Kincora Copper Ltd. (TSXV: KCC): High-Grade Gold and Copper Discovery in a District-Scale System as Australia’s Second Largest Porphyry Mine; Sam Spring, President and CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/13/2020

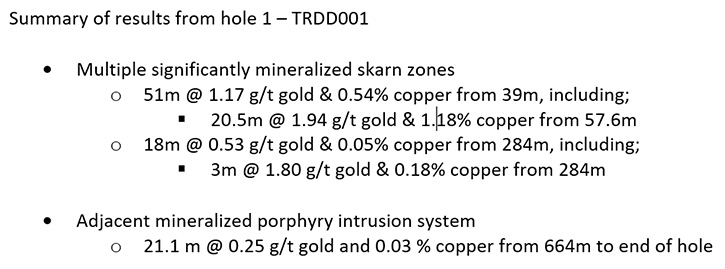

We learned from Sam Spring, President and CEO of Kincora Copper Ltd. (TSXV: KCC), that in third quarter of 2019, Kincora made the strategic decision to secure a district-scale position in the Macquarie Arc of the Lachlan Fold Belt, NSW, Australia. Kincora Copper’s flagship project, called Trundle, sits within the same mineralized system as Northparkes Copper and Gold Mine, which is Australia’s second largest porphyry mine. The high-grade near surface gold and copper results just announced from the first hole of their maiden drilling program, demonstrate the immense potential for further discoveries of high-grade porphyry and skarn-style copper-gold mineralization at Trundle. According to Mr. Spring, it is a rare opportunity for a junior to get their hands on such a brownfield project, with extensive mineralization, extensive list of untested targets and in a Tier 1 jurisdiction.

Drilling TRDD001 at the Trundle Park target, at Trundle within the Macquarie Arc, NSW

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Sam Spring, who is President and CEO of Kincora Copper. Sam, I wonder if you could give our readers/investors an overview of your Company and what differentiates it from others, and then tell us about some of the exciting recent results, drilling results, that Kincora has had.

Sam Spring: Thank you, Al, and very timely, given our first assay results out in the last week for initial drilling at Trundle. But in terms of background and addressing that first point you make, Kincora's an active, systematic explorer, looking for world-class copper porphyry discoveries. We've been the most active group undertaking regional systematic exploration in the Southern Gobi in Mongolia for a significant period of time – since BHP’s Falcon program. Our strategy really is based on three key concepts: Location, Team and Targets.

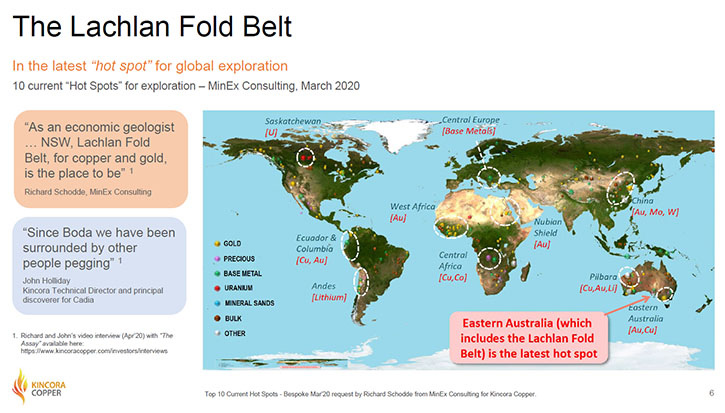

Late last year we made a bit of a transition into the Macquarie Arc of the Lachlan Fold Belt in central west New South Wales in Australia. And this is Australia's leading porphyry belt. Very similar sized targets, similar exploration approach and where we have a natural competitive advantage.

