Dr. Allen Alper Interviews Pini Althaus, CEO of USA Rare Earth LLC: Planning to be the First Mine to Magnet Operation Outside of China

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/9/2020

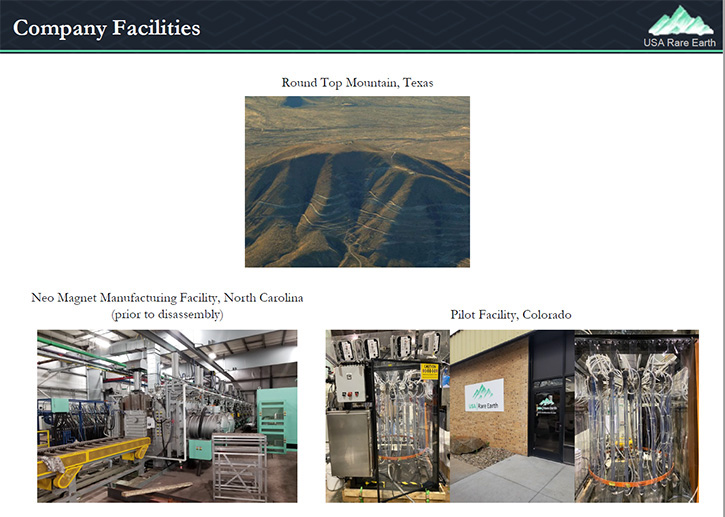

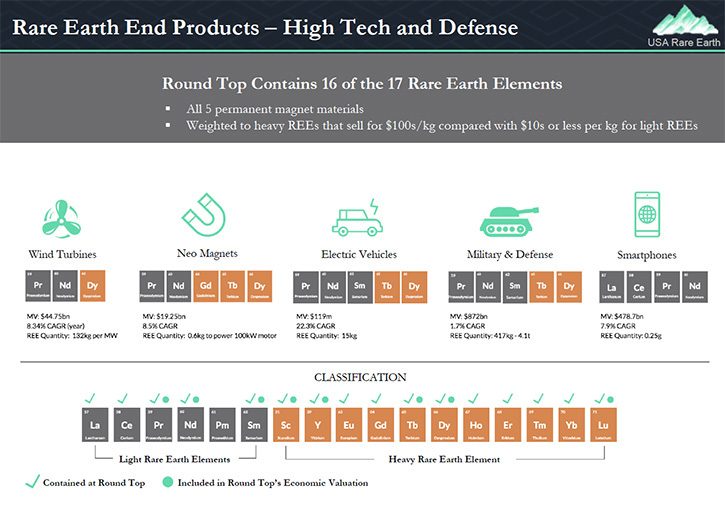

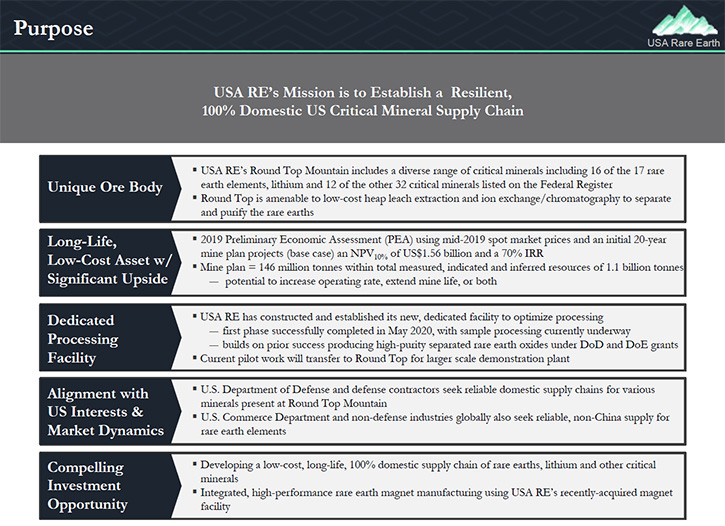

Pini Althaus, who is CEO of USA Rare Earth LLC., tells us that USA Rare Earth LLC. Pre-IPO, with facilities based in the USA, plans to be the first Mine-to-Magnet operation outside of China. The Round Top deposit has lithium and 16 of the 17 rare earths (REE’s), with a high concentration of heavy rare earths like Dysprosium and Terbium. Pini plans to make USA Rare Earths the second largest lithium producer in the United States by 2023. In April they acquired the only sintered neodymium iron boron (NdFeB) permanent magnet manufacturing plant in the Americas (formerly owned by Hitachi), located in North Carolina. The goal is to bring the magnet plant back into full operation, within the next 12 months. USA Rare Earth has a top-rated team, with vast experience in REE’s and magnet production. Watch USA Rare Earth for more exciting developments.

