Tietto Minerals (TIE.ASX), Expanding a 2.2-Million-Ounce Gold Resource in the Abujar, Cote d'Ivoire; Dr. Caigen Wang, Managing Director Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/10/2020

This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Dr. Caigen Wang, Managing Director of Tietto Minerals (TIE.ASX), who has a 2.2-million-ounce gold resource in the Abujar, Cote d'Ivoire project in the central west of Ivory Coast. The Company has been rerated because of a major increase in the resource and grade that was based on September 2019 drill results. They recently concluded a ~50,000 meter diamond drill program that will be used for the September 2020 Mineral Resource update. Watch for more news and results from Tietto Minerals, as they have just announced a 45,000m diamond and 25,000m aircore program for the next twelve months.

Dr. Caigen Wang, Managing Director of Tietto Minerals

Tietto Minerals

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Dr. Caigen Wang, Managing Director of Tietto Minerals. Could you give our readers/investors an overview of your Company and what differentiates your Company from others?

DR. Caigen Wang: Thanks, Dr. Alper. We started Tietto Minerals in 2010 with a focus on West Africa. We began exploration in Liberia in 2010 and then we expanded to Ivory Coast in 2012. The main difference between us and the majority of other exploration juniors is that we explore, use our own technical team and our diamond drilling teams, with advice from well-known outside consulting teams. We are also working very closely with our local partners. For our project in Ivory Coast, a small portion of project ownership belongs to our local partners, who initially helped us find the project. This works really well, particularly now with the traveling restrictions due to the COVID-19 pandemic. Our challenge is for experts, including myself, to travel to Ivory Coast. However, with our local partners in country, we have been able to manage our exploration and in-country project study smoothly and efficiently. That's the main difference, I think.

Dr. Allen Alper: I noticed that you've done a huge amount of drilling and you have a rather large open pit gold resource. Could you tell our readers/investors a little bit about what you found to date, your resource, your grade, et cetera?

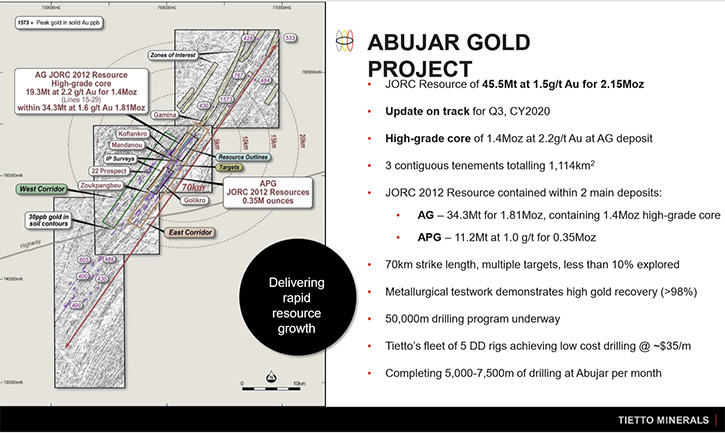

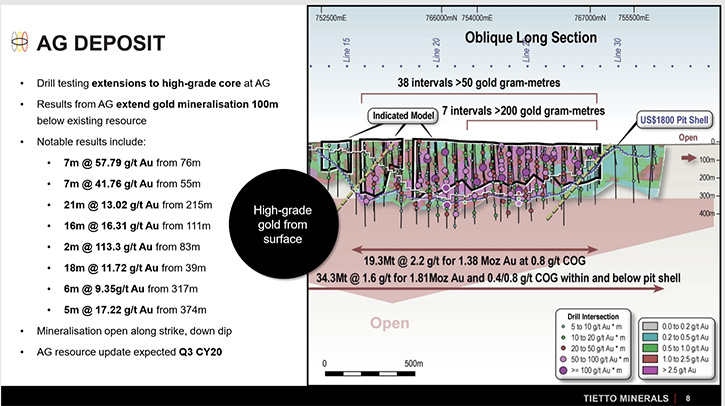

DR. Caigen Wang: Yes. We defined a 2.2 million ounce gold resource in the Abujar, Cote d'Ivoire project, in the central west of Ivory Coast. We are still drilling and we have just completed 50,000 meters of diamond drilling. So for the September resource update, we are well on track to see another significant resource increase. As can be seen from our regular announcement schedule, the drilling results have shown significant gold mineralisation outside of the current Resource, giving us confidence in expecting a major resource uplift in September.

Dr. Allen Alper:: Could you tell our readers/investors how many ounces of gold you've identified so far and also the grade?

DR. Caigen Wang: So far 2.2 million ounces of resource and the average grade is 1.5 grams per ton. The important thing is that we have a high-grade core of 1.4 million ounces at 2.2 grams per ton. That's in the Northern half of the AG deposit, we call the high-grade core. So this is the critical part focus of the current resource, which gives us confidence that a large high-grade open pit mining operation can be established even if we only on this portion of the resource. With our continuous drilling targeting resource extension along strike and down dip, as well as some infill drilling in this high-grade core. The September resource updated is expected to deliver a major uplift in both quantity, grade and confidence level.

