Lithium Power International (ASX: LPI): Developing Chile’s Next High-Grade Lithium Mine; Andrew Phillips, Executive Director, Company Secretary, and CFO, and also Richard Crookes, Executive Director, Corporate Finance

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/15/2020

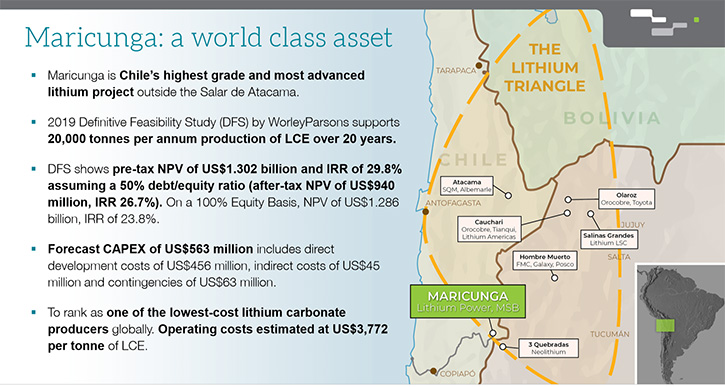

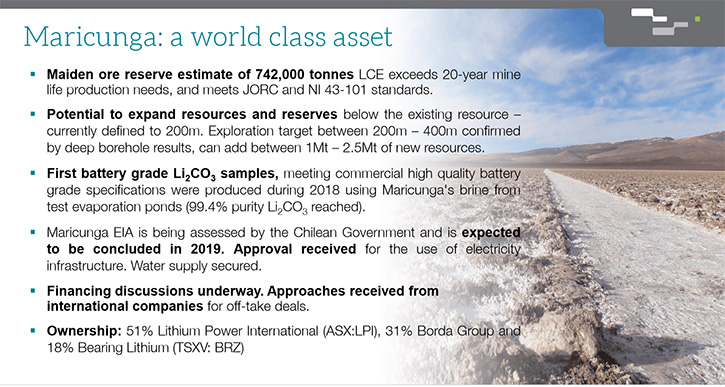

Lithium Power International (ASX: LPI) is a pure-play lithium company focused on the development of Chile’s next high-grade lithium mine. The Maricunga JV, in which LPI holds a 51% interest, is the highest quality, pre-production, lithium brine project, in South America and has one of the world’s highest-grade lithium resources at 1,167 mg/l lithium and 8,500 mg/l potassium. The 2019 JORC and NI 43-101 compliant resource estimate, for the deposit, totals 2.07 Mt LCE, now all classified as measured or Indicated & 5.38 Mt KCl from surface to 200m depth. We learned from Andrew Phillips, who's Executive Director, Company Secretary, and Chief Financial Officer, and also Richard Crookes, who is Executive Director, Corporate Finance, of Lithium Power International, that the project is very low-cost, with a robust feasibility study, permitted and ready for financing. The Company is currently in the phase of finalizing a collaboration, with Chile state miner Codelco, then moving towards finalizing off-take and project finance.

Lithium Power International

Dr Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Andrew Phillips, who's Executive Director, Company Secretary, and Chief Financial Officer, and also Richard Crookes, who is Executive Director, Corporate Finance.

Could you give our readers/investors an overview of the Company and what differentiates your Company from others?

Andrew Phillips:Lithium Power International is a public company in Australia. It listed on the ASX, June 2016 on the back of having some projects in Western Australia and Argentina.

About six months after we listed, we completed a joint-venture transaction for a Chilean project in the Maricunga Salar in Chile, of which Lithium Power now owns 51% of the joint venture company, Minera Salar Blanco. The other joint-venture partner is a Chilean family office, who owns about 30% and Bearing Lithium, a Company listed on the TSX in Canada who owns the balance of 19%

The flagship project we have is, of course, the Chilean lithium brine project, in the Maricunga region, part of the lithium triangle in Chile.

We've progressed from completing an exploration program through to engineering and completion of our Definitive Feasibility Study, issued in January 2019. We hit a significant milestone in February of this year, when our environmental impact assessment report was approved.

We now have a development-ready project in Chile, which is very comprehensive, very strategic and very important to both Chile and to us as a Company. The economics of the project are robust and are very appealing to the market.

