Dark Horse Resources Ltd. (ASX: DHR): Dark Horse Acquired Gold Projects in Finland and a Tungsten Project in Sweden and Argentine Gold Projects; Interview with David Mason, MD & CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/12/2020

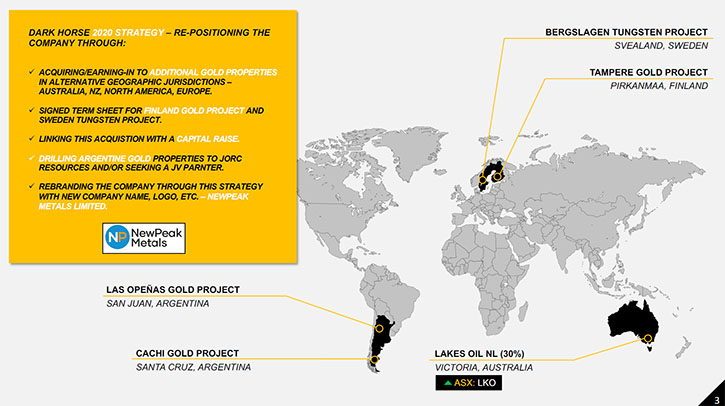

Dark Horse Resources Limited (ASX: DHR) is a project generator company focused on tier 1 Gold exploration projects. We learned from David Mason, Managing Director and CEO of Dark Horse Resources, that they have been working in Argentina for several years, and recently have decided to implement a new corporate strategy to find new gold projects in alternative jurisdictions. As a result of their search, Dark Horse is acquiring gold projects in Finland and a tungsten project in Sweden. Near-term plans include up to a 3000 meters diamond drilling program in Finland this Fall, with objectives to prove quite a reasonable and significant gold project, then continue drilling through into early next year. The Company also plans to advance its Argentine gold projects and find a joint venture partner to develop them. In addition, Dark Horse Resources holds 10 billion Lakes Oil NL (ASX: LKO) shares, representing 30% of the Company.

David Mason, Managing Director and CEO of Dark Horse Resources

Dark Horse Resources Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing David Mason, who is Managing Director and CEO of Dark Horse Resources. David, I wonder if you could give our readers/investors an overview of your Company and what differentiates your Company from others.

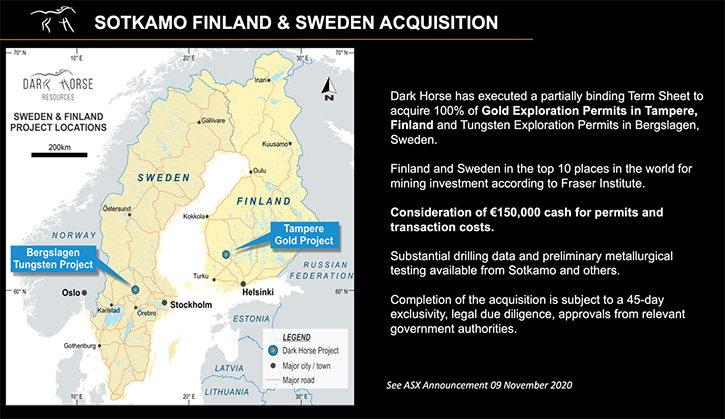

David Mason: I’m very pleased to be able to do so Al. We're focused on high-quality gold resources. Dark Horse has historically been working on two very high potential gold projects in Argentina, but with the current environment we find ourselves in, we've decided to expand our horizons and geographic jurisdictions. We're looking at Europe, North America and Australasia in terms of picking up new gold resource projects. Recently we signed a term sheet to acquire 100% of 7 gold permits in the Tampere region of Finland and it came with some Tungsten assets in Sweden too. This is an excellent outcome for Dark Horse.

We always look for a very good jurisdiction, so that is certainly very high on our priority list. Of course, we're looking at gold projects where there are at least some good drilling results or early stage geo-resources. Particularly projects where we see they may have been underexplored or overlooked, or some other attributes of the project where we can use our geoscientific technical expertise, add significant value to those projects, move them to a higher level, which is essentially defining international standard resources.

