Dr. Allen Alper Interviews Matt Gill, MD and CEO, White Rock Minerals Ltd. (ASX: WRM), Exploring for Globally Significant High-Grade VMS (Zinc, Silver, Gold) and IRGS Gold Deposits in Alaska.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/20/2020

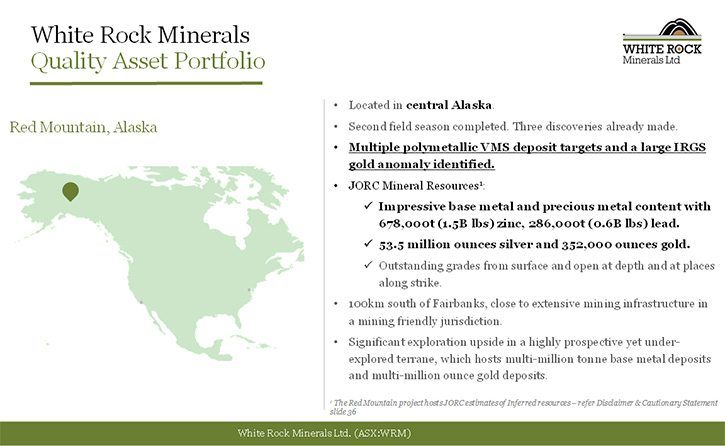

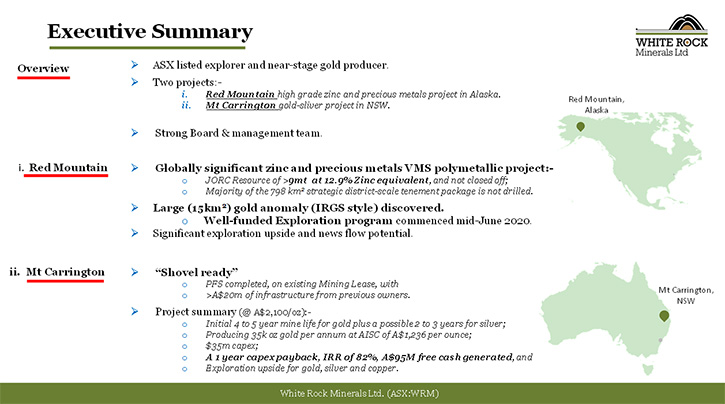

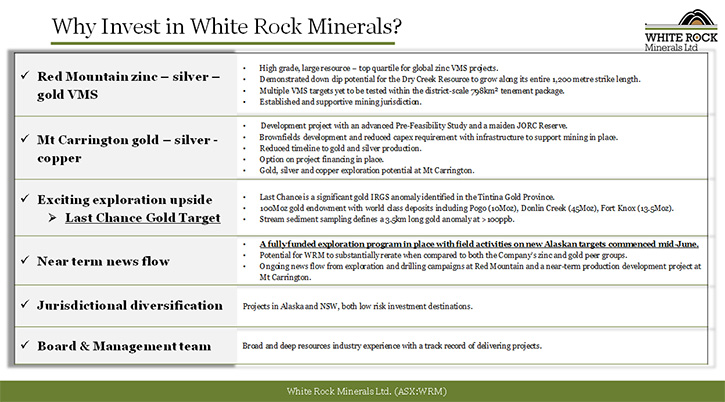

Matt Gill, Managing Director and CEO of White Rock Minerals Ltd. (ASX: WRM), updated us on White Rock. White Rock has undergone a 3 to 4-times re-rating since Metals News started covering them, and Matt sees the potential for a much greater upside. They have an advanced JORC compliant gold and silver project in northern New South Wales, Australia, and an exciting new large gold anomaly discovery, called Last Chance, situated in the high-prospective Tintina gold belt, in central Alaska. This gold target sits within the Company’s district-scale Red Mountain project, where there already exists a maiden-JORC compliant, high-grade zinc and precious metals resource. White Rock will be drilling new targets at Red Mountain until September this year and continuing in 2021. With a fully funded exploration program for 2020 and 2021 in Alaska, promising projects in great mining jurisdictions, an excellent team, and a planned revised share structure, White Rock ticks off all the boxes, and shows promise to continue its current successful gains.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Matthew Gill, who's the Managing Director and CEO of White Rock Minerals Ltd. Matt, I wonder if you could give our readers/investors an overview of your Company and what differentiates it from others. Also update our readers/investors on what has been happening since our last interview about a year ago.