Dr. Allen Alper: Richard, could you elaborate on the project metrics?

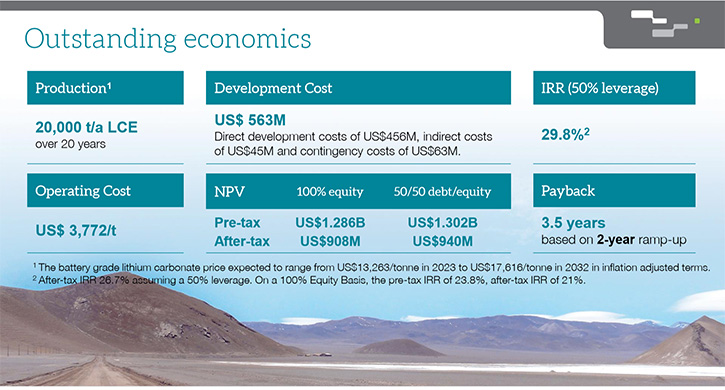

Richard Crookes: We have a lithium brine project in the Maricunga Salar, as Andy mentioned. It's completed its feasibility study, it's permitted and ready for financing. The project metrics are: we will build a conventional brine evaporation project and crystallization project to produce 20,000 tons per annum of battery-grade lithium-carbonate-equivalent, over 20 years; so 400,000 tons reserve of lithium-carbonate-equivalent.

Development capital is between US $550 and $600 million, comprising direct costs, indirects and a fair bit of contingency and some VAT. The after-tax IRR is about 27%, assuming a 50% leverage. On 100% equity basis, the pre-tax IRR is 24%. After-tax IRR is 21%.

The project is blessed by very low cash operating costs, compared to industry peers, so a very good position on the lithium carbonate cost curve. Cash operating costs are about $3,770 per ton. Payback on the capital is about three and a half years, based on a two-year ramp up. Our after-tax NPV is over US $900 million. So very strong financial and production economics!

We're now in the phase of finalizing a collaboration with Codelco and then we're moving towards finalizing off-take and project finance.

Dr. Allen Alper: Oh, that sounds excellent! That sounds like a very robust project and a very rapid return, for the size of the project. Excellent!

Richard Crookes: We have a very large resource, and all we've done is completed the study on the first 20 years of production. But the very attractive opportunity here, is this is very scalable. So you can always increase the size of the project, once you've proven the concept and generated some cashflow to fund further development, to increase the scale and increase the mine life, quite substantially. Because we're only, at this stage, exploiting the upper portion of the lithium brine resource down to about 200 meters. We know the deposit continues to 400 meters depth on our tenements. We have a very high-grade brine compared to our peers. We have great benefits; good location and scalability.

So I think it's very attractive for larger companies, once we've de-risked the project, to take into production, to really look at long-term scalability options for this particular location.

The Maricunga Salar is very significant. We believe it will be the next new lithium brine development project in Chile, given that it's fully permitted and ready to go.

Andrew Phillips: We've been working, for the last 12 months, with Codelco, the largest copper company in the world, to find a way to amalgamate and consolidate our tenements, which together account for about half of the exploitable area of the Salar.

With our land, DFS, EIA and with Codelco land and CEOL license, a development contract required for all new-coded tenements, over the entire Salar, we are in the position to jointly develop the Salar into Chile’s next lithium mine. We are working with Codelco, through the due diligence process, with the view of forming a new joint venture, or some kind of agreement, to work together to develop the Salar. As Richard said, our project has a 20-year mine life, which could be extended in terms of life and/or resource, if we would go deeper into the Salar. If we add the Codelco land to our land, all of a sudden, it's a much more significant project, in both its term of mine life and resource. Along with the economies of scale, having this relationship with Codelco makes perfect strategic sense.

All in all, it is a pretty exciting place to be for LPI, who currently owns 51% of this project.

Dr. Allen Alper: Oh, that sounds excellent. That's really exciting. It sounds like this year and going into 2021 is going to be a very important time for moving forward, with your vast project. Excellent! Could you tell our readers/investors a little bit more about both of your backgrounds and the Team?

