Anaconda Mining Inc. (TSX: ANX, OTCQX:ANXGF): Production, Development, and Exploration Company, in the Prolific Mining District of Newfoundland: Interview with Kevin Bullock, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/10/2020

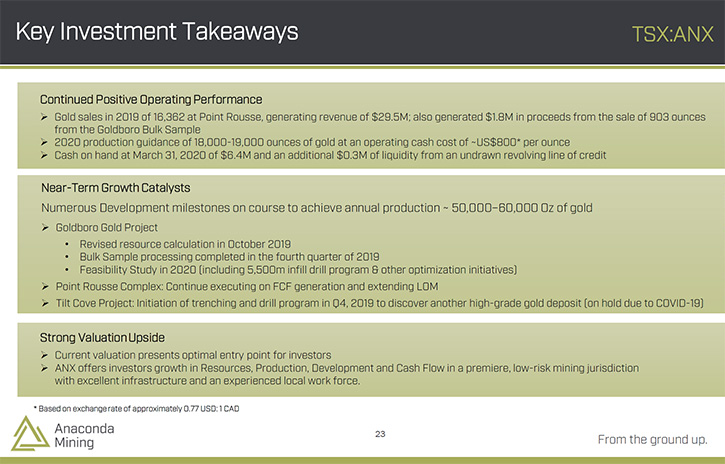

Anaconda Mining Inc. (TSX:ANX, OTCQX:ANXGF) a production, development, and exploration Company, with mining and milling operations, in the prolific Baie Verte Mining District of Newfoundland, which includes the fully-permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~11,000 hectares of highly prospective mineral lands, including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project. Anaconda is also developing the Goldboro Gold Project in Nova Scotia, a high-grade resource and the subject of an on-going feasibility study. We learned from Kevin Bullock, who is President and CEO of Anaconda Mining that they are producing between 18 and 19,000 ounces of gold per year in Newfoundland, with positive cash flow, and currently have approximately $7 million in cash. They are starting a 5,500 meter drilling program at Nova Scotia, to convert about 100,000 ounces, of currently inferred resources, into indicated resources and thereby allowing them to be used in the feasibility study. Anaconda also keeps ongoing exploration, around its producing mine in Newfoundland, continuously increasing the mine life.

Anaconda Mining Inc.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Kevin Bullock, who is President and CEO of Anaconda Mining. Kevin, I wonder if you could give our readers/investors an overview of your Company and what differentiates your Company from others?

Kevin Bullock: Thanks. I’m happy to be here, Allen. I think that we're a unique Company in the sense that for a market cap that's under 50 million, we have production, development, exploration, and growth, and you don't generally find that with small companies like us. We are producing between 18 and 19,000 ounces of gold per year, with positive cash flow at today's prices, especially in Canadian dollars, which is where we operate and our costs are associated. We're making quite a bit of money, free cash flow. We have a development project in Nova Scotia, which is going through a feasibility right now. We're identifying a lot of opportunities for optimization with that and have started a drill program, which was announced this morning. We’ll be doing 5,500 meters of drilling to convert currently inferred resources into indicated resources and thereby allowing them to be used in the feasibility study.

There're 160,000 ounces identified, in and around areas that we plan on developing, within the feasibility that are currently inferred. At historic conversion rates that would convert to around 100,000 ounces to add. With gold trading at $2,300 an ounce Canadian, that's another $450 million to add to the revenue side, should we be successful in conversion. That is started and is going to be a couple of month’s program, with announcements along the way. The mine currently continues to operate in Newfoundland, which is our producing mine. We're also exploring in and around our producing mine and finding some very interesting and exciting intersections that will be announced over the next few weeks. So it's quite a unique Company, with a lot of attributes and a lot of positive things happening over the next few months.

Dr. Allen Alper: Sounds excellent! Sounds like this year, in the coming months, will be an exciting time for the core investors and stakeholders of Anaconda Mining.

Kevin Bullock: Absolutely. We've turned a corner. We've made a lot of changes internally and externally, in all our projects. We're sitting on approximately $7 million of cash now, which is building weekly by our positive free cash flow, while we're carrying out all our work that's currently funded by that as well. So I think it is onwards and upwards from here.

Dr. Allen Alper: Sounds excellent! Could you tell our readers/investors a little bit about yourself and your Team?

