Nomad Royalty (TSX: NSR): New Company, Founded by an Experienced Successful Team, Excellent Globally Diversified Precious Metals Portfolio; Vincent Metcalfe, Founder and CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/23/2020

Vincent Metcalfe, Founder and Chief Executive Officer and Director of Nomad Royalty (TSX: NSR), has a new TSX listed royalty company, and his team has experience buying streams and portfolios. Nomad has 10 assets. Five of them are in production. Nomad’s globally diversified portfolio is 100% precious metals. 77% of the value is in gold and 23% is in silver. Nomad believes that it is a benefit to have various assets in different jurisdictions. Their goal is to limit volatility, by having multiple assets and to limit exposure to development and operational costs, by having multiple assets in production. Nomad is a new company with a fresh team that is energized and motivated to give younger investors a strong alternative to Bit Coin and marijuana stocks. With gold prices and stock prices soaring, investors should give Nomad Royalty serious consideration.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Vincent Metcalfe, who is Founder, Chief Executive Officer and Director of Nomad Royalty. Could you give our readers/investors, an overview of your Company and also what differentiates it from others and the vision for your Company?

Vincent Metcalfe: Absolutely. It's a very new Company. We've only been trading now for just over two months. We started trading on May 29th. We announced the creation of Nomad Royalty on February 26th, pre-pandemic and pre-financial crisis. So, a very, very interesting three months as we were trying to close the transaction. Obviously, we're pretty happy we got it done, because on the back of it, we're now enjoying much higher precious metal prices. From our perspective, we couldn't have asked for better timing on that front. The team, myself, Joseph and Elif have spent the last five, six years together, previously with another royalty company in the sector. We have all the experience of having built a royalty company in the past, having been with Osisko since inception in 2014.

Between Joseph, Elif and myself, we've bought royalties, we've bought streams, and we’ve bought portfolios for about five, six years. We have a lot of experience in the sector. We know all the players, we know most of the vendors, so it's going to be a very, very transaction-focused Company. We've created the Company with Orion and with Yamana Gold. We started the Company by acquiring two different portfolios and created about a $400 million U.S. Company at the start. We've also raised a bit of money concurrently, with that first announcement. And now, today we sit at around just under $800 million of market cap Canadian, and we have five cash flowing assets. We did our first acquisition post initiation of trading. A couple of weeks ago we bought 1% of Troilus Gold and we are obviously pretty happy on that front.

It's a new Company with a very fresh management team, from our vision's point of view, we want to be as diversified as possible. We want to be in multiple jurisdictions. We believe that that's actually a benefit for a royalty company, to have various assets in various different jurisdictions. We are more of an asset manager than an operator, given that we're in the royalty sector. From that perspective, our job is to limit volatility to one asset and to limit exposure to development and operational costs. That's why we want to be as diversified as possible. And we strongly believe that that will give us a higher valuation than some of our other peers.

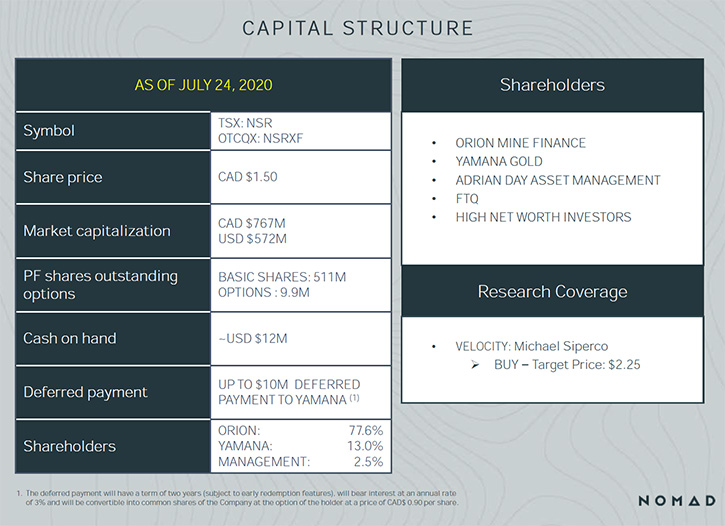

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors a little bit about your capital structure?

