Lumina Gold Corp. (TSXV: LUM, OTCQX: LMGDF): Exploring and Developing, the Largest Primary Gold Deposit in Ecuador. Interview with Scott Hicks, VP of Corporate Development & Communications

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/10/2020

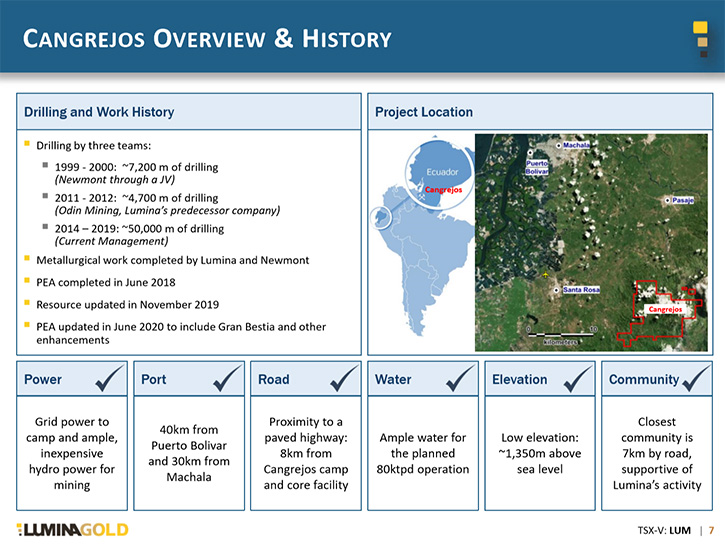

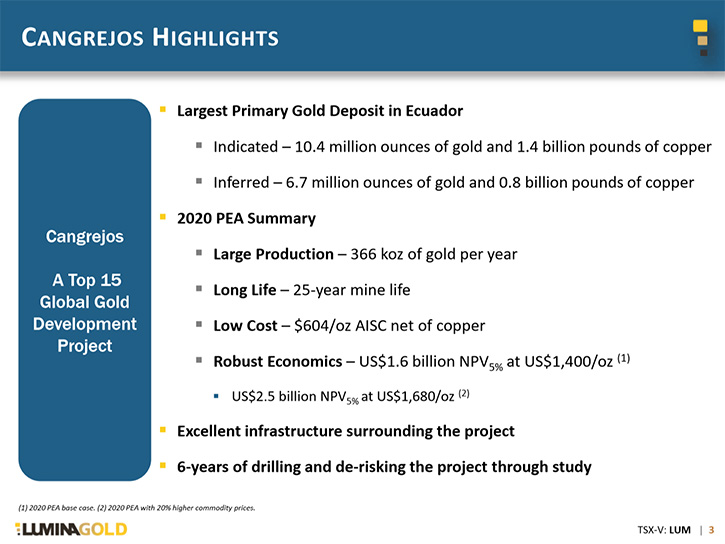

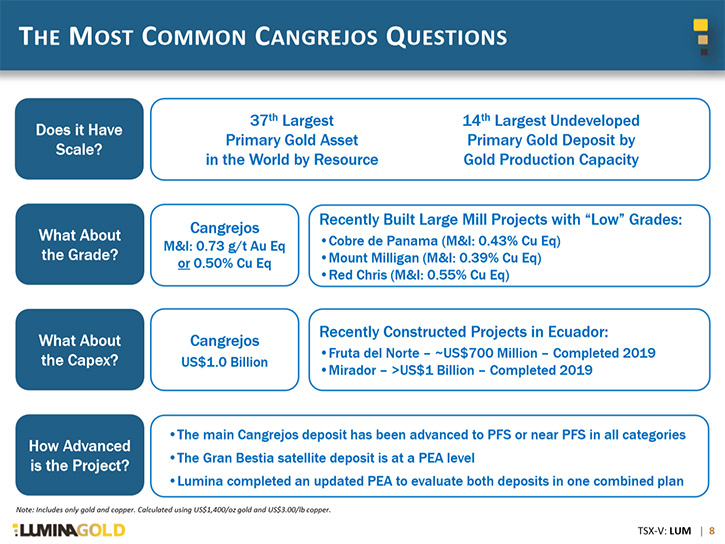

Lumina Gold Corp. (TSXV: LUM, OTCQX: LMGDF) is a precious and base metals exploration and development company focused on the Cangrejos Gold-Copper Project, the largest primary gold deposit in Ecuador. We learned from Scott Hicks, VP of Corporate Development and Communications of Lumina Gold, that they envision a 25 year mine life, with a large-scale open pit mine, producing about 80,000 tonnes per day, plus about 50 million pounds a year of copper by-products. The revenue mix for the asset is about 80% gold and 20% copper. The project, located in El Oro Province, Southwest Ecuador, is right near a deep sea port, and is blessed with very good infrastructure. Management's plan for Lumina Gold, is to sell the Company, which was part of the reason they spun out the other assets into a new Company called Luminex Resources (TSXV:LR, OTC:LUMIF).

Scott Hicks, VP of Corporate Development and Communications of Lumina Gold

Lumina Gold Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Scott Hicks, VP of Corporate Development and Communications of Lumina Gold. Scott, could you give our readers/investors an overview of your Company and also what differentiates Lumina Gold from others? I know you have a huge resource in Ecuador. It's a fantastic project.

