Hecla Mining Company (NYSE: HL): Leading Low-Cost U.S. Silver Producer and Gold Producer with Mines in North America; Interview with Phillips Baker Jr., President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/14/2020

Hecla Mining Company (NYSE: HL) is a leading low-cost U.S. silver producer, with operating mines in Alaska, Idaho, and Mexico and is a gold producer, with operating mines in Quebec, Canada and Nevada. The Company also has exploration and pre-development properties in eight world-class silver and gold mining districts in the U.S., Canada and Mexico, also an exploration office and investments in early-stage silver exploration projects in Canada. We learned from Phillips Baker Jr., who has been President and CEO of Hecla Mining for the past 17 years, that their assets have long lives. Currently the Company has by far the largest reserves in history. According to Mr. Baker, the prices of gold and silver will jump, once the world economies reopen, as the result of the COVID-19 stimulus packages. Hecla will be in a unique position to take advantage of the precious metal prices, as a Company that has significant reserves and resources, in the right jurisdictions.

Phillips S. Baker, Jr., President and CEO

Hecla Mining Company

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Phillips Baker, who is President/CEO of Hecla Mining Company. Phil, I wonder if you could give our readers/investors an overview of Hecla Mining Company, and also what differentiates Hecla from others.

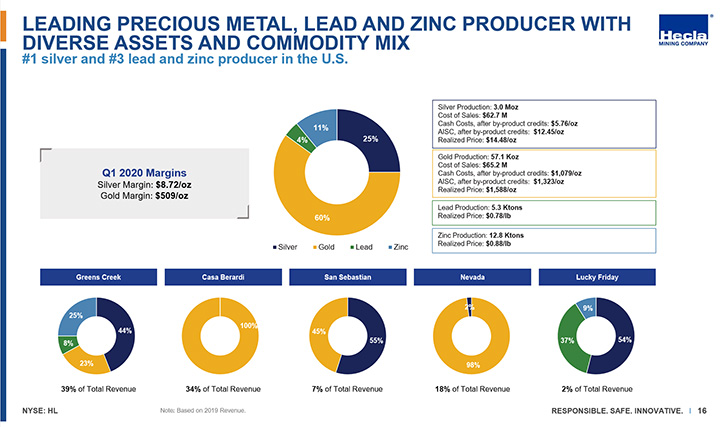

Phillips Baker: Glad to do that, Al. You know, Hecla is a 129-year-old mining company. That, in and of, itself makes it unique in our industry. In fact, you think about our country, there're not many companies that have been around as long as that. We, of course, experienced the last big pandemic, the pandemic of 1918. While we don't remember that, we do have a history of dealing with pandemics: Ebola, other pandemics. So we were prepared when the COVID-19 pandemic hit. We're a Company that has been known as a silver company. We are primarily in the United States, with operations in Quebec as well, and a very small operation in Mexico. We, in fact, produce a third of all the silver that is produced in the United States. We're three times larger than the next largest silver producer, which would be Rio Tinto. And we, of course, have also been a gold producer for the last 40 years.