Then ultimately a trade sale of those projects or the Company, which is going to create a premium value for our shareholders. Essentially that's what Dark Horse is about, and we will do that on a continuous basis, always looking after the capital of our shareholders.

Dr. Allen Alper: Well, that sounds very good. Could you tell our readers/investors a little bit about your background and the Directors and Management?

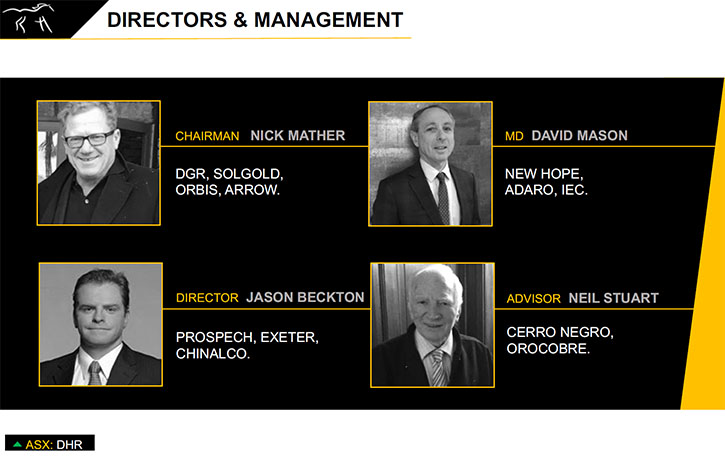

David Mason: Certainly. I've been the Managing Director of Dark Horse for the last five years. A lot of my previous experience in managing companies has been in the energy sector in Australia, Asia and in Africa. I've also worked in precious and industrial minerals as well. My Chairman, Mr. Nicholas Mather, runs a group, DGR Global. It's listed on the ASX, Australian Stock Exchange.

It's been a Company for quite some time and it has significant, but minority investments in a number of listed and unlisted public companies, resource companies, energy companies, of particular notary at the moment is SolGold. Nick Mather is the Managing Director and CEO of SolGold, which has a large porphyry copper-gold project in Ecuador. He's been involved in the minerals and resources industry for 40 plus years.

He's had some incredible successes in sourcing unique resource projects, adding value and creating very, very significant wealth for shareholders and stakeholders of those Companies. The other Board Members are Brian Moller who's a partner and legal counsel with HopgoodGanim, which is a leading Australian law firm and Jason Beckton, who's a geologist entrepreneur. He's been very much involved in South America, Australia and Europe in the discovery and resource definition of a number of precious metal projects, and adds a lot of technical value to the Dark Horse Board. Neil Stuart plays a large advisory role with the company, even though he is now retired. He has been very successful in resource discovery and exploration, namely with Cerro Negro and Orocobre in Argentina.

Dr. Allen Alper: Well, sounds like you and your team have a very strong background and are very experienced, so that's excellent.

David Mason: Three of us are geoscientists and all have long careers in the resources mineral industry, discovering resources or sourcing undervalued unexplored projects and making significant wealth for shareholders and stakeholders in just about every continent in the world.

Dr. Allen Alper: Well, that sounds great. That's fantastic. Could you tell our readers/investors a little bit about your capital structure?

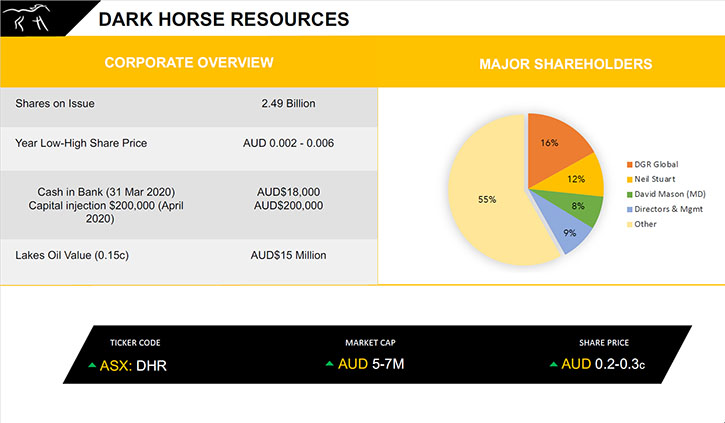

David Mason: We have quite a few shares outstanding, around two and a half billion plus. We've just gone through a capital raise. We had a placement a week to two weeks ago where we raised $675,000 Australian dollars. We have a share purchase plan for our existing shareholders open at the moment for the next couple of weeks at the same pricing as the placement. That will add shares to that two and a half billion outstanding. We're not really concerned about that number of shares. There are quite a number of resource companies in Australia, which have a fair amount of stock outstanding.

