Talon Metals Corp. (TSX: TLO): Joint Ventured with Rio Tinto on the High-Grade Nickel-Copper-Cobalt Project, in Minnesota, USA; Sean Werger, President and Dr. Etienne Dinel, VP of Geology.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/30/2020

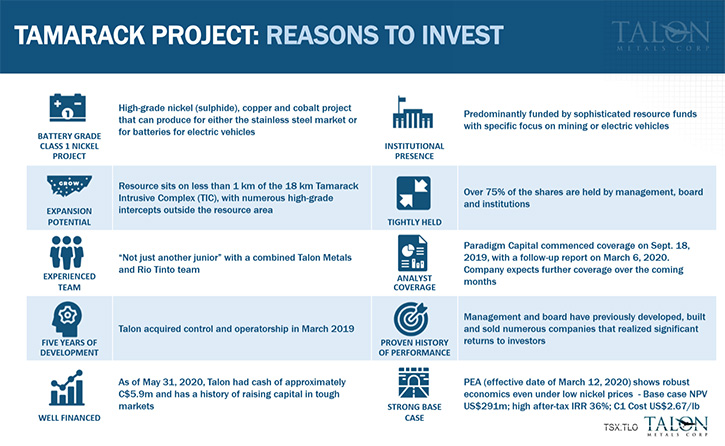

Talon Metals Corp. (TSX: TLO) is a base metals company, in a joint venture with Rio Tinto, on the high-grade Tamarack Nickel-Copper-Cobalt Project, located in Minnesota, USA, comprised of the Tamarack North Project and the Tamarack South Project. Talon, the Tamarack Project operator (as of October 2019), has an earn-in right to acquire up to 60% of the project. We learned from Sean Werger, President of Talon Metals, that they think having Rio Tinto as a partner gives them an operational and strategic advantage, and the Tamarack Project is the only high-grade nickel sulfide deposit based in the United States, after the Lundin's Eagle Mine. The PEA shows that the project will be a low-cost producer, with lots of optionality. According to Mr. Werger, if you get involved in Tamarack and Talon, you're positioning yourself both in a commodity and in a project that are well-positioned for some very serious growth over the next few years.

Talon Metals Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Sean Werger, who is President of Talon Metals Corp. I’m also talking with Dr. Etienne Dinel, VP of Geology. Sean, I wonder if you could give our readers/investors an overview of your Company and what differentiates your Company from others?

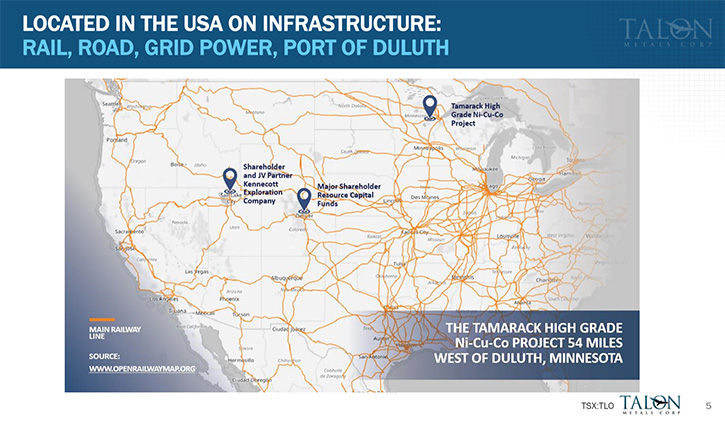

Sean Werger: Our Company is Talon Metals Corp. We are currently partners with Rio Tinto through their US subsidiary, Kennecott Exploration, on a high-grade nickel sulfide project that's located in Minnesota. It's called the Tamarack Project and it's in the town of Tamarack, Minnesota.

A number of things, ultimately differentiates us:

