Triumph Gold Corp. (TSX-V: TIG): Advancing the District Scale Freegold Mountain Project in the Yukon; Interview with John Anderson, Chairman and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/28/2020

Triumph Gold Corp. (TSX-V: TIG) is a growth-oriented, Canadian-based, precious metals exploration and development company, currently advancing the district scale Freegold Mountain project in Yukon. We learned from John Anderson, Chairman and CEO of Triumph Gold, that Freegold Mountain has a great advantage over others, such as the government-maintained road with access off the Klondike Highway, which goes through the property. The Freegold Mountain project has 2 million gold equivalent ounces at surface, where there has been extensive exploration work done over the last three years, as well as new discoveries outside of where that resource is. Near term plans include exploration drilling at the Freegold Mountain project. According to Mr. Anderson, Triumph Gold offers incredible leverage to the gold price, and, is one of the best risk/reward opportunities in the sector.

John Anderson, Chairman of Triumph Gold

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing John Anderson, who is Chairman and CEO of Triumph Gold. John, I wonder if you could give our readers/investors an overview of your Company and what differentiates your Company from others.

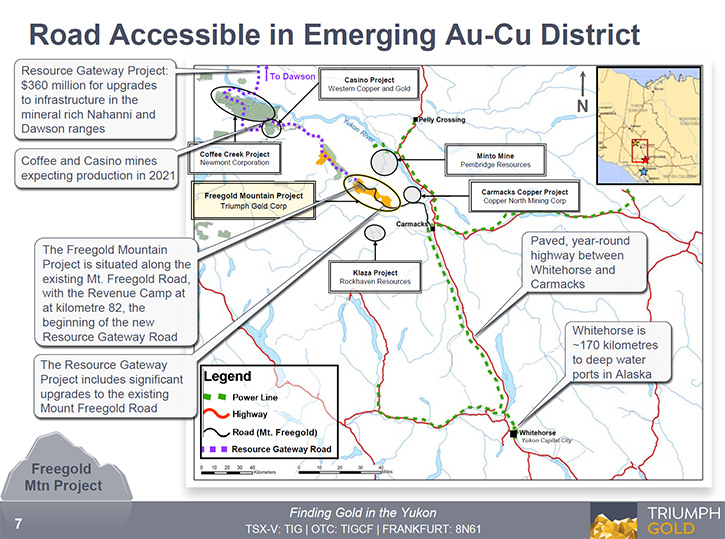

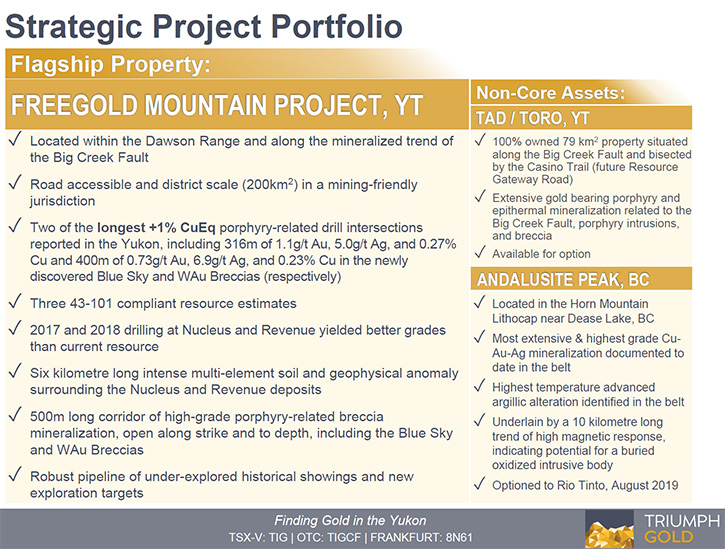

John Anderson: Great. Thank you. I really appreciate you allowing me to have this interview with you. Triumph Gold is a unique opportunity. We're a one project Company with a district sized property in the Yukon. It is one of the only ones that is blessed with great infrastructure. It has a government-maintained road that goes to our property off a major highway. It not only goes to our property, but through the majority of that property and all of our drilling locations. That has given us incredible advantages as far as the quick ability to move on things, but mainly for the cost. Our project is in a remote area, but again, because of the infrastructure, a lot of those costs and concerns are actually mitigated because of the access that we do have.

