Perseus Mining Limited (ASX/TSX: PRU): Appointed to the Prestigious S&P Dow ASX200index, Increasing Gold Production to 500,000 Plus Ounces Per Year; Jeff Quartermaine, Managing Director and CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/25/2020

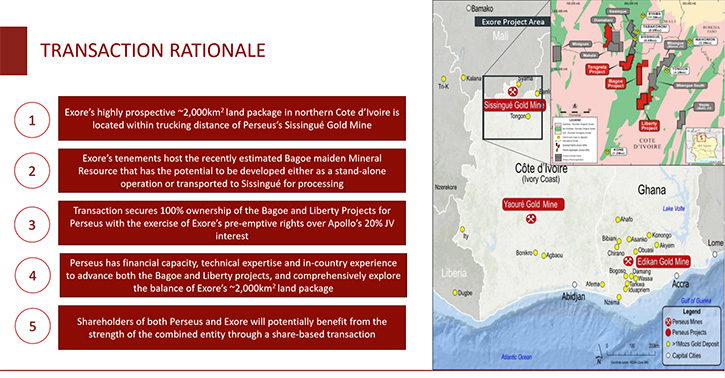

Perseus Mining Limited (ASX/TSX: PRU) is an Australian company, that operates two gold mines in West Africa, with first gold, from its third mine, Yaouré, expected in December 2020, increasing gold production to more than 500,000 ounces per year in 2021/2022. We learned from Jeff Quartermaine, Managing Director and CEO of Perseus Mining, that they are generating quite a lot of cash in the current gold price environment, and will acquire 100% of Exore Resources, who's Bagoe project, in northern Côte d’Ivoire, is located near Perseus's Sissingué Gold Mine and has a maiden JORC-compliant Mineral Resource containing 90,000 ounces of gold indicated, and a further 440,000 ounces classified inferred resource. According to Mr. Quartermaine, as a result of the increase in value of the Company over the last 12 months and as a result of the increased turnover of stock, they have been appointed to the prestigious S&P Dow ASX200 index.

Jeff Quartermaine, Managing Director and CEO of Perseus Mining

Perseus Mining Limited’s Sissingue Gold Mine

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Jeff Quartermaine, who is Managing Director and CEO of Perseus Mining. Could you give our readers/investors an overview of and also what differentiates Perseus Mining from others? Then tell us what's new. I know there's a potential acquisition, and also that you've now been chosen to be in the prestigious S&P Dow Jones 200. Could you give us an overview of your Company and what differentiates Perseus from others, also your amazing growth over the years in production?

Jeff Quartermaine: I’m pleased to, thanks for inviting me to speak with you and your readers/investors today. Perseus is an Australian company. We’re based here in Australia, listed both in Australia and in Toronto. But we're very much a West African focused business, a multi mine gold producer, active in multiple jurisdictions in West Africa, in Ghana and in Côte d'Ivoire to be specific.