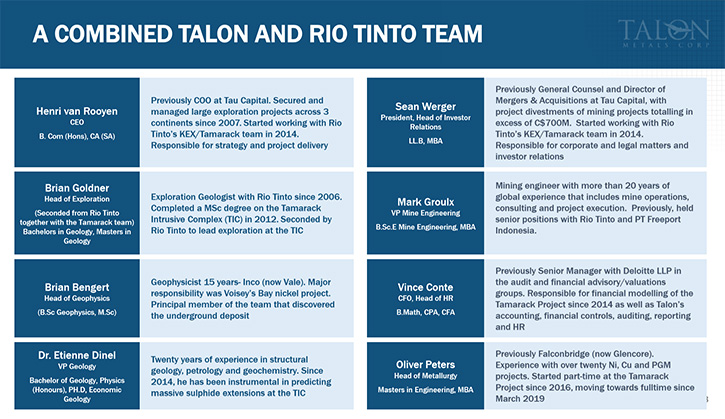

First of all, I would say, it is that special partnership with Rio Tinto. We're not a typical junior mining company because of the way we're structured. Our team is actually combined with that of Rio Tinto's team. So while we have the benefit of members, with whom we've worked, as part of the Talon Metals team, for a number of years, through a number of historical exploration projects, we've also been able to bring on board people, such as our head of exploration, who is a full time local Rio Tinto employee, who has been seconded to our team, on a permanent basis, for the Tamarack Project. So we have excellent support from Rio Tinto. They're excellent partners and they continue to show their support for the project by actively participating in quarterly technical meetings, even though our Company, Talon Metals, is currently the operator of the project. So that's one thing that differentiates us.

In terms of the project itself, I would say it really stands on its own merits and can differentiate itself from other projects that are out there. It's a high-grade nickel sulfide deposit, based in the United States. Currently, there is only one operating high-grade nickel sulfide project, within the United States. It's called the Eagle Mine and it's owned by Lundin Mining. They have said that project will be mined out by 2025. After that, in terms of high-grade nickel sulfide deposits in the United States, Tamarack is the only one.

I think that positions us in a very unique circumstance, where we are the only high-grade nickel sulfide deposit, based in the United States. As you probably know, one of the current uses of nickel is in lithium-ion batteries for electric vehicles. We think that it could potentially be very strategic to have a project located in the United States that could potentially help create a domestic supply chain for the electric vehicle market.

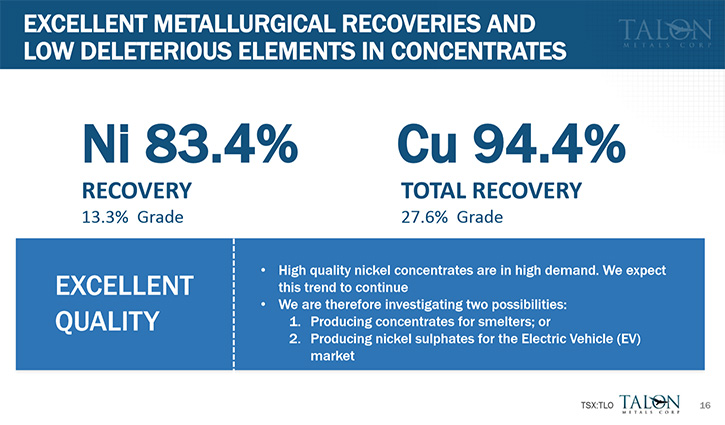

But having said all of that, because we're high-grade and because we have straightforward metallurgy, the other unique aspect of the project is that we, unlike many other nickel projects out there, are not reliant upon the electric vehicle market to take off, for our project to be successful. We expect to be a low cost producer and so we expect to have the optionality to produce profitably for either the electric vehicle market or the stainless steel market.

There are numerous ways in which we differentiate ourselves from others. But Tamarack really is a very special project and that's why our group worked so hard to be involved in it.

Dr. Allen Alper: Oh, that sounds excellent. I wonder if you could tell our readers/investors a little bit more about the Talon-Rio Tinto team and about your background too, Sean.

Sean Werger: The core group of Talon Metals has been together for about 15 years. It's combination of corporate, I'm a lawyer by background, as well as those that have basically grown up and lived with mines their entire lives, plus Etienne, who's on the call with us, who's been our senior geologist for many years. So the core Talon team has been together through numerous projects, historically mainly focused on Africa and South America. Together, we have developed a very successful track record for developing projects that ultimately have been purchased and taken out by some of the other major mining companies. We previously did that with two platinum projects of ours in South Africa, one of which the group had invested approximately $30 million and exited that project for about $500 million over a two year span. We had another project where we invested approximately $20 million and also within a two year span exited for about $200 million. Those are just a couple of examples. We've been involved in numerous projects that we've successfully taken through to a point where a major or mid-tier company has wanted to purchase it.

In terms of the team at Tamarack in particular, we have added to the team. We've added to the bench strength of the team. We now have a consultant metallurgist, who previously worked at Xstrata, previously Falconbridge, and we also have brought in a geophysicist that worked on Voisey's Bay. So lots of expertise within the group and really an excellent group to take this project forward.

And then, as you touched on, we have the additional benefit of our joint venture with Rio Tinto, from whom we have seconded a number of Rio Tinto employees to be part of our team. So we have that many years of experience. Those people, in particular, have been on the Tamarack project for numerous years, so we have the benefit of that continuity as well. We really are set up to take this project right through, and we've set ourselves up with an excellent team to do that.

