West Red Lake Gold Mines, Inc. (CSE: RLG, OTCQB: RLGMF, FSE: HYK): Has a Very Large Property Position, in the Prolific Red Lake Gold District of Northwest Ontario, CA; John Kontak, President Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/15/2020

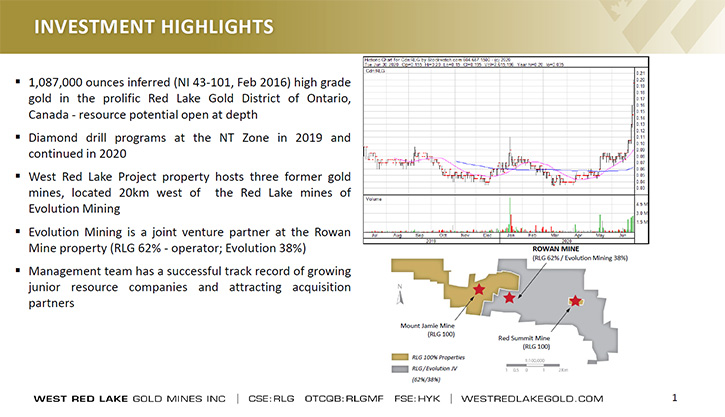

West Red Lake Gold Mines, Inc. (CSE: RLG, OTCQB: RLGMF, FSE: HYK) has assembled a significant property position, totaling 3,100 hectares, in the prolific Red Lake Gold District of Northwest Ontario, Canada, which contains three former gold mines. We learned from John Kontak, President and Director of West Red Lake Gold Mines, that they have commenced drilling, targeting new high-grade discoveries and aiming to expand the NT Gold Zone, located on the Rowan JV portion of the West Red Lake Project. Near-term plans also include permitting and economic studies at the former Rowan mine. The Company's team is experienced in monetizing mineral assets, and they are good at making the assets valuable and then selling them to a Canadian gold producer.

John Kontak, President and Director of West Red Lake Gold Mines

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing John Kontak, who is President and Director of West

Red Lake Gold Mines. Could you give our readers/investors, the investment highlights of West Red Lake Gold?

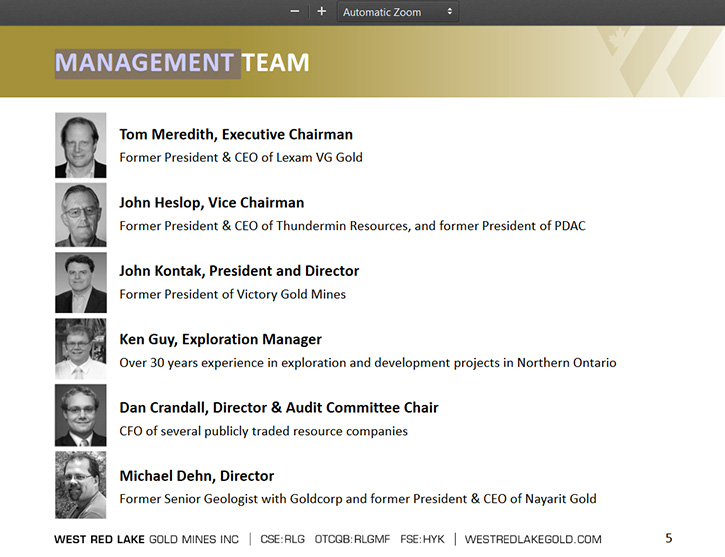

John Kontak: Yes. With myself as President, Tom Meredith as our Executive Chairman and Ken Guy our Exploration Manager, this will be the third time that we've monetized gold exploration and development assets in Ontario. Our two prior properties were in Timmins, Ontario. We've taken companies and assets that were valued around three or four million dollars and have done transactions, with those properties, for as much as a couple of hundred million dollars. So we're looking to do that with this asset as a Management Team. We now have a 3,100 hectare property in Red Lake Ontario, another prolific mining camp in Ontario.

