QMX Gold Corp. (TSX: V: QMX): Successfully Exploring, Extensive Property Position in Val d’Or Mining Camp, Abitibi District of Quebec, Brad Humphrey, President & CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/23/2020

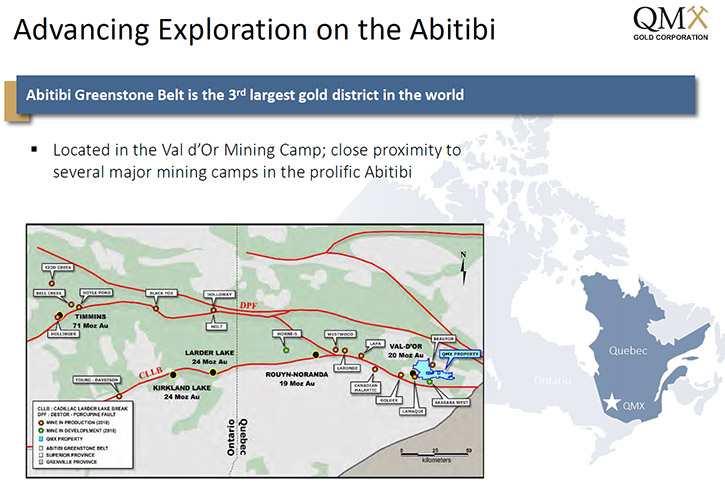

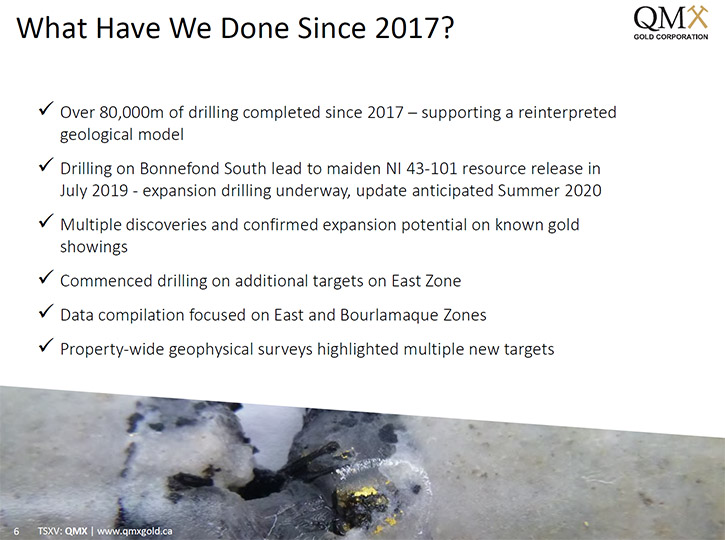

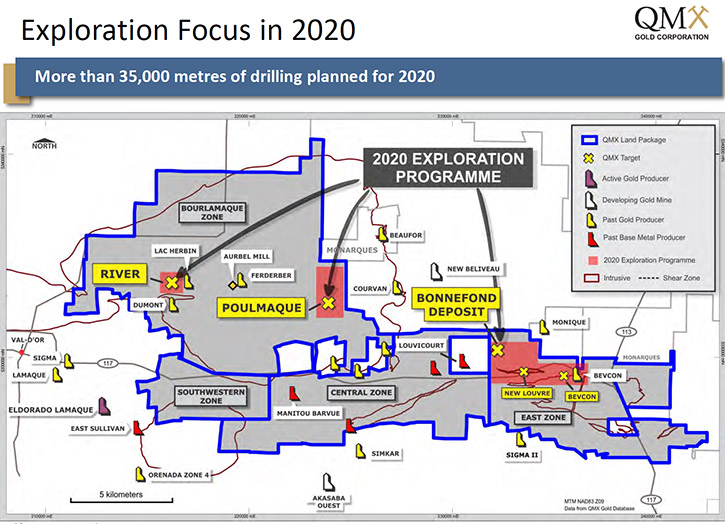

QMX Gold Corporation (TSX:V:QMX) is systematically exploring its extensive property position in the Val d’Or Mining Camp in the Abitibi District of Quebec. QMX Gold is currently drilling in the Val d’Or East portion of its land package, focused on the Bonnefond Deposit and in the Bourlamaque Batholith. We learned from Brad Humphrey, President and CEO of QMX Gold, that since 2017, they have completed over 90,000m of drilling, supporting a reinterpreted geological model, and making multiple discoveries and confirming expansion potential on known gold showings. In addition, drilling on Bonnefond South led to maiden NI 43-101 resource release, in July 2019, and expansion drilling is underway, with update anticipated by very early September. In 2020, QMX Gold has planned more than 35,000 meters of drilling. We learned from Mr. Humphrey that the Company has a strong balance sheet, with around 10 million in cash, and a number of key strategic shareholders. In addition to its extensive land package, QMX Gold owns the, strategically located, Aurbel gold mill and tailings facility.