In terms of the deal with Rio Tinto, we are currently the operator of the project. We took over operatorship of the Tamarack Project in October 2019 and we are now basically in control of the strategic direction of the project, albeit we often consult with our partner, Rio Tinto. We have an earn-in to earn a 60% interest in the project. Once we have a 60% interest, Rio Tinto will have a 40% interest in the project, with no back-in rights.

As operator, Talon completed our first exploration program at the Tamarack Project just a couple of months ago. Etienne can tell you more about that particular exploration program. In addition to that, we just raised some capital recently, and we're actually preparing for a further exploration program this coming summer at Tamarack.

Dr. Allen Alper: That sounds great. Maybe Etienne could tell our readers/investors a little bit about exploration plans for this year going into 2020.

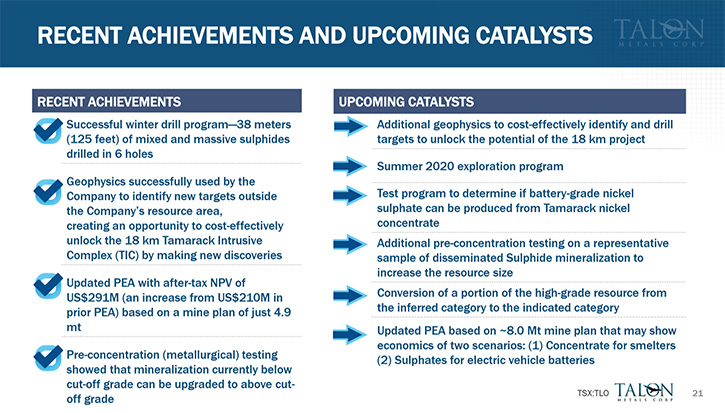

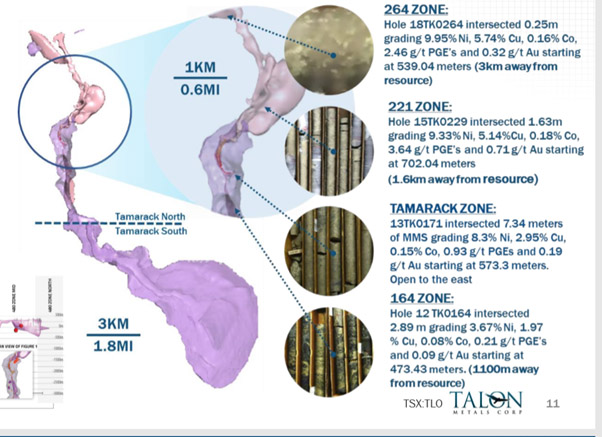

Dr. Etienne Dinel: We would like to continue to pursue our success that we had over the winter, with our drilling program, where we've drilled over 38 meters of the high-grade massive sulfide unit, with some exceptional grades in six drill holes. We've also proven that the geophysical technique of surface EM is an excellent tool to identify mineralization, such as the Tamarack resource and we plan to expand the exploration by doing surface EM over the whole 18 kilometer intrusive complex. The Tamarack resource is roughly over an 800 meter strike length of the intrusion. However, we have 18 kilometers of strike of that intrusion to explore and to properly identify targets for the next drilling programs. The goal is to find more mineralization at Tamarack, even a second or third, maybe another deposit along the intrusive complex.

This surface EM tool enables us to identify mineralization, viewed with the surface EM as a conductor. We can see from surface down to a depth of at least 600 or 700 meters. We're hoping we can see even deeper with the method. The goal is, over the month of June and July 2020, to deploy a surface EM over an area of almost five kilometers of strike length. Hopefully by early August, we will have a few genuine, decent-sized targets to drill in August.

Dr. Allen Alper: That sounds excellent. Sounds like it's going to be a very exciting year. You have a great project, so that sounds excellent. It'll be a lot of fun for you and your team.

Dr. Etienne Dinel: That's correct. There's no shortage of ideas and areas to drill, and to pursue. We had a few good historical drill results, as high as close to 10% nickel that we really need to follow-up, with proper exploration on the next step.

Dr. Allen Alper: Oh, that's excellent.

Dr. Etienne Dinel: Thank you.

Dr. Allen Alper: Sean. I wonder if you could tell our readers/investors a little bit about your share and capital structure.