Vincent Metcalfe: Yes, absolutely. Right now, we have about 520 million shares. How the company came to be is, Joseph and I had taken control of shell, which we ended up using to vend in the Yamana and Orion portfolios. Both companies ended up taking significant share positions in our Company. Today, Orion owns about 77 percent of the shares, Yamana owns 13 percent of the shares. It's pretty tight ownership from the top. The rest of us, Management owns about 2 to 3 percent of the shares. About 7 percent is fully trading. So very tight float. But from that perspective, from Orion and Yamana's point of view, they're fully aligned with our mandate to grow the business through future acquisitions and using our paper to grow the business.

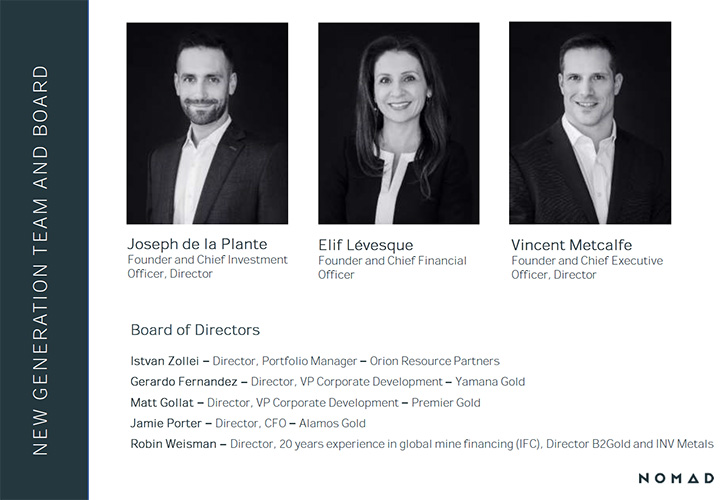

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors a little bit more about your team, your background, and the Management and the Board?

Vincent Metcalfe: Yeah. Joseph and I are both mid -thirties. We've been in the sector for 15 years. We actually both started as investment bankers together and Bank of Montreal. He ended up joining Osisko Group in 2009. I spent a bit more time on the investment banking front, but we started working together at Osisko in 2014. Elif, from her perspective, she's our CFO now and also a respected Founder of Nomad. She started her career with Cambior, and then I spent a bit of time with IAMGOLD, when they merged, and then went over to Osisko Mining, when they built Canadian Malartic as well. We have basically a good set of experience in the sense that we understand the capital markets, and we understand the corporate world. I think that's what gives us the advantage of understanding how to talk to shareholders, how to talk to investors. Because we understand what it takes to bridge that gap in terms of operationally, but also financially to make sure we deliver returns to our shareholders.

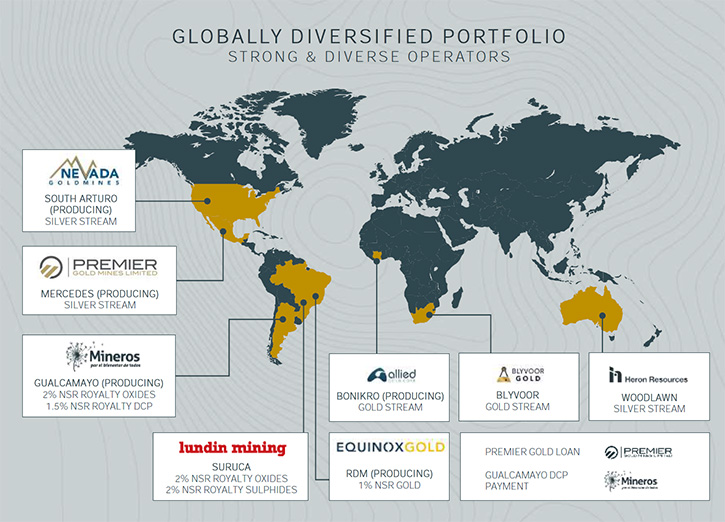

Dr. Allen Alper: Sounds great. Great group. Great experience. Great backing. Could you tell our readers/investors a little bit more about your portfolio, your globally diversified portfolio?

