BlueBird Battery Metals Inc. (TSXV: BATT; US: BBBMF): Developing a Nickel Based Discovery in Western Australia for the Electric Vehicle Battery Industry, Interview with Peter Dickie, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/23/2020

BlueBird Battery Metals Inc. (TSXV: BATT; US: BBBMF) is a small-cap Canadian junior resource exploration company, currently focused on developing a nickel-based discovery in Western Australia for the electric vehicle battery industry. We learned from Peter Dickie, who is President and CEO of BlueBird Battery Metals, they are busy reviewing the last exploration and drilling program on the Canegrass project that resulted in elevated levels of nickel and copper, as well as cobalt, vanadium, platinum and palladium credits. BlueBird is about to embark on a new, fairly aggressive, exploration and drilling program that is sure to generate lots of news, which hopefully will be reflected in appreciation of the market cap.

BlueBird Battery Metals

Dr. Allen Alper: This is Dr. Allen Alper Editor in Chief of Metals News, interviewing Peter Dickie, who is President and CEO of BlueBird Battery Metals. Peter, could you give our readers/investors an overview of your Company?

Peter Dickie: Sure Allen. We're a junior resource company, based in Vancouver, British Columbia. The Company followed the battery metals phenomenon, starting a few years back, with assets somewhat spread out around the globe, within Canada and various parts of Australia. It was a bit of a shotgun approach, which, as you know and your readers will know, is very tough to maintain. So I was asked to come in and get involved with the company, not too long ago. I reviewed all the projects and discovered that there were some very attractive battery metals projects in Australia. We've divested ourselves of other projects and we are focusing on two different battery metal projects in Australia, with the primary target a nickel sulphide based discovery, in Western Australia. Our goal is to develop this into a solid nickel deposit.

Dr. Allen Alper: Well that sounds great. What are your plans going forward?

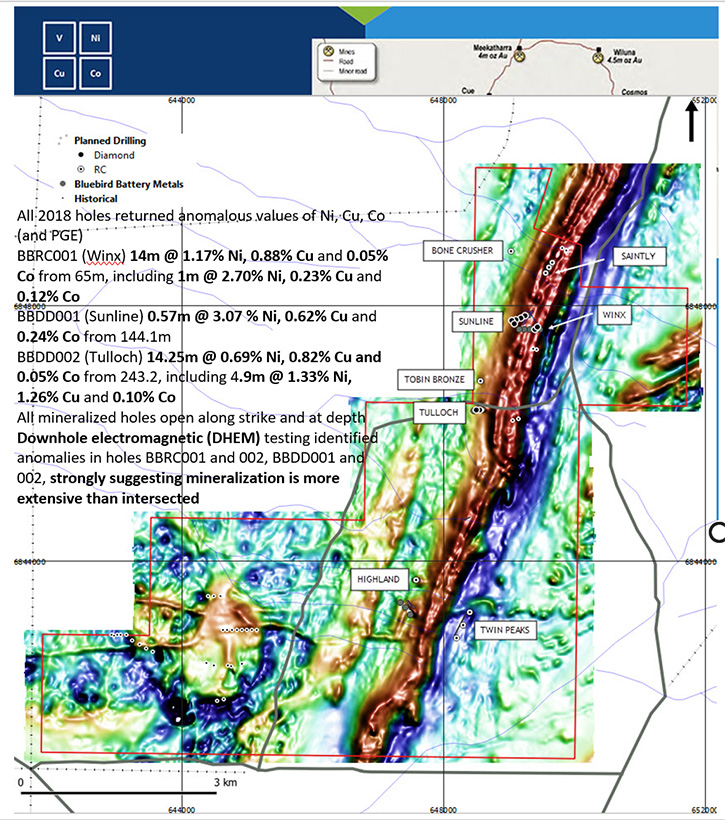

Peter Dickie: Going forward, we've just completed a review and announced plans for an exploration and drilling program on the project. The project is called the Canegrass and there was drilling done there in 2018 by Bluebird. Interestingly enough, the deposit is just south of a big vanadium deposit at Windimurra. The property was originally looked at as a vanadium target, which of course does have some battery implications as well. But in doing the drilling, lo and behold, they discovered that the sulphide nickel values and copper values were elevated as well.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors a little bit about why nickel is so important, and some of the other metals, in relation to the battery market and what's happening there?

