together with significant new money injected into gold exploration in the province.

It was only during 2012 that Claude Resources became the first primary gold miner to produce more than a million ounces in Saskatchewan. SSR Mining, following their takeover of Claude, have had continued success, with their Seabee and Santoy gold mines that are located approximately 60 kilometers from the MAS Gold properties.

Through the next few years, I believe Saskatchewan’s gold potential will be more widely recognized and new discoveries will allow the province to emerge as a significant future gold producer.

Dr. Allen Alper: How exactly can MAS Gold enhance the Southern Empire portfolio once the acquisition is completed?

Dale Wallster: MAS Gold has properties in Saskatchewan’s very gold-endowed, yet still very underexplored, La Ronge Gold Belt. In this belt, MAS Gold operates two primary projects; Greywacke and Preview-North.

The starting point for further exploration and development of MAS Gold’s properties is incredible. The Greywacke North deposit already has 255,500 tonnes defined at 9.92 grams gold per tonne with a cut-off grade of 5 g Au/t, plus an additional Inferred Mineral Resource of 59,130 tonnes at 7.42 g Au/t. Details are outlined in MAS Gold’s NI 43-101 Technical Report of June 1, 2016.

The Preview-North property covers the North Lake and Point advanced gold projects, each having drill-intercepted zones of gold mineralization. The North Lake deposit is estimated to contain an Inferred Mineral Resource of 14,110,000 tonnes grading 0.92 g Au/t, hence 417,000 contained ounces of gold.

Plus, there is a lot of very exciting exploration potential on MAS Gold’s other two properties in the portfolio, Henry Lake and Elizabeth Lake. MAS has control over 45,660 hectares of highly prospective ground.

We are very excited about the MAS Gold acquisition.

Dr. Allen Alper: That sounds excellent. Great and safe locations, and they're all places that sound like there's loads of potential for gold exploration.

Dale Wallster: Yes, we see great potential in our gold projects.

Dr. Allen Alper: Could you tell our readers/investors a little bit about your capital structure?

Dale Wallster:Southern Empire trades on the TSX Venture Exchange and on the Frankfurt Bourse. The trading symbols are SMP and 5RE respectively. Our company currently has 50,906,800 issued and outstanding common shares. The fully-diluted share capital is 55,156,800. At this moment, there are no warrants issued. So our share capital structure is quite tight and our market capitalization is around CAD $37 - $38 million.

Following the MAS Gold transaction, we'll have an issued and outstanding share capitalization of about 56.7 million shares; fully-diluted about 63.1 million shares.

Dr. Allen Alper: It all sounds very good. To summarize, could you tell our readers/investors the primary reasons they should consider investing in Southern Empire?

Dale Wallster: Well, I'm going straight to number one; the people that are involved in our Company, on all levels, as discussed earlier, have lots of experience and strengths in different, complementary areas, making our team exceptional.

Number two; we're well-financed. We've raised about $7 million since we went public in March and we have a very strong capability for raising money in the future.

Three; our properties are in several of the best mining friendly and law respecting jurisdictions in the world. We're in Nevada and Imperial County, California at the moment, and once we finalize the MAS Gold acquisition, we will be well-positioned in Saskatchewan, Canada with a dominant land package in the highly prospective La Ronge Gold Belt.

The fourth reason is that we have strong open-ended exploration projects with great starting points. Our cornerstone property, the Oro Cruz Gold Project, has a historical NI 43- 101 inferred resource of about 340,000 ounces already defined. It has great upside exploration potential especially with regard to the high-grade zones known within that property.

The fifth reason is infrastructure. The MAS Gold properties are effectively accessible by provincial highway and can be worked year-round.

Oro Cruz, in southeastern California, is a past producer, which produced 60 some odd thousand ounces between 1995 and 1996. It shut down in '96, because gold prices came off. The project at that time was operated by the American Girl Mining Joint Venture, owned by MK Gold Company, an American-listed offshoot of Morrison Knudsen Corporation, and Hecla Mining. As the gold price fell, they made a decision to shut down those operations after having produced around 600,000 ounces of gold at their American Girl, Padre y Madre and Oro Cruz operations.

Oro Cruz is about 15 miles from the city of Yuma, Arizona and, as such, has a local workforce and nearby power and road access. The existing underground development there totals about two and a half kilometers and it is in excellent condition; that represents a huge money save to us as we move forward.

We firmly believe that Oro Cruz has exploration potential for more than a million ounces. We'll explore the property using modern geological theory and high tech methods of exploration, and see what we can do.

In addition, a sweetener at Oro Cruz is that there are existing heap leach pads from the historical American Girl Mining Joint Venture operations. We've just recently taken some surface grab samples from those leach pads and the results were very encouraging. The samples averaged greater than half a gram gold.

And as you know, in that part of the world, for instance over at Equinox’s Mesquite operations, their cut-off grades are substantially less than half a gram. Despite that, Mesquite produces between 115 - 130,000 ounces of gold annually. They have profitable operations even with those low grades.

So, at Oro Cruz, we're going to go in and look at the existing heap leach pads and do some sonic drilling there to see whether or not we can establish a resource for those. If successful, this would be the “cherry on top” for us.

Dr. Allen Alper: Well, that sounds excellent. Is there anything else you'd like to add, Dale?

Dale Wallster: We also own about a 5% equity interest in Bullfrog Gold Corp. that has claims located near Beatty, Nevada, about 120 miles from Las Vegas. Their Bullfrog Gold project covers some of the open pit and underground operations from which Barrick Gold Corp. produced about 2.1 million ounces of gold in the 1990’s.

In summary, if everything goes as planned, Southern Empire will be very busy throughout the year on all of our properties. Since starting to trade in March, as investors have become aware of what we are doing, they seem to be responding well to our story. We will certainly do our best, to win their hearts and minds in this exciting world of junior mining.

Dr. Allen Alper: Well, those all sound like excellent reasons for our readers/investors to consider investing in Southern Empire Resources Corp.

For further information visit our website at:

https://smp.gold/

or our SEDAR filing page;

or contact: Lubica Keighery

e-mail:lubica@smp.gold

phone: +1 (778) 889-5476

|

|