We'll have a look at that capital structure over the next 12 months or so and we may consider some consolidation then. We have a market capitalization around five to 6 million Australian dollars. We're still a fairly junior company. Although in the lithium boom, about three years ago, we had an exciting lithium spodumene project in Argentina, where we were drilling and it looked like we were going to get quite a significant lithium spodumene project defined.

Unfortunately, it didn't quite turn out that way. The resource was quite large, but it didn't have the grades to turn it into a commercial project. Our market capitalization at that time was in the $50 to $60 million mark. We've been into the reasonable size company in the not too distant past. Certainly my objective, as the Managing Director of Dark Horse, is to take us to that level again over the next 12 months or so and even beyond that. We believe we have the project portfolio to be able to do that.

Dr. Allen Alper: That sounds excellent. Could you tell us a little bit about Lakes Oil value?

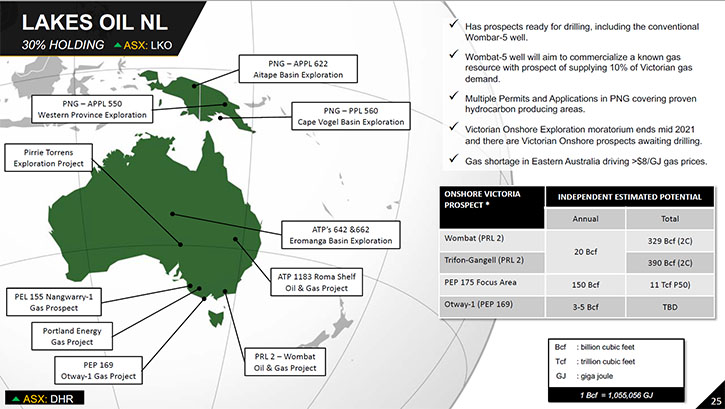

David Mason: Yes. That's a very significant investment in Dark Horse. It's a legacy investment where Dark Horse had a subsidiary company that held oil and gas properties in Queensland and South Australia. We blended those into Lakes Oil, an Australian publicly listed company for stock. At that time, about two years or so ago, we picked up a third of the stock of Lakes Oil. We still hold a 30% stake in Lakes Oil, which obviously is very significant.

Lakes has very large resources of gas onshore in the state of Victoria in Australia. Victoria has had a moratorium on the exploration of onshore gas. It's coming out of that in the middle of 2021. That will allow Lakes to consider further exploration and definition of their gas resources and ultimately production. We believe at that time, we'll start to see considerable value in Lakes. Lakes suspended from the Australian Stock Exchange towards the end of last year however, we understand they are working their way to coming out of suspension in the near future.

It remained suspended but it's looking to come out of suspension in the very near future. It last traded at 0.15 of a cent, which gave a value of Dark Horses' interest in Lakes at 15 million Australian dollars, which is a significant amount, almost three times the current market capital value of Dark Horse. Now, we will hold on to that investment. We believe that that $15 million could well turn into 20 or $50 million or more over the next 12 or 18 months period.

We will hold on to that investment and when we see good value for Dark Horse shareholders, we will look at crystallizing the value that we hold in Lakes and perhaps sell down some or a large majority of that stake. That of course we will use to fund Dark Horse or we may provide some of that back to the shareholders of Dark Horse.

Dr. Allen Alper: It sounds like a great opportunity for Dark Horse Resources. Could you tell our readers/investors a little bit about your Finland and Sweden acquisition?