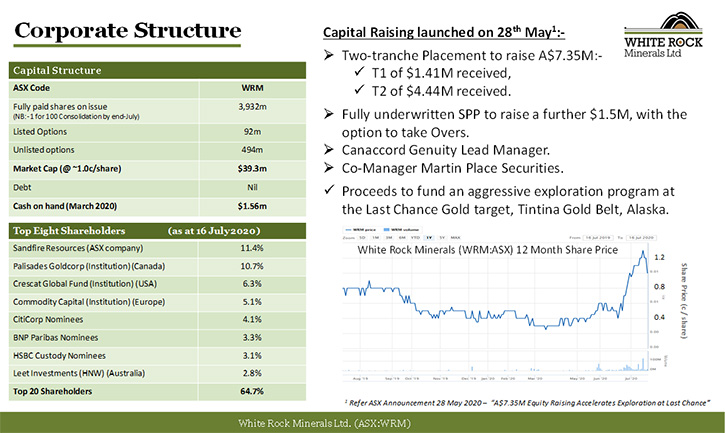

Matt Gill: Happy to. Thanks Al for the opportunity to update your readers/investors. White Rock is listed on the ASX in Australia. We've been listed for about 10 years. We have about 2500 shareholders. Our market capitalization is quite variable at the minute. We have just closed a A$15M capital raise and I'll come back to that, but we've increased our market cap in the last two months on the back of the interest generated in our exploration activities that I'll describe to your readers/investors, an increase from about A$8 million, to I think we're currently about A$35 million.

So we've had a three to four times re-rating, just in the last few months. We still have plenty of upside yet to come I believe and I'll explain why I say that. White Rock has two projects. We have an advanced gold and silver project in northern New South Wales here in Australia. That project has a JORC resource for the four gold deposits and a JORC resource for the four silver deposits. It has a JORC reserve for two of the four gold resources. It has a Gold First pre-feasibility study. It's on an approved mining lease. It has infrastructure, the two gold deposits are already pre-stripped so that you actually walk onto ore, and 100,000 meters of drilling, so a well-advanced project.

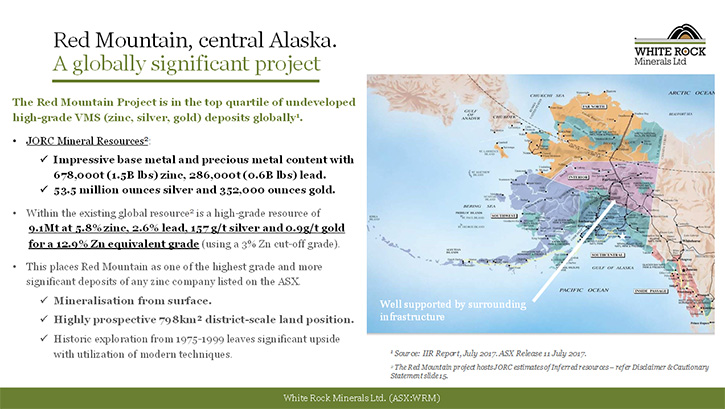

We have a second project, which is our current focus in this extremely exciting period that we're in, and which has attracted great interest in the market. We have a project in central Alaska, called Red Mountain. When we acquired it, our focus up until early this year was on the high grade, zinc, silver VMS opportunities. It has a high-grade maiden JORC resource, containing 9 million tonnes and grading 12.9% percent zinc equivalent. Earlier this year we announced the discovery of a significant gold anomaly in the same large tenement package, called Last Chance.

