Dr. Allen Alper Interviews Michael McNeilly, CEO of Metal Tiger PLC (AIM: MTR): Focused on Project Investments and Equity Investments in the Natural Resources Sector

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/2/2020

Michael McNeilly, CEO of Metal Tiger PLC (AIM: MTR) introduced us to his business. Metal Tiger is an AIM (London Stock Exchange) quoted investing company, focused on the natural resource sector. Metal Tiger has a portfolio of investments in development and exploration stage mining companies, with a current focus on precious and base metals, with a strong focus on copper, gold and silver. They hold 3 significant net smelter revenue (NSR) royalties.

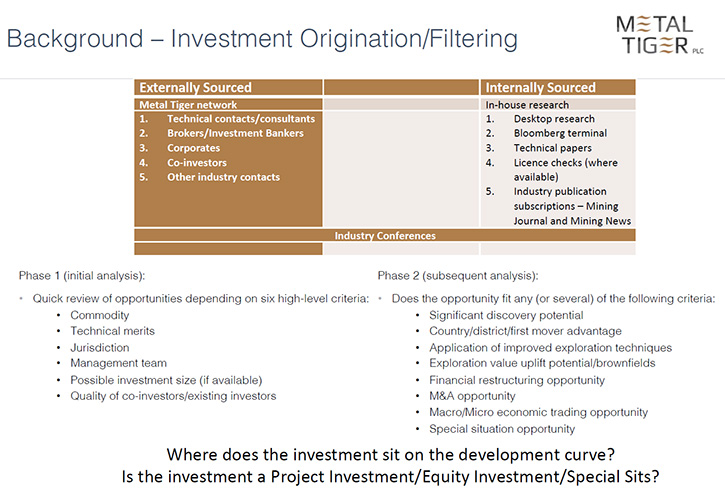

Potential projects are evaluated based on 7 criteria:

• significant discovery potential;

• country/district/first mover advantage;

• application of improved exploration techniques;

• exploration value uplift potential/brownfields;

• financial restructuring opportunity,

• M&A opportunity;

• macro/micro economic trading opportunity; and

• an 8th catch-all special situation opportunity.

Investments are either Project or Equity Investments and are categorized as either active or passive investments. When making an active investment, Metal Tiger’s goal is to take a minimum 10% stake and Board representation, where, if a 10% stake is held long enough can confer certain tax advantages upon exit. Metal Tiger has a strong balance sheet, is a multi-commodity investment, and has multi-risk exposure that gives investors a diverse and balanced investment opportunity.

Michael McNeilly, Chief Executive Officer of Metal Tiger

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Michael McNeilly, CEO of Metal Tiger PLC. Michael, I wonder if you could give our readers/investors an overview of your Company.

Michael McNeilly: Certainly. Thank you for interviewing Metal Tiger. We are an AIM quoted investing company, focused on the natural resources' sector. We focus on two main categories, which are project investments and equity investments. We invest primarily either looking to take an active position, which means taking over a 10% holding or we are looking at more passive/trading opportunities. For project investments, we're always taking over a 10% stake and taking Board representation. Project investments are almost always private investments, with direct asset exposure. We currently only have one project investment.

Then for equity investments, we either take a passive or active stake. Part of the rationale for taking a 10% holding is because if we hold that investment for over a year as a UK plc, subject to the UK not changing its tax regime, which may occur, from the recent statements that have been made in the UK. We wouldn’t have any capital gains tax and can apply for a substantial shareholder relief on exit with HMRC.

We tend to look at seven core categories, when we're looking at a potential investment, and there's an eighth category, which is a special situation that falls outside of our usual remit. Going through these categories, we look for assets or investments where we believe there's a significant potential of a discovery, country first mover advantage, where we believe that there's the potential to apply improved exploration techniques or have a new approach to exploration, exploration value uplift ie. brownfields, financial restructuring opportunities, an M&A opportunity ie., we believe that the investment has the potential to be acquired by a third party in the short to medium term or indeed have a discovery in the near future. Economic trading opportunities are more focused on macro and micro trends.

