Blackstone Minerals (ASX: BSX): Unlocking a World Class Nickel Sulfide District; Scott Williamson:, Managing Director Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/22/2020

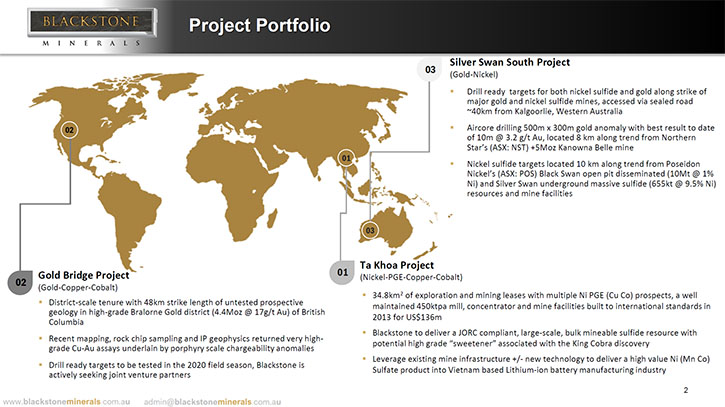

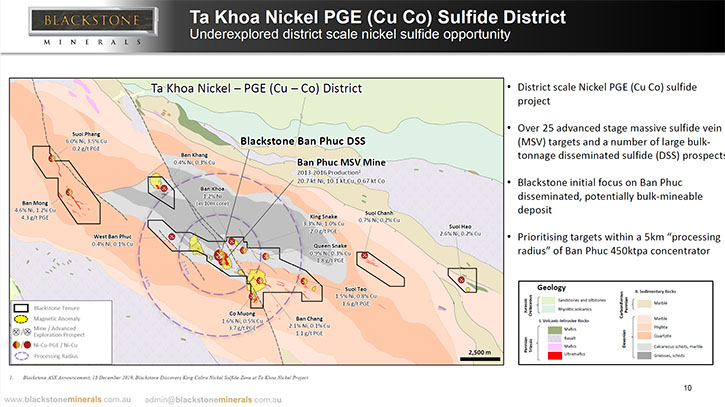

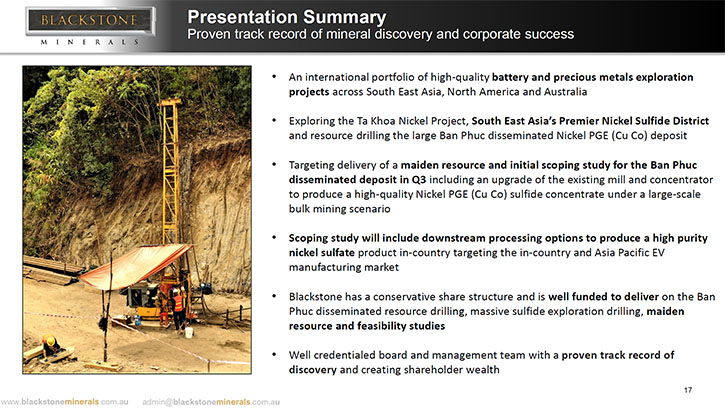

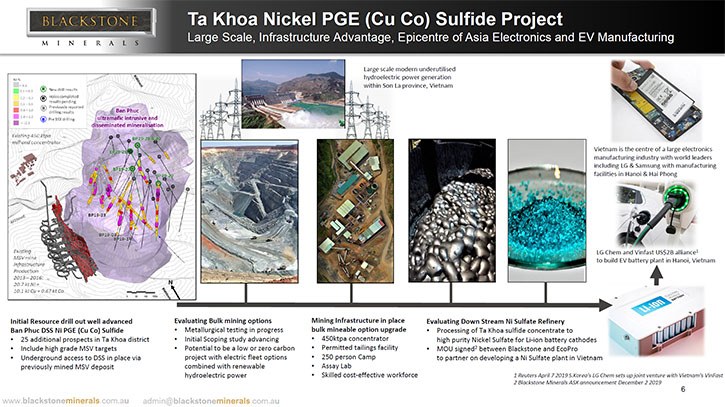

We learned from Scott Williamson, Managing Director of Blackstone Minerals (ASX: BSX), that they are looking to restart the past producing, high-grade Ban Phuc nickel mine, located at their, district-scale, Ta Khoa Project in Northern Vietnam. The Ta Khoa Nickel-Cu-PGE Project has existing modern mine infrastructure, built to International Standards, including a 450k tpa processing plant and permitted mine facilities. We learned from Mr. Williamson that they are focused on disseminated sulfide, as well as the massive sulfide. Near term plans include delivering a maiden resource at their new King Cobra discovery, followed by testing of the 25 brand-new massive sulfide vein targets. According to Mr. Williamson, Blackstone Minerals is going to unlock what is believed to be a world class nickel sulfide district. Blackstone also owns a large land holding at the Gold Bridge project, within the BC porphyry belt in British Columbia, Canada, with large scale drill targets, prospective for high-grade gold-cobalt-copper mineralization. In Australia, Blackstone is exploring for nickel and gold in the Eastern Goldfields and gold in the Pilbara region of Western Australia. Blackstone has a Board and Management Team, with a proven track record of mineral discovery and corporate success

Scott Williamson, Managing Director of Blackstone Minerals

The Ta Khoa Nickel-Cu-PGE Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Scott Williamson, who's Managing Director of Blackstone Minerals, Ltd. Scott, Could you give our readers/investors an overview of your Company and what differentiates it? Then could you discuss some of your outstanding drilling results that you have gotten recently, their significance and where you go from here?