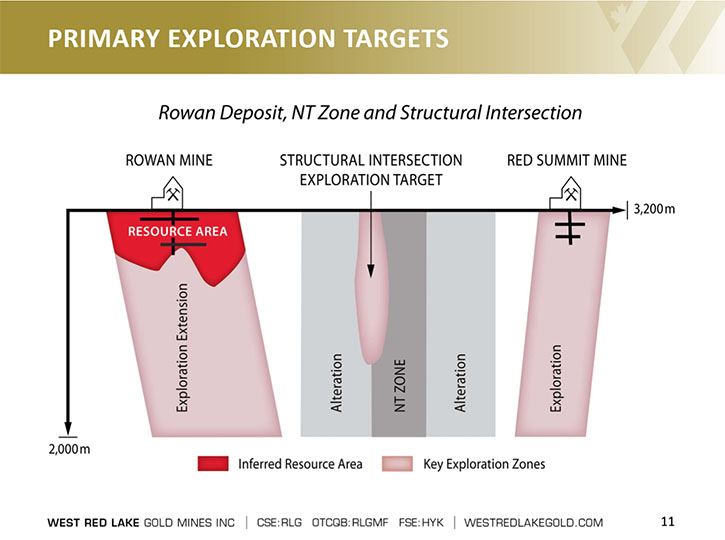

We're in a good jurisdiction of Ontario, in terms of supporting the mining industry. And we're in a very prolific mining camp in Red Lake, which has produced some 30 million ounces of gold. Of course, it's the historic home of Goldcorp, which has produced about 18 million ounces from the Red Lake Gold District, which is an underground gold mining camp and known for its high-grade deposits. We have an inferred resource of 1.1 million ounces, graded at 7.57 grams per ton, at the historic Rowan mine. It's open to depth, the resource is within 500 meters of surface and there's mining in Red Lake, Ontario down to 2000 meters. So we're looking to expand the resource as we go to depth at the Rowan, where we've been busy in 2018 and 2019, and where we're busy right now. The camp is now open. It is at the NT Zone, which is about 500 meters from the Rowan mine deposit and is a similar looking deposit. We're looking to add ounces at Rowan and develop a second resource at the NT Zone.

There are two kilometers of strike length at the NT Zone. So we're looking to add ounces and we're looking forward to ounces being revalued by capital markets, as the price of a gold in US Dollar terms is now approximately 1770. And I think with the monetary policies, the interest rate policies and the stimulus packages and unfunded government spending both in the US, Canada, the Eurozone, Japan, et cetera that this sets us up for a positive gold sentiment for the rest of 2020 into 2021. We're looking to monetize these assets. What we've done in the past is explore and develop, and make the assets valuable and then do a transaction with a Canadian gold producer in the future, at a much higher valuation.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit more about your properties?

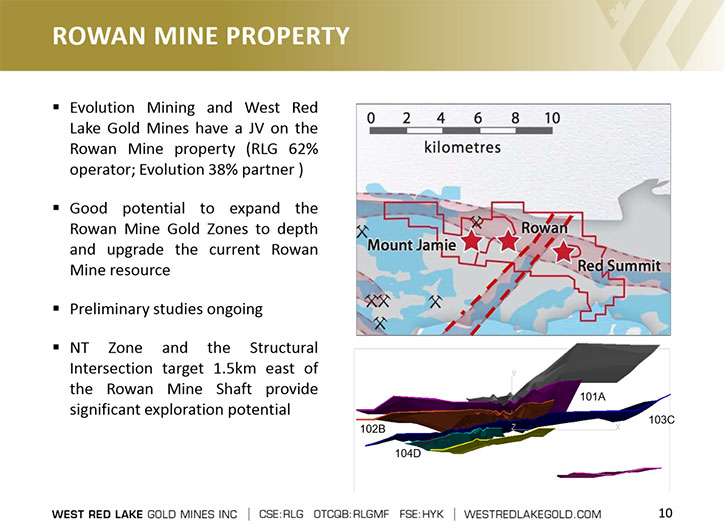

John Kontak: There are three former mines on our property. We own 100% of the Mount Jamie mine property, and the Red Summit mine property. Where we're most active now, is at the Rowan mine portion of our property. We're in a joint venture on that property. We have 62% and Evolution Mining has 38%. Evolution Mining is a 750,000 ounce Australian producer that bought the world class Gold Corp assets in Red Lake Ontario for about $500 million dollars. Of course, Goldcorp was acquired by Newmont. When that was completed, Newmont announced that they were going to sell their Red Lake Ontario assets. And they've done that effective April 1st of this year to Evolution Mining. So Evolution Mining is now our joint venture partner.