Economic trading activity is more of our passive equity investment framework, as we believe good assets will perform regardless of the cycle, depending on where they sit on the development curve.

While we are looking at new opportunities to fit one of these categories, ideally, we would like multiple boxes to be filled.

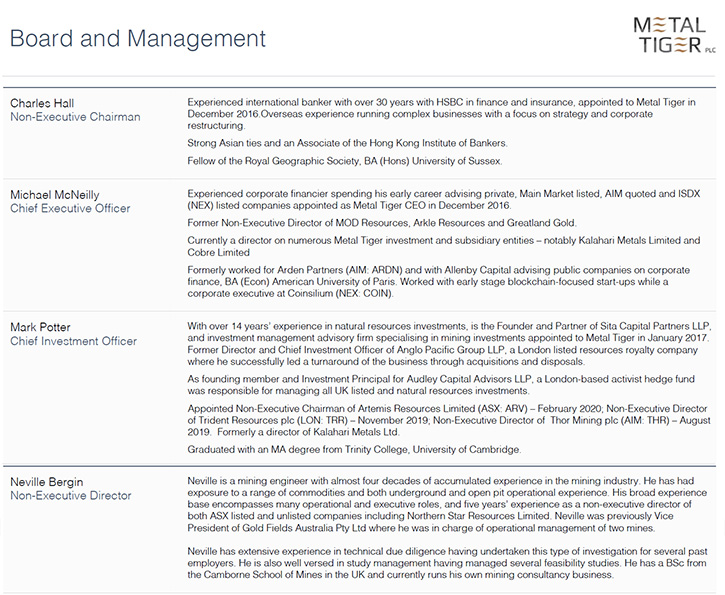

We are led by a Board, which is very corporately minded, but relies quite heavily on technical advisors. We recently brought on a gentleman named David Royle, to replace the experience that we had with Terry Grammer, a mentor and fellow Director, but who tragically passed away a few months ago. David is well known in the Canadian markets with over 46 years of experience a very long and interesting CV, which I'd invite you to look at on our website.

Running through the Board quickly. We have Charles Hall, who's our Chairman, ex-private banker, with HSBC and was the CEO Managing Director of HSBC Private Bank, Luxembourg and enjoyed a 30+ year career, with HSBC and has worked on some very high profile restructuring deals in the UK and has a wealth of UHNW clients. Myself, CEO. I'm a corporate financier, who used to work in London running IPO’s, RTO’s and M&A deals before venturing out to pursue a different path.

I've been with Metal Tiger for over four years now and have been CEO for over three and a half years. I was instrumental in the deal that saw us vend our 30% project interest in T3 into MOD Resources, but I should also tip my hat to the numerous advisers and the rest of the Board and Management Team that helped with that process, which ultimately culminated in MOD being sold less than a year later to Sandfire Resources. I sit on the Board of numerous of our Company's investments. Notably, Cobre Limited, which is listed on the ASX, and Southern Gold, which is also listed on the ASX, as well as our project investment Kalahari Metals Limited. I was previously on the Board of Greatland Gold plc, but regrettably resigned when Metal Tiger exited for an excellent return, but prior to them drilling Havieron. Thankfully we did reinvest and did well. We also have a gentleman named Mark Potter, who is our Chief Investment Officer. He's formerly a Director and Chief Investment Officer of Anglo Pacific Group PLC, which is a diversified royalty business. He was one of the founding members of Audley Capital, which was an activist hedge fund, a generalist, but also did several investments in the mining sector and perhaps the most notable deal was the successful distressed investment and turnaround of Western Coal Corp. and it's eventual 3.3 billion Canadian sale to Walter Energy Incorporated, which I believe netted their firm well over $600 million. Mark Potter, notably, is also Non-Exec Chair of Artemis Resources, where we recently invested A$500k and Trident Royalties plc where we recently invested US$700k. He also represents MTR’s interests on the Board of Thor Mining plc where he has been instrumental in cutting costs.