QMX Gold

Dr. Allen Alper: I’m interviewing Brad Humphrey, President and CEO of QMX Gold Corporation. I know you have a great Company, Brad, great support, great exploration, so I'm very interested in talking about it with you. Could you give our readers/investors an overview of your Company and what differentiates your Company from others?

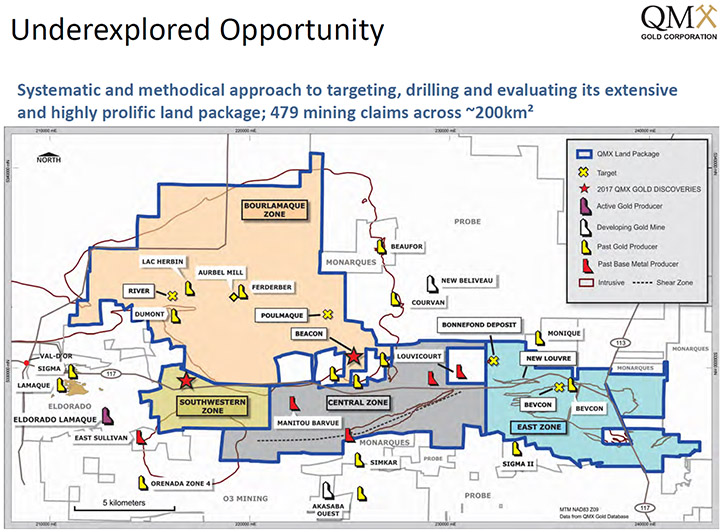

Brad Humphrey: Sure. First, thank you for interviewing us and for your interest in QMX. We trade on TSX venture, under the symbol QMX. What sets QMX apart is its dominant land position. It has nearly 200 square kilometers in the heart of the Val-d'Or Mining Camp, on the Abitibi, arguably one of the best mining jurisdictions in the world. We have a strong balance sheet, with around 10 million in cash on the balance sheet right now, and a number of key strategic shareholders. We have taken a very systematic and methodical approach to our extensive land package. We have a huge amount of historic data because there are a lot of past producing assets on our property and a number of historic gold showings. Before we do any drilling or set out our targets, we do go through that historic data.

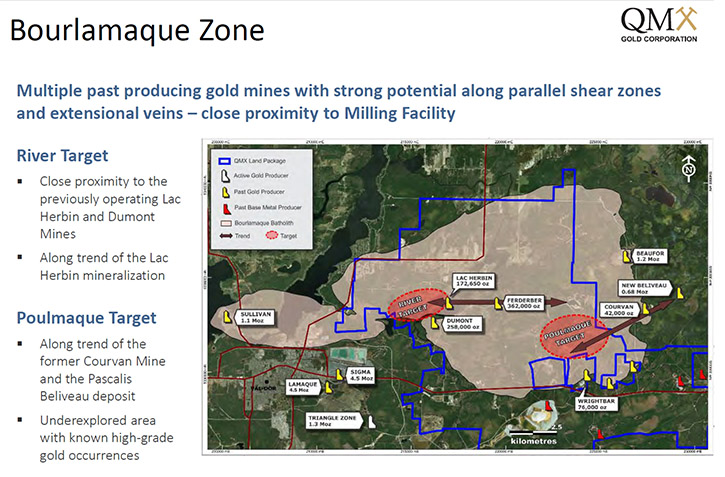

Since 2017, when we got back into drilling and really refocused the Company as an exploration company, that approach has really proven out. We've had a lot of success from our various drill programs, since then. We currently have three drill rigs turning, with a fourth soon to be added. We're currently focused on our high-grade River target and the shear zones to the North of the Bonnefond deposit. We have a new reconnaissance target called Poulmaque, which we're about to start to drill. This should continue to drive a lot of news flow, over the next several months. We are also releasing an updated resource estimate on our Bonnefond deposit later this month or early in September. We have more than 35,000 meters of drilling planned in 2020, which is quite a large drill program for a company our size.

That's on top of the 90,000 meters that we've already done since 2017. I would argue that we're still just scratching the surface. On top of the obvious exploration upside and resource growth potential at this property, we also have a permitted milling and tailings facility that pursues custom milling opportunities. Lastly, I think it's important to note that QMX has been fortunate enough to attract the support of a number of strategic investors, including, Eldorado, O3 Mining, Osisko Gold Royalties, Probe, and Eric Sprott. This is a bit of validation of our strategy and the success that we've reported to date.

Dr. Allen Alper: Pretty strong supporters you have there! That's great! It's great to be in an area that has great opportunities for gold exploration, and gold discovery, and to have such a large package, and to be so well funded and supported. You have a lot going for you, Brad, and for your Company.