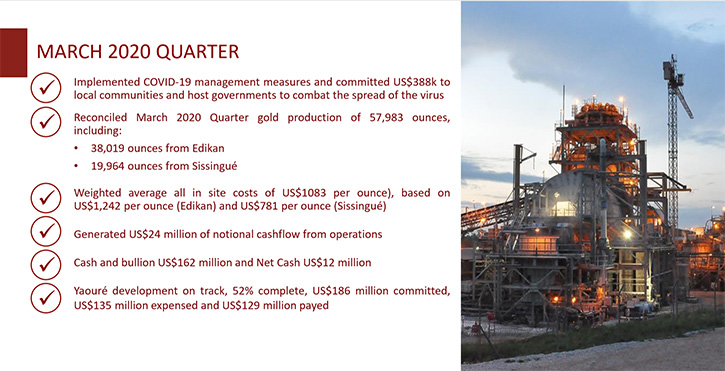

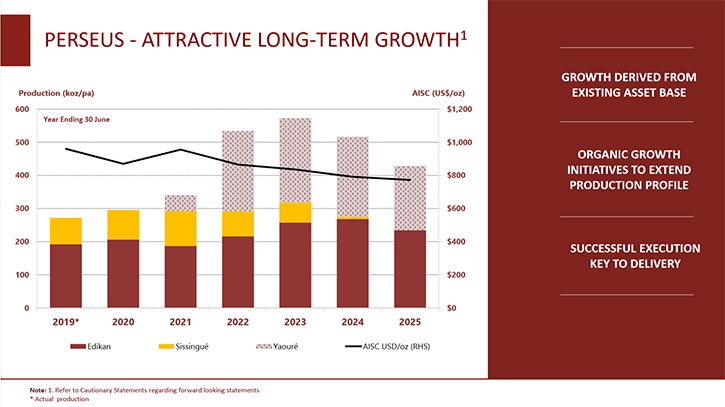

We have been growing steadily over a period of time and putting together a regional asset portfolio, working very hard at becoming a consistent and reliable producer of gold. As we stand at the moment, we're well on track to bring our third mine on stream at the end of this year. By which time, we will be producing gold at a rate of around 500,000 ounces a year at a weighted average all-in site cost of around $850 per ounce.

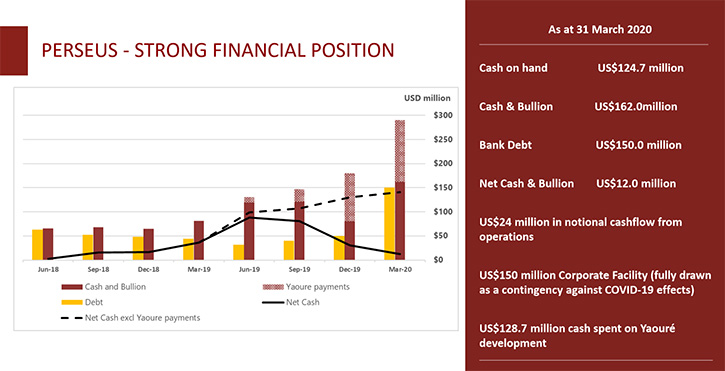

We're steadily getting to where we'd like to be. As part of our growth in production over time, we've built up our balance sheet. We're generating quite a lot of cash, as you might expect in the current gold price environment. We have a strong balance sheet. That's important because it puts us in a very good position to continue the growth of our Company, but still have sufficient cashflow available to be able to sustain a future dividend stream for shareholders.

That is something that is important to us. We'll be making some decisions concerning that before too much longer, about how much we allocate to grow and how much we allocate to return to shareholders. You asked what differentiates us from others. I guess one thing is that we have a very strong social license to operate in this part of the world, in West Africa. And it's based on very sound ESG practices.

It's one of the things that interests me, because in the last period, there's been quite a lot of interest, from a lot of institutional investors, around responsible investment and making a lot of noise around various ESG principles and United Nations charters etc. and goodness knows whatever else. Now for us, we're intrigued by this because this is old practice, with new labels on it. We've been doing these things ever since we've been operating in West Africa, in terms of being responsible, being ethical, managing our business in a way that is attractive to our host countries and host communities. That generates benefits for all of our stakeholders, not only shareholders and financiers, but also our employees, suppliers of goods and services, and of course our hosts.

We've been doing that for a long time and I think it has put us in quite good stead in the countries where we operate, because we are regarded as a Company that can be trusted, a sound corporate partner and a group that delivers on its promises. Taking that approach doesn't come without effort. And we have put together, over a period of time, a very experienced Board and Management Team, a group of people that do have a history of delivering on promises. We pride ourselves on that, and I think it does set us aside somewhat from some of the other companies in this space, who perhaps do over-promise at times. That's a bit of an overview of where we are in Perseus.

Dr. Allen Alper: That sounds excellent! Could you tell our readers/investors about the recent announcements that have been made on looking to acquire Exore Resources, and also the announcement of you being added to the S&P, 200 ASX index?

Jeff Quartermaine: Sure. Both of those things are interesting. First, the Exore acquisition. Our second operating mine is the Sissingué gold mine that is located in the north of Côte d'Ivoire, on the border with Mali. This mine has always been a relatively small business. We're producing, around 80,000 to 100,000 ounces a year and generating very strong cash from it.