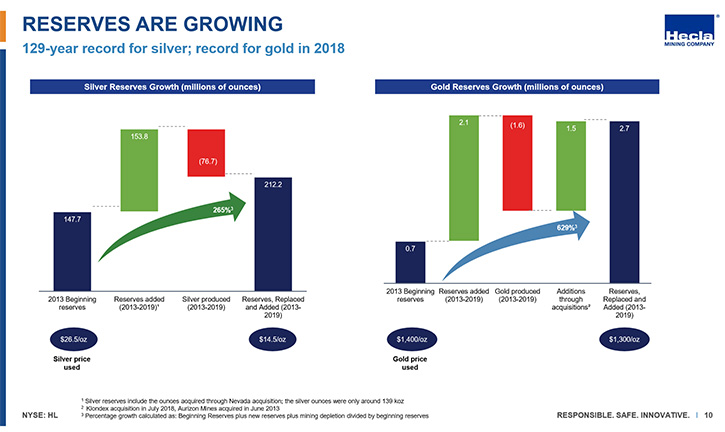

Hecla is a Company that has long lived assets. Of our three key mines, two have been around for 30 years, one of them for 75 years. The two 30 year old mines have at least another 20 years or so. The one that's 75, the Lucky Friday, probably has in excess of 30 years of life in front of it. The reason these mines have those long lives is that they have high margins. We have lots of flexibility as to when to make capital expenditures and so we've been able to weather downturns. I've been with Hecla for 20 years. I've been the CEO for the last 17. During that time, we now have by far the largest reserves we've ever had in our history, and the most production that we've ever had in our history. And the outlook looks the best it's been since I've been here. So it's an exciting time for the Company.

Dr. Allen Alper: Well, that's really fantastic. Could you mention a little bit about what Hecla did in this COVID-19 period, and what the outlook is now that we're pulling out of it?

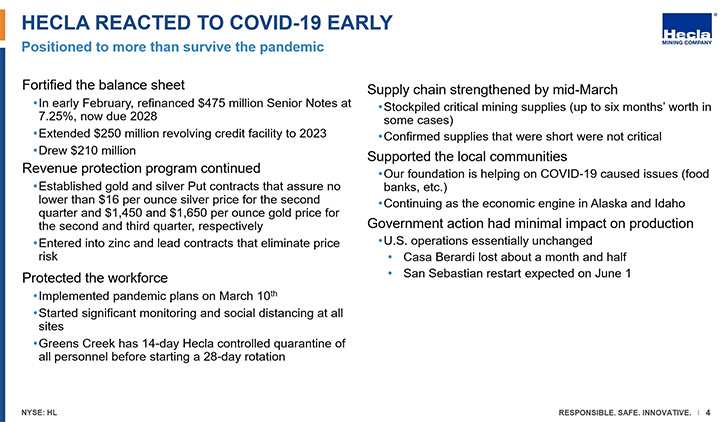

Phillips Baker: Yeah, we responded very quickly. When President Trump shut down travel to and from China, we immediately said, "There's something major going on here and we need to respond to that quickly." The first thing we did was accelerate our accessing the debt markets. We took debt that we had due in 2021 and we refinanced that debt to where it's now due in 2028. And we did it on similar terms that we had had previously. The second thing we did was shut down all travel. PDAC is an event that mining companies go to. And for the first time in 20 years, we wouldn't allow any employees to go. We just stopped all travel.

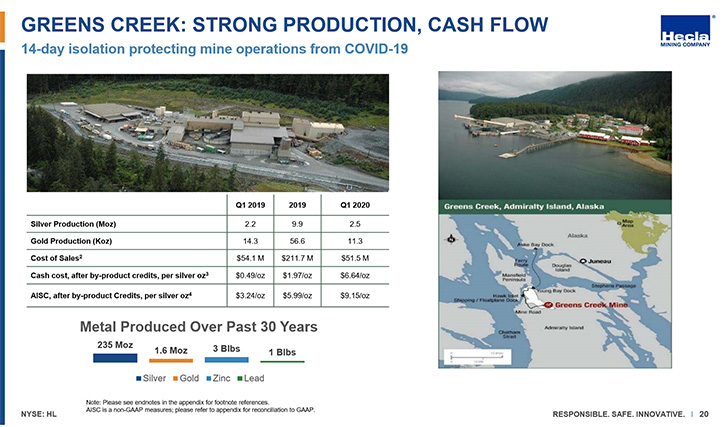

The third thing we did, in early March before a pandemic was declared, is we implemented our response to pandemics at each of our mines. And at our Greens Creek mine in Alaska, which is on an island, we isolated the mine from interactions, with people that could bring the virus to the island, to make it a fortress. We ended up putting people into quarantine for 14 days before we would allow them to go on the island, and that was everyone. No one was allowed to go on without that quarantine period. We then kept people on the island for 28 days, and then they would go home for 14 days and come back and do it again. And so we did that for the months of March, April, May. We've now been able to, with the testing, reduce it to seven days. And so we have done that. And we're now on a 21-day schedule with people on the site for 21 days and in quarantine for seven.

