Arizona Metals Corp. (TSX.V: AMC): Proven Leadership Team, Exploring and Developing a World-Class Gold-Copper-Zinc VMS and High Potential Gold Deposit; Marc Pais, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/15/2020

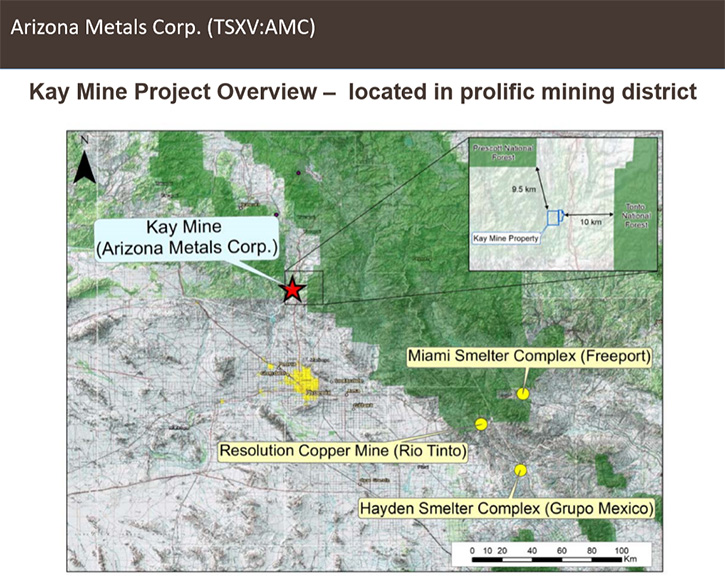

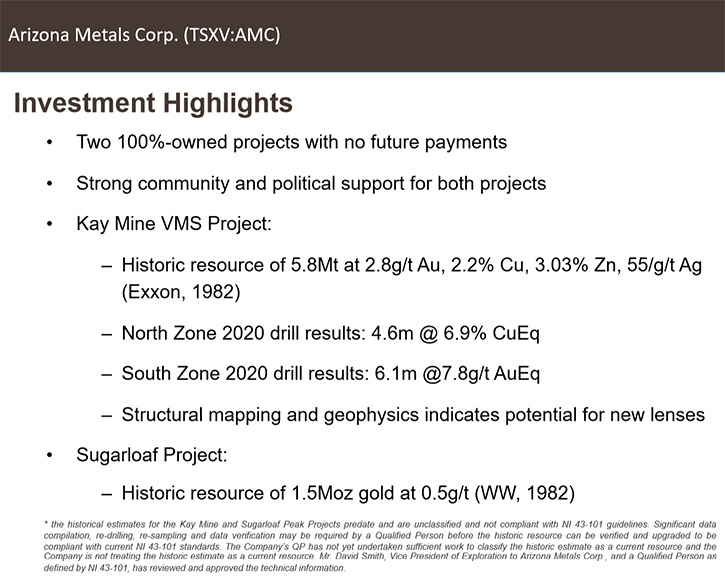

Arizona Metals Corp. (TSX.V: AMC) owns 100% of the Kay Mine Property, in Yavapai County, which is located one hour north of Phoenix, Arizona, on a combination of patented and BLM claims, totaling 1,370 acres that are not subject to any royalties. A historic estimate, by Exxon Minerals, in 1982, reported a “proven and probable reserve of 6.4 million short tons, at a grade of 2.2% copper, 2.8 g/t gold, 3.03% zinc, and 55 g/t silver.” We learned from Marc Pais, President and CEO of Arizona Metals, that they have just restarted the drilling program paused for the quarantine in March. The Company's other 100% owned project is called Sugarloaf Peak Project, located two hours directly west of Phoenix, in La Paz County. We learned from Mr. Pais that they have permitted a 5,000 meter drilling program at Sugarloaf Peak, which will commence on July 6, 2020. The Company's near-term plans include drilling at Kay Mine to increase the resource.

Arizona Metals Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Marc Pais, who is President and CEO of Arizona Metals Corp. Marc, I wonder if you could give our readers/investors an overview of your Company and what differentiates Arizona Metals Corp. from others.

