Champion Iron Limited (TSX: CIA, ASX: CIA): High-Grade Iron Ore Producer, Concentrate of 66.2% Fe., in Northern Quebec; Interview with Michael Marcotte, VP of Investor Relations

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/26/2020

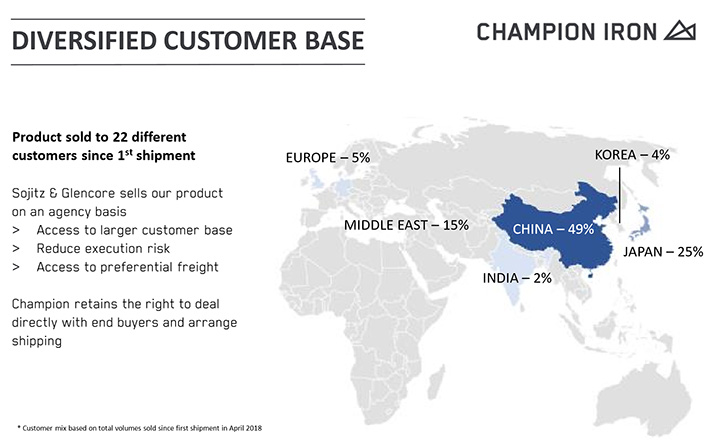

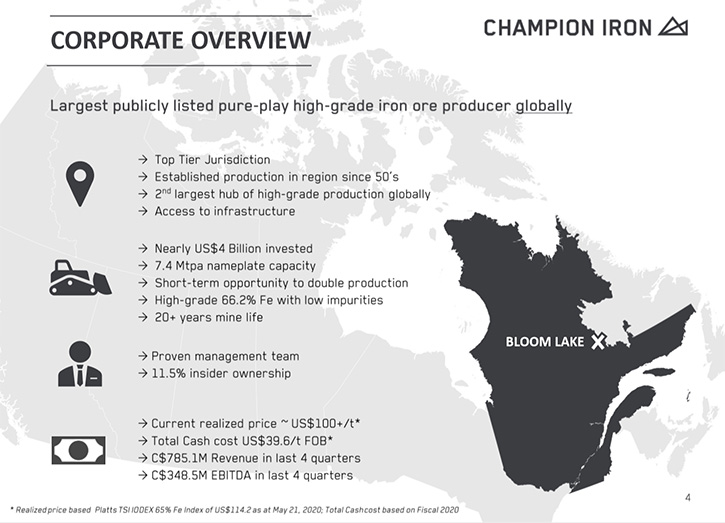

Champion Iron Limited (TSX: CIA, ASX: CIA), through its subsidiary Québec Iron Ore Inc., owns and operates the high-grade low-cost Bloom Lake Mining Complex, located on the south end of the Labrador Trough in Northern Québec, adjacent to established iron ore producers. Bloom Lake is an open-pit truck and shovel operation, with a concentrator, and it ships iron concentrate from the site by rail, initially on the Bloom Lake Railway, to a ship loading port in Sept-Îles, Québec. We learned from Michael Marcotte, who is VP of Investor Relations for Champion Iron, that their product is called a high-grade concentrate of 66.2% Fe that helps reduce C02 emission in the steelmaking process. The Company's balance sheet is very strong, the cash-flow is substantial, and they are in final consideration to completing a potential expansion project, which would double Bloom Lake's overall capacity from 7.4 Mtpa to 15 Mtpa. The largest markets for Champion Iron concentrate are China, Japan, Middle East, Europe, India, and Korea.

Champion Iron Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Michael Marcotte, who is VP of Investor Relations for Champion Iron. I wonder if you could give our readers/investors an overview of your Company and what differentiates your Company from others, Michael.

Michael Marcotte: Thank you, Allen, and thank you very much for taking the time to talk with me. We're very proud of what we've built with our Company to date and I'm pretty excited about the future. We are a high-grade iron ore producer, in Northern Quebec. We produce a high-grade product, a high-grade concentrate of 66.2% Fe. That really matters because we partake in the global solution to reduce C02 emission in the steelmaking process versus a lot of other iron ore producers in the world that produce a lower quality material, which requires more coal to transition the raw iron into steel.