Pini Althaus, CEO

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Pini Althaus, who is CEO of USA Rare Earth LLC. Could you give our readers/investors an overview of your Company and what differentiates your Company from others?

Pini Althaus: We will be the first Company to establish a real mine-to-magnet solution, outside of China. We have the pieces in place needed to achieve this.

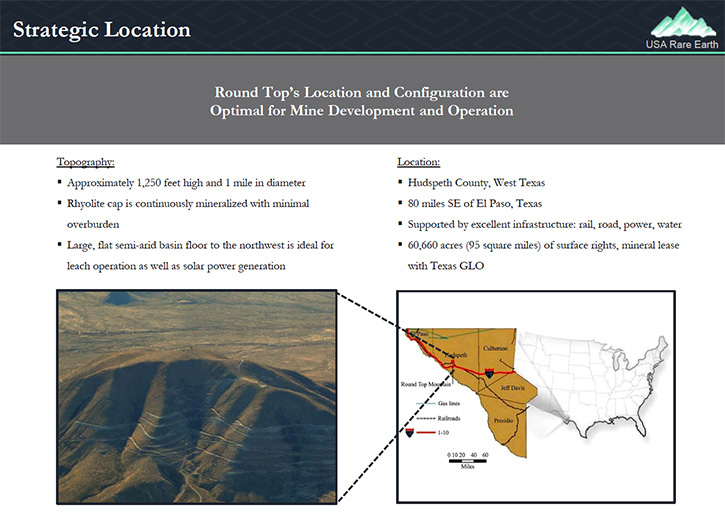

We have the Round Top deposit. I'll give you more detail on that and our progress with those deposits. We also have the recently opened rare earth and critical minerals processing facility in Colorado, where we'll be doing all of our own processing work, commissioning the pilot plant, which will then move to the Round Top site, in Texas. We will likely keep the Colorado processing facility open to process REE/critical minerals from other projects as well, non-Chinese projects. In April, we were very fortunate to be able to acquire the Neo Magnet plant, formerly owned and operated by Hitachi in North Carolina, which is the only sintered Neo Magnet plant in the Americas.

We have a mine-to-magnet solution in place. On the Round Top deposit, we have 16 of the 17 rare earths, with a high concentration of the very much sought after heavy rare earths like Dysprosium and Terbium.

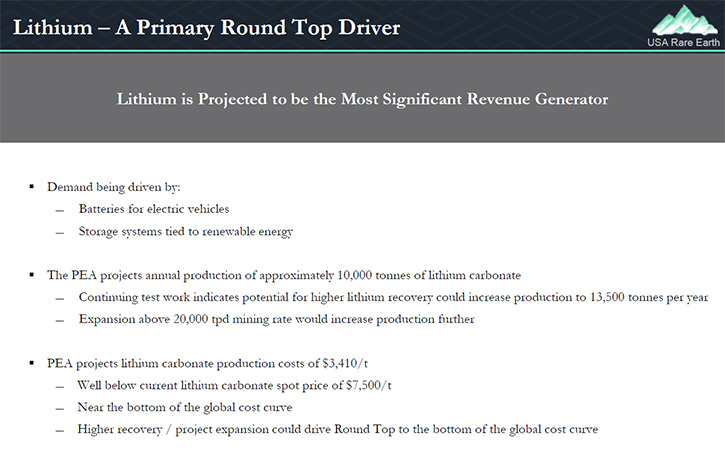

A third of the project is composed of lithium and currently we're projected to be the second largest lithium producer in the United States by 2023.