Brad Humphrey: This is the best condition the Company has been in since 2016. We're extremely happy. Everything that we'd been working on from 2016 to today, was with the plan to be where we are right now; with a strong balance sheet, a number of really interesting targets being drilled, and a pipeline of additional targets still to be drilled. We have a priority list that's dozens of targets long, and we are hoping to get through as many of those targets as possible. The original idea was to eliminate ground as quickly as possible. The challenge with that was that we kept hitting gold. So, we had a very good problem, but we haven't been able to really work down our priority list as quickly as I had hoped. So, it's a great problem, and we still do have a lot of targets to test.

Dr. Allen Alper: Sounds excellent. Could you tell our readers/investors some of the discoveries you've made so far, data you have on your drilling goal?

Brad Humphrey: When we first started to look at a land package and the amount of historic data that we had, a couple of the targets really moved to the surface. One called Bonnefond, which is on the Eastern side of our property, was originally discovered by Aur Resources. I'm sure you're familiar with Aur Resources. Bonnefond is pretty close to the old Louvicourt Mine. It looked like a gold bearing shear zone that had intersected an intrusive, and created broad intersections of one and a half, two gram type material, nice open pit potential. We started drilling that with the idea this would be a nice little open pit. Once we got more and more into it, we realized that it was becoming something much more substantial.

On top of that, when we were drilling the intrusive, we started hitting shear zones that had great grades to the North and to the South. So, an example of an intersection inside the intrusive would be 130 meters of a gram and a 1.7 grams. That's an example of what's inside the intrusive. And then, in the shear zones to the North and South, we're talking about one ounce over three to six meter type intersection. So, very interesting there as well. It's turned out to be something much more than we had expected and we continue to move that forward. We did put out our initial resource last year and we're working right now to update that. The previous resource didn't include any of that shear zone material. The reason for that was we didn't have a really good understanding, at the time, of what shear zones we were hitting, and how many there were, and all of those important factors before it goes into a resource. We now do have that information and that will be included in a resource update. That's anytime in the next couple of weeks.

And then, we wanted to test the other targets on the Western side of the property. Because we have a milling facility that's around some old historic mines, we started to compile some information around some of the historic gold showings up there and one was called the River target. We started a reconnaissance program, late in the fall of last year and that brought back some really interesting results. For example; 38.7 grams over three and a half meters, 39 grams over two meters, 17 grams over four meters. And, all of that's relatively close to surface and only a couple of kilometers from our existing milling facility.

So, we've started a much broader exploration program on that target and we're currently drilling there now. We have 10 holes completed and are waiting for assays. In the overall program, we plan to complete 20 holes this summer. On the other side of that region, where the River target is, is a target called Poulmaque, on which we're about to start a reconnaissance program. The historic work there does suggest that it would be something similar in grades to what we've seen on Probe’s property across the border, the Courvan project. So, we're very excited. We have those three targets going now. This fall and winter we'll also be looking at the trend between Bonnefond and Bevcon, and it appears that there might be some more Bonnefond type potential in that five kilometer trend.

Dr. Allen Alper: Yes, I see them and we'll add them. That's exciting to be exploring so many great targets and to be doing so much drilling. That's really fantastic.

Brad Humphrey: Yeah. We're really excited.

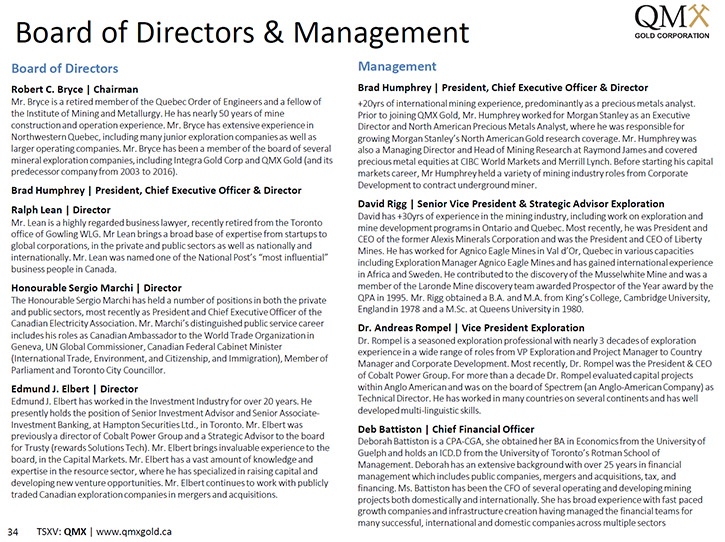

Dr. Allen Alper: Could you tell our readers/investors a little bit more about your background and your Team?