Sissingué has always had a relatively short life ahead of it. We felt we should seriously seek to extend the mine, because we have an absolutely first-class mine up there. The plant, the team, the workforce, the social license to operate are all first class, and if we can continue to feed ore to the mill, we're going to continue to make very good returns for our shareholders. I should point out that it cost us $106 million US to build that mine and we have repaid the $106 million, within two years.

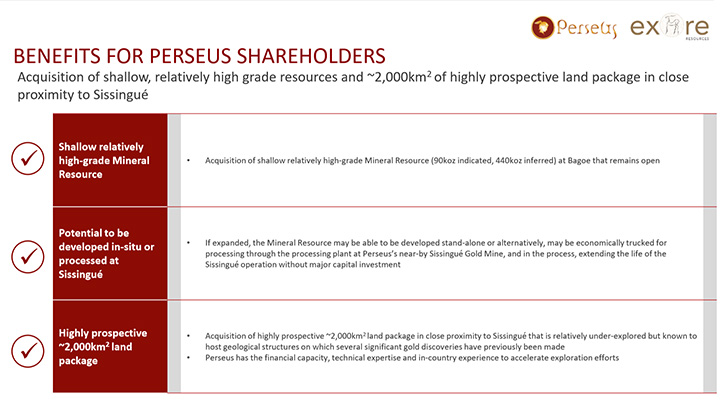

So it has been a very good operation for us. Our friends at Exore, a junior exploration company, have a fairly prospective land package, about 2000 square kilometers of land, located in Northern Cote d'Ivoire, within close proximity to our Sissingué mine. We looked at that situation and saw that quite recently, Exore had announced a maiden resource on one of their projects, the Bagoé project.

It indicated that there was mineralization down there that was probably well suited to our Sissingué plant. As it turned out, another transaction related to that project was underway. Exore had an 80% interest in that project and the owners of the remaining 20% were looking to sell their interest. So a number of things came together and we decided that now is the right time for us to acquire Exore and, as part of that transaction, have Exore exercise their pre-emptive right to pick up the remaining 20% taking their ownership of the project to 100%.

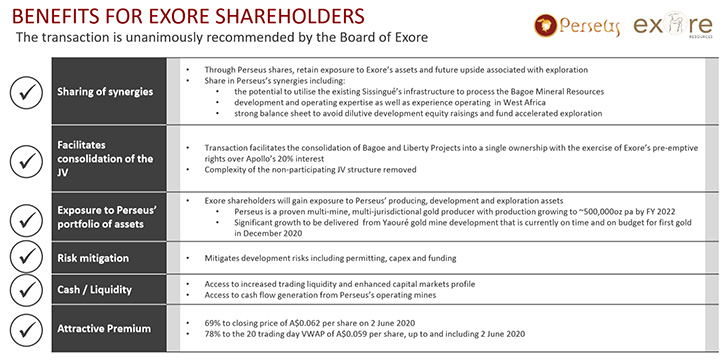

A couple of weeks ago, we announced that we would acquire all of the shares in Exore and that we would issue a Perseus share, for every 12.7 Exore shares held. It implied a value at the time, in Australian dollars, of around $60 million, which is about $40 odd million US dollars. The offering price implied a fairly healthy premium to not only the closing price, but also to the 20 day and 10 day VWAPs of Exore.

Based on what we know now, having spoken to a number of the Exore shareholders, they can see the very strong strategic sense in putting the two Companies together. Certainly, the views that have been expressed to us are overwhelmingly in favor of the transaction proceeding.

Now we're currently in the process of working with Exore to produce scheme documentation. This will go to the shareholders fairly shortly for approval. There will be a shareholder meeting held, we believe in early September. Subject to the views of the shareholders, the matter will then go to the courts and hopefully be approved by the middle of September, at which time Exore will become a wholly owned subsidiary of Perseus.

Ahead of that occurring, in the expectation that it will go through, we've had our technical teams meet with the Exore people. In fact, we spent three or four days down at their property last week, looking at the ground and looking at various things. Over the next month or two, we'll be preparing to hit the ground running with exploration programs and other test programs, designed to confirm the size of the resource and to prove the feasibility of developing that resource.