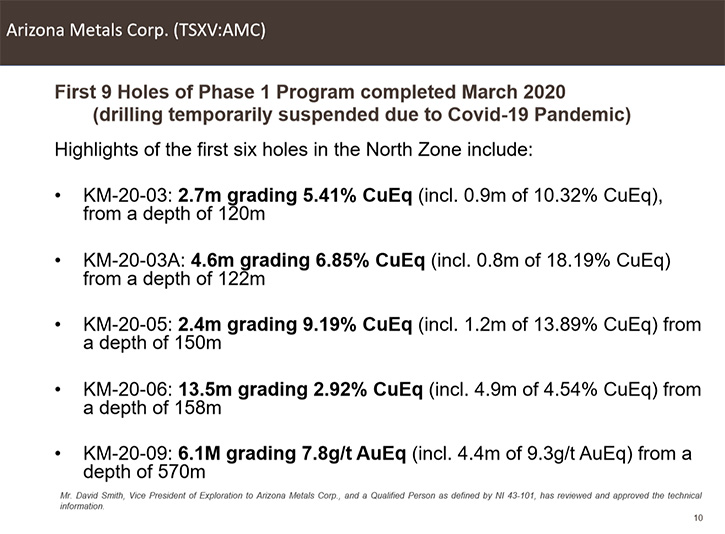

Marc Pais: Thank you, Al. Arizona Metals was listed in August of 2019. We own 100% of two projects in Arizona. Right now we are drilling the Kay VMS deposit, located one hour north of Phoenix. We have two drills currently turning there, and we are restarting a phase one program that was paused during the month of March, due to the COVID pandemic. In January and February, we completed nine holes at the Kay Mine; six in the North Zone, one in the South Zone. We have two drills turning at Kay, and will start drilling our Sugarloaf deposit in July. The initial Sugarloaf program will consist of four core holes to be used for metallurgical testing, and also to test the deposit at depth for potential higher grade “feeder zones”.

Dr. Allen Alper: Good. That sounds excellent.

Marc Pais: At the Kay Mine, we have two drills turning 24 hours per day, 7 days a week; one at the North Zone, and a second at the South Zone. We will also be testing the new gold-rich zinc zone encountered by Hole 9 in March. This is where we hit 6m of 4g/t gold and 8% zinc.

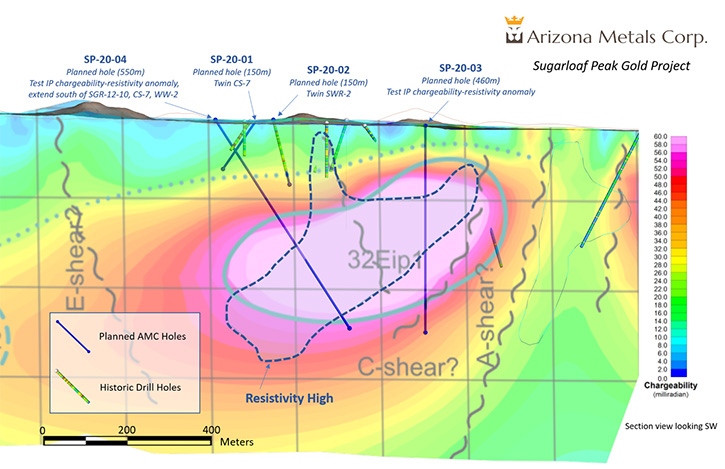

We have also received a drill permit for our Sugarloaf Peak Project, which is our second 100% owned project, located two hours directly west of Phoenix in La Paz County. Sugarloaf has a historic resource of 1.5 million ounces of gold, at 0.5 grams per ton. It's a heap leach, open-pit target.

We see some very good depth potential, and potential for finding some high-grade feeder zones at depth. We have three deeper holes permitted to test beneath the deposit. There are three large IP anomalies there that look like prime targets for a feeder zone, but have never been drilled. The first hundred metres of each hole will be used for metallurgical testing to determine the leach characteristics of the oxide portion of the deposit. Historic leach testing achieved gold recoveries of up to 75% in the near-surface oxide zone.

Sugarloaf will be a relatively smaller program of only 1,300m. Our focus will remain on drilling the Kay Mine. We're planning to do at least 10,000 meters of drilling at Kay.

Dr. Allen Alper: Could you tell our readers/investors about the results you received, from the first drilling that you did?