David Mason: Certainly. That's very important to Dark Horse. We'd previously been focused mostly on Argentina in South America, but early this year we implemented a new corporate strategy to find new gold projects in alternative jurisdictions. We've been doing due diligence on a number of projects in Australia, North America, Europe. We were very pleased to come across, a couple of months ago, a gold project in Finland at Tampere.

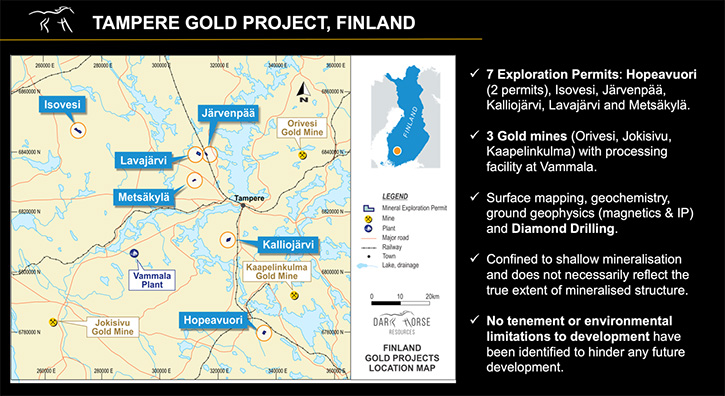

It's a series of exploration permits in the Tampere Gold District. There are some operating mines immediately surrounding the tenure. These tenure permits are owned by the Swedish-Finnish company, Sotkamo. They were developing and are in production at a silver mine in that area of Scandinavia. They decided to focus principally on that silver mine, ensuring that they brought that into production to the objectives and milestones that they'd set.

These gold exploration permits in Tampere in Finland were somewhat of a distraction and they were very pleased to find a home for them. We acquired those assets for a total sum of €150,000, which is a lump sum cash payment on conclusion of that acquisition for a hundred percent of those exploration permits. In addition to the gold, Sotkamo had a collection of tungsten exploration permits in the historical tungsten mining district of Sweden called Bergslagen.

They're essentially a bonus for Dark Horse. Tungsten's not, or hasn't been, one of our high priorities, but we're very pleased to acquire those within this package. We'll have a good evaluation and review of those assets over the next six to 12 months. If we believe that they have some good value for our shareholders, we'll progress and develop those assets alongside the gold project in Finland.

Those gold projects at Tampere have historical drilling on them, diamond drilling, and some of them are showing some quite anomalous gold intersections. Some of the drill holes are returning 10 and 11 meters thickness running 15 to 20 grams per ton Gold, from very shallow depths of four meters or 30 meters depth from the surface. This mineralization commences essentially at surface, which if commercial, would allow open pit mining initially.

It's very wide. It's in a mineralized zone up to 30 meters in thickness. It has very high grades. Now, a commercial gold vein type system needs anything more than five meters in thickness. Here we have potentially double or more of that in thickness, and grades of maybe greater than five grams per ton. Again, we're getting grades of 15 and 20 grams per ton. You can see these have some very anomalous grade and thickness values.

The strike length of this deposit at the moment is about 200 meters. In the due diligence work that we've done on the Tampere area, we can see this extending across the licenses for up to 800 meters. If you put those metrics together in terms of length and width and depth and the grade, we have a potentially very large exploration target. That's a target that hasn't been defined as yet, but that's what we'll be working on doing over the next 12 to 18 months.

Dr. Allen Alper: Sounds great. Could you tell our readers/investors your primary goals for the remainder of 2020 going into 2021?