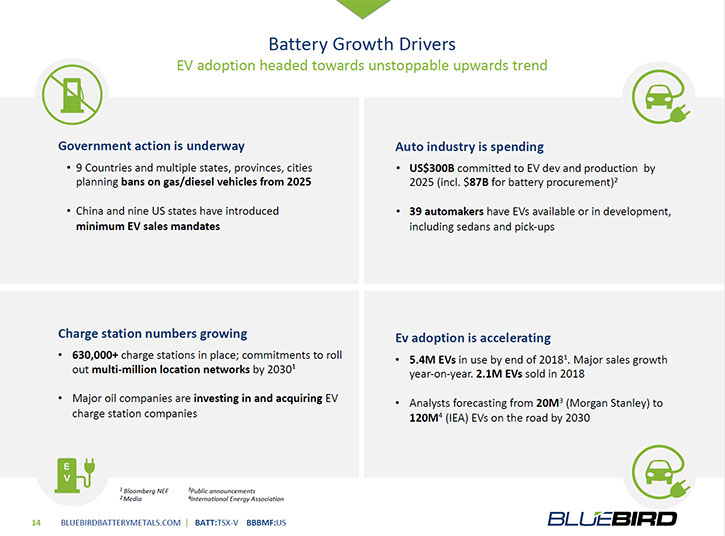

Peter Dickie: Sure, I'd love to do that. Nickel is the forgotten metal in the battery space, and it doesn't get a lot of credit. It is a very widely used mineral throughout the world, in a lot of different applications, sourced through laterite deposits, and also found in sulphide deposits, which are the higher valued minerals used in the battery space. And I tell you, the primary reason for that is, the current dominant battery in the electric vehicle automobile sector, contains very little nickel. One of the reasons electric automobile sales are yet to hit mainstream auto sales levels, is because people have tremendous concerns about range in vehicles.

If you look at a lot of the smaller subcompact electric vehicles that are being sold today, their range is very small, and that's a problem. I know personally, I've looked at these vehicles and it is a concern. Battery manufacturers and researchers have been looking into different commodities to try and extend the life and the range of electric vehicle batteries. There's a lot of development going into what they call NMC batteries, a nickel, manganese and cobalt combination that has substantially longer life and longer range. One of the batteries in particular that's attracting a lot of research is called an NMC 811, which is eight parts nickel, one part cobalt, and one part manganese and is on tap for widespread production and use in large Chinese electric car manufacturers. That same battery manufacturer, the largest in the world, recently announced the ability to produce a million mile battery. That particular battery is an NMC with 50% nickel cathodes and can be charged, drawn down and recharged enough to power a vehicle a million miles. That is a huge breakthrough as current battery life degrades long before that milestone.

So, you can see where this is going, as far as vehicle range being required for the electric vehicle, automobile sales to flourish, and the use of nickel in those batteries to allow that extra range to be brought into the mainstream.

For that reason, we're very highly encouraged as to the future of nickel production and nickel use in batteries.

Dr. Allen Alper: That sounds excellent. I know you have a very impressive background. Could you tell our readers/investors about your background, and also your team?

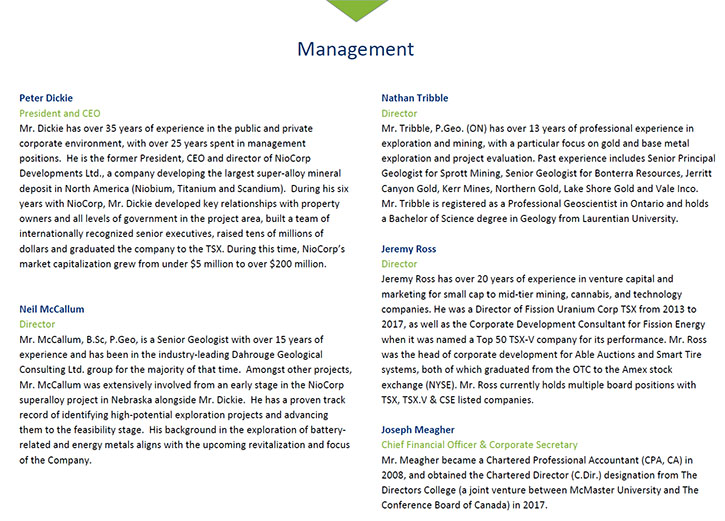

Peter Dickie: I've fairly recently become involved with BlueBird. Prior to that, my history, long-term goes back to the 1980s, when I was actually a stockbroker. Since then, I've spent several decades in a variety of management positions. In the early 2000s, I spent a lot of time with a couple of different junior companies, in one of which we put together a solid gold asset base which resulted in that company being taken over in the early 2000s.