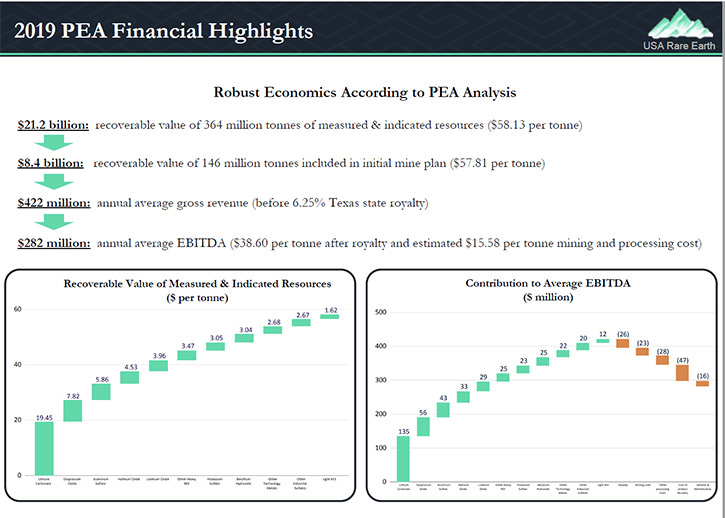

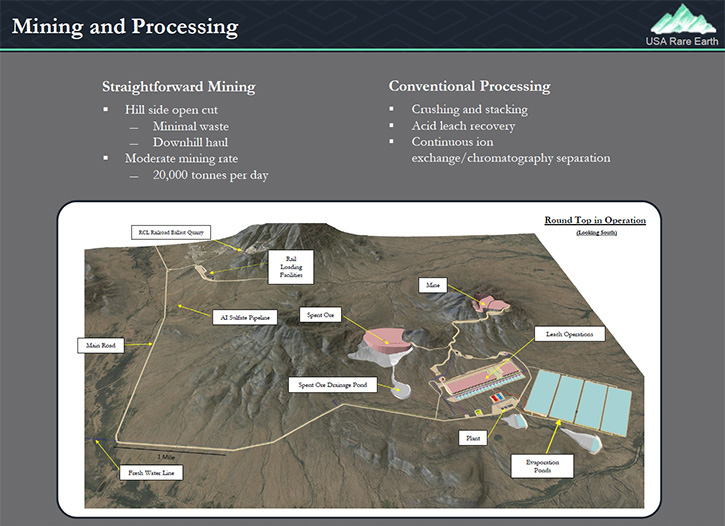

The other third is composed of aluminum sulfate and other industrial and tech metals. We have a very diversified project. We have a very low operating cost. We have existing major infrastructure on site, including roads, water, rail, and power. We have 130-year mine life, however, the economics in the August 2019 PEA, were based on the first 20 years mine life at a 20,000 ton per day operation. So, the $1.56 billion MPV, with the 70% IRR, which was actually the base case economics in that report, accounts for only 13%, of the overall delineated resource. We have about $22 billion of materials that have been accounted for under 43-101 compliance.

And then, as you know from our last discussion, we felt that was very much a requirement for us to keep the vertical integration of the mine to magnets all within the United States, without having to send them to China, like other companies are having to do. And given that we were having a lot of success with our processing, which included two grants, one from the Department of Defense, through the DLA and the other through the Department of Energy, where we demonstrate to each of those agencies, the ability to be able to do high-purity separation of six rare earths, three for each. So we ran with that, if you will, and decided that we can do our own processing here.