Scott Hicks: Our group was founded by Ross Beaty, who's also the founder of Pan American Silver and Equinox Gold. The Lumina Group has worked on a variety of things over the years. We have sold five public copper companies and one private company since being founded in the early 2000’s. We had Anfield Gold, which was merged into Equinox, which is a successful emerging mid-tier gold producer. In 2014 we started putting together a bunch of earlier stage gold assets in Ecuador back when gold was around $1,100.

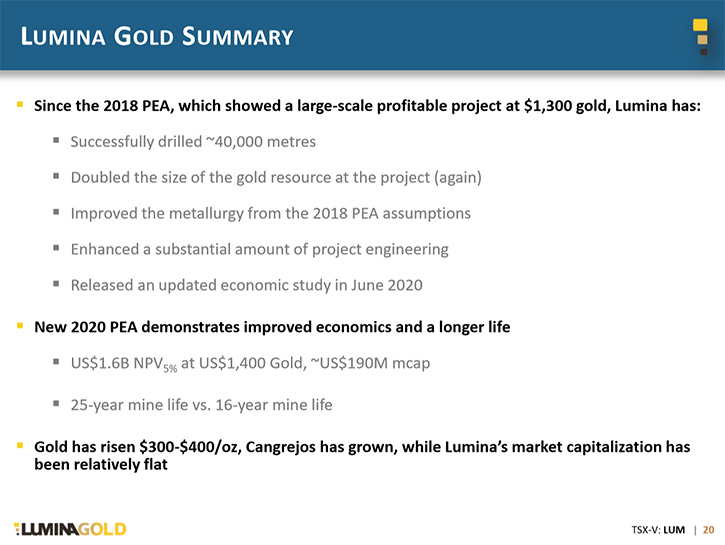

We thought gold was going to turn up, which has obviously proven out. And we thought that Ecuador would also improve dramatically and become an emerging mining jurisdiction, which has also proven out over that time period. We started in Ecuador in 2014, with our main asset that's in Lumina Gold, called Cangrejos. As you pointed out, it's a large resource. It's a 17 million ounce resource that we have an economic study on, that we just updated in June of this year. At one point Lumina Gold was the second largest land holder in Ecuador until we spun out our other assets out into our sister company, Luminex Resources. It's the same management team behind Lumina Gold with Cangrejos and all our other Ecuadorian assets and Luminex Resources.

Dr. Allen Alper: Well, that sounds great. Could you tell our readers/investors a little bit more about your two key properties in Ecuador?