Kevin Bullock: Yeah, certainly we've been able to retain some good people for the small company that we are. I think it's because we don't plan to remain a small company. We will grow into the people that we have. I'm a mining engineer. I've been in the business over 35 years. I have successes to my name in the past, I helped start and revamp Kirkland Lake Gold from a shell company and was part of the team that negotiated the purchase of the Macassa Mine. That's now a multibillion-dollar company. I was also involved with Iamgold Corporation, when it was private through it going public, which is now a multibillion-dollar company. I started my own company called Volta Resources, which eventually became purchased by B2Gold after a discovery of 10 million ounces of gold equivalent in West Africa.

I'm currently on the Board of Directors of B2Gold, because of that transaction. That's a multibillion-dollar company, and Anaconda is my next one.

We also have a CFO, Rob Dufour, who has been with the larger companies or helped some of the other companies grow into larger companies like Newmarket Gold and Crocodile Gold. He is very, very good with budgets and keeping track of expenditures and making sure that we're always pulling in money as opposed to putting it out. So quite a good team of people, we've just converted the consultant that's doing our feasibility study at the Goldboro project in Nova Scotia to a Company called Nordmin. Nordmin Engineering is a group that I've worked with in the past. The principal of it and I worked together, as co-managers, in an engineering company years back. Very, very good at narrow-vein underground deposits and doing a very good, exciting job finding opportunities in our feasibility study for the Goldboro project.

So we have the right people in place. We have an exploration team of people that have been in the East Coast their entire careers, and have discoveries under their belt, that are doing the exploration for us. It's exciting times ahead, with the help of these people that are second to none.

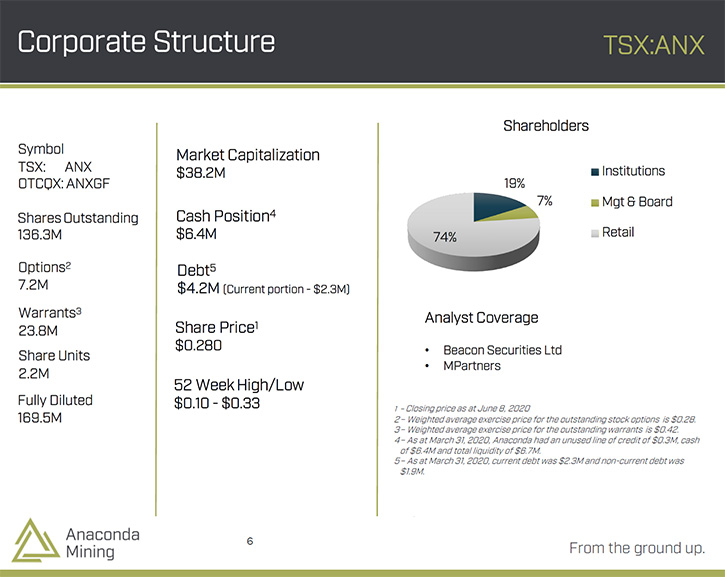

Dr. Allen Alper: Oh, that's great. You have a great Team and you have a great background. So that sounds excellent. Could you tell us a little bit about your corporate structure?

Kevin Bullock: Yes. We're very much into safety and environment as well as technology. And therefore, over the last few years, as we've been trying to develop new methods to mine narrower ore bodies, and to get our costs down, we've developed subsidiaries of which we hold pieces. Corporately, we're on the Toronto Stock Exchange, but we do have a very large interest in a Company called Novamera, which we just spun out a couple of months ago, which is in technology to do narrow-vein mining. We've managed to get an investor to fund it and take it outside of the Company so that there's no longer any drain of funds from us, but we retain about a 35% interest in that Company. And that continues to move forward.

Venture capitalists have invested two million into that. We also have a set of exploration properties that are grassroots and not going to develop into development properties in the near-term, but we have a lot of interest in the potential of discovery in them and managed to spin them out into a separate company called Magna Terra which is also listed, Magna Terra Minerals. That deal is currently halted at the moment, raising its funds as part of the transaction. We think it will close near the end of the month. Once that starts trading again, we'll have about a 35% interest in Magna Terra, a pure grassroots exploration company. So we've managed to spin off Companies for our own development and benefit from that. Now we'll continue to benefit the future without it costing us. We're completely focused on gold discovery, development and production.

Dr. Allen Alper: That sounds excellent. Could you tell us a little bit about your shareholders?

Kevin Bullock: We're particularly a retail company. We don't have a large institutional investor base. The way this Company was started and funded over the last 10 years, it's become a retail company. However, there's a lot of new interest from some funds and some institutions that are starting to pick up. About 8% of the Company is held by insider's Management and Directors. We have a couple of larger shareholders, a family house, investment house out of Florida and a couple of other institutions. The rest is all retail. It's about 70% retail held.