Richard Crookes: Yes certainly. I'm the Executive Director of Corporate Finance. My background is 15 years in mining operations in Australia, mainly in hardrock, underground and open pit mines. I'm a geologist by profession, but essentially worked in mining projects, rather than exploration. Then I worked for 12 years for an investment bank, in mining finance and investing, followed by six years in a mining-focused private equity fund. I'm now a Company Director and using my finance connections and technical background to help LPI secure the financing to take the project into production.

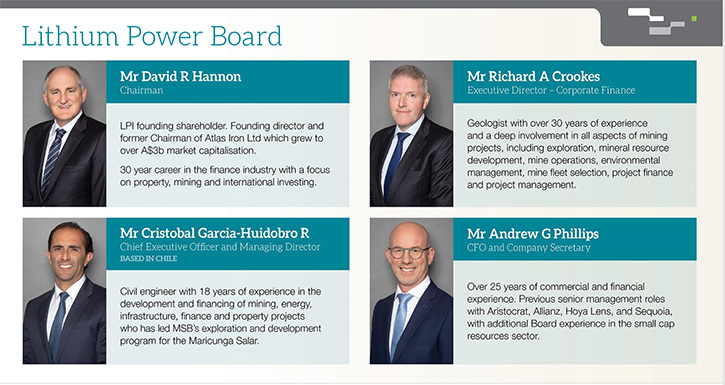

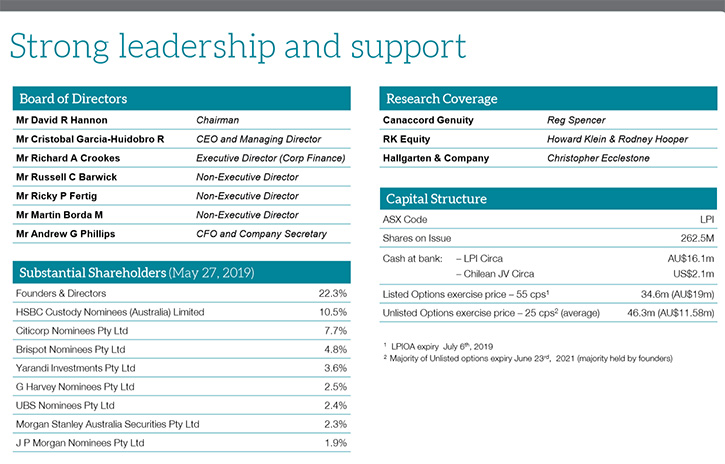

I'll give you the background of the Board. The Chairman of LPI, David Hannon, is a very experienced mining investor. He has chaired numerous ASX-listed companies and arranged finance for many projects, as well as being a successful investor himself.

We have a non-executive Director, Russell Barwick, who has over 40 years working in the mining industry, a very successful mining engineer, mine developer, with CEO-level expertise. He adds huge technical and wise counsel to our Board, and with South American project development experience in particular. So that's very helpful.

Andy, maybe you want to talk about yourself and then fill in the background of a couple of the other Directors?

Andrew Phillips: I have been CFO for some large companies here in Australia and in New Zealand. I'm relatively new to the mining industry, but I've done a lot of ASX-listed company work as a Director, Company Director or CFO. Prior to this I was on the Board of an ASX Listed financial services company, and merged a number of similar companies into this group. Prior to this, I was CFO for a very large Japanese company. So I have CFO, compliance, corporate expertise and I had a number of ASX-listed Company Executive and non-executive and Company Secretary roles.

The other Board Members; Cristobel Garcia-Huidobro, who is CEO and MD of the Company, is based in Chile, and he is tasked with developing the project. He has been working with the Maricunga project, prior to LPI being involved. He has had a successful career to-date at CEO /COO level in the development of various infrastructure projects in Chile, as well as being involved in investment banks in the past. He's an engineer by profession, highly-qualified and very well connected in the Chilean environment.

Speaking of Chile, another one of our Directors is Martin Borda. Martin is a well-established and a very well-known Chilean businessman. He owns one of the largest salmon farming companies in Chile. He's also a 30% shareholder in the project.

And finally, Ricky Fertig, who is a founding Director of LPI, has experience both in South Africa as well as Australia in a wide range of business interests, including medical, property and mining.