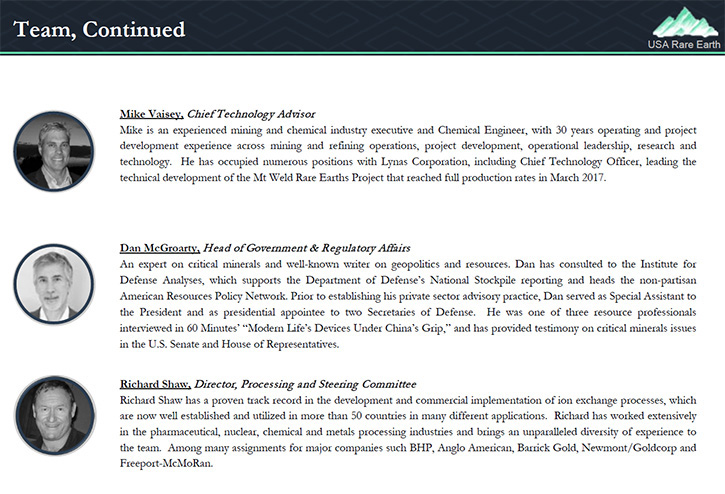

We probably have the foremost rare earth and critical minerals experts outside of China on our team, which includes Mike Vaisey, who was the CTO of Lynas for 15 years and is the only person outside of China to have built a rare earth facility, which is currently being used by Lynas.

And then Richard Shaw of Phoenix, who has worked for several majors as well, and their information is in a couple of our last press releases. We’ve built a very strong technical team, we've opened up the processing facility in Colorado. In fact, we recently announced that we have completed phase one of the processing work, which involved the separation of the rare earth from the non-rare earth materials. We are now working on separating the rare earths into individual oxides and separating the rare earths from the lithium and the other materials, and everything seems to be going very well. Everything on budget and on schedule, which isn't often the case for mining companies. With regards to the metals and alloys, that expertise does reside outside of China, and to some extent within the United States, we're considering various partnerships, joint venture type structures currently on offer to us.

With regards to the neo sintered magnet facility, Hitachi had sold that equipment in 2015 or 2016, and the group that had purchased that equipment put it up for sale. They had a deadline by which the equipment had to be disassembled and moved. That was during the outset of COVID, during April, and companies were not able to come in from overseas, who were looking to acquire the equipment. They didn't have the ability to send people to inspect the equipment, take inventory, and then put in bids etc. We, being on the ground and a somewhat smaller company, had the flexibility both to have the equipment inspected, and in fact, liaise with people that have been involved with Hitachi to get a better understanding of what was there. Subsequently, we were able to acquire it successfully, keeping a very, very important piece of the critical minerals supply chain here in the United States.

The goal now, and we are working on several options, is to bring the magnet plant back into full operation, within the next 12 months. At current scale, we can produce 2,000 ton of neo magnets a year, which accounts for about 17% of all U.S imports of neo magnets. Initially we'll be using feedstock from either recycled materials, or from other options, not from Round Top. Once Round Top goes into full production, we will be our own customer and produce from Round Top. It's been very well received in the market. It's been very well received by those in the private sector and the government as well, because it's a really important piece of equipment to have here, if we want to have some independence from China, when it comes to critical minerals and rare earths and stand up a fully-integrated supply chain.

Dr. Allen Alper: Well, I must say what you have accomplished, in a very short time, is extremely impressive! Your plan from mine to market seems to be very well thought out, and you're very well positioned to carry it out. I'm very impressed with what you're doing, Pini.

Could you tell us a little bit more your background and about your team?

Pini Althaus: It is a team effort. We have a good team in place and everyone's performing their respective roles.

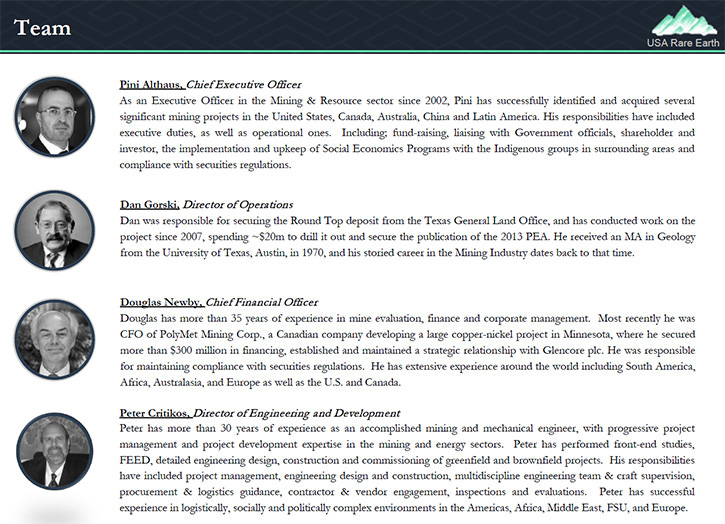

I've been in the natural resource space for about 20 years now, primarily in base and precious metals projects, in all different parts of the world. I've been involved, both as an executive and in a number of roles as a consultant as well, helping take projects to the next stage, which was what we were doing here in our joint venture with Texas Metal Resources Corp., TMRC. I would say my forte is seeing an opportunity and putting a good team together, because the team is obviously the critical part of making anything work.