Dr. Allen Alper: Well, that sounds excellent. I understand that your drilling cost and exploration costs are rather low compared to your competitors, is that correct?

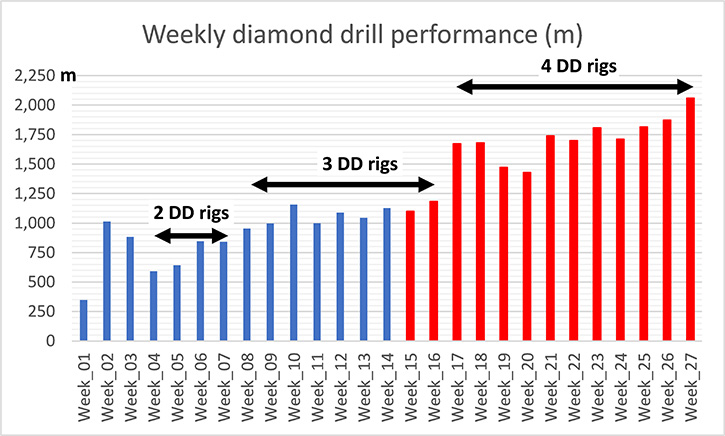

DR. Caigen Wang: That's exactly right. We are very pleased with current with five diamond drill rigs onsite. Four are being used with one as backup and we've been drilling very, very rapidly with extremely high quality.

Diamond drilling performance during the June quarter (Red) and March quarter (Blue) in 2020

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors a little bit about how important your company and how well your company is situated in the greenstone belt of the Ivory Coast?

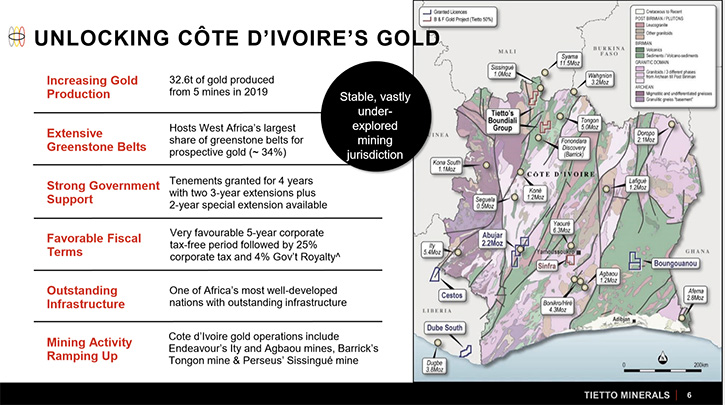

DR. Caigen Wang: Côte d'Ivoire is well known for having the largest greenstone belt in West Africa accounting for 34% of the Birimian Greenstone Belt within this country. In other words, the entire country is sitting within the Birimian Greenstone Belt. So the size of the land area prospective for gold mineralization is three times as big as the green stone belt in Ghana. The Abujar Project, is in the central west of Côte d'Ivoire, which has never had mining exploration in history due to the Country being agricultural focused in their economy. That resulted in the country being under-explored.

So when we and our local partner were looking for projects, from 2012 up to early 2014, we identified this area that has massive artisanal mining activities which, together with the general understanding of the geology, confirmed the existence of gold mineralization. So we started this project with the Abujar middle license, which holds our current resource, as well as our upcoming resource update. We also applied and were granted an Abujar Southern tenement. Meanwhile we developed a joint venture agreement for the Abujar northern tenement. Together the tenements cover 70 kilometres of mineralised shear zone. Strategically, it's a larger landholding. More importantly, the 70 kilometre strike list has been proved to be mineralized. So that's a significant upside.

Dr. Allen Alper: That sounds excellent, Dr. Wang. Could you tell our readers/investors about your excellent, outstanding background and your Directors great backgrounds?

DR. Caigen Wang: By training, I'm a mining engineer. I have quite a strong academic background in mining engineering. I was educated at the China University of Mining and Technology from 1982 to when I finished my PhD in 1995. But from 1989 to 1996 I lectured in the Mining Engineering Department at the China University of Mining and Technology. I came to West Australia School of Mines as a research fellow in 1996 and three and half years later, I working as a research associate at the University of Alberta for two years. Then in early 2003, I come back to Australia working as a Senior Geotechnical Engineer for Sons of Gwalia. Later on I joined West Mining and later on BHP Billiton, working also in West Australia. Then later on I joined St Barbara, working as a long-term planning engineer. Before I started at Tietto Minerals, I was working as a Managing Director for a junior, ASX listed, exploration company. So I do have a good interest in the exploring sector. It’s challenging, but very rewarding.