Vincent Metcalfe: Right now, we have about 10 assets. Five of them are in production already. We have a producing stream on South Arturo, which is a JV, between Premier Gold Miles and Nevada Gold Mines. We have a stream on the Mercedes gold mine, owned by Premier, so we get 100 percent of the silver stream there. We also have a producing royalty on Equinox's gold RDM mine in Brazil. Another one that's producing is Gualcamayo in Argentina, which was formerly owned by Yamana, and that's how they got the royalty, which was sold to us. And we also have a royalty in Ivory Coast on the Bonikro mine, which is a gold stream, currently being operated by Allied Gold Mines. So those are the producing assets.

We also have a different type of asset, a gold loan with Premier, whereby Premier will be delivering us a thousand ounces of gold on a quarterly basis for the next three years. 12 payments of a thousand ounces on a quarterly basis. It is a very nice way to have stable cashflow, starting in business, it's always good to have cashflow to look at different assets. So very happy with that asset as well!

In terms of the assets, which are currently in construction, we have an asset, which is called Blyvoor Gold, in South Africa. It's now nearing completion of the mine. They have done a tremendous job, basically rebuilding a whole plant, and now they are underground, preparing for the initial phases of mining. That asset still has about 26 million ounces of resources. It's an asset that was in production for 50 years in the past. So really looking forward to having Blyvoor up and running again.

Another one that's in construction is called Woodlawn mine. It's in Australia. It's a polymetallic mine. We have a silver stream on that. That mine was actually in production earlier in the year. Due to the COVID and pandemic situation, they put the mine in care and maintenance. We are awaiting a plan to see the mine go back to production, but a brand new mine, brand new mill, which they built. It was a past producing mine, but in terms of the mill and the operation, those are all brand new. It should be a nice asset for us in the future. We are looking forward to seeing that one go back online.

The last one we have is a royalty that we have on Lundin Mining, which is located in Brazil, the Suruca deposit, which is a satellite deposit right next to Chapada. We have a 2 percent on the oxide on that deposit and then another 2 percent on the sulfides. So that one is more on the development front. We don't necessarily forecast seeing that one in production, but it will be a very interesting asset to follow, given it's so close to Chapada.

The true last one, which we just acquired, is a 1 percent on the Troilus gold mine, located just north of Chibougamau in Quebec. We were obviously very happy to have the chance to acquire that asset. The Company is based in Montreal, Quebec, so we look forward to seeing that mine developed. It's a mine that was previously operated by Inmet, in the past, until 2010, and then recently Troilus bought the asset and they've started re-looking at the reserves and resources. Last Monday, they did increase their resources, just over 8 million ounces contained. We're very happy. We have a 1 percent on the main claims and they have a new discovery called Southwest, which has a lot of upside potential and they had limited drilling into that area already. We saw about just under 600,000 ounces of gold being discovered already.

It's a fully diversified portfolio. We're basically in every continent, and that's exactly the way we wanted to build this Company. But most importantly, we wanted to build it very diversified, but also very focused on cashflow. So today the portfolio has about 50 percent of the assets from an NPD point of view in production. Definitely, that will always be a focus for us.

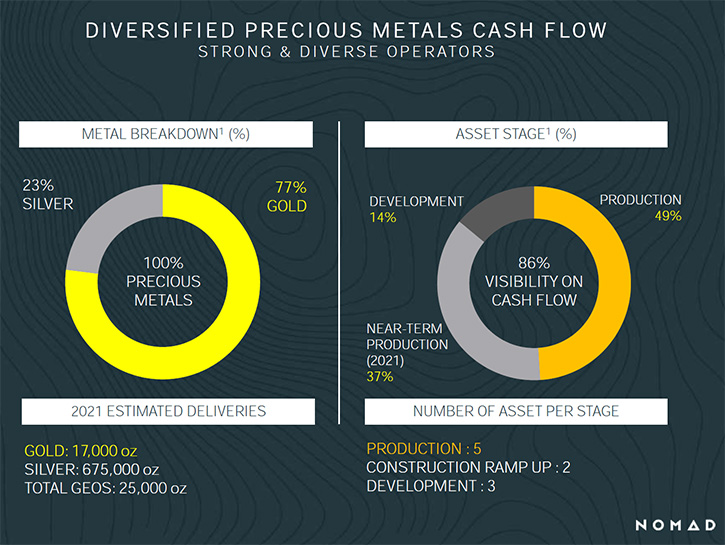

Dr. Allen Alper: That sounds excellent. That's really amazing, what your group has done in such a short time! That's really outstanding. Could you tell our readers/investors a little bit about the diversified precious metals cashflow, with gold and silver?