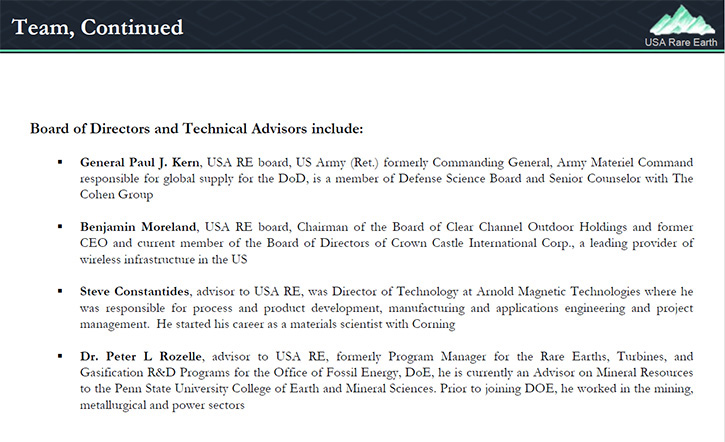

Also, on the call with us today, we have Dan McGroarty and Dan can give you his credentials. Dan is an advisor for the U.S Government on critical minerals. He has worked in the White House, advises U.S Government, and has testified before Congress.

Douglas Newby, our Chief Financial Officer, has been in the resource space for 35 years, initially as an analyst, and then in actual mining operations and working as an executive in mining companies, now for the last 15 plus years. He has extensive experience in precious metals, base metals, and now obviously battery materials as well.

Again on the technical side, we have Mike Vaisey, who was the Chief Technical officer of Lynas and built Lynas' project and the processing facility in Malaysia, and is probably one of the foremost experts in rare earths outside of China.

Richard Shaw runs a Company called Phoenix, and Richard has a proven track record in the development and commercial implementation of the ion exchange process. He's worked extensively in pharmaceutical, nuclear, chemical, and metal processing industries, including for majors like BHP, Anglo-American, Barrick Gold, Newmont Gold, and Freeport-McMoRan.

Deepak Malhotra, of Resources Development Inc. (RDI), has been involved in mining, for more than 40 years. He is one of the most well-regarded metallurgists in the United States and part of the faculty or lecturers of the Colorado school of mines.

And then we have Dan Gorski, Dan is the CEO of our essential partner TMRC, but he's also a project manager and an excellent geologists, very familiar with the work that we've been doing, given that he's, in great part, to be commended for getting the project where it is today. We have just brought on board a gentleman by the name of Peter Critikos, as our Director of Engineering and Development. Peter is very impressive, he's a QP and a member of the Mining and Metal society of America. He's been working for more than 30 years in engineering, project management, project development in industrial and technology minerals, including lithium and base and precious metals.

Most recently, he was the Senior Project Manager with Samuel Engineering in Denver. He's worked for Lithium Americas. He's participated in technical due diligence for equity investments, for groups like Red Kite, Orion, Liberty Metals and others. So very extensive mining experience. You could find more on that on our fairly recent press release. So we've assembled a very formidable team that has both the business development acumen, corporate acumen, and also the technical acumen to actually bring a project like this into fruition. And each, with their own set of expertise, whether it's the metallurgy, whether it's the geology, the engineering, the processing, and now we're actually bringing on some people with significant experience in the neo centered magnet space as well. So, each expert staying in their lane and working on their part of the process of the medical supply chain.

Dr. Allen Alper: You should be congratulated for putting together such a great, talented, experienced team. Excellent!

Pini Althaus: Thank you. I very much, appreciate it.

Dr. Allen Alper: Could you tell our readers/investors, what are your key plans for the remainder of 2020 and going into 2021?