More recently, and perhaps one of my better successes, we put together the land package and started developing a niobium, titanium, scandium deposit in Nebraska, which is in the company, NioCorp, of which I was the founding President and CEO. We brought in some very senior level mining people, with that company, as a natural transgression. We took the Company from the TSXV up to the big board, TSX, raised a very substantial amount of money, and that project is in feasibility financing stage right now. So it's been quite a success.

Following that, I took a few years off to spend some time with kids and grandkids that I didn't have the opportunity to do before. But, of course, I have a bit of an itch to get back into business, and slowly over the last six months I’ve started to become active again. I’m very anxious to get moving forward again on this project.

Dr. Allen Alper: That sounds excellent. Could you tell us a little bit more about some of the other members of your team?

Peter Dickie: We are slowly putting the team together. One of the fellows, just brought onto the Board, Neil McCallum, is a geologist that I've worked with extensively in the past. Neil and I worked together quite extensively on the NioCorp deposit. We also have Nathan Tribble on the board. He's also a geologist, with over a dozen years of experience. He was the Senior Principal Geologist for Sprott Mining, also extensively involved with BonTerra Resources, Jerritt Canyon and Kerr Mines and with VALE. He has a great track record.

Jeremy Ross is also a Director. He's been in the venture capital market for over two decades. He was the Director of Fission Uranium and also Fission Energy.

So we have a strong, solid foundation for the management team. We are actually talking to other individuals that we will be talking about bringing on board to expand the team, including potentially, some people down in Australia. I anticipate there will be announcements, with respect to personnel coming over the next few months.

Dr. Allen Alper: Well it sounds like you have a very strong core. Sounds great! Could you tell our readers/investors a little bit about your share structure?

Peter Dickie: Right now it's a relatively small market cap company. We have about 66 million shares outstanding. There are no warrants, but with stock options our fully diluted figure is just over 70 million shares at this point in time. Our market cap, right at the moment, is about ten and half million dollars, a fairly small company. But, this is a project and a company that's worth getting my head wrapped around and getting fully involved with, in an industry that is soon to experience massive growth.

You can’t forget that all big companies started out somewhere. For example, when I first was involved in NioCorp, our market cap was under half a million dollars, which climbed to over 250 million market cap. So the BlueBird has a lot of room for growth, and we will be working hard to make that goal a reality.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors the primary reasons they should consider investing in BlueBird?

Peter Dickie: At this point in time, Bluebird, is almost like a new company. I don't want to knock any previous management, but there wasn't a lot of time available and dedicated to the Company, in the past year or so. We've come in and had a fresh look at all the projects. We've discarded a couple of non-core assets. We’ve spent more time focusing on the core ones. And we are about to embark on a fairly aggressive exploration and drilling program, which I'm sure will generate plenty of news for readers and investors. We expect this will be reflected in appreciation of the market cap.

We're really at the ground floor of the exploration that we plan for this project. It is a nickel sulphide discovery, and is located in one of the best mining jurisdictions in the world. At the same time, the nickel business itself and the use of nickel in batteries is poised for massive growth. The combination of both things are set to explode and we could have a very exciting few years here.

Dr. Allen Alper: Oh, that sounds excellent, Peter, is there anything else you'd like to add?

Peter Dickie: I think that's about it for now. Certainly if anybody has any questions, info@bluebirdbatterymetals.com is perhaps, the easiest way to get me. Other than that, our website certainly has a lot of information, and allows people to sign up and receive regular updates. Beyond that, we welcome new shareholders, and are thankful to old shareholders. We look forward to a bright future.

Dr. Allen Alper: That sounds great! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.bluebirdbatterymetals.com/

Peter Dickie

President and CEO

1-855-584-0160

info@bluebirdbatterymetals.com

|

|