Finally, we have a gentleman named Neville Bergin, who is a mining engineer, with over four decades of technical experience. Multiple commodity operational experience and was previously VP of Gold Fields Australia. Aside from Neville’s vast experience he has been particularly helpful when assessing later stage potential investments, brownfields, and also the earlier stage investments. It’s critical to have a view as to whether or not an asset may or may not have the potential to be a mine one day.

In terms of our other technical advisors, we have a few, who are on consulting contracts, but are not named publicly as they have multiple clients. We try to identify and use people through our network, who have expertise either in a particular region, a particular geography, or a particular country, or a particular deposit type, when looking to assess investments. We think it is better than trying to rely solely on an internal team, because at the end of the day, technical talent is often quite specialized or has specific experience. Whilst you can have a lot of varied experience, it is good to speak to the experts in their respective fields.

Dr. Allen Alper: Could you tell our readers/investors what areas of the world you are looking at, and also what metals and minerals? And then some examples of the investments you have made and the projects you have going.

Michael McNeilly: Certainly. I'd say we're mostly weighted towards copper, in which we are huge believers, but to simplify we have a core focus on base metals and precious metals. We recently diversified into gold, by investing in a company called Southern Gold, which we can come to later.

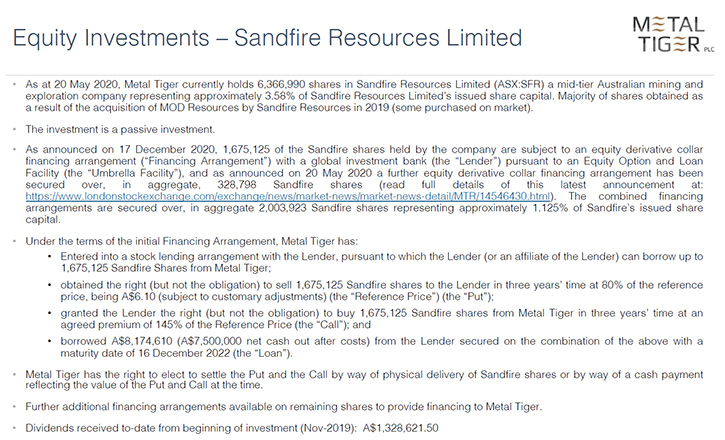

Our largest investments include a company called Sandfire Resources, where we own 3.53%, just under 6.3 million shares. That really is the linchpin and the backbone of a lot of the value, within our Company. Sandfire is a producer, with a mine which is known as DeGrussa in WA. It has roughly three years of mine life left. They also have a development project in Montana, called Black Butte, held via its majority equity stake in Sandfire Resources America, which is listed on the CVE.

Sandfire acquired our 30% joint venture with MOD Resources, as well as MOD Resources. That occurred and completed in November of last year, and that's the genesis of us having that stake in Sandfire. We were the largest shareholder in MOD Resources, and I was on the Board of MOD. We went through a lengthy and difficult process at the board level to determine the best outcome for all shareholders. Essentially we had to determine the optimal path for shareholders, considering whether MOD should try to raise financing for development (ie. go at it on our own), bring in private equity or effect a sale of the entire Company. Eventually we received an attractive offer from MOD, having run a thorough process, which led to a scheme of arrangement with Sandfire, ultimately buying MOD Resources and exercising an option to acquire our 30% JV stake. Since then, Sandfire Resources has been very active and we expect that they will be coming to a decision to mine over the T3 copper project in Botswana, in the coming months.

They also have uncovered a new deposit, eight kilometers away from T3, known as A4 on which they've been aggressively doing a drill-out, to generate a maiden resource, which we anticipate should be available in the coming months. That is quite critical because as part of the deal structure that we had with MOD Resources, we had pre-baked in an option for anybody acquiring MOD to acquire our 30% joint venture, which would leave us with a 2% NSR over the joint venture ground excluding the T3 project (which had previously been vended into MOD). The royalty is uncapped and with no buyback provision.