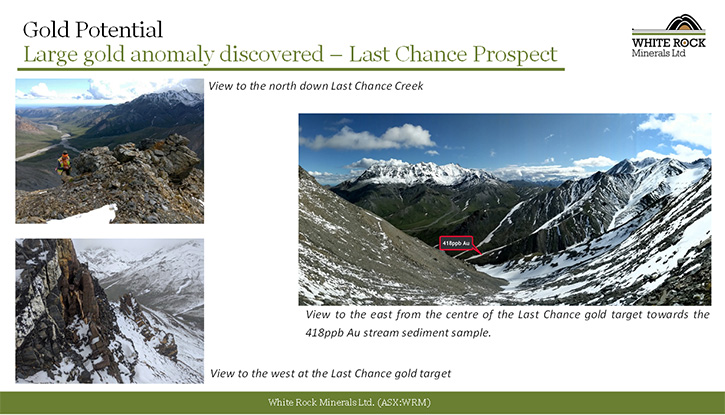

This gold anomaly sits in the same geology in the Tintina Gold Belt as the likes of Pogo (10 million ounces of gold), Fort Knox (13.5 million ounces of gold) and the 45 million ounce Donlin project. And we just closed a capital raising to allow us to explore this area for the first time. It's never had any claims on it before. It's never had any drilling before. So Al, as we speak, we currently have six geologists crawling all over this large gold anomaly. It's about 15 square kilometers in size. We're doing thousands of soil and rock-chip sampling and assaying, and we hope to be drilling this by early August. We've moved significantly since we last talked.

Dr. Allen Alper: Well, that's exciting. A lot of great things happening with White Rock Minerals this year! It’s going to be an extremely exciting time, getting drill results from your Alaskan project. Sounds great! I noticed you also made some additions to your Board, since we last talked.

Matt Gill: Yes, we added a technical advisor. Part of the huge interest in our Alaskan asset has come out of North America. So the current capital raise, half of the money to fund this exploration program in Alaska has come out of Canada and the U S., along with an overwhelming contribution from our own shareholders. And a gentleman that was pivotal to both understanding what White Rock wanted to do, and who appreciated the significance of this gold anomaly was a gentleman called Dr. Quinton Hennigh. Now, many of your readers/investors will know Quinton. He's a founding Director and currently Chairman of Novo Resources, TSX listed, which has a gold play here in Australia.

But he's also on the Boards of a few other companies. He's a very successful exploration geologist, and he's also a technical advisor to other companies. So he introduced us to a lot of groups in the North American capital markets, which was fantastic. And we're the beneficiary now of that support in our capital raise and share price. But he's also a fantastic sounding board with his technical knowledge to work with us and my exploration manager, Rohan, as we explore in Alaska. So Quinton has been very important for White Rock's success today, both in the capital markets, but also in the technical understanding of what we're doing on the ground at Red Mountain in Alaska.

Dr. Allen Alper: Yeah. He's an outstanding geologist. I've interviewed him many times, and I'm glad to see that he has joined your technical advisory team.

Matt Gill: Yes, he's been a fantastic addition. We talk regularly, obviously via Zoom. He sees all the raw data as we do, and we discuss regularly what we're seeing as we unpack the challenge that is exploration in Alaska.

Dr. Allen Alper: That sounds great. Could you elaborate a little bit more for our readers/investors, on what your plans are for the remainder of 2020 going into 2021?

Matt Gill: Happy to Al. Our six geologists on the ground in Alaska will continue for the next few weeks conducting recon, mapping and sampling. They've been on the ground doing this now for a month. The objective is to identify drill targets. We've signed a drilling contract. We're in the process of mobilizing the diamond drill and we hope to be drilling this Last Chance gold anomaly by early August. We intend to drill all through August and with weather permitting as far into September as we can.

So, your readers/investors can expect updates on the soil and rock chip assaying and what that's telling us. Then later, the results from the drilling. I remind people, it's exploration with no guarantee that we are going to have fantastic drill hole results with our first hole? We'd love that, but we actually will be going from announcing the discovery to drilling in eight months, I think that is a pretty good effort. We hope to get somewhere between 5 and 10 holes drilled in this our very first season. The initial area of interest is 15 square kilometres – this is likely a big gold system. So that's the plan for this year and we intend to, once winter is finished, get back on the ground there again in 2021.

Dr. Allen Alper: Sounds exciting. Could you refresh the memory of our readers/investors about your background and your Board?