So that's what we've done at Greens Creek. We've done similar things at the other mines, not nearly as comprehensive as that, because that is a unique situation to be on this Island and to have the workforce that comes in from outside. We've had no cases of any employees at any of our sites with COVID-19. We've been able to continuously operate, with the exception of Casa, our mine in Quebec. The government required all mines to be shut down. So we were shut down there for about three weeks, but are back at full production. Our small operation in Mexico, of course, was shut down like all the other mines there.

As we think about coming out of COVID-19. I think operationally we're well set up to weather whatever happens. We have our protocols in place. We think that people are safer at our operations and our offices than they are really anywhere else they could be. So we're comfortable with where we are going forward. We think ultimately, it will be quite positive for gold and silver prices and also lead and zinc, which are some byproducts that we produce.

Dr. Allen Alper: That sounds very good. I'm very impressed and I have to congratulate you and your Company. You understood the threat very early and responded strategically and responsibly in the COVID-19 crisis. You and your staff should be commended. You were brilliant! That's really fantastic!

Phillips Baker: Thank you.

Dr. Allen Alper: Could you say a little bit about what people are saying and forecasting for the outlook for gold and silver and discuss what you think might happen?

Phillips Baker: This clearly is not a dissimilar time to what you've seen in the past, where there's been easy money, a lot of monetary stimulus and a lot of fiscal stimulus. I view it as not dissimilar to where we were in 2001 when the price of silver was $4.56 and the price of gold was about $268. Over the course of the following 15 years or so, we saw prices reach not quite $50, for silver and $1800 for gold. That happened as a result of stimulus that occurred in 2000, 2001, and stimulus that occurred in 2008 and 2009. All the stimulus that you see, in those two periods of time, has been done in the course of basically the last four months or so.

And so you're going to see an outsized response from precious metals. But that response typically does not happen at least in full force until the economy starts opening up. So it's not surprising that gold and silver, while they have performed well relative to other asset classes, haven't had the outsized performance because the biggest consumers of the metals, like, India and China had been shut down. With the reopening of those countries and the United States and other places around the world, you'll see the metals prices increase dramatically just because of the stimulus.

Dr. Allen Alper: That will be really very important for the whole mining sector and for stakeholders and shareholders and gold and silver and precious metals.

Phillips Baker:Hecla, our 129-year-old Company, we've been on the New York Stock Exchange for 50 years. When you've had these events happen like what we've experienced, when you start to see the metals run, then you see the equities respond. Hecla, in the last 40 years, on two occasions we were the best performing stock on the New York Stock Exchange bar none, back in the 1979 timeframe and back in the 2001 timeframe. Also on another occasion, in 2009, we were in the top 10 or 15 companies. And that's going to happen again. The metals will go and then the equities will follow and they'll go further.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors about the locations Hecla is in and why that is so important? And also a little bit more about your properties and your mines?

Phillips Baker: Well, where mines are located is absolutely the second most critical thing an investor must consider. The number one critical thing is that you have reserves and resources. But after that, it's where it's located is absolutely critical. You know, having been in the business for over 30 years, I've worked for a couple of companies that had operations in Bolivia, Papua New Guinea, Chile, Argentina. And frankly, those are difficult places to operate. Oftentimes you'll have great resources, great reserves, which is a starting point. But you need to have a place where the rule of law matters, where you have a stable sort of tax system, and you have freedom to move your currency, ability to hire and fire people. When I first showed up at Hecla in 2001, our most important asset was in Venezuela. We were the largest gold producer in the country. It became quite apparent that it was not sustainable. And you're going to have other countries where mining will not be sustainable by companies that are from outside the country.