Depending on how large it is, it'll either be developed in situ or alternatively trucked up the road to our Sissingué operation. Until we've done the required testing, it'll be very difficult to say which of those alternatives makes the most sense, but certainly it's an interesting acquisition. It's what people would refer to as a bolt-on. It hasn't cost a vast amount of money, but it does have the potential to generate very substantial benefits for both sets of shareholders going forward.

Of course, from the point of view of Exore shareholders, not only do they get to participate in the upside from their project, but courtesy of the Perseus shares, going forward they also benefit from the growth across the Company and the things that we're doing at our other properties, such as at Edikan and at Yaouré.

It is one of these situations that scrutiny would suggest is a serious win-win, and of course they're the best kind of transactions.

You noted that we have been making progress, in recent times, on a number of fronts and that progress has been progressively recognized by the stock market. We have seen is a fairly material increase in the value of the Company over the last 12 months now. As a result of that increase in value and as a result of the increased turnover of stock, we've now become qualified to gain entry to the Standard and Poor’s ASX 200 index (S&P/ASX 200).

This took place Friday, June 19th. The ASX 200 index is widely regarded as the proxy for the Australian equity market. So, if investors are seeking to track the performance of the Australian equity market, they will need to buy our stock.

Probably, we will find some change to our share register as some of the passive funds that do track the index, buy our stock. Also people, who just track it themselves, will also be buying. So there will probably be some buying and selling taking place in the next short period of time. We hope that there won't be too much volatility in the market and things will settle down reasonably quickly. But certainly it's with some pride that we've been restored to the index.

We were in the ASX 200 index several years ago. Then the gold price fell and we had a few operational difficulties and we came out it. It is a recognition of the fact that we have turned the business around and that we now are worthy of taking our place in the top 200 stocks on the Australian market.

Dr. Allen Alper: That's excellent. You all deserve to be congratulated on the work you've done and bringing the Company around and growing the Company, both strategically and also improving operations. That's something of which you can all be proud.

Jeff Quartermaine: Thank you.

Dr. Allen Alper: Could you tell, our readers/investors a little bit more about some of your plans going forward and some of your other properties?

Jeff Quartermaine: We are planning to become a producer of around half a million ounces of gold a year, and to generate fairly healthy cash flows that we can use to continue to grow the Company and also return funds to shareholders. That is our strategic goal.

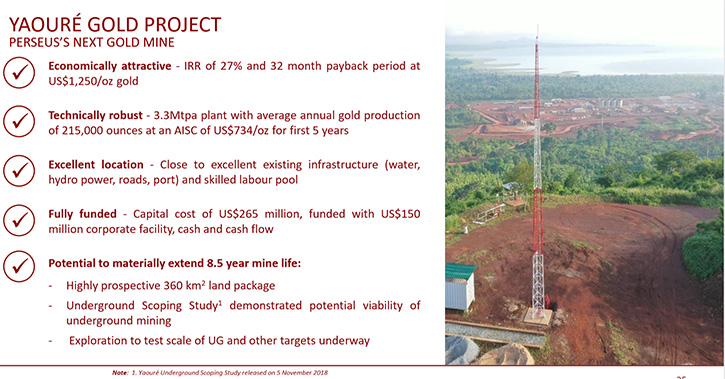

Now in the very short term, that requires us to operate our two existing mines as efficiently as we can, and I can assure you we're doing just that. Also we need to bring our third mine on stream, the Yaouré project that we bought back in 2016 from Amara Mining PLC. We took over Amara, who owned that property. Since then we have gone through the various stages of late stage exploration and feasibility, and now we're well and truly advanced into construction.

Where we sit with that project, as of the end of May we were at 63% complete. As of the date of this interview, we're probably 65% complete, building that particular project. We're well on track to deliver our first gold from there in December this year. As I was saying to people here yesterday, when we were having a catch-up around progress on the project, I think that if we can achieve the goal of getting to production ahead of schedule and under budget, it will be a very meritorious thing to do, particularly given the fact that it's occurred, against a backdrop of the coronavirus pandemic.

