Endeavour Silver Corp. (NYSE: EXK, TSX: EDR): Improved Performance of Three High-Grade, Silver-Gold Mines in Mexico, Advancing the Terronera Mine Project; Brad Cooke, Founder and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/5/2020

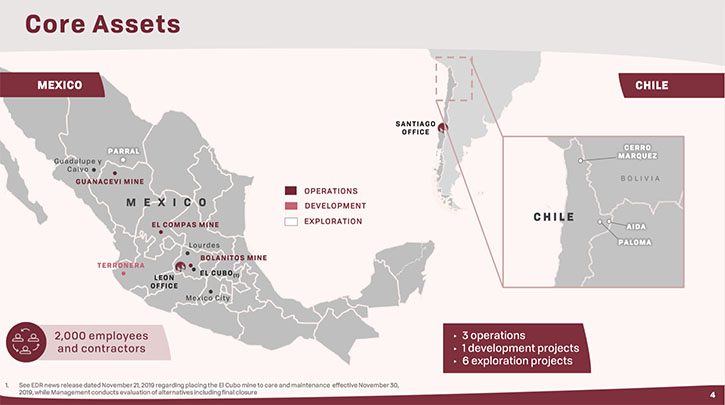

Endeavour Silver Corp. (NYSE: EXK, TSX: EDR) is a mid-tier precious metals mining company that owns and operates three high-grade, underground, silver-gold mines in Mexico. Endeavour is currently advancing the Terronera Mine project towards a development decision and exploring its portfolio of exploration and development projects in Mexico and Chile to facilitate its goal to become a premier senior silver producer. We learned from Bradford Cooke, Founder and CEO of Endeavour Silver, that their mines have been performing a lot better this year after falling on hard times last year. In addition, they have two new silver-gold discoveries, located in other historic mining districts in Mexico, one of which, Terronera, should not only become a future core asset, but also their largest and the lowest-cost mine. Once built, Terronera has the potential to double their production and half their operating costs.

Brad Cooke, Founder & CEO of Endeavour Silver

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Bradford Cooke, the Founder & CEO of Endeavour Silver. Brad, could you give our readers/investors an overview of Endeavour Silver and what differentiates Endeavour Silver from other silver mining companies?

Brad Cooke: Absolutely! Thank you for inviting me to interview with Metals News. Endeavour Silver Corp is a Company I founded 16 years ago, with a view to acquiring strategic silver and gold assets in Mexico, before the price of silver took off. As it turned out, our timing was magnificent and we were able to build a Company based on a business model of acquiring small historic mines in famous old mining districts in Mexico that had closed and been put up for sale because they ran out of ore. Our ability to recognize exploration potential and mobilize the money and expertise needed to unfold the full potential of these historic districts is really what set Endeavour apart from the pack. Today we're a mid-tier silver and gold producer. We own and operate three high-grade, underground, silver gold mines in Mexico. We're inter-listed on the big boards on both the Toronto and New York Stock Exchanges. We have a clean balance sheet, healthy cash position, and one of the best organic growth profiles to build new mines, grow our production and reduce our costs in the silver sector.

Dr. Allen Alper: That's fantastic. Could you tell our readers/investors a little bit more about your three mines?

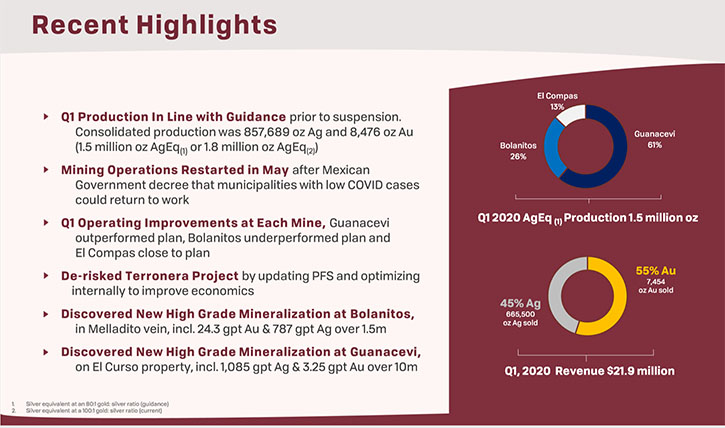

Brad Cooke: After many years of profitability, our three mines fell on hard times last year. There is no way to sugar coat this, we lost a significant amount of money at our mining operations in 2019. We moved quickly to stop the bleeding by initiating sweeping changes at each of the mine sites. As a result, our first and largest mine, Guanaceví, which was our biggest loser last year, has already returned to good financial health. In the first quarter 2020, it returned to profitability thanks to all of the positive changes we made last year.

Our second mine, Bolanitos, was our most profitable mine for over a decade. From 2009 to 2018 we pulled over $200 million of free cashflow out of the Bolanitos mine. But it also, for similar reasons, fell on hard times last year. Because we didn't start the operational turnaround at Bolanitos until the third quarter of last year, and it takes about three or four quarters for these changes to take full effect, we're expecting Bolanitos to break into the black by the end of the third quarter this year.