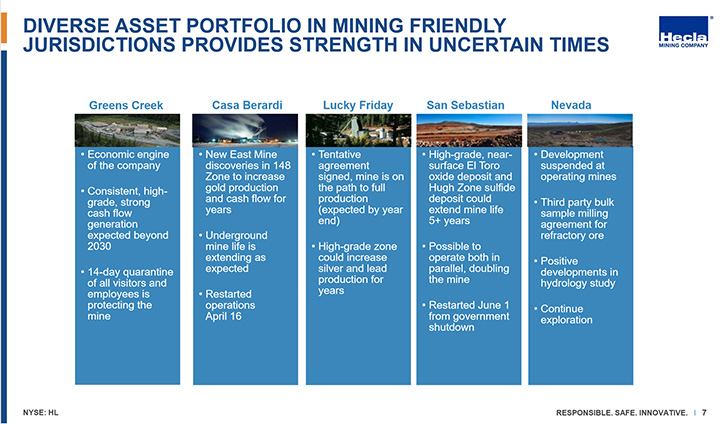

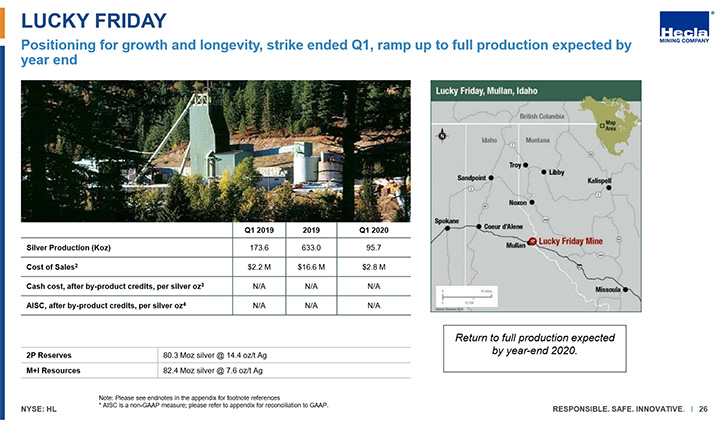

So where are our assets located? We're in Alaska, in Juneau, the capital of Alaska, on Admiralty Island, about a 40-minute boat ride from Juneau. We're in Idaho, with the Lucky Friday mine. That's a mine that's operated for 75 years. It was shut down, for a period of time, due to a strike. And that strike was resolved favorably. You’ll see a doubling of production there this year over last year. You'll see a doubling next year over this year. And you'll see about a 60% increase over the course of the next four years as we go deeper and have higher grade material.

We're in Quebec, with Casa Berardi mine that was put into production by Inco Gold, 30 years ago, when they put in great infrastructure. We've been able to, since the acquisition, extend the mine life, almost doubling it. Now we're increasing throughput. We now have two times the throughput, and we're in the process of improving the mill performance in order to drive costs down. We have all-in costs of about $1,200. We think we can get it down to about a thousand, and that of course compares to a gold price of $1700. So it's a big cashflow generator. We have some properties in Nevada, properties in Mexico. In the case of Mexico, we'll spend some more time doing some exploration to see if we can expand the known resource. In Nevada, we're doing a bulk sample, with Nevada Gold Mines, to see if we have a place to put refractory ore with them. Each of these operations has something about it that is unique.

Going back to Greens Creek. Greens Creek has, over the course of the last 30 years, generated almost $2 billion of free cash flow. More than a billion of that has come since we've owned all of it. We've been part of it since the beginning, but we've owned a hundred percent of it since 2008, and we've generated about $1.2 billion. When I look at the future of Greens Creek, I see a mine that's going to generate a hundred million or so of free cash flow a year for close to two decades.

Dr. Allen Alper: That's fantastic! That's really amazing!

Phillips Baker: It's a unique set of assets. I can talk about each one of them. Each one has something that's really quite remarkable about it.

Dr. Allen Alper: Well, that's great that Hecla's in such a strong position, with strong reserves, low costs, and long life projects and mines. Could you tell our readers/investors a little bit more about what your vision is for Hecla as you go forward?

Phillips Baker: The vision is to optimize the assets that we have. Greens Creek, is a mine that really provides the engine for the rest of the Company, but there are incremental improvements that we can make to this mine. Since we have been the operator of the mine in 2008, we've increased throughput from about 1800 tons to 2300. We're looking at further ways of increasing throughput and making small incremental improvements, like operating during the shift change, where we can take time that the mine is basically shut down and actually make it productive. So it will be this incremental sort of improvement over what we've been doing. Casa, big improvement in the mill, as I talked about.