So that's the Board, Al, a pretty diverse and variably-skilled team to steer the Company.

Dr Allen Alper: Well, it's an extremely strong Board. It's great to be diversified and so experienced and established. So, that's really excellent! Could you tell our readers/investors a bit about your share structure and capital structure?

Richard Crookes: We are listed on the Australian Stock Exchange under the code LPI, and we have about 263 million shares on issue. There are some outstanding listed options and some unlisted options, which are unexercised at this stage. The Director ownership of the Company is over 22%. We have some institutional investors also on the register.

Andrew Phillips: We have $8.5 million of cash, but we've also pushed cash down into MSB, the Chilean joint-venture company. MSB is funded by all shareholders, as a prorata of each shareholders stake in the Company, and currently, about US$2m in MSB.

Richard Crookes: The share price and the current market cap is depressed a little at the moment. I think that reflects the macro view of the lithium sector, which is obviously low lithium prices. But we believe the macro view still reaffirmed all of the market forecasters that are projecting a strong uptick in lithium commodity prices going forward, underpinned by the strong demand for electric vehicles and batteries that are going to be used for the future of energy storage. All of those batteries will have a huge component of lithium in them. The lithium demand is forecast to grow exponentially. Certainly by 2023, 2024, we're expecting there will be a need for several new lithium mines and projects to meet the demand forecast for that battery production.

So, we're fairly confident that as the lithium commodity price picks up, in combination with us advancing the development of our project, that our market cap will grow substantially. So there's a real investment opportunity, we think, at the current time in a Company, which has leverage to that lithium price uptick and also to a permitted project.

So the catalyst for the LPI stock is finalization of the Codelco joint venture. That in turn, potentially brings some strategic partners into the company to underwrite our off-take agreement; potentially some development capital alongside that; and then we will finalize the project finance debt. All of those key milestones in the next six months or so, which will allow us then to commence construction in 2021.

Andrew Phillips: To add to Richards comments, our top 20 shareholders account for around 65% the shares on issue. It's a very strong, loyal shareholder base, who understands the overall value of this project. The share price doesn't reflect the overall value of the project and we're determined to get the market to understand that.

With the new world of COVID, and the inability to go out and promote this stock, with face to face meetings, we're looking at ways to really get the word out there. But it is a very strong shareholder base, with shareholders, not only in Australia, but also throughout Asia and the States as well.

Dr Allen Alper: Well, that sounds like a very good opportunity for investors. Is there anything else you would like to add on why our readers/investors should consider investing in Lithium Power International?

Richard Crookes: I think they can be confident that we have a committed Board and Management Team, who want to develop this project. We've done very high-quality engineering studies, using solid tier-one engineering companies. The Definitive Feasibility Study numbers are robust and defendable. We're very confident in our forecasts and projections.

We think there's a real buying opportunity now because the lithium sector is depressed, and that's obviously weighed heavily on our share price. There hasn't been a catalyst for people to buy. But if you believe in the long-term demand macro for lithium, then I think the opportunity to grow capital value, with LPI is significant, because we have the most advanced and nearest-term production opportunity in the lithium brine sector. So I think those are all very strong reasons to follow our Company.

Andrew Phillips: I would like to add a couple of final things to that, Al. We have other holdings: our Western Australia hardrock assets and our Argentinean brine assets. However, we believe that from a geological and geographic point of view, brine, and Chile, is the place to be. We have good relationships with the government departments in Chile and the economics of the project are first class.

Our cost production is very low per ton of lithium carbonate, at the lower end of the cost curve of lithium production. We haven't cut corners in our progress with the project. We've gone to top-tier advisors, in all steps along the way. For example, our Environmental Impact Assessment, which was approved by the Environmental Departments in Chile, in February this year, was 14,000 pages long; very comprehensive, very robust, using a number of advisors. As a result, it is one of the only few environmental assessments that have been approved in Chile for some time. We're fully permitted, ready to go to the next stage of development, and we're very confident that we have something very special here with this project.

Dr Allen Alper: Well, that sounds excellent! Those are extremely strong reasons for our readers/investors to consider investing in Lithium Power International. We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

https://lithiumpowerinternational.com

+61 2 9089 8723

info@lithiumpowerinternational.com

|

|