Vincent Metcalfe: The portfolio is 100 percent precious metals. That was very important for us, when we were looking at the assets we wanted to include. We had access to certain assets, which were probably more base metal or more bulks, and we actually stayed away from there. So today we are 100 percent precious metals. 77 percent of the value is in gold and 23 percent is in silver. That was done as of the start of trading. Now we've seen silver obviously shoot up in terms of price. The important thing is that we're 100 percent precious metals, with a strong focus on gold. But we like silver a lot as well.

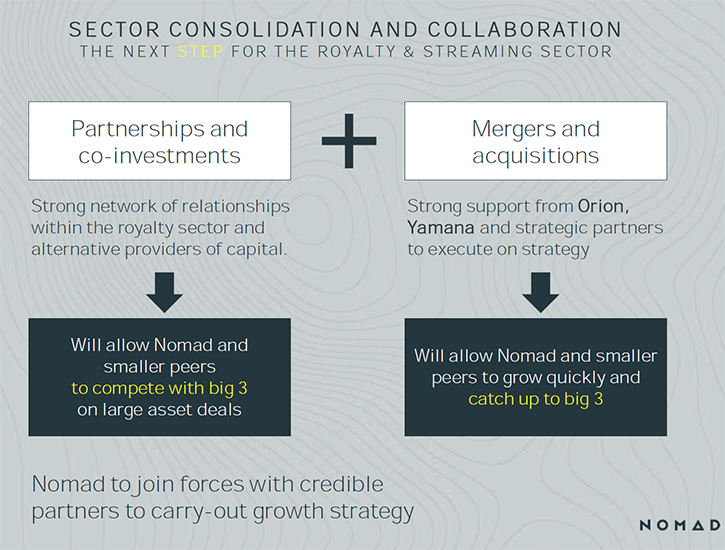

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors a little bit about the opportunity you have with consolidation and collaboration, going on right now in the mining sector?

Vincent Metcalfe: Absolutely. There are two different types of M&A. There's M&A in terms of consolidation in the royalty sector, which we want to be part of and we perhaps want to be a catalyst for that. But there's also the M&A within the gold sector or the base metal sector in general, where it might create opportunities for us to buy royalties or buy streams on assets in order to fund future expansions and so on, especially in the current environment, it's actually quite strong. But coming back to the royalty sector, there're clearly three big players in Franco, Wheaton, and Royal. With all the rest of the other players, starting with Maverix and Osisko and smaller players showing up to the race, Elemental, Vox, Trident, and so on.

I think going forward, there's definitely going to be a lot of opportunity to consolidate, because in terms of how the world trades and how the investors look at assets now, liquidity is very important, and size is also very important. From our perspective, we want to keep growing this business. Our ultimate plan, within the next 24 to 36 months is to be a 2 to 3-billion-dollar Company as quickly as possible, and perhaps even a 5-billion-dollar Company down the road. Because we strongly believe that that's going to be the way for us to get interest from the big generalist funds in Europe and in America, because they're looking for increased liquidity, they're looking for increased size and we will give them that. We have a plan; we're going to keep delivering on that plan. We're pretty happy to have been in the sector now for six years. We know what works; we know what the investors want. From that perspective, we're definitely going to be part of that consolidation sector.

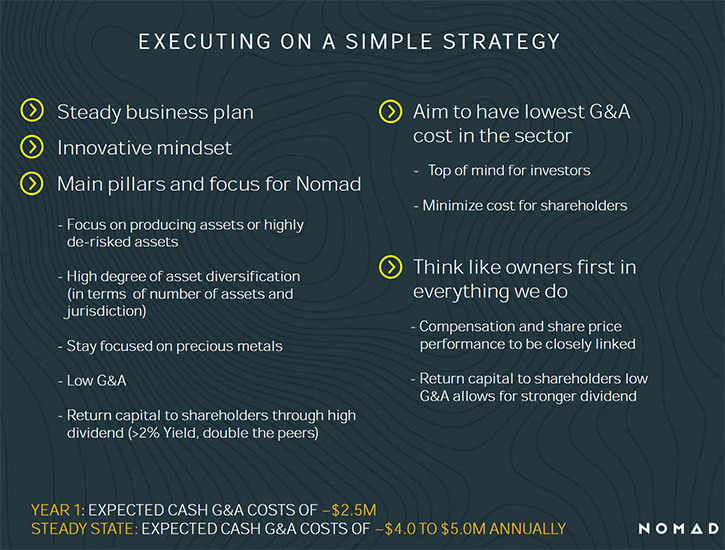

Dr. Allen Alper: Well, that sounds excellent. Could you explain to our readers/investors how you are executing your simple strategy?