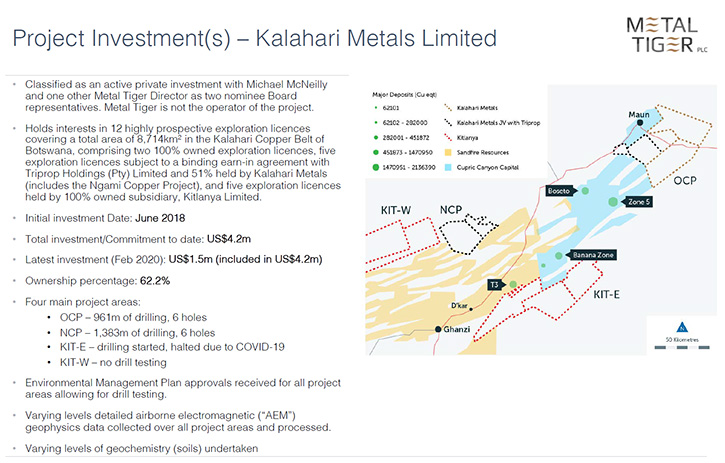

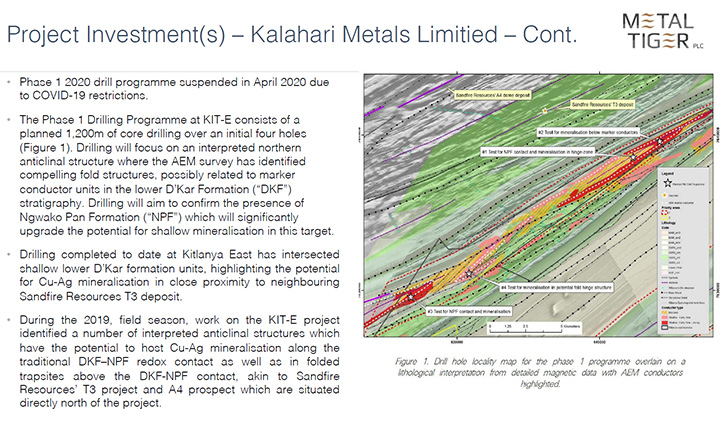

What we have is around 8,000 square kilometers, covered by that royalty on any future production. What we're hoping is that the assets for the A4 deposit will be drilled out and a maiden resource put on it, which will start to underpin a base case value for that royalty. Then one could get into all sorts of forward looking projections as to how much Sandfire will look to spend on exploration in the coming years and certainly in the coming next 12 months. I think what's most interesting for people to try and understand about why we're particularly excited about this, is we understand the geology quite well at Metal Tiger, having been involved in that joint venture with MOD and we also have another asset and that is Kalahari Metals, where we own 62.2%, which has over 8000 square kilometers of largely prospective ground in the belt as well.

Quite critically, a portion of the licensed tenements are just five kilometers to the South of T3. In fact, there's an announcement that went out on the 16th of June, showing the detailed analysis that we've done in terms of reinterpretation of geophysics and analysis of Geochem data. I know many people say, "Well that could just be close-ology." But this came about really as a result of a tremendous amount of analysis we have completed.

We've resumed drilling just this week and we believe that we are in the correct host rock. That's not just been confirmed by our own team. We've brought in a sedimentologist, who is specialized in the area to confirm that we are indeed in the lower D’kar, or at least the D’kar formation. We’ve compared mag susceptibility from the holes completed pre-Covid against publicly available data and this comparison also supports that thesis. So we are currently drilling a start hole and we are hopeful that that this will prove the prospectivity of this 22K of strike to the south of Sandfire's licensed area in the T3 project.

In terms of that royalty, the interesting thing about A4, compared to other deposits in the region, is that traditionally the deposits have been found hosted along the D’kar /Ngwako pan redox contact. The deposits have often been very vertical; meaning lots of tons per vertical meter when mining, but with decent grade and often with oxide/transition material nearer to surface. And what T3 and A4 are showing is that there's a potential for this mineralization to have been thrust up and to come up near surface so that you have something that is open pittable.