There're many good things about that. They're a quality producer and bring a strong technical team, and also they have two mills with extra capacity. So, it sets up well for us to be able to make the asset valuable and turn it over to a gold producer at the right time in the market, when the purchaser can have an asset in the Red Lake Gold District that is close to surface, high grade and with the infrastructure to produce gold, including the mills, the roads, the power, the trained workforce, et cetera.

Dr. Allen Alper: Well, that sounds excellent. Sounds like you have a great partner there to go forward.

John Kontak: Yes!

Dr. Allen Alper: That's always nice to have someone who's experienced, has funding to move a project and also has all sorts of infrastructure to help you with processing the mine, once you develop it.

John Kontak: In the past, at the right time in the cycle, we have sold our assets. Right now, we're getting about $30 an ounce at the Rowan for our Rowan mine resource. When capital flows into the sector, which could now be happening and could continue to happen for the rest of 2020 and 2021, quality gold assets will be revalued upwards. We'll continue to add ounces. We have 1.1 million at the Rowan now. We're looking to expand, as we go to depth and develop the NT Zone, so the possibility is that we could have another similar deposit, with as many ounces as the Rowan mine deposit we have now.

And when capital flows into the sector, rather than getting $30 an ounce in the ground, just historically speaking, you can get as much as $150 or $200 an ounce in the ground. That can show up in the market cap of the Company, and then eventually result in a transaction, like we've done in the past, for as much as a couple hundred million dollars. And right now our market cap is about $30 million.

Dr. Allen Alper: Well, that sounds like a fantastic opportunity for investors and stakeholders. That's excellent! Could you tell our readers/investors a little bit about your capital structure?

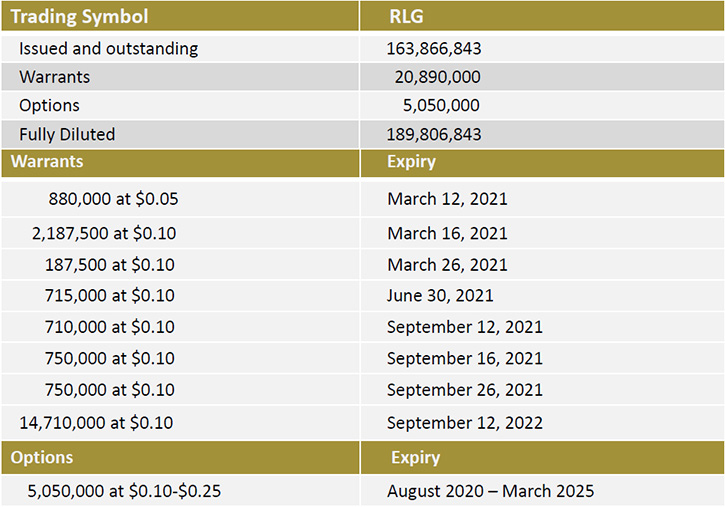

John Kontak: We have about 163 m shares outstanding. We have a major institutional shareholder that has about 25% of the Company. The Management Team has about 8% of the Company. And the Management Team has common shares that were bought on the open market and by participating in private placements like everyone else, we don't have options. So investors and stakeholders have the comfort that the Management Team is aligned with the common shareholder.

Then we have a retail following of people, who have invested in the prior companies that we've managed to monetize. So I can put my hands on almost 50% of the stock with just seven or eight phone calls. We're listed in Toronto, we're listed in the OTCQB in New York and were listed in Frankfurt, and we have investor relations and marketing activities in those three places. So we trade in those places and have active Investor Relations and marketing activities to ensure that the capital structure and our capital market activities are managed in a positive way.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors your primary goals for 2020 and going into 2021?

John Kontak: It's going to be to continue to explore the NT Zone, where we put 20 holes in the course of 2018 and 19. We're drilling now, just following the strike length as the NT Zone comes on our property from the Southwest and trends northeast. Most of the holes that we've drilled have ended in alteration. So the core is very positive. We're going to deepen some of them and continue along the strike length and then eventually we'll go to depth at the Rowan deposit and expand that resource and upgrade a certain amount of that resource from inferred to indicated. We're starting the pre-permitting process, with the water sampling, and doing some economic studies, so that eventually people can see the IRR and the NPV of an operating mine and the Capex to bring that mine into production.