Vincent Metcalfe: Absolutely! In the last two months and before that, since we've announced the creation of Nomad, we've announced Elif as our third Founder and she joined and CFO, we completed a $13 million financing in probably the worst possible time in the last 10 years, given the financial nature and the markets we were in, in March and April. We graduated the Company from the Venture to the TSX. Just closing the transaction was something that was not easy, given it was probably one of the largest IPOs on the stock market in a long time. Given also that it was a three way transaction between three different parties.

We have recently announced that we've listed on the OTCQX on the U.S. front. We announced the increase in financial capacity in terms that we got three banks to lend us up to $75 million U.S., through a revolving credit facility. We're in the midst of closing that shortly. And we've also announced our first acquisition since the beginning of trading for 1 percent and it's our royalty on Troilus. It's been a very, very busy two to six months.

And now we have in front of us more acquisitions. We're looking to put a dividend policy in place very shortly. We want to keep increasing market awareness, keep increasing trading liquidity. We actually got our first research coverage from Velocity Trade Capital and Michael Czetyrbok. We're definitely executing. We had a very aggressive list of things that we wanted to do and we're getting to the end of the list. We'll have to reload on things to do, but in the current environment, I don't think we'll be looking very long for things to do.

Dr. Allen Alper: Well, that sounds excellent. Could you highlight the primary reasons our readers/investors should consider investing in Nomad?

Vincent Metcalfe: Absolutely. We have a very, very steady business plan. We're looking for royalties that are near that cash loan stage. Our vision is to have the lowest GNA in the sector. We're all significant shareholders of the Company. We're actually not taking a cash salary for the first 12 months of operation. We're taking shares instead, because we want to be as aligned as possible, with our shareholders and we want those investors coming in with us for the ride. We strongly believe that there needs to be more alignment of management with shareholders. That's very, very important for us. We're going to stay focused on precious metals. We're going to be putting a dividend policy in place and we want to be leading with that dividend policy. We want to have that very, very strong yield. We want to return capital.

We want to think like owners first, in everything we do. That's really the important thing. We're going to be very aggressive, in terms of acquisitions and transactions. But does it make a difference to the bottom line? And does it make a difference to the share price and to the investors? Those are things that need to be thought of, prior to doing deals. And that's definitely something that we're going to be focused on for the investors.

Dr. Allen Alper: Well, that sounds excellent. Sounds like a great opportunity for our readers/investors.

Vincent Metcalfe: I would think so.

Dr. Allen Alper: Vincent, you've done an amazing job. I'm really impressed. You know, I interview 200 companies a year and I must say, you are outstanding, what you and your group have done.

Vincent Metcalfe: Well, thank you. I appreciate it.

Dr. Allen Alper: Is there anything else you'd like to add, Vincent?

Vincent Metcalfe: I would say that this is what the mining sector needs. We need new young teams. You've been in the business long enough to have seen a lot of companies come and go, and some of the management teams have been around for quite a long time. We strongly believe that we need new blood in this business. And we hope to start a movement on that front. We've seen a lot of our colleagues and friends, start that, with the Integra Group and Steve de Jong, a good friend of mine. We've seen a lot of younger management teams take the helm of certain companies.

We want to make sure the investors recognize that. Some people have liked to focus on Bitcoin and pot stocks. But, there are a lot of really exciting opportunities to come out of the mining sector. I think more investors are starting to focus on what we do. And we want to be one of those management teams that helps investors come back to the mining sector and even those younger generations that are starting to look at our sector again.

Dr. Allen Alper: Well, that sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://nomadroyalty.com/

Vincent Metcalfe, CEO

vmetcalfe@nomadroyalty.com

|

|