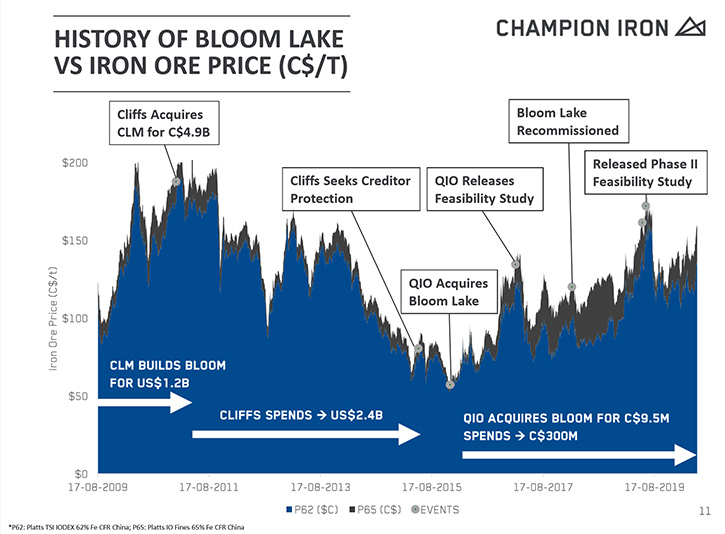

To give you a little bit of history about our Company, we're backed by an individual called Michael O'Keefe. He's a well-known mining entrepreneur. He was a senior partner at Glencore. Michael was leading the charge with Glencore for the bulk commodities and was in charge of the Asian corridor of business for them. He's built several businesses in the past and has been very successful doing so. He and our CEO, David Cataford, acquired a project called Bloom Lake in Quebec. That's a new project, but it has a lot of history. That project was built just over 10 years ago by a company called Consolidated Thompson. It cost Consolidated Thompson about $1.2 billion US to build the property.

And then a company called Cliffs in the US, or Cleveland-Cliff at the time, bought the project right after being first commissioned in 2011, and they bought it for $4.9 billion US. Cliff went on to do two things after that. They wanted to spend $1.2 billion US to try and improve the property and reduce costs. The second thing they did is they started an expansion that would double the nameplate capacity and they finished it about 75% of the way. And then the market turned on them and, sadly, their entire portfolio lowered their company valuation from $22 billion US down to $400 million. The market was very different at the time and very sadly, they had a lot of take or pay agreements that they had to obey within Canada, and they effectively had to let go of the portfolio in Canada and get the Canadian portfolio within the bankruptcy filing.

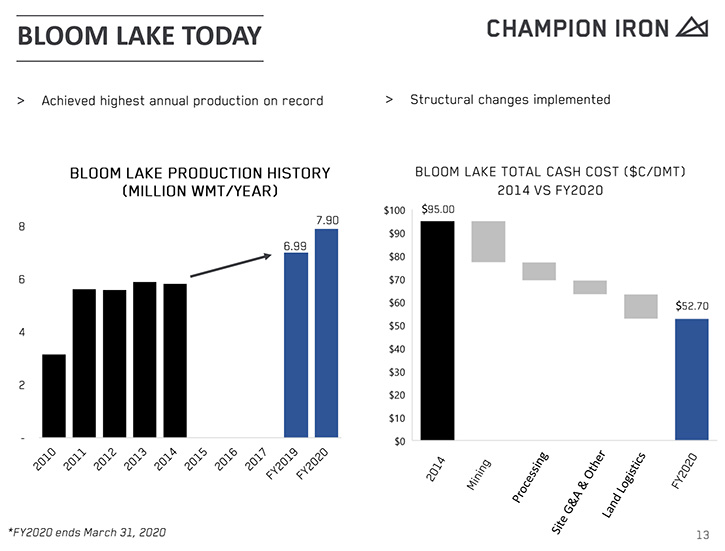

That's where we came in and we picked up the asset for pennies on the dollar, reinvested a substantial amount of dollars to do structural changes on the property. After we've completed just over $200 million of expenditures, since we acquired the project, we've now reduced operating costs from the predecessor by nearly half. We've now proven our ability to produce about 30% more than what the asset used to do and that really proves the structural investments that were completed on site. We've just recently released our first commercial production year and we've made just around $350 million in EBITDA. Our balance sheet is very strong. That enables us to look at completing the expansion of what we call phase two, which our predecessor had left behind. So we recently did a study about that. That's a very near term potential expansion project to complete.