Also interestingly, we've identified these domes, essentially large anticlines throughout the belt using airborne electromagnetics and modern processing. The carbonaceous units act as a nice start marker unit and what we foresee is that at A4 there's actually a break in the EM conductive marker unit where the mineralization has come up. So hopefully that is adding a new profile, of where to actually target the drill holes and where previous explorers haven’t properly tested for mineralisation. So, it’s a different paradigm to what traditionally companies would have been looking for. We think it's going to open up a whole new range of targets for Sandfire to drill and also for Kalahari Metals to drill.

Sandfire has announced that it's committing an Aussie $20 million budget for exploration this year. Now how much of that will be going towards infill drilling and drilling out a resource at A4, I don't have the breakdown of that, seeing as we don't have any representation in Sandfire. But, based on satellite imagery and their press releases it’s clear they are going for it aggressively. When we last spoke the MD of Sandfire seemed exceptionally excited about the potential of A4 and for the potential for it to be a mine that would provide feed to a T3 plant should there be a decision to mine.

If one starts putting a probabilistic model together of how many additional and potentially near surface copper deposits, based on improved EM targeting, could be found within the vicinity of T3 and A4 and discounts the wider license package potential, well the value of that royalty could be absolutely astonishing relative to the current market cap of Metal Tiger. The nice thing is that all that value is being added with other people’s money. This is the kind of royalty that I believe would attract a lot of interest in three to four years’ time, assuming things go well. I’ve already been asked if we’d be interested in selling the royalty and have politely pointed out the obvious. I believe if we ran a formal sale process post a maiden resource, we could attract a substantial cash offer even in the next six months. Frankly speaking though we’re happy to see how things play out and we would like to see a result that is well in excess of Metal Tiger’s current market cap, if we did look at selling that is. We’re going to have a copper bull market at some point in our timeframe and so it will pay to be patient. In terms of how we've been financing our investments, when we got the Sandfire shares in November, we moved very quickly to figure out how we could potentially leverage/borrow against the shares. We ended up signing an agreement with a large investment bank, which allowed us to put in place a collar facility, and basically borrow against our Sandfire shares, protected 20% on the downside, by a put, but also capping our upside to 45% to the strike price of the caller by selling a call option. These collars have all been done on a three-year term and at varying strike prices

To date we've collared circa 2.5 million Sandfire shares, which represents about 1.44% of their issued share capital. And we still have a large number of shares remaining, which we can use to draw down against to finance new investments and support existing investments. Part of the strategy has been to go into investments where we believe they fit one or several those seven categories that I touched on earlier. We’re looking for investments that have the potential to outperform what we may give up on future upside in Sandfire shares. It's quite a unique financing model, but it gives us a lot of flexibility and a lot of financial firepower and also manages to leave exposure to the upside in Sandfire. It's a bit like having your cake and eating it too. Sandfire has historically paid a dividend .We've received total dividends from the investment of circa 1.3 million Aussie and we're expecting the next dividend to be announced shortly and paid in September. I can run through some of the other investments if you would like.

Dr. Allen Alper: Yes.

Michael McNeilly: So, let me quickly go through the Kalahari Metals project investments, which I only touched on briefly earlier. We have four main projects at Kalahari Metals, given our ownership of 62.2% that is structured with two Board members from Metal Tiger and two Board members who operate and serve as representatives of the other shareholders, and are both large shareholders. It is operated by the other two Board members, in particular a gentleman known as Adam Wooldridge, who is a geophysicist with over 20 years of experience, and who runs a geological consulting company. We get very good rates. And with him and the team as well as our experience with MOD we understand the belt exceptionally well.