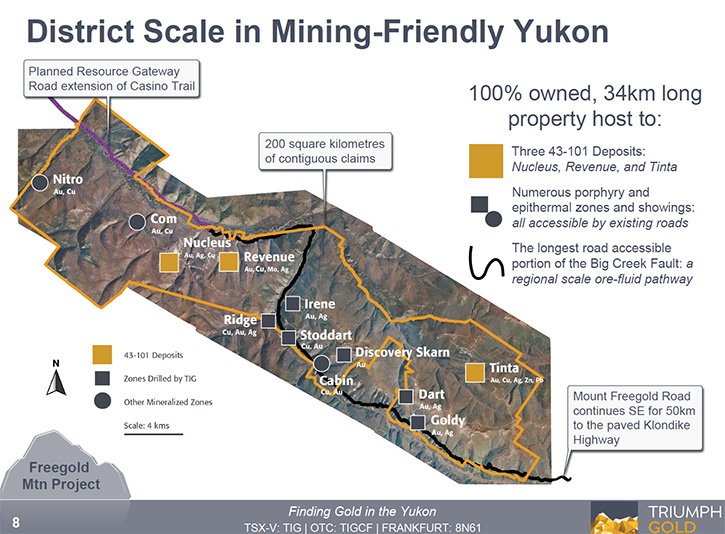

The property was put together by a second-generation prospector at the end of the last gold exploration cycle. Bill Harris was fortuitous to do that as he consolidated these properties into one big contiguous property that straddles the Big Creek fault, which is the big geological feature which controls many of the big deposits are found in the Yukon and down into BC as well as up to Alaska.

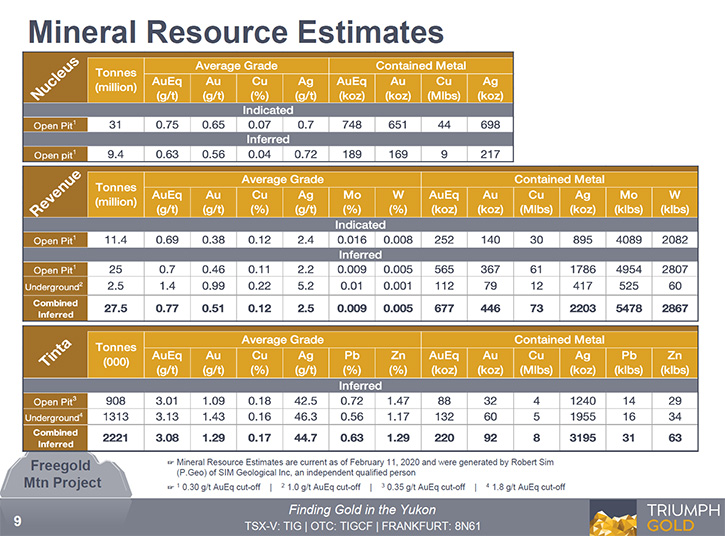

We are blessed, not only with the infrastructure, but the geology. There are some notable deposits close to us, including the Minto Mine 20 miles northwest of us as the crow flies. The mine has been operating for over a decade. There is the multi-billion ton casino deposit which has been being drilled since the 1970s and recently looked at differently with the current management of Western Copper. They just came up with that monster resource just a few weeks ago. 40 miles Northwest of us, is Goldcorp’s coffee project, which was subsequently bought by Newmont for $520 million in 2016. Not by coincidence, Newmont is our largest shareholder, owning over 15% of our shares. When we took control of the Company in 2015, it had some resources on it. We've updated those resources, open pit constrained resources that we just published in February.

This has 2 million gold equivalent ounces at surface, which is still open, Theis was also done at $1,500 gold and $2.50 Copper. Over the past three years, we've been doing a lot of work on new discoveries outside of where those resources are. I think that's where the real excitement is going into this years’ program. The opportunity with our Company now, at our market cap of just over $40 million, is that you're getting 2 million ounces of gold, essentially at $20 US market cap per ounce. You are also getting all this exploration work that we done over the last three years which we're going to follow up on this year and next year.