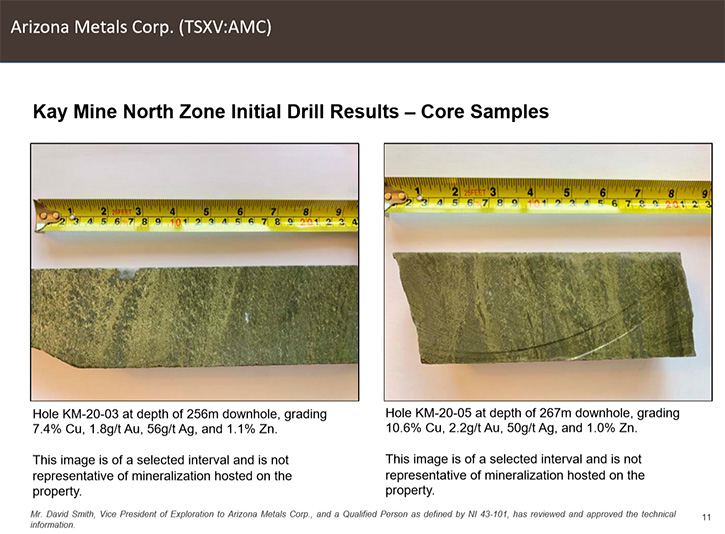

Marc Pais: When we started drilling at Kay in January of this year, the first seven holes we did were into the shallowest part of the North Zone. The North Zone starts at about 120 meters deep. We drilled from 120 meters deep down to 160 meters, so we tested about a 40 meter vertical extent. And we know from Exxon's historic records, the shallowest part of the North Zone is also the thinnest part. And their reports showed that at the North Zone, the grades and the thicknesses of the VMS lenses increase with depth, but we needed to calibrate our 3D model and our historic database. We compiled three historic databases to create our 3D wire frame model of the deposit, so the first few holes were to try to confirm that our model was right and also to calibrate the drill, which I think we've done very successfully.

Of the seven holes, six hit massive sulfides and we're very happy with the grades we found. The deepest hole in the North Zone, hole six, hit 13.5 meters of 2.9% copper equivalent, and within that was about five meters of 4.5% copper equivalent. I think the importance of that hole, really, is that it appears to confirm what Exxon reported in regards to the thickness of the lenses increasing with depth. That hole was about 160 meters deep. The hole we are testing right now, at the North Zone, is going to test the 500 meter level, which is where Exxon reported some very good grades and thicknesses. So we're going significantly deeper, but trying to find those wider, higher grade zones.

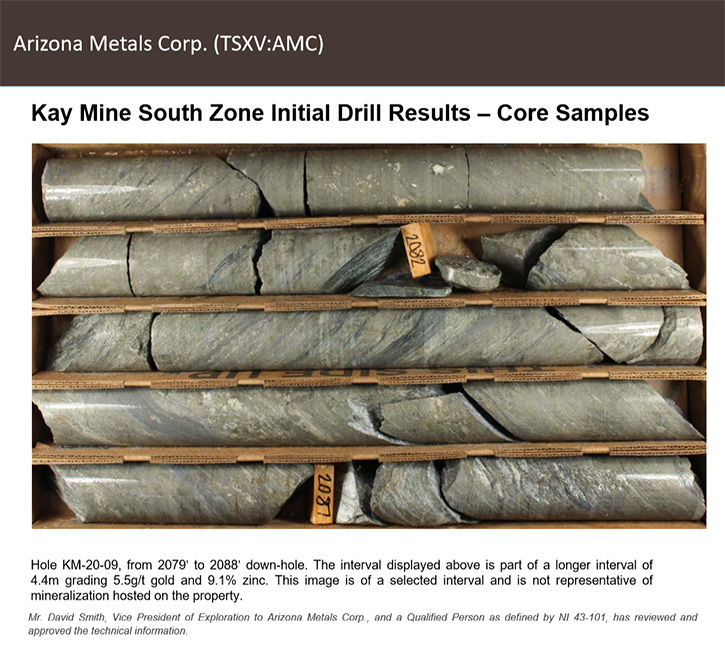

The first hole in the South Zone was KM-20-09, completed in March. The bottom of that hole hit six meters of four grams per ton gold and 8% zinc, which has a very different geological profile from the central core of the deposit, which is primarily copper gold. It looks like we've moved just outside of the envelope, defined by Exxon, into a very low copper area, but it's potentially very high in zinc and gold. We were expecting that, to some degree, as Exxon reported that as they moved south, they were encountering massive sphalerite, but because Exxon had no interest in zinc, in many cases, they wouldn't assay the sphalerite.

We're planning another hole into that gold-zinc area, that will serve as a trunk hole. The idea would be to branch three or four holes from that to try to define that high-grade gold zone. It's the same idea in our current holes in the North Zone and the South Zone. The first two holes will be trunk holes, and then we will use those to branch out. We'll wedge out and do three or four shorter holes from each trunk hole, three or four branch holes. The benefit of that is, significant cost savings because we don't have to drill a 500 meter hole each time. As the branches would be shorter holes, we expect to have better accuracy in our targeting.