The total investment slash commitment to date is US$4.2 million. The latest investment was $1.5 million US dollars, which we made in February of 2020 which is part of the $4.2 million. That is financing the current drill program. Prior to this drilling campaign we’ve drilled two of the projects. That's the Okavango project, which is looking for more of your steep traditional contact hosted mineralization. Our best hole was probably our 6th hole and certainly it showed us that the system is mineralized. Having done an analysis of all the other deposits in the area of similar nature, certainly merits some further drilling in due course. We also looked for mineralization at the Ngami project in anticlinal fold hinges, which could present good trap sites, but unfortunately whilst we hit the contact, we couldn’t piece together a good geophysical model for further efficient targeting as the EM conductor turned out to be a different stratigraphic package than what we were hoping for. Doesn’t write off the project by any means, but certainly, when combined with the fact Kalahari only owns 51% of the project, with a company called Triprop owning the other 49% so it pushes the project down the priority list.

We believe it's better to prioritize drilling in the more strategic 100% Kalahari Metals owned Kit-East project. We would like to do some follow up drilling at OCP and put some strat holes in at KIT West where, we haven't done any drill testing to date. We have done some geophysics and some soils and have some encouraging but early targets.

Both KIT East and KIT West were pegged by the same team involved in the discovery of Kamoa and of note Dr Ross McGowan, co-recipient of the PDAC Thayer Lindsley Award for an international Mineral Discovery (Kamoa). The rationale for pegging that ground was that it sits on what we believe to be the basin margin, which is a very good place to be looking for copper deposits. It's still very early days, but I think as Sandfire starts to explore aggressively, in the coming years, and indeed as we look to continue to explore in the region, if we can continue to prove that we're in the right host rocks, eventually we believe that we can have some exploration success there.

All of the license areas are approved for drilling. We've received our environmental management plans and we've done a large amount of geochem and also, although we would like to do a fair bit more detailed line spacing EM over some portions of Kit-East as well as KIT West, the priority for now is drilling. For people reading this, it's very important to note that one should be careful and cautious when people quote large land packages, that not all of that 8000 or so square kilometers that I mentioned will be in the right rocks to host potential mineralisation. So, again, proceed with caution and try to understand that there may only be a few areas, which will actually be prospective within large license holdings. But both the OCP project and the KIT West and KIT East projects do appear to be in the right rocks. The OCP project is a long strike from major deposits.

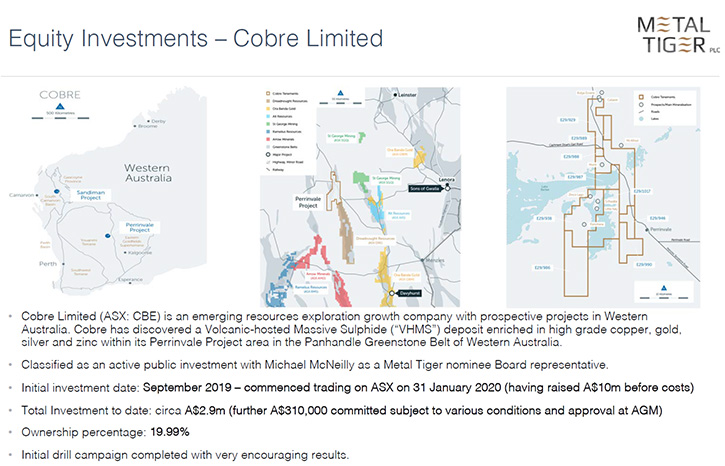

We also invested in a Company called Cobre Limited, which had a discovery hole prior to us investing. We invested in it privately for about A$500,000 middle of last year. And then we made a commitment to support it on an IPO. It IPOed at the end of January on the ASX and to date we have invested a total of A$2.9 million and have committed to invest a further A$310k subject to shareholder approval. So, we invested a total of $2.9 million Aussie; $2.4 million on IPO and $500,000 privately.

In its maiden drill campaign, the best assayed result was 5m @ 9.8% Cu, 3.2g/t Au, 34g/t Ag, 3.1% Zn from 50 meters. Again, with VHMS, there's a potential for it to be small, but there's also the potential for the deposits to occur in clusters or have potential at depth. We’re on a major drill campaign to further test Schwabe but also to test regional targets. Have really been doing things by the book, using airborne, surface and downhole EM as well as soils. We have also done some gravity work.