Matt Gill: It's a Board of four. I'm a mining engineer by training. I went to Melbourne University, and I've worked everything from an underground laborer, supervisor, department manager, site general manager, and previously also in CEO and MD roles. I've worked both underground and open pit. This is my third Managing Director role. I've had good exposure to corporate capital markets, mergers and acquisitions, exploration programs, feasibility studies, and also operations. I'd like to think, and I'm probably old enough, I should have fairly good experiences across the mining resources spectrum, without being too much of a specialist in any, and I think that's useful. I'm supported brilliantly by our Exploration Manager, Rohan Worland. Rohan, while not on the Board, is a key member of the White Rock team. Rohan's exploration experiences are in Australia and Nevada and South America, predominantly in gold. So, what we're doing in Alaska is right in his skillset. So, perfect.

The other three members of the Board, my Chairman, Peter Lester is a mining engineer. He has been a broker, and involved in business development and M & A, which is his main expertise. He's on the board of a few other ASX listed companies. So good depth and experience. Jeremy Gray is more Finance and Business development. He's been a metals analyst. He's based in London. Last but not least is Stephen Gorenstein. Steve is based here in Victoria and whilst he is trained as a geophysicist, he also is more in the business development and M & A space. So between the four of us on the Board, Rohan and Quinton in the technical exploration side, it's a well-skilled, broad-based group that can look at anything from exploration through to operations and development and anything in between.

We have a very capable, skilled CFO and Company Secretary in Shane Turner. He mans the engine room, the accounts, the ASX announcements, the corporate compliance, Auditors, corporate governance, and dealing with the ASX. You should never forget how important that role is. And that's the team. There are really only seven of us in White Rock. So we are small but capable and I'd like to think nimble and able to do things that maybe in larger companies take a bit longer. And that's what I think is also quite exciting that we can move quickly to make the decisions and move forward. I think that's important because it also keeps the corporate costs and corporate overheads low, the G & A, so that the majority of the money we have goes where it should do, which is into the ground exploring as an example.

Dr. Allen Alper: That sounds excellent. Could you give our readers/investors an update on your share structure? I know that's kind of changing, but what it looks like.

Matt Gill: It is changing and it will change again in the next few weeks, but right now we do have quite a number of shares out on issue. It's fairly common in Australia. It's about 7.2 billion shares. That is highly unusual, I know, in North America. Our share price gives us a market capitalization of about 35 million Aussie dollars. That number of shares will change. We held a shareholder meeting recently, and by the end of July, we will have conducted what we call a consolidation, but what in North America, you would call a rollback. So we'll have more like 72 million shares on offer. So we will crunch back that capital structure to something that's a bit more manageable and something that certainly looks more like a normal North American TSX-V listed company.

Dr. Allen Alper: That sounds very good, Matt. Could you tell our readers/investors the primary reasons that they should consider investing in your Company?

Matt Gill: Yeah. Good question Al. I think a key advantage we have is that we are fully funded for our current exploration program in gold in Alaska for this season and also for the 2021 season. There is no immediate need to go back to the capital markets to raise funds for this activity. And gold is probably the best commodity to be in right now, and we are located in an area that's highly prospective, Alaska and in the Tintina Gold Belt in particular. A large gold anomaly that is significant and never been tested, I think offers great news flow and exploration discovery opportunity, no guarantee, but great opportunity. We have just under 800 square kilometers (308 square miles) of tenement package in Alaska. It also has high grade zinc and silver VMS so it's not just gold. And further, White Rock also has this advanced gold and silver project in another great jurisdiction - Australia.

We have two assets from a risk diversification point of view. I always encourage investors to consider sovereign risk when they invest. We're in two first-world jurisdictions that speak English, in Australia and the U S and so rule of law comes into play. Very mining supportive, and a good Board with good experiences that at the end of the day, I think what an investor needs to consider is also who is handling their money as we advance the project. So in short, Al, I think it's the asset quality that we have; and the commodities we are in - gold, silver and zinc. The jurisdictions that we're in, the exploration potential that we have, the near term producing potential from our Australian asset and a Board that can guide and manage that as we grow the Company.

Dr. Allen Alper: Oh, they sound like excellent reasons to consider investing in White Rock Minerals Ltd. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.whiterockminerals.com.au/

Matt Gill

Managing Director and CEO of White Rock Minerals Ltd.

T +61 3 5331 4644

E: info@whiterockminerals.com.au

|

|