On our Board, we have our Chairman Francis Harper. He used to be a Chairman for West African Resources for six years before he joined Tietto Board, his sister asked for the ASX listing in early 2018. So Mark Strizek, is the Geologist. He used to be a Managing Director of an ASX-listed junior explorer (Vital Metals) as well. He also joined Tietto's Board before our listing. At the beginning of this year we were fortunate to secure Mark's position and his commitment as an Executive Director. Dr. Paul Kitto is a senior experienced Exploration Geologist. He used to be a General Manager of Exploration for Newcrest, taking West Africa for four years. Before that he was a Managing Director for a formerly ASX-listed company Ampella. They were exploring in Burkina Faso and had discovered this new million ounce gold resource. Mr. Hanjin Xu used to be an Executive Director for Sino Gold, back a few years ago, when Sino Gold was producing gold in China. So our Board has good experience on the geologist side, the mining engineering side and the long-term planning side. We have good Board experience on the corporate side as well.

Dr. Allen Alper: Excellent! You and your Board have excellent backgrounds, great experience and a record of outstanding accomplishments, so that's excellent.

DR. Caigen Wang: Thanks.

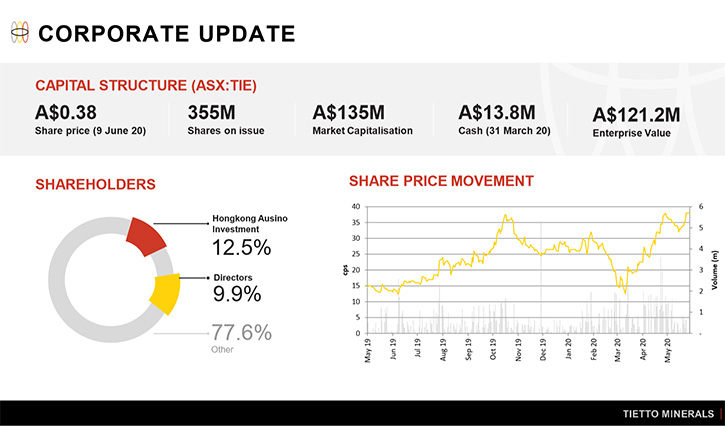

Dr. Allen Alper: Could you tell our readers/investors a little bit about your share structure and capital structure?

DR. Caigen Wang: Yes, altogether we have 356 million shares on issue. The market cap is just around the 250 million Australian dollars. We started as a private Company, with strong support from our Chinese investors which have been continuously supporting the Company as we grow. Since mid-2017, the Company started preparation for ASX listing with strong financial support from Australia, Europe and North America. Currently ownership of our Company is around 20% Chinese private investors and 80% from Australia and Europe and North America.

Dr. Allen Alper: Oh, that sounds very good. Could you tell our readers/investors how it is to operate in Ivory Coast?

DR. Caigen Wang: Ivory Coast is a really good investment-friendly destination. Technically, occupying 34% of the West Africa’s Birimian Greenstone Belt is one of the most attractive under explored regions in the world. More importantly, the Côte d'Ivoire (CDI) government is operating in a very proficient and friendly manner for gold investment. They have a five year corporate tax holiday for new gold producers, starting commercial gold production. Five large modern mining operations produced 32.6 tons of gold last year. Each mine produced more than six tons of gold, that's quite significant. Well established infrastructure in CDI is another great feature for gold mine development. Reliable, cheap and ample supply of grid power is another feature attractive for gold mine development. Since 2014, three big modern gold mines were built in CDI with the 4th big mine, Yaouré mine, owned by Perseus, being at its late stage of mine construction. So it's a really good destination and has favourable conditions for gold investment.

Dr. Allen Alper: Sounds excellent, Dr. Wang. Could you tell our readers/investors, the primary reasons they should consider investing in Tietto Minerals?

DR. Caigen Wang:Tietto Minerals, as a Company, we have really good points for investors to consider. First of all, we have large, high-grade, open-pitable gold resources, defined so far with huge upside to grow rapidly. The Abujar project’s existing 2.2 million ounce gold resource will soon be updated with a major uplift. But they are still at an early stage, in terms of overall resource. The project now is at the stage of having a mining license and environmental assessment. So we have a number of milestones ahead of us that we are expected to achieve in the next few months. So that's the project side.

On the corporate side, as Board members, we have a very good combination of experience. From an investor point of view, it's a critical part of the constellation. And the destination of the project, Ivory Coast, compares favourably with other destinations in the world and particularly, with other parts of Africa. It is probably one of the very few family destinations, where you can invest in gold. They have all the conditions ready for gold investment, technical, government to support infrastructure, and the people. So, that's all very good. The most important thing is security. General security is critical for long-term investment. All should come together to become a very attractive investment destination.

Dr. Allen Alper: Well, that sounds like very strong reasons to consider investing in your Company. Is there anything else you'd like to add?

DR. Caigen Wang: Yes. We need to look at the infrastructure. Our project sits beside a major sealed road as well as having a major power line running through it. Electricity-wise, grid power in Cote d'Ivoire is abundant and they produce more than they need and it's cheap, around nine to 11 cents US per unit. The Company is ready to go for development, in terms of infrastructure. Water in West Africa is not a problem. There is plenty of water there in this part of the world. So the infrastructure is there.

Dr. Allen Alper: Well, that sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.tietto.com/

Dr. Caigen Wang

Managing Director

Tel: +61 8 9331 6710

|

|