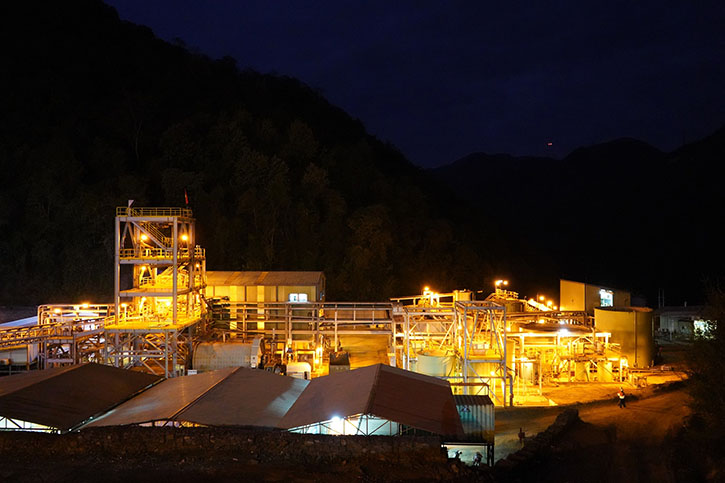

Scott Williamson: We at Blackstone have an international portfolio of battery and precious metals projects. Our flagship is the Ta Khoa Nickle project, in Northern Vietnam. We also have the Gold Bridge project, a Canadian cobalt and gold project in British Columbia, and the Silver Swan South golden and nickel sulfide project near Kalgoorlie. All of the focus and the excitement for us at the moment is around the Ta Khoa Nickle project. That's where we're looking to restart the Ban Phuc nickel mine, which operated between 2013 and 2016. It was actually a high-grade, underground, massive sulfide mine, and it has an existing concentrator. The previous owners sunk over $130 million into the infrastructure at the mine. And we're looking to unlock what we believe could be a world class nickel sulfide district. We're starting to do that, but we first went in there nearly 12 months ago now, and we've drilled out the Ban Phuc, disseminated, nickel sulfide ore body, which is right next to the existing underground mine. We're looking to restart with a different strategy from the previous owners.

The previous owners were focused on maiden sulfide, only. We're looking at disseminated sulfide, as well as methane sulfide. At the Ban Phuc disseminated ore body, we've made the King Cobra discovery, and we're looking to deliver a maiden resource in the next few months. That will be the basis of our scoping study. We’re looking to announce that in the next months as well. So yeah, a lot of good news on that development front. Now we're also looking to explore the massive sulfide options. The first 12 months we were focused on the Ban Phuc disseminated. Now we're looking to unlock the 25 massive sulfide vein targets, which haven't been tested. We have a lot of nickel outcropping. We have massive sulfide, nickel outcroppings all through this district, undrilled and untested. We're using systematic geophysical techniques, particularly electromagnetic AM to unlock the massive sulfide opportunities. Plenty of good stuff happening at Ta Khoa at the moment.