Scott Hicks: Sure. The two deposits in Lumina Gold are actually right next to each other and they're both incorporated into the PEA study. One is called Cangrejos and one is called Gran Bestia and together they form the 17 million ounce resource. We envision a large scale open pit mine, that would be about 80,000 tonnes per day that you could build for approximately US$1 billion and that would get you about a 25 year mine life, which is obviously a very long mine life. And about 360,000 ounces of gold production a year, a very large gold production profile. And then you also get about 50 million pounds a year of copper by-products. The revenue mix for the asset is about 80% gold and 20% copper.

And one of the best things about the asset, Allen, is that it's right by the coast. We are blessed with very good infrastructure. We are ~40 kilometers from the deep sea port of Puerto Bolivar from which Mirador, a large copper-gold mine in Ecuador ships their concentrate. We have hydro-power to site and we have paved roads almost to the site as well. A lot of really good infrastructure around there and also a local population from which we could draw a workforce. A lot of the time, when you see these large scale porphyry deposits, they're usually missing something, whether it's power, electricity, water maybe their high elevation. They're usually missing something but we're very fortunate in the sense that we have all of those things available to us.

Dr. Allen Alper: Oh, that sounds excellent. Could you tell our readers/investors a little bit about your senior management and some of your directors?

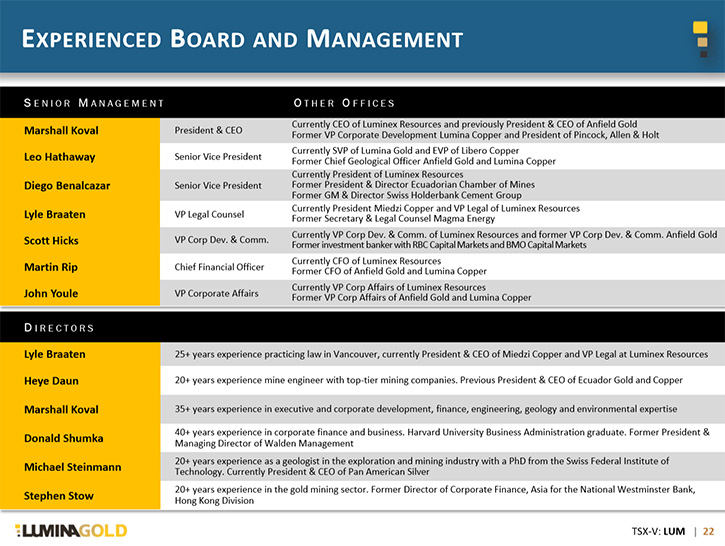

Scott Hicks: Our CEO is Marshall Koval, who's been with Lumina Group since 2004 and he's worked on all the Lumina Copper companies. He's currently on the Board of Equinox Gold. He used to be the President of Pincock, Allen & Holt, which was a technical services firm.

Our Chief Geologist, Leo Hathaway, has also been with the group for a similar amount of time and worked across all the companies.

Ross Beaty is not a Director or part of the Management team, but he is our largest shareholder. He's a 19.9% shareholder in the Company and typically participates in every financing at that 20% level and helps guide the strategy. Ross is very much part of the day to day team and what happens with the Companies.

Those are the key people. Myself, I've been with the group for three years. I came over from investment banking at RBC and BMO Capital Markets, where I worked in investment banking for about 10 years. I've been working on investor relations, equity financings and the M&A transactions we've done during that period of time.

Dr. Allen Alper: Well, that sounds like an extremely strong group that has been pulled together and with Ross, it's great to have someone with knowledge and strong finances to help keep you guys going forward. That's great. Could you tell our readers/investors, your primary goals for 2020 and 2021?

Scott Hicks: Sure. For us, we completed the new resource last November and we just completed the new PEA here in June. Ross has publicly stated that he would like to try to sell the Company at some point in 2020. I think when he said that in January, there wasn't the anticipation that we'd have a global pandemic, which has obviously disrupted a fair amount of people's business activities here, but it is still the primary goal right now to try to sell Lumina Gold in the near-term. That's part of the reason why we did the spin out of all the other assets into Luminex Resources, to get Lumina Gold ready for a sale. We have a variety of very interesting assets in Luminex resources, but we thought it would be too complicated to sell it all as one package together. We just have the Cangrejos asset now in Lumina Gold.