Dr. Allen Alper: It sounds very good. Sounds like an opportunity for our readers/investors. Could you tell us a little bit about your symbol and shares outstanding, et cetera?

Kevin Bullock: We currently have about 130 million shares issued and outstanding. We're trading at about 28, 29 cents Canadian, which gives us a market cap of just under 40 million Canadian. The facilities that we have at Point Rousse, where our operating mine has permitted tailings for 15 years and a port and a 1300 tonne a day mill, along with a project that's in feasibility now that looks like it's going to be well over 100 million net present value. There's a lot of value in this Company that hasn't been recognized yet. And that's what we're going to draw out over the next little while. So yeah, it's on the Toronto Stock Exchange, symbol is A-N-X. We're a highly liquid company. We've gone from about 13 or 14 cents a couple of months ago to our current value of 28, 29 cents.

We continue to have momentum. It's quite an interesting time for us, without many shares outstanding.

Dr. Allen Alper: Excellent!

Kevin Bullock: We continue to fund our programs with cashflow. So there's not a high amount of dilution involved in the Company.

Dr. Allen Alper: Well, that's excellent. Very few companies could do that. That's very good.

Kevin Bullock: We're very fortunate to have a producing mine.

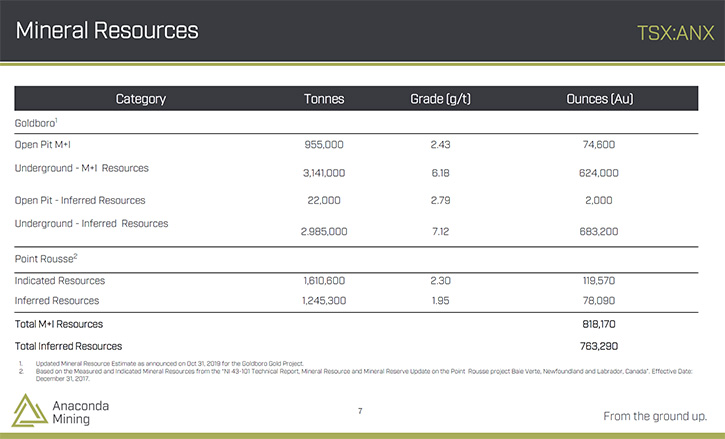

Dr. Allen Alper: That's excellent to have a producing mine and also the opportunity to increase your resources through exploration. So that's excellent. Could you tell our readers/investors a little bit more your mineral resources?

Kevin Bullock: Yeah. We currently have the largest single deposit in the province of Nova Scotia, the Goldboro deposit, which is just under a 1.5-million-ounce resource base at the moment. That will probably turn into somewhere between 350 and 450,000 ounces of minable material in this feasibility. We also have about 50,000 ounces at Point Rousse, which is the operating mine, which is about a two-and-a-half-year life, but that mine has had a two-and-a-half-year mine life for the last 10 years. We keep discovering more and we're still drilling around it. So global resource, one and a half million ounces, quality ounces, the Goldboro deposit averages over six grams per ton for that million and a half ounces.

Dr. Allen Alper: That's sounds excellent. Could you tell our readers/investors, the primary reasons they should consider investing in Anaconda Mining?

Kevin Bullock: It is early days, and if you are familiar with the Lassonde Curve, which is the curve from going through discovery to development, to production. We're at the point where we are in final feasibility about to develop a mine in Nova Scotia, while we have current free cashflow. Puts us in a very unique position on that curve. It should move towards being much more valuable over the next little while, as we jump the hurdles of permitting and feasibility and fundraising, and building the mine. That combined with a significant opportunity for discovery, creates a Company that has a lot of news that will be out over the next few months, that will be positive in putting and adding value to the current share price.

So that's number one, investing in something that's about to move not already after it has moved. You're betting on a Team of Management people that have done this several times in the past. Bet on Management with good projects. Generally, that's a good ratio for a win.

Dr. Allen Alper: Well, that sounds like excellent reasons to invest in Anaconda Mining. Is there anything else you would like to add, Kevin?

Kevin Bullock: We’ll stay the course. We do not hope for a rise in the gold price as part of our strategy, although we'll take it when it happens. We are planning and building things that can make it at today's price of gold or much less. We're mitigating the downside risk, while trying to get the best bang for our buck on the revenue, while the gold price is high.

Dr. Allen Alper: Well, that sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.anacondamining.com/

Kevin Bullock

President and CEO

(647) 388-1842

kbullock@anacondamining.com

|

|