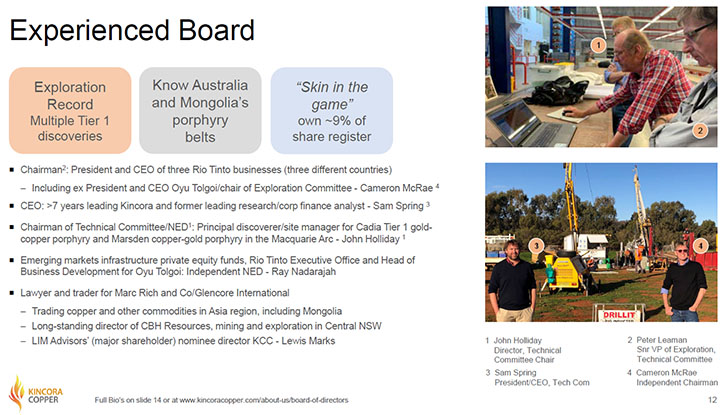

A key differentiator for us is our team, with track record of Tier 1 discovery success, skin in the game equity ownership, and track record of knowledge and success in the belts we operate in.

Our team is made up of a number of Australians, with John Holliday, our Technical Director, still living locally and being the principal discover and Project Manager for the Cadia project. Cadia is the largest porphyry in Australia and the biggest mine in this area, in the Lachlan Fold Belt. Our VP of Exploration, Peter Leaman has also been involved with a Tier 1 copper discovery, amongst others.

We're looking to apply the same approach that we have done in Mongolia that has yielded a large, low-grade discovery at Bronze Fox and apply the knowledge and experience John, Peter, and other members of the Team have within the Macquarie Arc.

Dr. Allen Alper: Oh, that sounds exciting. Could you tell our readers/investors a little more detail about the ground you have secured and data you are using for drill targeting?

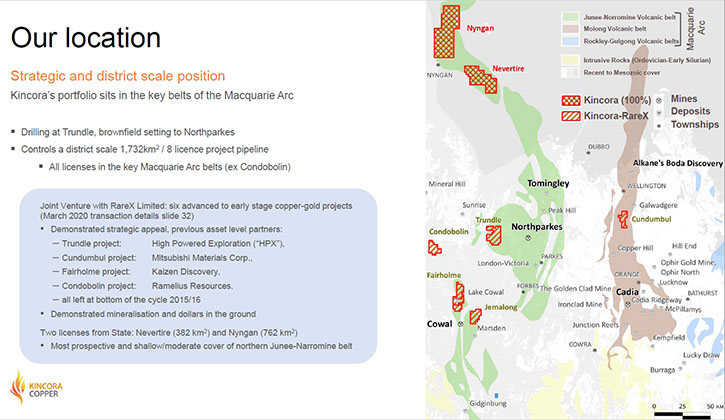

Sam Spring: Absolutely, Al. We secured a initial foothold in this region, in the third quarter last year, picking up some ground directly from the government as new license applications, in the northern part of the Junee-Narromine belt, you'll see Nyngan and Nevertire licenses. This was pre Alkane's Boda discovery. That discovery was in September, that's led to a large land pegging activity taking place in this belt. But the Boda discovery is the best greenfield discovery in this belt for porphyries, in the last 20-odd years, and some very exciting numbers coming out by Alkane.

We are quite fortunate to have secured that ground at Nyngan and Nevertire, that's since been surrounded by pegging of a lot of other groups, including Fortescue, that's been very aggressive.

But very importantly we have also secured a deal with a Company called RareX Limited, that's had some very exciting ground in the key porphyry belts, that hadn't been worked since 2015. Some excellent geology, detailed geological datasets, some excellent geophysics there, and the real sort of jewel in the crown, in our eyes, was the Trundle project. In our mind the excellent datasets we inherited supported multiple walk-up and high conviction drill targets, so we have looked to start drilling ASAP. We're just starting to announce initial drilling results for that project at the moment.

Dr. Allen Alper: Thanks Sam. Could you tell our readers/investors your plans for the rest of 2020?

Sam Spring: The focus at the moment is drilling at Trundle. We see that is a very unique environment for any junior, it's in a brownfield setting, in the same mineralized complex as Northparkes. It's not often that a junior is able to have that sort of ground anywhere in the world, let alone in a jurisdiction like Australia.

Northparkes is Australia’s second largest porphyry mine, a gold rich series of copper deposits, operated by China Molybdenum Co., Ltd. Northparkes recently was the focus of a US$550m pre-payment and streaming deal for gold and silver, secondary minerals of the operation, with Triple Flag. The FT estimates that the deal has a market value of $12 billion. This again illustrates the favorable geological and commercial setting we are operating in at Trundle.