We're in the midst of a 6,000-meter drill campaign currently and I'm looking forward to getting the results and the assays back from that in due course. We own just under 19.99% there, but we will be investing A$310,000, which is subject to shareholder approval of their AGM, which will take us back up to 19.99%. I sit on the Board of Cobre Limited.

Dr. Allen Alper: Sounds like excellent investments. What are the primary reasons for our readers/investors to consider investing in Metal Tiger PLC?

Michael McNeilly: Absolutely. Well, I think more often than not, when investors invest in projects or companies that are focused on earlier stage projects, they don't have much downside mitigation. The nice thing about Metal Tiger is we do have a very strong balance sheet. We also don't have to spend any money to see the value potentially increase with regard to our 2% net smelter royalty. Sandfire is an excellent counterparty and is incentivized to spend money on exploration and ultimately development. In summary, we have a strong balance sheet, multi-commodity, multi-development curve and jurisdictional risk exposure.

So in some senses its diversified, but what is appealing is that several of the projects have the potential to deliver significant upside. Again, of course, we are like any company in that we are still relying on the drill bit to deliver discoveries and drive value but we’re not focused on one or two projects and most of our investments are held via shares with varying liquidity profiles. I would say we do tend to do a fair amount of due diligence on the investments before we get involved. Not all of them, especially smaller stakes get the same level of due diligence, but certainly where making significant investments we do a lot of work before making an investment decision. The earlier stage ones are higher risk, but we are looking for these companies that we invest in to make discoveries and or to bring in a big brother in due course. We’re happy to take a medium to longer term view and we like to be co-invested with what we assess to be supportive shareholders with access to funds.

We think there’s plenty of potential for high impact news coming out of the various investments. Major exploration success at any one of the larger investments could truly be transformational. In particular, we do have, what I consider to be a commanding position in the Kalahari copper belt at all levels of the development cycle. We also have a 2% net smelter royalty over Kalahari Metals 100% owned ground, so not the ground covered by the Triprop joint venture. And we also have a US$2 million capped 2% net smelter royalty over the T3 Project, which we do believe will pay off in the near future. I do want to touch on one other investment that we made just because I think it really exemplifies how we can take a slightly different approach.

We recently invested in Southern Gold Limited. To structure a deal there we spent over six months doing due diligence and engaging with management before being introduced to the company through Doug Kirwin whom we met at the Sprott Symposium in Vancouver in 2019. Doug is very well-known and respected in geological circles. He's the ex-Ivanhoe executive VP and exploration manager. He was part of a team that had discovered Oyu Tolgoi. He had discovered the Eunsan-Moisan gold mines in South Korea, and then they hit Oyu Tolgoi and Friedland basically said it's time to pack up shop in South Korea, and head to Mongolia. Southern Gold is basically the only public gold exploration play in South Korea. We see a nice read across to Irving Resources and Japan gold. It is obviously not ring of fire mineralization, but you are looking for low sulfidation, medium sulfidation epithermal, and Breccia pipe style mineralization. There may be potential for other styles of mineralization as well. Southern Gold is not focused on orogenic gold as it is believed that this has been well explored and exploited historically.

We think South Korea is very under explored for gold. Unfortunately, whilst we had been looking for a very aggressive $10 million Aussie raise, which was raised and commitments had been made, COVID-19 derailed that raise, so the company ended up only raising A$4 million. Covid-19 has also stymied the pro gen aspect of the business as it has made getting expats into the country and back home again very difficult. We got comfortable when we conducted our site visit. The late Terry Grammer and I visited along with their technical team in November of last year. We quickly realized that, every time they were sending their pro gen teams out to conduct boots on the ground, exploration they were finding new areas with outcropping veins. The Southern portion of the country is largely under explored. We think they have an excellent team of geologists and local support and proved to us that they can operate in country. We just think it's a numbers game and a matter of time, and clearly a matter of dollars.