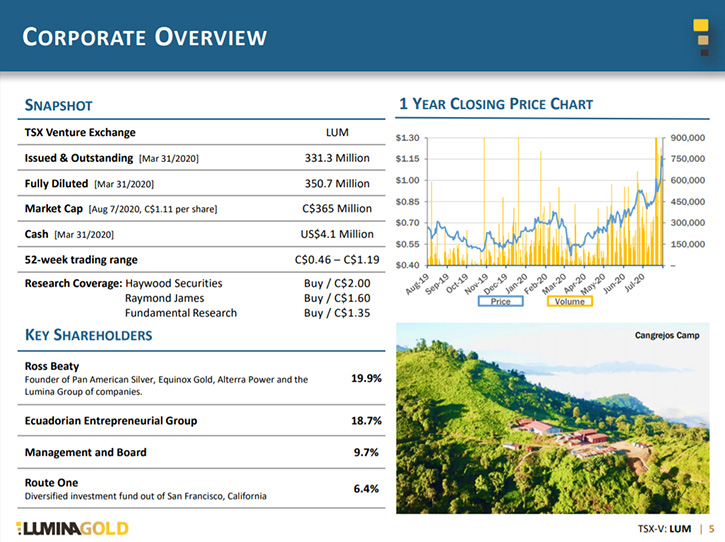

Dr. Allen Alper: Well, that sounds very good. Could you tell our readers/investors a little bit more about your share and capital structure?

Scott Hicks: We have about 330 million shares outstanding right now. We did a financing last December, with the goal that that amount of money would get us through the PEA and hopefully to an eventual sale of the Company. Our current share price is C$1.11. Our market cap would be just under $400 million Canadian.

We just recently experienced a bit of an uptick in our share price, helped by the move in gold, but we still think we're fairly undervalued, if you look at it on an ounce in the ground or NPV basis. We trade a little bit north of $10 a gold equivalent ounce in the ground. To give your readers a sense, in our PEA, our NPV at $1,400 gold was $1.6 billion. If you increase those commodity prices by 20%, to $1,680 gold, the NPV goes to $2.5 billion. And right now, gold's at about $2,030 an ounce. The asset is very, very valuable and there's not a lot of these large-scale assets out there that can produce over 300,000 ounces a year for so many years. We think it's a unique and valuable asset. We think that it'll be a mine one day and we're excited to hopefully have a major come in and develop it in the future.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors, what are the primary reasons they should consider investing in Lumina Gold?

Scott Hicks: I think the primary reasons your investors should look at Lumina Gold are, one, it already has a very large established resource that is economic at a much lower gold price than where we are today. I think it's an excellent way to be levered to increases in gold price. Two, you have a management team that has sold large scale assets before to majors and is hoping to do so again. And three, you have an improving mining jurisdiction in Ecuador that is continuing to get better. And all the public companies in Ecuador, right now, traded at a discount, but we think that as Ecuador proves itself as a mining jurisdiction, that discount will disappear and they'll fall more in line with other South American countries. In summary, we think there are three different avenues for investors to see share price appreciation.

Dr. Allen Alper: That sounds very good. Is there anything else you'd like to add, Scott?

Scott Hicks: Ecuador is going to be a new and exciting mining jurisdiction, which has been proved out by Lundin Gold and we think we have two very exciting companies there. Lumina Gold obviously, with the Cangrejos asset and the sister company, Luminex Resources, with a variety of assets, a big gold asset, Condor with 5.2Moz, a partnership with Anglo American on a copper property and a partnership with BHP on a copper property. We think we have a pretty unique set of assets in country and we were early movers, which has served us well.

Dr. Allen Alper: Well, that sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://luminagold.com/ |Twitter | LinkedIn

https://www.luminexresources.com/ | Twitter

| LinkedIn

Scott Hicks

shicks@luminagold.com

+1 604 646 1890

|

|