As soon as we were able to get on the ground and start drilling at Trundle, we did so, after having done that deal with RareX. In the last week, we've just announced our first assay results, with the first hole intersecting 51 meters of 1.17 grams a ton gold, and 0.5% copper, from only 39 meters. And within that, there's a very nice interval at 20.5 meters, at 1.94 grams a ton gold, and 1.18% copper.

So an excellent start, and again, highlighting why we were so excited to get on the ground and start drilling at Trundle, because it's not often that you have these sort of opportunities of being in a brownfield setting with extensive mineralization and a lot of untested targets, that a junior can get their hands on.

Dr. Allen Alper: That sounds excellent. That's really an exciting time for Kincora Copper, to have this opportunity to explore such a large and prolific area.

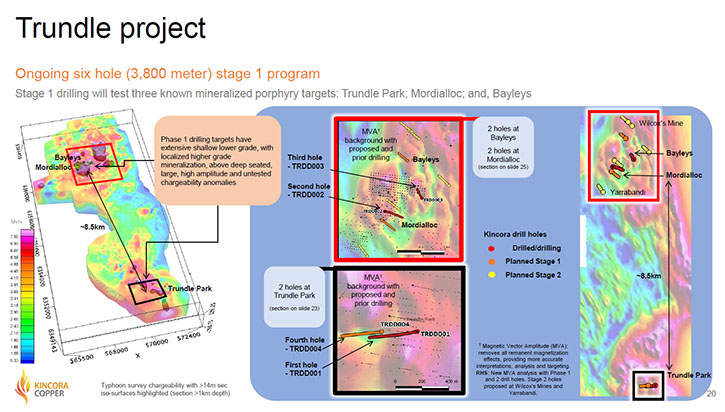

Sam Spring: It is. And one thing that really got our attention here, Al, with Trundle, is that there have been 60 odd thousand meters of drilling done in the past, with over 92% of those holes being in the top 50 meters. And only 11 holes being drilled below 300 meters. When you look at Cadia and Northparkes and Boda's discovery, and Cowal, which is another significant project in this region, all those projects at the core of the systems are at those 300 meter-type depths. You may get a bit of smoke in the top 50 meters, like what we've seen at Trundle, but unless you're prepared to drill deeper, when you look at the main deposits in this belt, you're unlikely to have significant success.

Boda's recent discovery by Alkane has really highlighted that, and that's the approach that we're taking at Trundle. We are exploring in a way that is increasingly accepted in the industry, but has never been systematically done at Trundle, despite its location, brownfield setting and extensive near surface mineralization.

We've commenced a six hole program. Assay results as mentioned for the first hole, and we'll have continual news flow for those ongoing six holes, and probably you'll see relatively soon an expansion to the program beyond just those six holes. Our existing cash position supports some further drilling and initial assay results from our first hole and visual indications at the second strongly supports further follow up beyond current plans.

Dr. Allen Alper: Thanks for that insight. Could you tell our readers/investors a little bit about your background, and your great Board and Team?

Sam Spring: Obviously with exploration companies, the team is extremely important. I guess the first point I'd make is that we're shareholders. Board and Management own about 9% of Kincora. The technical team is the engine room, obviously, for an exploration company, and that's led by John Holliday, who is our Technical Director. John lives locally, and was the Principal Discoverer of Cadia, and did a lot of work in this Lachlan fold belt region for Newcrest.

Peter Leaman is our VP of Exploration. Peter's had a long and distinguished career at BHP, credited with the Tier one discovery of Reko Diq, and a number of other significant copper and gold projects. The Board is led by our Chairman, Cameron McRae, 28 years with Rio Tinto. Developed three projects in three different continents, the most recent being the Oyu Tolgoi project in Mongolia, the largest expansion project for Rio under Cameron's watch. He invested $6 billion as he was CEO of that project. So, a very well credentialed team.

My background is more from the financial side, having worked in the junior resource sector for the last 15-odd years, and having joined Kincora in 2012.

Dr. Allen Alper: You have received some rather outstanding awards and recognition. I thought maybe you could mention those to our readers/investors.