We didn't get the amount of dollars that we wished to raise to execute on our core strategy because of COVID-19. Ultimately, we got a very attractive entry price and structured the deal in a fashion of our liking. I'm confident that when flights resume and they can get the pro gen team back in place, we will continue to add new projects and hopefully build a very exciting gold country play. A lot of people will be thinking South Korea. Why would you go there? It doesn't have a mega mining industry. Frankly, because when you drive around you can go anywhere in no-time, there's excellent infrastructure. There's excellent access to power and internet and where they are exploring is not densely populated. The operational team was clearly focused on working with the locals and the addition of Bee Jay Kim to the Board and the interaction between him and the locals gave us a lot of comfort. They're a very industrial nation, which would explain why they've overlooked a lot of the gold mineralization since the Korean war. At some point, if we can prove up enough potential and or discover a viable gold deposit, I believe it will be of interest to other players much in the same way as Irving Resources and Japan Gold attracted the majors. It's very early, but certainly has the right technical expertise there and the right geological potential. There are high barriers to entry and so they have a great first-mover advantage. I look forward to hopefully pursuing a much more aggressive drilling and pro-gen campaign once we are past COVID-19 restrictions.

Dr. Allen Alper: Well that sounds very exciting. It sounds like you have some great projects that you invested in. Great opportunity for growth and for wealth increase.

Michael McNeilly: Absolutely, and we're continuing to look at new investment opportunities daily and we’ve been actively investing and trading quite successfully.

Dr. Allen Alper: Well. That's excellent. That's really fantastic. And it sounds like this is a great time for it because it looks like everything, from what I understand, copper, gold, silver, and other metals are getting stronger and stronger. And the forecast is very promising.

Michael McNeilly: I'm very, very encouraged by the recent rise in the copper price. I think gold has a potential to go significantly higher, given the amount of money that has been printed globally, not just the USD. And I think most central banks and treasuries don't trust each other and will be looking to acquire a more physical gold. I think it's a great time to be in the gold space. It may not last past 12-18 months but let’s see. We made the wrong call on COVID-19 and believed that it would be more akin to SARS and therefore we didn’t cash up like we should have to take advantage of the drop as much as we would have liked. Plus thinking back to the mood in March it was a very confusing time. Luckily we did go into it COVID-19 with a very strong balance sheet, having written a collar at a reference price of A$6.10 over Sandfire shares and received net cash out ofA$7.5 million. I wish we’d done more in hindsight.

II think there's a great outlet for the commodities that you mentioned. If one thinks about the real economy, well, most governments are going to have to push large infrastructure budgets to try and prop up GDP growth as portions of the real economy are inevitably going to suffer for quite some time. Infrastructure spend and USD being printed is usually a good thing for commodity prices. I think we're heading into a great time, but it is hard to call on the supply/demand equation. I don't know if the supply demand side of the equation on copper, which is I think helping to drive the price up, as well as China actively buying, will be short-lived or longer lived. Even if copper does drop again in Q3/Q4, I think come Q1/Q2 2021 we could have a serious commodity price boom. The US election and the US China trade war are going to be critical factors and I think we’ll see more volatility and uncertainty as we get closer to November.

Dr. Allen Alper: Well there's a great demand for copper, an increasing demand with electrification in autos, and power, et cetera.

Michael McNeilly: Yeah. And I guess the truth is if you're going to be spending money on infrastructure, you're going to be building for the new green economy. And I also think a lot of people won't want to be taking public transport as much, but this will be balanced with fewer people working in offices. I think there's going to be a push for urban personal mobility in many major cities and I would like to see this transportation switch to being more electric. The growth in the two-wheeled electric scooter market will be interesting. A transition to electric will require more copper and it will require increased charging infrastructure. And I think governments, certainly in the West, where they are largely elected into power aren’t going to fight the trend. I think governments will promise and hopefully do what they think the people want and that is to be more green and to switch to electric. So that is my slightly cynical take on it, but it's obviously good for copper.

Dr. Allen Alper: That sounds good. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.metaltigerplc.com

Michael McNeilly

(Chief Executive Officer)

Tel: +44 (0)20 7099 0738

|

|