Our third mine, El Compas is our newest mine. We only commissioned it just over a year and it is breaking even at this time. We continue to tweak the grades, recoveries and operational performance to make money at El Compas.

Dr. Allen Alper: I know you have growth opportunities. Could you tell our readers/investors about that?

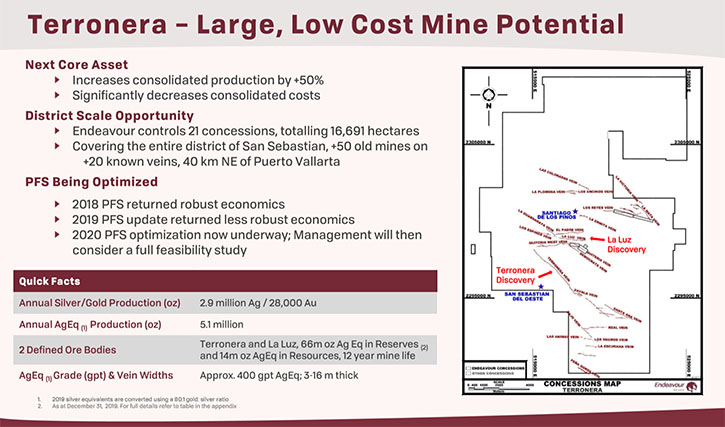

Brad Cooke: Yes, we have not one but two bona fide grassroots, silver gold discoveries in Mexico, also located in historic districts. But unlike our other mines, they don't come with fully built and permitted infrastructure. These are virgin discoveries in historic districts, Terronera in Jalisco State and Parral in Chihuahua State.

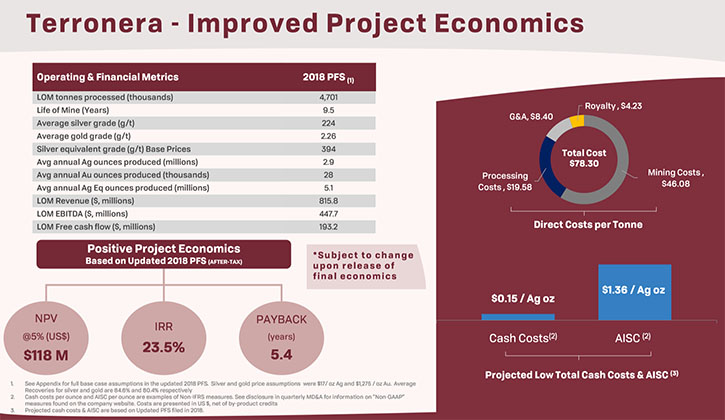

Terronera is the most advanced of our development projects and has the potential to become our next core asset and our largest and lowest cost mine. We've already published three pre-feasibility studies (PFS) with very positive results and we have a fourth and final PFS to release shortly. We then plan to complete a full feasibility study for less than $1.5 million over a 9 month period so we can make a development decision on what should be our best asset.

We have drilled about 80 million ounces of silver equivalent resources in all categories at Terronera. Since the two orebodies are shallower, thicker, and richer than any of our other mines, the economics are particularly compelling. Terronera revenues will be split approximately 67% from silver and 33% from gold. Our previously estimated cash cost of operations at Terronera per oz of silver, net of the gold credit was zero, in other words, gold pays for the operation and the silver is effectively free. Even the all in sustaining cost was estimated at a mere $1.36 per oz silver so once in production, Terronera should not only double our production, but significantly reduce our costs.

Dr. Allen Alper: And what do you think the timing will be?

Brad Cooke: Once we complete a feasibility study and make a development decision around mid-2021, the development timeline is approximately 18 months to construct and commission the new mine, so production and cash flow is anticipated by the end of 2022.

To speed things up, we will look for opportunities to raise money during the feasibility stage, so we can start working on some of the long lead time items. For instance, we need to mine 200,000 cubic yards of material off the top of a hill to level the plant site. That material is valuable because it goes down the hill to build our main tailings dam.

The two kilometer long main mine access ramp obviously will take a lot of time so we'd love to get a head start on that this year. And last but not least, we want to start building the camp not only for the construction crews, but also to house our employees during mining operations.

Dr. Allen Alper: That sounds very promising, a great opportunity for Endeavour Silver and for shareholders. Could you tell our readers/investors a little bit about your background and your team?

Brad Cooke: I'm a professional geologist by background and training. I've been in the mining business now for almost 44 years.

We have a great team who have been together at Endeavour for many years. Our COO Godfrey Walton, I've known since the 1970s. Our CFO Dan Dickson joined us from the accounting firm KPMG about 13 years ago. So we have a great core management at both offices in Vancouver and Mexico.