Pini Althaus: We're working right now on completing our pre-feasibility study (PFS), which includes commissioning the pilot plant. We anticipate having this completed within the next 12 months, at which stage the pilot plant will move over to Texas and we will then set up a demonstration plant on a larger scale, ahead of full commercial production. We have three phases that are part of this commissioning of the pilot plants, and we've completed phase one. We are working now on phase two. The idea is at the conclusion of the PFS and commissioning of the pilot plant, we will have a flow chart that will then be the blueprint for the production scenario onsite at full scale.

In addition to that, we are working with some other companies as part of the strategic alliance between the U.S and some other countries, for example, Australia and Canada. Dan will talk about the Canadian side shortly. For example, we have a strategic alliance with a light rare earth company in Australia called Arafura. They will be sending their materials to be tested at our Wheat Ridge Colorado facility as a potential way for them being able to avoid having to send their materials to China.

Recently, we announced an agreement with a Canadian company called Geo Mega Resources, which pertains to using recycled materials for our neo magnet plant.

Dr. Allen Alper: That sounds excellent.

Pini Althaus: We have a lot happening here. It all seems to be going in the right direction and we're obviously quite busy, but we're doing something that companies have spoken about doing and for whatever reason have not been able to do.

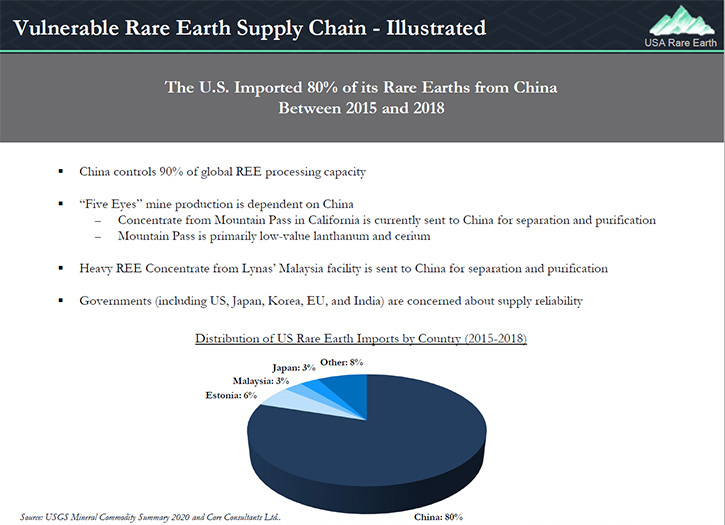

What we are seeing is a significant sense of urgency starting to come out of Washington. And the good news is, it's a bipartisan issue, with bipartisan support because China, especially as of late, has made very overt comments about their made in China 2025 initiative. In fact, Attorney General, William Barr made some very stark comments about how precarious the situation for the United States is as we've fallen behind China as the manufacturing leader, but it's even worse than this because China has become a net importer of rare earths and they will be utilizing their raw materials to further solidify themselves as the world leader for manufacturing. Therefore, the rare earth exports from China will be more difficult to procure as time goes on. We’re hearing that from a number of governments and countries that specialize in high tech manufacturing and from companies in the private sector.

And as somebody in Australia said, very eloquently, in an article this week. "France will sell you their wine, but they will not sell you their grapes."

Dr. Allen Alper: That was an excellent analogy for what's going on. China understands that they make themselves a global power by selling finished product, so that is their focus. So we are getting to a situation, where if the domestic rare earth sector does not get up and running in the near term, we will not be able to build defense applications, but even more frightening, medical equipment. There are nine rare earths that go into an array of medical equipment that are ubiquitous. We're talking about any hi-tech manufacturing. And I don't think people are aware of how ubiquitous rare earths are in our day to day lives. 50% of all imports into the United States contain rare earth elements.

Pini Althaus: We have this push and rightly so, for climate change and for electric vehicles. The electric vehicle sector is growing and it's expected and projected to grow many folds, over the next 5, 10, 15, 20 years, whether it's the Republican agenda or whether it's the democratic agenda. In Joe Biden's recent campaign speech, he announced about a $2 trillion spend on infrastructure, the 5G network, electric vehicles, technology, etc. This can only be done if we have the raw materials. But one thing that has struck us and we are starting to hear more conversation about is electric vehicles. It's great to be driving an electric vehicle, but to be driving an electric vehicle with materials sourced from China, where by their own admission, they've decimated the environment and cities and towns around their rare earth mines, where people have contracted cancer and other illnesses, to drive an electric vehicle sourced from those materials seems somewhat of a hypocrisy.