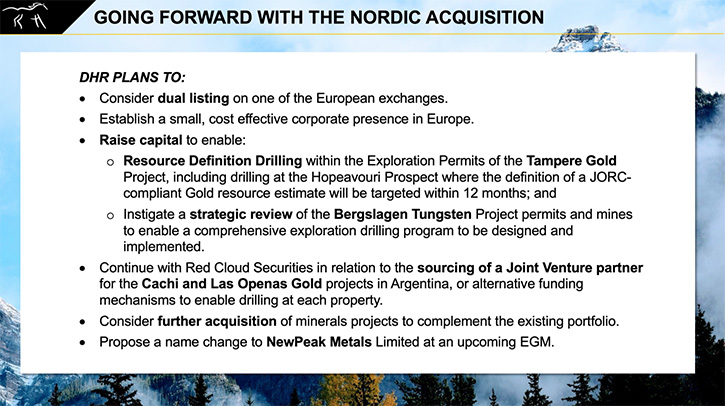

David Mason: Certainly. We've just raised $675,000. The share purchase plan will hopefully bring in another 750 up to a million dollars. We hope to have approx. 1.25 million dollars Australian in the treasury. We intend to do a diamond drilling program in country in Finland on our new gold projects, once we conclude that deal, which should be over the next month or so. We plan to implement that drilling program September-October later this year.

We'll be drilling up to about 3000 meters of diamond drilling. We will do that within that budget of about a million Australian dollars. We believe, with that amount of drilling, we'll be able to prove quite a reasonable and significant gold resource. We'll then likely raise some further funds at that time, with a plan to continue drilling through into early next year. The target is to bring that project into an international standard resource. That is the main plan.

We also have plans to advance our Argentine gold projects. We are looking to find a joint venture partner to come in and work with us and develop those two gold projects in Argentina. We're looking at some fairly large companies potentially to come into a joint venture with us. We'll have them co-fund the project and we intend to drill within the next 12 months, both the Cachi and the Las Opeñas gold projects in Argentina.

We believe that those initial drilling programs will bring those projects to discovery and then again, we will progress those projects through resource definition phases to prove an international standard gold resource. We've fairly aggressive plans, but we'll need some funding. We've been fairly successful in raising funds in the equity markets and we'll continue to do that. We have a good shareholder base.

They're very loyal shareholders and we will be raising capital and progressing our gold projects in Finland and in Argentina. We have some other acquisitions on the horizon that we may conclude in that period of time as well.

Dr. Allen Alper: That sounds excellent. David, could you tell our readers/investors the primary reasons they should consider investing in Dark Horse Resources?

David Mason: We've a very experienced management team, each of us have been in the industry for 30/40 years plus. We have created, each of us, significant wealth for the Companies that we work and manage and for the shareholders and stakeholders that are associated with those Companies. We have some excellent gold projects, both in Argentina and now in Finland, where we'll be expanding and increasing the projects we have. We’re confident that our large holding in Lakes Oil should bring a good return to Dark Horse over the next few years.

We have an enormous amount of expertise in being able to source and discover good gold projects and other mineral projects. We also have a lot of experience in raising funds. I would encourage new shareholders and existing shareholders to have a good look at what we're doing in raising capital at the moment. Particularly existing shareholders in our share purchase plan (SPP), which is open for the next couple of weeks still.

I believe those attributes are going to make Dark Horse a very successful Company. We'll expect to crystallize some value for our shareholders and stakeholders over the next 12 months going forward.

Dr. Allen Alper: Well, those sound like excellent reasons for our readers/investors to consider investing in Dark Horse Resources. David, is there anything else you'd like to add?

David Mason: Not right now. It's been a pleasure speaking with you. Thanks very much for the opportunity for me to tell the Dark Horse story. I wish you all the best in your future as I wish all the best for the future of the Dark Horse shareholders and Dark Horse and ourselves. Thanks very much.

Dr. Allen Alper: Well, thank you. For about 35 years I was involved in tungsten and at one point I ran the largest tungsten powder organization in the world, which still is the largest. It's now owned by Plansee. So if you need any kind of advice or connections on tungsten, I'd be glad to give it to you.

David Mason: Oh, that would be excellent Al because our knowledge on tungsten is at a fairly low base at the moment. As I said, we want to have a really good look at these tungsten assets. Historically, it's the main area of Sweden where tungsten has been mined and some of those leases that we hold contain those old mines and the surrounding resources. We expect there to be quite some significant commercial resources of tungsten. Yeah. I'd be very pleased to communicate with you on that as we go forward.

Dr. Allen Alper: Oh, that's great. I’ll be pleased to help. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.darkhorseresources.com.au/

Mr. David Mason

Managing Director

Dark Horse Resources Ltd

Phone: 07 3303 0650

|

|