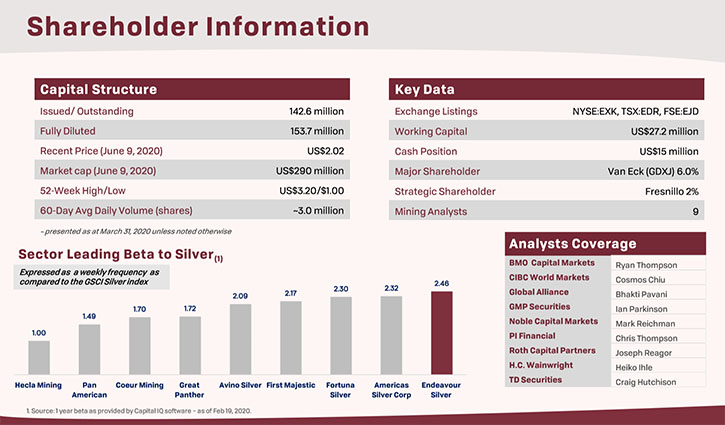

Dr. Allen Alper: Could you tell our readers/investors about your share capital structure?

Brad Cooke:Endeavour is a 16 year old company. We have approximately 149 million shares issued. There're no warrants outstanding and about 11 million employee stock options so around 160 million fully diluted. The shares are currently trading in the US$2.20 range for a market capitalization of approximately US$330 million.

Dr. Allen Alper: Could you tell us about your balance sheet too?

Brad Cooke: At the end of the last quarter, we reported cash of about $15 million, working capital of around $27 million and no long-term debt. So a clean balance sheet.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in Endeavor Silver?

Brad Cooke: We have the expertise to recognize exploration upside and make new discoveries to unfold the full potential of our mineral properties. Every single ore body we've discovered, not only the three mines, but each of the development projects, are discoveries by our exploration team.

We're very proud of our people and their accomplishments. We've been together for years and we're not half done yet. Simply by building our fourth mine, we expect to double our production and halve our costs. And stay tuned, because for the upside, for the long term, we have three world-class exploration projects in Chile that we expect to start drilling late this year. All we need is one of them to succeed to secure decades of future production for the Company.

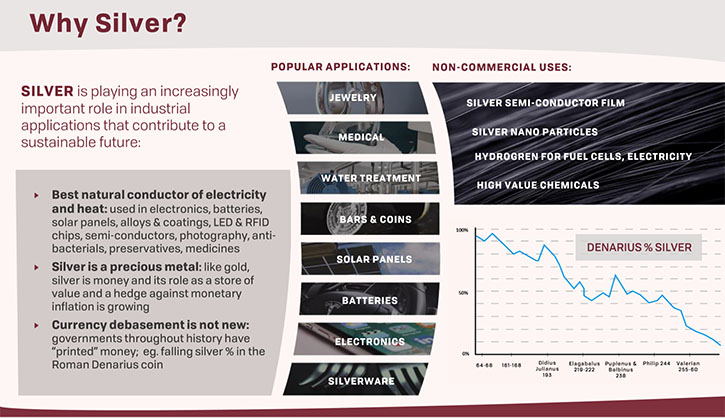

Dr. Allen Alper: Sounds exciting. Could you tell our readers/investors a little bit about the silver market, what's happening, and what the outlook is like?

Brad Cooke: I am currently the Vice President of the Silver Institute, based in Washington DC, so I have good access to information on what's new in silver. I’ll comment first on where we are in the silver cycle. Suffice to say that after gold and silver double bottomed in 2018, they were very slow to recover relative to the rest of the markets. But recover they did and it was clear, about a year ago that gold had entered into a new secular bull market.

Silver however seemed reluctant to join the party. In the March panic of this year, the gold/silver ratio actually crashed from 85 all the way down to 125. In other words, gold sold off in the March panic, but recovered all of its losses in 10 trading days. Silver on the other hand took three months to recover what it lost in the March panic. This is the traditional relationship of silver to gold. In any monetary cycle gold always moves first because it's primarily a monetary metal whereas silver, because it has both a monetary role and an industrial role, typically delays, lags behind gold and then plays catch up in a hurry.

Silver has started to catch up to gold, the ratio has come from 125 in March down to around the 99 range today. And I fully expect silver will continue to gain on gold through the rest of this cycle, as it normally does historically in a bull market for the precious metals.

So that's where we are in the silver cycle. And I'm obviously a bull. I think that next year should be another breakout year for both of the precious metals.

Dr. Allen Alper: Is there anything else you'd like to add Brad?

Brad Cooke: Well, we've been at this now for 16 years in Endeavour, but we're not half done yet. We have one of the best organic growth profiles to build new mines and expand our production and reduce our costs in the entire silver sector. We are trying to build a premier silver mining company to generate extraordinary shareholder value in the coming gold and silver cycle.

Dr. Allen Alper: Oh, that sounds excellent! Sounds like Endeavor Silver's going to be an outstanding opportunity for your stakeholders and shareholders. So that sounds great! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.edrsilver.com

Galina Meleger, Director, Investor Relations

Toll free: (877) 685-9775

Tel: (604) 640-4804

Email: gmeleger@edrsilver.com

|

|