Dr. Allen Alper: That sounds great. That's fantastic work that Champion Iron has been doing and accomplishing. Could you tell us more about your operating results?

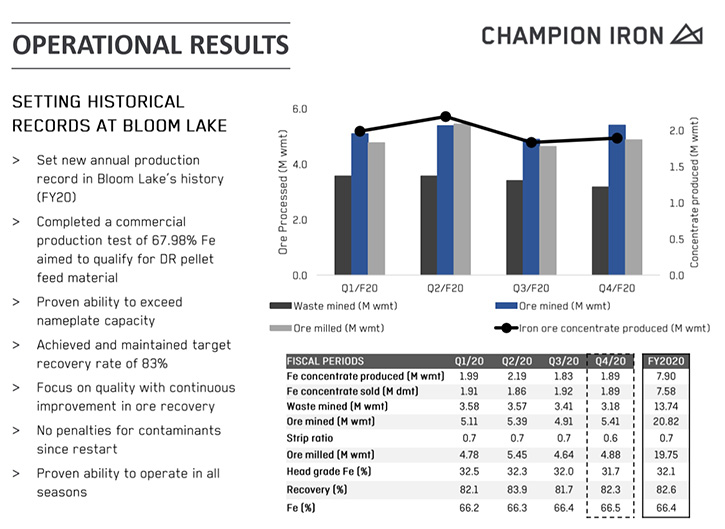

Michael Marcotte: Absolutely. We just recently released our first full year of commercial production and achieved new historical records at Bloom Lake. Under our predecessor, the mine had never surpassed 6 million tonnes per year despite a nameplate capacity of 7.4 million tonnes. With the structural changes implemented, we have not delivered 7.9 million tonnes in the last year which is more than 30% above historical production rates. So we've proven our ability not only to achieve, but even surpass the name plate capacity. When you look in on the cost front, we've proven our ability to deliver a ton of high-grade iron ore to the Port of Sept- Îles for just under $40 US, which compares favorably to other producers in the region who have been in production for decades.

When you look at our realized price today, the high-grade iron ore benchmark, from which we price is going for about $115 US. We do have to pay for freight to get the product to customers, which in the current market is just below $20 US. From $115, deducting freight, we're still realizing near $100 US per ton. And our total cost in the vessel, which we call free onboard or FOB is just around $40 US. So we have the ability to generate substantial margin. When you multiply those margin times or production run rate, you can see that we're bringing a substantial cashflow for investors.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors, who are your primary markets?

Michael Marcotte: Yes, absolutely. Iron ore is sold on a global seaborne market. The largest consumer of the product by far is China and has been growing at a very good pace over the last few decades. China imports nearly 60% of the global seaborne market. In tandem with that, that's a very important client for us.

We've sold, to date, to 23 different customers just in the last two years. Within those 23 different customers, about half of that material has found a home in China. About 20% has found a home in Japan, about 20% in the Middle East, and then after that, we've engaged with customers across Europe, India, Korea, and other places like that.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors your principle plans for the rest of 2020 and going into 2021?

Michael Marcotte: Our Company has always focused on the health and safety of its employees, partners and communities. So implementing measures to mitigate risk for COVID-19 is at the forefront of our priority. Our Company continues to evaluate several things that could unlock value for investors. Our Team and Company is well positioned to advance on some strategic opportunities including our proposed phase II expansion project. Our Board of Directors, having given us the green light on some of our proposed initiatives, prior to COVID-19, obviously wants to make sure that the market and COVID-19 related events stabilize.

So irrespective of us making a very strong margin of operation, irrespective of iron ore being almost at a decade high, we're trying to make things as safe as possible for our workers. But, as things stabilize, we will continue to look at advance on growth initiatives, such as our proposed expansion project that has very strong economics, given it is nearly 80% completed already. That would also come along with a financing package, which we aim to do, without diluting investors. Our balance sheet is in a very strong position. We have a strong financial partner to look to increase debt, if required to complete the project.