Dr. Allen Alper: Well, that sounds excellent! Could you tell our readers/investors a little bit more about some of the data you have, some of the results, what the property looks like and it's potential? Why the potential of this property is so exciting?

Scott Williamson: Recently, we started drilling the Ban Chang prospect, which is two and a half kilometers from Ban Phuc, the Ban Phuc mine and concentrator. We're two and a half kilometers to the South East of Ban Phuc and we're intersecting massive sulfide. We've hit three holes with massive sulfide so far. On the first hole assays we're getting up to 3% nickel, up to 2% copper and up to 3.4 grams per ton in the platinum plus grade and plus gold. So it's a great high-grade opportunity. We have over 1.2 kilometers of strike of EM anomalies that are indicating massive sulfide potential. We're systematically testing those EM plates. Hole one and two are over 200 meters apart. Hole three is one kilometer from hole one. So we're stepping out aggressively through this Ban Chang prospect to understand the full potential of Ban Chang, remembering that Ban Chang is only one of the 25 targets that we will look to explore over the coming months and years.

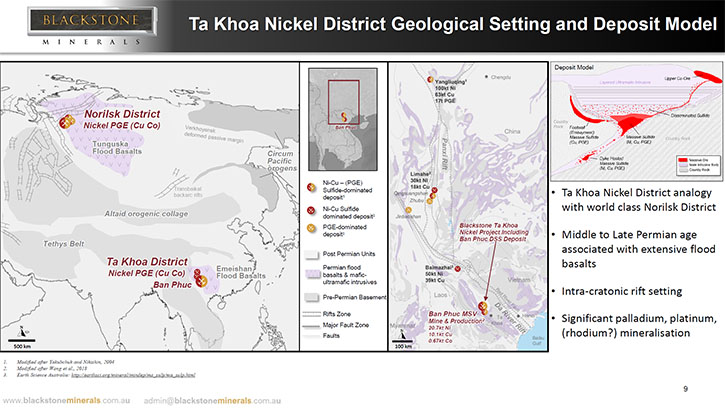

We're unlocking these massive sulfide opportunities throughout what we believe is a nickel sulfide district, which has the same geology as Norilsk in Russia and Jingchuan Formation in China. So we have a magmatic nickel sulfide system. These are large magmatic intrusions, and they lend to potentially very large ore bodies and ore mining complexes, similar to what we have in Canada and also in Australia.

So that is the geology, but more importantly, we have the partner that can turn this back into a mine. So we are partnering with EcoPro, which is the largest cathode manufacturer in South Korea. And they're looking to help us unlock the geology, but then understand the potential for the downstream processing. So we're looking at downstream processing of the nickel concentrate, which will be delivered from the mine. And we're looking to create a joint venture partnership with EcoPro, where we will build a downstream processing facility to produce nickel sulfate in Northern Vietnam.

That distinguishes us from our peers because we already have the customer ready. And we're working with EcoPro to build a downstream processing facility as a partnership. So we are partnered with one of the major players in the lithium ion battery industry in South Korea.

Dr. Allen Alper: Well, that sounds very exciting! It sounds like this year and going forward is going to be a very important time for Blackstone. Could you tell our readers/investors about your timetable? When you're thinking of going forward and developing your project?