Certainly in developed countries, such as the United States, it's no secret as to what's occurred in terms of the effect of the virus. And Africa's no different. Both Ghana and Côte d'Ivoire have increasing cases of COVID-19, being recorded amongst the population. Whereas a lot of developed countries have managed to flatten the curve, the curve is actually heading in the other direction in Africa.

To be able to operate your businesses, without missing too many beats along the way, and to develop a major mining operation as we're doing at Yaouré, with that as the backdrop, does speak volumes for the quality of the people that are on the ground, dealing with the day-to-day stresses and strains of that situation. So, we are very much on track and hopefully, in the next three months, we'll be able to maintain that and be producing gold by the end of the year from three operations.

What that means is that, based on the existing reserve base, we should be able to produce at least 500,000 ounces for the next four years. Our aim is to continue that, into the future, for well beyond four years. There're two ways of doing that. One is that we replace our reserve inventory through exploration success. To that end, we've mounted exploration programs around Yaouré and Edikan and acquired Exore, which is adjacent to Sissingué.

So we are looking to grow our reserve base through exploration, but we're also looking at the broader market from the perspective of asking, “Are there opportunities that we could sensibly acquire and bring these assets into our portfolio going forward?” Now, a lot of people talk about M&A, a lot of people talk about the need to consolidate the industry in West Africa and things like that. They give all the reasons under the sun, why that is a good idea.

It is a good idea in principle, but let me assure you, it's a lot more challenging in practice to be able to find opportunities that actually do create value for your shareholders. We've looked at a number of things over time and we'll continue to do that. If we can find assets that fit strategically with the Company and can be acquired at a price that will generate a suitable return going forward, Perseus won't hesitate to pull the trigger and move on with such acquisitions.

We're at an interesting point in our journey. We have a long way to go, but we're at an interesting point. We’re just about to become a three mine operation, and we have some interesting thoughts as to what the future might hold for the Company.

Dr. Allen Alper: Well, that sounds excellent. That sounds like a great opportunity, both in acquiring and also internally developing and exploring. You've done an excellent job growing your Companies and controlling your costs. It sounds like you've done everything right, you and your team. So, that's excellent!

Jeff Quartermaine: It is very much a team effort here. I can assure you of that. I am the leader of the group, but I am supported by an excellent group of people, both in our corporate office and at each of our sites around Africa. So it is very much a team effort. Everyone is very focused and committed to deliver the same outcomes and we're doing it in accordance with a very clearly defined set of values.

Dr. Allen Alper: Well, that sounds great! Could you tell our readers/investors the primary reasons they should consider investing in Perseus Mining?

Jeff Quartermaine: The primary reason is, we believe there is an opportunity here to make a significant return on our investment. We believe that we will be in the position shortly to offer investors a recurring return through a dividend stream. Probably also, with the strategic thinking that we have, we should be able to realize capital growth as well. So, I think the primary reason for investing in Perseus now, is to make money. And I think there is an opportunity here at Perseus to do that.

I know a lot of people are concerned to know that the investee companies will act in a responsible manner in terms of environment and our society. We are very definitely seeking to do that as well. So in that sense, the interest of prospective shareholders and the interest of the Company will align. And so I think that all of those things add up to make Perseus an investment that's certainly worth considering.

Dr. Allen Alper: It sounds excellent! Sounds like compelling reasons for our readers/investors to consider investing in Perseus Mining. Jeff, is there anything else you would like to add?

Jeff Quartermaine: No. I think that's a fairly complete run through on what's happened since we last spoke. It's been a fairly busy period of time. As we say at Perseus, there's never a dull moment. That seems to be our motto. And we live up to that every day. There's lots happening. And we are starting to make some real progress. So that's pleasing.

Dr. Allen Alper: That's great! It looks like 2020, 2021 will be exciting times for Perseus and they'll be doing a lot of great things.

https://perseusmining.com

Jeff Quartermaine, Managing Director

+61 8 6144 1700

jeff.quartermaine@perseusmining.com

|

|