Outside of the phase two project, we also have other plans where we had recently addressed potential redomiciliations from Australia to Canada. That positions us very well if we want to get access to more institutional investors globally and potentially other indices including the TSX. That redomiciliation would also require final approval of our Board of Directors. But this was a process we had started earlier this year, which was stalled because of increasing volatility due to COVID-19.

Dr. Allen Alper: Well, that sounds very good. Could you tell our readers/investors a little bit about your share structure and capital structure?

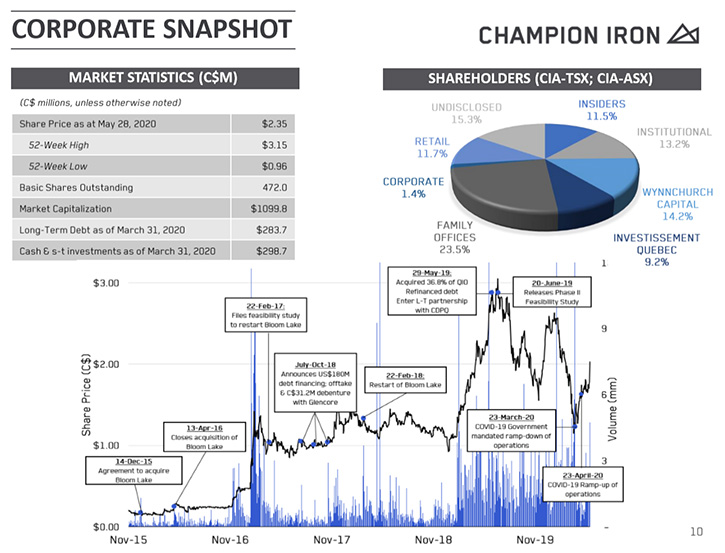

Michael Marcotte: Yes, absolutely. We have 472 shares outstanding. Our stock price is around $2.5 per share. That gives us a market cap of approximately $1.2 billion Canadian. As of the end of last quarter, we had $200 million US of debt, which in Canadian currency would be around $280 million Canadian. Our cash as of last quarter was $298 million Canadian. On that basis, we're effectively in a net cash position. Our producing subsidiary called Québec Iron Ore also has a preferred equity investment with Caisse de dépôt et placement du Québec for $185 million Canadian. That's a perpetual preferred, but we have the ability to buy it back, within two years of issuance. So that's something that over time, we may consider refinancing to reduce the burden of interest payments for the Company. Caisse de dépôt has been an amazing partner for us over the years and their investment in our Company provided great flexibility for our capital structure.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors the primary reasons they should consider investing in Champion Iron?

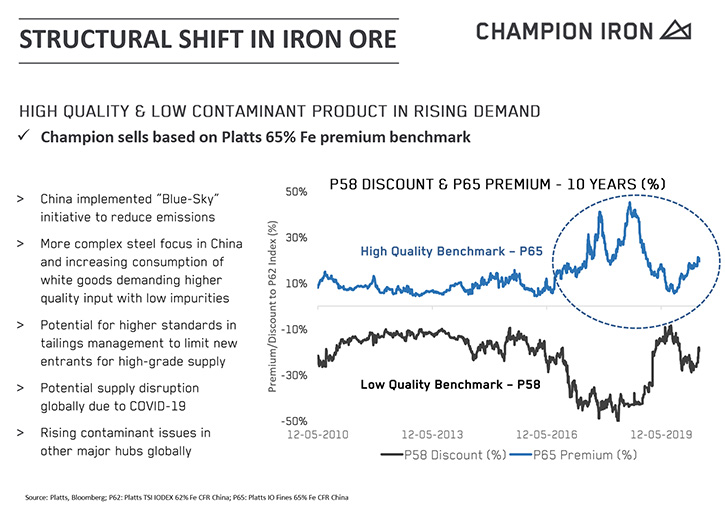

Michael Marcotte: Well, I think there're really three things that differentiate us. One, we're owner operators, the insiders own 12% of the Company and we really look to creating value for the Company and its shareholders. Two, when you look at our business, and we're really unique, where we're effectively the only pure play, high-grade iron ore producer listed globally. When you look at the massive shift that's ongoing, on the demand side, for high-grade iron ore, it is really a one way street. Steelmakers are trying to reduce emissions globally and our high-grade iron ore helps them to achieve that. When you look at the supply of high-grade iron ore, 80% comes from Brazil, which had several operating issues in the last few years. In 2015, they had a very unfortunate tailings failure. That tailings, in addition to another one, beginning in 2019 wrought several hundred deaths in the country.