Sam Spring: The whole team has a pretty exceptional track record. It's not just one individual, it really is a pretty strong balanced team with no passengers. You have the right skillsets from the technical team through to the non-executive Board Members. There have been a few personal successes within that group, which I guess we're looking to do again here, with what we have in the portfolio now in New South Wales.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors a little bit about your share and capital structure?

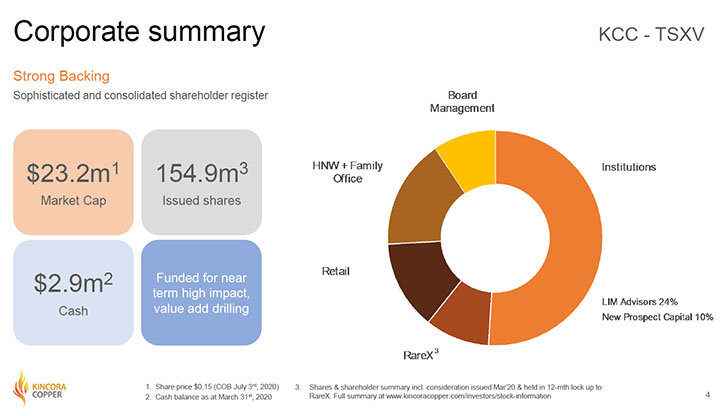

Sam Spring: We're listed on the TSXV, with the ticker “KCC”. We have quite an institutionalized shareholder register, about 50% being in institutional hands, with LIM Advisors out of Hong Kong, our largest shareholder with 24%. New Prospect Capital, a large private equity group specialist out of Hong Kong, with about 10%. A number of other very good institutions there, with single digit percentages. RareX Limited, which is “REE” on the ASX, has about nine and a half percent of Kincora, from the deal that we did in the Macquarie arc, and to secure the Trundle project earlier this year.

Board and Management, as mentioned, own about 9% of the company, with family, office and retail being a relatively small free float.

Exploring for porphyries, we have a register that reflects that they do generally take a little bit of time and money. But, we have a very strong foundation of good names that have done significant due diligence before investing in us.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors the primary reasons they should consider investing in your Company?

Sam Spring: A very good question, Al. The key thing with an explorer is to be systematic and active, getting results. While this first hole is only one hole, we have excellent gold and copper assay results, and near surface, and there's some very good benchmarking that we've done in our latest corporate presentation on slides 29 and 30, that show that for an early stage hole, this first one ranks very well.

There's been a real lack of new copper exploration success stories in Tier one jurisdictions recently. This first initial result ranks extremely well against those copper peers as illustrated on slide 29, and also as slide 30 illustrates versus copper and gold plays that have seen significant re-ratings in Australia over the last six or seven months.

An excellent start there, very timely also given the strength of both the gold and copper prices. I should also note positive visual indications from our second hole being announced, not yet in the core of a porphyry system, but suggesting given the nature of the deposits in this belt to be not too far away from where you want to be, and really supporting that Trundle is a very unique project to be held in a junior's hands.

We just have to keep drilling, better understanding these targets and systems, getting good results and demonstrating to the market what we think Trundle is, a very attractive and unique investment proposition.

Dr. Allen Alper: Oh, that's excellent! Very compelling reasons to consider investing in Kincora Copper! Sam, is there anything else you'd like to add?

Sam Spring: A key element is the track record of our Team’s Tier one success, which we are looking to repeat again.

With initial results from Trundle being positive, and an attractive valuation relative to others in our peer group that have had good results, exploring for attractive gold and copper grades in Australia.

It's not often you see the sort of grade that we've already announced in hole one, within a porphyry setting. There's that old saying, “Explore for grade and drill for tons.” And we're in a good position to do exactly that and we think we will emerge as the leading pure play porphyry explorer in Australia’s foremost porphyry belt, which is also importantly gold rich, with further strategic appeal coming from the brownfield setting of Trundle to Northparkes.

Dr. Allen Alper: That sounds excellent.

https://www.kincoracopper.com/

Referenced peer group benchmarking on slides 29 and 30 of: https://www.kincoracopper.com/media/downloads/presentations/corporate-presentation-7-6-2020.pdf

Sam Spring

President & CEO

enquiries@kincoracopper.com

Melbourne +61431 329 345

Ulaanbaatar +976 701 0095

Vancouver +1 604 283 1722

|

|