We can't say "as long as that's happening in China, that's okay". But we're going to keep a clean environment here. There has to be a global responsibility and a global response to this. We're seeing companies move away from, for example, cobalt in the Congo for obvious reasons, and now battery materials and rare earths from China, for the same reasons. And that sentiment is starting to grow. It's not just supply and demand. There's an idealistic side to this as well, but practically speaking, we were almost getting to that stage of the Saudi Arabian oil embargo in the seventies. But this has far wider implications, if we don't do something about this now. The time has come, we are getting close to midnight, as they say, as far as this matter is concerned.

Dr. Allen Alper: Well, what you and your team are doing and how you're positioning your Company will make the United States so much more independent of China and be able to mine, process and manufacture rare earths and end products. So, very impressive!

Could you tell us a little bit about your investors?

Pini Althaus: Since these are critical minerals deposits, we're sticking primarily to U.S investors or investors from five countries; Australia, New Zealand, UK, Canada, and the United States. We've been very selective on who our investor base would be. We have a couple of institutional investors. One that would be of interest is the Navajo Nation through NTEC, the Navajo Transitional Energy Company. Their mandate is to move away from fossil fuels and invest in clean or green energy solutions.

In excess of 60% of the materials from Round Top will have a clean green energy application to them. The process that we're using, continuous ion exchange, or CIX, is a very benign process. We'll be making an announcement, shortly, about our intention to use renewable energy on site and various other things. We want this to be a completely green project, to the extent that we can. Mining at this particular site will be extremely benign. We want to hold this project up as a standard for not only the materials that are coming out and their applications toward clean and green energy, but the way we're actually going about the extraction process.

Dr. Allen Alper: Well, that sounds excellent. Pini could you tell our readers/investors, the primary reasons that they should consider investing in USA Rare Earth?

Pini Althaus: I'm reluctant to give anyone investment advice, but I think one needs to look at the backbone of manufacturing, which is rare earth elements and other critical minerals. As I mentioned earlier, there really is no competition at this stage among any of the projects. We are way behind China. We will not take over China for at least a couple of decades, assuming that we start putting our feet in the right direction immediately. In fact, from just the initial conversations that we're having, with regards to potential off-take agreements, the demand will far outweigh our ability to supply, even with a project as large as ours, with the mine life and with the quantity of resources. So I think we're dealing with something that is pretty much what oil and gas was a number of years ago, but perhaps with a wider ranging effect, in terms of you really can't do much these days without rare earths and critical materials.

We stand out as being a very different project from any other rare earth or critical minerals deposit in the world. We not only have 16 of the 17 rare earths and in significant abundance, we also having the lithium and some of the other tech metals and industrial materials. We have a very well-diversified project, which makes our operating costs a lot lower. The fact that we're able to heap leach the material at Round Top, further adds to the lower operating costs. And the fact that we have the major infrastructure in place already, reduces our CapEx significantly. There's a lot going for the project, and it's certainly unique and certainly something which I think we all have to get behind.

I strongly believe we have to get behind all of the viable rare earth mining concessions in this country, the ones that can prove themselves to either have the materials that can be extracted economically or the processing capability, because I think it's all about collaboration at this stage. There's no one project or one company that can take on China or no one project or company that's going to put China out of business. It's all about being able to supply, not just the United States, but also the EU countries and other friendly countries, whether it's NTIB countries, NATO countries, allies, etcetera, that are looking for materials. And we can have another 10 rare earth mines come online tomorrow and maybe it'll start meeting the long-term demands. We are well positioned at USA Rare Earth, so I'll let investors read this and make up their own minds about where they'd like to invest, but that's the position we take on our project.

Dr. Allen Alper: Well, that sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

USA Rare Earth LLC

Pini Althaus

Chief Executive Officer

pini@usarareearth.com

Twitter: @USARareEarth

http://usarareearth.com/

|

|