It was really a tragedy and that brought forward a lot of regulators, putting a stop on operations that were supplying high-grade iron ore and the ability for Brazil to bring on new supply is now being questioned. In addition to those issues, very recently, they had other rainfall that massively impacted supply, and now, an outbreak of COVID-19 that appears to be out of control in Brazil. All these things together are causing the only large supplier of high-grade iron ore in the world, Brazil, to have recurring issues. So the steelmakers that are expressing rising demand for a high-grade iron ore are trying to turn to other places to secure the material. Quebec is the second largest export hub of high-grade iron ore globally after Brazil, and Champion is the only really independent entity, within that producing hub.

So I think that scarcity of high-grade and/or the ability to be a pure play producer of a high-grade really stands us apart. And three, when you look at our valuation, I can let your readers/investors do the math on that, but this asset cost $4 billion US to build. Our current market valuation is a fraction of that number. So, when you look at other projects that are being proposed by the super majors, like BHP and Rio's of this world and you look at a capital intensity on a per ton basis, our Company's valuation is still very much undervalued.

That undervaluation takes time to unlock. We bought this asset for pennies on the dollar. Our operational know-how led us to change things structurally and really prove that we were able to compete on the global seaborne market. But for the Company's valuation to go from where it was, to acquire this for pennies on the dollar, to just get replacement value or what's been sunk in the ground takes time and that's where the opportunity knocks. So those three key points would probably be what sets us apart.

Dr. Allen Alper: Well, that sounds like reasons for readers/investors to consider investing in Champion Iron. Michael, is there anything else you'd like to add?

Michael Marcotte: No, I think that's a very strong overview. For readers/investors that have an investment horizon, that's a little bit longer, we think we recently accomplished something that really sets us apart even further. And we think this is the single largest accomplishment of our Company since we recommissioned Bloom Lake. We've proven our ability to produce an even higher grade concentrate with even lower contaminants. While our product was already very high-grade, this new product, which is what we call, “direct reduction concentrate”, would allow us to get into a different market over time.

Historically and currently, there're two ways to manufacture steel. The first is via a blast furnace that primarily consumes iron ore and coal, and the second way is via electric arcs, which primarily consume scrap material. In developed markets like Europe, like the US, like Japan, where there's a lot of scrap available, those electric arcs can compete with blast furnaces because scrap is cheap and there's plenty to go around.

Emerging markets like China, where people are still struggling to buy their first car at 40, there's not enough scrap for these electric arcs to compete with the blast furnaces. But over time, this transition is a one way street, the more scrap there is the cheaper it becomes. Electric arcs also produce less emissions than blast furnaces in the steel making process. However, electric arcs require a diluent, which is an iron ore of very high quality to dilute the contaminants from the scrap. That's a very key point because there're very few entities in the world, very few that have the ability to produce that diluent. We've just proven our ability to do that.

So short term, we're very enthused to participate in the reduction of CO2 emission in the steelmaking process, with the current steelmaking method that dominated the world. But long-term, over the next 10 to 20 years, it is inevitable that electric arcs will take more market share over blast furnaces. There's a lot of iron ore that's low quality, primarily produced by Australians, that's likely to have difficulty finding a home. As electric arcs grow, there's going to be a squeeze of demand for the high-grade iron ore, used as a diluent in the electric arcs. And we're one of the only ones in the world that have the ability to produce it, in a very safe jurisdiction. Our sizeable resource that is measured in decades, if not over a century, will have an appeal for steelmakers that are thinking through the decades. So for investors thinking in the same timeframe, as we do, and our customers do, it really gets us excited.

Dr. Allen Alper: That sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.championiron.com//a>

Michael Marcotte

Vice‑President, Investor Relations

514‑316‑4858 Ext. 128

info@championironmines.com

|

|