Brad Humphrey: Sure. I joined the Company in 2016. Back in the late '90s, I was working in the corporate world, everything from underground miner all the way to corporate development type roles. And then, just after Bre-X and the gold price started going to $250 an ounce, I moved into institutional equity research. I worked at a number of investment banks from Yorkton Securities, Canaccord, all the way to the CIBC, Raymond James, and most recently I was at Morgan Stanley. Then, I came in to help with the restructuring and the refocusing of QMX. Our Senior Vice President, a gentleman named David Rigg, has well over 30 years of experience in the mining industry. He's been very focused on this particular region in the Abitibi. He was part of the original group that put the land package together back in 2002, 2003, 2004, extremely well known in this area. He's worked with Agnico and various other companies in the area.

Dr. Andreas Rompel, our VP of exploration, is a structural geologist, which is very important in this area and that's Andy's focus. He's had a number of roles in the mining industry, VP of exploration, project manager to corporate development. He's worked with Anglo, and a number of other well-known mining companies. Deb Battiston is our CFO. She's been focused on the mining business for decades, everything from exploration companies, developers to producers. So, we have a great team running the show at the Toronto office and up in Val-d'Or, we have a spectacular team on the ground that runs the day-to-day operations, headed up by Melanie Pichon.

Dr. Allen Alper: That's a fantastic group, very impressive, the experience and the background of all of you! Could you also tell our readers/investors a little bit more about your share and capital structure?

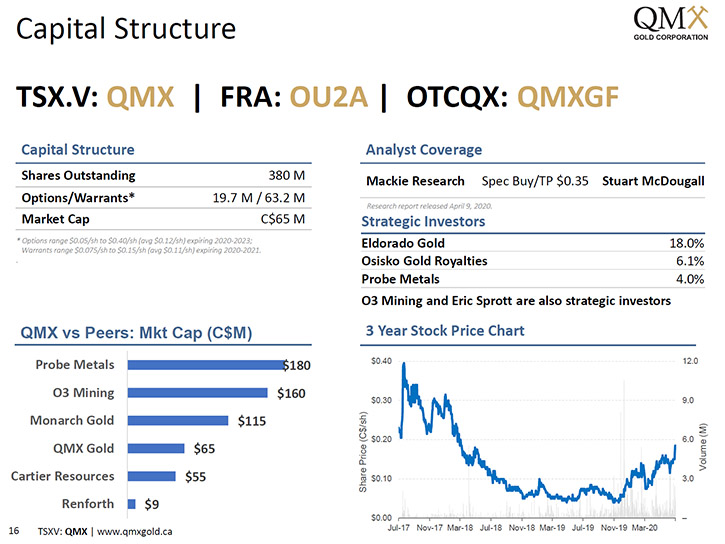

Brad Humphrey: Sure. We have about a 380 million shares outstanding. Of those shares, Eldorado has 18%, Osisko Gold Royalties is sitting out around 6.1%, Probe's around four, and then O3. Eric Sprott came in recently here and they don't file, but they're in about the same range as Probe and Osisko. So, the rest of the free trading float, we wouldn't include that. We have 19.7 million in options. And about 60 million warrants, the warrants expire between November 2020, and I believe it is March 2022. They're all in the money above 18 cents. Our market cap right now is about 70-ish million.

Dr. Allen Alper: Well, that sounds excellent. Could you tell us the primary reasons our readers /investors should consider investing in QMX Gold?

Brad Humphrey: As an investor looking at exploration companies, which is a high risk part of the mining business, I think you try to reduce your risk as much as possible, while remaining exposed to great upside. There're a few ways to do that. One is jurisdiction and we obviously checked that box being located in Val-d'Or, Quebec. It's just a great place to be doing exploration and all the infrastructure is there. And, it's relatively lower on costs. The other reason would be, we have a 200 square kilometer property, between Eldorado's Lamaque mine, O3's property to the South and Probe to the North and East. And they've all been putting out great results. They're all a little bit ahead of us. They all started drilling well before we did, but we're rapidly catching up.

If you look at some of the market caps of our peers in the area, you can get a sense of where we see ourselves going over the next year or so, as we work to recognize the value from the property. On top of that, I would say we have a spectacular property, extremely strong balance sheet, good corporate support, and dozens and dozens of targets to still test. So this is a great time to be involved in QMX. Everything that we've worked towards from 2017 was to get us to this spot right here. And, this is where I think things really start to change for us.

Dr. Allen Alper: Sounds like outstanding reasons for our readers/investors to consider investing in QMX. Brad, is there anything else you'd like to add?

Brad Humphrey: No. I think we've touched on a lot. We do have a lot of results pending assay right now, and with our resource estimate expected in the next couple of weeks, I think we'll have a lot of key catalysts over the next couple of weeks and months ahead. It's an exciting time to be involved with QMX.

Dr. Allen Alper: Sounds Excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.qmxgold.ca/

Brad Humphrey

President and CEO

Toll free: +1 877-717-3027

Email: info@qmxgold.ca

|

|