Dr. Allen Alper: That sounds excellent. Could you tell us your primary goals for 2020 and 2021?

Marc Pais: In 2020, our goal is to continue drilling the Kay deposit, with an aim to start proving the expansion potential. To achieve this, we will test it on strike and at depth. Exxon's internal estimate was that they could increase the resource size from 6 million tons to 15 million tons, and that was based on testing on strike and at depth. We also noticed that Exxon did really no drilling to the south of the historic estimate, because that's where it was getting into more zinc mineralization, but our first hole in that area has shown that that high zinc grade has the potential to be associated with high gold grades. So another goal will be to test that zinc area, and try to define a zone of gold-zinc mineralization in the South. The third aim for 2020 and probably going into 2021 will be to start drilling the Western targets at Kay, where we have two large untested geophysical anomalies identified very near surface.

The first anomaly is 500 meters west of Kay, and we call that the Central Conductor. The second anomaly is a very large conductor, 80 meters thick, called the Western Conductor, and is located about one kilometer directly west of Kay. We're currently working on drill permits for those two anomalies, which we expect to receive later this year. It would probably take a few weeks or a couple months to rebuild the roads that go out to those targets, with the aim of starting up later this year and continuing to next year.

Dr. Allen Alper: And then at Sugarloaf?

Marc Pais: At our Sugarloaf project, the goal for this year is to do some infill drilling and some step out drilling to show that the size can be expanded on strike and also a few deeper holes to show the depth potential. And we have the metallurgical program plan to do bottle roll testing and column leach testing in the oxide portion of the deposit. In 2011 some initial metallurgy was done that showed gold recoveries up to 75% in the oxide, and we want to do more detailed metallurgical tests to confirm that. It will probably run into the end of this year to get that metallurgy done.

Dr. Allen Alper: Well, it sounds like this year, going into next year, will be a very exciting time for Arizona Metals Corp, as you explore and get more data on your property.

Marc Pais: Yes, we're excited that we’re going to have at least two drills running at Kay for the near term and hopefully add a third one later this year for the Western targets. We'll also have a drill program going at Sugarloaf. We expect to have very steady news flow over the next few months and for the rest of the year.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors about the Leadership Team?

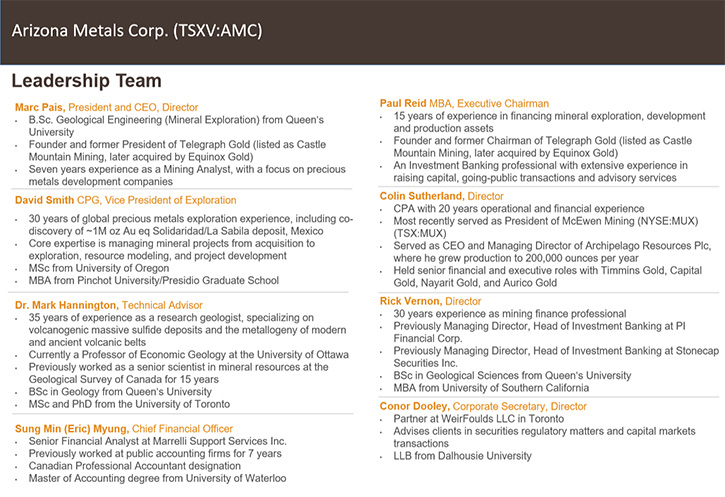

Marc Pais: Yes. The Company was founded by myself and Paul Reid, who's the Chairman. I'm a geological engineer by background and Paul was an investment banker. We worked together for many years in the capital markets business. I was doing equity research on junior mining companies, and Paul was the banker for those same companies. In 2011, we founded a company called Telegraph Gold and raised money to acquire the Castle Mountain Mine in California, which was listed as Castle Mountain Mining, and then became New Castle Gold and last year was acquired by Equinox Gold. The Castle Mountain mine is going back into production this year. We think our Sugarloaf deposit is geologically very similar. It's on the same geological trend, the Sonora-Mohave megashear zone, which is how we became aware of Sugarloaf. Our geologist, David Smith has 30 years of experience in drilling out various types of gold deposits around the world. He has been working on our Sugarloaf project for the last four years and on the Kay Mine for the last two years. So he's very familiar with both deposits, and he wrote both of our technical reports.