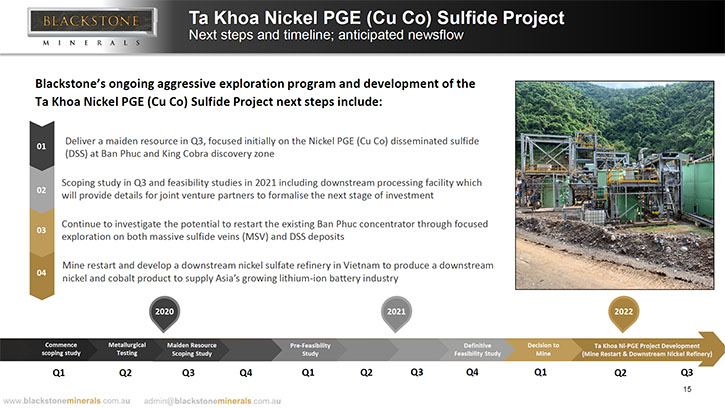

Scott Williamson: The first two milestones: We need to deliver the mining resource on Ban Phuc disseminated ore body, which we are looking to deliver in the next couple of months. Q3 will have a maiden resource and then, within a short period of time soon after, we will deliver the scoping study for the Ban Phuc disseminated. That scoping study will include the downstream processing facility and, and we'll include the nickel sulfate product. We’re looking at a study that not just includes the concentrator and creating a nickel concentrate, but then moving that concentrate into nickel sulfide so that our scoping study will have all of the numbers associated with that downstream processing facility, as well as the upstream mine. So that's all happening in Q3 and then we want to move straight towards the pre-feasibility study or the PFS, which we would like to deliver in Q1 next year.

We plan to start delivering the more definitive study later in 2021. We'll have a bankable or definitive feasibility study in late 2021, and then look at a decision to mine soon after that. We are aiming to build this downstream processing facility and upgrading the concentrator in 2022, and then looking to deliver nickel sulfate into the growing lithium ion battery industry in 2023. This is a really important time for the industry. That's where we believe the supply crunch will come in 2023. We will be feeding into what will be a really interesting period for the lithium ion battery industry, because that's when we believe the demand for nickel in the lithium ion battery war will far outweigh the supply of nickel and, nickel sulfide. Very busy couple of years ahead!

Dr. Allen Alper: Well, that really sounds exciting and it sounds like your timing is going to be great, matching the growth in demand for nickel and the lithium ion battery industry. Could you tell our readers/investors how nickel and cobalt products are used in the lithium ion battery industry? How they're critical?

Scott Williamson: We initially started looking at cobalt exploration in British Columbia. We started talking to EcoPro nearly two years ago now. EcoPro are the largest cathode manufacturer in South Korea and the second largest in the world. They are at the forefront of battery chemistry. About 18 months ago they said to us, "We're moving towards the high nickel cathode, where we will have eight times more nickel than cobalt." The initial lithium ion battery had a one to one to one ratio of nickel to manganese to cobalt. There's a movement towards eight times more nickel manganese than cobalt, an eight to one, to one ratio.

The nickel increases the energy density, which allows you to have longer range. To get a long range electric vehicle, you need high energy density and you need nickel and/or cobalt. You can actually substitute nickel for cobalt. The substitution occurred when the companies realized that it's difficult to explore for and to find suppliers of cobalt because that supply is controlled mainly by the Democratic Republic of Congo, the DRC. They had been engineering the cathode chemistry towards high nickel and that was when we moved away from our cobalt exploration to the top high nickel project in Northern Vietnam. That relationship with EcoPro pushed us towards the high nickel cathode chemistry. They s we need to look for nickel sulfide, which is the easiest type of nickel to be converted into nickel sulfate for the cathode. We have a strong relationship with EcoPro that allowed us to change our focus towards nickel, because that is the movement in the chemistry for the cathode.

Dr. Allen Alper: That sounds excellent. Could you refresh the memory of our readers/investors and tell our new readers/investors about your background and your team?

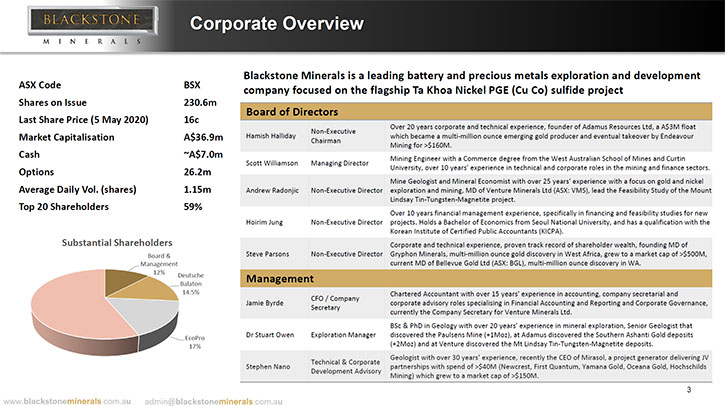

Scott Williamson: The first half of my career, I was a mining engineer. I worked particularly in underground mining operations around Australia. I did some open pit mining. I also went off shore and did a bit of work in West Africa. Then I went into the capital markets, as a mining analyst. I have a blended skillset of technical and engineering, but also financial and equity capital markets.