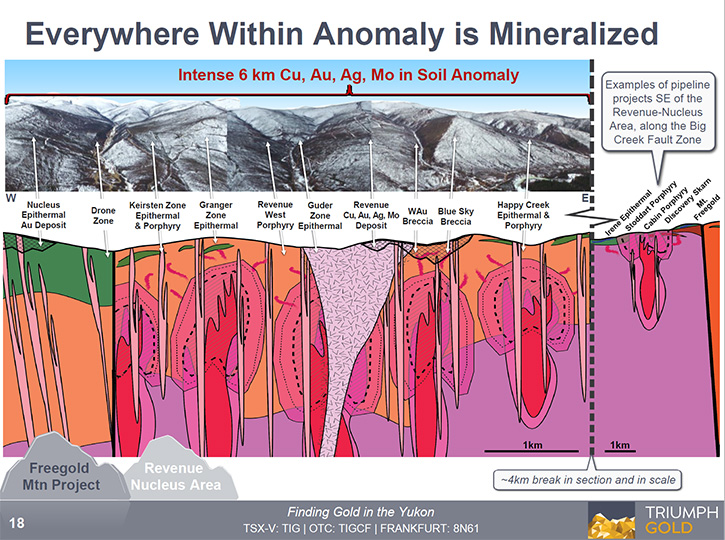

I think our shares were penalized pretty hard in the fall. In the last three years, our shares did extremely well, based on the discoveries that we did have and defied the bear market. We went up five, six fold in our shares. And now we've come back and given up some of those gains. We focused on the deep porphyry model that we were going after and were successful at finding it. But, a lot of people see these big porphyry models as really large company projects developed by copper companies. We have it, we've discovered it, but we're taking a different direction on the property this year following up on the high grade near surface targets.

We just completed a $6 million financing, more than enough to do our initial program. We spent between $5 and $6 million each of the last three years, but year, we won't be spending nearly that much. This is somewhat of a result of COVID-19, where we couldn’t access the property with our technical team until recently, due to the restrictions of the Yukon while we were planning and financing our plans for the property. Our technical team is not from Yukon or even British Columbia, where you're allowed access without quarantine. So we planned accordingly and now we are going to be on-site in August. We are going to be drilling. And we're going to be drilling some of those high-grade shallow targets that created a lot of excitement in the past. Even our shareholders, Newmont and another fund, were extremely happy to hear that we're taking this approach this year.

Dr. Allen Alper: Sounds like this will be a promising year for Triumph Gold! It'll be exciting as you start your drilling programs again.

John Anderson: It is exciting. Last year when we did those deep holes, and even the year before, we were drilling the deep targets. Those are expensive holes. They take a long time to do and take a long time to get results back. And of course, for the last couple of years, when we've delivered our results, they've been extremely late, because when you have problems with any part of the hole on your assay with QAQC, you have to redo the whole hole. However, we won't have any of those problems this year because we are drilling shallow holes which will be quick with a quick turnaround. We have plans to do some winter drilling in the new year as well, for which we are financed.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your background and your team?

John Anderson: I became involved in this Company as an investor, originally, in that IPO in 2006. I was a co-general manager of a fund based out of New York. We loved the thesis for Triumph Gold so much, we put in our own money. We also helped get co-investment in the Company. I was not really involved in Triumph Gold. We only took it over in 2015 because we saw the opportunity. I've been around in the resource sector for quite some time, since 1995, when I used to work at Bema Gold in investor relations and corporate development. That was a really great learning experience, where Bema went from an exploration company to a full development company to owning a world-class asset in Chile. So that was my first foray into the market and a heck of a learning experience with incredible people. After I did some independent work with a company called International Minerals that developed two mines in Peru that were bought up by Hochschild Mining and Arizona Star that was purchased by Barrick

Then there was this one other company that I was really excited about. Back between International Minerals and taking over Triumph Gold, We developed a project in the Philippines where we built a 200 ton a day mill on a 700,000 ounce deposit which was put that in production and sold it off. Triumph Gold, I took over in 2015 at the bottom of the market, because I know it had a substantial resource and I knew that this little project would be worth a lot more in a higher gold price environment because of the nature of the ounces and the amount of money that was spent on it. And I think we're starting to see the rewards of that patience.

We recently, involved a gentleman named Brian Bower in the Company. This was mainly because we're onto a block of rocks up in the Yukon that we think are pretty special. The previous group that we'd been working with were trying to drill off a big porphyry, thinking someone was going to buy it. So, if we have one of those big porphyries, how do we develop it? We did a search, and found Brian. Brian has actually built an underground blockcave mine as he was with New Gold when New Afton drilled it off. There he headed up that technical team. He's also worked up in the Yukon, on the Casino Project, where he drilled that, year round, in the 1990s. He thinks we're onto something special. Rather than just build up a resource and then work on a feasibility to hopefully sell off, we're now taking a different approach. I think you're going to see a lot more additions to the team with a strong technical base behind it.