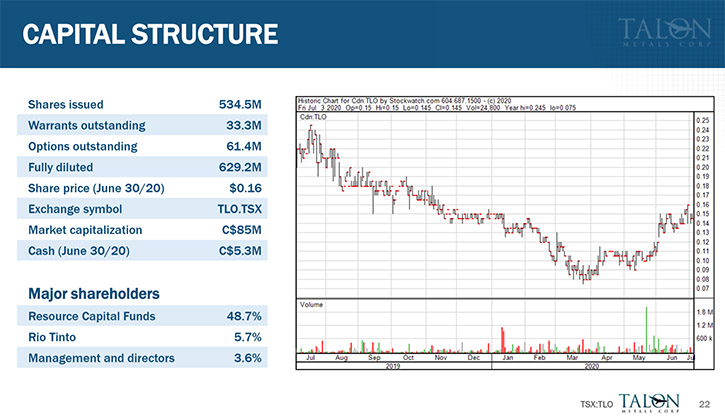

Sean Werger: Currently, the Company has approximately 534 million shares issued. In terms of our market cap today, we currently have a market cap of approximately $70 million. /*** Since the time of the interview it has grown to $135M ***/

The Company benefits from an excellent shareholder base, especially on the institutional side. Resource Capital Funds is currently our largest shareholder. They are a pure play mining private equity fund. They currently have approximately a 48% interest in Talon.

Beyond them, we have numerous mining-specific institutional partners that span from North America, the UK, and even a number of shareholders that have recently come into the Company from Australia. So we're very well supported. We just completed, in May 2020, a capital raise. So now we have a strong treasury. We raised the money amidst a macro environment that, as I'm sure you will agree, is virtually impossible for junior base metals companies. So having the success of raising the money recently, we think, in and of itself that shows the quality of the project. Now we have the proceeds that we require for the upcoming summer program that Etienne had touched on.

As Etienne mentioned, the real focus and goal of the summer program is to do some very major step-outs, potentially a kilometer away from our resource area, with the goal of using the geophysics to try to make a new discovery at Tamarack. The existing resource itself is robust, but now we really want to see how big the project can get because there have been lots of historical drill holes outside of the resource area that have hit high-grades of nickel, 4% to 10% nickel in zones that are kilometers away from the resource area.

Dr. Allen Alper: Sounds excellent! Could you give me the highlights of the preliminary economic assessment?

Sean Werger: The PEA, first of all, is currently based on only a portion of the resource. The PEA contemplates 4.9 million tons of material going into the mine plan. Going forward, we do plan to update this PEA, which we expect will include the entire resource, within the mine plan. But having said that, just with a portion of the resource, the PEA showed an after-tax NPV of US$291 million and an after-tax IRR of 36%, which is obviously excellent. Our C1 cash cost was at the lower end of the cost curve for sure. And then in terms of capex on the project, a $220 million of initial capex, so a financeable project.

Just the initial PEA, in and of itself, we believe demonstrates for our investors that with the resource that's there today, one can feel confident that there is a robust deposit there that should work in almost any nickel environment. The question for an investor is: How much bigger can the deposit get? But even with no further exploration success, the PEA shows that this is a project that is economic. The C1 cost of $2.67 per pound of nickel in concentrate shows the project will be profitable in high and low nickel price environments.

Dr. Allen Alper: That sounds very good. Excellent! Could you tell our readers/investors the primary reasons they should consider investing in Talon Metals?

Sean Werger: As an investor, coming in, you have a robust deposit to begin with. The numbers show that the project today is economic, even at low nickel prices. This is unlike most other nickel projects, out there, that are relying upon the price of nickel to rise in order for them to be economic and for them to be successful. Tamarack, as it exists today, does not require a higher nickel price. Beyond that, the current resource sits on a small portion of the Tamarack intrusive complex. It sits on 800 meters of 18 kilometers of strike, with a number of historical drill holes that show evidence of high-grade mineralization outside of the resource area.

Most investors get involved in junior exploration projects because they're looking for a discovery plus exploration upside. Well, the discovery is much more than a discovery at Tamarack. We have an economic PEA with a high after-tax IRR of 36% at this stage of the game. And then beyond that, we're now embarking on what I believe is the most exciting time to be an investor in Tamarack because of the exploration upside potential, outside of the resource area. There are a number of people that feel that Tamarack is going to prove out to be much larger than it is today.

That's the project itself, and then beyond that, you have the macro-environment in terms of the fundamentals of the nickel market, in particular, the expected nickel deficit as a result of new demand for batteries for electric vehicles in the coming years. We believe, again coming back to investors, that if you get involved in Tamarack and Talon, you're really positioning yourself, both in a commodity and in a project that are well positioned for growth over the coming years.

Dr. Allen Alper: Well, those sound like compelling reasons to consider investing in Talon Metals. Sean, is there anything else you'd like to add?

Sean Werger: I don't think so. I think that covers it. You’ve asked some excellent questions. We really appreciate you interviewing us for Metals News.

Dr. Allen Alper: We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://talonmetals.com/

Sean Werger, President

Email: werger@talonmetals.com

Telephone: 416-361-9636

|

|