And then at the Lucky Friday, as we go to normal throughput, ounce production will go from 700 thousand last year to 1.5 million ounces this year to about 3 million ounces next year. But because the grade is rising, we'll go to five million ounces in the next 5 years. But, as we're going deeper, we're looking at ways of mining it better. We're focused on two approaches: one that focuses on smaller disturbances and the other large infrequent disturbances. The small disturbances option uses a machine that cuts the rock, like a tunnel boring machine that people use to build tunnels, but in a much miniaturized form. It's still going to cut a swath of rock that's 10 feet, 12 feet wide, and 15 feet high, so it's not that small. But relative to what a big tunnel boring machine will do, it's quite small. So we're testing that. It's in Sweden. We've been working on this for a number of years and expect the testing to be completed this year. So we expect to see it next year.

We will test it on site after it arrives. The alternative that we are testing is a much larger blast, where we induce the seismicity allowing after the seismicity dies down to mine it continuously. So we're looking at ways of improving the Lucky Friday over and above just the grade going up. And I think, if we're successful, you'll see this mine grow from not five million ounces, but seven million ounces. And the costs should be sub-$3 an ounce if we can get to that level.

So that's the primary focus of our existing assets, but we are doing lots of work in Nevada and in Mexico. We have other exploration properties that we're anxious to do more work on, but we'll do it in a judicious way, so that we're managing our cash flows. Finally, we have an asset in Montana called Rock Creek and Montanore. These two projects, which are adjoining one another, are the third-largest undeveloped copper assets in the United States. It has three billion pounds of copper, and half a billion ounces of silver. We're going through the permitting process with that. We're hopeful that over the course of the next few years, we'll be in a position to go underground and do the close space drilling that we need to do in order to advance that project. That's a mine that, obviously with that kind of resource, will operate for 30-plus years.

Those are the things that we're primarily looking at, but we're also mindful of the fact that we think silver prices and gold prices are going to increase dramatically. We have a dividend policy that, should prices rise and we're generating lots of additional cashflow, we do take a portion of that and return it to the shareholders. We have a multi-pronged approach as to how we deliver value for shareholders.

Dr. Allen Alper: Oh, that sounds extremely excellent for your shareholders and stakeholders. That's really excellent, Phil. I wonder if you could summarize and highlight the primary reasons our readers/investors should consider investing in Hecla Mining Company.

Phillips Baker: I think the first thing our people need to keep in mind is having significant reserves and resources, and then having them in the right jurisdictions. The fact that Hecla produces three times more silver than any other producer of silver in the US puts us in a unique position and it should create a unique value for shareholders. People are not so interested in this when silver prices are low. But I think we all understand why silver prices will rise, and likely rise significantly, in the future. Silver is a metal that is really fundamental to the economy that we're in today. You think about this response to COVID-19, the fact that people are working remotely. They're doing that because they have the electronics that allows them to do it. Well, you can't have the electronics if you don't have silver in those electronics. You can't have silver if you don't have the power generation. As more and more things go low carbon footprint, there's more need for silver.

The silver market is a billion-ounce market, and it's only going to grow. You need to have that growth in jurisdictions that are secure. And there really are not many of those jurisdictions where you produce silver. Investors should consider their investment in precious metals. A piece of it should go towards silver as well as gold. There's more leverage for the silver. A silver and gold investment should outperformance a pure gold investment. A Company like Hecla, with such a significant portion of our revenues being silver, and that we have these assets in the US, should convince investors to consider us as a place to put their funds.

Dr. Allen Alper: Well, those are compelling reasons for our readers/investors to consider investing in Hecla Mining Company. Phil, was there anything else you'd like to add?

Phillips Baker: Al, I just appreciate the opportunity to talk with you about Hecla.

Dr. Allen Alper: I enjoyed talking with you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.hecla-mining.com/

Jeanne DuPont

Corporate Communications Coordinator

800-HECLA91 (800-432-5291)

Investor Relations

Email: hmc-info@hecla-mining.com

|

|