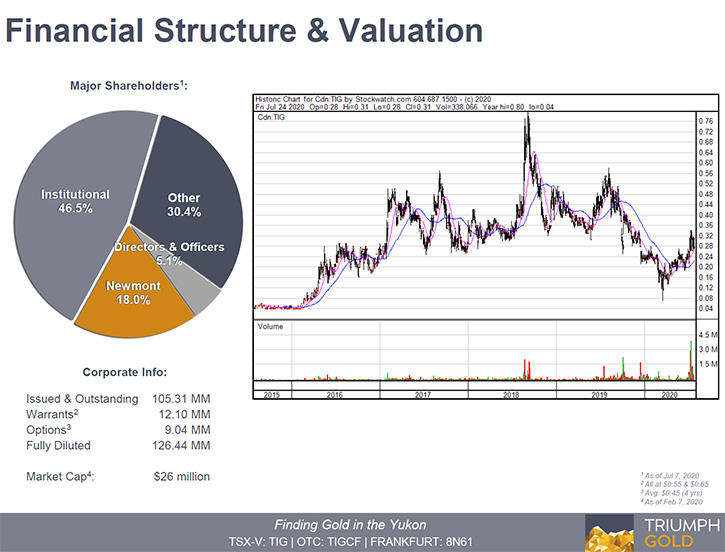

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors a little bit about your share and capital structure?

John Anderson: We have just over 120 million shares out, I think it's pretty interesting to see who the shareholders are. Newmont has over 15%. Palisades Capital has just over 10%, and Zijin Mining Fund, which is a subsidiary of Zijin Mining out of China, owns 10%. We have good institutions in there as well. Management owns a good 6% of the stock. We just closed a financing this past week and everyone actually participated on the management side. So that was really encouraging to see.

Dr. Allen Alper: Well, that sounds great. Sounds like you're in a very good position to move forward and explore aggressively.

John Anderson: We're going to do it. We think we have a tiger by the tail and we're going to shake it. We have a 2 million ounce resource already. As the gold price and the copper price increases, those ounces are going to be worth a lot more money, a heck of a lot more than they're trading at right now. I think the driver on the property is going to be these exploration successes we think we're going to have this year and next year.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in Triumph Gold?

John Anderson:Triumph Gold offers incredible leverage to the gold price. We're hugely discounted for the ounces that we have, so we will get that story out. We also have a district size play. We have twice our market cap of dollars spent on the ground. That data is still being compiled and put together for a real district size scale property. I think the best pitch of why to buy Triumph Gold is that it's probably the best risk reward opportunity in the sector. Your downside is very minimal because it's backed by 2 million ounces of gold. Your upside is incredible. In 2016, in the last, start of this bull market cycle, Kaminak Resources was bought for a hundred dollars an ounce, with near surface ounces similar to what we have. That was the purchase of the Coffee Project by Goldcorp that I mentioned earlier. So if we could get that kind of valuation just on the 2 million ounces, we have a substantial increase in share price, let alone everything else we're finding.

Dr. Allen Alper: That sounds like an excellent opportunity for our readers/investors.

John Anderson: We're also probably one of the more frugal companies out there. We do our exploration onsite, in the Yukon, because of our infrastructure, cheaper than anyone. We typically drill for between $200 and $250 per meter. That's all-in costs, including cap, everything. Our competitors are all typically over, $400 and up to $700 because the helicopter-assisted programs and the remoteness of their projects. So again, you get a really good bang for your buck on Triumph, but you also have people that believe in what we have and what we are doing. And, finally, we have a bull market in our back, which we haven’t had in years.

Dr. Allen Alper: That sounds excellent. Is there anything else you'd like to add, John?

John Anderson: Yes. I'm personally really bullish on gold. I'm not a gold bug, but I am really bullish on gold and copper. And this property just has it everywhere. I think for the first time in the last couple of years, we're going to go out and really tell that story, explain to the marketplace what we have, and rather than raising the money directly, we're starting to get a lot of interest from bankers, which we haven't been able to see in the last three years. I think people are going to hear a lot about this story and follow it.

Dr. Allen Alper: That sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.triumphgoldcorp.com/

John Anderson, Chairman

Triumph Gold Corp.

(604) 218-7400

janderson@triumphgoldcorp.com

|

|