The team is comprised of a number of geologists that have taken major discoveries and moved them through the study phases and towards development. We also have Steve Ennor, who's now a big part of our team. Steve was the metallurgist, who built the Ban Phuc nickel mine concentrator, and he was the vendor of the project. We've now bought the mine from Steve Ennor and he's now a major player and a major part of our team because he has the metallurgical expertise to help us deliver the downstream nickel sulfide. We have a very strong seasoned nickel metallurgist, who will be helping us to move this mine back into production. So we have mining, engineering, geology, and metallurgy, within our team and we will look to build our team up as well with further technical expertise as we move this mine back into production.

Dr. Allen Alper: Sounds excellent! Could you tell our readers/investors a little bit about your capital structure?

Scott Williamson: Our EcoPro investment is now up to approximately 250 million shares on issue. Blackstone Minerals has a very tight capital structure. Management has a position of around 17%. Steve Ennor is now a part of that Board and Management Team. He was given 8.6 million shares as part of the transaction. So he's now part of that 17%. We have EcoPro now sitting around 16%. We also have a very supportive German shareholder around 14% or 15% and that's Deutsche Balaton. We have a very supportive tight structure, the top 20 have around 60% of the stock. We still have very good liquidity for a stock that's very tight at the top end. We have very tight capital structure in the top 20 and top 50, but then we have plenty of liquidity with a lot of speculators in and out of the stock.

So, good liquidity, well-funded, $7 million of cash, EcoPro invested six point eight million and I paid a 62% premium to the current price at the time. They paid around about the same level as we are today, but they paid a premium during, I suppose, the downturn due to the virus. So yeah, well-funded, very tight capital structure, well-supported by Board and Management and major shareholders in EcoPro and Deutsche Balaton. It should lead to a good day, when we come out with all this great news.

Dr. Allen Alper: Well, it sounds like you're in an excellent position. That's really terrific! Could you tell our readers/investors the primary reasons they should consider investing in Blackstone Minerals?

Scott Williamson: The reasons to invest in Blackstone are; we are well located, well leveraged to the future of the lithium ion battery industry, well positioned with one of the major players, EcoPro as our partner, we have a nickel sulfide district that hadn't been explored properly by the previous owners. We have the existing infrastructure worth over $130 million that we will leverage and use.

But most importantly, we believe we are in one of the best nickel sulfide districts you can find. We have similar geology to some of the major nickel mining districts like Norilsk and Jingchuan Formation and we are only just starting. We are 12 months into what we believe will be a 10 or 20 year opportunity and we will unlock this geology over the coming months and years. We will show that this is a world class nickel sulfide district, and we will deliver value for our shareholders.

Dr. Allen Alper: It sounds fantastic! Could you tell our readers/investors how it is operating in Vietnam?

Scott Williamson: Vietnam has been a really great place for us to work. There are particularly low operating costs. We have a very, very good skilled workforce and very cheap labor. We can drill much cheaper. We can do a lot more work for a lot less money. We have a very strong relationship with the provincial government. There were 20 years of relationship building by the previous owners and we are just moving into that same situation, whereby there's a very good relationship with the provincial government. This mine paid good taxes and looked after the local people. So we have a very good relationship with not just the provincial government, but also the central government.

There's an established mining industry. There are over 20 underground mines and over 20 open pit mines. We're moving into a region that has all the skilled labor and skilled service providers that are required. This has been a very refreshing move into a new emerging market and we believe one of the most exciting and better emerging markets, in which we've ever operated. We are very happy in Vietnam.

Dr. Allen Alper: Well, that sounds excellent, Scott. Is there anything else you'd like to add?

Scott Williamson: Thank you for interviewing Blackstone Minerals for Metals News. We are always keen to talk to new investors. We are very active on the social media channels so, stay tuned. We believe we are looking at moving into a period where the market will start to appreciate and understand what we are trying to achieve, particularly now with our massive sulfide opportunities. We believe now is the time to be having a much closer look at Blackstone Minerals.

Dr. Allen Alper: Ah, that's great! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Scott Williamson:

Managing Director

+61 8 9425 5217

admin@blackstoneminerals.com.au

http://www.blackstoneminerals.com.au

LinkedIn blackstone-minerals

Twitter @Blackstone_BSX

Facebook @blackstoneminerals

|

|