Our Board also has extensive experience. Rick Vernon is a geologist, but also worked in investment banking for 30 years, financing mining and exploration companies. Colin Sutherland was formerly the CEO of McEwen Mining. Prior to that was the CEO of Capital Gold, which had a heap leach deposit, very similar to our Sugarloaf project. That mine was producing about 50,000 ounces per year, at half a gram per ton gold, and he sold that Company in 2011 to Gammon Gold for about $400 million. Colin has been giving us a lot of input in developing our Sugarloaf project. We also have Dr. Mark Hannington as a strategic advisor to the Board. He's considered one of the premier world experts in VMS deposits. He's written many of the models and the research papers and textbooks on VMS deposits, and he's also worked as a consultant for some of the big VMS producers around the world. He's played a very critical role in helping guide us through the exploration process at the Kay deposit.

Dr. Allen Alper: Well, you have a very strong, successful, well balanced and experienced Team and Consultants. With you and Paul and the rest, truly a very strong team. Could you tell our readers/investors about your capital structure?

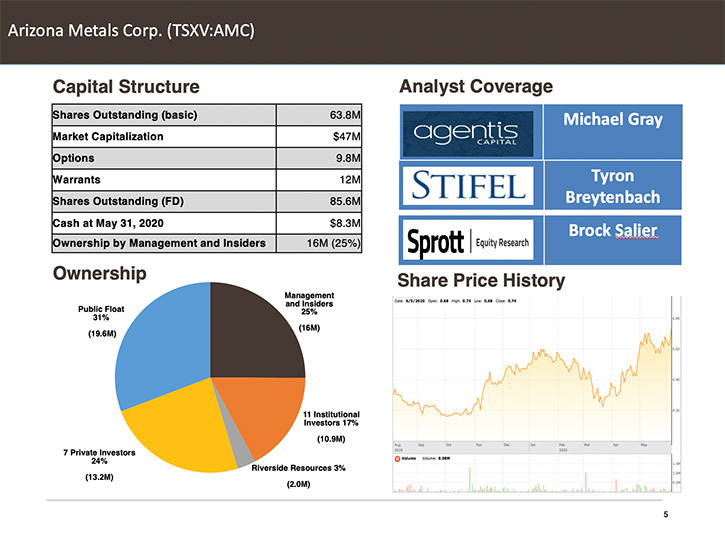

Marc Pais: In May of this year, we closed a $6 million bought deal private placement deal led by Stifel and Canaccord. This consisted of a unit priced at 65 cents, with a half warrant at 85 cents for 18 months. We have 64 million basic shares outstanding and our market cap today, at a share price of around 65 cents is $45 million. We have more than $8M in cash, and the planned work programs at both Kay and Sugarloaf are fully funded for the next year.

Dr. Allen Alper: That's very good. Could you say a little bit more about the ownership?

Marc Pais: The Company is owned 25% by Management and insiders. Institutional ownership is just under 20%. And then high-net-worth private investors own about another 25%. So the actual free trading float is only about 20 million shares.

Dr. Allen Alper: Well, that's good to see that you have such strong support both by management and institutional and high-net-worth investors. That's huge that you all have a lot of skin in the game and believe in the project, willing to put your own money on the line. So that's excellent!

Marc Pais: We're very aligned with the rest of our shareholders.

Dr. Allen Alper: That's great. Could you tell our readers/investors the primary reasons they should consider investing in Arizona Metals Corp?

Marc Pais: We have two projects in mining friendly jurisdictions of Arizona, and both are 100% owned with no future payments.

We have two historic resources. We see excellent potential to expand both resources significantly. We're starting with 6 million tons of very high-grade VMS at the Kay Mine that hasn't been drilled in the last 40 years. In our first eight holes, seven of the eight holes have hit massive sulfides. So we're confident we're going to continue to get good results there. And Sugarloaf Peak also hasn't been explored since 2011. Before that, there was no drilling done since 1982.

Both projects are at a very good starting point and both are under-explored. We've see real potential to drive value by drilling to prove up and increase the size of the historic estimates at each deposit.

Dr. Allen Alper: Well, that sounds excellent. And also you're in a great location, in a mining friendly location, and a very safe area and you have a great Team. Is there anything else you would like to add Mark?

Marc Pais: Yes, we are currently working on an OTC listing in the US, which we expect to announce in the next few weeks.

Dr. Allen Alper: That’s excellent! I’m very impressed with what you’re doing, so it’s been very interesting. We’ll publish your press releases as they come out for our readers/investors to follow your progress.

https://www.arizonametalscorp.com/

Marc Pais

President and CEO Arizona Metals Corp.

(416) 565-7689

mpais@arizonametalscorp.com

|

|