As well as the NT zone, which is where we're busy now. There’s also a second gold bearing structure, the Pipestone Bay St Paul Deformation Zone, which is the major east-west regional gold bearing structure that's made the Red Lake Gold District so positive. And we have 12 kilometers of strike length of the Pipestone Bay St Paul Deformation Zone on our property. The three former mines are on that Deformation Zone. But the east-west structure is intersected by the NT Zone, as it trends Northeast on the property. Where they intersect that's what we call a structural intersection. And of course, Red Lake Ontario is famous for structural intersections. That is where the high-grade zone, found by Goldcorp some 30 years ago, took that Company from a $50 million junior producer to a multibillion dollar company. And that was at a structural intersection. So we'll eventually be putting holes in that structural intersection to see whether we can find a large discovery.

Dr. Allen Alper: Oh, that sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing and West Lake Gold Mines?

John Kontak: Well, I think the number one thing Al, for any investor, who's looking at a junior resource company, is an experienced management team. A management team that's done it before, and that's what we have at our Company. Tom Meredith Executive Chairman, his last Company was VG Gold, and he took that Company that was worth $3 or $4 million and did a transaction that was worth more than a couple hundred million dollars. Victory Gold Mines was the last Company I was the President of, and that Company was sold and it's now held by O3 Mining, the former Osisko Mining. So it's an experienced Management Team. And for both of those Companies, the Exploration Manager was Ken Guy, who's the Exploration Manager of this Company. So it's a team that's technical, familiar with the operational issues of junior mining companies and managing the capital market side of things.

The second thing I would say is that they have a resource that the Company can build on. And we have a high-grade, close to surface resource at the Rowan mine. 1.1 million ounces that we can expand, as we go to depth. In addition, we have other gold targets, as they say, at the NT Zone and the Structural Intersection. And the third thing is that the asset should be in a mining friendly jurisdiction and Ontario is a mining friendly jurisdiction. So you have the comfort that the asset is securely in the Company, that they have an asset in terms of a resource and that it's being developed by an experienced Management Team. And we have all three of those things.

Dr. Allen Alper: It sounds excellent. Sounds like compelling reasons for our readers/investors to consider investing in West Red Lake Gold Mines. John is there anything else you'd like to add?

John Kontak: What I would add Al, is that we're in a very cyclical industry, in terms of the gold sentiment. We thought the gold sentiment was positive on December 31st of 2019, for the reasons that have traditionally ended up in a positive gold sentiment, low interest rates and negative, real interest rates. When you take the interest rate and deduct the inflation rate from it, we are in negative real interest rate territory, and we're going to be for an extended period of time, a number of years. Any chart you look at, negative real interest rates end up in a positive gold sentiment. We're in a high money supply, and the printing press of fiat currencies is continuing, and then budget deficits and sovereign debt. These things add up to a positive gold sentiment. So I think the cycle is coming towards the gold investor and we at West Red Lake Gold Mines intend to take advantage of that for our shareholders as we have in prior positive gold sentiment cycles.

Dr. Allen Alper: I think you're right. I think this is an excellent time to consider investing in gold mines and West Red Lake Gold. Which is in an excellent area, has an excellent Management Team, and has an excellent partner. So I think you have everything coming together. That's really fantastic. Is there anything else you'd like to say?

John Kontak: Well, we've already seen it in the price of gold. The major gold producers are hitting 52 week highs, the major indexes, the GDX and the GDXJ are breaking out. And then it comes to the junior exploration and development stories like us. The good thing about that is that we provide the most leverage, when capital flows into our side of the sector. You can really get good leverage from your investment and that could possibly be the case over the next 24, 30 months. So it's a good time to enter. It's a good entry point. And at the end of the day, what we intend to do is sell the Company to a Canadian gold producer or a non-Canadian gold producer. And everyone gets upgraded to more senior paper. And that's the exit strategy for everyone, including the management team. In that way, it works out for everyone.

Dr. Allen Alper: That sounds excellent.

Disclaimer: Dr Allen M. Alper owns stock in West Red Lake Gold Mines

https://www.westredlakegold.com/

John Kontak, President

Phone: 416-203-9181

Email: jkontak@rlgold.ca

|

|